Professional Documents

Culture Documents

Các Dạng Bài Tập Trong Tax f6

Các Dạng Bài Tập Trong Tax f6

Uploaded by

namhua540 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageCác Dạng Bài Tập Trong Tax f6

Các Dạng Bài Tập Trong Tax f6

Uploaded by

namhua54Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

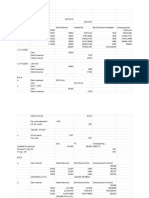

A.

CIT

1. The first and the last tax assessment period+ conversion tax period.

+ the first and the last tax assessment of an enterprise should be:

- Not below 3 months

- Not exceed 15 months.

Note:

the first period: newly established enterprise.

The last period: enterprise change the form of business, collide,etc...

treatment for this:

If the last and the first tax period is <=3 months:

Add up to the period of the subsequent year.

Add up to the period of the previous year.

Fiscal year: năm tài chính, ( tùy loại doanh nghiệp)

Calendar year: năm dương lịch

Conversion tax period.

If an enterprise change its tax period, tax assessment period of the changed year must be <= 12

months.

If there are CIT incentives, the compant should choose either:

+ apply the CIT incentives for the changed year.

+ apply the standard rate for CIT and defer the CIT incentives to the following year.

2. Taxable revenue.

You might also like

- Basis PeriodDocument26 pagesBasis Periodbehzadji7No ratings yet

- Taxpayer Responsibilities in Malaysia 2Document3 pagesTaxpayer Responsibilities in Malaysia 2Nurul AmiraNo ratings yet

- Lecture 3 - Accounting Period and Methods of AccountingDocument21 pagesLecture 3 - Accounting Period and Methods of AccountingSKEETER BRITNEY COSTANo ratings yet

- Chapter 1 - Basis Period and Change in Accounting DatesDocument7 pagesChapter 1 - Basis Period and Change in Accounting DatesNURKHAIRUNNISA100% (3)

- Lecture 3 Concept of Income Accounting Period and Methods of AccountingDocument21 pagesLecture 3 Concept of Income Accounting Period and Methods of AccountingCassie ParkNo ratings yet

- TOPIC 3 - SELF-ASSESSMENT SYSTEM FOR COMPANY - NoridayuDocument18 pagesTOPIC 3 - SELF-ASSESSMENT SYSTEM FOR COMPANY - NoridayuNik Fatehah NajwaNo ratings yet

- Calculating Gratuity For The Employees No Longer Covered Below The Gratuity ActDocument1 pageCalculating Gratuity For The Employees No Longer Covered Below The Gratuity ActTanisha SharmaNo ratings yet

- Now in Case of Company or CorporateDocument2 pagesNow in Case of Company or CorporaterajeshkumarrkollamNo ratings yet

- Basis PeriodDocument3 pagesBasis PeriodAbhiraj RNo ratings yet

- Basis PeriodDocument39 pagesBasis PeriodMuhamad Affandi Mohd SithNo ratings yet

- Filing Requirementsestimated Returns and PaymentsDocument8 pagesFiling Requirementsestimated Returns and Paymentsbest tax filerNo ratings yet

- Course Title - Financial Accounting - 4Document13 pagesCourse Title - Financial Accounting - 4IK storeNo ratings yet

- Chapter 3taxDocument21 pagesChapter 3taxJustine AbreaNo ratings yet

- Tax Changes in 2016 in HungaryDocument9 pagesTax Changes in 2016 in HungaryAccaceNo ratings yet

- How 2 Fillforn 280Document6 pagesHow 2 Fillforn 280anon_639359071No ratings yet

- Lesson 5 Accounting PeriodDocument42 pagesLesson 5 Accounting PeriodCASTRO, HANNAH CAMILLE E.No ratings yet

- VAT Other Aspects - January 2024Document5 pagesVAT Other Aspects - January 2024Charisma CharlesNo ratings yet

- Worked Example - I: Payment of Tax Before AssessmentDocument2 pagesWorked Example - I: Payment of Tax Before AssessmentAnonymous 5Pub2IAbNo ratings yet

- Accounting Adjusting EntryDocument20 pagesAccounting Adjusting EntryClemencia Masiba100% (1)

- Advance TaxDocument9 pagesAdvance TaxManvi JainNo ratings yet

- Part DDocument20 pagesPart DAra Bianca InofreNo ratings yet

- Assessment ReturnDocument10 pagesAssessment ReturnTriila manillaNo ratings yet

- Different TypesDocument2 pagesDifferent Typesseid negashNo ratings yet

- Basic ConceptsDocument4 pagesBasic ConceptsHarry IcwaNo ratings yet

- 1645195113green Joanna 407 AssignmentDocument6 pages1645195113green Joanna 407 AssignmentFawziyyah AgboolaNo ratings yet

- Tax Planning Under Minimum Alternate TaxDocument1 pageTax Planning Under Minimum Alternate TaxchrisNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesAleck CondesNo ratings yet

- TaxDocument6 pagesTaxKhánh LinhNo ratings yet

- 655 Week 12 Notes PDFDocument63 pages655 Week 12 Notes PDFsanaha786No ratings yet

- ĐIỀU BẠN CẦN BIẾT KHI LÀM KẾ TOÁNDocument4 pagesĐIỀU BẠN CẦN BIẾT KHI LÀM KẾ TOÁNhokhanhngoc79No ratings yet

- Accounting Cycle, Entries and ConceptDocument64 pagesAccounting Cycle, Entries and Conceptdude devil100% (1)

- Practice Note On Change in Accounting DateDocument8 pagesPractice Note On Change in Accounting DatememphixxNo ratings yet

- Introduction To Corporation TaxDocument5 pagesIntroduction To Corporation TaxausizuberiNo ratings yet

- Tax FinalDocument16 pagesTax FinalAnany UpadhyayNo ratings yet

- Credits The Expense Object Code From Which The Bill Was PaidDocument3 pagesCredits The Expense Object Code From Which The Bill Was PaidtoravisharmaNo ratings yet

- Advance Payment of TaxDocument8 pagesAdvance Payment of TaxdeeptiNo ratings yet

- Generally Accepted Accounting Principle: GaapDocument19 pagesGenerally Accepted Accounting Principle: GaapediwowNo ratings yet

- F3 Topics Single Entry RelatedParties Etc - Batuyong ConcepcionDocument27 pagesF3 Topics Single Entry RelatedParties Etc - Batuyong ConcepcionAngelou Ferrer PrietoNo ratings yet

- The Payment of Bonus ActDocument10 pagesThe Payment of Bonus Actshanky631No ratings yet

- Fiscal Year and Calendar YearDocument9 pagesFiscal Year and Calendar YearbngideaNo ratings yet

- Key Highlights of The Finance Budget - 2017Document1 pageKey Highlights of The Finance Budget - 2017Paymaster ServicesNo ratings yet

- Chapter 4Document38 pagesChapter 4Rochelle ChuaNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting Entriesyeeaahh56No ratings yet

- Chapter2 Statement of Comprehensive IncomeDocument46 pagesChapter2 Statement of Comprehensive IncomeRonald De La Rama100% (1)

- Accounting Periods and Methods and Other Compliance RequirementsDocument5 pagesAccounting Periods and Methods and Other Compliance RequirementsTurks50% (2)

- Accounting Periods and MethodsDocument51 pagesAccounting Periods and MethodsKenzel lawasNo ratings yet

- GSTTTTDocument8 pagesGSTTTTYo TuNo ratings yet

- ContactOne Bookkeeping Fee Quote Preparatory Form ClientDocument2 pagesContactOne Bookkeeping Fee Quote Preparatory Form Clientmappu08No ratings yet

- Assignment Taxation 2Document13 pagesAssignment Taxation 2afiq hisyamNo ratings yet

- Interim Financial ReportingDocument17 pagesInterim Financial ReportingAlexa LeeNo ratings yet

- Jamia Millia Islamia: Tax LawDocument17 pagesJamia Millia Islamia: Tax LawpriyanshuNo ratings yet

- Accounting Period: AssignmentDocument15 pagesAccounting Period: Assignmentankitb9No ratings yet

- Posting, Adjusting Entries, Process of Doing A 10-Columnar Worksheets, Closing Entries For Service Type of BusinessDocument18 pagesPosting, Adjusting Entries, Process of Doing A 10-Columnar Worksheets, Closing Entries For Service Type of BusinessRalphjoseph Tuazon100% (1)

- Standalone Financial Results For June 30, 2016 (Result)Document6 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- IAS34:Interim Financial ReportingDocument37 pagesIAS34:Interim Financial ReportingTanvir HossainNo ratings yet

- Accounting Princple: 1. Economic Entity AssumptionDocument3 pagesAccounting Princple: 1. Economic Entity AssumptionjoeyNo ratings yet

- Profit or Loss Pre and Post Incorporation PDFDocument59 pagesProfit or Loss Pre and Post Incorporation PDFsvenkat375% (4)

- Taxation NotesDocument2 pagesTaxation NotesPavlov Kumar HandiqueNo ratings yet

- Cách Mô Tả Xu Hướng Trong Ielts Writing Task1Document7 pagesCách Mô Tả Xu Hướng Trong Ielts Writing Task1namhua54No ratings yet

- Chương 19Document2 pagesChương 19namhua54No ratings yet

- Đề Thi Giữa Kì Của HưngDocument15 pagesĐề Thi Giữa Kì Của Hưngnamhua54No ratings yet

- 1H A Phương NambaitapDocument2 pages1H A Phương Nambaitapnamhua54No ratings yet

- BTKTDNVN Chương 6Document3 pagesBTKTDNVN Chương 6namhua54No ratings yet

- Bài tập về nhà - Trang tính1Document4 pagesBài tập về nhà - Trang tính1namhua54No ratings yet