Professional Documents

Culture Documents

Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return

Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return

Uploaded by

jenner.domasCopyright:

Available Formats

You might also like

- Customer Credit CardInfo High Sev EDMDocument4 pagesCustomer Credit CardInfo High Sev EDMFabian Valero Duque100% (8)

- No VBVDocument2 pagesNo VBVJuan C Garzn90% (10)

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- I10 FormDocument1 pageI10 Formleomal320% (1)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (2)

- Lista Produselor 2-8 CDocument5 pagesLista Produselor 2-8 Cadelina78100% (3)

- W 2Document3 pagesW 2lysprr33% (3)

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Marie Aladin 2019 Tax PDFDocument60 pagesMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- ACPAMIN InvitationDocument2 pagesACPAMIN InvitationJenika JoyceNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- W2 - 2022 Ryan OnealDocument1 pageW2 - 2022 Ryan Onealjhonsmith900012No ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- 2 41923892Document1 page2 41923892spurlock90No ratings yet

- Bill W2Document2 pagesBill W2ISSA AWADHNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Returnlucasortegabrandonarturo24No ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- Batch #02283: Starco Group 250 26TH ST Sant A Monica Ca 90402Document1 pageBatch #02283: Starco Group 250 26TH ST Sant A Monica Ca 90402allthewayupp21No ratings yet

- Carlosw 2Document2 pagesCarlosw 2winnievaledocsNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- Screenshot 2023-02-07 at 8.19.04 PMDocument1 pageScreenshot 2023-02-07 at 8.19.04 PMKyle FelkinsNo ratings yet

- Tax FormsDocument2 pagesTax FormsJose Manuel Aranzazu ManzaneroNo ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- Misal RomanoDocument2 pagesMisal RomanoJairo RBNo ratings yet

- R SwieratDocument2 pagesR SwieratDe Gen G.No ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 44kbzdsfw8kNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008dashaviaNo ratings yet

- Myadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesDocument2 pagesMyadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesnxtbh6xy6yNo ratings yet

- PE7 Ihh 72036 H 1914320215440222104202Document2 pagesPE7 Ihh 72036 H 1914320215440222104202Joali uwuNo ratings yet

- Gamaliel Bribiesca 523 S Huron DR Santa Ana, CA 92704: Wage and Tax Employee Reference Copy StatementDocument2 pagesGamaliel Bribiesca 523 S Huron DR Santa Ana, CA 92704: Wage and Tax Employee Reference Copy Statementgamaliel.lomeNo ratings yet

- Wage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125Document2 pagesWage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125rachel sanchezNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Jesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy StatementDocument2 pagesJesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy Statementcg727841No ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- Employee W-2 Report 20240115172542Document1 pageEmployee W-2 Report 20240115172542ANAYELI GUTIERREZNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- Mona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementDocument3 pagesMona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementManubhai PatelNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wa0000.Document1 pageWa0000.tkduong889No ratings yet

- Family OfficeDocument1 pageFamily OfficeTurcan Ciprian Sebastian100% (1)

- 1 Assignment TO BIG TOO FAILDocument2 pages1 Assignment TO BIG TOO FAILHaroon Z. ChoudhryNo ratings yet

- Schedule C Scenario 5: Mary JonesDocument5 pagesSchedule C Scenario 5: Mary JonesCenter for Economic ProgressNo ratings yet

- Haig-Simons: - Income = Consumption + Change in Wealth - Y = C + Δw - More important to focus onDocument18 pagesHaig-Simons: - Income = Consumption + Change in Wealth - Y = C + Δw - More important to focus onechasonNo ratings yet

- Ft. Lauderdale-Q2 2012 ReportDocument14 pagesFt. Lauderdale-Q2 2012 ReportKen RudominerNo ratings yet

- Calgary Real Estate Market Stats - 2006-2010Document2 pagesCalgary Real Estate Market Stats - 2006-2010Selling Calgary GroupNo ratings yet

- دريد آل شبيب ، عبد الرحمان الجبوري ، أهمية تطوير هيئة الرقابة على الأوراق المالية لرفع كفاءة السوق المالي حالة شركة وورلدكم الأمريكية PDFDocument17 pagesدريد آل شبيب ، عبد الرحمان الجبوري ، أهمية تطوير هيئة الرقابة على الأوراق المالية لرفع كفاءة السوق المالي حالة شركة وورلدكم الأمريكية PDFKrimo DzNo ratings yet

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- IRS Publication Form 8867Document4 pagesIRS Publication Form 8867Francis Wolfgang UrbanNo ratings yet

- Tarp PresentationDocument18 pagesTarp PresentationVivek_RNo ratings yet

- 2022 Turbo Tax ReturnDocument14 pages2022 Turbo Tax ReturndsutetyrNo ratings yet

- Letter by Lehman Whistle Blower Matthew Lee, Dated May 16, 2008Document3 pagesLetter by Lehman Whistle Blower Matthew Lee, Dated May 16, 2008DealBookNo ratings yet

- Capshaw WagesDocument2 pagesCapshaw Wagesapi-583619940No ratings yet

- 42126annex F WaiverDocument1 page42126annex F WaiverLacel TolentinoNo ratings yet

- New Text DocumentDocument9 pagesNew Text DocumentOscar MassemynNo ratings yet

- Project 3 FinalDocument11 pagesProject 3 Finalapi-261340346No ratings yet

- CO Form 104 InstructionsDocument24 pagesCO Form 104 Instructionskdavis9250No ratings yet

- Sears BanglaDocument1 pageSears Banglamorshed_mahamud7055No ratings yet

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocument1 pageCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnNo ratings yet

- The Advertising Coalition EIA Final Report - November 2021Document48 pagesThe Advertising Coalition EIA Final Report - November 2021Zoro SakaNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/22Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/22Blade CheesyNo ratings yet

- Dir IT Infra 1Document14 pagesDir IT Infra 1CharlesNo ratings yet

Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return

Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return

Uploaded by

jenner.domasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return

Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return

Uploaded by

jenner.domasCopyright:

Available Formats

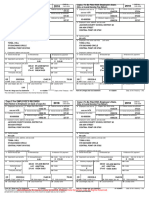

Copy B—To Be Filed With Employee’s Copy 2—To Be Filed With Employee’s State,

OMB No. 1545-0008 OMB No. 1545-0008

FEDERAL Tax Return. City, or Local Income Tax Return

a Employee’s soc. sec. no. 1 Wages, tips, other comp. 2 Federal income tax withheld a Employee’s soc. sec. no. 1 Wages, tips, other comp. 2 Federal income tax withheld

4236.77 241.07 4236.77 241.07

861250233 3 Social security wages 4 Social security tax withheld 861250233 3 Social security wages 4 Social security tax withheld

b Employer ID number (EIN) 4236.77 262.68 b Employer ID number (EIN) 4236.77 262.68

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

751771388 4236.77 61.43 751771388 4236.77 61.43

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

Advanced Temporaries Advanced Temporaries

P.O. Box 8022 P.O. Box 8022

Tyler, TX 75711 Tyler, TX 75711

d Control number d Control number

430399 430399

e Employee’s name, address, and ZIP code e Employee’s name, address, and ZIP code

Jenner E Moreno Jenner E Moreno

55 w center street apt 292 55 w center street apt 292

North salt lake, UT 84085 North salt lake, UT 84085

7 Social security tips 8 Allocated tips 9 7 Social security tips 8 Allocated tips 9

10 Dependent care benefits 11 Nonqualified plans 12a Code See inst. for box 12 10 Dependent care benefits 11 Nonqualified plans 12a Code

13 Statutory employee 14 Other 12b Code 13 Statutory employee 14 Other 12b Code

Retirement plan 12c Code Retirement plan 12c Code

Third-party sick pay 12d Code Third-party sick pay 12d Code

UT 15791105002WTH 4236.77 171.50 UT 15791105002WTH 4236.77 171.50

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form W-2 Wage and Tax Statement Dept. of the Treasury - IRS Form W-2 Wage and Tax Statement Dept. of the Treasury - IRS

This information is being furnished to the Internal Revenue Service.

Copy C—For EMPLOYEE’S RECORDS (See Copy 2—To Be Filed With Employee’s State,

OMB No. 1545-0008 OMB No. 1545-0008

Notice to Employee on the back of Copy B.) City, or Local Income Tax Return

a Employee’s soc. sec. no. 1 Wages, tips, other comp. 2 Federal income tax withheld a Employee’s soc. sec. no. 1 Wages, tips, other comp. 2 Federal income tax withheld

4236.77 241.07 4236.77 241.07

861250233 3 Social security wages 4 Social security tax withheld 861250233 3 Social security wages 4 Social security tax withheld

b Employer ID number (EIN) 4236.77 262.68 b Employer ID number (EIN) 4236.77 262.68

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

751771388 4236.77 61.43 751771388 4236.77 61.43

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

Advanced Temporaries Advanced Temporaries

P.O. Box 8022 P.O. Box 8022

Tyler, TX 75711 Tyler, TX 75711

d Control number d Control number

430399 430399

e Employee’s name, address, and ZIP code e Employee’s name, address, and ZIP code

Jenner E Moreno Jenner E Moreno

55 w center street apt 292 55 w center street apt 292

North salt lake, UT 84085 North salt lake, UT 84085

7 Social security tips 8 Allocated tips 9 7 Social security tips 8 Allocated tips 9

10 Dependent care benefits 11 Nonqualified plans 12a Code See inst. for box 12 10 Dependent care benefits 11 Nonqualified plans 12a Code

13 Statutory employee 14 Other 12b Code 13 Statutory employee 14 Other 12b Code

Retirement plan 12c Code Retirement plan 12c Code

Third-party sick pay 12d Code Third-party sick pay 12d Code

UT 15791105002WTH 4236.77 171.50 UT 15791105002WTH 4236.77 171.50

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form W-2 Wage and Tax Statement Dept. of the Treasury - IRS Form W-2 Wage and Tax Statement Dept. of the Treasury - IRS

This information is being furnished to the IRS. If you are required to file a tax return, a negligence

penalty or other sanction may be imposed on you if this income is taxable and you fail to report it. BW24UP NTF 2585808 3 BW24UP

You might also like

- Customer Credit CardInfo High Sev EDMDocument4 pagesCustomer Credit CardInfo High Sev EDMFabian Valero Duque100% (8)

- No VBVDocument2 pagesNo VBVJuan C Garzn90% (10)

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- I10 FormDocument1 pageI10 Formleomal320% (1)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (2)

- Lista Produselor 2-8 CDocument5 pagesLista Produselor 2-8 Cadelina78100% (3)

- W 2Document3 pagesW 2lysprr33% (3)

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Marie Aladin 2019 Tax PDFDocument60 pagesMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- ACPAMIN InvitationDocument2 pagesACPAMIN InvitationJenika JoyceNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- W2 - 2022 Ryan OnealDocument1 pageW2 - 2022 Ryan Onealjhonsmith900012No ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- 2 41923892Document1 page2 41923892spurlock90No ratings yet

- Bill W2Document2 pagesBill W2ISSA AWADHNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Returnlucasortegabrandonarturo24No ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- Batch #02283: Starco Group 250 26TH ST Sant A Monica Ca 90402Document1 pageBatch #02283: Starco Group 250 26TH ST Sant A Monica Ca 90402allthewayupp21No ratings yet

- Carlosw 2Document2 pagesCarlosw 2winnievaledocsNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- Screenshot 2023-02-07 at 8.19.04 PMDocument1 pageScreenshot 2023-02-07 at 8.19.04 PMKyle FelkinsNo ratings yet

- Tax FormsDocument2 pagesTax FormsJose Manuel Aranzazu ManzaneroNo ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- Misal RomanoDocument2 pagesMisal RomanoJairo RBNo ratings yet

- R SwieratDocument2 pagesR SwieratDe Gen G.No ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 44kbzdsfw8kNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008dashaviaNo ratings yet

- Myadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesDocument2 pagesMyadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesnxtbh6xy6yNo ratings yet

- PE7 Ihh 72036 H 1914320215440222104202Document2 pagesPE7 Ihh 72036 H 1914320215440222104202Joali uwuNo ratings yet

- Gamaliel Bribiesca 523 S Huron DR Santa Ana, CA 92704: Wage and Tax Employee Reference Copy StatementDocument2 pagesGamaliel Bribiesca 523 S Huron DR Santa Ana, CA 92704: Wage and Tax Employee Reference Copy Statementgamaliel.lomeNo ratings yet

- Wage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125Document2 pagesWage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125rachel sanchezNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Jesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy StatementDocument2 pagesJesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy Statementcg727841No ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- Employee W-2 Report 20240115172542Document1 pageEmployee W-2 Report 20240115172542ANAYELI GUTIERREZNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- Mona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementDocument3 pagesMona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementManubhai PatelNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wa0000.Document1 pageWa0000.tkduong889No ratings yet

- Family OfficeDocument1 pageFamily OfficeTurcan Ciprian Sebastian100% (1)

- 1 Assignment TO BIG TOO FAILDocument2 pages1 Assignment TO BIG TOO FAILHaroon Z. ChoudhryNo ratings yet

- Schedule C Scenario 5: Mary JonesDocument5 pagesSchedule C Scenario 5: Mary JonesCenter for Economic ProgressNo ratings yet

- Haig-Simons: - Income = Consumption + Change in Wealth - Y = C + Δw - More important to focus onDocument18 pagesHaig-Simons: - Income = Consumption + Change in Wealth - Y = C + Δw - More important to focus onechasonNo ratings yet

- Ft. Lauderdale-Q2 2012 ReportDocument14 pagesFt. Lauderdale-Q2 2012 ReportKen RudominerNo ratings yet

- Calgary Real Estate Market Stats - 2006-2010Document2 pagesCalgary Real Estate Market Stats - 2006-2010Selling Calgary GroupNo ratings yet

- دريد آل شبيب ، عبد الرحمان الجبوري ، أهمية تطوير هيئة الرقابة على الأوراق المالية لرفع كفاءة السوق المالي حالة شركة وورلدكم الأمريكية PDFDocument17 pagesدريد آل شبيب ، عبد الرحمان الجبوري ، أهمية تطوير هيئة الرقابة على الأوراق المالية لرفع كفاءة السوق المالي حالة شركة وورلدكم الأمريكية PDFKrimo DzNo ratings yet

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- IRS Publication Form 8867Document4 pagesIRS Publication Form 8867Francis Wolfgang UrbanNo ratings yet

- Tarp PresentationDocument18 pagesTarp PresentationVivek_RNo ratings yet

- 2022 Turbo Tax ReturnDocument14 pages2022 Turbo Tax ReturndsutetyrNo ratings yet

- Letter by Lehman Whistle Blower Matthew Lee, Dated May 16, 2008Document3 pagesLetter by Lehman Whistle Blower Matthew Lee, Dated May 16, 2008DealBookNo ratings yet

- Capshaw WagesDocument2 pagesCapshaw Wagesapi-583619940No ratings yet

- 42126annex F WaiverDocument1 page42126annex F WaiverLacel TolentinoNo ratings yet

- New Text DocumentDocument9 pagesNew Text DocumentOscar MassemynNo ratings yet

- Project 3 FinalDocument11 pagesProject 3 Finalapi-261340346No ratings yet

- CO Form 104 InstructionsDocument24 pagesCO Form 104 Instructionskdavis9250No ratings yet

- Sears BanglaDocument1 pageSears Banglamorshed_mahamud7055No ratings yet

- Current Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-NegotiableDocument1 pageCurrent Pay Statement: This Is A Statement of Earnings and Deductions. This Pay Statement Is Non-Negotiablekevin kuhnNo ratings yet

- The Advertising Coalition EIA Final Report - November 2021Document48 pagesThe Advertising Coalition EIA Final Report - November 2021Zoro SakaNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/22Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/22Blade CheesyNo ratings yet

- Dir IT Infra 1Document14 pagesDir IT Infra 1CharlesNo ratings yet