Professional Documents

Culture Documents

Sampoorna Raksha Supreme

Sampoorna Raksha Supreme

Uploaded by

ashish khandelwalCopyright:

Available Formats

You might also like

- Printable Flash CardsDocument96 pagesPrintable Flash CardsSnehil SinghNo ratings yet

- Comparison of ATM and EthernetDocument3 pagesComparison of ATM and EthernetAvneet KaurNo ratings yet

- Sampoorna Raksha SupremeDocument3 pagesSampoorna Raksha Supremejbbheda789No ratings yet

- Sampoorna Raksha Supreme - 2024-06-15T125809.026Document3 pagesSampoorna Raksha Supreme - 2024-06-15T125809.026xemflux.oneNo ratings yet

- Iamred IamredDocument3 pagesIamred Iamredhimi199393No ratings yet

- SIS With LSPO and Regular PayDocument3 pagesSIS With LSPO and Regular PayJyoti PandeyNo ratings yet

- Benefit IllustrationDocument2 pagesBenefit IllustrationusefulNo ratings yet

- Sampoorna Raksha SupremeDocument3 pagesSampoorna Raksha SupremeNaren BurraNo ratings yet

- Sampoorna Raksha Supreme - 2023-09-15T150349.974Document4 pagesSampoorna Raksha Supreme - 2023-09-15T150349.974Karthikeyan SakthivelNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsDocument4 pagesTata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsRavi PrakashNo ratings yet

- Sampoorna Raksha SupremeDocument5 pagesSampoorna Raksha Supremeriddhi SalviNo ratings yet

- Dear Mr. Akhil E G: Key FeaturesDocument4 pagesDear Mr. Akhil E G: Key FeaturesAkhil GirijanNo ratings yet

- Scope No. 19Document5 pagesScope No. 19Chetan GuptaNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusĄńıkęť MâhîñďNo ratings yet

- Class NotesDocument3 pagesClass NotesMUKESH MEHTANo ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusvidyadhreevidyashreeNo ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- Plan/Benefit Options Benefit Description: Dear Udayan PandeyDocument4 pagesPlan/Benefit Options Benefit Description: Dear Udayan PandeyudayanNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageDINESH JYOTHINo ratings yet

- Mon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueDocument3 pagesMon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueRamesh SharmaNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- I Am Red: Policy DetailsDocument3 pagesI Am Red: Policy DetailsKalpesh MoreNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Sanchay Par 75Document3 pagesSanchay Par 75Soumen BeraNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusScribbydooNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- IllustrationDocument3 pagesIllustrationpraharshafciNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Total Death Benefit Under SRS Vitality Protect: 2,00,00,000Document6 pagesTotal Death Benefit Under SRS Vitality Protect: 2,00,00,000Anvi MahajanNo ratings yet

- Benefit IllustrationDocument3 pagesBenefit IllustrationPragnNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Total Death Benefit Under SRS Vitality Protect: 1,50,00,000Document6 pagesTotal Death Benefit Under SRS Vitality Protect: 1,50,00,000tushar potekarNo ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- 7 Month Waiver of PremiumDocument4 pages7 Month Waiver of PremiumnikhilraoNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- BI - OutputGBP VDocument4 pagesBI - OutputGBP VSagrika SagarNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Rajeev Ranjan Bharti Axa Life InsuranceDocument8 pagesRajeev Ranjan Bharti Axa Life Insurancemeet15062024No ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- Guaranteed Return Insurance PlanDocument3 pagesGuaranteed Return Insurance PlanScribbydooNo ratings yet

- Fortune Guarantee Plus - 2021-03-26T180943.267Document3 pagesFortune Guarantee Plus - 2021-03-26T180943.267sk3146No ratings yet

- Illustration - 2022-07-30T141948.715Document3 pagesIllustration - 2022-07-30T141948.715Soumen BeraNo ratings yet

- Guaranteed Return Insurance PlanDocument2 pagesGuaranteed Return Insurance Planashutosh chaturvediNo ratings yet

- I Am RedDocument3 pagesI Am RedSudeep MandalNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Max APE 1 Lac PPT 10 Years PT 25 YearsDocument3 pagesMax APE 1 Lac PPT 10 Years PT 25 YearsSumitt SinghNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- JanuaryDocument4 pagesJanuaryalihassan459001No ratings yet

- AA SAP T-Codes - Example - Config ReferenceDocument97 pagesAA SAP T-Codes - Example - Config Referencedbambros100% (1)

- Change of OwnershipDocument3 pagesChange of Ownerships2gfxzkw2wNo ratings yet

- 0-3-2 E-KanbanDocument33 pages0-3-2 E-Kanbanprasetyo ilhamNo ratings yet

- Secure FirewallDocument1 pageSecure FirewallHB BLOGSNo ratings yet

- Journal Reading: Oleh: M. Isyhaduul Islam Arifiana Khusnul Hidayati Ulfi Shofahati Puskesmas GedongtengenDocument17 pagesJournal Reading: Oleh: M. Isyhaduul Islam Arifiana Khusnul Hidayati Ulfi Shofahati Puskesmas GedongtengenIka Wardhani KaruniaNo ratings yet

- Travel Vocabulary Words For Vacations: Package HolidaysDocument3 pagesTravel Vocabulary Words For Vacations: Package HolidaysVera AtanasovaNo ratings yet

- 3G4010CF V4-0 IM Eng 29009088R002 enDocument32 pages3G4010CF V4-0 IM Eng 29009088R002 enTyler HiggsNo ratings yet

- Strategic Management - MeezanDocument9 pagesStrategic Management - MeezanNida ShahzadNo ratings yet

- Cashback Card BrochureDocument11 pagesCashback Card BrochureRaju NagNo ratings yet

- ZX100 User Manual - en v1.1 PDFDocument67 pagesZX100 User Manual - en v1.1 PDFJose Maria Giraldo RodriguezNo ratings yet

- 11th Com DepreciationDocument4 pages11th Com DepreciationObaid KhanNo ratings yet

- Users Manual 4215923Document7 pagesUsers Manual 4215923smallhausenNo ratings yet

- Rov 1 Py 3 Ax Qo Ulv DDDocument7 pagesRov 1 Py 3 Ax Qo Ulv DDRajwinder SandhuNo ratings yet

- TrackingDocument3 pagesTrackingAnonymous dkRjp5rNo ratings yet

- Kalix User ManualDocument5 pagesKalix User ManualMd Golam RabbiNo ratings yet

- Unit - 5: Overview of Current Trends in Service IndustriesDocument16 pagesUnit - 5: Overview of Current Trends in Service IndustriesRiya KaushikNo ratings yet

- Lecture 2-SOA Case StudiesDocument23 pagesLecture 2-SOA Case Studiesزينب علىNo ratings yet

- Putting The Spotlight On ERP: Supply Chain & Logistics TechnologyDocument4 pagesPutting The Spotlight On ERP: Supply Chain & Logistics TechnologymrklickNo ratings yet

- Health Informatics SDocument4 pagesHealth Informatics SnourhanNo ratings yet

- Chart of AccountsDocument16 pagesChart of Accountsvinod_edathodiNo ratings yet

- Executive SummaryDocument24 pagesExecutive SummaryrajNo ratings yet

- Trace Result #CELL-1160500 - CellTrack PDFDocument6 pagesTrace Result #CELL-1160500 - CellTrack PDFJess BonacchiNo ratings yet

- Internet and IntranetDocument20 pagesInternet and IntranetSneha SamNo ratings yet

- Accounting Cycle MechanicsDocument6 pagesAccounting Cycle MechanicsAnjali BalmikiNo ratings yet

- Amazon Web Services Versus Microsoft Azure, Google, OracleDocument24 pagesAmazon Web Services Versus Microsoft Azure, Google, Oracledmwv55No ratings yet

- The Open Future of Radio Access NetworksDocument23 pagesThe Open Future of Radio Access NetworksWaleska De Fátima MonteiroNo ratings yet

- Discontinuation ACG 17 PDFDocument3 pagesDiscontinuation ACG 17 PDFBalvantray RavalNo ratings yet

Sampoorna Raksha Supreme

Sampoorna Raksha Supreme

Uploaded by

ashish khandelwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sampoorna Raksha Supreme

Sampoorna Raksha Supreme

Uploaded by

ashish khandelwalCopyright:

Available Formats

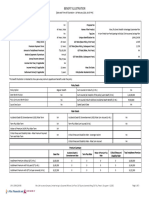

Name of the Prospect / Policyholder: ixt Proposal No: 1264214957769

Age (years) : 47 Gender: Male Name of the Product: Tata AIA Life Insurance Sampoorna Raksha

Supreme

Name of the Life Assured : ixt

Tag Line : Non-Linked, Non-Participating Life Insurance

Age (years) : 47 Gender: Male Smoker: No Plan

Policy Term : 18 Years 00 Income Start Age Unique Identification No.: 110N160V04

months (years): NA

GST Rate Year 1: 18.0%

Premium Payment Term : 18 Years 00 Income Rate:

months NA% GST Rate Year 2 onwards: 18.0%

Amount of Instalment Premium (Rs.): 52628 Credit Interest Rate: NA I am red I am red

Mode of Payment of Premium : Annual

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

Policy Details

Policy Option: Life option Lumpsum(Rs): 15000000

Sum Assured (Rs): 15000000 Income p.a (Rs): 0

Sum Assured on Death (at inception of the policy) (Rs): 15000000 Income Duration (months): 0

Rider Details

Tata AIA Vitality

(Wellness No

Program)

Details of Life

Rider Name/UIN^ Insured/Partner under the Benefit Payout

Benefit Option Return of Benefit Premium Sum Premium p.a. Year 1

(Benefit

premium Option Payment Assured without GST Discount

Option/Benefit Income

Lumpsum Income Option Term Term (Rs.) (Rs.) (Rs.)

Payout Option) Name Age(yrs) Gender Duration

(Rs.) p.a.(Rs.)

(years)

Premium Summary

Base Plan Riders Total Instalment Premium

Instalment Premium without GST (Rs.) 44600 0 44600

Instalment Premium with First year GST (Rs.) 52628 0 52628

Instalment Premium post applicable discount with First year GST (Rs.) 52628 0 52628

Instalment Premium with GST 2nd year onwards (Rs.) 52628 0 52628

Total Discount for first year premium includes -

(Amount in Rupees)

Guaranteed# Non - Guaranteed

Policy Single/ Annualised Survival

Year Premium Benefit / Other Benefits, if Maturity Death Min Guaranteed Surrender Special Surrender

Loyalty any Benefit Benefit Value Value

Additions

1 44600 NA NA NA 15000000 0 NA

2 44600 NA NA NA 15000000 0 NA

3 44600 NA NA NA 15000000 0 NA

4 44600 NA NA NA 15000000 0 NA

5 44600 NA NA NA 15000000 0 NA

6 44600 NA NA NA 15000000 0 NA

7 44600 NA NA NA 15000000 0 NA

8 44600 NA NA NA 15000000 0 NA

9 44600 NA NA NA 15000000 0 NA

10 44600 NA NA NA 15000000 0 NA

11 44600 NA NA NA 15000000 0 NA

12 44600 NA NA NA 15000000 0 NA

13 44600 NA NA NA 15000000 0 NA

14 44600 NA NA NA 15000000 0 NA

15 44600 NA NA NA 15000000 0 NA

16 44600 NA NA NA 15000000 0 NA

17 44600 NA NA NA 15000000 0 NA

18 44600 NA NA NA 15000000 0 NA

Note: "Annualized Premium" shall be the premium payable in a year under a non-single pay option chosen by the policyholder, excluding the taxes, rider

premiums, underwriting extra premiums, loading for modal premiums, if any.

"Single Premium" shall be the premium payable under a single pay option chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra

premiums if any.

#The benefits illustrated are as at the end of the policy year.

Income Tax benefits would be available as per the prevailing income tax laws, subject to fulfillment of conditions stipulated therein. Tata AIA Life Insurance

Company Ltd. does not assume responsibility on tax implication mentioned anywhere in this document. Please consult your own tax consultant to know the tax

benefits available to you.

This plan has an inbuilt benefit called “Payor Accelerator Benefit” wherein a benefit amount equal to 50% of the Base SA as on the date of diagnosis is paid out

as lump sum on acceptance of a Terminal Illness (TI) claim by the company. Upon payment of the TI claim, the policy continues and any due premiums continue

to remain payable. Please refer to the Sales Literature for further details.

I _______________________________ (name), have explained the I _______________________________ (name), having received the information with

premiums and benefits under the product fully to the prospect / respect to the above, have understood the above statement before entering into the

policyholder. contract.

Place: i am red

Date: Signature of Agent/ Intermediary/ Official Date: Signature of Prospect/ Policyholder

Unique Reference Number - L&C/Advt/2023/Sep/2978 (Rider- L&C/Advt/2022/Sep/2271)

Tata AIA Life Insurance Company Ltd. (IRDA of India Regn No. 110) (CIN: U66010MH2000PLC128403)

Registered and Corporate Office: 14th Floor, Tower A, Peninsula Business Park, Senapati Bapat Marg, Lower Parel, Mumbai- 400013

Trade logo displayed above belongs to Tata Sons Ltd and AIA Group Ltd. and is used by Tata AIA Life Insurance Company Ltd under a license.

For more information, Call the Tata AIA Life Insurance Company Ltd Helpline number1860-266-9966 (local charges apply) or Visit us at: www.tataaia.com

(I)V.99.00/FY2023-2024_Q4/RELEASE 01-01-24/EXPIRY 31-03-2024 WS 11-03-2024,03:32 PM

You might also like

- Printable Flash CardsDocument96 pagesPrintable Flash CardsSnehil SinghNo ratings yet

- Comparison of ATM and EthernetDocument3 pagesComparison of ATM and EthernetAvneet KaurNo ratings yet

- Sampoorna Raksha SupremeDocument3 pagesSampoorna Raksha Supremejbbheda789No ratings yet

- Sampoorna Raksha Supreme - 2024-06-15T125809.026Document3 pagesSampoorna Raksha Supreme - 2024-06-15T125809.026xemflux.oneNo ratings yet

- Iamred IamredDocument3 pagesIamred Iamredhimi199393No ratings yet

- SIS With LSPO and Regular PayDocument3 pagesSIS With LSPO and Regular PayJyoti PandeyNo ratings yet

- Benefit IllustrationDocument2 pagesBenefit IllustrationusefulNo ratings yet

- Sampoorna Raksha SupremeDocument3 pagesSampoorna Raksha SupremeNaren BurraNo ratings yet

- Sampoorna Raksha Supreme - 2023-09-15T150349.974Document4 pagesSampoorna Raksha Supreme - 2023-09-15T150349.974Karthikeyan SakthivelNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsDocument4 pagesTata AIA Life Insurance Sampoorna Raksha Supreme: Policy DetailsRavi PrakashNo ratings yet

- Sampoorna Raksha SupremeDocument5 pagesSampoorna Raksha Supremeriddhi SalviNo ratings yet

- Dear Mr. Akhil E G: Key FeaturesDocument4 pagesDear Mr. Akhil E G: Key FeaturesAkhil GirijanNo ratings yet

- Scope No. 19Document5 pagesScope No. 19Chetan GuptaNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusĄńıkęť MâhîñďNo ratings yet

- Class NotesDocument3 pagesClass NotesMUKESH MEHTANo ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusvidyadhreevidyashreeNo ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- Plan/Benefit Options Benefit Description: Dear Udayan PandeyDocument4 pagesPlan/Benefit Options Benefit Description: Dear Udayan PandeyudayanNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageDINESH JYOTHINo ratings yet

- Mon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueDocument3 pagesMon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueRamesh SharmaNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- I Am Red: Policy DetailsDocument3 pagesI Am Red: Policy DetailsKalpesh MoreNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Sanchay Par 75Document3 pagesSanchay Par 75Soumen BeraNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusScribbydooNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- IllustrationDocument3 pagesIllustrationpraharshafciNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Total Death Benefit Under SRS Vitality Protect: 2,00,00,000Document6 pagesTotal Death Benefit Under SRS Vitality Protect: 2,00,00,000Anvi MahajanNo ratings yet

- Benefit IllustrationDocument3 pagesBenefit IllustrationPragnNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Total Death Benefit Under SRS Vitality Protect: 1,50,00,000Document6 pagesTotal Death Benefit Under SRS Vitality Protect: 1,50,00,000tushar potekarNo ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- 7 Month Waiver of PremiumDocument4 pages7 Month Waiver of PremiumnikhilraoNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- BI - OutputGBP VDocument4 pagesBI - OutputGBP VSagrika SagarNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Rajeev Ranjan Bharti Axa Life InsuranceDocument8 pagesRajeev Ranjan Bharti Axa Life Insurancemeet15062024No ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- Guaranteed Return Insurance PlanDocument3 pagesGuaranteed Return Insurance PlanScribbydooNo ratings yet

- Fortune Guarantee Plus - 2021-03-26T180943.267Document3 pagesFortune Guarantee Plus - 2021-03-26T180943.267sk3146No ratings yet

- Illustration - 2022-07-30T141948.715Document3 pagesIllustration - 2022-07-30T141948.715Soumen BeraNo ratings yet

- Guaranteed Return Insurance PlanDocument2 pagesGuaranteed Return Insurance Planashutosh chaturvediNo ratings yet

- I Am RedDocument3 pagesI Am RedSudeep MandalNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Max APE 1 Lac PPT 10 Years PT 25 YearsDocument3 pagesMax APE 1 Lac PPT 10 Years PT 25 YearsSumitt SinghNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- JanuaryDocument4 pagesJanuaryalihassan459001No ratings yet

- AA SAP T-Codes - Example - Config ReferenceDocument97 pagesAA SAP T-Codes - Example - Config Referencedbambros100% (1)

- Change of OwnershipDocument3 pagesChange of Ownerships2gfxzkw2wNo ratings yet

- 0-3-2 E-KanbanDocument33 pages0-3-2 E-Kanbanprasetyo ilhamNo ratings yet

- Secure FirewallDocument1 pageSecure FirewallHB BLOGSNo ratings yet

- Journal Reading: Oleh: M. Isyhaduul Islam Arifiana Khusnul Hidayati Ulfi Shofahati Puskesmas GedongtengenDocument17 pagesJournal Reading: Oleh: M. Isyhaduul Islam Arifiana Khusnul Hidayati Ulfi Shofahati Puskesmas GedongtengenIka Wardhani KaruniaNo ratings yet

- Travel Vocabulary Words For Vacations: Package HolidaysDocument3 pagesTravel Vocabulary Words For Vacations: Package HolidaysVera AtanasovaNo ratings yet

- 3G4010CF V4-0 IM Eng 29009088R002 enDocument32 pages3G4010CF V4-0 IM Eng 29009088R002 enTyler HiggsNo ratings yet

- Strategic Management - MeezanDocument9 pagesStrategic Management - MeezanNida ShahzadNo ratings yet

- Cashback Card BrochureDocument11 pagesCashback Card BrochureRaju NagNo ratings yet

- ZX100 User Manual - en v1.1 PDFDocument67 pagesZX100 User Manual - en v1.1 PDFJose Maria Giraldo RodriguezNo ratings yet

- 11th Com DepreciationDocument4 pages11th Com DepreciationObaid KhanNo ratings yet

- Users Manual 4215923Document7 pagesUsers Manual 4215923smallhausenNo ratings yet

- Rov 1 Py 3 Ax Qo Ulv DDDocument7 pagesRov 1 Py 3 Ax Qo Ulv DDRajwinder SandhuNo ratings yet

- TrackingDocument3 pagesTrackingAnonymous dkRjp5rNo ratings yet

- Kalix User ManualDocument5 pagesKalix User ManualMd Golam RabbiNo ratings yet

- Unit - 5: Overview of Current Trends in Service IndustriesDocument16 pagesUnit - 5: Overview of Current Trends in Service IndustriesRiya KaushikNo ratings yet

- Lecture 2-SOA Case StudiesDocument23 pagesLecture 2-SOA Case Studiesزينب علىNo ratings yet

- Putting The Spotlight On ERP: Supply Chain & Logistics TechnologyDocument4 pagesPutting The Spotlight On ERP: Supply Chain & Logistics TechnologymrklickNo ratings yet

- Health Informatics SDocument4 pagesHealth Informatics SnourhanNo ratings yet

- Chart of AccountsDocument16 pagesChart of Accountsvinod_edathodiNo ratings yet

- Executive SummaryDocument24 pagesExecutive SummaryrajNo ratings yet

- Trace Result #CELL-1160500 - CellTrack PDFDocument6 pagesTrace Result #CELL-1160500 - CellTrack PDFJess BonacchiNo ratings yet

- Internet and IntranetDocument20 pagesInternet and IntranetSneha SamNo ratings yet

- Accounting Cycle MechanicsDocument6 pagesAccounting Cycle MechanicsAnjali BalmikiNo ratings yet

- Amazon Web Services Versus Microsoft Azure, Google, OracleDocument24 pagesAmazon Web Services Versus Microsoft Azure, Google, Oracledmwv55No ratings yet

- The Open Future of Radio Access NetworksDocument23 pagesThe Open Future of Radio Access NetworksWaleska De Fátima MonteiroNo ratings yet

- Discontinuation ACG 17 PDFDocument3 pagesDiscontinuation ACG 17 PDFBalvantray RavalNo ratings yet