Professional Documents

Culture Documents

UBL Annual Report 2018-182

UBL Annual Report 2018-182

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-182

UBL Annual Report 2018-182

Uploaded by

IFRS LabCopyright:

Available Formats

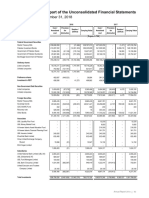

Notes to and forming part of the Consolidated Financial Statements

For the year ended December 31, 2018

Remeasurement of defined benefit obligations

Remeasurement gains and losses arising from experience adjustments and changes in actuarial assumptions are

recognized in other comprehensive income when they occur with no subsequent recycling through the profit and loss

account.

Remeasurement gains and losses pertaining to long term compensated absences are recognized in the profit and loss

account immediately.

5.12.2 United National Bank Limited (UBL UK)

Defined benefit scheme

UBL UK operates a pension scheme (defined benefit scheme) for certain staff. This scheme is closed for new members

and the accrual of benefits has ceased from January 1, 2010. Gains and losses on settlements and curtailments are

charged to the profit and loss account. The interest cost and the expected return on assets are included in other liabilities

and other assets respectively. Remeasurement gains and losses are recognised immediately in other comprehensive

income.

The defined benefit scheme is funded, with the assets of the scheme held separately from those of UBL UK, in separate

trustee administered funds. Pension scheme assets are measured at fair value and liabilities are measured based on

actuarial valuations using the Projected Unit Credit Method. The actuarial valuations are obtained at least triennially and

are updated at each statement of financial position date.

Defined contribution scheme

UBL UK operates a defined contributory pension scheme. The contribution payable in the year in respect of pension costs

and other post-retirement benefits is charged to the profit and loss account. Differences between the contribution payable

in the year and contribution actually paid are shown as either accruals or prepayments in the statement of financial

position.

5.12.3 UBL Fund Managers Limited (UFML)

Defined benefit plan

UFML operates an approved funded gratuity scheme for all employees. Annual contributions to the fund are made on the

basis of actuarial advice using the Projected Unit Credit Method. Remeasurement gains and losses arising from

experience adjustments and changes in actuarial assumptions are recognized in other comprehensive income when they

occur with no subsequent recycling through the profit and loss account.

Defined contribution plan

UFML operates an approved contributory provident fund (defined contribution scheme) for all eligible employees.

Employee Stock Option Scheme

UBL Fund Managers provides an incentive scheme for its top performing employees in the form of share options under the

Employee Stock Option Scheme (ESOS). The scheme has been approved by the SECP.

5.12.4 UBL (Switzerland) AG

UBL (Switzerland) AG maintains a contribution-oriented pension scheme for employees who have reached the age of 25.

It bears a large share of the costs of the occupational pension plan for all employees as well as their surviving dependents

pursuant to legal requirements. The employee benefit obligations and the assets serving as coverage are outsourced to a

collective insurance firm. The organization, management and financing of the pension plan comply with legal regulations,

the deed of foundation and the applicable regulations of the benefit plan.

5.12.5 UBL Bank (Tanzania) Limited

All eligible employees are members of the Public Pension Fund (PPF) or National Social Security Fund (NSSF). The fund

is a defined contribution scheme with the Bank having no legal or constructive obligation to pay further top-up

contributions.

180 United Bank Limited

You might also like

- Foreign Rights Publishing AgreementDocument2 pagesForeign Rights Publishing AgreementUbita PunterNo ratings yet

- Manufacturing Accounts Notes and QuestionsDocument31 pagesManufacturing Accounts Notes and QuestionsRoshan Ramkhalawon100% (1)

- Karen Leary CaseDocument2 pagesKaren Leary Caseteresa_fong_1100% (2)

- Employee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansDocument10 pagesEmployee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansallyssajabsNo ratings yet

- PresentationDocument7 pagesPresentationravi0% (1)

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- Pension Chap 1 IntroductionDocument5 pagesPension Chap 1 IntroductionJoe KimNo ratings yet

- Far28 Employee BenefitsDocument26 pagesFar28 Employee BenefitsCzar John JaudNo ratings yet

- IPSAS 25 Employees BenefitsDocument38 pagesIPSAS 25 Employees BenefitsREJAY89No ratings yet

- IAS 26 Accounting and Reporting by Retirement Benefit Plans: ScopeDocument5 pagesIAS 26 Accounting and Reporting by Retirement Benefit Plans: ScopevicsNo ratings yet

- 5.12.3 Employee BenefitsDocument5 pages5.12.3 Employee BenefitsBaher MohamedNo ratings yet

- IAS 19 SummaryDocument6 pagesIAS 19 SummaryMuchaa VlogNo ratings yet

- Module 7 - Ia2 Final CBLDocument22 pagesModule 7 - Ia2 Final CBLErika EsguerraNo ratings yet

- LIC Group Insurance SchemeDocument4 pagesLIC Group Insurance SchemeSavi SharmaNo ratings yet

- Employee Benefits: PAS 19 Corpuz, Mary Lorie Anne ODocument38 pagesEmployee Benefits: PAS 19 Corpuz, Mary Lorie Anne OMarylorieanne CorpuzNo ratings yet

- Ac Standard - AS15Document9 pagesAc Standard - AS15api-3705877No ratings yet

- International Accounting Standard 26 Accounting and Reporting by Retirement Benefit PlansDocument7 pagesInternational Accounting Standard 26 Accounting and Reporting by Retirement Benefit PlansmovelikejaggerNo ratings yet

- Pas-26 FarDocument8 pagesPas-26 FarMarie dela sernaNo ratings yet

- Chapter 20Document21 pagesChapter 20Diana SantosNo ratings yet

- Chapter 17 Ia2 No ProblemsDocument23 pagesChapter 17 Ia2 No ProblemsJM Valonda Villena, CPA, MBANo ratings yet

- IAS 19 Employee BenefitsDocument56 pagesIAS 19 Employee BenefitsziyuNo ratings yet

- CH20 PDFDocument81 pagesCH20 PDFelaine aureliaNo ratings yet

- Accounting For Pensions and Postretirement BenefitsDocument3 pagesAccounting For Pensions and Postretirement BenefitsDhivena JeonNo ratings yet

- Asset Management-Pension FundsDocument9 pagesAsset Management-Pension FundsKen BiiNo ratings yet

- Demas - Task 2Document7 pagesDemas - Task 2DemastaufiqNo ratings yet

- Foundations of Financial Markets and Institutions 4th Edition Fabozzi Solutions ManualDocument8 pagesFoundations of Financial Markets and Institutions 4th Edition Fabozzi Solutions Manualfinificcodille6d3h100% (25)

- MFRS 2, MFRS 119 Nestle V Ho HupDocument5 pagesMFRS 2, MFRS 119 Nestle V Ho HupNur ShahiraNo ratings yet

- Accounting and Reporting by Retirement Benefit PlansDocument6 pagesAccounting and Reporting by Retirement Benefit PlansTanvir PrantoNo ratings yet

- EmployeebenefitsreportDocument172 pagesEmployeebenefitsreportMikaela LacabaNo ratings yet

- Ias 19Document43 pagesIas 19Reever RiverNo ratings yet

- Actuarial Glossary PDFDocument18 pagesActuarial Glossary PDFmiguelNo ratings yet

- Chapter 2 Lecture Notes.2021Document15 pagesChapter 2 Lecture Notes.2021Hoyin SinNo ratings yet

- Cfas Pas 19Document4 pagesCfas Pas 19Zyribelle Anne JAPSONNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- Employee BenefitDocument32 pagesEmployee BenefitnatiNo ratings yet

- Provident Fund FAQDocument4 pagesProvident Fund FAQgodsthomachayanNo ratings yet

- Pension Topic One and TwoDocument7 pagesPension Topic One and Twonogarap767No ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoNo ratings yet

- 19095as36announ10377 PDFDocument13 pages19095as36announ10377 PDFratiNo ratings yet

- Unit 7 E-Tutor PresentationDocument18 pagesUnit 7 E-Tutor PresentationKatrina EustaceNo ratings yet

- Pension Terminology FinalDocument8 pagesPension Terminology FinalEugeneNo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- ULIP's SATHYADocument9 pagesULIP's SATHYAsantoduNo ratings yet

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariNo ratings yet

- Group Saving Linked Insurance SchemeDocument14 pagesGroup Saving Linked Insurance SchemeSam DavidNo ratings yet

- CFAS. Pages 10Document3 pagesCFAS. Pages 10Julienne CaitNo ratings yet

- Module 3 Packet: College of CommerceDocument21 pagesModule 3 Packet: College of CommerceDexie Jane MayoNo ratings yet

- Employer Benefit - Part 2Document9 pagesEmployer Benefit - Part 2Julian Adam PagalNo ratings yet

- VillanuevaJohnLloydA Module4ActivityDocument2 pagesVillanuevaJohnLloydA Module4ActivityJan JanNo ratings yet

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (2)

- Module 3 Superannuation SlidesDocument68 pagesModule 3 Superannuation SlidesChua Rui TingNo ratings yet

- SBF Iocl 19.11.12Document18 pagesSBF Iocl 19.11.12ParameshNo ratings yet

- Chapter 5 Employee BenefitsDocument29 pagesChapter 5 Employee BenefitsDudz MatienzoNo ratings yet

- Updated Pensions Training - Slides 05.03.18Document101 pagesUpdated Pensions Training - Slides 05.03.18archanaanuNo ratings yet

- Unit 03Document9 pagesUnit 03bobo tangaNo ratings yet

- Chapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That Is EstablishedDocument11 pagesChapter 6: Pension Fund: Definition: A Pension Plan Is A Fund That Is EstablishedJahangir AlamNo ratings yet

- IAS 19 NotesDocument15 pagesIAS 19 NotesArsalan AliNo ratings yet

- Objectives: Chapter 5 - Employee Benefits - Ias 19Document82 pagesObjectives: Chapter 5 - Employee Benefits - Ias 19Tram NguyenNo ratings yet

- Chapter 25 (Pension Fund Operation)Document20 pagesChapter 25 (Pension Fund Operation)Aguntuk ShawonNo ratings yet

- Case Study Ch03Document3 pagesCase Study Ch03Munya Chawana0% (1)

- Deegan5e SM Ch23Document13 pagesDeegan5e SM Ch23Rachel Tanner100% (1)

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-89Document1 pageUBL Annual Report 2018-89IFRS LabNo ratings yet

- Professional Salesmanship Notes - 1Document8 pagesProfessional Salesmanship Notes - 1Christine Joy MendigorinNo ratings yet

- Business Process Procedure: IconsDocument8 pagesBusiness Process Procedure: IconsDinesh GuptaNo ratings yet

- Coca Cola Uses The Following Distribution ChannelsDocument9 pagesCoca Cola Uses The Following Distribution ChannelsRouful AniNo ratings yet

- Personal Assignment Inventory (Materi 5)Document2 pagesPersonal Assignment Inventory (Materi 5)Cita Setia RahmiNo ratings yet

- HC 10157Document67 pagesHC 10157Rahul JainNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- BA 190 THY Group 4 Bengco, Catabay, Esler, Go, Ong, PelegrinoDocument6 pagesBA 190 THY Group 4 Bengco, Catabay, Esler, Go, Ong, PelegrinoJohn Paul EslerNo ratings yet

- TOPIC 2 - SCI-Single-Step (Preparation)Document6 pagesTOPIC 2 - SCI-Single-Step (Preparation)JUDITH PIANONo ratings yet

- IDBI FEDERAL Bank Annual Report 2017-18 PDFDocument239 pagesIDBI FEDERAL Bank Annual Report 2017-18 PDFYash BendreNo ratings yet

- Customer Financing Application PDFDocument7 pagesCustomer Financing Application PDFAlvin PhuongNo ratings yet

- Project Report On Sanvie Retail Private LimitedDocument65 pagesProject Report On Sanvie Retail Private Limitednavya singhNo ratings yet

- BFSI Training Manual - PDF - 20230810 - 164502 - 0000Document136 pagesBFSI Training Manual - PDF - 20230810 - 164502 - 0000deepak643aNo ratings yet

- Mid Term IBFDocument40 pagesMid Term IBFQuỳnh Lê DiễmNo ratings yet

- Managing Innovation Chapter 1Document72 pagesManaging Innovation Chapter 1Manuel uY100% (1)

- t1 - Introduction of School Financial ManagementDocument15 pagest1 - Introduction of School Financial ManagementSARIPAH BINTI ABDUL HAMID MoeNo ratings yet

- Performance Appraisal SummaryDocument9 pagesPerformance Appraisal SummaryAndrey MilerNo ratings yet

- Mabel's Labels Case StudyDocument6 pagesMabel's Labels Case StudyRaj KumarNo ratings yet

- Ksutt 7Document3 pagesKsutt 7Kelle SuttonNo ratings yet

- On January 1 2013 Morey Inc Exchanged 178 000 For 25Document1 pageOn January 1 2013 Morey Inc Exchanged 178 000 For 25Miroslav GegoskiNo ratings yet

- Knowledge Management PDFDocument252 pagesKnowledge Management PDFKasiraman RamanujamNo ratings yet

- Auditor Independence Challenges Faced by External Auditors When Auditing Large Firms in ZimbabweDocument7 pagesAuditor Independence Challenges Faced by External Auditors When Auditing Large Firms in ZimbabweInternational Journal of Business Marketing and ManagementNo ratings yet

- Identify The Industry-Analysis of Financial StatmentDocument5 pagesIdentify The Industry-Analysis of Financial StatmentAbdul RehmanNo ratings yet

- Part A: Multiple Choice Questions (20 Marks)Document18 pagesPart A: Multiple Choice Questions (20 Marks)Anonymous f5ZhkfZmk9100% (1)

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocument2 pagesا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportkalm Altalb BookNo ratings yet

- A Survey On Adoption of E-Procurement in Indian OrganisationsDocument35 pagesA Survey On Adoption of E-Procurement in Indian OrganisationsbagemaNo ratings yet

- Capital Goods As NotifiedDocument74 pagesCapital Goods As NotifiedRamesh RamNo ratings yet