Professional Documents

Culture Documents

Class Test-2

Class Test-2

Uploaded by

arjun guptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Test-2

Class Test-2

Uploaded by

arjun guptaCopyright:

Available Formats

Class Test-2

Derivative and Risk Management

Date: 16 Apr 2024

Max Marks: 30

Attempts any three.

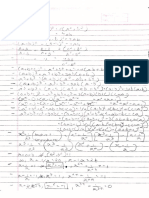

Q1. Three put options on a stock have the same expiration date and strike prices of ₹ 5500, ₹

6000, and ₹ 6500. The market prices are ₹ 230, ₹ 250, and ₹ 280, respectively. Explain how

a butterfly spread can be created. Show graphically and construct a table depicting the profit

from the strategy. For what range of stock prices would the butterfly spread lead to a loss and

by what amount?

Q2. What are the minimum and maximum bounds on the prices of call & put option?

Explain.

Q3. A call with a strike price of INR 920 costs INR 140. A put with the same strike price and

expiration date cost INR 120. Construct a table that shows the profit from straddle. For what

range of stock price would the straddle lead to loss?

Q4. A stock is trading at 500. A call option on the same with three months to maturity and an

exercise price of 550 is selling for 12. What should the price of a put option on the stock with

three months to expiry and an exercise price of 550 be? Assume a risk-free interest rate at

8%.

Q5. At NSE, a share of Reliance is trading at 2100, a call option with a strike of 2200 with

three months to expiry is trading at 26 while a put option with the same strike is valued at

110. Draw a payoff diagram for a long position in the stock, a short position in the stock, a

call option and a put option.

You might also like

- Teri Maa Ki ChutDocument6 pagesTeri Maa Ki ChutNoah JonesNo ratings yet

- Test Bank Financial InstrumentDocument13 pagesTest Bank Financial InstrumentMasi100% (1)

- 2840202Document4 pages2840202lathigara jayNo ratings yet

- OFD Question PapersDocument7 pagesOFD Question PapersLeo DeepakNo ratings yet

- Winter 2020 04-01-2021Document2 pagesWinter 2020 04-01-2021Grishma BhindoraNo ratings yet

- GE Comm - Invt in Stock Markets - CBCS 2021 (OBE)Document4 pagesGE Comm - Invt in Stock Markets - CBCS 2021 (OBE)Jeva AroraNo ratings yet

- Summer 2019 (06-05-2019)Document2 pagesSummer 2019 (06-05-2019)Grishma BhindoraNo ratings yet

- CUHK FINA4110 Assignment2Document5 pagesCUHK FINA4110 Assignment2MOON TVNo ratings yet

- RM Question Paper-May 2014Document2 pagesRM Question Paper-May 2014shruthi_9327No ratings yet

- TEST 1: ASC570 Financial Economics II: All The BestDocument1 pageTEST 1: ASC570 Financial Economics II: All The BestSumaiyyahRoshidiNo ratings yet

- Options AnsDocument16 pagesOptions Ansskalidas67% (3)

- Options Trading StrategiesDocument27 pagesOptions Trading Strategieskanabaramit50% (2)

- Options Trading Strategies: Long Stock - Long PutDocument7 pagesOptions Trading Strategies: Long Stock - Long PutDebasish SahooNo ratings yet

- Investments Portfolio 2020Document5 pagesInvestments Portfolio 2020Raissa KoffiNo ratings yet

- Tutorial 7: Derivatives (Options)Document2 pagesTutorial 7: Derivatives (Options)KÃLÅÏ SMÎLĒYNo ratings yet

- FINC4306 Assessed Practice QuestionsDocument5 pagesFINC4306 Assessed Practice Questionssykirin00No ratings yet

- Derivatives and Risk Management: Options - Basics and StrategiesDocument8 pagesDerivatives and Risk Management: Options - Basics and StrategiesRakshith PsNo ratings yet

- Assigment 2 Spring 2013Document3 pagesAssigment 2 Spring 2013JustinNo ratings yet

- Options SumsDocument15 pagesOptions SumsTamarala SrimanNo ratings yet

- Futures and Options Final Exam.1. 2020 EJndU7vIaaDocument3 pagesFutures and Options Final Exam.1. 2020 EJndU7vIaaAbhishek DeswalNo ratings yet

- Options Strategy PPTDocument41 pagesOptions Strategy PPTMax von Sydow guptaNo ratings yet

- Short Answer QuestionsDocument5 pagesShort Answer QuestionsMuthu KrishnaNo ratings yet

- (A) (B) (C) (D) (E) (F) : Combination StrategiesDocument3 pages(A) (B) (C) (D) (E) (F) : Combination StrategiesParth DahujaNo ratings yet

- End Sem Derivatives 2021Document2 pagesEnd Sem Derivatives 2021vinayNo ratings yet

- Finance AssignmentDocument12 pagesFinance AssignmentYanni PoonNo ratings yet

- Hedging Is A Risk Management Strategy Employed To Offset Losses in Investments byDocument3 pagesHedging Is A Risk Management Strategy Employed To Offset Losses in Investments byShubham SinghNo ratings yet

- FIN 6515 Futures Options TAproblemsDocument1 pageFIN 6515 Futures Options TAproblemsZion WilliamsNo ratings yet

- Derivatives RevisionDocument14 pagesDerivatives RevisionshankruthNo ratings yet

- T3.Hull Chapter 10Document11 pagesT3.Hull Chapter 10Abhishek Gupta100% (1)

- CF-EndTerm Question Paper - 2022 - 1Document2 pagesCF-EndTerm Question Paper - 2022 - 1madhavan prasathNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsSagar KotakNo ratings yet

- GB622HOMEWORK2013Document5 pagesGB622HOMEWORK2013Kai ZhouNo ratings yet

- Financial Derivatives - Prof. Vandana BhamaDocument3 pagesFinancial Derivatives - Prof. Vandana BhamakaranNo ratings yet

- Assignment 2Document2 pagesAssignment 2Dhruv SharmaNo ratings yet

- Summer 2021 19-08-2021Document2 pagesSummer 2021 19-08-2021Grishma BhindoraNo ratings yet

- End Exam PortfolioDocument6 pagesEnd Exam PortfolioRaissa KoffiNo ratings yet

- International Finance 2018-19 ReDocument2 pagesInternational Finance 2018-19 ReNAITIK SHAHNo ratings yet

- Midterm Exam (2024)Document4 pagesMidterm Exam (2024)Sunmarg DasNo ratings yet

- Financial Markets and Institutions t7P4ji9nrXDocument2 pagesFinancial Markets and Institutions t7P4ji9nrXKhushi SangoiNo ratings yet

- Fi 2022 23 Chapter - 7 Part II - ExercisesDocument11 pagesFi 2022 23 Chapter - 7 Part II - ExercisesPedroNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- Problem Set 3Document2 pagesProblem Set 3rtchuidjangnanaNo ratings yet

- Øving 8Document5 pagesØving 8Aurora SauarNo ratings yet

- 10.books Not Yet Received Volume 5 Options-For Only Running BatchDocument4 pages10.books Not Yet Received Volume 5 Options-For Only Running BatchRajkumar SharmaNo ratings yet

- Finale Exam (MICRO)Document15 pagesFinale Exam (MICRO)Farhan AshrafNo ratings yet

- Crabel, Toby - Price Patterns in Soybeans (Stocks & Commodities)Document6 pagesCrabel, Toby - Price Patterns in Soybeans (Stocks & Commodities)Leonardo LopezNo ratings yet

- Test 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTDocument6 pagesTest 1 DERIVATIVES & INTEREST RATE RISK MANAGEMENTprakhar rawatNo ratings yet

- Question Paper Financial Risk Management - II (232) : April 2006Document16 pagesQuestion Paper Financial Risk Management - II (232) : April 2006api-27548664100% (2)

- Options ContractsDocument7 pagesOptions Contractsfatima-kassoulNo ratings yet

- NISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFDocument40 pagesNISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFNeeraj Kumar100% (6)

- ECDDDocument2 pagesECDDGauravNo ratings yet

- BMS Financial Institutions and M KUAlyBqDocument3 pagesBMS Financial Institutions and M KUAlyBqishaNo ratings yet

- Unit 6 Option CombinationsDocument13 pagesUnit 6 Option CombinationsFadil Ashrafi Barkati KhanNo ratings yet

- Problem Set 3-Group 9Document6 pagesProblem Set 3-Group 9WristWork Entertainment100% (1)

- Investment and Portfolio Theory W2 HomeworkDocument10 pagesInvestment and Portfolio Theory W2 HomeworkhannahfavrefergusonNo ratings yet

- DER1 1516 Assignment 01 PDFDocument1 pageDER1 1516 Assignment 01 PDFvalleNo ratings yet

- How To Use Binary Options StrategiesDocument28 pagesHow To Use Binary Options Strategiessumilang100% (1)

- Short Answer QuestionsDocument7 pagesShort Answer QuestionsSai Srinivas Murthy .GNo ratings yet

- Class Test-3Document1 pageClass Test-3arjun guptaNo ratings yet

- DRM II Chapter-5Document47 pagesDRM II Chapter-5arjun guptaNo ratings yet

- DRM II Chapter-6Document22 pagesDRM II Chapter-6arjun guptaNo ratings yet

- Convexity and ImmunizationDocument8 pagesConvexity and Immunizationarjun guptaNo ratings yet

- ResponseDocument11 pagesResponsearjun guptaNo ratings yet

- FormulaeDocument8 pagesFormulaearjun guptaNo ratings yet

- Output PDFDocument13 pagesOutput PDFarjun guptaNo ratings yet

- Biology Revision Notes (English) by RaMO SirDocument18 pagesBiology Revision Notes (English) by RaMO Sirarjun guptaNo ratings yet

- Computer RbeDocument123 pagesComputer Rbearjun guptaNo ratings yet

- 2022 Financial ManagementDocument4 pages2022 Financial Managementarjun guptaNo ratings yet