Professional Documents

Culture Documents

TCB 2023 Banking Crisis US by The Numbers

TCB 2023 Banking Crisis US by The Numbers

Uploaded by

saurabh srivastavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TCB 2023 Banking Crisis US by The Numbers

TCB 2023 Banking Crisis US by The Numbers

Uploaded by

saurabh srivastavaCopyright:

Available Formats

2023 Banking Crisis

US By the Numbers

6 April 2023 Dana M Peterson (ESF) and Mitchell Barnes (CED)

Place cover photo here

1 © 2023 The Conference Board, Inc. | ConferenceBoard.org

2023 Banking Crisis

▪ Insights for What’s Ahead

✓ The worst of the banking crisis appears to be over, but some stress in financial markets remains.

✓ Banks are still borrowing from the Fed to remain liquid, although it appears to be stabilizing. Money being withdrawn

from the FDIC has fallen from a daily average of nearly $70 billion to just $5 billion. Outflows of deposits from small

banks to large banks or various financial assets seems to have paused.

✓ Policymakers are considering a variety of proposed changes for medium-sized banks, deposit insurance, and regulatory

scrutiny. Reaching consensus on action in a divided Congress will be difficult unless the crisis were to deepen. But

congressional investigations of the failures are the first order of business. Regulators are examining whether stricter

regulations should be reimposed on banks having assets between $100 billion and $250 billion. There is bipartisan

interest in considering proposals to protect small and medium sized banks, including increasing the amount of insurance

for deposits. Regulators are undergoing reviews to search for failures in oversight.

✓ So far, credit spreads remain narrow, and liquidity appears to be adequate. Still, the Fed anticipates some tightening in

financial conditions (akin to a 25-basis point interest rate hike) due to the banking crisis. Businesses, small and large,

may be more affected than consumers, who have already pulled back on big-ticket items requiring financing.

✓ Other shoes to drop might include difficulty for corporations to obtain cash from either banks or capital markets.

Additionally, CRE loan defaults may place added stress on banks at a delicate time.

✓ Against this backdrop, The Conference Board continues to anticipate two more Fed interest rate hikes as the banking

crisis appears under control, but inflation remains uncomfortably high. The Fed’s tighter monetary policy is likely to

induce a short and shallow recession, potentially starting in 2Q 2023, that results in some weakening in a fairly robust

labor market. Source: The Conference Board.

2 © 2023 The Conference Board, Inc. | ConferenceBoard.org

2023 Banking Crisis

What Happened?

▪ SVB and Signature Bank Failure Causes

✓ Drained deposits

✓ Shrinking net interest margin

✓ Mismatched durations of assets to liabilities

✓ Industry (i.e., tech sector) concentration exposure

✓ Poor internal risk controls (liquidity)

▪ Institutions Rescued

✓ SVB, Signature Bank (US)

✓ First Republic Bank (US)

✓ Credit Suisse (Switzerland)

▪ Rescuers

✓ FDIC

✓ FED, Swiss National Bank

✓ White House

✓ Large Banks Source: The Conference Board.

3 © 2023 The Conference Board, Inc. | ConferenceBoard.org

2023 Banking Crisis

Actions of US Regulators and the Central Bank

▪ Systemic Risk Exceptions for SVB and Signature

✓ Allowed FDIC to backstop uninsured depositors

✓ Both banks taken into FDIC receivership; FDIC coordinated sales to First Citizens Bank and to

Flagstar Bank

✓ Estimated loss to FDIC fund of $22.5B; to be made up by special assessment fee on banks

▪ Fed Liquidity Injections

✓ Fed established new Bank Term Funding Program to allow banks access to one-year loans

collateralized by government debt securities recognized at par value

✓ Fed coordinated with 5 other central banks to enhance provision of US dollar liquidity swaps through

at least the end of April

Source: The Conference Board.

4 © 2023 The Conference Board, Inc. | ConferenceBoard.org

2023 Banking Crisis

Legislative and Regulatory Considerations and Future Actions

▪ Capital and Liquidity Rules

✓ Progressive lawmakers have proposed rescinding the 2018 law that exempted banks between

$100B-$250B in assets from certain liquidity, stress test, and resolution planning requirements

✓ Supported by White House and Fed, FDIC, and Treasury regulators in testimony to Congress

✓ Proposed regulatory changes face challenge in Republican-controlled House

▪ FDIC Insurance

✓ Bipartisan concern about viability of small and medium sized banks, including interest behind

revisiting FDIC deposit insurance limits; no formal proposal yet

✓ Considerations include raising $250,000 limit or applying different treatment to business deposits

✓ Pushed for by trade groups representing community and regional banks

▪ Accountability and Regulator Reviews

✓ Internal reviews from Fed and FDIC both to be released by May 1; separate reviews being

conducted by SEC and DOJ

✓ Many lawmakers have objected to regulatory changes before fact-finding complete

Source: The Conference Board.

5 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Stock Volatility Low

▪ The banking crisis notwithstanding, stock

market volatility has remained low compared

to the start of the pandemic shutdowns in

2020 and the UK pension crisis of 2022.

Sources: Chicago Board of Options Exchange and The Conference Board.

6 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Bank Stocks Bottoming

▪ Most of the damage to the stock market was

for banking stocks, which tumbled amid the

banking crisis.

▪ However, recent data suggest that banking

stocks are bottoming and the stock market

on aggregate is recovering from the crisis

swoon

Sources: S&P and The Conference Board.

7 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Bond Market Calming

▪ Most of the volatility was in bond markets, as

indicated by the MOVE index.

▪ This largely reflected investor flight to safety

(i.e., US Treasury securities) as banking

stocks convulsed and panic set in.

▪ In recent days and due to the quick

response of regulators, central banks, and

large banking institutions to contain the

crisis, bond markets are calming.

Sources: BoA / Merrill Lynch and The Conference Board.

8 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Liquidity Swaps Stable

▪ To ensure the availability of US dollars

abroad, the Fed along with five other central

banks established liquidity swap facilities.

▪ To-date there is been little if any activity with

these swap lines, signaling that there have

not been tremendous difficulties accessing

dollars.

▪ Additionally, after a brief rally in the weeks

just after the crisis, the US dollar has

returned to its depreciating trend triggered

by investor belief the Fed is close to ending

its interest rate tightening cycle.

▪ A cheaper dollar is beneficial for economies

with floating exchange rates as it cuts

inflation.

Sources: Federal Reserve Bank of New York and The Conference Board.

9 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Fed Lending to Banks Astounding

▪ As in prior crises – The Great Financial

Crisis/Great Recession and the most recent

pandemic – the Federal Reserve has

stepped in to provide liquidity to financial

markets, businesses and consumers.

▪ Instruments the Fed has used include credit

to depository institutions (i.e., banks),

primary dealers, mutual funds, the paycheck

protection program, commercial paper,

corporates large and small, and the latest

the Bank Term Funding Program (BTFP).

Sources: Federal Reserve Board and The Conference Board.

10 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Fed Lending to Banks Astounding

▪ Amid the 2023 Banking Crisis, the Fed is

mostly extending loans via its credit to

primary depository institutions, the BTFP,

and “other credit extensions,” which include

direct cash to institutions.

▪ Cash injections of cash and loans to banks

by the Fed surged in the first two weeks of

the crisis, but appeared to stabilize in the

most recent weeks

Sources: Federal Reserve Board and The Conference Board.

11 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Net Effect of Liquidity Provision Growing Fed Balance Sheet

Sources: Federal Reserve Board and The Conference Board. Sources: Federal Reserve Board and The Conference Board.

12 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Money Moving

▪ The banking crisis sparked withdrawals of

deposits from small domestic commercial

banks to other locations.

▪ Anecdotally, some of the money is being

funneled into large commercial banks.

▪ Anecdotally, some money is flowing into

money market funds, high yield savings

accounts, certificates of deposits, and US

Treasury securities.

▪ These assets can be issued by banks or

non-bank financial institutions.

▪ Money flowing to large banks raises the

concern about making SIFIs or “too-big-to-

fail” banks even larger.*

Sources: Federal Reserve Board and The Conference Board. * SIFIs – Systemically Important Financial Institutions

13 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Money Moving

▪ An outsized amount of cash ($300 billion) is

moving into money market funds since the

bank crisis started, some of which are

issued by banks others by non-bank

financial institutions.

Sources: Investment Company Institute and The Conference Board.

14 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – FDIC Withdrawals Outsized Initially But Now Cooling

▪ Cash withdrawals from the FDIC spiked toa

daily average of $69 billion but have

dropped to just $5 billion in recent days.

Sources: U.S. Treasury and The Conference Board.

15 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Global Funding Stress Low

▪ The swift actions of central banks,

regulators, and large banks – both in the US

and Switzerland – has kept a broad measure

of global financial stress low.

▪ The funding component of the Office of

Financial Research Global Financial Stress

Index, which measures liquidity stress,

remains just below the average level.

Sources: Office of Financial Research and The Conference Board.

16 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Systemic Stress is Elevated But Headed Lower

▪ The European Central Bank’s measure of

systemic stress for the United States surged

to levels seen during the 2022 UK pension

crisis but has started to ease as panic

recedes.

Sources: European Central Bank and The Conference Board.

17 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Credit Slowing Before Bank Crisis May Accelerate

▪ At the March FOMC meeting, Fed officials

chose to continue dialing down the assets

on the balance sheets and raise interest

rates by another 25 basis points.

▪ This was a signal that the Fed could

effectively do two things at once: 1) address

inflation through the credit channel (i.e.,

interest rates and “quantitative easing;” and

2) provide liquidity to struggling US banks

with loans via its other facilities.

▪ Nonetheless, Fed officials said the banking

crisis (i.e., banks’ fears of declining deposits)

might result in less lending to firms and

consumers.

▪ Domestically chartered banks were already

limiting loans before the banking crisis amid

Sources: Federal Reserve Board and The Conference Board. rapidly rising interest rates

18 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Foreign Bank Credit to Consumers Halted in 2022

▪ Foreign banking institutions operating in the

US were also slowing commercial and real

estate lending before the banking crisis.

▪ Foreign banking institutions operating in the

US stopped lending to US consumers

shortly after the Fed began raising interest

rates in March 2022.

Sources: Federal Reserve Board and The Conference Board. Sources: Federal Reserve Board and The Conference Board.

19 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Spending on Durable Goods Slowing Before Bank Crisis

▪ Consumers spent copiously on goods during

the pandemic during lockdowns and as they

received cash injections from fiscal stimulus.

▪ Now that lockdowns have ended, consumers

are spending less on durable goods, which

are often big-ticket items needing financing,

and more on services, which are less likely

to be financed.

▪ The slower goods consumption predated the

banking crisis.

▪ The more balanced demand between goods

and services suggests consumers may not

suffer as much from banks withholding

lending.

Sources: Bureau of Economic Analysis and The Conference Board.

20 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Durable Goods Spending Slowing Before Bank Crisis

▪ Month-over-month consumer spending data

reveals that household consumption of

durable goods was negative in three of the

last four months.

▪ The January spike in consumption in general

likely reflected generally favorable weather

in the US.

Sources: Bureau of Economic Analysis and The Conference Board.

21 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Residential Investment Slowing Before Bank Crisis

▪ Mortgage rates have already risen to 23-

year highs as the Fed raised interest rates

quickly and aggressively over the last year

to force consumer inflation gauges back to

the 2-percent target.

▪ Mortgage rates have only ticked a hair lower

amid the banking crisis.

Sources: Federal Home Loan Mortgage Corporation and The Conference Board. Sources: Bureau of Economic Analysis and The Conference Board.

22 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Residential Investment Slowing Before Bank Crisis

▪ Consumers already pulled back on home

purchases before the banking crisis as the

Fed had raised the federal funds rate target

to almost 5 percent.

▪ New and existing home sales collapsed,

home price valuations are declining in some

regions, and construction has ebbed.

▪ Consequently, real residential investment in

structures has plummeted from the

pandemic-era peak.

Sources: Federal Home Loan Mortgage Corporation and The Conference Board. Sources: Bureau of Economic Analysis and The Conference Board.

23 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Corporate Debt Spreads Remain Narrow, But Watch

the Levels

▪ Spreads of corporate investment grade and high-yield debt to US Treasury securities remain

narrow.

▪ Spreads of different types of commercial paper to the federal funds rate also remain narrow.

▪ These are signs that there are not material strains on businesses or corporation’s ability to

borrow over the short-term.

▪ However, it is important to keep an eye on the levels of debt and liquidity, as cash could dry up

quickly in a panic and stress business operations and swell corporate bond yields

▪ This very scenario occurred during the Great Financial Crisis, suggesting corporations may wish

to be conservative with their balance sheets and hold more cash until the financial market

backdrop improves.

24 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Corporate Spreads Narrow

Sources: ICE/Bank of America Merrill Lynch and The Conference Board. Sources: ICE/Bank of America Merrill Lynch and The Conference Board.

25 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Commercial Paper Spreads Narrow

Sources: Federal Reserve Board and The Conference Board.

26 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Business Investment Likely to Slow

▪ Business investment after adjusting for

inflation has been ebbing (IP, equipment) or

negative since 2021’s peak.

▪ The Fed’s rate hikes were contributing to the

slowing ahead of the banking crisis.

▪ However, the divestment may be

accelerated because of the banking crisis.

▪ As banks borrow money from the Fed to

remain liquid, they are unlikely to provide

much credit (short- or long-term) credit to

businesses.

▪ Hence, we posit the impact of tightening

financial conditions caused by the banking

crisis may be more acute for firms than for

Sources: Bureau of Economic Analysis and The Conference Board.

households.

27 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Market Expectations Accelerated Rate Cut Path

▪ Fed officials estimate that the net effect of

the banking crisis on financial conditions

tightening would be approximately

equivalent to one 25 basis point rate hike.

▪ Potentially this is reflected in the roughly 25

basis point narrowing in the expected

increase in the fed funds rate at the May

FOMC meeting.

▪ Markets are also pricing in rate cuts

sometime in 3Q 2023 in the wake of the

banking crisis, potentially in greater

anticipation of a recession than before the

crisis began.

Sources: Bloomberg and The Conference Board.

28 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – Market Expectations

▪ The 2yr-10yr yield curve became less

inverted when the banking crisis began, as

markets priced in fewer interest rate hikes in

the very near term and interest rate cuts as

soon as 3Q 2023.

▪ Treasuries yields also flagged amid flight to

safety: investors gobbled up US Treasuries

to park their cash in a relatively safe place

which raised the price but lowered the yield.

▪ Nonetheless, the yield curve remains

inverted, which is one among many signs

that investors anticipate a recession ahead.

▪ The Conference Board® US Leading

Economic Index™, which includes an

inverted yield curve, suggests a recession

may begin in short order.

Sources: US Treasury and The Conference Board.

29 © 2023 The Conference Board, Inc. | ConferenceBoard.org

Banking Crisis Effect – The Next Shoe to Drop?

▪ US domestically chartered banks hold nearly

60 percent of commercial real estate (CRE)

loans.

▪ Empty offices due to the pandemic and

hybrid work, and stalling in residential real

estate spend, which often draws CRE

investment, as interest rates rise, are

weighing on the CRE market.

▪ Defaults on CRE loans are on the rise

stoking concerns that this might negatively

impact US banks at a vulnerable time.

Sources: Federal Reserve Board and The Conference Board.

30 © 2023 The Conference Board, Inc. | ConferenceBoard.org

The Conference Board

CED / Public Economy, Environment, Human Marketing &

Policy Strategy & Social & Capital Communications

Finance Governance

Economy, Strategy & Finance (ESF) Center

Regine Medor Vincent Vacanti

Dana Peterson

Member Engagement Member Engagement

Center Leader, EVP &

Director Associate

Global Chief Economist

Regine.Medor@conference- Vincent.Vacanti@conference-

dana.peterson@conference-

board.org board.org

board.org

+1 737 249 0688 +1 212 339 0493

+1 212 339 0352

31 © 2023 The Conference Board, Inc. | ConferenceBoard.org

You might also like

- Musical Acoustics PDFDocument26 pagesMusical Acoustics PDFGino Mendoza0% (1)

- To Make Flip Flop Led Flasher Circuit Using Transistor Bc547Document17 pagesTo Make Flip Flop Led Flasher Circuit Using Transistor Bc547ananyabedekar83No ratings yet

- SVB Crisis and ImpactDocument1 pageSVB Crisis and Impactharshad jainNo ratings yet

- 1st Essay Corporate Banking - Caitlynn Hans SetiabudiDocument10 pages1st Essay Corporate Banking - Caitlynn Hans SetiabudicaitlynnsetiabudiNo ratings yet

- Unveiling The Banking Crisis of 2023Document19 pagesUnveiling The Banking Crisis of 2023Arsalan SumarNo ratings yet

- The Fall of USA Silicon Valley Bank and Credit Suisse BankDocument8 pagesThe Fall of USA Silicon Valley Bank and Credit Suisse Bankannettechristie30No ratings yet

- Assignment 4 Subprime Mortgage Crisis 2008: Case BackgroundDocument6 pagesAssignment 4 Subprime Mortgage Crisis 2008: Case BackgroundShrey ChaudharyNo ratings yet

- End of Cheap Deposits: Implications For Banks' Deposit Betas, Asset Growth, and FundingDocument9 pagesEnd of Cheap Deposits: Implications For Banks' Deposit Betas, Asset Growth, and FundingMinzhe LiNo ratings yet

- Global Issues For The Finance ProfessionalDocument21 pagesGlobal Issues For The Finance ProfessionalUsmanNo ratings yet

- Course File 3-AssessmentDocument5 pagesCourse File 3-AssessmentLilibeth OrongNo ratings yet

- Financial Meltdown - Crisis of Governance?Document6 pagesFinancial Meltdown - Crisis of Governance?Atif RehmanNo ratings yet

- Commercial Banking - SVBDocument6 pagesCommercial Banking - SVBAgnes JosephNo ratings yet

- Liquidity Spigot 1684333089Document27 pagesLiquidity Spigot 1684333089Alexei LeonNo ratings yet

- Restoring Confidence in Troubled FIsDocument16 pagesRestoring Confidence in Troubled FIsSanchu DhingraNo ratings yet

- CHUYÊN ĐỀ 1A -Analysis of bank failures and lessons learnedDocument19 pagesCHUYÊN ĐỀ 1A -Analysis of bank failures and lessons learnedPhượng PhạmNo ratings yet

- Five Things Investors Have Learned This YearDocument1 pageFive Things Investors Have Learned This YearGloria GloriaNo ratings yet

- 2023 United States Banking CrisisDocument12 pages2023 United States Banking CrisisJyotirmaya SubudhiNo ratings yet

- Dudley On TALFDocument8 pagesDudley On TALFZerohedgeNo ratings yet

- 1 REF45 TrustDocument15 pages1 REF45 TrustAntonioNo ratings yet

- Global Financial CrisisDocument9 pagesGlobal Financial CrisisAnkit Sanjay KhetanNo ratings yet

- FI - M Lecture 7-Why Do Financial Crises Occur - PartialDocument37 pagesFI - M Lecture 7-Why Do Financial Crises Occur - PartialMoazzam ShahNo ratings yet

- Risk Management Failures During The Financial Crisis: November 2011Document27 pagesRisk Management Failures During The Financial Crisis: November 2011Khushi ShahNo ratings yet

- Ben Bernanke Testimony B-F Congress 4-3-08Document7 pagesBen Bernanke Testimony B-F Congress 4-3-08TNT1842No ratings yet

- The 2008 Financial CrisisDocument14 pagesThe 2008 Financial Crisisann3cha100% (1)

- Mishkin Econ13e PPT 11Document39 pagesMishkin Econ13e PPT 11hangbg2k3No ratings yet

- Practical Exercise - Analysis of The Collapse of Silicon Valley BankDocument2 pagesPractical Exercise - Analysis of The Collapse of Silicon Valley Bankhanna.ericssonkleinNo ratings yet

- Current Global Economic Issues Lyst5264Document11 pagesCurrent Global Economic Issues Lyst5264aishwarya raoNo ratings yet

- Commercial Real Estate Exposure at US Banks 1707339030Document7 pagesCommercial Real Estate Exposure at US Banks 1707339030Jazlee JlNo ratings yet

- Interest Rate Risk Article Jul 09Document3 pagesInterest Rate Risk Article Jul 09rpowell64No ratings yet

- Presented To:: Authored byDocument16 pagesPresented To:: Authored byankushsonigraNo ratings yet

- ProjectDocument7 pagesProjectmalik waseemNo ratings yet

- Notes On Basel IIIDocument11 pagesNotes On Basel IIIprat05No ratings yet

- 03 Noyer Financial TurbulenceDocument3 pages03 Noyer Financial Turbulencenash666No ratings yet

- Applied Philosophy-Tighten Until Something BreaksDocument13 pagesApplied Philosophy-Tighten Until Something BreaksRahul SNo ratings yet

- GF&Co - April 13 - Mortgage Servicing, Forbearance & GSEs - Liquidity Events Versus Credit EventsDocument5 pagesGF&Co - April 13 - Mortgage Servicing, Forbearance & GSEs - Liquidity Events Versus Credit EventsJoshua Rosner100% (1)

- Regulation of Financial Markets Take Home ExamDocument22 pagesRegulation of Financial Markets Take Home ExamBrandon TeeNo ratings yet

- Capital Group - Securitised Credit A Useful Diversifier in Bond Portfoliosen - EeauDocument7 pagesCapital Group - Securitised Credit A Useful Diversifier in Bond Portfoliosen - Eeauramachandra rao sambangiNo ratings yet

- Reflective ReportDocument10 pagesReflective ReportNaim AhmedNo ratings yet

- Fixed Income Strategist: Price Discovery ModeDocument30 pagesFixed Income Strategist: Price Discovery ModeIsaac GoldNo ratings yet

- 5a24240b dcb0 4979 BDFC 60237042bf93market Analysis March 2023Document21 pages5a24240b dcb0 4979 BDFC 60237042bf93market Analysis March 2023ArifNo ratings yet

- Crear - Cooperative Banks, CUDocument12 pagesCrear - Cooperative Banks, CUAmeliaNo ratings yet

- Bank Bail-Ins? - Learn How To Protect YourselfDocument4 pagesBank Bail-Ins? - Learn How To Protect YourselfjavalassieNo ratings yet

- Impact of Covid-19 and Government Response On Capital MarketsDocument8 pagesImpact of Covid-19 and Government Response On Capital Marketsahsan habibNo ratings yet

- Barth Wihlborg NIES Dec 17 15Document96 pagesBarth Wihlborg NIES Dec 17 15Chi NguyenNo ratings yet

- Marathon's 2023-2024 Credit Cycle White PaperDocument23 pagesMarathon's 2023-2024 Credit Cycle White PaperVincentNo ratings yet

- Unit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovDocument5 pagesUnit 4 Written Assignment BUS 2203: Principles of Finance 1 University of The People Galin TodorovMarcusNo ratings yet

- Barth Wihlborg NIES Dec 17 15Document96 pagesBarth Wihlborg NIES Dec 17 15kouts2006No ratings yet

- Metrick 2024 The Failure of Silicon Valley Bank and The Panic of 2023Document20 pagesMetrick 2024 The Failure of Silicon Valley Bank and The Panic of 2023Haiping ZhangNo ratings yet

- Lecture 9 Monetary Policy Decision Making 2022Document40 pagesLecture 9 Monetary Policy Decision Making 2022Onyee FongNo ratings yet

- BANKING - Reviewer Module 2.2.1Document6 pagesBANKING - Reviewer Module 2.2.1Arianne JhadeNo ratings yet

- Big Freeze IIDocument5 pagesBig Freeze IIKalyan Teja NimushakaviNo ratings yet

- The Bitcoin Monthly March 2023 PDFDocument24 pagesThe Bitcoin Monthly March 2023 PDFMariano Javier DenegriNo ratings yet

- Critical Analysis of Northern Rock S Failure - Free Finance Essay - Essay UKDocument6 pagesCritical Analysis of Northern Rock S Failure - Free Finance Essay - Essay UKZekria Noori AfghanNo ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- The Crisis in UK BankingDocument9 pagesThe Crisis in UK BankingGautam ChaudhariNo ratings yet

- Chapter 7Document102 pagesChapter 7kapil DevkotaNo ratings yet

- Bonds Today Part 2 Its Not A Bound Its An OpinionDocument12 pagesBonds Today Part 2 Its Not A Bound Its An OpinionFranklinNo ratings yet

- Us Credit Crisis and Feds Response 1229898176101407 2Document26 pagesUs Credit Crisis and Feds Response 1229898176101407 2salonid17No ratings yet

- Global Financial Crisis and SecuritizationDocument6 pagesGlobal Financial Crisis and SecuritizationSumit KumramNo ratings yet

- Bank FailureDocument4 pagesBank FailureIntesar Osman TahmidNo ratings yet

- risk management - svbDocument4 pagesrisk management - svbAkshat GuptaNo ratings yet

- 2023-10-20 041022-Annexure 01-Notebook Work CH 17-6532589e43eb5Document2 pages2023-10-20 041022-Annexure 01-Notebook Work CH 17-6532589e43eb5saurabh srivastavaNo ratings yet

- J Management Studies - 2021 - Jiang - The Sharing Economy and Business Model Design A Configurational ApproachDocument28 pagesJ Management Studies - 2021 - Jiang - The Sharing Economy and Business Model Design A Configurational Approachsaurabh srivastavaNo ratings yet

- SOF NSO Class 4 Certificate Revised - CompressedDocument11 pagesSOF NSO Class 4 Certificate Revised - Compressedsaurabh srivastavaNo ratings yet

- Achieving Sustainability in Sharing-Based Product Service System - A Contingency PerspectiveDocument11 pagesAchieving Sustainability in Sharing-Based Product Service System - A Contingency Perspectivesaurabh srivastavaNo ratings yet

- Leadership Unravelled: Upcoming EventDocument1 pageLeadership Unravelled: Upcoming Eventsaurabh srivastavaNo ratings yet

- Math Kangaroo-2022-23Document6 pagesMath Kangaroo-2022-23saurabh srivastavaNo ratings yet

- Syllabus and Schedule Sharma Research Methods For IS IIT Delhi Ver 2 May 2022Document5 pagesSyllabus and Schedule Sharma Research Methods For IS IIT Delhi Ver 2 May 2022saurabh srivastavaNo ratings yet

- AJG 2018 Journal Guide PDFDocument33 pagesAJG 2018 Journal Guide PDFsaurabh srivastavaNo ratings yet

- Prospects and Challenges of Sharing Economy For The Public SectorDocument11 pagesProspects and Challenges of Sharing Economy For The Public Sectorsaurabh srivastavaNo ratings yet

- Beyond Cultural Distance - Switching To A Friction Lens in The Study of Cultural DifferencesDocument6 pagesBeyond Cultural Distance - Switching To A Friction Lens in The Study of Cultural Differencessaurabh srivastavaNo ratings yet

- Phd:304 Lab Report Advanced Mathematical Physics: Sachin Singh Rawat 16PH-06 (Department of Physics)Document12 pagesPhd:304 Lab Report Advanced Mathematical Physics: Sachin Singh Rawat 16PH-06 (Department of Physics)sachin rawatNo ratings yet

- Vii-Philosophy of HPERD & SportsDocument4 pagesVii-Philosophy of HPERD & SportsAnonymous hHT0iOyQAz100% (1)

- Dedication Certificate John Clyde D. Cristobal: This Certifies ThatDocument1 pageDedication Certificate John Clyde D. Cristobal: This Certifies ThatAGSAOAY JASON F.No ratings yet

- Data Sheet 68749835 Electronic Throttle BodyDocument3 pagesData Sheet 68749835 Electronic Throttle BodyDaniel AguirreNo ratings yet

- English Biofertilizers BrochureDocument2 pagesEnglish Biofertilizers BrochurekerateaNo ratings yet

- State of The Handloom Industry of BangladeshDocument8 pagesState of The Handloom Industry of BangladeshNoshin NawarNo ratings yet

- The Law of ParkinsonDocument5 pagesThe Law of Parkinsonathanassiadis2890No ratings yet

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Document7 pagesAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNo ratings yet

- Legal Reasoning For Seminal U S Texts Constitutional PrinciplesDocument13 pagesLegal Reasoning For Seminal U S Texts Constitutional PrinciplesOlga IgnatyukNo ratings yet

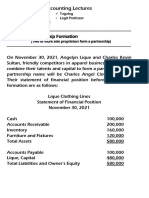

- 8 Lec 03 - Partnership Formation With BusinessDocument2 pages8 Lec 03 - Partnership Formation With BusinessNathalie GetinoNo ratings yet

- SG Unit5progresscheckfrq 5e815f88c4fb70Document9 pagesSG Unit5progresscheckfrq 5e815f88c4fb70api-485795043No ratings yet

- IPD Rolando AtaDocument2 pagesIPD Rolando AtaMarcela RamosNo ratings yet

- Ie 2e Level 4 Unit 9-4Document4 pagesIe 2e Level 4 Unit 9-4Stasya EgorovaNo ratings yet

- HCI634K - Technical Data SheetDocument8 pagesHCI634K - Technical Data SheetQuynhNo ratings yet

- Birinci Pozisyon Notalar Ve IsimleriDocument3 pagesBirinci Pozisyon Notalar Ve IsimleriEmre KözNo ratings yet

- Minimal Stimulation IVF Vs Conventional IVFDocument8 pagesMinimal Stimulation IVF Vs Conventional IVFpolygoneNo ratings yet

- Linkages and NetworkDocument28 pagesLinkages and NetworkJoltzen GuarticoNo ratings yet

- NT Organic FarmingDocument17 pagesNT Organic FarmingSai Punith Reddy100% (1)

- Homework Helper FreeDocument8 pagesHomework Helper Freeh48gh6sy100% (1)

- View AnswerDocument112 pagesView Answershiv anantaNo ratings yet

- Tunis Stock ExchangeDocument54 pagesTunis Stock ExchangeAnonymous AoDxR5Rp4JNo ratings yet

- Notes On HAMDocument89 pagesNotes On HAMCletus Paul100% (1)

- Prop Design PacketDocument8 pagesProp Design Packetapi-236024657No ratings yet

- PDFDocument86 pagesPDFAnonymous GuMUWwGMNo ratings yet

- Roger Dale Stafford, Sr. v. Ron Ward, Warden, Oklahoma State Penitentiary at McAlester Oklahoma Drew Edmondson, Attorney General of Oklahoma, 59 F.3d 1025, 10th Cir. (1995)Document6 pagesRoger Dale Stafford, Sr. v. Ron Ward, Warden, Oklahoma State Penitentiary at McAlester Oklahoma Drew Edmondson, Attorney General of Oklahoma, 59 F.3d 1025, 10th Cir. (1995)Scribd Government DocsNo ratings yet

- How To Register A Partnership in SECDocument4 pagesHow To Register A Partnership in SECMa Zola EstelaNo ratings yet

- Engr Qazi Arsalan Hamid AliDocument4 pagesEngr Qazi Arsalan Hamid AliEnpak ArsalanNo ratings yet

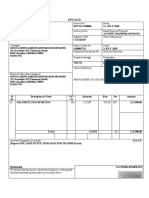

- Invoice: Qrt. No - : Cc-15, Civil Township Rourkela, Dist - (Sundargarh (Odisha) - 769012 GSTIN - 21ACWFS2234G1Z4Document2 pagesInvoice: Qrt. No - : Cc-15, Civil Township Rourkela, Dist - (Sundargarh (Odisha) - 769012 GSTIN - 21ACWFS2234G1Z4PUNYASHLOK PANDANo ratings yet