Professional Documents

Culture Documents

GSTR7 15shle01037b1du 022024

GSTR7 15shle01037b1du 022024

Uploaded by

Hmingsanga HauhnarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR7 15shle01037b1du 022024

GSTR7 15shle01037b1du 022024

Uploaded by

Hmingsanga HauhnarCopyright:

Available Formats

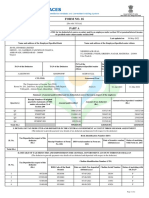

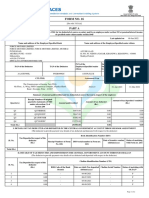

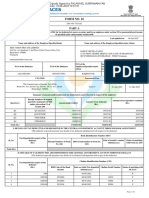

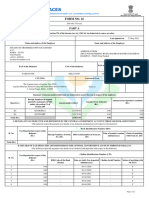

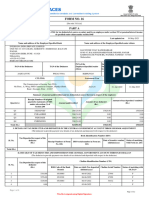

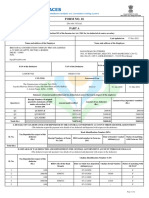

Form GSTR-7

[See rule 66(1)]

Return for Tax Deducted at Source

Financial Year 2023-24

Month February

1. GSTIN 15SHLE01037B1DU

2(a). Legal name of the registered person EXECUTIVE ENGINEER PHED AIZAWL WATER

DISTRIBUTION DIVISION SOUTH AIZAWL

2(b). Trade name, if any EXECUTIVE ENGINEER PHED AIZAWL WATER

DISTRIBUTION DIVISION SOUTH AIZAWL

2(c). ARN AA1502240013521

AL

2(d). Date of ARN 05/03/2024

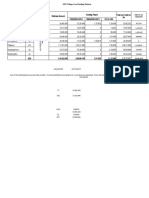

3. Details of the tax deducted at source

No. of Total Amount Paid to Integrated Tax Central Tax State/UT Tax

Records Deductees (₹) (₹) (₹) (₹)

1 2,46,11,895.00 0.00 2,46,119.00 2,46,119.00

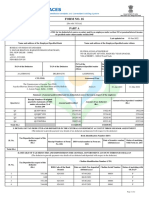

4. Amendments to details of tax deducted at source in respect of any

earlier tax period

No. of Revised Total Amount Paid to Integrated Tax Central Tax State/UT

Records Deductees(₹) (₹) (₹) Tax (₹)

FIN

0 0.00 0.00 0.00 0.00

5,6. Payment of tax

Description Tax Payable Tax Paid in Interest Interest Late Fee Late Fee

(₹) Cash (₹) Amount Paid in Amount Paid in

Payable (₹) Cash (₹) Payable (₹) Cash (₹)

Integrated 0.00 0.00 0.00 0.00 - -

Tax

Central Tax 2,46,119.00 2,46,119.00 0.00 0.00 0.00 0.00

State/UT 2,46,119.00 2,46,119.00 0.00 0.00 0.00 0.00

Tax

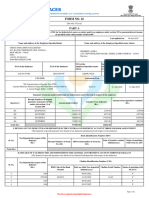

8. Debit entries in electronic cash ledger for TDS/interest payment

Debit entry no. DC1503240000130 Debit entry date. 05-03-2024

Description Tax Paid in Cash (₹) Interest (₹) Late Fee (₹)

Integrated Tax (₹) 0.00 0.00 -

Central Tax (₹) 2,46,119.00 0.00 0.00

State/UT Tax (₹) 2,46,119.00 0.00 0.00

Verification

I hereby solemnly affirm and declare that the information given herein above is true and correct

to the best of my knowledge and belief and nothing has been concealed therefrom.

AL

Name of authorized signatory

Lalsanga

Date: 05/03/2024 Designation /Status

Sr Executive Engineer

FIN

You might also like

- Sample Format of Individual Income Tax Return y A 2017 2018Document3 pagesSample Format of Individual Income Tax Return y A 2017 2018Chathuranga LSISNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- GSTR7 15shle01037b1du 052024Document2 pagesGSTR7 15shle01037b1du 052024Hmingsanga HauhnarNo ratings yet

- GSTR7 23bple00705f1ds 012024Document2 pagesGSTR7 23bple00705f1ds 012024Umang NagarNo ratings yet

- GSTR7 01amrc10451a1d9 052024Document2 pagesGSTR7 01amrc10451a1d9 052024ansar.rafiqiNo ratings yet

- GSTR7 37vpne00462a1d1 102018Document2 pagesGSTR7 37vpne00462a1d1 102018A Prabhakar RaoNo ratings yet

- From16 A PDFDocument2 pagesFrom16 A PDFAadarshNo ratings yet

- Form16 Signed-1Document7 pagesForm16 Signed-1akh.278No ratings yet

- TDS and TCS Credit Received 24aejfs9609e1zu 102021Document2 pagesTDS and TCS Credit Received 24aejfs9609e1zu 102021JIGNESH VAGHANINo ratings yet

- Annual Aso14211form16Document8 pagesAnnual Aso14211form16SOUMITRA CHATTERJEENo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- Form16 2012 AAXPE4654P 2023-24Document2 pagesForm16 2012 AAXPE4654P 2023-24Srinivas Etikala0% (1)

- Form 16 - Fy 2019-20Document4 pagesForm 16 - Fy 2019-20CA SHOBHIT GoelNo ratings yet

- Annual I-Mumd44312form16Document7 pagesAnnual I-Mumd44312form16dbind1999No ratings yet

- Rajesh TambeDocument1 pageRajesh TambemodakmmNo ratings yet

- Form 15 FY 23-24_1001190Document6 pagesForm 15 FY 23-24_1001190untiliwin0852No ratings yet

- Form16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Document6 pagesForm16 GeethapandyK MKS00006 60009369290 600117359 230726 140121Mankamuthaka VemaratananaNo ratings yet

- Goods and Services Tax - GSTR-3B Offline UtilityDocument14 pagesGoods and Services Tax - GSTR-3B Offline UtilitymayoorNo ratings yet

- FS46265257 PDFDocument9 pagesFS46265257 PDFPankaj KumarNo ratings yet

- Form 16Document6 pagesForm 16Ashwani KumarNo ratings yet

- Rrr3Document2 pagesRrr3rohitkawade2707No ratings yet

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- Monthly Regular Pay BillDocument26 pagesMonthly Regular Pay BillNiyojan Monthly ReportNo ratings yet

- Bgupv5366d Q4 2019-20Document2 pagesBgupv5366d Q4 2019-20Parth VaishnavNo ratings yet

- Binder 1Document2 pagesBinder 1PARAMJEETSINGHNo ratings yet

- Deve 60398Document7 pagesDeve 60398Devesh Pratap ChandNo ratings yet

- Santhosh Form16Document7 pagesSanthosh Form16shonnuraswamyNo ratings yet

- Annual.202111684 Form16 - Kaustubh KandharkarDocument8 pagesAnnual.202111684 Form16 - Kaustubh KandharkarKaustubh KandharkarNo ratings yet

- It Reply Merge - PavaniDocument5 pagesIt Reply Merge - Pavanibharath reddyNo ratings yet

- Tushar - Jagtap@amdocs - Com f16Document10 pagesTushar - Jagtap@amdocs - Com f16pvd6d52kd2No ratings yet

- TDS and TCS Credit Received 24aejfs9609e1zu 062022Document2 pagesTDS and TCS Credit Received 24aejfs9609e1zu 062022JIGNESH VAGHANINo ratings yet

- TDS and TCS Credit Received 27ecxpd4691f1z2 112022Document2 pagesTDS and TCS Credit Received 27ecxpd4691f1z2 112022Sanket ShingaviNo ratings yet

- 2307 Non Vat 3 Kitchennete (Autorecovered)Document2 pages2307 Non Vat 3 Kitchennete (Autorecovered)Rough Moon Mags Urasuta IINo ratings yet

- Form 16 - Vijaya Raja SelvanDocument4 pagesForm 16 - Vijaya Raja SelvansadhanaNo ratings yet

- TDS and TCS Credit Received 10amtpk4713d1ze 032023 PDFDocument2 pagesTDS and TCS Credit Received 10amtpk4713d1ze 032023 PDFADVOCATE KUNDANNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMurthy KarumuriNo ratings yet

- Form16 122726 DBKPS7123E AY-2022-23Document9 pagesForm16 122726 DBKPS7123E AY-2022-23Damodar SurisettyNo ratings yet

- GSTR9 09bwbpk7755a1zk 032021Document8 pagesGSTR9 09bwbpk7755a1zk 032021Ankit JainNo ratings yet

- Aagpe6585l 2022-23Document2 pagesAagpe6585l 2022-23ELUMALAI BALACHANDRANNo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- Annual 3683form16Document9 pagesAnnual 3683form16modi jiNo ratings yet

- Form 16Document9 pagesForm 16Ponns KarnanNo ratings yet

- Bir Form 2307Document2 pagesBir Form 2307Geraldine BacoNo ratings yet

- Cybdeer at Q1Document2 pagesCybdeer at Q1KALASH SHARMANo ratings yet

- Chand GSTR 3B 03 2024Document3 pagesChand GSTR 3B 03 2024CHAND DISTRIBUTORNo ratings yet

- CMP08 10afvpg0268g2zm 142021Document2 pagesCMP08 10afvpg0268g2zm 142021MILTON MOHANTYNo ratings yet

- Declaration 5340321962733Document4 pagesDeclaration 5340321962733Muhammad salman SalmanNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- GSTR3B 07aasfb3116c1zs 032023Document4 pagesGSTR3B 07aasfb3116c1zs 032023VIKRAMJEET SINGHNo ratings yet

- Igkc TanDocument2 pagesIgkc TanJyoti prakash MohapatraNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document4 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023ianveed64No ratings yet

- Akapr2160g 2019-20Document2 pagesAkapr2160g 2019-20Satyanarayana Sharma ValluriNo ratings yet

- GAR 13 (Outer)Document5 pagesGAR 13 (Outer)BipasaNo ratings yet

- 2307 WestmontDocument2 pages2307 WestmontMarie Francisco100% (1)

- GSTR4 08aespg3645k1z1 2023-24Document4 pagesGSTR4 08aespg3645k1z1 2023-24its4u365No ratings yet

- Form16-2021-2022 Part ADocument2 pagesForm16-2021-2022 Part Athaarini doraiswamiNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- QUestions OnlyDocument26 pagesQUestions OnlyHmingsanga HauhnarNo ratings yet

- Quadratic ZETDocument3 pagesQuadratic ZETHmingsanga HauhnarNo ratings yet

- Time and WorkDocument8 pagesTime and WorkHmingsanga HauhnarNo ratings yet

- Adobe Scan 18 Aug 2022Document1 pageAdobe Scan 18 Aug 2022Hmingsanga HauhnarNo ratings yet

- Tawi UCDocument14 pagesTawi UCHmingsanga HauhnarNo ratings yet

- Connection ChallanDocument5 pagesConnection ChallanHmingsanga HauhnarNo ratings yet

- BinomialDocument3 pagesBinomialHmingsanga HauhnarNo ratings yet

- CCS Leave RulesDocument47 pagesCCS Leave RulesHmingsanga HauhnarNo ratings yet

- Forms Abstract Contigent BillDocument3 pagesForms Abstract Contigent BillHmingsanga HauhnarNo ratings yet

- NRDWP StatementDocument28 pagesNRDWP StatementHmingsanga HauhnarNo ratings yet

- NotesDocument6 pagesNotesHmingsanga HauhnarNo ratings yet

- LalremruatiDocument1 pageLalremruatiHmingsanga HauhnarNo ratings yet

- Basic Service Rules&Financial Rules NominationDocument3 pagesBasic Service Rules&Financial Rules NominationHmingsanga HauhnarNo ratings yet

- Deductions/recoveries Adjustable in The Book of Treasury/IFMIS S.NoDocument3 pagesDeductions/recoveries Adjustable in The Book of Treasury/IFMIS S.NoHmingsanga HauhnarNo ratings yet

- Audit Observation 2021Document23 pagesAudit Observation 2021Hmingsanga HauhnarNo ratings yet

- Work Register JJM 2ndDocument13 pagesWork Register JJM 2ndHmingsanga HauhnarNo ratings yet

- CHK Ddo FRM20379Document1 pageCHK Ddo FRM20379Hmingsanga HauhnarNo ratings yet

- Hmeichhiate Dikna ChanvoDocument4 pagesHmeichhiate Dikna ChanvoHmingsanga HauhnarNo ratings yet

- AMBEDKARDocument4 pagesAMBEDKARHmingsanga HauhnarNo ratings yet

- CCS Conduct RulesDocument49 pagesCCS Conduct RulesHmingsanga HauhnarNo ratings yet

- AWDDN A ThawnDocument2 pagesAWDDN A ThawnHmingsanga HauhnarNo ratings yet

- Annexure IIDocument10 pagesAnnexure IIHmingsanga HauhnarNo ratings yet

- Bank StatementDocument1 pageBank StatementHmingsanga HauhnarNo ratings yet

- Ada 2014Document4 pagesAda 2014Hmingsanga HauhnarNo ratings yet

- E - !IT COPY - Social Welfare - UDC 2018Document9 pagesE - !IT COPY - Social Welfare - UDC 2018Hmingsanga HauhnarNo ratings yet

- E - !IT COPY - UDC Under Agricultu 2018Document9 pagesE - !IT COPY - UDC Under Agricultu 2018Hmingsanga HauhnarNo ratings yet

- E - !IT COPY - SAD - UDC Direct Unde 2018Document10 pagesE - !IT COPY - SAD - UDC Direct Unde 2018Hmingsanga HauhnarNo ratings yet

- E !it Copy Udc, Excise Udc Dir 2018Document10 pagesE !it Copy Udc, Excise Udc Dir 2018Hmingsanga HauhnarNo ratings yet

- MR Bill ChungchangDocument2 pagesMR Bill ChungchangHmingsanga HauhnarNo ratings yet

- Om On Opening of SB AccountDocument1 pageOm On Opening of SB AccountHmingsanga HauhnarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pradip kr BhattacharyaNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part Ahelpdesk svscenterNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form PDF 337279780310722Document7 pagesForm PDF 337279780310722hitendraNo ratings yet

- 25 - MCQ Late Filing Fees and PenaltyDocument11 pages25 - MCQ Late Filing Fees and PenaltyRohit KumarNo ratings yet

- Deduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToDocument169 pagesDeduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToRajNo ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- Ekxps0001n 2021Document4 pagesEkxps0001n 2021SiddharthNo ratings yet

- Tds Challan 281 Nov'2021Document6 pagesTds Challan 281 Nov'2021tojendra laltenNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Neeraj JoshiNo ratings yet

- Form PDF 475707440150723Document7 pagesForm PDF 475707440150723Pralay RautNo ratings yet

- Aaafz8016h 2022Document5 pagesAaafz8016h 2022yogiprathmeshNo ratings yet

- Form PDF 345858330310722Document10 pagesForm PDF 345858330310722narasimhahanNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- GBVPM5241K 2020 21Document6 pagesGBVPM5241K 2020 21Nishant RoyNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Akapd2195f 2023Document4 pagesAkapd2195f 2023enjoy enjoy enjoyNo ratings yet

- Form PDF 869004400261222Document10 pagesForm PDF 869004400261222mohilNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 523799420050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 523799420050920 Assessment Year: 2020-21Sushant MishraNo ratings yet

- Dinkar Thakur - ATBPT9919P - 2023-24Document11 pagesDinkar Thakur - ATBPT9919P - 2023-24Dinkar Prasad ThakurNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ElvisPresliiNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Wa0000.Document2 pagesWa0000.anpro1299No ratings yet

- TDS - and - TCS Rate Chart 2024Document5 pagesTDS - and - TCS Rate Chart 2024Taxation KTPL (Kalyani Techpark Taxation)No ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961forty oneNo ratings yet

- Itr4 EnglishDocument7 pagesItr4 Englishvagiw16705No ratings yet

- Name of Assessee: Ghevarchand Premchand Jain PAN: AAUPJ0346ADocument3 pagesName of Assessee: Ghevarchand Premchand Jain PAN: AAUPJ0346ADpr MachineriesNo ratings yet

- A Practical Approach To Tds & Tcs (Amended Upto 31.10.2020) : Ca Rs KalraDocument177 pagesA Practical Approach To Tds & Tcs (Amended Upto 31.10.2020) : Ca Rs KalraRohini UbaleNo ratings yet

- From16 A PDFDocument2 pagesFrom16 A PDFAadarshNo ratings yet