Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsDecember

December

Uploaded by

chandjk778Reasearch history

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Payslip For The Month of January 2023: CRM Services India Private LimitedDocument1 pagePayslip For The Month of January 2023: CRM Services India Private Limitednaman porwalNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- Payslip 2020 2021 2 100000000544479 IGSL 1Document1 pagePayslip 2020 2021 2 100000000544479 IGSL 1x foxNo ratings yet

- Legal Requirements For Starting A Business in The PhilippinesDocument4 pagesLegal Requirements For Starting A Business in The PhilippinesJobena Rose Serdena50% (2)

- Payslip 2023 2024 3 9118630 JUBLDocument1 pagePayslip 2023 2024 3 9118630 JUBLReddy TharunNo ratings yet

- Payslip Sep2023Document2 pagesPayslip Sep2023ALINo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- PayslipDocument1 pagePayslipojhashivam1997No ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Payslip 2023 2024 2 9118630 JUBLDocument1 pagePayslip 2023 2024 2 9118630 JUBLReddy TharunNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- Earning For The Month - April 2023: Jubilant Foodworks LTDDocument1 pageEarning For The Month - April 2023: Jubilant Foodworks LTDnishankithkumarNo ratings yet

- Shabaz Farukh Shaikh Payslip Jan 2024Document1 pageShabaz Farukh Shaikh Payslip Jan 2024eliajaun71No ratings yet

- Payslip 2023 2024 6 200000000029454 IGSLDocument1 pagePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Shabaz Jabbar Shaikh Payslip 2024 JanDocument1 pageShabaz Jabbar Shaikh Payslip 2024 Janeliajaun71No ratings yet

- Shaik Shabaz Payslip Jan24Document1 pageShaik Shabaz Payslip Jan24eliajaun71No ratings yet

- Payslip 2023 2024 1 9118630 JUBLDocument1 pagePayslip 2023 2024 1 9118630 JUBLReddy TharunNo ratings yet

- Pay Slip - Z4333 - Dec-23Document1 pagePay Slip - Z4333 - Dec-23senthildad75No ratings yet

- Payslip Feb 2024Document1 pagePayslip Feb 2024usemask2No ratings yet

- 20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - PayslipDocument1 page20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - PayslipKaran SharmaNo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (2)

- Prabhu Datta Pay SlipDocument3 pagesPrabhu Datta Pay Slipprabhu.peelaNo ratings yet

- Tushar Saini (MOB2314) - Sep23payslipDocument1 pageTushar Saini (MOB2314) - Sep23payslipvikasdixit95200No ratings yet

- Shahabaz Ayub Shaikh Payslip Feb24Document1 pageShahabaz Ayub Shaikh Payslip Feb24shahbaz029200No ratings yet

- Payslip Jan 2024 Shehbaz Shakeel ShaikhDocument1 pagePayslip Jan 2024 Shehbaz Shakeel Shaikheliajaun71No ratings yet

- Payslip25797627 PDFDocument1 pagePayslip25797627 PDFObaid KhanNo ratings yet

- Jan18 PDFDocument1 pageJan18 PDFomkassNo ratings yet

- JuneDocument1 pageJunenishankithkumarNo ratings yet

- EMP1314Document1 pageEMP1314Laxmi JaiswalNo ratings yet

- Null 2Document1 pageNull 2INFINITY GÄMËRNo ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Debosmita Sarkar - 121328 - Settlement Payslip - RerunDocument3 pagesDebosmita Sarkar - 121328 - Settlement Payslip - RerunMajumdar VijayNo ratings yet

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- PAYSLIP Mar24Document1 pagePAYSLIP Mar24swapnil.sardarNo ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Payslip 2022 2023 2 9130712 JUBLDocument1 pagePayslip 2022 2023 2 9130712 JUBLnishankithkumarNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerANAND RADHAWALNo ratings yet

- Standard Monthly Salary INR Earnings INR Deductions INRDocument1 pageStandard Monthly Salary INR Earnings INR Deductions INRPrashant RajNo ratings yet

- PaySlip Jan 2024Document1 pagePaySlip Jan 2024shashwat.dhaseNo ratings yet

- ITCS 0089192 Feb-24Document2 pagesITCS 0089192 Feb-24Kanickai DsouzaNo ratings yet

- Runi 1816Document1 pageRuni 1816Harsh JasaniNo ratings yet

- Nov Payslip 23Document1 pageNov Payslip 23Lakshaya ChauhanNo ratings yet

- Dec Payslip 23Document1 pageDec Payslip 23Lakshaya ChauhanNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerRohit SolomonNo ratings yet

- PAYSLIP Feb24Document1 pagePAYSLIP Feb24swapnil.sardarNo ratings yet

- Pay Slip For The Month of December-2017Document1 pagePay Slip For The Month of December-2017omkassNo ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- May Salary SlipDocument1 pageMay Salary Slipaishamansuri9867No ratings yet

- Null 1Document1 pageNull 1INFINITY GÄMËRNo ratings yet

- FNF 02 I33514 Ankit ShuklaDocument3 pagesFNF 02 I33514 Ankit ShuklaAnkit ShuklaNo ratings yet

- Apr 23Document1 pageApr 23Amit ShindeNo ratings yet

- Salary PNB Bank, RakeshDocument1 pageSalary PNB Bank, Rakeshv4959034No ratings yet

- PAYSLIP April24Document1 pagePAYSLIP April24swapnil.sardarNo ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- July SlipDocument1 pageJuly SlipNILAMANI SAHOONo ratings yet

- 100000000494378Document1 page100000000494378Dalbir SinghNo ratings yet

- 6 - The World of RegionsDocument38 pages6 - The World of RegionsMarie Antionette MondragonNo ratings yet

- Tort NotesDocument3 pagesTort NotesShäränyä Subramaniam100% (1)

- Swashamtaa Foundation Newsletter Jan 2024Document5 pagesSwashamtaa Foundation Newsletter Jan 2024RituNo ratings yet

- SWD 2023 698 Moldova ReportDocument127 pagesSWD 2023 698 Moldova ReportZiarul de GardăNo ratings yet

- Ijma and QiyasDocument4 pagesIjma and QiyasMohammad MustafaNo ratings yet

- JMS Labs Vs Yusufali EesmailDocument5 pagesJMS Labs Vs Yusufali EesmailRONAK PATTANAIKNo ratings yet

- Worthington v. Office of National Drug Control Policy Et AlDocument63 pagesWorthington v. Office of National Drug Control Policy Et AlMuhammad Yar LakNo ratings yet

- The Ascent of Money Niall Ferguson. Peng PDFDocument2 pagesThe Ascent of Money Niall Ferguson. Peng PDFAn NguyễnNo ratings yet

- Law On CreditsDocument9 pagesLaw On CreditsMojiNo ratings yet

- Manwani TutorialsDocument3 pagesManwani TutorialsMukesh ManwaniNo ratings yet

- Chapter 2 Pad104Document5 pagesChapter 2 Pad1042022460928No ratings yet

- Diocese LawsuitDocument80 pagesDiocese LawsuitWTVCNo ratings yet

- School Consolidated Report On Incidents of Bullying: School: Sto. Nino Integrated SchoolDocument6 pagesSchool Consolidated Report On Incidents of Bullying: School: Sto. Nino Integrated SchoolMario TamayoNo ratings yet

- Mod17Wk15-Constitutional-LawDocument30 pagesMod17Wk15-Constitutional-LawTiara LlorenteNo ratings yet

- Nepal National Building Code: Requirements For State-Of-The Art Design An IntroductionDocument16 pagesNepal National Building Code: Requirements For State-Of-The Art Design An IntroductionPrakriti PokhrelNo ratings yet

- Post Deliberation ReportDocument14 pagesPost Deliberation Reportapi-507454838No ratings yet

- Food, Medicine and Health Care Administration and Control Authority of EthiopiaDocument4 pagesFood, Medicine and Health Care Administration and Control Authority of EthiopialemmabekeleNo ratings yet

- Philippine Press Institute, Inc: Ermin Garcia JR., in Behalf of 139 MembersDocument2 pagesPhilippine Press Institute, Inc: Ermin Garcia JR., in Behalf of 139 MembersJude ChicanoNo ratings yet

- Securitisation As A Self-Fulfilling Prophecy RefugDocument21 pagesSecuritisation As A Self-Fulfilling Prophecy RefugMaria DialNo ratings yet

- 1 Cases (15) Rule 110Document119 pages1 Cases (15) Rule 110Anisah AquilaNo ratings yet

- Criticisms of FunctionalismDocument2 pagesCriticisms of FunctionalismAmber47No ratings yet

- Amotions of No Confidence Guidance DocumentDocument2 pagesAmotions of No Confidence Guidance DocumentllybjicNo ratings yet

- People vs. Sison (2017)Document2 pagesPeople vs. Sison (2017)Junelyn T. Ella0% (1)

- F1-FAB Assignment 1 Chapters 1 and 2Document8 pagesF1-FAB Assignment 1 Chapters 1 and 2Kj NayeeNo ratings yet

- Monitoring of Weekly Status of Barangay Development Program (BDP)Document16 pagesMonitoring of Weekly Status of Barangay Development Program (BDP)Batangas ISOSNo ratings yet

- La Excellence Recap Monthly Current Affairs Topics List Month: Sept 2020 Subject Topic NameDocument35 pagesLa Excellence Recap Monthly Current Affairs Topics List Month: Sept 2020 Subject Topic NamebalajiNo ratings yet

- Demand NoticeDocument2 pagesDemand NoticeMohit KumarNo ratings yet

- Haryana Mains 2022 - Paper 1Document2 pagesHaryana Mains 2022 - Paper 1Sukriti tripathiNo ratings yet

- Miami: Condominio-1 de La Familia RomeroDocument5 pagesMiami: Condominio-1 de La Familia RomeroConrado Gonzalo Garcia JaminNo ratings yet

December

December

Uploaded by

chandjk7780 ratings0% found this document useful (0 votes)

2 views1 pageReasearch history

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReasearch history

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageDecember

December

Uploaded by

chandjk778Reasearch history

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

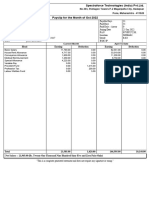

BNY MELLON INTERNATIONAL OPERATIONS INDIA PRIVATE LIMITED

TOWER S3,LEVEL 1, CYBERCITY,

MAGARPATTA, HADAPSAR,

PUNE, MAHARASHTRA - 411013

Payslip for the Month of Dec 2023

Emp Code 100104982 Current Pay Period From 01/12/2023

Emp Name Mr. Palthuru Chand Current Pay Period To 31/12/2023

Grade H Current Month LWP Days 0.0

Designation Associate, Fund Administration II Prior month LWP Days 0.0

Bank Name ICICI Reversal LWP days 0.0

Bank A/c No XXXXXXXX2959 Attendance Regularization 0

P.F.No PUPUN01231720000034351 Reversal Attendance Regularization 0

UAN ID 101254427558 ESIC

Mgt.Unit 1430121 PAN EFWPP5724P

Joining Date 05-12-2022 MDID No

Current Month April to Date

Head

Earning Deduction Earning Deduction

Basic 33,333.00 299,997.00

House Rent Allowance 16,667.00 150,003.00

LTA Allowance 2,777.00 24,993.00

Telephone Allowance 3,000.00 27,000.00

Special Allowance 27,556.00 248,004.00

Public holiday 0.00 3,846.00

Overtime(OT)_New 0.00 73,201.00

WK-Off Allowance_New 0.00 23,981.00

Recognition Non Cash Award 1,106.00 2,209.00

Food Book Non Cash Gross Up 0.00 1,365.00

Provident Fund 4,000.00 36,000.00

Professional Tax 208.00 1,874.00

Labour Welfare Fund 20.00 20.00

Food Book Net Adj 0.00 1,152.00

Recognition Award Cash Net Adj 1,106.00 2,209.00

Income Tax 4,739.00 58,476.00

Total:- 84,439.00 10,073.00 854,599.00 99,731.00

Net Salary : Rs. 74366.0 ( Rs. Seventy Four Thousand Three Hundred and Sixty Six only )

NPS Percentage 0 NPS Employer Amount 0.0 PRAN

Perdiem Perquisite: - 0 Overtime Hrs Weekly Off Hrs

“In case you have any query related to your pay slip or PAN details, please raise a request through “MYHR”

Note: All discretionary quarterly and/or annual incentive or bonus payments, if any, paid and/or to be paid to you by the company from time to time will include all mandatory & statutory bonus

payments and arrears of statutory bonus of any previous accounting year that you may be entitled to under the Payment of Bonus Act, 1965 (“Act”), if applicable to you or under other applicable

laws, rules, statutes, enactments, orders and regulations currently in force and as amended from time to time. Upon adjustment of the discretionary quarterly and/or annual incentive or bonus

payments against the statutory bonus payable under the Act, if there is any amount which is still payable as statutory bonus under the Act, the same shall be paid to you within the time limit as

prescribed for payment of Bonus under the Act. The company shall deduct tax at source at the applicable rate.”

This is a computer generated letter and does not require any further authentication, seal or attestation.

You might also like

- Payslip For The Month of January 2023: CRM Services India Private LimitedDocument1 pagePayslip For The Month of January 2023: CRM Services India Private Limitednaman porwalNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- Payslip 2020 2021 2 100000000544479 IGSL 1Document1 pagePayslip 2020 2021 2 100000000544479 IGSL 1x foxNo ratings yet

- Legal Requirements For Starting A Business in The PhilippinesDocument4 pagesLegal Requirements For Starting A Business in The PhilippinesJobena Rose Serdena50% (2)

- Payslip 2023 2024 3 9118630 JUBLDocument1 pagePayslip 2023 2024 3 9118630 JUBLReddy TharunNo ratings yet

- Payslip Sep2023Document2 pagesPayslip Sep2023ALINo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- PayslipDocument1 pagePayslipojhashivam1997No ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Payslip 2023 2024 2 9118630 JUBLDocument1 pagePayslip 2023 2024 2 9118630 JUBLReddy TharunNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- Earning For The Month - April 2023: Jubilant Foodworks LTDDocument1 pageEarning For The Month - April 2023: Jubilant Foodworks LTDnishankithkumarNo ratings yet

- Shabaz Farukh Shaikh Payslip Jan 2024Document1 pageShabaz Farukh Shaikh Payslip Jan 2024eliajaun71No ratings yet

- Payslip 2023 2024 6 200000000029454 IGSLDocument1 pagePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Shabaz Jabbar Shaikh Payslip 2024 JanDocument1 pageShabaz Jabbar Shaikh Payslip 2024 Janeliajaun71No ratings yet

- Shaik Shabaz Payslip Jan24Document1 pageShaik Shabaz Payslip Jan24eliajaun71No ratings yet

- Payslip 2023 2024 1 9118630 JUBLDocument1 pagePayslip 2023 2024 1 9118630 JUBLReddy TharunNo ratings yet

- Pay Slip - Z4333 - Dec-23Document1 pagePay Slip - Z4333 - Dec-23senthildad75No ratings yet

- Payslip Feb 2024Document1 pagePayslip Feb 2024usemask2No ratings yet

- 20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - PayslipDocument1 page20 - 2020-21 - Ind - Pawar Pratik - Spectraforce - PayslipKaran SharmaNo ratings yet

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (2)

- Prabhu Datta Pay SlipDocument3 pagesPrabhu Datta Pay Slipprabhu.peelaNo ratings yet

- Tushar Saini (MOB2314) - Sep23payslipDocument1 pageTushar Saini (MOB2314) - Sep23payslipvikasdixit95200No ratings yet

- Shahabaz Ayub Shaikh Payslip Feb24Document1 pageShahabaz Ayub Shaikh Payslip Feb24shahbaz029200No ratings yet

- Payslip Jan 2024 Shehbaz Shakeel ShaikhDocument1 pagePayslip Jan 2024 Shehbaz Shakeel Shaikheliajaun71No ratings yet

- Payslip25797627 PDFDocument1 pagePayslip25797627 PDFObaid KhanNo ratings yet

- Jan18 PDFDocument1 pageJan18 PDFomkassNo ratings yet

- JuneDocument1 pageJunenishankithkumarNo ratings yet

- EMP1314Document1 pageEMP1314Laxmi JaiswalNo ratings yet

- Null 2Document1 pageNull 2INFINITY GÄMËRNo ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Debosmita Sarkar - 121328 - Settlement Payslip - RerunDocument3 pagesDebosmita Sarkar - 121328 - Settlement Payslip - RerunMajumdar VijayNo ratings yet

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- PAYSLIP Mar24Document1 pagePAYSLIP Mar24swapnil.sardarNo ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Payslip 2022 2023 2 9130712 JUBLDocument1 pagePayslip 2022 2023 2 9130712 JUBLnishankithkumarNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerANAND RADHAWALNo ratings yet

- Standard Monthly Salary INR Earnings INR Deductions INRDocument1 pageStandard Monthly Salary INR Earnings INR Deductions INRPrashant RajNo ratings yet

- PaySlip Jan 2024Document1 pagePaySlip Jan 2024shashwat.dhaseNo ratings yet

- ITCS 0089192 Feb-24Document2 pagesITCS 0089192 Feb-24Kanickai DsouzaNo ratings yet

- Runi 1816Document1 pageRuni 1816Harsh JasaniNo ratings yet

- Nov Payslip 23Document1 pageNov Payslip 23Lakshaya ChauhanNo ratings yet

- Dec Payslip 23Document1 pageDec Payslip 23Lakshaya ChauhanNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerRohit SolomonNo ratings yet

- PAYSLIP Feb24Document1 pagePAYSLIP Feb24swapnil.sardarNo ratings yet

- Pay Slip For The Month of December-2017Document1 pagePay Slip For The Month of December-2017omkassNo ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- May Salary SlipDocument1 pageMay Salary Slipaishamansuri9867No ratings yet

- Null 1Document1 pageNull 1INFINITY GÄMËRNo ratings yet

- FNF 02 I33514 Ankit ShuklaDocument3 pagesFNF 02 I33514 Ankit ShuklaAnkit ShuklaNo ratings yet

- Apr 23Document1 pageApr 23Amit ShindeNo ratings yet

- Salary PNB Bank, RakeshDocument1 pageSalary PNB Bank, Rakeshv4959034No ratings yet

- PAYSLIP April24Document1 pagePAYSLIP April24swapnil.sardarNo ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- July SlipDocument1 pageJuly SlipNILAMANI SAHOONo ratings yet

- 100000000494378Document1 page100000000494378Dalbir SinghNo ratings yet

- 6 - The World of RegionsDocument38 pages6 - The World of RegionsMarie Antionette MondragonNo ratings yet

- Tort NotesDocument3 pagesTort NotesShäränyä Subramaniam100% (1)

- Swashamtaa Foundation Newsletter Jan 2024Document5 pagesSwashamtaa Foundation Newsletter Jan 2024RituNo ratings yet

- SWD 2023 698 Moldova ReportDocument127 pagesSWD 2023 698 Moldova ReportZiarul de GardăNo ratings yet

- Ijma and QiyasDocument4 pagesIjma and QiyasMohammad MustafaNo ratings yet

- JMS Labs Vs Yusufali EesmailDocument5 pagesJMS Labs Vs Yusufali EesmailRONAK PATTANAIKNo ratings yet

- Worthington v. Office of National Drug Control Policy Et AlDocument63 pagesWorthington v. Office of National Drug Control Policy Et AlMuhammad Yar LakNo ratings yet

- The Ascent of Money Niall Ferguson. Peng PDFDocument2 pagesThe Ascent of Money Niall Ferguson. Peng PDFAn NguyễnNo ratings yet

- Law On CreditsDocument9 pagesLaw On CreditsMojiNo ratings yet

- Manwani TutorialsDocument3 pagesManwani TutorialsMukesh ManwaniNo ratings yet

- Chapter 2 Pad104Document5 pagesChapter 2 Pad1042022460928No ratings yet

- Diocese LawsuitDocument80 pagesDiocese LawsuitWTVCNo ratings yet

- School Consolidated Report On Incidents of Bullying: School: Sto. Nino Integrated SchoolDocument6 pagesSchool Consolidated Report On Incidents of Bullying: School: Sto. Nino Integrated SchoolMario TamayoNo ratings yet

- Mod17Wk15-Constitutional-LawDocument30 pagesMod17Wk15-Constitutional-LawTiara LlorenteNo ratings yet

- Nepal National Building Code: Requirements For State-Of-The Art Design An IntroductionDocument16 pagesNepal National Building Code: Requirements For State-Of-The Art Design An IntroductionPrakriti PokhrelNo ratings yet

- Post Deliberation ReportDocument14 pagesPost Deliberation Reportapi-507454838No ratings yet

- Food, Medicine and Health Care Administration and Control Authority of EthiopiaDocument4 pagesFood, Medicine and Health Care Administration and Control Authority of EthiopialemmabekeleNo ratings yet

- Philippine Press Institute, Inc: Ermin Garcia JR., in Behalf of 139 MembersDocument2 pagesPhilippine Press Institute, Inc: Ermin Garcia JR., in Behalf of 139 MembersJude ChicanoNo ratings yet

- Securitisation As A Self-Fulfilling Prophecy RefugDocument21 pagesSecuritisation As A Self-Fulfilling Prophecy RefugMaria DialNo ratings yet

- 1 Cases (15) Rule 110Document119 pages1 Cases (15) Rule 110Anisah AquilaNo ratings yet

- Criticisms of FunctionalismDocument2 pagesCriticisms of FunctionalismAmber47No ratings yet

- Amotions of No Confidence Guidance DocumentDocument2 pagesAmotions of No Confidence Guidance DocumentllybjicNo ratings yet

- People vs. Sison (2017)Document2 pagesPeople vs. Sison (2017)Junelyn T. Ella0% (1)

- F1-FAB Assignment 1 Chapters 1 and 2Document8 pagesF1-FAB Assignment 1 Chapters 1 and 2Kj NayeeNo ratings yet

- Monitoring of Weekly Status of Barangay Development Program (BDP)Document16 pagesMonitoring of Weekly Status of Barangay Development Program (BDP)Batangas ISOSNo ratings yet

- La Excellence Recap Monthly Current Affairs Topics List Month: Sept 2020 Subject Topic NameDocument35 pagesLa Excellence Recap Monthly Current Affairs Topics List Month: Sept 2020 Subject Topic NamebalajiNo ratings yet

- Demand NoticeDocument2 pagesDemand NoticeMohit KumarNo ratings yet

- Haryana Mains 2022 - Paper 1Document2 pagesHaryana Mains 2022 - Paper 1Sukriti tripathiNo ratings yet

- Miami: Condominio-1 de La Familia RomeroDocument5 pagesMiami: Condominio-1 de La Familia RomeroConrado Gonzalo Garcia JaminNo ratings yet