Professional Documents

Culture Documents

2 Week Payroll Calculator

2 Week Payroll Calculator

Uploaded by

Daniel_Scott_WestOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Week Payroll Calculator

2 Week Payroll Calculator

Uploaded by

Daniel_Scott_WestCopyright:

Available Formats

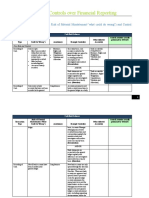

actual actual night hours calc OT diff #REF! #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF!

0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 4/15/2012 Extra #REF! #REF! #REF! pay rate/hr $0.00 night diff 0% pay day 5/29/2010 Enter date (A10) for pay ONLY edit cells on lines 10 & 21 2 wk period ending: 4/28/2012 period or leave blank add times as 'hours.mins', for ex. '9:25' would be entered as '9.25' #REF! #REF! #REF! #REF! #REF! #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! 0.00 #REF! #REF! Extra #REF! #REF! #REF! 2 wk period ending: 5/12/2012 5/12/2012 #REF! day #REF! clock in #REF! clock out #REF!

calc OT + night diff hours #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! est net

pay #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF!

. '9:25' would be entered as '9.25' #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! est net

#REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF! #REF!

Timestam p

Date

Clock In

Clock Out

Comments

#REF! #REF!

#REF! #REF! #REF! #REF! #REF! #REF!

#REF! #REF!

day Sunday Monday Tueday Wednesday Thursday Friday Saturday Extra pay rate/hr

calc OT + actual actual night night diff clock in clock out hours calc OT diff hours 0.00 0.00 $0.00 0.00 0.00 0.00 $0.00 0.00 0.00 0.00 $0.00 0.00 0.00 0.00 $0.00 0.00 0.00 0.00 $0.00 0.00 0.00 0.00 $0.00 0.00 0.00 0.00 $0.00 0.00 0.00 0.00 $0.00 0.00 $7.25 night diff 7% est net 1/2/10 Only edit Yellow cells period ending: add times as 'hours.mins', for ex. '9:25' would be entered as '9.25'

pay $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

Payroll Calculator Payroll Calculator

Form

Form Data

Dynamic Sheet

Dynamic Sheet

Individual Week 1

Live Form READ ME PLEASE!

Payroll Calculator

Thank you for trying out my template. In order to get the best experience, please read these instructions first. There are 5 sheets and a form in this document, the 1st of which you are reading right now. To see the form, click on the 'Form' tab in the toolbar above. When you have entered information into the form, it will appear on a new row in the 'Form!' sheet automatically. If you go to the 'Form!' sheet now you will see my test entry from 9:00 to 17:00, you can delete the contents of this row now. You come back here to edit a cell if you made a mistake when entering data through the form. DO NOT enter times here, use the live form instead (from the 'Form' tab on the toolbar above, next to 'File', 'Edit', etc.).

The data from the sheet 'Form!' is automatically displayed on the sheet 'Form Data!' and the sorted by date. DO NOT EDIT anything on this sheet. It is just a mirror of what is on the 'Form!' sheet. The 'Dynamic Sheet!' pulls its data from the 'Form Data!' sheet, and uses it to calculate your paycheck and estimated net for the current and past week. To personalize these calculations please go to the 'Dynamic Sheet!' now and edit the colored cells on rows 10 and 21. First enter you hourly salary in cell C10. Then enter the percentage for your companies night differential as a decimal in E10 (7% would be entered as 0.07). The night differential is calculated for the complete hours of any shift starting between 14:00 - 2:00, and is included in overtime calculations (i.e. if you earned $20 in night diff for an overtime shift, you'd be paid $30). If your company does not offer night differential, enter a 0, or delete the contents to leave it blank. The third cell you need to edit is the estimated net income in I10. This cell (I10) calculates both your estimated taxes, and weekly standard deductions (medical insurance, etc.). First estimate the percentage of your weekly check which you keep after paying taxes, including social security etc., you can do this by taking an average of the last few checks. [To calculate; put your total gross income in cell B5 on this page, and the total you paid to taxes on those check in cell C5 on this page, the percentage will display in cell D5.] Then add together all your standard deductions (medical insurance, etc.). In cell I10 on the 'Dynamic Sheet!' in the first parenthesis where it says "I9*0.74", replace the 0.74 with the amount of the check which you keep (from D5 on this sheet) in decimal format (80% would be entered as 0.8). In the second parenthesis where it says "0", put the dollar amount of your standard weekly deductions (medical insurance premiums, etc.). Now copy cell I10 to cell I21 so that the same calculation is made for both weeks being displayed. The hours and dates are pulled from the 'Form Data!' sheet to be displayed here in columns B-D. Column A will calculate the day of the week for that specific date. The information being displayed will be only for the current week, and the week which has just ended. To display information from a different week please enter the date you wish to see displayed in cell A10, and the display will update to show the week of the date you entered and the one prior. to revert to automatically displaying the current weeks just clear the contents of cell A10. If you have a bonus which you wish to add to the total of a weeks salary it can be entered in cells C9, D9, C20, and D20 for the respective weeks, just remember to clear it when the week is done so it won't affect your calculations of other weeks. To calculate specific weeks salaries with special circumstances, use the 'Individual Week 1!' sheet described below. DO NOT EDIT any cells on this sheet aside for the above mentioned ones on rows 10 and 21, or you risk affecting the functionality of these calculations. If you see "--" displayed in the cells on this page, clear them from the cells ONLY in columns B, C, & D. Clearing them from these cells will make the calculations functional again. This sheet uses all the same calculations as the dynamic sheet, however it does not pull data from any of the other sheets. You must make all of the personalization adjustments mentioned for the 'Dynamic Sheet!' here as well on row 10. you can use this sheet to calculate predicted salaries, missing time, or anything else where you'd like to fudge the numbers a little to figure something out, without having to worry about affecting your records. If you would like you can also duplicate this sheet easily for more copies by clicking on the the little arrow next to its name on the bottom of the page and clicking 'Duplicate'. Congratulations, you've setup the calculator. Now to enhance your data entry experience, please click on the 'Form' tab above, and click 'Edit Form'. Here you can change the name displayed at the top of the form by clicking on the name and editing it. You can also change the theme by clicking on the "Theme : Time" button on the top bar and choosing one to your liking. you can now delete this sheet, or move it to the right (by clicking the little arrow next to its name on the bottom of the page, and clicking 'Move Right>>') to save for future reference.

If you like what you see, and find this calculator useful, please rate it in the template gallery, thank you very much, and good luck. If you have any suggestions please feel free to email me.

enter your total gross below

enter your total taxes below

this is the percentage of your check which you keep

$353

$47

87%

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Problems CH 14Document14 pagesProblems CH 14StephenMcDaniel50% (4)

- Partnership Agreement ENTDocument12 pagesPartnership Agreement ENTLenny JMNo ratings yet

- Untitled DocumentDocument1 pageUntitled DocumentDaniel_Scott_WestNo ratings yet

- Progress Notes (SOAP (ER) )Document1 pageProgress Notes (SOAP (ER) )Daniel_Scott_WestNo ratings yet

- Progress Notes (SOAP (ER) )Document1 pageProgress Notes (SOAP (ER) )Daniel_Scott_WestNo ratings yet

- Contact Details TemplateDocument2 pagesContact Details TemplateDaniel_Scott_WestNo ratings yet

- ORIGINAL Proposal and ContractDocument2 pagesORIGINAL Proposal and ContractDaniel_Scott_WestNo ratings yet

- Artist Booking ConfirmationDocument1 pageArtist Booking ConfirmationDaniel_Scott_WestNo ratings yet

- Comic ScriptDocument2 pagesComic ScriptDaniel_Scott_WestNo ratings yet

- Quasar Instruments Service ContactDocument7 pagesQuasar Instruments Service ContactDaniel_Scott_WestNo ratings yet

- Calls For 20 JulyDocument3 pagesCalls For 20 JulyDaniel_Scott_WestNo ratings yet

- Modern PROPOSAL and CONTRACTDocument2 pagesModern PROPOSAL and CONTRACTDaniel_Scott_WestNo ratings yet

- Homeless For Wiki-LinksDocument5 pagesHomeless For Wiki-LinksDaniel_Scott_WestNo ratings yet

- LOGIN SHEETDocument2 pagesLOGIN SHEETDaniel_Scott_WestNo ratings yet

- Wicked Goodies OrderDocument2 pagesWicked Goodies OrderDaniel_Scott_WestNo ratings yet

- ABOUT MEDocument8 pagesABOUT MEDaniel_Scott_WestNo ratings yet

- Circles ResumeDocument1 pageCircles ResumeDaniel_Scott_WestNo ratings yet

- Travel ItineraryDocument5 pagesTravel ItineraryDaniel_Scott_WestNo ratings yet

- Seperate Paths of Disalution-By - Daniel Scott WestDocument1 pageSeperate Paths of Disalution-By - Daniel Scott WestDaniel_Scott_WestNo ratings yet

- CLSR Newsletter CenteredDocument2 pagesCLSR Newsletter CenteredDaniel_Scott_WestNo ratings yet

- Distraction Free Writing TemplateDocument1 pageDistraction Free Writing TemplateDaniel_Scott_WestNo ratings yet

- 395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30Document6 pages395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30blazeweaverNo ratings yet

- UntitledDocument633 pagesUntitledDarius KD FrederickNo ratings yet

- Asignment # 1: Management Accounting Decision MakingDocument6 pagesAsignment # 1: Management Accounting Decision MakingDaood AbdullahNo ratings yet

- Japanese Embroidery: (Nihon Shishu)Document11 pagesJapanese Embroidery: (Nihon Shishu)VerdeamorNo ratings yet

- Difference Between Domestic and International BusinessDocument3 pagesDifference Between Domestic and International BusinessVedansh PalNo ratings yet

- T1275 Trojan Data SheetsDocument2 pagesT1275 Trojan Data SheetsZombi AnacoretaNo ratings yet

- AdvertisementDocument14 pagesAdvertisementNur Al AhadNo ratings yet

- Envirofit Case StudyDocument2 pagesEnvirofit Case StudyrcrsanowNo ratings yet

- Choosing The Right Valuation ModelDocument7 pagesChoosing The Right Valuation Modelbma0215No ratings yet

- 01 PartnershipDocument6 pages01 Partnershipdom baldemorNo ratings yet

- # 17,, New Delhi 110021, India Payment File: RBI-DEL/id1033/13 Payment Amount: IN INDIA RUPEES 500,000.00GBP Reserve Bank of India Official Payment NotificationDocument2 pages# 17,, New Delhi 110021, India Payment File: RBI-DEL/id1033/13 Payment Amount: IN INDIA RUPEES 500,000.00GBP Reserve Bank of India Official Payment Notificationनटराज नचिकेताNo ratings yet

- Audit of Expenditure CycleDocument5 pagesAudit of Expenditure CycleMa Tiffany Gura RobleNo ratings yet

- IRF540N: 33A, 100V, 0.040 Ohm, N-Channel, Power Mosfet Packaging FeaturesDocument11 pagesIRF540N: 33A, 100V, 0.040 Ohm, N-Channel, Power Mosfet Packaging Featureschristianc15No ratings yet

- Ratio Analysis FormulasDocument2 pagesRatio Analysis Formulassatya100% (2)

- AppendixDocument8 pagesAppendixapi-285669050No ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaPraveen KumarNo ratings yet

- Urs For Export DocumentationDocument14 pagesUrs For Export DocumentationSubhash ReddyNo ratings yet

- SEED Program Case StudyDocument10 pagesSEED Program Case StudykeerthanaNo ratings yet

- Lecture 6 BJT1Document13 pagesLecture 6 BJT1马铃淑No ratings yet

- Assets Increases Decreases Liabilities Decreases Increases Income Decreases Increases Expenses Increases DecreasesDocument9 pagesAssets Increases Decreases Liabilities Decreases Increases Income Decreases Increases Expenses Increases DecreasesprashantsdpikiNo ratings yet

- Types of PlanningDocument16 pagesTypes of PlanningTeresa Carter100% (1)

- Reaction Paper ElasticityDocument2 pagesReaction Paper Elasticityelizabeth_cruz_53100% (1)

- JFK Airtrain Brochure EnglishDocument2 pagesJFK Airtrain Brochure Englishপিঁপড়া পিঁপড়াNo ratings yet

- Cover Your Assets KiyosakiDocument13 pagesCover Your Assets KiyosakiEdwin Gonzalito100% (1)

- Summary (Case Study)Document2 pagesSummary (Case Study)Sangeetha GangaNo ratings yet

- BMA Information BulletinDocument9 pagesBMA Information BulletinkiyotakaayaNo ratings yet

- Bthma2e ch06 SMDocument183 pagesBthma2e ch06 SMAd UnmNo ratings yet

- Appendix - 1 - Illustrative List of RoMMs and Control ActivitiesDocument190 pagesAppendix - 1 - Illustrative List of RoMMs and Control ActivitiesspandanNo ratings yet