Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

4 viewsTut 8 MEMO ChatGPT

Tut 8 MEMO ChatGPT

Uploaded by

Thridev Maharajhv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Cost Analysis-Tata MotorsDocument6 pagesCost Analysis-Tata MotorsSubhrajyoti Sarkar57% (7)

- Chapter 19 Assignment IAF410 Excel SheetDocument14 pagesChapter 19 Assignment IAF410 Excel SheetTati AnaNo ratings yet

- Price Action Diver Power - Manual EngDocument5 pagesPrice Action Diver Power - Manual EngAdnan Wasim0% (1)

- Vederinus Stefanus 86220 0Document9 pagesVederinus Stefanus 86220 0PdoneeverNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- Security DepositsDocument3 pagesSecurity DepositsQueen ValleNo ratings yet

- CC Loan ProjectDocument11 pagesCC Loan ProjectAjay ThakurNo ratings yet

- Cat 1 SD23Document2 pagesCat 1 SD23HarusiNo ratings yet

- S Mallick 22 - 082630Document9 pagesS Mallick 22 - 082630suniloffcNo ratings yet

- Balance Sheet As at 31St March 2008:: Share Capital Share Application Money Received Pending Allotment of SharesDocument1 pageBalance Sheet As at 31St March 2008:: Share Capital Share Application Money Received Pending Allotment of Sharesbirat_thapa18No ratings yet

- FINANCIAL ACCOUNTING 2 CAT FinalDocument7 pagesFINANCIAL ACCOUNTING 2 CAT FinalmusajamesNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- FAR570 GROUP PROJECT KedahDocument12 pagesFAR570 GROUP PROJECT KedahAmmarNo ratings yet

- Interim Assessment 2 With Answer KeysDocument4 pagesInterim Assessment 2 With Answer KeyscaraaatbongNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- Module 2PartnershipOperations Illustration SolutionsDocument11 pagesModule 2PartnershipOperations Illustration SolutionsShara Mae SameloNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Accountancy FinancialDocument9 pagesAccountancy Financialverma.vineet.officialNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 2 PDFDocument56 pagesGroup - I Paper - 1 Accounting V2 Chapter 2 PDFShrinivas GirnarNo ratings yet

- Exercices + Answers (Capital Structure) PDFDocument4 pagesExercices + Answers (Capital Structure) PDFSonal RathhiNo ratings yet

- Prelim Exercises Pretest Partnership OperationDocument2 pagesPrelim Exercises Pretest Partnership OperationGarp BarrocaNo ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- Project Report For Flour MillDocument11 pagesProject Report For Flour MillSHRUTI AGRAWALNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- Accounting For LeaseDocument19 pagesAccounting For LeaseMikaela Joy FloraNo ratings yet

- Quiz 2 - Audit of Receivables SolutionDocument1 pageQuiz 2 - Audit of Receivables SolutionmillescaasiNo ratings yet

- Bhaivav Laxmi Ma Galla Bhandar7677Document14 pagesBhaivav Laxmi Ma Galla Bhandar7677Ravi KarnaNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- Darshan Shetty - AnnexureDocument1 pageDarshan Shetty - Annexuredarshan shettyNo ratings yet

- Chapter-1 (Additional Illustrations)Document20 pagesChapter-1 (Additional Illustrations)yashkumaryash11No ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- Financial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleDocument11 pagesFinancial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleNadrahNo ratings yet

- SESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012Document38 pagesSESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012roalan1No ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- Buscom ReportDocument2 pagesBuscom ReportJashly FuentesNo ratings yet

- Accounting Level 3/series 3 2008 (Code 3012)Document15 pagesAccounting Level 3/series 3 2008 (Code 3012)Hein Linn Kyaw100% (1)

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- #75 Busns CombinationDocument3 pages#75 Busns CombinationJon Dumagil InocentesNo ratings yet

- 06 - 2020 Barmm FS ComparativeDocument3 pages06 - 2020 Barmm FS ComparativeAbdulmanan HaridNo ratings yet

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- GROUP PROJECT REPORT 1 AmsyarDocument24 pagesGROUP PROJECT REPORT 1 AmsyarAmmarNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Paranoid Company Journal Entries: Date Account Title and ExplanationDocument8 pagesParanoid Company Journal Entries: Date Account Title and ExplanationKristel FieldsNo ratings yet

- Example 21.19 Text BookDocument4 pagesExample 21.19 Text BookNUR DARWISYAH KAMARUDINNo ratings yet

- Test 10 - Problem 1Document4 pagesTest 10 - Problem 1YhamNo ratings yet

- Acca SBR 691 698 PDFDocument8 pagesAcca SBR 691 698 PDFYudheesh P 1822082No ratings yet

- Cashflow From Financing ActivtiesDocument3 pagesCashflow From Financing ActivtiespuxvashuklaNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- Partnership Accounts-1Document27 pagesPartnership Accounts-1g.indu3009No ratings yet

- Revision AnswersDocument27 pagesRevision Answersi.minkovaNo ratings yet

- Answer Key Final Exam IA 2Document4 pagesAnswer Key Final Exam IA 2Carlos arnaldo lavadoNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Ordinary Member 2022-23Document45 pagesOrdinary Member 2022-23uma maheshwariNo ratings yet

- Standard Operating Procedure For Media DestructionDocument3 pagesStandard Operating Procedure For Media DestructionMohsin AliNo ratings yet

- Raccord Pour Fenêtre de Toit Velux EDWDocument13 pagesRaccord Pour Fenêtre de Toit Velux EDWDavid DelplaceNo ratings yet

- Swap Free Accounts Commission 13.05.2020Document3 pagesSwap Free Accounts Commission 13.05.2020Ayman AlghanimNo ratings yet

- Module 3Document32 pagesModule 3Manuel ErmitaNo ratings yet

- Reuse SalwarDocument4 pagesReuse Salwarshakir hussainNo ratings yet

- Module 2 Concept of IncomeDocument3 pagesModule 2 Concept of IncomeNormel DecalaoNo ratings yet

- Consumption Function and Investment Function Chap 2 160218025106 PDFDocument39 pagesConsumption Function and Investment Function Chap 2 160218025106 PDFlizakhanamNo ratings yet

- Notes On Economic EnvironmentDocument9 pagesNotes On Economic EnvironmentJahid HasanNo ratings yet

- 1910 Commodity Air Cart Ground Drive IntroductionDocument5 pages1910 Commodity Air Cart Ground Drive IntroductionOleksandr YermolenkoNo ratings yet

- ClayCraft 22 2019Document84 pagesClayCraft 22 2019OksanaNo ratings yet

- Dung Sonang RohangkuDocument3 pagesDung Sonang RohangkuRichoNo ratings yet

- 21yo83 2023-24Document1 page21yo83 2023-24Raghu NayakNo ratings yet

- Dheo's TeamDocument1 pageDheo's TeamDheo AlviansyahNo ratings yet

- Summative Test For Genmath Quarter 2 Final PrintDocument3 pagesSummative Test For Genmath Quarter 2 Final PrintClemente Ace Burce Macorol100% (2)

- Zimbabwe Banking Swift Codes: Here For AfricaDocument1 pageZimbabwe Banking Swift Codes: Here For AfricaTadiwanashe BurukaiNo ratings yet

- BankDocument116 pagesBanknravindranathreddyNo ratings yet

- AKM 3H-06-Aura Dewi AndiniDocument12 pagesAKM 3H-06-Aura Dewi Andiniandini dewiNo ratings yet

- Cost Accounting: 6 EditionDocument13 pagesCost Accounting: 6 EditionGiannis SalaNo ratings yet

- Garrett RankingDocument14 pagesGarrett RankingCorey Wells88% (25)

- Discussion Forum Unit 1 University of The People BUS 2204-01 Personal Finance - AY2022 - T4 Instructor: Angela Wright 7 April 2022Document2 pagesDiscussion Forum Unit 1 University of The People BUS 2204-01 Personal Finance - AY2022 - T4 Instructor: Angela Wright 7 April 2022Karsa SambasNo ratings yet

- Chermon Chery Notification of Registration Under Section 8 (A) Filed On Form N-8A (Amendment) N-8A-ADocument4 pagesChermon Chery Notification of Registration Under Section 8 (A) Filed On Form N-8A (Amendment) N-8A-AjdNo ratings yet

- Tax Invoice: Total 3Document19 pagesTax Invoice: Total 3Ankit DayalNo ratings yet

- Eco261 Banking IndustryDocument25 pagesEco261 Banking IndustryAHMAD FILZA ADIRANo ratings yet

- GL Bajaj Group of Institutions: Fee ReceiptDocument2 pagesGL Bajaj Group of Institutions: Fee Receiptveenayak sirohiNo ratings yet

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocument7 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNo ratings yet

- Goods and Services: Super Teacher WorksheetsDocument2 pagesGoods and Services: Super Teacher WorksheetsJorge AlvarezNo ratings yet

- Specific Borrowing, P2, Number 5, Page 295Document2 pagesSpecific Borrowing, P2, Number 5, Page 295Jxrriz Cyrxl EhxllaNo ratings yet

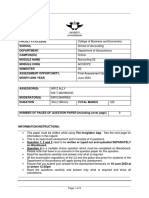

Tut 8 MEMO ChatGPT

Tut 8 MEMO ChatGPT

Uploaded by

Thridev Maharajh0 ratings0% found this document useful (0 votes)

4 views2 pagesv

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesTut 8 MEMO ChatGPT

Tut 8 MEMO ChatGPT

Uploaded by

Thridev Maharajhv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

3.

1 Statement of Changes in Equity for Make Me a Hero Partnership for the year

ended 28 February 2023:

Particulars Teddy Sam Total

Capital Account - Opening Balance 420,000 900,000 1,320,000

Additional Capital Contribution by Teddy 380,000 - 380,000

Salary Adjustment (150,000 - 250,000) 100,000 (250,000) (150,000)

Profit Share (2:1 ratio) 674,400 336,800 1,011,200

Interest on Loan to Teddy 30,600 - 30,600

Interest on Capital 31,500 47,250 78,750

Drawings by Sam - (50,000) (50,000)

Interest on Sam's Drawings - (2,000) (2,000)

Capital Account - Closing Balance 1,636,500 1,982,050 3,618,550

Current Account - Opening Balance (425,320) (505,730) (931,050)

Adjustments for Recognition as Liability (425,320) (505,730) (931,050)

Total Equity 1,211,180 1,476,320 2,687,500

3.2 Partnership Recognition of Current Accounts as Liabilities: The partnership may

choose to recognize the current accounts of the partners as liabilities when they

exceed their capital contributions or when there is uncertainty regarding their

repayment. Recognizing the current accounts as liabilities may affect the statement

of changes in equity by reducing the equity balance, as these amounts are treated as

debts owed by the partners to the partnership.

3.3 Advantages and Disadvantages of Partnerships:

Advantages:

1. Shared Responsibility: Partnerships distribute responsibilities among partners,

allowing for shared decision-making and workload distribution.

2. Access to Capital and Resources: Partnerships can pool together resources, expertise,

and capital from multiple partners, making it easier to start and grow a business.

3. Tax Benefits: Partnerships often enjoy tax advantages, such as pass-through taxation,

where profits and losses are passed directly to the partners' personal tax returns.

Disadvantages:

1. Unlimited Liability: Partnerships expose partners to unlimited personal liability for

business debts and obligations, putting personal assets at risk.

2. Potential for Conflict: Disagreements among partners regarding business decisions,

profit sharing, or management can lead to conflicts and strains on the partnership.

3. Shared Profits: Partnerships require partners to share profits and decision-making,

which may lead to conflicts over control, direction, and resource allocation.

You might also like

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Cost Analysis-Tata MotorsDocument6 pagesCost Analysis-Tata MotorsSubhrajyoti Sarkar57% (7)

- Chapter 19 Assignment IAF410 Excel SheetDocument14 pagesChapter 19 Assignment IAF410 Excel SheetTati AnaNo ratings yet

- Price Action Diver Power - Manual EngDocument5 pagesPrice Action Diver Power - Manual EngAdnan Wasim0% (1)

- Vederinus Stefanus 86220 0Document9 pagesVederinus Stefanus 86220 0PdoneeverNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- Security DepositsDocument3 pagesSecurity DepositsQueen ValleNo ratings yet

- CC Loan ProjectDocument11 pagesCC Loan ProjectAjay ThakurNo ratings yet

- Cat 1 SD23Document2 pagesCat 1 SD23HarusiNo ratings yet

- S Mallick 22 - 082630Document9 pagesS Mallick 22 - 082630suniloffcNo ratings yet

- Balance Sheet As at 31St March 2008:: Share Capital Share Application Money Received Pending Allotment of SharesDocument1 pageBalance Sheet As at 31St March 2008:: Share Capital Share Application Money Received Pending Allotment of Sharesbirat_thapa18No ratings yet

- FINANCIAL ACCOUNTING 2 CAT FinalDocument7 pagesFINANCIAL ACCOUNTING 2 CAT FinalmusajamesNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- FAR570 GROUP PROJECT KedahDocument12 pagesFAR570 GROUP PROJECT KedahAmmarNo ratings yet

- Interim Assessment 2 With Answer KeysDocument4 pagesInterim Assessment 2 With Answer KeyscaraaatbongNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- Module 2PartnershipOperations Illustration SolutionsDocument11 pagesModule 2PartnershipOperations Illustration SolutionsShara Mae SameloNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- Accounting 22 - Final Exam - 2023Document9 pagesAccounting 22 - Final Exam - 2023LaurenNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Accountancy FinancialDocument9 pagesAccountancy Financialverma.vineet.officialNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 2 PDFDocument56 pagesGroup - I Paper - 1 Accounting V2 Chapter 2 PDFShrinivas GirnarNo ratings yet

- Exercices + Answers (Capital Structure) PDFDocument4 pagesExercices + Answers (Capital Structure) PDFSonal RathhiNo ratings yet

- Prelim Exercises Pretest Partnership OperationDocument2 pagesPrelim Exercises Pretest Partnership OperationGarp BarrocaNo ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- Project Report For Flour MillDocument11 pagesProject Report For Flour MillSHRUTI AGRAWALNo ratings yet

- NoneDocument1 pageNoneDonny EmanuelNo ratings yet

- Accounting For LeaseDocument19 pagesAccounting For LeaseMikaela Joy FloraNo ratings yet

- Quiz 2 - Audit of Receivables SolutionDocument1 pageQuiz 2 - Audit of Receivables SolutionmillescaasiNo ratings yet

- Bhaivav Laxmi Ma Galla Bhandar7677Document14 pagesBhaivav Laxmi Ma Galla Bhandar7677Ravi KarnaNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- Darshan Shetty - AnnexureDocument1 pageDarshan Shetty - Annexuredarshan shettyNo ratings yet

- Chapter-1 (Additional Illustrations)Document20 pagesChapter-1 (Additional Illustrations)yashkumaryash11No ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- Financial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleDocument11 pagesFinancial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleNadrahNo ratings yet

- SESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012Document38 pagesSESB-Budget 2013 (Departmental Budget) - Corp Comm Revised As at 17OCT2012roalan1No ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- Buscom ReportDocument2 pagesBuscom ReportJashly FuentesNo ratings yet

- Accounting Level 3/series 3 2008 (Code 3012)Document15 pagesAccounting Level 3/series 3 2008 (Code 3012)Hein Linn Kyaw100% (1)

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- #75 Busns CombinationDocument3 pages#75 Busns CombinationJon Dumagil InocentesNo ratings yet

- 06 - 2020 Barmm FS ComparativeDocument3 pages06 - 2020 Barmm FS ComparativeAbdulmanan HaridNo ratings yet

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- GROUP PROJECT REPORT 1 AmsyarDocument24 pagesGROUP PROJECT REPORT 1 AmsyarAmmarNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Paranoid Company Journal Entries: Date Account Title and ExplanationDocument8 pagesParanoid Company Journal Entries: Date Account Title and ExplanationKristel FieldsNo ratings yet

- Example 21.19 Text BookDocument4 pagesExample 21.19 Text BookNUR DARWISYAH KAMARUDINNo ratings yet

- Test 10 - Problem 1Document4 pagesTest 10 - Problem 1YhamNo ratings yet

- Acca SBR 691 698 PDFDocument8 pagesAcca SBR 691 698 PDFYudheesh P 1822082No ratings yet

- Cashflow From Financing ActivtiesDocument3 pagesCashflow From Financing ActivtiespuxvashuklaNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- Partnership Accounts-1Document27 pagesPartnership Accounts-1g.indu3009No ratings yet

- Revision AnswersDocument27 pagesRevision Answersi.minkovaNo ratings yet

- Answer Key Final Exam IA 2Document4 pagesAnswer Key Final Exam IA 2Carlos arnaldo lavadoNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Ordinary Member 2022-23Document45 pagesOrdinary Member 2022-23uma maheshwariNo ratings yet

- Standard Operating Procedure For Media DestructionDocument3 pagesStandard Operating Procedure For Media DestructionMohsin AliNo ratings yet

- Raccord Pour Fenêtre de Toit Velux EDWDocument13 pagesRaccord Pour Fenêtre de Toit Velux EDWDavid DelplaceNo ratings yet

- Swap Free Accounts Commission 13.05.2020Document3 pagesSwap Free Accounts Commission 13.05.2020Ayman AlghanimNo ratings yet

- Module 3Document32 pagesModule 3Manuel ErmitaNo ratings yet

- Reuse SalwarDocument4 pagesReuse Salwarshakir hussainNo ratings yet

- Module 2 Concept of IncomeDocument3 pagesModule 2 Concept of IncomeNormel DecalaoNo ratings yet

- Consumption Function and Investment Function Chap 2 160218025106 PDFDocument39 pagesConsumption Function and Investment Function Chap 2 160218025106 PDFlizakhanamNo ratings yet

- Notes On Economic EnvironmentDocument9 pagesNotes On Economic EnvironmentJahid HasanNo ratings yet

- 1910 Commodity Air Cart Ground Drive IntroductionDocument5 pages1910 Commodity Air Cart Ground Drive IntroductionOleksandr YermolenkoNo ratings yet

- ClayCraft 22 2019Document84 pagesClayCraft 22 2019OksanaNo ratings yet

- Dung Sonang RohangkuDocument3 pagesDung Sonang RohangkuRichoNo ratings yet

- 21yo83 2023-24Document1 page21yo83 2023-24Raghu NayakNo ratings yet

- Dheo's TeamDocument1 pageDheo's TeamDheo AlviansyahNo ratings yet

- Summative Test For Genmath Quarter 2 Final PrintDocument3 pagesSummative Test For Genmath Quarter 2 Final PrintClemente Ace Burce Macorol100% (2)

- Zimbabwe Banking Swift Codes: Here For AfricaDocument1 pageZimbabwe Banking Swift Codes: Here For AfricaTadiwanashe BurukaiNo ratings yet

- BankDocument116 pagesBanknravindranathreddyNo ratings yet

- AKM 3H-06-Aura Dewi AndiniDocument12 pagesAKM 3H-06-Aura Dewi Andiniandini dewiNo ratings yet

- Cost Accounting: 6 EditionDocument13 pagesCost Accounting: 6 EditionGiannis SalaNo ratings yet

- Garrett RankingDocument14 pagesGarrett RankingCorey Wells88% (25)

- Discussion Forum Unit 1 University of The People BUS 2204-01 Personal Finance - AY2022 - T4 Instructor: Angela Wright 7 April 2022Document2 pagesDiscussion Forum Unit 1 University of The People BUS 2204-01 Personal Finance - AY2022 - T4 Instructor: Angela Wright 7 April 2022Karsa SambasNo ratings yet

- Chermon Chery Notification of Registration Under Section 8 (A) Filed On Form N-8A (Amendment) N-8A-ADocument4 pagesChermon Chery Notification of Registration Under Section 8 (A) Filed On Form N-8A (Amendment) N-8A-AjdNo ratings yet

- Tax Invoice: Total 3Document19 pagesTax Invoice: Total 3Ankit DayalNo ratings yet

- Eco261 Banking IndustryDocument25 pagesEco261 Banking IndustryAHMAD FILZA ADIRANo ratings yet

- GL Bajaj Group of Institutions: Fee ReceiptDocument2 pagesGL Bajaj Group of Institutions: Fee Receiptveenayak sirohiNo ratings yet

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocument7 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNo ratings yet

- Goods and Services: Super Teacher WorksheetsDocument2 pagesGoods and Services: Super Teacher WorksheetsJorge AlvarezNo ratings yet

- Specific Borrowing, P2, Number 5, Page 295Document2 pagesSpecific Borrowing, P2, Number 5, Page 295Jxrriz Cyrxl EhxllaNo ratings yet