Professional Documents

Culture Documents

Dependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)

Dependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)

Uploaded by

Niranjan JainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)

Dependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)

Uploaded by

Niranjan JainCopyright:

Available Formats

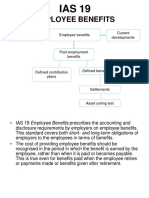

IND AS 19: EMPLOYEE BENEFITS

Financial statements are prepared on the accrual basis of accounting. the effects of transactions and other

events are recognised when they occur and not when cash or its equivalent is received or paid.

Employee benefits include benefits provided either to Employees, their dependants, or their beneficiaries and

Employee includes directors and other management personnel.

Employee benefits may be settled by payments directly to the employees, their spouses, children, other

dependents or insurance companies.

An employee may provide services on a Full time, part time, permanent, casual or temporary basis.

Types of Employee Benefits (STEB, PEB, LTEB, TB) Reporting Period

Short Term Employee Benefits (STEB) – Settled within 12 months from end of R.P. (Eg – Wages, Salaries, Profit

Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits). Remeasurement Gain or Loss in P/L. It is

measured on an Undiscounted Basis.

Post Employee Benefits (PEB) – Payable after completion of employment other than STEB or TB. (Eg Pension,

Gratuity, Provident Fund, Post Employment Medical Care). Remeasurement Gain or Loss recognised in OCI. It is

discounted to Present Value.

Other Long Term Employee Benefits (LTEB) – Not expected to settle wholly before 12 months after end of Annual

R.P. (Eg. – Long term paid absences, long term disability benefits, Profit sharing and bonuses etc.).

Remeasurement Gain or Loss recognised in P/L and not in OCI. It is discounted to Present Value

Termination Benefits – Dealt separately from other benefits because obligation is due to termination of employment rather than

employee service. TB results from i) Entity’s decision to terminate or

ii) Employee accepted entity’s offer of benefits in exchange for termination.

Termination at employee request without entity’s offer are Post Employee Benefits

Short Term Compensated Absences

A) Accumulating

i) Vesting - Cash Payment for Unutilised Leave)

ii) Non Vesting - Not entitled to Cash but Provision made for Leave on expectations

regarding probability of utilisation of unused leaves by employees, Expected salary

increase and Entity’s restriction on Carry forward of leaves.

B) Non Accumulating – Leaves cannot be carried forward and expires. (No A/c treatment)

Refer ill 7 & 8

Profit Sharing and Bonus plan recognised only when Entity has present legal or constructive obligation

to pay as a result of past events and Reliable Estimate of Obligation can be made.

• If settled before 12m after end of Annual R.P. – Short term employee benefits

• If not settled before 12m after end of Annual R.P. – Long term employee benefits.

www.pratikjagati.com CA PRATIK JAGATI

IND AS 19: EMPLOYEE BENEFITS

2. Post Employment Benefits (PEB)

PEBs are classified as either - i) Defined contribution Plan or ii) Defined Benefit Plans.

Defined contribution Plan (DCP) Defined Benefit Plan (DBP)

1. Entity’s Legal or Constructive Obligation limited 1. Entity’s obligation to provide agreed

to contribution of Amount to the fund. benefits to current & former employees.

2. Actuarial or Investment Risk fall to employee. 2. Actuarial or Investment Risk fall to Entity.

(ie Entitys obligation only to contribute) (ie final settlement obligation to entity)

Exceptions to DCP (Means it will be classified as DBP) – Guarantee of a specified return on contribution,

Entity has history of increasing benefits for former employees to keep pace with inflation even if no

legal obligation, Entity provides further contribution if assets are insufficient to meet benefits.

Defined Benefit Plan can be Funded (Plan Asset) or Non Funded. Acturial Valuation is done applying

Projected Unit Credit Method (Refer practical example on Class Notes).

Accounting of Defined Benefit Plan

1. Current service cost – Increase in PVDBO from employee service in current period

2. Past service cost – Change in PVDBO for employee service in prior period resulting from plan

amendment or curtailment.

3. Net Interest on NDBL/NDBA ( Time Basis) – Change in Net defined benefit liability (asset)

that arises from passage of time.

4. Remeasurement of NDBL/NDBA - comprises Actuarial Gain/loss, Return on Plan Asset excl

Net Interest on NDBA/NDBL.

5. Net defined benefit liability (NDBL) – PVDBO less Plan Asset

6. Net defined benefit Asset (NDBA) – Lower of Surplus (ie Plan Asset less PVDBO) or Asset

ceiling

Past Service Cost (PSC) - Change in PVDBO resulting from Modifications, Plan Amendment

or Curtailment is known as Past Service Cost. PSC recognizes as Expense as Earlier of:

i) When Plan Amendments or Curtailment Occurs, or

ii) When entity recognizes related restructuring cost or termination benefits.

Plan Assets - Financial Assets held in a retirement plan and used to generate income to fund

the plan (Eg of plan assets can include stocks, bonds,and mutual fund inv.). It Comprise -

i) Assets held by Long Term Employee Benefit Fund which exists Those Assets are

solely to pay or fund employee benefits. not available to

reporting entity’s

ii) Qualifying Insurance Policies issued by an insurer whose proceeds own creditors even

can be used only to pay or fund employee benefits. in bankruptcy.

www.pratikjagati.com CA PRATIK JAGATI

IND AS 19: EMPLOYEE BENEFITS

Net defined benefit liability = PVDBO less Plan Asset (where PVDBO > Plan Asset )

Net defined benefit Asset = Surplus or Asset Ceiling whichever is lower

if plan asset > PVDBO

Discount Rate is determined by reference to market yield on Govt bonds at R.P. end.

For Subsidiaries, Associates, Joint Venture & Branches outside india, Discount Rate is

determined by reference to market yield on high quality corporate bonds.

If there is no deep markets, Market rate on Govt bonds of that country shall be used.

Curtailment & Settlement

Curtailment arises when entity significantly reduces no. of employees covered by the plan. It

may arise due to closing of a plant, discontinuance of an operation or termination or suspension

of a plan. Curtailment reduces PVDBO

A Settlement occurs when entity enters into transaction that eliminates all further legal or

constructive obligation ( Gain or Loss = PV of obligation settled LESS Settlement Price )

Cash Paid or Plan Assets tfd.

3. Other Long Term Employee Benefits

Accounting of LTEB is same as PEB except that Remeasurement Gain or Loss is recognised In P/L

instead of OCI. The reason is degree of uncertainity in case of LTEB is less as compared to PEB.

4. Termination Benefits

i) Entity’s decision to terminate or ii) Employee accepted entity’s offer of benefits in exchange for termination.

Note

1. Benefits paid should not be conditional on future services being provided by employees.

2. An Entity recognises expenses and liability for termination at earlier of –

a) when entity can no longer withdraw offer of benefits

b) When entity recognises Restructuring Cost and involves payment of termination benefits.

3. If TB expected to be settled wholly before 12m after end of R.P. – Apply STEB Requirements

4. If TB not expected to be settled wholly before 12m after end of R.P – Apply LTEB Requirements

Closing PVDBO on B/s = Opening PVDBO + Interest cost + CSC + PSC – Benefits Paid +- Actuarial

gain or loss

Closing Plan Asset on B/s = Opening Plan Asset + Interest Income + Contribution – Benefits

paid +- Actuarial gain or loss.

www.pratikjagati.com CA PRATIK JAGATI

You might also like

- Sample Contract - Consultancy AgreementDocument7 pagesSample Contract - Consultancy AgreementYicheng QinNo ratings yet

- Employee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansDocument10 pagesEmployee Benefits Related Standards: Pas 19 - Employee Benefits Pas 26 - Accounting & Reporting by Retirement Benefit PlansallyssajabsNo ratings yet

- IAS 19 - Employee BenefitsDocument1 pageIAS 19 - Employee BenefitsClarize R. MabiogNo ratings yet

- PAS 19 Employee BenefitsDocument62 pagesPAS 19 Employee BenefitsBenj FloresNo ratings yet

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariNo ratings yet

- Employee BenefitDocument32 pagesEmployee BenefitnatiNo ratings yet

- Lecture Notes - IAS 19Document14 pagesLecture Notes - IAS 19Muhammed NaqiNo ratings yet

- IAS 19 Employee BenefitsDocument5 pagesIAS 19 Employee Benefitshae1234No ratings yet

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoNo ratings yet

- Csfas Pas19Document30 pagesCsfas Pas19Jack GriffoNo ratings yet

- PAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenDocument5 pagesPAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenKaila Clarisse CortezNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- Module 11 - Employee BenefitsDocument8 pagesModule 11 - Employee BenefitsLuiNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- IAS 19 Employee Benefits (2021)Document6 pagesIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- Lecture # 11: Employee Benefits IAS-19Document3 pagesLecture # 11: Employee Benefits IAS-19ali hassnainNo ratings yet

- Lesson Six: Accounting For Employee BenefitsDocument27 pagesLesson Six: Accounting For Employee BenefitssamclerryNo ratings yet

- Pas 19,20,21Document53 pagesPas 19,20,21ssamporna19157No ratings yet

- Module 18 - Employee Benefits - With AnswersDocument6 pagesModule 18 - Employee Benefits - With AnswersLui100% (1)

- Ias 19 Employee BeneftDocument24 pagesIas 19 Employee Beneftesulawyer2001No ratings yet

- FR17 - Employee Benefits (Stud) .Document45 pagesFR17 - Employee Benefits (Stud) .duong duongNo ratings yet

- 19 Employee Benefits s22 - tesFINALDocument16 pages19 Employee Benefits s22 - tesFINALasiphileamagiqwa25No ratings yet

- Employee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Document10 pagesEmployee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Mica DelaCruzNo ratings yet

- Short Notes - IAS 19Document7 pagesShort Notes - IAS 19Fakhur Zaman Mujeeb Ur RehmanNo ratings yet

- Chapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsDocument50 pagesChapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsLovely AbadianoNo ratings yet

- Module 12 - PAS 19 Employee BenefitsDocument6 pagesModule 12 - PAS 19 Employee BenefitsAKIO HIROKINo ratings yet

- IAS 19 SummaryDocument6 pagesIAS 19 SummaryMuchaa VlogNo ratings yet

- Liabilities - Debt RestructuringDocument4 pagesLiabilities - Debt RestructuringChinchin Ilagan DatayloNo ratings yet

- Post Employment BenefitsDocument31 pagesPost Employment BenefitsSky SoronoiNo ratings yet

- IAS 19 Employee BenefitDocument20 pagesIAS 19 Employee BenefitAklilNo ratings yet

- Employee Benefit (Ias 19) FinalDocument36 pagesEmployee Benefit (Ias 19) FinalKanbiro OrkaidoNo ratings yet

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsDocument11 pagesPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaNo ratings yet

- Ias 19Document43 pagesIas 19Reever RiverNo ratings yet

- Revised PAS 19Document2 pagesRevised PAS 19jjmcjjmc12345No ratings yet

- SBR - Chapter 5Document6 pagesSBR - Chapter 5Jason KumarNo ratings yet

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (2)

- IA2 10 01 Employee Benefits PDFDocument17 pagesIA2 10 01 Employee Benefits PDFAzaria MatiasNo ratings yet

- FARAP-4413 (Post-Employment Benefits)Document5 pagesFARAP-4413 (Post-Employment Benefits)Dizon Ropalito P.No ratings yet

- Pas 19Document5 pagesPas 19elle friasNo ratings yet

- Chapter 6 Employee Benefits (Part 2)Document21 pagesChapter 6 Employee Benefits (Part 2)not funny didn't laughNo ratings yet

- I. Concept Notes IAS19: Employee BenefitsDocument5 pagesI. Concept Notes IAS19: Employee Benefitsem cortezNo ratings yet

- EmployeebenefitsreportDocument172 pagesEmployeebenefitsreportMikaela LacabaNo ratings yet

- Employee Benefits Part 1 PDFDocument21 pagesEmployee Benefits Part 1 PDFHerald JoshuaNo ratings yet

- Module 1 - Employee BenefitsDocument38 pagesModule 1 - Employee BenefitsMitchie Faustino100% (1)

- Handout 3.0 ACC 226 Sample Problems Employee BenefitsDocument12 pagesHandout 3.0 ACC 226 Sample Problems Employee BenefitsLyncee BallescasNo ratings yet

- Employee Benefits IAS 19Document17 pagesEmployee Benefits IAS 19Sbonga Gift Blessedbeyondmeasure MbathaNo ratings yet

- Ias 19-Employee BenefitsDocument3 pagesIas 19-Employee Benefitsbeth alviolaNo ratings yet

- PCOA Module 4 - For LMSDocument5 pagesPCOA Module 4 - For LMSJan JanNo ratings yet

- Revised PAS 19 (PAS 19R) Employee Benefits Technical SummaryDocument4 pagesRevised PAS 19 (PAS 19R) Employee Benefits Technical SummaryJBNo ratings yet

- Chapter 5 Employee Benefit Part 1Document9 pagesChapter 5 Employee Benefit Part 1maria isabellaNo ratings yet

- 1FU491 Employee BenefitsDocument14 pages1FU491 Employee BenefitsEmil DavtyanNo ratings yet

- IAS 19 Employee BenefitsDocument32 pagesIAS 19 Employee BenefitsTamirat Eshetu WoldeNo ratings yet

- Analysis of Finanacing ActivitiesDocument48 pagesAnalysis of Finanacing ActivitiesPrateek SinglaNo ratings yet

- Employees Benefit PalnDocument60 pagesEmployees Benefit PalnHimanshu GaurNo ratings yet

- PAT P13 Notes - Ias 19, 10, Ifrs 11 & Ifrs 12Document14 pagesPAT P13 Notes - Ias 19, 10, Ifrs 11 & Ifrs 12HSFXHFHXNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Pick ListDocument1 pagePick ListNiranjan JainNo ratings yet

- Definitions:: VOL-1 - Ca Pratik JagatiDocument3 pagesDefinitions:: VOL-1 - Ca Pratik JagatiNiranjan JainNo ratings yet

- Readily Convertible Into Known Amount of CashDocument3 pagesReadily Convertible Into Known Amount of CashNiranjan JainNo ratings yet

- C-18 Spec. ShhetDocument6 pagesC-18 Spec. ShhetNiranjan JainNo ratings yet

- AIB CPLT V15W K EN Wuxi 2950 8550 01Document60 pagesAIB CPLT V15W K EN Wuxi 2950 8550 01Niranjan JainNo ratings yet

- Poverty As A ChallangeDocument9 pagesPoverty As A ChallangeDeepakNo ratings yet

- Chapter - 3 Public Relations in India: 3.1 Historical DevelopmentDocument42 pagesChapter - 3 Public Relations in India: 3.1 Historical DevelopmentRhea VermaNo ratings yet

- Maryland Casualty Company v. Pedro Figueroa, 358 F.2d 817, 1st Cir. (1966)Document5 pagesMaryland Casualty Company v. Pedro Figueroa, 358 F.2d 817, 1st Cir. (1966)Scribd Government DocsNo ratings yet

- NSG Education SeminarDocument27 pagesNSG Education SeminarBHUKYA USHARANINo ratings yet

- Business and Society Chapter 2Document10 pagesBusiness and Society Chapter 2rajanityagi23No ratings yet

- Primer On Grievance MachineryDocument37 pagesPrimer On Grievance MachineryRose Ann CalanglangNo ratings yet

- GlobalizationDocument11 pagesGlobalizationJanssen Feihl P. Geyrozaga0% (2)

- 2022 Mba Mba Batchno 203Document83 pages2022 Mba Mba Batchno 203gohildigu90No ratings yet

- The Code of Ethics For Professional TeachersDocument34 pagesThe Code of Ethics For Professional TeachersKen HijastroNo ratings yet

- STS Group 1Document13 pagesSTS Group 1Patrick CortesNo ratings yet

- Privacy Notice For Heliix FINALDocument9 pagesPrivacy Notice For Heliix FINALHari HaranNo ratings yet

- 53 53 Impartant Labour Judgments 2009Document28 pages53 53 Impartant Labour Judgments 2009Anonymous 1Ye0Go7Ku100% (1)

- Hogan Interpretation Slides Eli ZelkhaDocument13 pagesHogan Interpretation Slides Eli ZelkhaCol Shankar100% (2)

- 11 Economics Notes Ch15Document5 pages11 Economics Notes Ch15HackerzillaNo ratings yet

- Qatar Labour LawDocument34 pagesQatar Labour LawMadhurima HemaniNo ratings yet

- Oap NC IiDocument92 pagesOap NC IiagnesNo ratings yet

- Form of ContractDocument74 pagesForm of ContractSyattah Min Ki100% (1)

- Comm3020 AssignmentDocument7 pagesComm3020 Assignmentapi-291849652No ratings yet

- Development EconomicsDocument11 pagesDevelopment EconomicsRahmathullah BaluchNo ratings yet

- Quality of Work Life - ICICIDocument94 pagesQuality of Work Life - ICICIArunKumarNo ratings yet

- Risk Assessment in Construction PDFDocument50 pagesRisk Assessment in Construction PDFdanudmwNo ratings yet

- Anthony GiddensDocument15 pagesAnthony GiddensGalang LegowoNo ratings yet

- Ikwezi April 1977Document79 pagesIkwezi April 1977ferneaux81No ratings yet

- Plano Animal Shelter ProjectDocument16 pagesPlano Animal Shelter ProjectCara DoughertyNo ratings yet

- (123doc) Tieng Anh GV Vu Mai Phuong Sach Tham Khao de 11 Image Marked Image MarkedDocument17 pages(123doc) Tieng Anh GV Vu Mai Phuong Sach Tham Khao de 11 Image Marked Image MarkedTrang ThuNo ratings yet

- Software Requirement Specification: Micro Finance SolutionsDocument14 pagesSoftware Requirement Specification: Micro Finance Solutionsshruti_04No ratings yet

- FAQ - Leave PDFDocument8 pagesFAQ - Leave PDFVIJAY KUMAR HEERNo ratings yet

- A Marxist Criticism of Marissa Reorizo-Redburn's Service TeaDocument2 pagesA Marxist Criticism of Marissa Reorizo-Redburn's Service TeaGomer MagtibayNo ratings yet

- Human Resource Management QuestionnaireDocument4 pagesHuman Resource Management QuestionnairerishiNo ratings yet