Professional Documents

Culture Documents

Documentary Stamp Tax

Documentary Stamp Tax

Uploaded by

anascoj302Copyright:

Available Formats

You might also like

- Outbound Sales No FluffDocument76 pagesOutbound Sales No FluffBhuvanesh SampathNo ratings yet

- PRELIM EXAM - Strategic ManagementDocument13 pagesPRELIM EXAM - Strategic ManagementRoseNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Case Study Inside LaaxDocument17 pagesCase Study Inside LaaxBrenda TuctoNo ratings yet

- Documentary Stamp Tax PDFDocument9 pagesDocumentary Stamp Tax PDFQuinnee VallejosNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Session 3Document26 pagesSession 3SURBHI MITTALNo ratings yet

- DST SummaryDocument19 pagesDST SummaryRb BalanayNo ratings yet

- DSTDocument2 pagesDSTveloxenergy.taxcompspecialistNo ratings yet

- Tax II Prefinals AnnexesDocument5 pagesTax II Prefinals AnnexesVincent john NacuaNo ratings yet

- Documentary Stamp TaxDocument10 pagesDocumentary Stamp TaxDura LexNo ratings yet

- DST & OPT LectureDocument31 pagesDST & OPT LectureJeffrey Fuentes100% (2)

- DST Tax RatesDocument4 pagesDST Tax RatesmixxNo ratings yet

- Documentary Stamp TaxDocument13 pagesDocumentary Stamp TaxJessNo ratings yet

- Documentary Stamp Ta1Document12 pagesDocumentary Stamp Ta1JessNo ratings yet

- Accounting Treatment For Documentary Stamp TaxDocument22 pagesAccounting Treatment For Documentary Stamp TaxJo CelNo ratings yet

- DST OverviewDocument14 pagesDST OverviewMa. Corazon CaramalesNo ratings yet

- Tax 3 Chapter 14 Documentary Stamp TaxDocument13 pagesTax 3 Chapter 14 Documentary Stamp Taxokay alexNo ratings yet

- Index For Documentary Stamp TaxDocument16 pagesIndex For Documentary Stamp TaxWilma P.No ratings yet

- Tax 3 Chapter 14 Documentary Stamp Tax EditedDocument10 pagesTax 3 Chapter 14 Documentary Stamp Tax Editedokay alexNo ratings yet

- Document Taxable Unit Tax Due Per Unit % of UnitDocument6 pagesDocument Taxable Unit Tax Due Per Unit % of Unitveloxenergy.taxcompspecialistNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- Taxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orDocument2 pagesTaxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orFabrienne Kate LiberatoNo ratings yet

- Lecture-Documentary Stamp TaxDocument13 pagesLecture-Documentary Stamp TaxJaiselle EscobedoNo ratings yet

- Sec 180 186Document4 pagesSec 180 186Shaina ObreroNo ratings yet

- Documentary Stamp Tax - BIRDocument11 pagesDocumentary Stamp Tax - BIRBenjamin Hernandez Jr.No ratings yet

- Ch05 Documentary Stamp TaxDocument9 pagesCh05 Documentary Stamp TaxRenelyn FiloteoNo ratings yet

- Documentary Stamp TaxDocument5 pagesDocumentary Stamp Taxarnold marianoNo ratings yet

- Documentary Stamp TaxDocument120 pagesDocumentary Stamp Taxnegotiator50% (2)

- Documentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orDocument2 pagesDocumentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orShaina ObreroNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument5 pagesDocumentary Stamp Tax - Bureau of Internal RevenueArlene2 ColoradoNo ratings yet

- Additional Subscription by Way of Shares of StockDocument3 pagesAdditional Subscription by Way of Shares of Stockregine rose bantilanNo ratings yet

- Documentary Stamp Tax: DST DefinedDocument9 pagesDocumentary Stamp Tax: DST DefinedLumingNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- Atty. Aranas Lecture Presentation On DST and OPTDocument37 pagesAtty. Aranas Lecture Presentation On DST and OPTEder EpiNo ratings yet

- Tax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument6 pagesTax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseNJPMsmashNo ratings yet

- TAX - 3 Documentary Stamp Tax RatesDocument2 pagesTAX - 3 Documentary Stamp Tax RatesYamateNo ratings yet

- Documentary Stamp TaxDocument6 pagesDocumentary Stamp TaxchrizNo ratings yet

- 4.0 Doc Stamp TaxDocument41 pages4.0 Doc Stamp Taxmoshi kpop cartNo ratings yet

- Train Law FaqsDocument3 pagesTrain Law FaqsChlover VillanuevaNo ratings yet

- Chapter 11 Documentary Stamp TaxDocument8 pagesChapter 11 Documentary Stamp TaxRygiem Dela CruzNo ratings yet

- Tax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument3 pagesTax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BasecristinatubleNo ratings yet

- TST Les5Document3 pagesTST Les5leomartinqtNo ratings yet

- The Revised Consolidated Schedule of Compromise Penalties For Violations of The National Internal Revenue CodeDocument25 pagesThe Revised Consolidated Schedule of Compromise Penalties For Violations of The National Internal Revenue CodeJoyceMendozaNo ratings yet

- Documentary Stamps Tax Transaction / Document Rate Tax BaseDocument3 pagesDocumentary Stamps Tax Transaction / Document Rate Tax BaseMark AbraganNo ratings yet

- Scales of Fines: (SEC Memorandum Circular No. 6, Series of 2005)Document3 pagesScales of Fines: (SEC Memorandum Circular No. 6, Series of 2005)Reginald ManitoNo ratings yet

- Secondary Market Order Form 2020.09.07Document1 pageSecondary Market Order Form 2020.09.07Agnes BofillNo ratings yet

- Title ViiDocument5 pagesTitle ViiErica Mae GuzmanNo ratings yet

- DOCSTAMPCOMPARISONDocument10 pagesDOCSTAMPCOMPARISONLyka Dennese SalazarNo ratings yet

- Consolidated Financial Statements - Acquistion DateDocument52 pagesConsolidated Financial Statements - Acquistion DateXavier AresNo ratings yet

- Final PL FormDocument5 pagesFinal PL FormMarvin BonaobraNo ratings yet

- Accounting For Business Combination - Practice Material 2Document5 pagesAccounting For Business Combination - Practice Material 2ZYRENE HERNANDEZNo ratings yet

- Fabian & Associates, CPAs-TRAIN-Transfer Tax, Doc Stamp, PassiveDocument21 pagesFabian & Associates, CPAs-TRAIN-Transfer Tax, Doc Stamp, PassiveHomer GaangNo ratings yet

- (ACCLIME) Quick Guide - Vietnam Capital Gains 2023Document1 page(ACCLIME) Quick Guide - Vietnam Capital Gains 2023Khoi NguyenNo ratings yet

- MARCH Estate and Inheritance TaxDocument6 pagesMARCH Estate and Inheritance TaxJewelyn CioconNo ratings yet

- Description Tax Form Documentary Requirements Tax Rates Procedures Related Revenue Issuances Codal Reference Frequently Asked QuestionsDocument15 pagesDescription Tax Form Documentary Requirements Tax Rates Procedures Related Revenue Issuances Codal Reference Frequently Asked QuestionsJamel torresNo ratings yet

- Documentary Stamp Tax & Excise TaxDocument8 pagesDocumentary Stamp Tax & Excise TaxJade BelenNo ratings yet

- SMC 60 Billion Bonds SEC Form 12-1 2022-09-27 PDFDocument6 pagesSMC 60 Billion Bonds SEC Form 12-1 2022-09-27 PDFMark ChamnessNo ratings yet

- Advanced AccountingDocument10 pagesAdvanced AccountingLhyn Cantal CalicaNo ratings yet

- Chapters 10 and 11Document51 pagesChapters 10 and 11Carlos VillanuevaNo ratings yet

- Documentary Stamp TaxesDocument2 pagesDocumentary Stamp TaxesOwlHeadNo ratings yet

- Amount of Investment Bonus Method: Than Investment Greater Than InvestmentDocument14 pagesAmount of Investment Bonus Method: Than Investment Greater Than InvestmentElla Mae Clavano NuicaNo ratings yet

- DT Shrey RathiDocument33 pagesDT Shrey RathiranveerNo ratings yet

- ACCTG 111B - Chapter 7 ReportDocument41 pagesACCTG 111B - Chapter 7 ReporttempoNo ratings yet

- Redeployment & Exit StrategiesDocument5 pagesRedeployment & Exit Strategiesapurvachallawar100% (2)

- CXC Principles of Business Exam Guide: Section 5: ProductionDocument2 pagesCXC Principles of Business Exam Guide: Section 5: ProductionAvril CarbonNo ratings yet

- Startup AtlantaDocument34 pagesStartup AtlantaDavidNo ratings yet

- Franchise Recruitment ProcessDocument1 pageFranchise Recruitment ProcesssanjeetvermaNo ratings yet

- Week 1 Introduction To Entrepreneurial CapitalDocument42 pagesWeek 1 Introduction To Entrepreneurial CapitalMichael AurynnNo ratings yet

- Project FormulationDocument9 pagesProject FormulationNorms WalkerNo ratings yet

- Angola Mining Sector Opportunities: December 2020Document37 pagesAngola Mining Sector Opportunities: December 2020Gonçalo SantosNo ratings yet

- Dilli Haat: Reviving Lost Glory: Submitted byDocument7 pagesDilli Haat: Reviving Lost Glory: Submitted byDaniyalNo ratings yet

- Periodical Test EntrepreneurDocument2 pagesPeriodical Test EntrepreneurMiss RonaNo ratings yet

- Operations & Training Risk Management Plan: ObjectiveDocument3 pagesOperations & Training Risk Management Plan: ObjectiveSagar JadhavNo ratings yet

- Glossary of Commonly Used Terms: © Consulting & Analytics Club, IIT GuwahatiDocument5 pagesGlossary of Commonly Used Terms: © Consulting & Analytics Club, IIT GuwahatiAhire Ganesh Ravindra bs20b004No ratings yet

- Prosecutor Exhibit in Marilyn Mosby CaseDocument6 pagesProsecutor Exhibit in Marilyn Mosby CaseChris BerinatoNo ratings yet

- Management Accounting - CH 1 and 2Document23 pagesManagement Accounting - CH 1 and 2Katie CruzNo ratings yet

- IFS Guideline Product Fraud Mitigation V2 enDocument56 pagesIFS Guideline Product Fraud Mitigation V2 enJohan VeraNo ratings yet

- A Report On KFCDocument27 pagesA Report On KFCTabaraAnannya100% (1)

- Appendix 74 Inventory and Inspection Report of Unserviceable PropertyDocument1 pageAppendix 74 Inventory and Inspection Report of Unserviceable PropertyCoreen Denielle T. Dela VegaNo ratings yet

- Workshop Customer Satisfaction ToolsDocument5 pagesWorkshop Customer Satisfaction ToolsANDRES DAVID CALDERON RODRIGUEZNo ratings yet

- CA Uday Kumar Yelchuri Chapter2 Day 2 1649657868Document36 pagesCA Uday Kumar Yelchuri Chapter2 Day 2 1649657868khanzode shenwaiNo ratings yet

- Accounts Receivable Management: MenuDocument8 pagesAccounts Receivable Management: MenuMuhammad YahyaNo ratings yet

- Mattel Case AnswerDocument1 pageMattel Case AnswerArra FresnoNo ratings yet

- Practice Actp 4 SubsDocument4 pagesPractice Actp 4 SubsWisley GamuzaNo ratings yet

- Cost Benefit Analysis: (One Time)Document1 pageCost Benefit Analysis: (One Time)Maina MathengeNo ratings yet

- Nissan PS ImplementationDocument1 pageNissan PS ImplementationAkash GhulghuleNo ratings yet

- WSC Paris-Chartres Round Registration Form 2024Document5 pagesWSC Paris-Chartres Round Registration Form 2024Studio TaivasNo ratings yet

- BRM Research Article Final 1Document41 pagesBRM Research Article Final 1Marwa KharalNo ratings yet

- Refund Policy TermifyDocument3 pagesRefund Policy Termifynadaredha16No ratings yet

Documentary Stamp Tax

Documentary Stamp Tax

Uploaded by

anascoj302Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Documentary Stamp Tax

Documentary Stamp Tax

Uploaded by

anascoj302Copyright:

Available Formats

Documentary Stamp Tax (DST)

▪ A national tax

▪ An Excise tax

▪ Deductible for income tax expenses

▪ Defined as a tax upon documents, instruments, loan agreements, papers evidencing acceptances, assignments, sales and transfers of obligations, rights or

properties, and in respect of the transaction so had or accomplished.

▪ Collected whenever the document is:

T - transferred

A – accepted

Obligation and right arises from Philippine

M – made

sources, or the property is situated in the PH

I – issued

S – signed

▪ Imposed on the transaction rather than on the document.

▪ The transactions entered into by the taxpayer need not be embodied in a document or debt instrument for them to be subject.

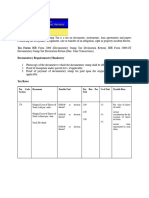

Tax Document Taxable Unit Tax % of Taxable Base

Code Due Unit

Secti Per

on Unit

174 Original Issue of Shares of Stock with par value P200.00 or fraction 2.00 1% Par value of shares of

thereof stocks

P200.00 or fraction thereof 2.00 1% Actual consideration for the issuance of shares of

Original Issue of Shares of Stock without par value

stocks

Stock Dividend P200.00 or fraction thereof 2.00 1% Actual value represented by each share

175 Sales, Agreements to Sell, Memoranda of Sales, P200.00 or fraction thereof 1.50 0.75 Par value of such stock

Deliveries or Transfer of Shares or Certificates of %

Stock

Stock without par value 50% DST paid upon the original issuance of said stock.

176 Bonds, Debentures, Certificate of Stock or P200.00 or fraction thereof .75 .375 Par value of such bonds, debentures, Certificate of

Indebtedness issued in foreign Countries % Stock or Indebtedness

177 Certificate of Profits or Interest in Property or P200.00 or fraction thereof 1.00 .5% Face value of such certificates / memorandum

Accumulation

178 Bank Checks, Drafts, Certificate of Deposit not On each Document 3.00

bearing interest and other Instruments

179 All Debt Instruments P200.00 or fraction thereof 1.50 .75% Issue price of any such debt instruments or a

fraction of 365 days for instrument with term of less

than 1 year

180 All Bills of Exchange or Drafts P200.00 or fraction thereof .60 .3% Face value of any such bill of exchange or draft

181 Acceptance of Bills of Exchange or order for the P200.00 or fraction thereof .60 .3% Face value of such bill of exchange or order or the

payment of money purporting to be drawn in Philippine equivalent of such value, if expressed in

a foreign country but payable in the Philippines foreign currency

182 Foreign Bills of Exchange and Letters of Credit P200.00 or fraction thereof .60 .3% Face value of such bill of exchange or letter of credit

or the Philippine equivalent of such value, if

expressed in foreign currency

183 Life Insurance Policies If the amount of insurance exemp Amount of Insurance

does not exceed P100,000.00 t

If the amount of insurance

exceeds P100,000.00 but 20.00 Amount of Insurance

does not exceed P300,000.00

If the amount of insurance

exceeds P300,000.00 but

does not exceed P500,000.00 50.00 Amount of Insurance

If the amount of insurance

exceeds P500,000.00 but

does not exceed P750,000.00 100.0 Amount of Insurance

0

If the amount of insurance

exceeds P750,000.00 but 150.0 Amount of Insurance

does not exceed 0

P1,000,000.00

If the amount of insurance

exceeds P1,000,000.00 200.0 Amount of Insurance

0

184 Policies Of Insurance upon Property P4.00 premium or fraction .50 12.5 Premium charged

thereof %

185 Fidelity Bonds and other Insurance Policies P4.00 premium or fraction .50 12.5 Premium charged

thereof %

186 Policies of Annuities or other instruments P200.00 or fraction thereof 1.00 .5% Premium or installment payment or contract price

collected

Pre-Need Plans P200.00 or fraction thereof .40 .20% Premium or contribution collected

187 Indemnity Bonds P4.00 or fraction thereof .30 7.5% Premium charged

188 Certificates of Damage or otherwise and Each Certificate 30.00

Certificate or document issued by any customs

officers, marine surveyor, notary public

and certificate required by law or by rules and

regulations of a public office

189 Warehouse Receipts (except if value does not Each Receipt 30.00

exceed P200.00)

190 Jai-alai, Horse Race Tickets, lotto or Other P1.00 and below cost of ticket .20 20% Cost of the ticket

Authorized Number Games

Additional P0.20 on every Cost of the ticket

P1.00 or fraction thereof if

cost of ticket exceeds P1.00

191 Bills of Lading or Receipts(except charter party) If the value of such goods 2.00 Value of such goods

exceeds P100.00 and does

not exceed P1,000.00

If the value exceeds P1,000.00 20.00 Value of such goods

Freight tickets covering goods,

merchandise or effects carried

as accompanied baggage of Exemp

passengers on land and water t

carriers primarily engaged in

the transportation of

passengers

192 Proxies (except proxies issued affecting the Each proxy 30.00

affairs of associations or corporations, organized

for religious, charitable or literary purposes)

193 Powers of Attorney (except acts connected with Each Document 10.00

the collection of claims due from or accruing to

the Government of the Republic of the

Philippines, or the government of any province,

city or Municipality)

194 Leases and other Hiring agreements or First 2,000 or fractional part 6.00 .3%

memorandum or contract for hire, use or rent of thereof

any lands or tenements or portions thereof

For every P1,000 or fractional

part thereof in excess of 2.00 .2%

the first P2,000 for each year

of the term of the said contract

or agreement

195 Mortgage or Pledge of lands, estate, or property First 5,000 40.00 .8% Amount Secured

and Deeds of Trust

On each P5,000 or fractional 20.00 .4% Amount Secured

part thereof in excess of 5,000

196 Deed of Sale, Conveyances, Donations of First 1,000 15.00 1.5% Consideration or Fair Market Value, whichever is

Real Property (except grants, patents or original higher (if government is a party, basis shall be the

certificate of adjudication issued by the consideration)

government)

For each additional P1,000 or 15.00 1.5% Consideration or Fair Market Value, whichever is

fractional part thereof in higher (if government is a party, basis shall be the

excess of P1,000 consideration)

197 Charter parties and Similar Instruments Charter parties and similar

instruments if gross tonnage of

the ship, vessel or steamer is:

1,000 tons and below 1st 6 Registered gross tonnage

months

P1,000.00

In excess +

P 100.00

1,001 to 10,000 tons 1st 6 Registered gross tonnage

months

P2,000.00

In excess +

P200.00

Over 10,000 tons 1st 6 Registered gross tonnage

months

P3,000

In excess +

300

198 Stamp Tax on Assignments and Renewals or At the same rate as that imposed on the original

Continuance of Certain Instruments instrument.

Persons Subject : https://www.bir.gov.ph/index.php/tax-information/documentary-stamp-tax.

The person making, signing, issuing, accepting, or transferring the document. When one party enjoys exemption, the other party who is not exempt shall be the one

directly liable for the tax.

Time of Filing and Payment:

Generally, the tax return shall be filed within 5 days after the close of the month when the document was made, signed, accepted or transferred.

Place of Filing and Payment:

1)Authorized agent bank (AAB) within the territorial jurisdiction of the RDO which has jurisdiction over the residence or principal place of business of the taxpayer; or

2)If there be no AAB, with the Revenue District Officer, collection agent, or duly authorized treasurer of the city or municipality in which the taxpayer has his legal

residence or principal place of business.

Modes of Payment:

1)The tax due on the return is paid at the time the return is filed; or

2)The tax may be paid through purchase and actual affixture of the DSTs on the document; or

3)By imprinting the DSTs, through a DST metering machine, on the taxable document; or

4)For certificates issued by government agencies and instrumentalities (GAs), the tax shall be paid to the GA which amount shall be indicated in the government official

receipt. Such receipt shall be attached to the certificate as proof of payment of the DST.

Effect of Failure to Stamp a Taxable Document:

1)Shall not be recorded;

2)Shall not be admitted or used in evidence in any court;

3)The notary public shall not add his jurat or acknowledgement to the document Until the DSTs are paid.

You might also like

- Outbound Sales No FluffDocument76 pagesOutbound Sales No FluffBhuvanesh SampathNo ratings yet

- PRELIM EXAM - Strategic ManagementDocument13 pagesPRELIM EXAM - Strategic ManagementRoseNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Case Study Inside LaaxDocument17 pagesCase Study Inside LaaxBrenda TuctoNo ratings yet

- Documentary Stamp Tax PDFDocument9 pagesDocumentary Stamp Tax PDFQuinnee VallejosNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Session 3Document26 pagesSession 3SURBHI MITTALNo ratings yet

- DST SummaryDocument19 pagesDST SummaryRb BalanayNo ratings yet

- DSTDocument2 pagesDSTveloxenergy.taxcompspecialistNo ratings yet

- Tax II Prefinals AnnexesDocument5 pagesTax II Prefinals AnnexesVincent john NacuaNo ratings yet

- Documentary Stamp TaxDocument10 pagesDocumentary Stamp TaxDura LexNo ratings yet

- DST & OPT LectureDocument31 pagesDST & OPT LectureJeffrey Fuentes100% (2)

- DST Tax RatesDocument4 pagesDST Tax RatesmixxNo ratings yet

- Documentary Stamp TaxDocument13 pagesDocumentary Stamp TaxJessNo ratings yet

- Documentary Stamp Ta1Document12 pagesDocumentary Stamp Ta1JessNo ratings yet

- Accounting Treatment For Documentary Stamp TaxDocument22 pagesAccounting Treatment For Documentary Stamp TaxJo CelNo ratings yet

- DST OverviewDocument14 pagesDST OverviewMa. Corazon CaramalesNo ratings yet

- Tax 3 Chapter 14 Documentary Stamp TaxDocument13 pagesTax 3 Chapter 14 Documentary Stamp Taxokay alexNo ratings yet

- Index For Documentary Stamp TaxDocument16 pagesIndex For Documentary Stamp TaxWilma P.No ratings yet

- Tax 3 Chapter 14 Documentary Stamp Tax EditedDocument10 pagesTax 3 Chapter 14 Documentary Stamp Tax Editedokay alexNo ratings yet

- Document Taxable Unit Tax Due Per Unit % of UnitDocument6 pagesDocument Taxable Unit Tax Due Per Unit % of Unitveloxenergy.taxcompspecialistNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- Taxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orDocument2 pagesTaxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orFabrienne Kate LiberatoNo ratings yet

- Lecture-Documentary Stamp TaxDocument13 pagesLecture-Documentary Stamp TaxJaiselle EscobedoNo ratings yet

- Sec 180 186Document4 pagesSec 180 186Shaina ObreroNo ratings yet

- Documentary Stamp Tax - BIRDocument11 pagesDocumentary Stamp Tax - BIRBenjamin Hernandez Jr.No ratings yet

- Ch05 Documentary Stamp TaxDocument9 pagesCh05 Documentary Stamp TaxRenelyn FiloteoNo ratings yet

- Documentary Stamp TaxDocument5 pagesDocumentary Stamp Taxarnold marianoNo ratings yet

- Documentary Stamp TaxDocument120 pagesDocumentary Stamp Taxnegotiator50% (2)

- Documentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orDocument2 pagesDocumentary Stamp Tax of Two Peso (P2.00) On Each Two Hundred Pesos (P200), orShaina ObreroNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument5 pagesDocumentary Stamp Tax - Bureau of Internal RevenueArlene2 ColoradoNo ratings yet

- Additional Subscription by Way of Shares of StockDocument3 pagesAdditional Subscription by Way of Shares of Stockregine rose bantilanNo ratings yet

- Documentary Stamp Tax: DST DefinedDocument9 pagesDocumentary Stamp Tax: DST DefinedLumingNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- Atty. Aranas Lecture Presentation On DST and OPTDocument37 pagesAtty. Aranas Lecture Presentation On DST and OPTEder EpiNo ratings yet

- Tax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument6 pagesTax Rates: Tax Code Sectio N Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseNJPMsmashNo ratings yet

- TAX - 3 Documentary Stamp Tax RatesDocument2 pagesTAX - 3 Documentary Stamp Tax RatesYamateNo ratings yet

- Documentary Stamp TaxDocument6 pagesDocumentary Stamp TaxchrizNo ratings yet

- 4.0 Doc Stamp TaxDocument41 pages4.0 Doc Stamp Taxmoshi kpop cartNo ratings yet

- Train Law FaqsDocument3 pagesTrain Law FaqsChlover VillanuevaNo ratings yet

- Chapter 11 Documentary Stamp TaxDocument8 pagesChapter 11 Documentary Stamp TaxRygiem Dela CruzNo ratings yet

- Tax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument3 pagesTax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BasecristinatubleNo ratings yet

- TST Les5Document3 pagesTST Les5leomartinqtNo ratings yet

- The Revised Consolidated Schedule of Compromise Penalties For Violations of The National Internal Revenue CodeDocument25 pagesThe Revised Consolidated Schedule of Compromise Penalties For Violations of The National Internal Revenue CodeJoyceMendozaNo ratings yet

- Documentary Stamps Tax Transaction / Document Rate Tax BaseDocument3 pagesDocumentary Stamps Tax Transaction / Document Rate Tax BaseMark AbraganNo ratings yet

- Scales of Fines: (SEC Memorandum Circular No. 6, Series of 2005)Document3 pagesScales of Fines: (SEC Memorandum Circular No. 6, Series of 2005)Reginald ManitoNo ratings yet

- Secondary Market Order Form 2020.09.07Document1 pageSecondary Market Order Form 2020.09.07Agnes BofillNo ratings yet

- Title ViiDocument5 pagesTitle ViiErica Mae GuzmanNo ratings yet

- DOCSTAMPCOMPARISONDocument10 pagesDOCSTAMPCOMPARISONLyka Dennese SalazarNo ratings yet

- Consolidated Financial Statements - Acquistion DateDocument52 pagesConsolidated Financial Statements - Acquistion DateXavier AresNo ratings yet

- Final PL FormDocument5 pagesFinal PL FormMarvin BonaobraNo ratings yet

- Accounting For Business Combination - Practice Material 2Document5 pagesAccounting For Business Combination - Practice Material 2ZYRENE HERNANDEZNo ratings yet

- Fabian & Associates, CPAs-TRAIN-Transfer Tax, Doc Stamp, PassiveDocument21 pagesFabian & Associates, CPAs-TRAIN-Transfer Tax, Doc Stamp, PassiveHomer GaangNo ratings yet

- (ACCLIME) Quick Guide - Vietnam Capital Gains 2023Document1 page(ACCLIME) Quick Guide - Vietnam Capital Gains 2023Khoi NguyenNo ratings yet

- MARCH Estate and Inheritance TaxDocument6 pagesMARCH Estate and Inheritance TaxJewelyn CioconNo ratings yet

- Description Tax Form Documentary Requirements Tax Rates Procedures Related Revenue Issuances Codal Reference Frequently Asked QuestionsDocument15 pagesDescription Tax Form Documentary Requirements Tax Rates Procedures Related Revenue Issuances Codal Reference Frequently Asked QuestionsJamel torresNo ratings yet

- Documentary Stamp Tax & Excise TaxDocument8 pagesDocumentary Stamp Tax & Excise TaxJade BelenNo ratings yet

- SMC 60 Billion Bonds SEC Form 12-1 2022-09-27 PDFDocument6 pagesSMC 60 Billion Bonds SEC Form 12-1 2022-09-27 PDFMark ChamnessNo ratings yet

- Advanced AccountingDocument10 pagesAdvanced AccountingLhyn Cantal CalicaNo ratings yet

- Chapters 10 and 11Document51 pagesChapters 10 and 11Carlos VillanuevaNo ratings yet

- Documentary Stamp TaxesDocument2 pagesDocumentary Stamp TaxesOwlHeadNo ratings yet

- Amount of Investment Bonus Method: Than Investment Greater Than InvestmentDocument14 pagesAmount of Investment Bonus Method: Than Investment Greater Than InvestmentElla Mae Clavano NuicaNo ratings yet

- DT Shrey RathiDocument33 pagesDT Shrey RathiranveerNo ratings yet

- ACCTG 111B - Chapter 7 ReportDocument41 pagesACCTG 111B - Chapter 7 ReporttempoNo ratings yet

- Redeployment & Exit StrategiesDocument5 pagesRedeployment & Exit Strategiesapurvachallawar100% (2)

- CXC Principles of Business Exam Guide: Section 5: ProductionDocument2 pagesCXC Principles of Business Exam Guide: Section 5: ProductionAvril CarbonNo ratings yet

- Startup AtlantaDocument34 pagesStartup AtlantaDavidNo ratings yet

- Franchise Recruitment ProcessDocument1 pageFranchise Recruitment ProcesssanjeetvermaNo ratings yet

- Week 1 Introduction To Entrepreneurial CapitalDocument42 pagesWeek 1 Introduction To Entrepreneurial CapitalMichael AurynnNo ratings yet

- Project FormulationDocument9 pagesProject FormulationNorms WalkerNo ratings yet

- Angola Mining Sector Opportunities: December 2020Document37 pagesAngola Mining Sector Opportunities: December 2020Gonçalo SantosNo ratings yet

- Dilli Haat: Reviving Lost Glory: Submitted byDocument7 pagesDilli Haat: Reviving Lost Glory: Submitted byDaniyalNo ratings yet

- Periodical Test EntrepreneurDocument2 pagesPeriodical Test EntrepreneurMiss RonaNo ratings yet

- Operations & Training Risk Management Plan: ObjectiveDocument3 pagesOperations & Training Risk Management Plan: ObjectiveSagar JadhavNo ratings yet

- Glossary of Commonly Used Terms: © Consulting & Analytics Club, IIT GuwahatiDocument5 pagesGlossary of Commonly Used Terms: © Consulting & Analytics Club, IIT GuwahatiAhire Ganesh Ravindra bs20b004No ratings yet

- Prosecutor Exhibit in Marilyn Mosby CaseDocument6 pagesProsecutor Exhibit in Marilyn Mosby CaseChris BerinatoNo ratings yet

- Management Accounting - CH 1 and 2Document23 pagesManagement Accounting - CH 1 and 2Katie CruzNo ratings yet

- IFS Guideline Product Fraud Mitigation V2 enDocument56 pagesIFS Guideline Product Fraud Mitigation V2 enJohan VeraNo ratings yet

- A Report On KFCDocument27 pagesA Report On KFCTabaraAnannya100% (1)

- Appendix 74 Inventory and Inspection Report of Unserviceable PropertyDocument1 pageAppendix 74 Inventory and Inspection Report of Unserviceable PropertyCoreen Denielle T. Dela VegaNo ratings yet

- Workshop Customer Satisfaction ToolsDocument5 pagesWorkshop Customer Satisfaction ToolsANDRES DAVID CALDERON RODRIGUEZNo ratings yet

- CA Uday Kumar Yelchuri Chapter2 Day 2 1649657868Document36 pagesCA Uday Kumar Yelchuri Chapter2 Day 2 1649657868khanzode shenwaiNo ratings yet

- Accounts Receivable Management: MenuDocument8 pagesAccounts Receivable Management: MenuMuhammad YahyaNo ratings yet

- Mattel Case AnswerDocument1 pageMattel Case AnswerArra FresnoNo ratings yet

- Practice Actp 4 SubsDocument4 pagesPractice Actp 4 SubsWisley GamuzaNo ratings yet

- Cost Benefit Analysis: (One Time)Document1 pageCost Benefit Analysis: (One Time)Maina MathengeNo ratings yet

- Nissan PS ImplementationDocument1 pageNissan PS ImplementationAkash GhulghuleNo ratings yet

- WSC Paris-Chartres Round Registration Form 2024Document5 pagesWSC Paris-Chartres Round Registration Form 2024Studio TaivasNo ratings yet

- BRM Research Article Final 1Document41 pagesBRM Research Article Final 1Marwa KharalNo ratings yet

- Refund Policy TermifyDocument3 pagesRefund Policy Termifynadaredha16No ratings yet