Professional Documents

Culture Documents

FIN 450 Notes

FIN 450 Notes

Uploaded by

g00089581Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN 450 Notes

FIN 450 Notes

Uploaded by

g00089581Copyright:

Available Formats

Chapter 01: Working Capital Management

Monday, August 28, 2023 8:26 AM

1. Income Statement

a. Transactions are recording over a period of time.

b. A summary of business costs, revenue, and sales.

c. Publicly held companies are required to published quarterly and annually.

2. Balance Sheet

a. Transactions are recorded as of a moment in time.

b. Shows the financial position of the company i.e., the company's the liability, assets, and equity.

c. Assets - Liability = Net Worth of the Company

d. Also called Statement of Financial Position.

3. Statement of Cash Flows

a. There's a difference between Net Income and Net Cash flows. A company that has a high net income can have issues with the Net cash flows because net cashflows

only takes into account the actual inflows and outflows of the company and not accrued income and expenses like depreciation etc.

b. Essential for every company.

- Value of an asset - Net present value of the future cash flows the asset will generate, hence we always need cash flow statements too.

FIN 450 Page 1

Case Study 01: Jones Electrical Distribution

Wednesday, August 30, 2023 9:36 AM

Key Notes related to the Case - An Introduction

i. Jones Electrical Distribution competes in the wholesale distribution industry where they (Jones) buy a huge quantity of a pro duct from a supplier

and then resells them to retailers in smaller quantities.

a. Wholesalers will have multiple suppliers, however each supplier will provide a bulk quantity of one particular product. Hencethe wholesaler

will have a huge inventory of different kinds /varieties of products.

b. What a retailer requires is a small batch of different varieties. Even though they are small quantities of a product, when adding the different

requirements, they become a large order.

ii. Does the business model practiced by Jones Electrical add value to its customers?

a. Yes! The intermediate role Jones plays here is vital for its customers (retailers) because they make is easier and more accessible for retailers

to have access to numerous varieties of products in small quantities at competitive prices within a short period of time.

iii. What does it take for the Wholesaler to be profitable in this industry ?

a. The wholesale industry is extremely competitive in terms of pricing. Retailers or clients will go for the wholesaler that provides the most

appealing and competitive prices. Apart from that there are several aspects that are essential for ensuring success for the wholesale

business

i. Inventory Management (Current Assets)

a) There should be a reasonable stock of inventory to satisfy demand of clients

b) However, wholesalers should also ensure to not have excess inventory sitting idle because then there is a risk for the

technology to go obsolete and tying cash into less effective idle assets.

ii. Supplier Relationship ** (Accounts Payable - Current Liabilities)

a) Suppliers are an essential part of the value chain for wholesalers. Hence to maintain a good relation with them, it is

essential to meet the payments on time.

b) Usually payments are due within 30 days and anything beyond this timeline is problematic that might affect your reputation

to receive credit in the future.

c) In order to incentivize wholesalers to make payment prior to the due date, suppliers provide a discount of about 2% to the

wholesalers.

1) BUSINESS MATH APPLICATION (Extremely Important to understand)

a) We know that suppliers incentivize wholesalers to pay beforehand by providing purchase discounts of around 2%. Hence if

wholesalers pay the due amount within 10 days rather than 30 days, they are given a 2% upfront discount. However 2%

seems small … what do you think ?

i) Even though 2% seems small in number, the effect is has on the wholesale business is nowhere trivial.

ii) If the wholesaler differs payments, the number of additional days he gets before losing his reputation with the

supplier is 20 days (30-10). Hence for a 20 day delay, the wholesaler's loss is 2% i.e., If the wholesaler where to make

the payment on the 10th day, he would have paid $98. However, for a 20 day delay, he pays an additional $2 for his

delayed payments and ends up paying $100.

iii) If you were to annualize the 2% discount it would reach to an annualized interest rate of 36% (2%*(360/20)=0.36 ).

Even banks do not lend money at this interest rate. Hence for a 20 day delay of payment, you are paying an additional

36% in annual terms which will have a HUGE IMPACT on the cost of goods sold for the wholesaler.

iv) If the COGS are effected, then the price per unit is effected, if price per unit is effected, then there is a risk of losing

clients as they would lean to other wholesalers who manage to provide them with better pricing efforts. In this

industry cost reduction, management of finances, and pricing are very critical for success.

iii. Customer Relationship (Accounts Receivable - Current Assets)

a) It is fair to assume that the customer of the wholesaler is also purchasing on credit. Hence there must be a proper system to

collect cash and maintain Accounts Receivable.

iv. Sales Personnel Relationship (Current Liabilities)

a) Sales Representatives are vital to pursue clients to make deals with wholesalers and win over businesses to make revenue.

Hence they play a vital role in creating long lasting business that are profitable.

b) In order to retain the best personnel, proper incentives and working environment should be provided. Apart from the base

salary, these representatives should be paid through commission for performance, incentivizing them for winning more

deals for the business.

i) Why should we pay commission rather than paying a monthly fixed salary ?

1. We as a business do not need to increase our overhead costs, especially for inefficient employees.

2. Commission based payments will ensure that the ones that perform well are rewarded according and

the ones that are having a hard time to reach their target be trained.

iv. Notice that all the above mentioned are related to current assets and liabilities meaning that the case is related to financing working capital

management because working capital = Current Asset - Current Liabilities.

v.

Case Facts - Detailed

• The case talks about Jones Electronics who competes in the wholesale industry. This means that Jones buy electrical products

from a 100+ suppliers at large quantities and sell these variety of products to retailers in smaller portions with the help of the

salesmen.

• The case is set in 2007, and the company is experiencing a huge growth and it is growing beyond its capacity. We can come to

this conclusion because

▪ Jones Electricals is having a hard time paying back suppliers on time let alone get trade discounts which was the

normal situation.

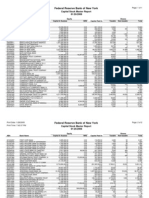

▪ If you look at the income statement of Jones (Exhibit 1 from pdf), there is a steep increase in the sales. An ~18%

increase in sales each year (2004-2006).

□ When sales increases, automatically the Accounts Receivables of a company increases and so does the need for

the inventory. Hence when the sales increases, the need to invest in current assets also increases.

□ Apart from the increase in inventory, there will be an increase in Accounts payable. How ?

When the inventory requirements increase, the wholesaler will need to purchase more from the suppliers. Since

liquidity is low due to higher A/R, the wholesaler will also buy it on credit apart from higher demand for the

reason for buying more.

□ Therefore, when there is an increase in sales, there is an increase in both current assets and current liabilities.

When Current Assets and Current Liabilities increase, the Net Working Capital Rises .

This is because, usually for a stable company, the net working capital of a company is positive. As sales

increases the spread between the Current Assets - current Liabilities increases, and hence the net working

capital rises.

FIN 450 Page 2

• As you can see from the above, as business expand there is a need to inject finance into working capital requirements.

• One thing we need to understand is that even though current assets such as inventory and current liabilities are part of the short

term investments, people might assume that working capital requires short term financing.

○ However, we need to understand that even though working capital seems short term, the firm will keep having

inventories, Accounts receivables, and Accounts payable. These will exists as long as the business is running. Hence, if

the company is growing, the company needs to borrow through long term financing, not short term even though they are

called Current Assets and Current Liabilities.

○ As long as the business is running there will be working capital requirements. The only time CA and CL will be zero is

when the business is not running. Hence long term financing is the required source rather than short term finances.

• We have come to the conclusion that Jones Electricals requires long term loan and now is in a predicament as to where he

should borrow from and how much he should borrow too. He has decided to switch from Metropolitan Bank to Southern Bank.

However, he is unsure if $350,000 will be enough for the business right now.

○ In order to determine if the amount is enough or not we need to make some analysis from the Income Statement, Balance

Sheet, and then make some estimates from it.

Case Study 01 Jones Electrical Distribution - Spreadsheet

• Form the above Income Statement and Balance Sheet, the following observations can be made

1. Net Sales of the company has been increasing (~18%) per year.

2. Cost of Goods Sold are increasing at a higher pace than the Net Sales (Only the % chance in 2006 from 2005) and one

reason might be Jones Electricals' inability to acquire the trade discounts from suppliers.

3. Moving to the balance sheet, the Cash Balance plummets in 2006 by 56% from $53 to $23. Rest all current assets as well

as both current liabilities and long term liabilities are increasing.

4. We can see that under current liabilities there is an item called Long term debt, current portion of $24 each year. This

means that the Long term debt that is shown in the balance sheet has installment payments each year. So whenever there is

an installment payment due in each year, the installment amount is recorded as a current liability item.

i. Then the installment amount is subtracted from the principle amount and then recorded in the long term liability.

5. One of the most important observation to make in this balance sheet is the Net Worth of the Company. We can see that the

net worth is rising but there is another inconspicuous event happening.

i. We can say that Jones Electricals have not paid dividends from 2004 - 2006. How ?

If you have a look at the difference between the increase in the Net Worth for each year, the entire amount of the Net

Income has been retained and not given as dividends.

Ex: In 2005, the Net Income increased by exactly $29 which was the exact value of the Net Income of the company

in 2005.

6. RATIO CALCULATIONS:

Particulars Formula Interpretation 2004 2005 2006

Receivable Sales / Accounts how quickly a company 1624/187 = 1916/231 = 2242/264 =

Turnover Receivable collects payments from 8.6845 8.2944 8.4924

customers

Days' Sales in 365 / Receivable average time it takes to collect 365/8.6845 = 365/8.2944 = 365/8.4924 =

Receivablesq Turnover outstanding receivables 42.0289 44.0056 42.9796

Payables Sales / Accounts assesses how fast a company 1624/ 36 = 1916/42 = 2242/120 =

Turnover Payable pays its suppliers 45.1111 45.619 18.6833

Days' Sales in 365/ Payables average time it takes to settle 365/45.111 = 365/45.619 = 365/18.6833 =

Payables Turnover payables 8.0912 8.0011 19.5362

Inventory Sales / how often a company sells its 1624/243 = 1916/278 = 2242/379 =

Turnover Inventories inventory 6.6831 6.8921 5.9156

Days' Sales in 365 / Inventory average time it takes to sell 365/6.6831 = 365/6.8921 = 365/5.9156 =

Inventory Turnover inventory. 54.6154 52.9592 61.7013

• From all this information, we also have to prepare a cash flow statement for the company.

CASH FLOW STATEMENT

Particulars 2005 2006 Change

Net Income (Income Statement) 29 30 1

Depreciation (Balance Sheet : Shows accumulated dep.) 99-74 = 25 134-99 = 35 35 - 25 = 10

New Total before (+ / - ) increase / decrease in CA & CL 54 65 11

Increase in Accounts Receivable (cash outflow) (44) (33) (77)

Increase in Inventory (cash outflow) (35) (101) (136)

Increase in Accounts Payables (cash inflow) 6 78 84

Increase in line of credit payable (cash inflow) 65 35 100

Increase in Accrued Expenses (cash inflow) 1 0 1

Long-term, current potion (cash outflow) (24) (24 ) (48)

Net cash inflow / outflow from operations 23 20 -65

Purchase of Plant, Property, & Equipment (Cash outflow) (15) (50) (65)

Net cash inflow/outflow from investing activities (15) (50) (65)

Decrease in long term debt (cash outflow) (24) (24) (48)

Increase in line of credit payable (cash inflow) 65 35 100

Net cash inflow/outflow from financing activities 41 11 52

Increase/(Decrease) in cash 8 (30) (22)

FIN 450 Page 3

Chapter 02:

Monday, September 18, 2023 9:33 AM

Weakness of IRR Measure:

1. In the case of some unusual projects, strangely the project may have more than 1 IRR value.

2. We only have 2 or more IRRs when there unconventional cash flows

Year Cash Flows

0 (800)

a.

1 5000

2 (5000)

3. NPV = -5000 / (1+R) ^ 2 + 5000 / (1+R)^1 - 800

a. 25% discount rate = (-5000/(1+0.25)^2)+(5000/(1+0.25))-800 = 0

b. 400% discount rate = (-5000/(1+4)^2)+(5000/(1+4))-800 = 0

c. 100% discount rate = (-5000/(1+1)^2) + (5000/(1+1))-800 = 450

4. When evaluating a single project, the NPV and IRR usually they agree and give the same output, BUT NOT ALWAYS. Usually you have a downward sloping curve.

5. When you say Y = a+BX1+CX2+dX3 -------> inflation is a variable of Exchange rate, you use historical data to estimate A, B,C and then u predict.

Year Cash Flow Reinvestment Rate for 1 yrs

0 (2500) N/A ----- Outflow The cash flows during the project is called INTERIM CASHFLOWS THAT CAN BE RE-INVESTED.

700 CAN BE REINVESTED F0R 3 YRS, 900 FOR 2 YRS ETC

FIN 450 Page 4

5. When you say Y = a+BX1+CX2+dX3 -------> inflation is a variable of Exchange rate, you use historical data to estimate A, B,C and then u predict.

Year Cash Flow Reinvestment Rate for 1 yrs

0 (2500) N/A ----- Outflow The cash flows during the project is called INTERIM CASHFLOWS THAT CAN BE RE-INVESTED.

700 CAN BE REINVESTED F0R 3 YRS, 900 FOR 2 YRS ETC

1 700 Money received canbe reinvested at 12% (for 1 yer not al 3 yrs)

6.

2 900 15%

3 1250 16%

4 1700 N/A

NPV = (1700/(1+0.1)^4) +(1250/(1+0.1)^3)+(900/(1+0.1)^2)+(700/(1+0.1)^1)-2500 = 980.4317 -----------> Profitable project.

We need a discount rate when you need to compare. To compute NPV we need the IRR

Modified NPV (Includes Reinvesmtne rate computation)

a. FIND THE TERMINAL VALUE:

i. Terminal Value in order to find the modified NPV is the future value of all the cash inflows of the project ("re-investment values also included") by the

end of the life of the project.

ii. TV = 700 (1.12*1.15*1.16)+900*(1.15*1.16)+1250(1.16)+1700 = 5,396.456

iii. Modified NPV = (5253.36/(1+0.1)^4) -2500 = 1088.1156

One. (5396.456/(1+0.1)^4) - 2500 = 1185.8521

Modified IRR = 5396.456/(1+r)^4 - 2500 = 0

Whatever Modified IRR tells it’s the same for Modified NPV.

FIN 450 Page 5

Case 02: New Heritage Doll Company

Wednesday, September 20, 2023 9:52 AM

Key Notes

• The case gives the company 2 projects and their projected cash flow …. And the company needs to choose one

project.

○ Project 1: Match my doll clothing

▪ Builds on prior success.

▪ Idea from Hollywood moms and daughters (Fad that emerged) and then used that fad to follow the

girls who buy dolls and dress the same as what they wear.

○ Project 2: Design your own doll

▪ Developing a software where the young girl can design her own doll as she likes which is custom

made.

▪ More durable for the company in the long term because the other on is just a fad that lasts for a short

time.

▪ 2x bigger than match my doll clothing in terms of financial requirements.

• Investments are always part of the corporate strategy and both the projects fit the business model, but they are

not identical.

• In absence of any constraints, taking in both the projects are profitable provided that their NPVs are positive. (they

are positive .. Check the excel file)

• When calculating the NPV of the project, we will just take out the taxes and not the interest out

• Tax rate is already given in the case which is 40%

New_Herita

ge_Excel_...

• If we want to know how wealthier the shareholders got, we look at the NPV

• Prior to the calculation of NPV, we were comparing the IRR and NPV between the 2 projects and afterwards

calculated the terminal.

• The 2 projects are represented as mutually exclusive, how about taking one now and the other one a a year or 2

later. If the case says choose 1 from the 2 it might not mean that you have to cancel one out, you can always defer

one project.

FIN 450 Page 6

Chapter 03:

Monday, October 2, 2023 10:13 AM

Notes

1. Under Condition of uncertainty, we do not know the possible outcome and or we do not know

what the probability of the possible outcomes

Project : (unsure of cash inflow)

Period 0 Period 1

State 01: NPV = -100 (50%) State 01: NPV = 100

State 02: NPV = 100 (50% -- condition State 02: NPV = 0 (because you received a bad news so you

of risk) don’t invest)

E(NPV) = -100*0.5 + 100*0.5 = 0 [NOT DESIRABLE] in period 0 (decision before the information)

E(NPV) =

FIN 450 Page 7

Case 03

Wednesday, October 4, 2023 9:42 AM

• If there is gonna be a sequel to a movie, the one that produces the sequel need to get the rights from the original production for making the sequel.

• In this case if the price of the right is 1M dollar, then the studio will not consider making the order. (They are trying toacquire the right to produce a sequel)

• Question 01: What is the value added by the Company / Client.

• Value Added here: A studio is not well diversified, but if Arundel Partners if they work with many studios will be diversified and hence can easily raise capital with better terms

than a single studio can raise on its own.

NUMERICAL CALCULATION

• One Year Return (formula) = (PV of Inflows (yr 4) / PV of cost of the Negative film( yr 3))- 1 . (100 / 21.5) = 4.6512 - 1 = 3.6512

○ So in order for this to be profitable then the one year return must be higher than 12% (discount rate)

• The PV of inflows in year one but the outflows is in year 0. Hence in order for PV Inflow / PV Outflow > 1, you need to identity

• P* = Highlighted projects that are profitable because they are higher than 0.12 (1.12 % - 1%) = 0.12%

Not all studios are equally profitable.

FIN 450 Page 8

LP Problem - Base Case (Excel file)

Monday, October 9, 2023 9:36 AM

Project Goodwill - Not only the profitability of the project but also how many reosuces it use. High

goodwill = profitable and uses fewer resources

A project that is rejected will automatically have a negative project goodwill

A project that is fully accepted the project wil have a positive project goodwill.

A partially accepted projected will have 0 goodwill. = Marginal Projects

\

Shadow price applied ot all the resources

FIN 450 Page 9

FIN 450 Page 10

FIN 450 Page 11

FIN 450 Page 12

Monday, October 16, 2023 9:52 AM

FIN 450 Page 13

FIN 450 Page 14

FIN 450 Page 15

Wednesday, October 18, 2023 9:40 AM

FIN 450 Page 16

FIN 450 Page 17

FIN 450 Page 18

Sunday, October 22, 2023 10:12 AM

Borrow means

Debt increases by 50 M

Assets Increase by 50 M

Stock Buyback

14*18.5=259

Cash decreases by 259

Equity decreases by 259

New Equity = 489-259 = 230

New Debt Equity = 50/230 = 0.2174 *100 = 21.74%

New Market Cap of the Firm = (59-14)*18.05 = 812.25

New cash = 230 - 209 = 21

FIN 450 Page 19

Equity decreases by 259

New Equity = 489-259 = 230

New Debt Equity = 50/230 = 0.2174 *100 = 21.74%

New Market Cap of the Firm = (59-14)*18.05 = 812.25

New cash = 230 - 209 = 21

Net Debt = 50 - 21 = 29

New D/E Ratio = 29/812.25 = 0.0357 *100 = 3.57%

FIN 450 Page 20

FIN 450 Page 21

FIN 450 Page 22

Midterm 02: Extra Notes

Friday, October 27, 2023 11:57 AM

Chapter 10: Capital Structure in a Perfect Market

• The Law of One Price implies that the choice of debt or equity financing will not affect the total value of a firm, its

share price, or its cost of capital.

• If this project is financed using equity alone, how much would investors be willing to pay for the firm’s shares?

○ The price of a security equals the present value of its cash flows.

• Equity in a firm with no debt is called unlevered equity .

• With perfect capital markets, the total value of a firm should not depend on its capital structure ~ Franco

Modigliani & Merton Miller.

○ Their reasoning: The firm’s total cash flows still equal the cash flows of the project, and therefore have the

same present value of $1000 calculated earlier.

• The Law of One Price the combined values of debt and equity must be $1000 . Therefore, if the value of the debt

is $500, the value of the levered equity must be E = $1000 - $500 = $500.

○ Because the cash flows of levered equity are smaller than those of unlevered equity,

▪ Levered equity will sell for a lower price ($500 versus $1000).

▪ However, the fact that the equity is less valuable with leverage does not mean that the entrepreneur

is worse off.

▪ She will still raise a total of $1000 by issuing both debt and levered equity, just as she did with

unlevered equity alone. As a consequence, she will be indifferent between these two choices for the

firm’s capital structure.

• Investors in levered equity require a higher expected return to compensate for its increased risk .

• leverage increases the risk of equity even when there is no risk that the firm will default .

I hope this message finds you well.

The exam covers Topics 4, 5 and 6.

Please make sure you study all the materials we covered in class (lectures and case studies). The case

studies illustrated and explained some of the concepts we covered in the class lectures. The class

notes prepare you very well for the exam.

In addition to the class notes and case studies solved in class, I want you to use the materials on

ilearn to study the following 4 questions only:

1. What happens under Chapter 7 of the Bankruptcy Code in the USA?

2. What happens under Chapter 11 of the Bankruptcy Code in the USA?

3. Explain the "debt-overhang problem"

- Bond Holders have priority of the claim

- Onjectoin of cash other things held constant, is insurace for bond holders if the company is

high leverage. The transfer of weath from share holders to bond holders because the risk

decreases but the return stays the sames. So bond prices increase.

- Share price increase, cost of eauity increase, and the NPV will decarease meaning tha the

company wil stop incecsting in marginal projects.

4. What is the purpose of debt covenants and how do they potentially affect corporate investment?

FIN 450 Page 23

FIN 450 Page 24

(Please mark your response on the scantron sheet)

Please answer questions 1 through problem formulation and solution by referring to the attached

pages that include the LP

l. Which of the following statements is true?

a. Given the constraints. the maximum NPV that this company can have is 76.60

b. Project E has the largest NPV and it was accepted fully in the optimal solution.

c. Project I is more desirable than Project F since a higher percentage of project I was

accepted as compared to Project E (as one can see from the optimal solution column).

d. None of the above.

2. Which Of the following statements is true?

a. Resource 3 was not fully utilized.

b. The regulation requiring a minimum Of 15 points was exceeded.

c. Resources I and 2 were fully utilized.

d. All the above.

3. Which of the following statements is true?

a. Projects have shadow prices that can be negative or positive.

b. Resources have goodwill that can be positive or negative.

c. Projects can be ranked in terms of desirability based on their goodwill.

d. All the above.

4. Which of the following statements is true?

a. Project E has the highest NPV. If we insist on undertaking it counter to the optimal

solution, total NPV for this firm will increase.

b. Under resource constraints, those projects with the largest NPV may be not chosen in

the optimal solution.

c. The most attractive project to this firm is Project G.

d. All the above.

FIN 450 Page 25

d. All the above.

5. Which of the following statements is true?

a. For every additional S added to Resource # l, the total NPV for this firm will increase

by 0.4

b. Relaxing Resource # I by one unit is more desirable than relaxing Resource # 2 by One

unit.

c. Among all the constraints, the priority of this firm should be to ask the government to

relax Regulation # l.

d. None of the above.

6. In this mathematical programming exercise applied to a firm's investment decision, we

allowed partial or fractional acceptance of a project. model we used is called Linear

Programming. One can require either full acceptance (100%) or complete rejection (0%). In

this case, the model applied is called Integer Programming.

a. True

b. False

7. Under resource constraints, if two projects require the exact same amount of resources they

must also have the same NPV.

a. True

b. False

8. For the purpose of financing a new investment project. a firm will raise: (l) new Or additional

debt Capital at an after-tax Cost of and (2) new or additional common equity capital at a

cost Of 12 Therefore. the weighted average cost of capital (WACC) of this firm is:

a. 8 percent

b. 10 percent

c. 12 percent

d. The answer cannot be determined because Of insufficient information.

9. An increase in a firm's corporate tax rate will increase the firm's cost Of debt capital, Other

things held constant.

a. True

b. False (note if corporate taxes increase, the cost of debt capital decreases)

10. XYZ firm issued a number of bonds and sold them to the public at par value. These bonds

pay an annual coupon rate Of 8 'Percent. The company's tax rate is 33 percent. This means

that the cost of debt capital for this firm is:

a. 2.64

b. 5.36 percent

c. 8 Percent

d. None Of the above

WORKING OF THE SOLUTION:

The cost of debt for a company can be calculated using the after-tax cost of debt formula, which takes

into account the company's tax rate. The formula is:

A bond's yield to maturity (YTM) is the same thing as the before-tax cost of debt, kd

The bond is sold at par value hence, the YTM = Discount

Cost of Debt = Yield on Debt × (1 - Tax Rate)

In this case, the annual coupon rate on the bonds is 8 percent, and the company's tax rate is 33

percent.

Cost of Debt = 0.08 (8 percent) × (1 - 0.33) (33 percent)

Cost of Debt = 0.08 × 0.67

Cost of Debt = 0.0536, or 5.36 percent

So, the cost of debt capital for this firm is 5.36 percent, which corresponds to option (b).

11. The cost of equity should account for the systematic risk of the project only. The

unsystematic risk should not be considered.

a. True

b. False

FIN 450 Page 26

b. False

12. Which of the following is true?

a. Following the Capital Asset Pricing Model (CAPM), if beta of a common stock is equal

to 1, then the required return on the stock must be equal to the risk-free rate.

b. Following the Capital Asset Pricing Model (CAPM), beta represents the unsystematic

risk of the stock.

c. The Capital Asset pricing Model (CAPM) determines what an investor will actually

earn on a stock.

d. None Of the above.

13. In determining the risk-free rate to use when applying CAPM, the best thing to do is to

always use the rate on the U.S. Treasury bills which have the shortest maturity,

a. True

b. False

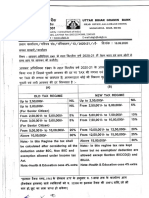

Q14 AND 15 - PLS REFER FROM THE IMAGE

16. Which Of the following Statements is true?

a, According to Proposition I or Modigliani and Miller. the market value of a firm is

independent Of the Sources of financing that have been used to undertake its

investments (i.e., independent of debt-to-equity ratio Of the firm).

b. According to Modigliani and Miller, the Value Of a firm is based on the value Of its

assets. This latter is determined as the present value of the net cash flows these assets

Generate.

C- According to Modigliani and Miller, the main thing that bondholders and shareholders

alike care about is getting a good return on their money given the risk they are

assuming.

d All the above.

17. Through financial leveraging, one can potentially increase the return on equity. Therefore,

the financial leveraging argument is a strong criticism against Modigliani and Miller's

Proposition l. In fact, it shows that their proposition is not valid.

a. True

b. False

18. Which of the following statements is true?

a. When we consider the tax laws in the U.S., the productivity of the firm's assets

becomes unimportant in determining the value of a firm.

b. The tax laws in the U.S. encourage companies to use more equity financing.

c. When we consider the tax laws in the U.S., using debt financing results in tax savings.

However, these so called tax-savings are not real money being saved for the investors

of the firm. It is all just accounting numbers.

d. None of the above

19. Which of the following statements is true?

a. Using debt financing at a firm has advantages and disadvantages. One important

advantage is that it results in the financial leveraging effect.

Q14. D

b. Using debt financing at a firm has advantages and disadvantages. One important

Q15. A

advantage is that it results in an annual tax savings (i.e., not one time only).

Q20. A

There are 2 more options for Q19 and Q20 is missing, pls refer to the image.

21. Which Of the following statements is true?

a. Financial leverage increases equity of a firm, and firm Will require a higher return to compensate for

the increased This however, is not true if capital markets are perfect. (Karam put A )

b. The firm's average cost of capital with leverage is the same as for the unlevered firm in

perfect capital markets.

c. With perfect Capital markets, financial transactions can add or destroy value.

d. All the above.

22. Which of the following statements is true?

a. Suppose a firm borrows debt D and keeps the debt at the same level permanently. If the

firm's marginal tax rate is constant , and if the debt is riskiness with a constant risk-free

interest rate , then the interest tax shield each year is T* D, and the tax shield can

be valued as a perpetuity. The PV of the interest tax shield is then: 1, D.

b. No corporate tax benefit arises from incurring interest payments that are less than the

EBIT.

FIN 450 Page 27

EBIT.

C. Increasing the level of debt increases the probability of bankruptcy. However, bankruptcy

costs are always less than the tax advantages of debt financing.

d. None Of the above.

23. Most corporate investment and growth is financed by issuing new shares.

a. True

b. False

24. R&D-intensive firms with high future growth opportunities typically maintain high debt

levels.

a. True

b. False

25. Airlines, automakers, utilities, and financial firms have low financial leverage ratios because

they tend to have lower current free cash flows and riskier business strategies than

biotechnology or high technology firms.

a. True

b. False

26. Which of the following statements is true?

a. The average direct costs of bankruptcy are approximately 3% to 4% of the pre- tax market value of

total assets.

b. While the indirect costs of bankruptcy are difficult to measure accurately. they are often

much larger than the direct costs of bankruptcy. The indirect costs include: Loss of

Customers. Loss Of Suppliers; Loss of Employees, and Fire Sale of Assets, among others.

C. Financial distress Costs will vary by industry. Technology firms will likely incur high

financial distress costs due to the potential for loss of customers and key personnel. as

Well as a lack of tangible assets that can be easily liquidated. Real estate firms are likely

to have low costs Of financial distress since the majority of their assets can be sold

relatively easily.

d. All the above.

27. "Over-investment Problem" refers to when a firm faces financial distress, shareholders

can gain at the expense Of debt holders by taking a negative-NPV project, if it is sufficiently

risky.

a. True

b. False

28. A situation in which equity holders choose not to invest in a positive NPV project because

the firm is in financial distress and the value of undertaking the investment opportunity will

accrue to bondholders rather than themselves is referred to as:

a. Over-investment problem.

b. Debt-overhang problem.

c. Free cash now problem.

d. None Of the above.

29. Which of the following statements is true?

a. Agency costs are smallest for long-term debt and highest for Short-term debt.

b. Debt covenants may help to reduce agency costs, however, because covenants hinder

management flexibility, they have the potential to prevent investment in positive NPV

Opportunity

c. All the above.

d. None of the above.

30. Which of the following statements is true?

a. Managers of large firms tend to earn higher salaries, and they may also have more

prestige and garner greater publicity than managers of small firms. Therefore, a concern

for large corporations is that managers may engage in empire building (i.e., make large,

unprofitable investments).

b. According to the free cash flow hypothesis, leverage increases firm value because it

commits the firm to making future interest payments, thereby reducing excess cash flows

And wasteful investment by managers. In other words, when cash is tight, managers will

be motivated to run the firm as efficiently as possible.

FIN 450 Page 28

be motivated to run the firm as efficiently as possible.

c. All the above.

d. None of the above.

Karam's previous (60/(40+60))*0.12 + (40/(40+60))*0.08 = 0.104 *100 = 10.4

Q1 D 0.07*(1-0.33) = 0.0469 *100 = 4.69

Q2 B 0.03+1.2*(0.08-0.03) = 0.09 *100 = 9.0

Q3 B

Q4 C

Q5 A Q17

Q6 C Option A says we can increase ROE with financial leverage

Option B Financial Leverage is a strong argument against M&M's proposition 01

Q7 A

Q8 B

Q9 A

Q10 A Hey Abdallah,

Q11 C I hope you're doing well! I wanted to chat with you about my application for the Associate

Consultant role.

Q12 D

Q13 C I applied 3 weeks back and took the required tests, but I haven't heard anything about the

Q14 B status. Should I assume that I am rejected?

Q15 B (not sure cause I couldn’t see the option) I understand that the hiring process can take time, but I wanted to kindly inquire if there's

Q16 D (still not sure cause blurred) any information or updates you might be able to provide regarding the current status of my

application.

Q17 A

Q18 D If you're able to provide any information or guidance, I would greatly appreciate it.

Q19 D

Thank you for taking the time to consider my inquiry, and I look forward to hearing from you

Q20 C when it's convenient for you. Thanks for considering this, Abdallah.

Q21 C

Q22 A

Q23 D

From <https://www.linkedin.com/feed/>

FIN 450 Page 29

Midterm 01 - Previous

Wednesday, November 1, 2023 3:57 PM

FIN 450 Page 30

FIN 450 Page 31

FIN 450 Page 32

Wednesday, October 25, 2023 9:34 AM

FIN 450 Page 33

FIN 450 Page 34

Facts on the Theories:

Impereiccal Evideence on Dividend policy

1. Annoucements of Dividend Initiations and Dividend increases

a. Are accosiated with statistically significant abnormal stock returns, where as annoucments

of dividend cuts and dividend omissions are accociated with statistically significant negative

abnormal stock returns.

b. Dividend initiation: Firm never paid dividends, but now for the first time starts paying.

Microsoft did not pay dividends for decades. The stock price increased. Once Microsoft

reached maturity, they initiated to pay dividends.

c. ABNORMAL -

FIN 450 Page 35

FIN 450 Page 36

Corporate Governance

Wednesday, November 8, 2023 9:46 AM

Managerial Capitalism :

- Introduced by Adam Smith

- Manufacturing sector : The production and manufacturing is based on managerial decision.

- Vertically integrated business: different value chains are done internally.

- Managerial capitalism is when the management holds

USA - Anglo Saxon Model

UK -

Europe - Rhine Model (After the River the Rhine)

Japanese Model / Far East Model ( there is difference between Japanese and Chinese model)

FIN 450 Page 37

FIN 450 Page 38

FIN 450 Page 39

FINAL PREPARATION

Saturday, November 25, 2023 3:01 PM

FIN 450 Page 40

FIN 450 Page 41

FIN 450 Page 42

FIN 450 Page 43

FIN 450 Page 44

FIN 450 Page 45

FIN 450 Page 46

FIN 450 Page 47

FIN 450 Page 48

FIN 450 Page 49

FIN 450 Page 50

Saturday, November 25, 2023 3:53 PM

FIN 450 Page 51

FIN 450 Page 52

FIN 450 Page 53

FIN 450 Page 54

FIN 450 Page 55

FIN 450 Page 56

You might also like

- WorldcomDocument5 pagesWorldcomHAN NGUYEN KIM100% (1)

- FM Management NotesDocument96 pagesFM Management NotesGovindh200178% (9)

- CHAPTER 6-Working CapitalDocument30 pagesCHAPTER 6-Working CapitalLyndaEidaNo ratings yet

- Statement of Fees: Unicredit Bank Austria AgDocument3 pagesStatement of Fees: Unicredit Bank Austria Agnear3st1No ratings yet

- Factoring Training GuideDocument76 pagesFactoring Training GuidemarganiNo ratings yet

- Credit Periods Also Influence The Size and Composition of Working Capital. WhenDocument3 pagesCredit Periods Also Influence The Size and Composition of Working Capital. WhenVinayak IngalahalliNo ratings yet

- Comment Type QuestionsDocument38 pagesComment Type QuestionsgoforcsNo ratings yet

- Working Capital ManagementDocument9 pagesWorking Capital ManagementYogesh SainiNo ratings yet

- IGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesDocument4 pagesIGCSE-OL - Bus - CH - 23 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

- Financial Management 1. Cash Management (Cash Conversion Cycle) ProblemDocument4 pagesFinancial Management 1. Cash Management (Cash Conversion Cycle) ProblemVivian SantosNo ratings yet

- Management of Account RecivablesDocument16 pagesManagement of Account RecivablesSumit SamtaniNo ratings yet

- Financial Management: Q1) 1) Analysis of Financial StatementsDocument9 pagesFinancial Management: Q1) 1) Analysis of Financial StatementsKrishnanand AnvekarNo ratings yet

- Working Capital ManagementDocument35 pagesWorking Capital ManagementNilesh KasatNo ratings yet

- ToyworldDocument3 pagesToyworldVinay MohanNo ratings yet

- University of Tunis Tunis Business School: Corporate FinanceDocument3 pagesUniversity of Tunis Tunis Business School: Corporate FinanceArbi ChaimaNo ratings yet

- Working Capital Samsoe MadocDocument14 pagesWorking Capital Samsoe Madocanuragsamanta1208No ratings yet

- Theories of Capital Structure 1. Net Income ApproachDocument33 pagesTheories of Capital Structure 1. Net Income ApproachAhmad NaseerNo ratings yet

- Module 2 General Functions of CreditDocument41 pagesModule 2 General Functions of CreditCaroline Grace Enteria MellaNo ratings yet

- Receivables ManagementDocument30 pagesReceivables Managementjibinjohn140No ratings yet

- Working Capital ManagementDocument3 pagesWorking Capital ManagementSoumya MishraNo ratings yet

- Working Capital ManagementDocument9 pagesWorking Capital ManagementSaket MehtaNo ratings yet

- Lecture Notes On Receivable ManagementDocument9 pagesLecture Notes On Receivable Managementritika rustagiNo ratings yet

- AMARA RAJA POWER SYSTEMS-infinie SolutionsDocument51 pagesAMARA RAJA POWER SYSTEMS-infinie SolutionsInitz TechnologiesNo ratings yet

- Ko Shu SBM Mock Exam 2020Document6 pagesKo Shu SBM Mock Exam 2020Ko ShuNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Suggested Solution Sample Exam Questions 2: in Their Answers, These 2 Points Must Be Clearly Related To The SituationDocument4 pagesSuggested Solution Sample Exam Questions 2: in Their Answers, These 2 Points Must Be Clearly Related To The Situationcatherine wisartaNo ratings yet

- Questions FinmanDocument8 pagesQuestions FinmanNiña Rhocel YangcoNo ratings yet

- Working Capital ManagementDocument30 pagesWorking Capital Managementdigen55No ratings yet

- Unit 5 Woking CapitalDocument10 pagesUnit 5 Woking CapitalRich ManNo ratings yet

- Institute of Accountancy ArushaDocument4 pagesInstitute of Accountancy ArushaAurelia RijiNo ratings yet

- Cash FlowDocument15 pagesCash Flowken philipsNo ratings yet

- Grade 12 Accounting Case StudyDocument4 pagesGrade 12 Accounting Case StudyJeff BrookerNo ratings yet

- Lesson 7 Working Capital ManagementDocument30 pagesLesson 7 Working Capital ManagementDavid Lumaban GatdulaNo ratings yet

- WC & Cash MGMTDocument41 pagesWC & Cash MGMTtreelover143No ratings yet

- Topic 9 (Part 1) SolutionsDocument8 pagesTopic 9 (Part 1) SolutionsLiang BochengNo ratings yet

- Abm 4 Module 7 8Document4 pagesAbm 4 Module 7 8Argene AbellanosaNo ratings yet

- Working Capital ManagementDocument22 pagesWorking Capital ManagementTherrineNo ratings yet

- Working CapitalDocument55 pagesWorking Capitalashish_20kNo ratings yet

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- Exam SampleDocument10 pagesExam Samplejedwebb9156360No ratings yet

- Project On Accounts ReceivableDocument61 pagesProject On Accounts ReceivableNilesh JhaNo ratings yet

- Chapter-1 Objective of The StudyDocument52 pagesChapter-1 Objective of The StudyShilpi JainNo ratings yet

- Business EnvironmentDocument14 pagesBusiness EnvironmentBensonOTJr.No ratings yet

- Accounts Receivable and Inventory ManagementDocument15 pagesAccounts Receivable and Inventory ManagementYesha TenorNo ratings yet

- Business Finance - DocxnotesDocument70 pagesBusiness Finance - DocxnotesKimberly ReignsNo ratings yet

- Corporate FinanceDocument31 pagesCorporate FinanceAbhi RainaNo ratings yet

- Dmba202 Financial ManagementDocument5 pagesDmba202 Financial ManagementshikhatiwaryNo ratings yet

- Receivables: Credit Standards, Length of Credit Period, Cash Discount, Discount Period EtcDocument7 pagesReceivables: Credit Standards, Length of Credit Period, Cash Discount, Discount Period EtcKristine RazonabeNo ratings yet

- MB 0045Document4 pagesMB 0045Yuvraj SinghNo ratings yet

- Receivables Management SelfDocument36 pagesReceivables Management Selfnitik chakmaNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementLeora CameroNo ratings yet

- Receivables ManagementDocument22 pagesReceivables Managementshayan.53260No ratings yet

- Earnings Management TechniquesDocument24 pagesEarnings Management TechniquesTehmeena RiazNo ratings yet

- Quiz 1 - Period 3 Working Capital Mansgement Wioth AnswersDocument4 pagesQuiz 1 - Period 3 Working Capital Mansgement Wioth AnswersLieza Jane AngelitudNo ratings yet

- WCM - Unit 1 & 2Document14 pagesWCM - Unit 1 & 2Nayan kakiNo ratings yet

- Sai Kiran Print PDFDocument53 pagesSai Kiran Print PDFThanuja BhaskarNo ratings yet

- 1cm8numoo 989138Document52 pages1cm8numoo 989138javed1204khanNo ratings yet

- Accounts Receivable Factoring Guide: Expedite & Improve Your Cash FlowsFrom EverandAccounts Receivable Factoring Guide: Expedite & Improve Your Cash FlowsRating: 1 out of 5 stars1/5 (1)

- Firestone Ans-MergedDocument18 pagesFirestone Ans-MergedVincent ChanNo ratings yet

- KFin Technologies - Flash Note - 12 Dec 23Document6 pagesKFin Technologies - Flash Note - 12 Dec 23palakNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument37 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Format Lembar Kerja AkuntansiDocument29 pagesFormat Lembar Kerja AkuntansiBudi SusantoNo ratings yet

- G.C.E. (Advanced Level) EconomicsDocument147 pagesG.C.E. (Advanced Level) EconomicsMaliNo ratings yet

- FR New Papers & RTP'sDocument165 pagesFR New Papers & RTP'sKeshav SethiNo ratings yet

- Cromwell European REIT PHS (22 Nov 2017)Document12 pagesCromwell European REIT PHS (22 Nov 2017)Khriztopher PhayNo ratings yet

- Partnership OperationsDocument8 pagesPartnership OperationsNerish PlazaNo ratings yet

- Key Fact Sheet (HBL MoneyClub) - July 2017Document1 pageKey Fact Sheet (HBL MoneyClub) - July 2017RanaFaizanNo ratings yet

- Financial Inclusion - Research PaperDocument3 pagesFinancial Inclusion - Research PaperDeepmala JasujaNo ratings yet

- HDFC Life Super Income Plan SHAREDocument6 pagesHDFC Life Super Income Plan SHARESandeep MookerjeeNo ratings yet

- La Salle University College of Business and Accountancy Integrated Enhancement Course For Accountancy Multiple ChoiceDocument3 pagesLa Salle University College of Business and Accountancy Integrated Enhancement Course For Accountancy Multiple ChoiceFrances Mae Ortiz MaglinteNo ratings yet

- PolicySchedule P0022000100/4102/721320Document3 pagesPolicySchedule P0022000100/4102/721320Jegan JegaNo ratings yet

- Business Math Reviewer ShortDocument12 pagesBusiness Math Reviewer ShortJames Earl AbainzaNo ratings yet

- Intermediate Accounting Vol 2 Canadian 3Rd Edition Lo Fisher 0133865959 9780133865950 Solution Manual Full Chapter PDFDocument20 pagesIntermediate Accounting Vol 2 Canadian 3Rd Edition Lo Fisher 0133865959 9780133865950 Solution Manual Full Chapter PDFdaniel.walters996100% (20)

- Aud 1.1.1Document3 pagesAud 1.1.1Marjorie BernasNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- List of Group Companies of AMC and SPONSOR 31-12-2023Document7 pagesList of Group Companies of AMC and SPONSOR 31-12-2023final bossuNo ratings yet

- FrbNY Owners2 PDFDocument3 pagesFrbNY Owners2 PDFqvlwvtppNo ratings yet

- Income Tax Circular F.Y. 2020-21Document10 pagesIncome Tax Circular F.Y. 2020-21Rohit SinhaNo ratings yet

- MCQ - BasicDocument22 pagesMCQ - BasicLalitNo ratings yet

- CH-03 (Time Value of Money)Document10 pagesCH-03 (Time Value of Money)Devraj Singh100% (2)

- Gr11 Acc P1 (English) November 2019 Marking GuidelinesDocument8 pagesGr11 Acc P1 (English) November 2019 Marking GuidelinesShriddhi MaharajNo ratings yet

- Backflu SH Costing: Yusi, Mark Lawrence - Group 4Document19 pagesBackflu SH Costing: Yusi, Mark Lawrence - Group 4Mark Lawrence YusiNo ratings yet

- Case Descriptive Solve 2Document8 pagesCase Descriptive Solve 2rocken samiunNo ratings yet

- Cheque Brief Introduction and RequisitesDocument3 pagesCheque Brief Introduction and Requisitespurinaresh850% (1)

- Commercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Document10 pagesCommercial Banking & Management Project 1: (Camels and Dupont Analysis of 2 Banks)Pro BroNo ratings yet

- Gold Mastercard Titanium Mastercard Platinum MastercardDocument3 pagesGold Mastercard Titanium Mastercard Platinum MastercardRoseyy GalitNo ratings yet