Professional Documents

Culture Documents

Rathish Babu Unnikrishnan Vs The State Govt of NCT of Delhi On 26 April 2022

Rathish Babu Unnikrishnan Vs The State Govt of NCT of Delhi On 26 April 2022

Uploaded by

onevikasCopyright:

Available Formats

You might also like

- Judgment On Chit Fund Act and 138 of The NI ActDocument28 pagesJudgment On Chit Fund Act and 138 of The NI ActRam Prakash100% (1)

- Agency Reviewer (Villanueva)Document73 pagesAgency Reviewer (Villanueva)iam560100% (2)

- Rathish Babu Unnikrishnan Vs The State Govt of NCTSC20222704221820075COM329067Document6 pagesRathish Babu Unnikrishnan Vs The State Govt of NCTSC20222704221820075COM329067Reaa MehtaNo ratings yet

- 2014-Binod Kumar & Ors Vs State of BiharDocument9 pages2014-Binod Kumar & Ors Vs State of BiharPRASHANT SAURABHNo ratings yet

- Josy ChequeDocument16 pagesJosy ChequealbinNo ratings yet

- Criminal Appeal Number 1570 Supreme Court of IndiaDocument9 pagesCriminal Appeal Number 1570 Supreme Court of Indiachintuchacha444No ratings yet

- Manupatra 7303Document2 pagesManupatra 7303Karthik SaranganNo ratings yet

- 305 Vijay Kumar Ghai V State of West Bengal 22 Mar 2022 412838Document19 pages305 Vijay Kumar Ghai V State of West Bengal 22 Mar 2022 412838Aoman BoroNo ratings yet

- Civil Remedy - No Bar - Criminal ProsecutionDocument21 pagesCivil Remedy - No Bar - Criminal ProsecutionSudeep Sharma100% (1)

- D SaibabaDocument6 pagesD SaibabaRupali KondedeshmukhNo ratings yet

- Roshan Gupta v. The State of Bihar & OrsDocument16 pagesRoshan Gupta v. The State of Bihar & OrsHARSH KUMARNo ratings yet

- K.S. Bakshi vs. StateDocument6 pagesK.S. Bakshi vs. StateJaya KohliNo ratings yet

- Vikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrDocument6 pagesVikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrJayant SharmaNo ratings yet

- 6997 2023 9 1504 44877 Judgement 04-Jul-2023Document18 pages6997 2023 9 1504 44877 Judgement 04-Jul-2023Harneet KaurNo ratings yet

- Arun Ahluwalia Vs - ARJUN OBEROIDocument17 pagesArun Ahluwalia Vs - ARJUN OBEROImeghaNo ratings yet

- Vimal Naryan Sharma Vs State of UP and Ors 3011202UP2021081221161542395COM851132Document11 pagesVimal Naryan Sharma Vs State of UP and Ors 3011202UP2021081221161542395COM851132Sakshi RoyNo ratings yet

- C.P. 3059 2021Document8 pagesC.P. 3059 2021Ghulam Abbas Khan WattooNo ratings yet

- 82 Vijaya V Shekharappa 17 Feb 2022 412784Document6 pages82 Vijaya V Shekharappa 17 Feb 2022 412784SR LegalNo ratings yet

- 2019 5 1501 37183 Judgement 11-Aug-2022Document17 pages2019 5 1501 37183 Judgement 11-Aug-2022Rohit kumar SharmaNo ratings yet

- J 2021 SCC OnLine Del 4387 2021 228 AIC 335Document7 pagesJ 2021 SCC OnLine Del 4387 2021 228 AIC 335mohitguptaNo ratings yet

- ResearchDocument26 pagesResearchbhavyaNo ratings yet

- CR 1732 2016 31 07 2017 Final OrderDocument8 pagesCR 1732 2016 31 07 2017 Final OrderBhuwan Nafs Safiyaah SharmaNo ratings yet

- 1175 2023 6 27 52094 Judgement 08-Apr-2024Document14 pages1175 2023 6 27 52094 Judgement 08-Apr-2024Faizan BhatNo ratings yet

- 420 AND NI ACT Both Canot Be AdmitDocument15 pages420 AND NI ACT Both Canot Be AdmitHR FINANCENo ratings yet

- 2021 3 1501 37190 Judgement 11-Aug-2022Document7 pages2021 3 1501 37190 Judgement 11-Aug-2022neerinder sandhuNo ratings yet

- Burhanuddin Patanwala TOPA IRACDocument11 pagesBurhanuddin Patanwala TOPA IRACburhanp2600No ratings yet

- Kali Hanuman Vani HanumanjiDocument11 pagesKali Hanuman Vani HanumanjiDharmendrasinh AtaliaNo ratings yet

- 563 Malkeet Singh Gill V State of Chhattisgarh 5 July 2022 424597Document4 pages563 Malkeet Singh Gill V State of Chhattisgarh 5 July 2022 424597AbxNo ratings yet

- S. Abdul Nazeer and Krishna Murari, JJ.: Equiv Alent Citation: 2022 (2) C TC 555Document16 pagesS. Abdul Nazeer and Krishna Murari, JJ.: Equiv Alent Citation: 2022 (2) C TC 555charuNo ratings yet

- 2015 Order 05-Dec-2017Document16 pages2015 Order 05-Dec-2017SAHIL GUPTANo ratings yet

- 2019 1 1501 34407 Judgement 22-Mar-2022Document33 pages2019 1 1501 34407 Judgement 22-Mar-2022sankalpmiraniNo ratings yet

- Decisions On Forum Shopping 1715190930Document53 pagesDecisions On Forum Shopping 1715190930Baguma Patrick RobertNo ratings yet

- Bombay High Court Default Bail 416667Document14 pagesBombay High Court Default Bail 416667sushil RajkumarNo ratings yet

- Lawyer FeeDocument17 pagesLawyer FeeThe Indian JuristNo ratings yet

- Rafale Review PetitionDocument30 pagesRafale Review PetitionThe Quint100% (1)

- Summary Trial - Section 138 - Delhi HCDocument8 pagesSummary Trial - Section 138 - Delhi HCSudeep SharmaNo ratings yet

- PDF Upload 362689Document8 pagesPDF Upload 362689Shahzeb SaifiNo ratings yet

- Negotiable Instrument Act 1881Document26 pagesNegotiable Instrument Act 1881ae828434No ratings yet

- Vijendra Singh Vs State of UP and Ors 13012014 ALU140164COM96243 PDFDocument5 pagesVijendra Singh Vs State of UP and Ors 13012014 ALU140164COM96243 PDFManu chopraNo ratings yet

- Ap HC Contractual Matters 413002Document12 pagesAp HC Contractual Matters 413002bobby1993 DunnaNo ratings yet

- Jai Narain Vyas University: Submitted To: Submitted By: Raghav DagaDocument13 pagesJai Narain Vyas University: Submitted To: Submitted By: Raghav DagaKaushlya DagaNo ratings yet

- 3 Deepak Gaba V State of Uttar Pradesh 2 Jan 2023 452199Document10 pages3 Deepak Gaba V State of Uttar Pradesh 2 Jan 2023 452199Arshil ShahNo ratings yet

- JKL HC CPC 444148hahaDocument11 pagesJKL HC CPC 444148hahaqasimnasir699No ratings yet

- UntitledDocument19 pagesUntitledArshad KhanNo ratings yet

- Arbitral Proceedings CaseDocument8 pagesArbitral Proceedings CaseBidisha GhoshalNo ratings yet

- 70 DLR (HD) 303-Aleya - Vs - State - and - Ors - 20022018 - BDHCBDHC20182307181401103COM957349Document10 pages70 DLR (HD) 303-Aleya - Vs - State - and - Ors - 20022018 - BDHCBDHC20182307181401103COM957349Mehmud MehmudNo ratings yet

- Displayphp 17 489462Document8 pagesDisplayphp 17 489462AnshutakNo ratings yet

- Harish Chandra Tiwari v. Baiju, 2002 (1) SCR 83Document3 pagesHarish Chandra Tiwari v. Baiju, 2002 (1) SCR 83SatishNo ratings yet

- Swami Satyanand Vs Rajiv Ranjan Kumar Singh 1106W120910COM634098Document8 pagesSwami Satyanand Vs Rajiv Ranjan Kumar Singh 1106W120910COM634098The Legal LensNo ratings yet

- Discharge KGKDocument8 pagesDischarge KGKPreston DiasNo ratings yet

- A482 (A) 26037 2022Document5 pagesA482 (A) 26037 2022Lau BonnettNo ratings yet

- Amrendra Singh Vs State of U.P.And AnotherDocument8 pagesAmrendra Singh Vs State of U.P.And AnotherJason BalakrishnanNo ratings yet

- Beacon - Electronics - Vs - Sylvania - and - Laxman - LTD - DEL HC 1998Document5 pagesBeacon - Electronics - Vs - Sylvania - and - Laxman - LTD - DEL HC 1998Atul KumarNo ratings yet

- Bombay HC Asks Errant Police Officers To Pay Compensation To Doctors For Their Illegal Detention in A Bailable CrimeDocument12 pagesBombay HC Asks Errant Police Officers To Pay Compensation To Doctors For Their Illegal Detention in A Bailable CrimesumitkejriwalNo ratings yet

- Supreme Court Judgment On Professional MisconductDocument17 pagesSupreme Court Judgment On Professional MisconductLatest Laws TeamNo ratings yet

- New Delhi Tele Tech Pvt. Ltd. vs. CISCODocument5 pagesNew Delhi Tele Tech Pvt. Ltd. vs. CISCOZalak ModyNo ratings yet

- Dashrathbhai Trikambhai Patel SC Part Payment of Cheque 138Document21 pagesDashrathbhai Trikambhai Patel SC Part Payment of Cheque 138Adv Sanya ThakurNo ratings yet

- Saurabh Negi & Another Versus Smt. Vibha Negi & Another Lnind 2018 Uttar 1542Document4 pagesSaurabh Negi & Another Versus Smt. Vibha Negi & Another Lnind 2018 Uttar 1542Avinash DangwalNo ratings yet

- 2023LHC2938Document12 pages2023LHC2938Ch.muhammad imran kainth advocate high courtNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Maharaja Agrasen Hospital Vs Master Rishabh Sharma On 16 December 2019Document30 pagesMaharaja Agrasen Hospital Vs Master Rishabh Sharma On 16 December 2019onevikasNo ratings yet

- Aditi Alias Mithi Vs Jitesh Sharma On 6 November 2023Document13 pagesAditi Alias Mithi Vs Jitesh Sharma On 6 November 2023onevikasNo ratings yet

- 215 CRPC Vinubhai - Ranchhodbhai - Patel - Vs - Rajivbhai - Dudabhai - Patel - On - 16 - May - 2018Document29 pages215 CRPC Vinubhai - Ranchhodbhai - Patel - Vs - Rajivbhai - Dudabhai - Patel - On - 16 - May - 2018onevikasNo ratings yet

- CRM-M 24093 2022 31 05 2022 Final OrderDocument9 pagesCRM-M 24093 2022 31 05 2022 Final OrderonevikasNo ratings yet

- Delhi High Court RosterDocument9 pagesDelhi High Court RosteronevikasNo ratings yet

- Useful Case Laws On 138 Ni ActDocument69 pagesUseful Case Laws On 138 Ni ActonevikasNo ratings yet

- Praveen Pandey Vs The State of Madhya Pradesh On 10 April 2018Document14 pagesPraveen Pandey Vs The State of Madhya Pradesh On 10 April 2018onevikasNo ratings yet

- Important MCQs Based On Latest Supreme Court Judgments For Law ExaminationsDocument11 pagesImportant MCQs Based On Latest Supreme Court Judgments For Law ExaminationsonevikasNo ratings yet

- The Basics of "Criminal Trial" Q and A-Part-III)Document5 pagesThe Basics of "Criminal Trial" Q and A-Part-III)onevikasNo ratings yet

- Times of IndiaDocument1 pageTimes of IndiaonevikasNo ratings yet

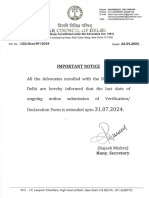

- Important Notice - BCD Verification ProcessDocument1 pageImportant Notice - BCD Verification ProcessonevikasNo ratings yet

- Vakalatnama Form - 2Document1 pageVakalatnama Form - 2onevikasNo ratings yet

- Sahil Raj V State 441016Document10 pagesSahil Raj V State 441016onevikasNo ratings yet

- MAN MOHAN PATNAIK Vs CISCO 138 NIDocument5 pagesMAN MOHAN PATNAIK Vs CISCO 138 NIonevikasNo ratings yet

- What Diabetes Means? Type 1 Type 2Document47 pagesWhat Diabetes Means? Type 1 Type 2onevikasNo ratings yet

- Dinesh Bhakta Shreshtha Vs MMTC LTD Anr On 31 May 2012Document5 pagesDinesh Bhakta Shreshtha Vs MMTC LTD Anr On 31 May 2012onevikasNo ratings yet

- Meta Data Form For Digital Courts NI ActDocument2 pagesMeta Data Form For Digital Courts NI ActonevikasNo ratings yet

- India Budget 2022-23Document23 pagesIndia Budget 2022-23onevikasNo ratings yet

- UntitledDocument1 pageUntitledonevikasNo ratings yet

- Republic of The Philippines Manila Second Division: Supreme CourtDocument8 pagesRepublic of The Philippines Manila Second Division: Supreme Court莊偉德No ratings yet

- Rule 168 175B Conduct With Regard To General PublicDocument3 pagesRule 168 175B Conduct With Regard To General PublicBareerah99No ratings yet

- 5 Land Use and Planning PDFDocument19 pages5 Land Use and Planning PDFSyuen PhuaNo ratings yet

- Cases Consti 1Document37 pagesCases Consti 1Karen DyNo ratings yet

- Presumption of Advancement (Ponniah Case)Document2 pagesPresumption of Advancement (Ponniah Case)IZZAH ZAHIN100% (4)

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (6)

- Business LAW 531 Final Exam New Assignments.Document12 pagesBusiness LAW 531 Final Exam New Assignments.assignmentsehelp0% (1)

- OLIVER v. PSB (2016) Topic: PartiesDocument3 pagesOLIVER v. PSB (2016) Topic: Partiesdelayinggratification100% (1)

- Abilla vs. People, 900 SCRA 120, April 03, 2019Document20 pagesAbilla vs. People, 900 SCRA 120, April 03, 2019j0d3No ratings yet

- United States v. Martinez, Julio. Appeal of Julio Martinez, 785 F.2d 111, 3rd Cir. (1986)Document7 pagesUnited States v. Martinez, Julio. Appeal of Julio Martinez, 785 F.2d 111, 3rd Cir. (1986)Scribd Government DocsNo ratings yet

- Application Form - N RailwayDocument10 pagesApplication Form - N RailwaySandeep K TiwariNo ratings yet

- Sample Letter Requesting Mediation in A Commercial Court CaseDocument2 pagesSample Letter Requesting Mediation in A Commercial Court CaseShoukat100% (4)

- Business Transaction Laws ReviewerDocument3 pagesBusiness Transaction Laws ReviewerCZARINA AUDREY SILVANONo ratings yet

- Roldan Vs Arca GR L-25434Document6 pagesRoldan Vs Arca GR L-25434Anonymous geq9k8oQyONo ratings yet

- Sonza v. ABS-CBNDocument4 pagesSonza v. ABS-CBNLoreen DanaoNo ratings yet

- Complainant vs. vs. Respondent: Second DivisionDocument7 pagesComplainant vs. vs. Respondent: Second DivisionCharmaine GraceNo ratings yet

- Unfair Prejudice Petitions Lessons To Be Learnt and Recent Developments 1Document3 pagesUnfair Prejudice Petitions Lessons To Be Learnt and Recent Developments 1ChetanNo ratings yet

- HVAC User GuideDocument514 pagesHVAC User GuideDmitriy RybakovNo ratings yet

- ThirdPartyNotices MSHWLatinDocument8 pagesThirdPartyNotices MSHWLatinevi zaqiyahNo ratings yet

- United States v. Grelle, 1st Cir. (1996)Document33 pagesUnited States v. Grelle, 1st Cir. (1996)Scribd Government DocsNo ratings yet

- 3) Addendum To FIDIC RedDocument67 pages3) Addendum To FIDIC RedQue Iskandar100% (1)

- Hindustan Lever Vs SDocument12 pagesHindustan Lever Vs SNeeleash GantaNo ratings yet

- Contract ProjectDocument18 pagesContract ProjectRishabh Singh100% (1)

- Partnership Memory Aid AteneoDocument13 pagesPartnership Memory Aid AteneojdispositivumNo ratings yet

- 2019 36 9 27689 Order 20-Apr-2021Document3 pages2019 36 9 27689 Order 20-Apr-2021HimanshuNo ratings yet

- Nat'l Commercial Bank of Saudi Arabia Vs CADocument2 pagesNat'l Commercial Bank of Saudi Arabia Vs CAKristine KristineeeNo ratings yet

- Self-Made Reviewer On Obligation and ContractsDocument51 pagesSelf-Made Reviewer On Obligation and ContractsKarl ChuaNo ratings yet

- Sardul Singh Vs Pritam Singh & Ors. On 18 March, 1999Document4 pagesSardul Singh Vs Pritam Singh & Ors. On 18 March, 1999Studd HunkNo ratings yet

- Remedies For Breach of ContractDocument16 pagesRemedies For Breach of ContractFatima Tariq100% (6)

Rathish Babu Unnikrishnan Vs The State Govt of NCT of Delhi On 26 April 2022

Rathish Babu Unnikrishnan Vs The State Govt of NCT of Delhi On 26 April 2022

Uploaded by

onevikasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rathish Babu Unnikrishnan Vs The State Govt of NCT of Delhi On 26 April 2022

Rathish Babu Unnikrishnan Vs The State Govt of NCT of Delhi On 26 April 2022

Uploaded by

onevikasCopyright:

Available Formats

Rathish Babu Unnikrishnan vs The State Govt Of Nct Of Delhi on 26 April, 2022

Rathish Babu Unnikrishnan vs The State Govt Of Nct Of Delhi on

26 April, 2022

Author: Hrishikesh Roy

Bench: Hrishikesh Roy, K.M. Joseph

REPORTABLE

IN THE SUPREME COURT OF INDIA

CRIMINAL APPELLATE JURISDICTION

CRIMINAL APPEAL NOS.694-695 OF 2022

(Arising out of SLP (Crl) Nos.5781-5782 OF 2020)

Rathish Babu Unnikrishnan Appellant(s)

VERSUS

The State (Govt. of NCT of Delhi) & Anr. Respondent(s)

J U D G M E N T

Hrishikesh Roy, J.

Leave granted.

2. The challenge in these appeals is to the judgment and order dated 02.08.2019 in the Crl. M.C.

No.414/2019 and Crl.M.A.No.1754/2019 whereby the Delhi High Court dismissed the application

under Section 482 of the Code of Criminal Procedure, 1973 (hereinafter referred to as “Cr.P.C”) for

quashing of the summoning order dated 1.6.2018 and the order framing notice dated 3.11.2018,

issued against the appellant under Section 138 of the Negotiable Instruments Act, 1881 (hereinafter

referred to as the ‘N.I. Act’). On the criminal complaint instituted by one Satish Gupta (respondent

no.2), the order under Section 251 of the Cr.P.C. was issued against the appellant by the Magistrate’s

Court. The High Court on considering the rival contention opined that the grounds agitated by the

appellant are “factual defences” which should not be considered within the parameters of limited

enquiry permissible in a petition under Section 482 Cr.P.C. Accordingly, the petition was dismissed

but the accused’s liberty to raise his defence in the competent Court was safeguarded in the

impugned order.

3. For the appellant, Mr. Krishnamohan K., the learned counsel argues that without satisfying the

essential ingredients for the offence under Section 138 of the N.I. Act to the effect that the

Indian Kanoon - http://indiankanoon.org/doc/133827759/ 1

Rathish Babu Unnikrishnan vs The State Govt Of Nct Of Delhi on 26 April, 2022

dishonoured cheque received by the complainant is against “legally enforceable debt or liability”, the

criminal process could not have been issued. Relying on few judgments, it is next argued that the

ingredients necessary to constitute the offence under Section 138 of the N.I. Act is missing in the

instant case and therefore the appellant cannot be prosecuted for the offence under the said

provision. According to the appellant, the concerned post-dated cheques drawn by him in favour of

the complainant were, contingent/security cheques for buyback of shares of AAT Academy

(appellant’s company), held by the complainant, and therefore the cheques could not have been

prematurely presented to the bank and should have been presented for encashment only after

transfer of the complainant’s shareholding in the appellant’s company. In other words, as the

complainant was still holding the shares of the appellant’s company when the cheques were

presented, the complainant is not entitled to receive any payment at that stage, through encashment

of the cheques, made available to him

4. The complainant per-contra contends that when the cheque are issued and the signatures thereon

are admitted, the presumption of a legally enforceable debt will arise in favour of the holder of the

cheque. In a situation such as this, it is for the accused to rebut the legal presumption by adducing

necessary evidence before the trial Court. Reading the provisions of Section 118 of the N.I. Act, it is

submitted by Mr. K.M. Nataraj, learned ASG and Ms. Rebecca M. John the learned Senior Counsel

for the complainant, that it is obligatory for the Court to raise the legal presumption against the

accused when his cheque is dishonoured on presentation. The learned Magistrate therefore correctly

drew such presumption which of course is rebuttable by the appellant, by adducing evidence in

course of trial. It is specifically contended by the complainant that in share purchase transactions,

the consideration is first paid to the seller as per the customary practice and only thereafter the

formalities with respect to the share transfer is completed. In support of such contention, the

respondent relies on Section 56 (1) of the Companies Act, 2013 and also the Form SH-4 in the said

Act, relating to transfer of securities.

5. The records would show that there were transactions between the parties under which the

complainant invested a substantial sum in the appellant’s company. At later stage, dispute arose

amongst them but they resolved that the invested money would be returned to the complainant and

the shares allotted to the complainant will be proportionately transferred to the appellant. With

such understanding, the four cheques forming the part of the criminal complaint were handed over

by the appellant. When the complainant presented one of those cheques, the same was dishonoured

by the bank with the endorsement, “fund insufficient”. Further, the complainant issued notice

stating that the appellant had failed to make the due payment. Thereafter, he filed the complaint

under Section 138 of the N.I. Act which led to the summons and process against the appellant.

6. As noted earlier, the appellant’s basic contention is that the cheque in question was not issued in

discharge of “legally recoverable debt”. They also raised a contention on the obligation of the

complainant to transfer the concerned shares. A defence plea is raised by the appellant to the effect

that the cheques in question were issued as “security” and not in discharge of any “legally

recoverable debt”.

Indian Kanoon - http://indiankanoon.org/doc/133827759/ 2

Rathish Babu Unnikrishnan vs The State Govt Of Nct Of Delhi on 26 April, 2022

7. The learned Judge of the Delhi High Court while considering the petition under Section 482

Cr.P.C kept in mind the scope of limited enquiry in this jurisdiction by referring to the ratio in HMT

Watches Limited vs. M.A. Abida & Anr1. and in Rajiv Thapar & Ors. vs. Madan Lal Kapoor2 and

opined that the exercise of powers by the High Court under Section 482 Cr.P.C, would negate the

complainant’s case without allowing the complainant to lead evidence. Such a determination should

necessarily not be rendered by a Court not conducting the trial. Therefore, unless the Court is fully

satisfied that the material produced would irrefutably rule out the charges and such materials being

of sterling and impeccable quality, the invocation of Section 482 Cr.P.C power to quash the criminal

proceedings, would be unmerited. Proceeding on this basis, verdict was given against the appellant,

who was facing the proceeding under Section 138 of the 1 (2015) 11 SCC 776 2 (2013) 3 SCC 330 N.I.

Act. With all liberty given to the appellant to raise his defence in the trial court, his quashing petition

came to be dismissed.

8. The issue to be answered here is whether summons and trial notice should have been quashed on

the basis of factual defences. The corollary therefrom is what should be the responsibility of the

quashing Court and whether it must weigh the evidence presented by the parties, at a pre-trial stage.

9. The transactional arrangement between the complainant and the accused reveals the nature of

obligations that both had undertaken. The cheques in question were accepted by the complainant

for an agreed price consideration, for the shares in the appellant’s company. According to the

complainant, the appellant is to first pay and then as per the usual practice in the trade, the shares

would be transferred to the appellant in due course within the time permitted by law. A bare perusal

of Section 56(1) of the Companies Act, 2013 indicates that a transfer of securities of a company can

take place only when a proper instrument of transfer is effectuated. The operation of legally

transferring shares involves several distinct steps. At first, a contract of sale needs to be entered

upon. The nature of transaction in this contract logically then requires payment of the price by the

prospective transferee to fulfil their promise first. In exchange, transferor would move to fill Form

SH-4 and thus, effectuate a valid instrument. Depending on the nature of the company and its

Articles of Association, then upon the presentation of the instrument of transfer to the board of the

company and its acceptance by the board, the entry of the transferee in the register of the company

in place of the transferor, takes place. Thus, the transfer of share is complete. To say it in another

way, in shares transactions, there is a time lag between money going out from the buyer and shares

reaching to the seller. In earlier days the time gap was longer. It has now become speedier but the

gap still remains. The share transactions in India generally follows this pattern.

10. It is also relevant to bear in mind that the burden of proving that there is no existing debt or

liability, is to be discharged in the trial. For a two judges Bench in M.M.T.C. Ltd. & Anr. vs. Medchl

Chemicals and Pharma (P) Ltd. & Anr.3, Justice S.N. Variava made the following pertinent

observation on this aspect: -

“17. There is therefore no requirement that the complainant must specifically allege

in the complaint that there was a subsisting liability. The burden of proving that there

was no existing debt or liability was on the respondents. This they have to discharge

in the trial. At this stage, merely on the basis of averments in the petitions filed by

Indian Kanoon - http://indiankanoon.org/doc/133827759/ 3

Rathish Babu Unnikrishnan vs The State Govt Of Nct Of Delhi on 26 April, 2022

them the High Court could not have concluded that there was no existing debt or

liability.”

11. The legal presumption of the cheque having been issued in the discharge of liability must also

receive due weightage. In a situation where the accused moves Court for quashing even before trial

has commenced, the Court’s approach should be careful enough to not to prematurely extinguish the

case by disregarding the legal presumption which supports the complaint. The opinion of Justice

K.G. Balakrishnan for a three judges 3 (2002) 1 SCC 234 Bench in Rangappa vs. Sri Mohan4 would

at this stage, deserve our attention: -

“26. ... we are in agreement with the respondent claimant that the presumption

mandated by Section 139 of the Act does indeed include the existence of a legally

enforceable debt or liability. As noted in the citations, this is of course in the nature of

a rebuttable presumption and it is open to the accused to raise a defence wherein the

existence of a legally enforceable debt or liability can be contested. However, there

can be no doubt that there is an initial presumption which favours the complainant.”

12. At any rate, whenever facts are disputed the truth should be allowed to emerge by

weighing the evidence.

On this aspect, we may benefit by referring to the ratio in Rajeshbhai Muljibhai Patel vs. State of

Gujarat5 where the following pertinent opinion was given by Justice R. Banumathi: -

“22. ………….. When disputed questions of facts are involved which need to be

adjudicated after the parties adduce evidence, the complaint under Section 138 of the

NI Act ought not to have been quashed by the High Court by taking recourse to

Section 482 CrPC. Though, the Court has the power to quash the criminal complaint

filed under Section 138 of the NI Act on the legal issues like limitation, etc. criminal

complaint filed under Section 138 of the NI Act against Yogeshbhai ought not to have

been quashed

4 (2010) 11 SCC 441 5 (2020) 3 SCC 794 merely on the ground that there are inter se disputes

between Appellant 3 and Respondent

2. Without keeping in view the statutory presumption raised under Section 139 of the NI Act, the

High Court, in our view, committed a serious error in quashing the criminal complaint in CC No.

367 of 2016 filed under Section 138 of the NI Act.”

13. Bearing in mind the principles for exercise of jurisdiction in a proceeding for quashing, let us

now turn to the materials in this case. On careful reading of the complaint and the order passed by

the Magistrate, what is discernible is that a possible view is taken that the cheques drawn were, in

discharge of a debt for purchase of shares. In any case, when there is legal presumption, it would not

be judicious for the quashing Court to carry out a detailed enquiry on the facts alleged, without first

permitting the trial Court to evaluate the evidence of the parties. The quashing Court should not

Indian Kanoon - http://indiankanoon.org/doc/133827759/ 4

Rathish Babu Unnikrishnan vs The State Govt Of Nct Of Delhi on 26 April, 2022

take upon itself, the burden of separating the wheat from the chaff where facts are contested. To say

it differently, the quashing proceedings must not become an expedition into the merits of factual

dispute, so as to conclusively vindicate either the complainant or the defence.

14. The parameters for invoking the inherent jurisdiction of the Court to quash the criminal

proceedings under S.482 CrPC, have been spelled out by Justice S. Ratnavel Pandian for the two

judges’ bench in State of Haryana v. Bhajan Lal6, and the suggested precautionary principles serve

as good law even today, for invocation of power under Section 482 of the Cr.P.C.

“103. We also give a note of caution to the effect that the power of quashing a criminal proceeding

should be exercised very sparingly and with circumspection and that too in the rarest of rare cases;

that the court will not be justified in embarking upon an enquiry as to the reliability or genuineness

or otherwise of the allegations made in the FIR or the complaint and that the extraordinary or

inherent powers do not confer an arbitrary jurisdiction on the court to act according to its whim or

caprice.”

15. In the impugned judgment, the learned Judge had rightly relied upon the opinion of Justice

J.S.Khehar for a Division Bench in Rajiv Thapar (supra), which succinctly express the following

relevant parameters to be considered by the quashing Court, at the stage of issuing process,

committal, or framing of charges, 6 AIR 1992 SC 604 “28. The High Court, in exercise of its

jurisdiction under Section 482 CrPC, must make a just and rightful choice. This is not a stage of

evaluating the truthfulness or otherwise of the allegations levelled by the prosecution/ complainant

against the accused. Likewise, it is not a stage for determining how weighty the defences raised on

behalf of the accused are. Even if the accused is successful in showing some suspicion or doubt, in

the allegations levelled by the prosecution/ complainant, it would be impermissible to discharge the

accused before trial. This is so because it would result in giving finality to the accusations levelled by

the prosecution/complainant, without allowing the prosecution or the complainant to adduce

evidence to substantiate the same.”

16. The proposition of law as set out above makes it abundantly clear that the Court should be slow

to grant the relief of quashing a complaint at a pre-trial stage, when the factual controversy is in the

realm of possibility particularly because of the legal presumption, as in this matter. What is also of

note is that the factual defence without having to adduce any evidence need to be of an

unimpeachable quality, so as to altogether disprove the allegations made in the complaint.

17. The consequences of scuttling the criminal process at a pre-trial stage can be grave and

irreparable. Quashing proceedings at preliminary stages will result in finality without the parties

having had an opportunity to adduce evidence and the consequence then is that the proper forum

i.e., the trial Court is ousted from weighing the material evidence. If this is allowed, the accused may

be given an un-merited advantage in the criminal process. Also because of the legal presumption,

when the cheque and the signature are not disputed by the appellant, the balance of convenience at

this stage is in favour of the complainant/prosecution, as the accused will have due opportunity to

adduce defence evidence during the trial, to rebut the presumption.

Indian Kanoon - http://indiankanoon.org/doc/133827759/ 5

Rathish Babu Unnikrishnan vs The State Govt Of Nct Of Delhi on 26 April, 2022

18. Situated thus, to non-suit the complainant, at the stage of the summoning order, when the

factual controversy is yet to be canvassed and considered by the trial court will not in our opinion be

judicious. Based upon a prima facie impression, an element of criminality cannot entirely be ruled

out here subject to the determination by the trial Court. Therefore, when the proceedings are at a

nascent stage, scuttling of the criminal process is not merited.

19. In our assessment, the impugned judgment is rendered by applying the correct legal principles

and the High Court rightly declined relief to the accused, in the quashing proceeding. Having said

this, to rebut the legal presumption against him, the appellant must also get a fair opportunity to

adduce his evidence in an open trial by an impartial judge who can dispassionately weigh the

material to reach the truth of the matter. At this point, one might benefit by recalling the words of

Harry Brown, the American author and investment advisor who so aptly said - “A fair trial is one in

which the rules of evidence are honored, the accused has competent counsel, and the judge enforce

the proper court room procedure – a trial in which every assumption can be challenged.” We expect

no less and no more for the appellant.

20. We might add before parting that the observation made in this judgment is only for the limited

purpose of this order and those should not stand in the way of the trial Court to decide the case on

merit. The appeals are accordingly dismissed leaving the parties to bear their own cost.

………………………………………………………J. [K.M. JOSEPH] ………………………………………………………J.

[HRISHIKESH ROY] NEW DELHI APRIL 26, 2022

Indian Kanoon - http://indiankanoon.org/doc/133827759/ 6

You might also like

- Judgment On Chit Fund Act and 138 of The NI ActDocument28 pagesJudgment On Chit Fund Act and 138 of The NI ActRam Prakash100% (1)

- Agency Reviewer (Villanueva)Document73 pagesAgency Reviewer (Villanueva)iam560100% (2)

- Rathish Babu Unnikrishnan Vs The State Govt of NCTSC20222704221820075COM329067Document6 pagesRathish Babu Unnikrishnan Vs The State Govt of NCTSC20222704221820075COM329067Reaa MehtaNo ratings yet

- 2014-Binod Kumar & Ors Vs State of BiharDocument9 pages2014-Binod Kumar & Ors Vs State of BiharPRASHANT SAURABHNo ratings yet

- Josy ChequeDocument16 pagesJosy ChequealbinNo ratings yet

- Criminal Appeal Number 1570 Supreme Court of IndiaDocument9 pagesCriminal Appeal Number 1570 Supreme Court of Indiachintuchacha444No ratings yet

- Manupatra 7303Document2 pagesManupatra 7303Karthik SaranganNo ratings yet

- 305 Vijay Kumar Ghai V State of West Bengal 22 Mar 2022 412838Document19 pages305 Vijay Kumar Ghai V State of West Bengal 22 Mar 2022 412838Aoman BoroNo ratings yet

- Civil Remedy - No Bar - Criminal ProsecutionDocument21 pagesCivil Remedy - No Bar - Criminal ProsecutionSudeep Sharma100% (1)

- D SaibabaDocument6 pagesD SaibabaRupali KondedeshmukhNo ratings yet

- Roshan Gupta v. The State of Bihar & OrsDocument16 pagesRoshan Gupta v. The State of Bihar & OrsHARSH KUMARNo ratings yet

- K.S. Bakshi vs. StateDocument6 pagesK.S. Bakshi vs. StateJaya KohliNo ratings yet

- Vikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrDocument6 pagesVikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrJayant SharmaNo ratings yet

- 6997 2023 9 1504 44877 Judgement 04-Jul-2023Document18 pages6997 2023 9 1504 44877 Judgement 04-Jul-2023Harneet KaurNo ratings yet

- Arun Ahluwalia Vs - ARJUN OBEROIDocument17 pagesArun Ahluwalia Vs - ARJUN OBEROImeghaNo ratings yet

- Vimal Naryan Sharma Vs State of UP and Ors 3011202UP2021081221161542395COM851132Document11 pagesVimal Naryan Sharma Vs State of UP and Ors 3011202UP2021081221161542395COM851132Sakshi RoyNo ratings yet

- C.P. 3059 2021Document8 pagesC.P. 3059 2021Ghulam Abbas Khan WattooNo ratings yet

- 82 Vijaya V Shekharappa 17 Feb 2022 412784Document6 pages82 Vijaya V Shekharappa 17 Feb 2022 412784SR LegalNo ratings yet

- 2019 5 1501 37183 Judgement 11-Aug-2022Document17 pages2019 5 1501 37183 Judgement 11-Aug-2022Rohit kumar SharmaNo ratings yet

- J 2021 SCC OnLine Del 4387 2021 228 AIC 335Document7 pagesJ 2021 SCC OnLine Del 4387 2021 228 AIC 335mohitguptaNo ratings yet

- ResearchDocument26 pagesResearchbhavyaNo ratings yet

- CR 1732 2016 31 07 2017 Final OrderDocument8 pagesCR 1732 2016 31 07 2017 Final OrderBhuwan Nafs Safiyaah SharmaNo ratings yet

- 1175 2023 6 27 52094 Judgement 08-Apr-2024Document14 pages1175 2023 6 27 52094 Judgement 08-Apr-2024Faizan BhatNo ratings yet

- 420 AND NI ACT Both Canot Be AdmitDocument15 pages420 AND NI ACT Both Canot Be AdmitHR FINANCENo ratings yet

- 2021 3 1501 37190 Judgement 11-Aug-2022Document7 pages2021 3 1501 37190 Judgement 11-Aug-2022neerinder sandhuNo ratings yet

- Burhanuddin Patanwala TOPA IRACDocument11 pagesBurhanuddin Patanwala TOPA IRACburhanp2600No ratings yet

- Kali Hanuman Vani HanumanjiDocument11 pagesKali Hanuman Vani HanumanjiDharmendrasinh AtaliaNo ratings yet

- 563 Malkeet Singh Gill V State of Chhattisgarh 5 July 2022 424597Document4 pages563 Malkeet Singh Gill V State of Chhattisgarh 5 July 2022 424597AbxNo ratings yet

- S. Abdul Nazeer and Krishna Murari, JJ.: Equiv Alent Citation: 2022 (2) C TC 555Document16 pagesS. Abdul Nazeer and Krishna Murari, JJ.: Equiv Alent Citation: 2022 (2) C TC 555charuNo ratings yet

- 2015 Order 05-Dec-2017Document16 pages2015 Order 05-Dec-2017SAHIL GUPTANo ratings yet

- 2019 1 1501 34407 Judgement 22-Mar-2022Document33 pages2019 1 1501 34407 Judgement 22-Mar-2022sankalpmiraniNo ratings yet

- Decisions On Forum Shopping 1715190930Document53 pagesDecisions On Forum Shopping 1715190930Baguma Patrick RobertNo ratings yet

- Bombay High Court Default Bail 416667Document14 pagesBombay High Court Default Bail 416667sushil RajkumarNo ratings yet

- Lawyer FeeDocument17 pagesLawyer FeeThe Indian JuristNo ratings yet

- Rafale Review PetitionDocument30 pagesRafale Review PetitionThe Quint100% (1)

- Summary Trial - Section 138 - Delhi HCDocument8 pagesSummary Trial - Section 138 - Delhi HCSudeep SharmaNo ratings yet

- PDF Upload 362689Document8 pagesPDF Upload 362689Shahzeb SaifiNo ratings yet

- Negotiable Instrument Act 1881Document26 pagesNegotiable Instrument Act 1881ae828434No ratings yet

- Vijendra Singh Vs State of UP and Ors 13012014 ALU140164COM96243 PDFDocument5 pagesVijendra Singh Vs State of UP and Ors 13012014 ALU140164COM96243 PDFManu chopraNo ratings yet

- Ap HC Contractual Matters 413002Document12 pagesAp HC Contractual Matters 413002bobby1993 DunnaNo ratings yet

- Jai Narain Vyas University: Submitted To: Submitted By: Raghav DagaDocument13 pagesJai Narain Vyas University: Submitted To: Submitted By: Raghav DagaKaushlya DagaNo ratings yet

- 3 Deepak Gaba V State of Uttar Pradesh 2 Jan 2023 452199Document10 pages3 Deepak Gaba V State of Uttar Pradesh 2 Jan 2023 452199Arshil ShahNo ratings yet

- JKL HC CPC 444148hahaDocument11 pagesJKL HC CPC 444148hahaqasimnasir699No ratings yet

- UntitledDocument19 pagesUntitledArshad KhanNo ratings yet

- Arbitral Proceedings CaseDocument8 pagesArbitral Proceedings CaseBidisha GhoshalNo ratings yet

- 70 DLR (HD) 303-Aleya - Vs - State - and - Ors - 20022018 - BDHCBDHC20182307181401103COM957349Document10 pages70 DLR (HD) 303-Aleya - Vs - State - and - Ors - 20022018 - BDHCBDHC20182307181401103COM957349Mehmud MehmudNo ratings yet

- Displayphp 17 489462Document8 pagesDisplayphp 17 489462AnshutakNo ratings yet

- Harish Chandra Tiwari v. Baiju, 2002 (1) SCR 83Document3 pagesHarish Chandra Tiwari v. Baiju, 2002 (1) SCR 83SatishNo ratings yet

- Swami Satyanand Vs Rajiv Ranjan Kumar Singh 1106W120910COM634098Document8 pagesSwami Satyanand Vs Rajiv Ranjan Kumar Singh 1106W120910COM634098The Legal LensNo ratings yet

- Discharge KGKDocument8 pagesDischarge KGKPreston DiasNo ratings yet

- A482 (A) 26037 2022Document5 pagesA482 (A) 26037 2022Lau BonnettNo ratings yet

- Amrendra Singh Vs State of U.P.And AnotherDocument8 pagesAmrendra Singh Vs State of U.P.And AnotherJason BalakrishnanNo ratings yet

- Beacon - Electronics - Vs - Sylvania - and - Laxman - LTD - DEL HC 1998Document5 pagesBeacon - Electronics - Vs - Sylvania - and - Laxman - LTD - DEL HC 1998Atul KumarNo ratings yet

- Bombay HC Asks Errant Police Officers To Pay Compensation To Doctors For Their Illegal Detention in A Bailable CrimeDocument12 pagesBombay HC Asks Errant Police Officers To Pay Compensation To Doctors For Their Illegal Detention in A Bailable CrimesumitkejriwalNo ratings yet

- Supreme Court Judgment On Professional MisconductDocument17 pagesSupreme Court Judgment On Professional MisconductLatest Laws TeamNo ratings yet

- New Delhi Tele Tech Pvt. Ltd. vs. CISCODocument5 pagesNew Delhi Tele Tech Pvt. Ltd. vs. CISCOZalak ModyNo ratings yet

- Dashrathbhai Trikambhai Patel SC Part Payment of Cheque 138Document21 pagesDashrathbhai Trikambhai Patel SC Part Payment of Cheque 138Adv Sanya ThakurNo ratings yet

- Saurabh Negi & Another Versus Smt. Vibha Negi & Another Lnind 2018 Uttar 1542Document4 pagesSaurabh Negi & Another Versus Smt. Vibha Negi & Another Lnind 2018 Uttar 1542Avinash DangwalNo ratings yet

- 2023LHC2938Document12 pages2023LHC2938Ch.muhammad imran kainth advocate high courtNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- California Supreme Court Petition: S173448 – Denied Without OpinionFrom EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionRating: 4 out of 5 stars4/5 (1)

- Maharaja Agrasen Hospital Vs Master Rishabh Sharma On 16 December 2019Document30 pagesMaharaja Agrasen Hospital Vs Master Rishabh Sharma On 16 December 2019onevikasNo ratings yet

- Aditi Alias Mithi Vs Jitesh Sharma On 6 November 2023Document13 pagesAditi Alias Mithi Vs Jitesh Sharma On 6 November 2023onevikasNo ratings yet

- 215 CRPC Vinubhai - Ranchhodbhai - Patel - Vs - Rajivbhai - Dudabhai - Patel - On - 16 - May - 2018Document29 pages215 CRPC Vinubhai - Ranchhodbhai - Patel - Vs - Rajivbhai - Dudabhai - Patel - On - 16 - May - 2018onevikasNo ratings yet

- CRM-M 24093 2022 31 05 2022 Final OrderDocument9 pagesCRM-M 24093 2022 31 05 2022 Final OrderonevikasNo ratings yet

- Delhi High Court RosterDocument9 pagesDelhi High Court RosteronevikasNo ratings yet

- Useful Case Laws On 138 Ni ActDocument69 pagesUseful Case Laws On 138 Ni ActonevikasNo ratings yet

- Praveen Pandey Vs The State of Madhya Pradesh On 10 April 2018Document14 pagesPraveen Pandey Vs The State of Madhya Pradesh On 10 April 2018onevikasNo ratings yet

- Important MCQs Based On Latest Supreme Court Judgments For Law ExaminationsDocument11 pagesImportant MCQs Based On Latest Supreme Court Judgments For Law ExaminationsonevikasNo ratings yet

- The Basics of "Criminal Trial" Q and A-Part-III)Document5 pagesThe Basics of "Criminal Trial" Q and A-Part-III)onevikasNo ratings yet

- Times of IndiaDocument1 pageTimes of IndiaonevikasNo ratings yet

- Important Notice - BCD Verification ProcessDocument1 pageImportant Notice - BCD Verification ProcessonevikasNo ratings yet

- Vakalatnama Form - 2Document1 pageVakalatnama Form - 2onevikasNo ratings yet

- Sahil Raj V State 441016Document10 pagesSahil Raj V State 441016onevikasNo ratings yet

- MAN MOHAN PATNAIK Vs CISCO 138 NIDocument5 pagesMAN MOHAN PATNAIK Vs CISCO 138 NIonevikasNo ratings yet

- What Diabetes Means? Type 1 Type 2Document47 pagesWhat Diabetes Means? Type 1 Type 2onevikasNo ratings yet

- Dinesh Bhakta Shreshtha Vs MMTC LTD Anr On 31 May 2012Document5 pagesDinesh Bhakta Shreshtha Vs MMTC LTD Anr On 31 May 2012onevikasNo ratings yet

- Meta Data Form For Digital Courts NI ActDocument2 pagesMeta Data Form For Digital Courts NI ActonevikasNo ratings yet

- India Budget 2022-23Document23 pagesIndia Budget 2022-23onevikasNo ratings yet

- UntitledDocument1 pageUntitledonevikasNo ratings yet

- Republic of The Philippines Manila Second Division: Supreme CourtDocument8 pagesRepublic of The Philippines Manila Second Division: Supreme Court莊偉德No ratings yet

- Rule 168 175B Conduct With Regard To General PublicDocument3 pagesRule 168 175B Conduct With Regard To General PublicBareerah99No ratings yet

- 5 Land Use and Planning PDFDocument19 pages5 Land Use and Planning PDFSyuen PhuaNo ratings yet

- Cases Consti 1Document37 pagesCases Consti 1Karen DyNo ratings yet

- Presumption of Advancement (Ponniah Case)Document2 pagesPresumption of Advancement (Ponniah Case)IZZAH ZAHIN100% (4)

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (6)

- Business LAW 531 Final Exam New Assignments.Document12 pagesBusiness LAW 531 Final Exam New Assignments.assignmentsehelp0% (1)

- OLIVER v. PSB (2016) Topic: PartiesDocument3 pagesOLIVER v. PSB (2016) Topic: Partiesdelayinggratification100% (1)

- Abilla vs. People, 900 SCRA 120, April 03, 2019Document20 pagesAbilla vs. People, 900 SCRA 120, April 03, 2019j0d3No ratings yet

- United States v. Martinez, Julio. Appeal of Julio Martinez, 785 F.2d 111, 3rd Cir. (1986)Document7 pagesUnited States v. Martinez, Julio. Appeal of Julio Martinez, 785 F.2d 111, 3rd Cir. (1986)Scribd Government DocsNo ratings yet

- Application Form - N RailwayDocument10 pagesApplication Form - N RailwaySandeep K TiwariNo ratings yet

- Sample Letter Requesting Mediation in A Commercial Court CaseDocument2 pagesSample Letter Requesting Mediation in A Commercial Court CaseShoukat100% (4)

- Business Transaction Laws ReviewerDocument3 pagesBusiness Transaction Laws ReviewerCZARINA AUDREY SILVANONo ratings yet

- Roldan Vs Arca GR L-25434Document6 pagesRoldan Vs Arca GR L-25434Anonymous geq9k8oQyONo ratings yet

- Sonza v. ABS-CBNDocument4 pagesSonza v. ABS-CBNLoreen DanaoNo ratings yet

- Complainant vs. vs. Respondent: Second DivisionDocument7 pagesComplainant vs. vs. Respondent: Second DivisionCharmaine GraceNo ratings yet

- Unfair Prejudice Petitions Lessons To Be Learnt and Recent Developments 1Document3 pagesUnfair Prejudice Petitions Lessons To Be Learnt and Recent Developments 1ChetanNo ratings yet

- HVAC User GuideDocument514 pagesHVAC User GuideDmitriy RybakovNo ratings yet

- ThirdPartyNotices MSHWLatinDocument8 pagesThirdPartyNotices MSHWLatinevi zaqiyahNo ratings yet

- United States v. Grelle, 1st Cir. (1996)Document33 pagesUnited States v. Grelle, 1st Cir. (1996)Scribd Government DocsNo ratings yet

- 3) Addendum To FIDIC RedDocument67 pages3) Addendum To FIDIC RedQue Iskandar100% (1)

- Hindustan Lever Vs SDocument12 pagesHindustan Lever Vs SNeeleash GantaNo ratings yet

- Contract ProjectDocument18 pagesContract ProjectRishabh Singh100% (1)

- Partnership Memory Aid AteneoDocument13 pagesPartnership Memory Aid AteneojdispositivumNo ratings yet

- 2019 36 9 27689 Order 20-Apr-2021Document3 pages2019 36 9 27689 Order 20-Apr-2021HimanshuNo ratings yet

- Nat'l Commercial Bank of Saudi Arabia Vs CADocument2 pagesNat'l Commercial Bank of Saudi Arabia Vs CAKristine KristineeeNo ratings yet

- Self-Made Reviewer On Obligation and ContractsDocument51 pagesSelf-Made Reviewer On Obligation and ContractsKarl ChuaNo ratings yet

- Sardul Singh Vs Pritam Singh & Ors. On 18 March, 1999Document4 pagesSardul Singh Vs Pritam Singh & Ors. On 18 March, 1999Studd HunkNo ratings yet

- Remedies For Breach of ContractDocument16 pagesRemedies For Breach of ContractFatima Tariq100% (6)