Professional Documents

Culture Documents

4.5.1 Impact of Internationalization On Commercial Banks' Performance

4.5.1 Impact of Internationalization On Commercial Banks' Performance

Uploaded by

kayodeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4.5.1 Impact of Internationalization On Commercial Banks' Performance

4.5.1 Impact of Internationalization On Commercial Banks' Performance

Uploaded by

kayodeCopyright:

Available Formats

4.5.

1 Impact of Internationalization on Commercial Banks’ Performance

The survey sought to understand the effects of internationalization on the profitability of

Nigerian commercial banks. Respondents were asked to assess the impact of their banks'

international operations on various profitability metrics, such as return on assets (ROA), return

on equity (ROE), and net interest margin (NIM). To analyze the impact of internationalization on

the profitability of Nigerian commercial banks, correlation and regression analyses were

conducted using the survey data from the 38 participating senior executives.

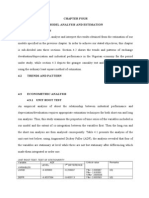

Correlation Analysis

Table 4.8 presents the correlation matrix, which examines the strength and direction of the

relationship between the degree of internationalization (measured by the foreign assets to total

assets ratio) and various profitability metrics such as return on assets (ROA), return on equity

(ROE), and net interest margin (NIM).

Table 4.8: Correlation Matrix

Foreign Asset/Total Asset ROA ROE NIM

Foreign Asset/Total Asset 1

ROA 0.6814 1

ROE 0.6121 0.5722 1

NIM 0.5417 0.6721 0.5142 1

The correlation coefficients in Table 4.8 indicate a moderate positive relationship between the

degree of internationalization and profitability metrics, suggesting that higher levels of

internationalization are associated with improved profitability.

Regression Analysis

To quantify the impact of internationalization on profitability, regression analysis was performed,

treating the profitability metrics as dependent variables and the degree of internationalization as

the independent variable.

Table 4.9: Model Summary (Employee Motivation)

Model Summary

Model R R-Square [ R2 ¿ Adjusted R-Square ( Ŕ2) SEE

a

1 0.842 0.613 0.601 0.42773

a . Predictors: (Constant)

The R-squared value in Table 4.9 indicates that the degree of internationalization explains a

significant portion of the variance in profitability metrics. The adjusted R-squared value suggests

that the model has good explanatory power.

As part of the usual approach, the variability in the variable's distribution must be presented with

the model summary. Table 4.10 presents the ANOVA model.

Table 4.10: Analysis of Variance (ANOVA)

a

ANOVA

Model Sum of squares d.f Mean Square F-Statistic Significance

Regression 83.254 3 14.231 73.655 b

0.000

1 Residual 16.306 221 0.186

Total 99.56 224

a. Dependent variable: Profitability

The ANOVA results in Table 4.10 show a statistically significant F-statistic (p-value < 0.05),

indicating that the regression model predicts profitability metrics more accurately than using the

mean values alone. This suggests a significant relationship between the degree of

internationalization and profitability.

Table 4.11: Coefficients of the Variables

Second Niger Project Performance

Unstandardized Coefficients Standard Coefficients

Variable

B Std. Error B t Sig.

C .263 0.18 0.15 0.31

Communication 0.471 0.016 0217 0.44 0.00

Trust 0.496 0.017 0.143 2.32 0.00

Knowledge sharing 0.217 0.012 0.302 3.36 0.00

Dependent Variable: Profitability (ROA, ROE, NIM)

The regression coefficients in Table 4.11 quantify the impact of the degree of internationalization

on each profitability metric (ROA, ROE, NIM). Positive and statistically significant coefficients

(p-value < 0.05) indicate that higher levels of internationalization are associated with improved

profitability. The analysis provides empirical evidence supporting a positive relationship between

the degree of internationalization and profitability for Nigerian commercial banks, based on the

survey responses from the sampled banks’ senior executives.

You might also like

- Questions Nde Level 1-2-UTDocument57 pagesQuestions Nde Level 1-2-UTMOhammed PatelNo ratings yet

- File Test 1 Grammar, Vocabulary, and Pronunciation BDocument7 pagesFile Test 1 Grammar, Vocabulary, and Pronunciation BB McNo ratings yet

- A Tall Man Executes A Jig - Irving LaytonDocument3 pagesA Tall Man Executes A Jig - Irving LaytonRolf AuerNo ratings yet

- Sharing The Planet PYP Planner ScienceDocument4 pagesSharing The Planet PYP Planner ScienceDanielRobertson0% (1)

- EUI Injector Test Plan Worksheet MasterDocument14 pagesEUI Injector Test Plan Worksheet MasterDjebali MouradNo ratings yet

- Acct Sra Chapter FourDocument3 pagesAcct Sra Chapter Foursadiqmedical160No ratings yet

- Predicting Bankruptcy Using Financial IndicatorsDocument4 pagesPredicting Bankruptcy Using Financial IndicatorsIjbmm JournalNo ratings yet

- Chapter 4: Data AnalysisDocument11 pagesChapter 4: Data AnalysissaadNo ratings yet

- Jurnal Ilmiah Manajemen Dan Bisnis Vol.7 No.2Document10 pagesJurnal Ilmiah Manajemen Dan Bisnis Vol.7 No.2arifpamulang087No ratings yet

- Linear Regression Model Before EstimationDocument4 pagesLinear Regression Model Before EstimationAddisu TsegayeNo ratings yet

- Model SummaryDocument9 pagesModel Summarykassa mnilkNo ratings yet

- Aishat Acct Chapter FourDocument8 pagesAishat Acct Chapter Foursadiqmedical160No ratings yet

- Ijcrt2106187 Paper Analysis of Banks Total Factor Productivity by Disaggregate LevelDocument15 pagesIjcrt2106187 Paper Analysis of Banks Total Factor Productivity by Disaggregate LevelDr Bhadrappa HaralayyaNo ratings yet

- Empirical Results & Discussion:: Table 1: Descriptive StatisticsDocument5 pagesEmpirical Results & Discussion:: Table 1: Descriptive Statisticssyeda uzmaNo ratings yet

- Practice Questions - Quantitative - Reading 7Document13 pagesPractice Questions - Quantitative - Reading 7Khải HoànNo ratings yet

- (The Mcgraw-Hill Economics Series) Christopher Thomas, S. Charles Maurice-Managerial Economics-McGraw-Hill Education (2015)Document84 pages(The Mcgraw-Hill Economics Series) Christopher Thomas, S. Charles Maurice-Managerial Economics-McGraw-Hill Education (2015)danyalNo ratings yet

- 1.1.1 Influence of Proctive Personality On Employee MotivationDocument6 pages1.1.1 Influence of Proctive Personality On Employee Motivationعباس ناناNo ratings yet

- Name: Marcelina SRN: 1901120020 Class: 5C Course: Statistics Research Methodology Meet 11Document6 pagesName: Marcelina SRN: 1901120020 Class: 5C Course: Statistics Research Methodology Meet 11Marcelina InaaNo ratings yet

- Impact of Current Ratio and Debt Ratio On Return On Investment in Retail and Wholesale Companies On The Indonesia Stock ExchangeDocument9 pagesImpact of Current Ratio and Debt Ratio On Return On Investment in Retail and Wholesale Companies On The Indonesia Stock ExchangeErica AliciaNo ratings yet

- Journal AnalysisDocument21 pagesJournal AnalysisLa AnggaNo ratings yet

- Chapter 4: Research Results: Variables Proxy Mean Median Stdev. Min Max ObsDocument10 pagesChapter 4: Research Results: Variables Proxy Mean Median Stdev. Min Max ObsFestusNo ratings yet

- Term PaperDocument21 pagesTerm PaperNoush NazmiNo ratings yet

- Interpratation of Regression 2Document3 pagesInterpratation of Regression 2Adil HassanNo ratings yet

- CHAPTER 4-5 Cashless Policy Data AnalysisDocument22 pagesCHAPTER 4-5 Cashless Policy Data AnalysisDiiyor LawsonNo ratings yet

- PPD1041 Sem1 2023 LU5 AssignmentDocument9 pagesPPD1041 Sem1 2023 LU5 Assignmentchunkit033No ratings yet

- Chapter 14Document16 pagesChapter 14Dr Bhadrappa HaralayyaNo ratings yet

- Interbank Comparison: Some Important KeywordsDocument8 pagesInterbank Comparison: Some Important KeywordsAvneet ChawlaNo ratings yet

- Chapter Four Model Analysis and Estimation 4.1Document8 pagesChapter Four Model Analysis and Estimation 4.1Oladipupo Mayowa PaulNo ratings yet

- Hypothesis Testing H04Document4 pagesHypothesis Testing H04Antony RukwaroNo ratings yet

- CHAPTER FIVE FinalDocument11 pagesCHAPTER FIVE FinalNejash Abdo IssaNo ratings yet

- Chapter Four Findings and DiscussionDocument7 pagesChapter Four Findings and DiscussionAhmad AriefNo ratings yet

- HinaDocument23 pagesHinaAsmita KantariyaNo ratings yet

- NishaDocument10 pagesNishaNishanthini SankaranNo ratings yet

- MMW Chapter 4Document11 pagesMMW Chapter 4abercrombieNo ratings yet

- 6.2. MethodologyDocument12 pages6.2. MethodologyAtiaTahiraNo ratings yet

- Oup 5Document42 pagesOup 5TAMIZHAN ANo ratings yet

- Maureen T. Lauzon BS Biology I: Figure 1 Migration Intention vs. IncomeDocument3 pagesMaureen T. Lauzon BS Biology I: Figure 1 Migration Intention vs. IncomeMaureen LauzonNo ratings yet

- List of TablesDocument91 pagesList of TablesManoj KumarNo ratings yet

- Linear Regression AnalysisDocument7 pagesLinear Regression AnalysisEhtasham ul haqNo ratings yet

- Midterm TestDocument32 pagesMidterm Testhamziya1993No ratings yet

- 14 Chapter 5Document43 pages14 Chapter 5Neetu KumariNo ratings yet

- Assignment For Research Methods For Business NAME: Bhavya Bharti ROLL No.: GM19049 Section: BDocument4 pagesAssignment For Research Methods For Business NAME: Bhavya Bharti ROLL No.: GM19049 Section: BBhavya BhartiNo ratings yet

- Chika AnalysisDocument15 pagesChika AnalysisYasith WeerasingheNo ratings yet

- FINAL QT PROJECT v1.1Document8 pagesFINAL QT PROJECT v1.1Harsh DuaNo ratings yet

- Score: Analysing Potential Bankruptcy Threat Using Altman Z-Score: Study of Randomly Selected Borrowers From Psu BanksDocument8 pagesScore: Analysing Potential Bankruptcy Threat Using Altman Z-Score: Study of Randomly Selected Borrowers From Psu BanksHarsh DuaNo ratings yet

- North South University: Course: BUS 173 Sec: 06Document9 pagesNorth South University: Course: BUS 173 Sec: 06Alizay NishatNo ratings yet

- Global Engineering Economics 4EDDocument554 pagesGlobal Engineering Economics 4EDSyed TamzidNo ratings yet

- SPSS 4Document10 pagesSPSS 4Lehar GabaNo ratings yet

- Chapter 2.2Document42 pagesChapter 2.2Sherefedin AdemNo ratings yet

- Statistics For Business Decision Making and Analysis 3rd Edition Stine Test BankDocument7 pagesStatistics For Business Decision Making and Analysis 3rd Edition Stine Test Bankselinaanhon9a100% (25)

- 1.10 Simple Linear Regression - AnswersDocument22 pages1.10 Simple Linear Regression - AnswersThe SpectreNo ratings yet

- Statistics For Data Analytics Project - CA 2: Multiple Linear Regression and Binary Logistic RegressionDocument11 pagesStatistics For Data Analytics Project - CA 2: Multiple Linear Regression and Binary Logistic RegressionRahul JajuNo ratings yet

- Task Report On Financial Modelling ModuleDocument22 pagesTask Report On Financial Modelling ModuleLa Ode SabaruddinNo ratings yet

- Running Head: Testing Correlation and Bivariate Regression 1Document6 pagesRunning Head: Testing Correlation and Bivariate Regression 1Juliet vutemeNo ratings yet

- 08 Chapter 5Document48 pages08 Chapter 5Surbhi MahendruNo ratings yet

- Multiple Regression and Issues in Regression AnalysisDocument25 pagesMultiple Regression and Issues in Regression AnalysisRaghav BhatnagarNo ratings yet

- (Ahmed Riahi-Belkaoui) Earnings Measurement, DeterDocument200 pages(Ahmed Riahi-Belkaoui) Earnings Measurement, DeterdolutamadolutamaNo ratings yet

- An Application of Factor Analysis in The Evaluation of Country Economic RankDocument7 pagesAn Application of Factor Analysis in The Evaluation of Country Economic RankMechanical Maths TutionNo ratings yet

- Tugas 2 Identifikasi Jurnal Tentang Pengaruh Likuiditas Dengan ProfitabilitasDocument11 pagesTugas 2 Identifikasi Jurnal Tentang Pengaruh Likuiditas Dengan ProfitabilitasNelis AwotkayNo ratings yet

- RIQAS PerformanceDocument18 pagesRIQAS PerformanceAditya JayaprakashNo ratings yet

- Документ Microsoft Word - КопияDocument13 pagesДокумент Microsoft Word - КопияDavid ANo ratings yet

- Interpretation EcotrixDocument7 pagesInterpretation EcotrixA BhNo ratings yet

- Analysis and Discussion: Responsibility and Do Not Have InstitutionalDocument11 pagesAnalysis and Discussion: Responsibility and Do Not Have InstitutionalHafizhHermawanNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- Public PolicyDocument17 pagesPublic PolicykayodeNo ratings yet

- Public DebtDocument2 pagesPublic DebtkayodeNo ratings yet

- FederalismDocument6 pagesFederalismkayode100% (1)

- Government ExpenditureDocument3 pagesGovernment ExpenditurekayodeNo ratings yet

- Institutional Quality and Economic GrowthDocument2 pagesInstitutional Quality and Economic GrowthkayodeNo ratings yet

- LeadershipDocument56 pagesLeadershipkayodeNo ratings yet

- Examination of The Evolution and Importance of Diplomatic Mission and Consulate in Relation To Diplomatic PrivilegesDocument9 pagesExamination of The Evolution and Importance of Diplomatic Mission and Consulate in Relation To Diplomatic PrivilegeskayodeNo ratings yet

- Enamelled Copper WireDocument8 pagesEnamelled Copper WireNNN MMMNo ratings yet

- 910-911-914-915 Fanuc Ram Parity AlarmDocument2 pages910-911-914-915 Fanuc Ram Parity AlarmShumail JavedNo ratings yet

- PDMS Course SyllabusDocument3 pagesPDMS Course SyllabusBalu MuruganNo ratings yet

- It's Getting Better: Andy Timmons That Was Then, This Is NowDocument12 pagesIt's Getting Better: Andy Timmons That Was Then, This Is NowyesscaballeroNo ratings yet

- Op CdmaDocument19 pagesOp Cdmarosev15No ratings yet

- Body of Knowledge: AWS Certified Welding InspectorDocument1 pageBody of Knowledge: AWS Certified Welding InspectorobanizeNo ratings yet

- Chapter 16 PSK DemodDocument18 pagesChapter 16 PSK DemodberkahNo ratings yet

- Diagonals of TilesDocument2 pagesDiagonals of TileskheyNo ratings yet

- CPM Guidelines PDFDocument538 pagesCPM Guidelines PDFVivek KumarNo ratings yet

- Steel Futures April 09Document4 pagesSteel Futures April 09whwy99No ratings yet

- List PPB Open 20221125Document8 pagesList PPB Open 20221125martaNo ratings yet

- Analogue and Digital RecordingDocument4 pagesAnalogue and Digital RecordingKavita koNo ratings yet

- 2022-2023 Second Term First Exams Make Up PDFDocument3 pages2022-2023 Second Term First Exams Make Up PDFpasajr7No ratings yet

- Bluetooth Hands Free Car Kit Audio Compactpact: Installation Instructions & Operating ManualDocument48 pagesBluetooth Hands Free Car Kit Audio Compactpact: Installation Instructions & Operating ManualIonut RabaNo ratings yet

- Clinical GoalsDocument13 pagesClinical GoalsHycient PaulNo ratings yet

- S006 - Suicide in An Airpla PDFDocument19 pagesS006 - Suicide in An Airpla PDFruso1900No ratings yet

- 02.06.05 3-Way Valve 1240 6519 - enDocument6 pages02.06.05 3-Way Valve 1240 6519 - enabuya3kubmNo ratings yet

- Bab 1-5 The Use Textless To Narrative TextDocument51 pagesBab 1-5 The Use Textless To Narrative TextRestu MiasariNo ratings yet

- Introduction To UMTS: Charles M.H. NobletDocument31 pagesIntroduction To UMTS: Charles M.H. NobletAnonymous g8YR8b9No ratings yet

- Sultan Al Baqami Est. For TradingDocument7 pagesSultan Al Baqami Est. For Tradingsalman KhanNo ratings yet

- MAN - CH - 2 - MCQsDocument6 pagesMAN - CH - 2 - MCQsSaquibh ShaikhNo ratings yet

- ResumeDocument2 pagesResumeEmmah PetersNo ratings yet

- Eonomics Class 6Document12 pagesEonomics Class 6mubin.pathan765No ratings yet

- Operating Instructions (Central Lubrication System)Document26 pagesOperating Instructions (Central Lubrication System)drmassterNo ratings yet

- Xquery Tutorial: What You Should Already KnowDocument21 pagesXquery Tutorial: What You Should Already KnowAnirudh PandeyNo ratings yet