Professional Documents

Culture Documents

Lecture # 43

Lecture # 43

Uploaded by

Hussain0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

43. Lecture # 43

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesLecture # 43

Lecture # 43

Uploaded by

HussainCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Integrated Questions

Lecture # 43

Notes to the Financial Statements

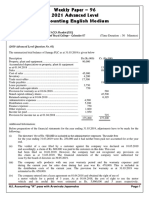

Question # 09 Page # 134 (Autumn-19 Q # 06-17 Marks) Cost/Revalued Accumulated

Assets

The following information pertains to Monday Limited (ML): amount depreciation

(i) The balances of property, plant and equipment as on 1 January 2018: Rs. in million

Revaluation surplus related to the office building as at 1 January 2018 Office building 240 36

amounted to Rs.8.5 million. Equipment 190 60

(ii) On 1 September 2018, a new equipment was acquired by making payment of Rs.70 million to the supplier. An old

equipment was also given in exchange to the supplier. The fair values of the old and new equipment were

assessed at Rs.21 million and Rs.93 million respectively. The old equipment had been acquired at a cost of Rs.40

million on 1 July 2016. Cost incurred on installing the new equipment amounted to Rs.5 million.

(iii) On 1 January 2018, ML commenced construction of a manufacturing plant. The whole process of assembling and

installation was completed on 31October 2018. However, the work was stopped from 16 to 31 August-2018 due

to unexpected rains. The total cost of Rs.660 million incurred on the plant was paid as under:

The plant was financed through a bank loan of Rs.500 million obtained Description Payment date Rs.in million

1st payment 1 February 2018 140

on 1 March 2018. The loan carries a mark-up of 18% payable annually. 2nd payment 1 April 2018 214

The surplus funds available from the loan were invested in a saving 3rd payment 1 September 2018 146

account and earned Rs.17 million during capitalization period. 4th payment 1 December 2018 160

(iv)31 December 2018, the revalued amount of office building was assessed at Rs.178 million by Precise Valuers, an

independent valuation firm. Value in use of the office building as at 31.12.18 was estimated at Rs.186 million.

(v) Other relevant details are as follows: Depreciation Subsequent

Assets Life/rate

ML accounts for revaluation on net replacement method measurement

Office building Straight line 20 years* Revaluation

value method and transfers the maximum possible Equipment Reducing balance 20% Cost

amount from revaluation surplus to retained Manufacturing plant Straight line 15 years Cost

earnings on an annual basis. * Remaining life at the date of last revaluation

Required: In accordance with IFRSs, prepare a note on ‘Property plant and equipment’ for inclusion in ML’s financial

statements for the year ended 31 December 2018.

You might also like

- Updated - FAR 1 Sir ARM Final BookDocument527 pagesUpdated - FAR 1 Sir ARM Final BookZain Jamil100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Quality Case No.1 2Document5 pagesQuality Case No.1 2Lilian Candido57% (7)

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Financial Accounting and Reporting 1Document11 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- Financial Accounting and Reporting-IDocument7 pagesFinancial Accounting and Reporting-IWasim SajadNo ratings yet

- LO5 QuestionDocument2 pagesLO5 QuestionFrederick LekalakalaNo ratings yet

- Module 1 Ias 16 & Ias 38Document6 pagesModule 1 Ias 16 & Ias 38Muhammad Zulqarnain NainNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- MFR203 FAR-4 AssignmentDocument5 pagesMFR203 FAR-4 Assignmentgillian soonNo ratings yet

- RTP Cap III GR I June 2022Document92 pagesRTP Cap III GR I June 2022मदन कुमार बिस्टNo ratings yet

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- IAS 16 QuestionsDocument8 pagesIAS 16 QuestionsAhmad SaleemNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- Property, Plant, and EquipmentDocument3 pagesProperty, Plant, and EquipmentIzza Mae Rivera KarimNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Moderator: Mr. L.J. Muthivhi (CA), SADocument11 pagesModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIZahidNo ratings yet

- IAS 36 Final 08122022 104310amDocument6 pagesIAS 36 Final 08122022 104310amAdnan MaqboolNo ratings yet

- Impairment of AssetsDocument21 pagesImpairment of AssetsSteffanie Granada50% (2)

- Prior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountDocument2 pagesPrior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountBabar MalikNo ratings yet

- 5 Nov 2020Document28 pages5 Nov 2020Aditya PrajapatiNo ratings yet

- Problem 1Document3 pagesProblem 1Beverly MindoroNo ratings yet

- IAS 36 Impairment of Assets (2021)Document12 pagesIAS 36 Impairment of Assets (2021)Tawanda Tatenda HerbertNo ratings yet

- Far-1 Revaluation JE 2Document2 pagesFar-1 Revaluation JE 2Janie HookeNo ratings yet

- 007 - Chapter 04 - IAS 16 Property, Plant and EquipmentDocument7 pages007 - Chapter 04 - IAS 16 Property, Plant and EquipmentHaris ButtNo ratings yet

- FA Dec 2019Document6 pagesFA Dec 2019Shawn LiewNo ratings yet

- SKANS School of Accountancy Financial Accounting and Reporting-IIDocument11 pagesSKANS School of Accountancy Financial Accounting and Reporting-IImaryNo ratings yet

- 3 - (Ppe)Document3 pages3 - (Ppe)fbaabgfgbfdNo ratings yet

- Final Mock by TSB CFAP6 S2020Document5 pagesFinal Mock by TSB CFAP6 S2020Umar FarooqNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument5 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- Final Exam W MCQDocument12 pagesFinal Exam W MCQPatrick SalvadorNo ratings yet

- RT#1 CAF-1 FAR-1 - Question PaperDocument2 pagesRT#1 CAF-1 FAR-1 - Question Paperawaisawais95138No ratings yet

- Crescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadDocument124 pagesCrescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadAr Sal AnNo ratings yet

- AAFRDocument313 pagesAAFRNajamNo ratings yet

- CAF 1 FAR1 Spring 2023Document6 pagesCAF 1 FAR1 Spring 2023haris khanNo ratings yet

- Test 1 - Test On IND As 16, 38, 40 - QuesDocument3 pagesTest 1 - Test On IND As 16, 38, 40 - Quesbhallavishal.socialmediaNo ratings yet

- ARM - FAR 1 Mock For March 2024 With Solution - FinalDocument26 pagesARM - FAR 1 Mock For March 2024 With Solution - FinalTooba MaqboolNo ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- AFAB233 Tutorial - PPE - 021819Document7 pagesAFAB233 Tutorial - PPE - 021819Leshiga GunasegarNo ratings yet

- ACC304-Group Assignment 1-2020Document3 pagesACC304-Group Assignment 1-2020George AdjeiNo ratings yet

- Fa May June - 2019Document5 pagesFa May June - 2019xodic49847No ratings yet

- FRK201 Nov2019Document11 pagesFRK201 Nov2019Alex ViljoenNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- On January 1Document2 pagesOn January 1UNKNOWNNNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Test 1 - InD As 16, 38, 40 - QuestionsDocument5 pagesTest 1 - InD As 16, 38, 40 - Questionskapsemansi1No ratings yet

- RTP AFR CompiledDocument455 pagesRTP AFR Compiledgopal adhikariNo ratings yet

- Accounting English Medium: Weekly Paper - 96 2021 Advanced LevelDocument2 pagesAccounting English Medium: Weekly Paper - 96 2021 Advanced LevelMalar SrirengarajahNo ratings yet

- FAR 1 3rd Mock - ComprehensiveDocument4 pagesFAR 1 3rd Mock - Comprehensiveahsanalipalipoto17No ratings yet

- Problems - PPE & DepnDocument5 pagesProblems - PPE & DepnSaurabh SinghNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- CAF 1 IA Spring 2020 PDFDocument6 pagesCAF 1 IA Spring 2020 PDFWaseim KhanNo ratings yet

- AARS Test 4 Q.paper FinalDocument3 pagesAARS Test 4 Q.paper FinalShahzaib VirkNo ratings yet

- Audit PpeDocument4 pagesAudit Ppenicole bancoroNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- RTP June 2018 QnsDocument14 pagesRTP June 2018 QnsbinuNo ratings yet

- ACC2143ACC2543 Test 1 2023Document9 pagesACC2143ACC2543 Test 1 2023kamichidorahNo ratings yet

- Audit Test 6 QP Ch#14 (ISA 700 & 701)Document2 pagesAudit Test 6 QP Ch#14 (ISA 700 & 701)HussainNo ratings yet

- Lecture # 58Document5 pagesLecture # 58HussainNo ratings yet

- Lecture # 54Document4 pagesLecture # 54HussainNo ratings yet

- Lecture # 42Document2 pagesLecture # 42HussainNo ratings yet

- Lecture # 57Document3 pagesLecture # 57HussainNo ratings yet

- Introduction To Operations Management: Dr. Rinki Rola PHD (Management) Mba (Finance) B. E. (Chemical)Document27 pagesIntroduction To Operations Management: Dr. Rinki Rola PHD (Management) Mba (Finance) B. E. (Chemical)rupasree deyNo ratings yet

- Chapter 6 Part 1Document55 pagesChapter 6 Part 1Khalid Abdirashid AbubakarNo ratings yet

- Table 3-1 Metric Definitions: R A M - C Report ManualDocument1 pageTable 3-1 Metric Definitions: R A M - C Report Manualoblex15No ratings yet

- British Gas Edition 16 Lesson Resource Organisational StructureDocument2 pagesBritish Gas Edition 16 Lesson Resource Organisational StructureAmmer Yaser MehetanNo ratings yet

- Production & Material ManagementDocument67 pagesProduction & Material ManagementmohitprkNo ratings yet

- Bbfa1033 CW2 - 202305Document17 pagesBbfa1033 CW2 - 202305HOO VI YINGNo ratings yet

- Chapter 14 KMPDocument11 pagesChapter 14 KMPjaoceelectricalNo ratings yet

- RAM Matrix and Quality Management PlanDocument21 pagesRAM Matrix and Quality Management PlanCindy Ortiz GastonNo ratings yet

- Afm 311 A - 2013Document8 pagesAfm 311 A - 2013Dolly VongweNo ratings yet

- Ermias OC ManagmentDocument16 pagesErmias OC ManagmentErmias Assaminew AlmazNo ratings yet

- Strategic MGMT ch09Document19 pagesStrategic MGMT ch09farazalam08100% (3)

- Strategi Swot Danau TobaDocument13 pagesStrategi Swot Danau TobaHaepsa KimNo ratings yet

- EMAPTA Video Resume Recording Guide - 2024Document5 pagesEMAPTA Video Resume Recording Guide - 2024Ivana MadrigalNo ratings yet

- CH 18 PPTaccessibleDocument41 pagesCH 18 PPTaccessibleHARRY HINGNo ratings yet

- VCE Mathematical Methods Units 3&4 Exam 1 Suggested Solutions Booklet 2021Document10 pagesVCE Mathematical Methods Units 3&4 Exam 1 Suggested Solutions Booklet 2021soniaNo ratings yet

- Huff Gravity ModelDocument7 pagesHuff Gravity ModelJorge luis TarquiNo ratings yet

- Staff Instructions Adb Consulting PDFDocument56 pagesStaff Instructions Adb Consulting PDFBatjargal EnkhbatNo ratings yet

- 0.quantification and Costing - Slides - Lvl3Document19 pages0.quantification and Costing - Slides - Lvl3xyzhyn100% (1)

- Cost and Pricing MGT For Competitive AdvantageDocument45 pagesCost and Pricing MGT For Competitive Advantageilona gabrielNo ratings yet

- Management MathematicsDocument2 pagesManagement MathematicsMuigai MungaiNo ratings yet

- Statements of Changes in EquityDocument51 pagesStatements of Changes in EquityBeverly EroyNo ratings yet

- Formatted Accounting Finance For Bankers AFB 4 PDFDocument7 pagesFormatted Accounting Finance For Bankers AFB 4 PDFSijuNo ratings yet

- Goods and Services DesignDocument4 pagesGoods and Services Designkim zamoraNo ratings yet

- Customer Lifetime Value Calculator For Financial Institutions: Follow The Four Steps and Input Your CLV DataDocument29 pagesCustomer Lifetime Value Calculator For Financial Institutions: Follow The Four Steps and Input Your CLV DataPooja GuptaNo ratings yet

- Analysis of Third Party Logistics PerformanceDocument24 pagesAnalysis of Third Party Logistics PerformanceYasmine MohamedNo ratings yet

- Establishing Strategic Intent: Vision, Mission, Objectives and GoalDocument40 pagesEstablishing Strategic Intent: Vision, Mission, Objectives and GoalVirendra ChoudhryNo ratings yet

- نموذج تسعير الأصول الرأسمالية (CAPM) مع مقياس السحبDocument10 pagesنموذج تسعير الأصول الرأسمالية (CAPM) مع مقياس السحبHamza AlmostafaNo ratings yet

- GlucoTain Flex - 277626 - Revision 7Document1 pageGlucoTain Flex - 277626 - Revision 7tmlNo ratings yet

- M/s. Khadim India Ltd. Stock Register of Goods Sent For Job - WorkDocument4 pagesM/s. Khadim India Ltd. Stock Register of Goods Sent For Job - WorkSukumar DasNo ratings yet