Professional Documents

Culture Documents

The Mba As A Finance Case - Sumit Malik

The Mba As A Finance Case - Sumit Malik

Uploaded by

drgreen244Copyright:

Available Formats

You might also like

- PGMP Complete Reference SampleDocument45 pagesPGMP Complete Reference Samplemhamrawy100% (3)

- C Planning Campaigns - April 2021Document23 pagesC Planning Campaigns - April 2021George Osolo100% (3)

- Crocs Inc. STRAMA PaperDocument22 pagesCrocs Inc. STRAMA PaperAnne Marieline Buenaventura100% (2)

- BusinessBecause MBA Funding GuideDocument19 pagesBusinessBecause MBA Funding GuideoraywattNo ratings yet

- Is MBA A Rat RaceDocument1 pageIs MBA A Rat RaceSona DuttaNo ratings yet

- Go Mba: Investment AdviceDocument5 pagesGo Mba: Investment AdvicenabuashviliNo ratings yet

- Mba Finance CourseworkDocument7 pagesMba Finance Courseworkbcrqs9hr100% (2)

- BB Cost of Mba Report 2022 PDFDocument17 pagesBB Cost of Mba Report 2022 PDFNfaNo ratings yet

- Scope of MBA in IndiaDocument4 pagesScope of MBA in IndiaSmu MidNo ratings yet

- Global MBADocument6 pagesGlobal MBAomkar nadavadekarNo ratings yet

- Rivers Project 1 Third and Final DraftDocument13 pagesRivers Project 1 Third and Final Draftapi-547629172No ratings yet

- Georgetown Business Spring/Summer 1998Document28 pagesGeorgetown Business Spring/Summer 1998tmm53No ratings yet

- Branding MBA Programs - The Use of Target Market Desired Outcomes For Effective Brand PositioningDocument34 pagesBranding MBA Programs - The Use of Target Market Desired Outcomes For Effective Brand PositioningKnott Abdul HamidNo ratings yet

- AssignmentsDocument4 pagesAssignmentsAnitha ONo ratings yet

- The Economist - 20170506 79Document1 pageThe Economist - 20170506 79Mario Alejandro Pérez GutiérrezNo ratings yet

- LBS Employement Report PDFDocument14 pagesLBS Employement Report PDFarisht jainxNo ratings yet

- Academic MBA Programs For The 21 Century Workforce DevelopmentDocument12 pagesAcademic MBA Programs For The 21 Century Workforce DevelopmentaijbmNo ratings yet

- 2000 MSB Magazine Spring SummerDocument44 pages2000 MSB Magazine Spring Summertmm53No ratings yet

- Maroon and White Minimalist Modern Website Development and Digital Marketing Proposal-6Document11 pagesMaroon and White Minimalist Modern Website Development and Digital Marketing Proposal-6api-617753904No ratings yet

- 407 ArticleText 1263 1 10 20220513Document12 pages407 ArticleText 1263 1 10 20220513Adrian BaliloNo ratings yet

- Context: Academic Skills, Employability Skills, and Technical, Career-Specific SkillsDocument3 pagesContext: Academic Skills, Employability Skills, and Technical, Career-Specific SkillsMohitAhujaNo ratings yet

- Harvard Mba CourseworkDocument8 pagesHarvard Mba Courseworkafiwfnofb100% (2)

- What Is BBADocument2 pagesWhat Is BBAJatin KharbandaNo ratings yet

- IveyMBA Permanent Employment ReportDocument13 pagesIveyMBA Permanent Employment Reportelton6henriquesNo ratings yet

- Qs Mba Roi Report 2018 v2 PDFDocument26 pagesQs Mba Roi Report 2018 v2 PDFIndra SarNo ratings yet

- Gmac Roi AnalysisDocument12 pagesGmac Roi AnalysisdecnovNo ratings yet

- 2000 MSB Magazine Fall WinterDocument32 pages2000 MSB Magazine Fall Wintertmm53No ratings yet

- DFBE Placement Report 2021 22Document10 pagesDFBE Placement Report 2021 22Devesh SinghNo ratings yet

- WashUolin Entrepreneurship-SellsheetDocument2 pagesWashUolin Entrepreneurship-SellsheetmalinginternetNo ratings yet

- Affordable MBA Programs in CanadaDocument17 pagesAffordable MBA Programs in CanadaChannpreet Singh SabharwalNo ratings yet

- Questions Approfondies D'economie M. Cincera - J. RavetDocument29 pagesQuestions Approfondies D'economie M. Cincera - J. RavetleakarkNo ratings yet

- PoetsQuants What Business School Professors Are Paid May Surprise YouDocument1 pagePoetsQuants What Business School Professors Are Paid May Surprise YouFaze amuzante '16No ratings yet

- FinalProjects-Wi20 - FinalProject - Group010.ipynb at Master COGS108 - FinalProjects-Wi20Document25 pagesFinalProjects-Wi20 - FinalProject - Group010.ipynb at Master COGS108 - FinalProjects-Wi20Dickson Mugo Wambui TU01SC21107032019No ratings yet

- Collapse Subdiscussion Jodi JohnsonDocument2 pagesCollapse Subdiscussion Jodi JohnsonBeniah TussahNo ratings yet

- Bachelor of Business AdministrationDocument4 pagesBachelor of Business AdministrationMd. Ariful HaqueNo ratings yet

- Articulos Originales MbaDocument40 pagesArticulos Originales MbaJuan SantosNo ratings yet

- Sohan Angal-8136775Document6 pagesSohan Angal-8136775sohanangalNo ratings yet

- Resource Book 1Document4 pagesResource Book 1Kanza MusharrafNo ratings yet

- Why MBADocument3 pagesWhy MBAashokkmr123No ratings yet

- Everette E. Dennis, Sharon P. Smith - Finding The Best Business School For You - Looking Past The Rankings (2006, Praeger) PDFDocument221 pagesEverette E. Dennis, Sharon P. Smith - Finding The Best Business School For You - Looking Past The Rankings (2006, Praeger) PDFAniket NairNo ratings yet

- #Jobsecurityand and For The Recent Graduates, The Welcome To TheDocument1 page#Jobsecurityand and For The Recent Graduates, The Welcome To TheDaksh AnejaNo ratings yet

- Marketing HigherDocument8 pagesMarketing HigherWabisa AsifNo ratings yet

- Finance Graduates Knowledge and Skills Development Graduate and Employer Perceptions in United Arab Emirates 2022-04-07 11 - 39 - 03Document8 pagesFinance Graduates Knowledge and Skills Development Graduate and Employer Perceptions in United Arab Emirates 2022-04-07 11 - 39 - 03norimomo 911No ratings yet

- Borderless Financing: For Tomorrow's Global LeadersDocument15 pagesBorderless Financing: For Tomorrow's Global Leadersstephjohnson15No ratings yet

- 23 Annual CBA WeekDocument8 pages23 Annual CBA WeekRaymart E. PabiLonaNo ratings yet

- Managerial Economics CEC 1Document13 pagesManagerial Economics CEC 1arkaprava paulNo ratings yet

- Mba CourseworkDocument6 pagesMba Courseworkf5dct2q8100% (2)

- Department of Economics Working Paper SeriesDocument36 pagesDepartment of Economics Working Paper SeriesChittesh SachdevaNo ratings yet

- Mba Thesis ReportsDocument4 pagesMba Thesis ReportsPaperWriterUK100% (2)

- Boler School of Business Annual ReportDocument36 pagesBoler School of Business Annual ReportjohncarrolluniversityNo ratings yet

- SistprojectDocument6 pagesSistprojectAbdulazizNo ratings yet

- The MBA Qualification JacobDocument13 pagesThe MBA Qualification JacobShivagami GuganNo ratings yet

- Bge CSC16Document2 pagesBge CSC16Maha MadhuNo ratings yet

- Haas Recruit05Document16 pagesHaas Recruit05chienNo ratings yet

- People in The Coming Years: Investigate Report On The Demand For College TrainedDocument10 pagesPeople in The Coming Years: Investigate Report On The Demand For College TrainedAshutosh Kumar DubeyNo ratings yet

- Universum FTIS 2 FS Report PDFDocument27 pagesUniversum FTIS 2 FS Report PDFSaiganesh KrishnamoorthyNo ratings yet

- CBS MBA FT BrochureDocument8 pagesCBS MBA FT BrochureMarc-Rémy N'driNo ratings yet

- BBA (Bachelor of Business Administration) : (1) - About The CourseDocument7 pagesBBA (Bachelor of Business Administration) : (1) - About The Courseswathi palaniswamyNo ratings yet

- 2 Updated VISA Interview QADocument21 pages2 Updated VISA Interview QAsharikajahan456No ratings yet

- Vaishnavi Dandekar - Financial Performance Commercial BankDocument67 pagesVaishnavi Dandekar - Financial Performance Commercial BankMitesh Prajapati 7765No ratings yet

- Social Media: Leadership in The MBA ClassroomDocument7 pagesSocial Media: Leadership in The MBA ClassroomShubham DeolNo ratings yet

- Why Are You Here and Not Somewhere Else: Selected EssaysFrom EverandWhy Are You Here and Not Somewhere Else: Selected EssaysRating: 5 out of 5 stars5/5 (1)

- The Doctor of Business Administration: Taking your professional practice to the next levelFrom EverandThe Doctor of Business Administration: Taking your professional practice to the next levelNo ratings yet

- Web Design RFP SampleDocument9 pagesWeb Design RFP Samplebarneygurl0% (1)

- TSI SBSP BrochureDocument12 pagesTSI SBSP BrochureShafreej HidayathNo ratings yet

- Lean Customer Returns (BDD - MX) : Test Script SAP S/4HANA - 29-09-22Document31 pagesLean Customer Returns (BDD - MX) : Test Script SAP S/4HANA - 29-09-22Enrique MarquezNo ratings yet

- Roles of Comm DirectorDocument10 pagesRoles of Comm DirectorSukhdeepNo ratings yet

- Secretary Day - Secretaries, PAs, and EAsDocument4 pagesSecretary Day - Secretaries, PAs, and EAsMr MathipsNo ratings yet

- Budget Manning 2022 V01Document13 pagesBudget Manning 2022 V01Marnhy SNo ratings yet

- Warren County EDA Communication On Lawsuit Against Director On FraudDocument2 pagesWarren County EDA Communication On Lawsuit Against Director On FraudBeverly TranNo ratings yet

- Electronic Data InterchangeDocument8 pagesElectronic Data InterchangealbertNo ratings yet

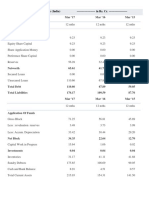

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- List of Delegates / Visitors To The Pharmexcil - India Pavilion CPHI 2005Document3 pagesList of Delegates / Visitors To The Pharmexcil - India Pavilion CPHI 2005katsinelis greenhouseNo ratings yet

- Emabb Ebook - Share 150523Document8 pagesEmabb Ebook - Share 150523Suyitno Bunga Abimanyu RetnoNo ratings yet

- MA Course Outline (Revised)Document4 pagesMA Course Outline (Revised)Ali Adil0% (1)

- Compliance Audit and Corporate Financial Performance-Banks in Rivers StateDocument9 pagesCompliance Audit and Corporate Financial Performance-Banks in Rivers StateAlexander DeckerNo ratings yet

- Tax Drills Weeks 1-7 & DiagnosticDocument119 pagesTax Drills Weeks 1-7 & DiagnosticMitch MinglanaNo ratings yet

- Surveillance 02 Audit Report (Remote) - BRSU TABANAN BALI PDFDocument20 pagesSurveillance 02 Audit Report (Remote) - BRSU TABANAN BALI PDFTantie WidyaNo ratings yet

- SBR Text BookDocument889 pagesSBR Text BookRiaz Ibrahim100% (3)

- Case 2 9 Coping With Piracy in ChinaDocument3 pagesCase 2 9 Coping With Piracy in Chinaesraa karam0% (1)

- Enterprise Security Risk Management: Data Is PotentialDocument15 pagesEnterprise Security Risk Management: Data Is PotentialKampeephorn SantipojchanaNo ratings yet

- Wazir Advisors - Wastra Credential DocumentDocument12 pagesWazir Advisors - Wastra Credential DocumentPriyam PanditNo ratings yet

- EY The New Case For Shared ServicesDocument12 pagesEY The New Case For Shared ServicesRahul MandalNo ratings yet

- Case 1: Location-Based Marketing and AdvertisingDocument15 pagesCase 1: Location-Based Marketing and AdvertisingAdinda Salsabila0% (2)

- Tmint Creative - Penelusuran GoogleDocument1 pageTmint Creative - Penelusuran GoogleNur ImanahNo ratings yet

- Reflection Paper - Pledge 1% Model - Ronan VillagonzaloDocument1 pageReflection Paper - Pledge 1% Model - Ronan Villagonzaloronan.villagonzaloNo ratings yet

- Ruang Seminar 02.06.2023 - Effective Technique For Internal AuditDocument29 pagesRuang Seminar 02.06.2023 - Effective Technique For Internal Auditmuhammad alhamamiNo ratings yet

- Module 22Document23 pagesModule 22FUNIC CameroonNo ratings yet

- Mergers, Acquisitions, and Corporate Control: Fundamentals of Corporate FinanceDocument19 pagesMergers, Acquisitions, and Corporate Control: Fundamentals of Corporate FinanceMuh BilalNo ratings yet

- Job Vacancy Announcement Action Contre La Faim-Myanmar: Head of Project (Nutrition)Document3 pagesJob Vacancy Announcement Action Contre La Faim-Myanmar: Head of Project (Nutrition)draftdelete101 errorNo ratings yet

The Mba As A Finance Case - Sumit Malik

The Mba As A Finance Case - Sumit Malik

Uploaded by

drgreen244Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Mba As A Finance Case - Sumit Malik

The Mba As A Finance Case - Sumit Malik

Uploaded by

drgreen244Copyright:

Available Formats

PAGE FOUR THE HARBUS NEWS FEBRUARY 2018

OPINION AND COMMENT

The MBA

as a Finance Case

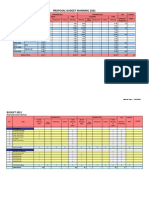

Editor-in-Chief Sum,it Malik (HBS '19) exam,ines the MBA through the lens of a FIN case,

illustrating that even setting aside the substantial personal, professional, and experiential

benefits of the degree, students can expect a robust return on their investm,ent.

$300

-~ f,400

t:

'"

-.;

"" $200

5

E

.,:,,

0,:.

$0

i 8 9 ID 11 12 13 14 15 16 17 18 1Q 20 21 11 23 24 2:5 26 27 28 2g :l O 31 32 3:l 34 35 36 37 '.l8 39 40

~ Year

.2

($200)

($400)

Exhibit: illustrative Earnings Increase with MBA

SumitMalik of the program. The HBS rate of 2%, close to inflation.

Editor-in-Chief experience, designed around For comparison, income "Students and alumni chara.cteri.ze the strength

a mission to "educate leaders before obtaining an MBA of ofthe community and enduring relationships

who make a difference in $85K is plotted in black with

the world," teaches students the same growth trajectory. that itfosters as invaluable. The earnings

to embrace and harness The result is that the costs premium afforded by the MBA is a single

diversity of thought, create of the MBA-both the tuition consideration out ofa much broader set."

With Round I MBA value for society before and fees of about $80K per

admissions in the books and claiming value from society, year and two years of forgone

Round 2 underway, we are and show leadership both salary-are recouped through Council (GMAC), which not preclude becoming part

now seeing the mix of HBS inside and outside the higher earnings within 5-6 manages the Graduate of this community, a cause

campus visitors shift from workplace. Students and years of graduation. Here, as Management Admission that HBS backs up with an

Class of2020 hopefuls toward alumni characterize the a purely financial investment, Test (GMAT) exam required annual financial aid budget

Class of 2021 prospects. For strength of the community the annual internal rate of to apply to most business of over $30 million. Even

many, the decision to apply and enduring relationships return is upwards of 20% schools, estimates that for the most challenging,

entails weighing benefits that it fosters as invaluable. over 40 years of employment. MBAs across all business idiosyncratic cases, the

of the MBA-facilitating The earnings premium Importantly, this analysis is schools may see a cumulative university is committed to

personal and professional afforded by the MBA is a illustrative and simplified: earnings bump reaching ensuring that, from a financial

growth, gaining access to a single consideration out of a I assume a student with no seven figures over the course perspective, the numbers add

strong brand and network, much broader set. partner or children, wage of 20 years, relative to peers up.

taking the opportunity for Turning to the numbers, growth follows the same who skipped the degree,

introspection and self- in naming HBS its top trajectory with or without depending on wage growth.

reflection, honing managerial business school for 20 I 7, an MBA, and the MBA The return on investment in Sumit Malik (HBS '19) is an

skills-against the significant Bloomberg compiled data is financed with savings. monetary terms at HBS is investor, writer, and entrepreneur.

financial investment, both on median compensation for Furthermore, post-MBA amplified by the generous Prefessional!J; his background

in terms of tuition costs and a student entering the HBS salary is not perfectly financial aid offered by the is in venture capital and private

forgone salary. In practice, MBA program ($85K), salary comparable with pre-MBA university: roughly half of equity at Warburg Pincus, strategy

however, if you come to HBS, at the first job after graduating salary given much of the HBS students are eligible as a board member ef Santander

you can expect the degree to ($ l 50K), and compensation median compensation boost for need-based fellowships, Asset Management Chile, and

pay for itself within a handful 6-8 years later ($280K). is likely driven by rotation which average $37K per year. investment banking al Goldman

of years through increased The Exhibit illustrates into higher-paying and HBS has a deeply rooted

interest in ensuring that its Sachs. Personal/); he writes far

earnings, even if you shell this earnings trajectory potentially more demanding academic and popul.ar publications

out sticker price. in crimson, assuming the industries. classrooms and campus are

Critically , While individual repletewithdiverse,impactful and performs music and poi (light-

roughly 9% implied annual

notwithstanding the expected growth in post-MBA circumstances vary, the voices, which contribute to or fire-spinning). He previously

financial return on investment compensation from $ l 50K to takeaway is that for most the academic experience received anA.B., summa cum l.aud~

of the MBA, reducing the $280K subsequently ramps there is a strong financial case in unquantifiable ways. from Harvard College and an S.M.

benefits to economic terms down to a long-term growth for the MBA. The Graduate There's an ardent belief that from the Harvard Graduate School

alone would miss the point Management Admission financial constraints should ef Aris and Sciences.

You might also like

- PGMP Complete Reference SampleDocument45 pagesPGMP Complete Reference Samplemhamrawy100% (3)

- C Planning Campaigns - April 2021Document23 pagesC Planning Campaigns - April 2021George Osolo100% (3)

- Crocs Inc. STRAMA PaperDocument22 pagesCrocs Inc. STRAMA PaperAnne Marieline Buenaventura100% (2)

- BusinessBecause MBA Funding GuideDocument19 pagesBusinessBecause MBA Funding GuideoraywattNo ratings yet

- Is MBA A Rat RaceDocument1 pageIs MBA A Rat RaceSona DuttaNo ratings yet

- Go Mba: Investment AdviceDocument5 pagesGo Mba: Investment AdvicenabuashviliNo ratings yet

- Mba Finance CourseworkDocument7 pagesMba Finance Courseworkbcrqs9hr100% (2)

- BB Cost of Mba Report 2022 PDFDocument17 pagesBB Cost of Mba Report 2022 PDFNfaNo ratings yet

- Scope of MBA in IndiaDocument4 pagesScope of MBA in IndiaSmu MidNo ratings yet

- Global MBADocument6 pagesGlobal MBAomkar nadavadekarNo ratings yet

- Rivers Project 1 Third and Final DraftDocument13 pagesRivers Project 1 Third and Final Draftapi-547629172No ratings yet

- Georgetown Business Spring/Summer 1998Document28 pagesGeorgetown Business Spring/Summer 1998tmm53No ratings yet

- Branding MBA Programs - The Use of Target Market Desired Outcomes For Effective Brand PositioningDocument34 pagesBranding MBA Programs - The Use of Target Market Desired Outcomes For Effective Brand PositioningKnott Abdul HamidNo ratings yet

- AssignmentsDocument4 pagesAssignmentsAnitha ONo ratings yet

- The Economist - 20170506 79Document1 pageThe Economist - 20170506 79Mario Alejandro Pérez GutiérrezNo ratings yet

- LBS Employement Report PDFDocument14 pagesLBS Employement Report PDFarisht jainxNo ratings yet

- Academic MBA Programs For The 21 Century Workforce DevelopmentDocument12 pagesAcademic MBA Programs For The 21 Century Workforce DevelopmentaijbmNo ratings yet

- 2000 MSB Magazine Spring SummerDocument44 pages2000 MSB Magazine Spring Summertmm53No ratings yet

- Maroon and White Minimalist Modern Website Development and Digital Marketing Proposal-6Document11 pagesMaroon and White Minimalist Modern Website Development and Digital Marketing Proposal-6api-617753904No ratings yet

- 407 ArticleText 1263 1 10 20220513Document12 pages407 ArticleText 1263 1 10 20220513Adrian BaliloNo ratings yet

- Context: Academic Skills, Employability Skills, and Technical, Career-Specific SkillsDocument3 pagesContext: Academic Skills, Employability Skills, and Technical, Career-Specific SkillsMohitAhujaNo ratings yet

- Harvard Mba CourseworkDocument8 pagesHarvard Mba Courseworkafiwfnofb100% (2)

- What Is BBADocument2 pagesWhat Is BBAJatin KharbandaNo ratings yet

- IveyMBA Permanent Employment ReportDocument13 pagesIveyMBA Permanent Employment Reportelton6henriquesNo ratings yet

- Qs Mba Roi Report 2018 v2 PDFDocument26 pagesQs Mba Roi Report 2018 v2 PDFIndra SarNo ratings yet

- Gmac Roi AnalysisDocument12 pagesGmac Roi AnalysisdecnovNo ratings yet

- 2000 MSB Magazine Fall WinterDocument32 pages2000 MSB Magazine Fall Wintertmm53No ratings yet

- DFBE Placement Report 2021 22Document10 pagesDFBE Placement Report 2021 22Devesh SinghNo ratings yet

- WashUolin Entrepreneurship-SellsheetDocument2 pagesWashUolin Entrepreneurship-SellsheetmalinginternetNo ratings yet

- Affordable MBA Programs in CanadaDocument17 pagesAffordable MBA Programs in CanadaChannpreet Singh SabharwalNo ratings yet

- Questions Approfondies D'economie M. Cincera - J. RavetDocument29 pagesQuestions Approfondies D'economie M. Cincera - J. RavetleakarkNo ratings yet

- PoetsQuants What Business School Professors Are Paid May Surprise YouDocument1 pagePoetsQuants What Business School Professors Are Paid May Surprise YouFaze amuzante '16No ratings yet

- FinalProjects-Wi20 - FinalProject - Group010.ipynb at Master COGS108 - FinalProjects-Wi20Document25 pagesFinalProjects-Wi20 - FinalProject - Group010.ipynb at Master COGS108 - FinalProjects-Wi20Dickson Mugo Wambui TU01SC21107032019No ratings yet

- Collapse Subdiscussion Jodi JohnsonDocument2 pagesCollapse Subdiscussion Jodi JohnsonBeniah TussahNo ratings yet

- Bachelor of Business AdministrationDocument4 pagesBachelor of Business AdministrationMd. Ariful HaqueNo ratings yet

- Articulos Originales MbaDocument40 pagesArticulos Originales MbaJuan SantosNo ratings yet

- Sohan Angal-8136775Document6 pagesSohan Angal-8136775sohanangalNo ratings yet

- Resource Book 1Document4 pagesResource Book 1Kanza MusharrafNo ratings yet

- Why MBADocument3 pagesWhy MBAashokkmr123No ratings yet

- Everette E. Dennis, Sharon P. Smith - Finding The Best Business School For You - Looking Past The Rankings (2006, Praeger) PDFDocument221 pagesEverette E. Dennis, Sharon P. Smith - Finding The Best Business School For You - Looking Past The Rankings (2006, Praeger) PDFAniket NairNo ratings yet

- #Jobsecurityand and For The Recent Graduates, The Welcome To TheDocument1 page#Jobsecurityand and For The Recent Graduates, The Welcome To TheDaksh AnejaNo ratings yet

- Marketing HigherDocument8 pagesMarketing HigherWabisa AsifNo ratings yet

- Finance Graduates Knowledge and Skills Development Graduate and Employer Perceptions in United Arab Emirates 2022-04-07 11 - 39 - 03Document8 pagesFinance Graduates Knowledge and Skills Development Graduate and Employer Perceptions in United Arab Emirates 2022-04-07 11 - 39 - 03norimomo 911No ratings yet

- Borderless Financing: For Tomorrow's Global LeadersDocument15 pagesBorderless Financing: For Tomorrow's Global Leadersstephjohnson15No ratings yet

- 23 Annual CBA WeekDocument8 pages23 Annual CBA WeekRaymart E. PabiLonaNo ratings yet

- Managerial Economics CEC 1Document13 pagesManagerial Economics CEC 1arkaprava paulNo ratings yet

- Mba CourseworkDocument6 pagesMba Courseworkf5dct2q8100% (2)

- Department of Economics Working Paper SeriesDocument36 pagesDepartment of Economics Working Paper SeriesChittesh SachdevaNo ratings yet

- Mba Thesis ReportsDocument4 pagesMba Thesis ReportsPaperWriterUK100% (2)

- Boler School of Business Annual ReportDocument36 pagesBoler School of Business Annual ReportjohncarrolluniversityNo ratings yet

- SistprojectDocument6 pagesSistprojectAbdulazizNo ratings yet

- The MBA Qualification JacobDocument13 pagesThe MBA Qualification JacobShivagami GuganNo ratings yet

- Bge CSC16Document2 pagesBge CSC16Maha MadhuNo ratings yet

- Haas Recruit05Document16 pagesHaas Recruit05chienNo ratings yet

- People in The Coming Years: Investigate Report On The Demand For College TrainedDocument10 pagesPeople in The Coming Years: Investigate Report On The Demand For College TrainedAshutosh Kumar DubeyNo ratings yet

- Universum FTIS 2 FS Report PDFDocument27 pagesUniversum FTIS 2 FS Report PDFSaiganesh KrishnamoorthyNo ratings yet

- CBS MBA FT BrochureDocument8 pagesCBS MBA FT BrochureMarc-Rémy N'driNo ratings yet

- BBA (Bachelor of Business Administration) : (1) - About The CourseDocument7 pagesBBA (Bachelor of Business Administration) : (1) - About The Courseswathi palaniswamyNo ratings yet

- 2 Updated VISA Interview QADocument21 pages2 Updated VISA Interview QAsharikajahan456No ratings yet

- Vaishnavi Dandekar - Financial Performance Commercial BankDocument67 pagesVaishnavi Dandekar - Financial Performance Commercial BankMitesh Prajapati 7765No ratings yet

- Social Media: Leadership in The MBA ClassroomDocument7 pagesSocial Media: Leadership in The MBA ClassroomShubham DeolNo ratings yet

- Why Are You Here and Not Somewhere Else: Selected EssaysFrom EverandWhy Are You Here and Not Somewhere Else: Selected EssaysRating: 5 out of 5 stars5/5 (1)

- The Doctor of Business Administration: Taking your professional practice to the next levelFrom EverandThe Doctor of Business Administration: Taking your professional practice to the next levelNo ratings yet

- Web Design RFP SampleDocument9 pagesWeb Design RFP Samplebarneygurl0% (1)

- TSI SBSP BrochureDocument12 pagesTSI SBSP BrochureShafreej HidayathNo ratings yet

- Lean Customer Returns (BDD - MX) : Test Script SAP S/4HANA - 29-09-22Document31 pagesLean Customer Returns (BDD - MX) : Test Script SAP S/4HANA - 29-09-22Enrique MarquezNo ratings yet

- Roles of Comm DirectorDocument10 pagesRoles of Comm DirectorSukhdeepNo ratings yet

- Secretary Day - Secretaries, PAs, and EAsDocument4 pagesSecretary Day - Secretaries, PAs, and EAsMr MathipsNo ratings yet

- Budget Manning 2022 V01Document13 pagesBudget Manning 2022 V01Marnhy SNo ratings yet

- Warren County EDA Communication On Lawsuit Against Director On FraudDocument2 pagesWarren County EDA Communication On Lawsuit Against Director On FraudBeverly TranNo ratings yet

- Electronic Data InterchangeDocument8 pagesElectronic Data InterchangealbertNo ratings yet

- Balance Sheet of Shakti PumpsDocument2 pagesBalance Sheet of Shakti PumpsAnonymous 3OudFL5xNo ratings yet

- List of Delegates / Visitors To The Pharmexcil - India Pavilion CPHI 2005Document3 pagesList of Delegates / Visitors To The Pharmexcil - India Pavilion CPHI 2005katsinelis greenhouseNo ratings yet

- Emabb Ebook - Share 150523Document8 pagesEmabb Ebook - Share 150523Suyitno Bunga Abimanyu RetnoNo ratings yet

- MA Course Outline (Revised)Document4 pagesMA Course Outline (Revised)Ali Adil0% (1)

- Compliance Audit and Corporate Financial Performance-Banks in Rivers StateDocument9 pagesCompliance Audit and Corporate Financial Performance-Banks in Rivers StateAlexander DeckerNo ratings yet

- Tax Drills Weeks 1-7 & DiagnosticDocument119 pagesTax Drills Weeks 1-7 & DiagnosticMitch MinglanaNo ratings yet

- Surveillance 02 Audit Report (Remote) - BRSU TABANAN BALI PDFDocument20 pagesSurveillance 02 Audit Report (Remote) - BRSU TABANAN BALI PDFTantie WidyaNo ratings yet

- SBR Text BookDocument889 pagesSBR Text BookRiaz Ibrahim100% (3)

- Case 2 9 Coping With Piracy in ChinaDocument3 pagesCase 2 9 Coping With Piracy in Chinaesraa karam0% (1)

- Enterprise Security Risk Management: Data Is PotentialDocument15 pagesEnterprise Security Risk Management: Data Is PotentialKampeephorn SantipojchanaNo ratings yet

- Wazir Advisors - Wastra Credential DocumentDocument12 pagesWazir Advisors - Wastra Credential DocumentPriyam PanditNo ratings yet

- EY The New Case For Shared ServicesDocument12 pagesEY The New Case For Shared ServicesRahul MandalNo ratings yet

- Case 1: Location-Based Marketing and AdvertisingDocument15 pagesCase 1: Location-Based Marketing and AdvertisingAdinda Salsabila0% (2)

- Tmint Creative - Penelusuran GoogleDocument1 pageTmint Creative - Penelusuran GoogleNur ImanahNo ratings yet

- Reflection Paper - Pledge 1% Model - Ronan VillagonzaloDocument1 pageReflection Paper - Pledge 1% Model - Ronan Villagonzaloronan.villagonzaloNo ratings yet

- Ruang Seminar 02.06.2023 - Effective Technique For Internal AuditDocument29 pagesRuang Seminar 02.06.2023 - Effective Technique For Internal Auditmuhammad alhamamiNo ratings yet

- Module 22Document23 pagesModule 22FUNIC CameroonNo ratings yet

- Mergers, Acquisitions, and Corporate Control: Fundamentals of Corporate FinanceDocument19 pagesMergers, Acquisitions, and Corporate Control: Fundamentals of Corporate FinanceMuh BilalNo ratings yet

- Job Vacancy Announcement Action Contre La Faim-Myanmar: Head of Project (Nutrition)Document3 pagesJob Vacancy Announcement Action Contre La Faim-Myanmar: Head of Project (Nutrition)draftdelete101 errorNo ratings yet