Professional Documents

Culture Documents

Questions For Panel Discussion-Zonal Seminar Patna

Questions For Panel Discussion-Zonal Seminar Patna

Uploaded by

shivesh.agrawal0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

Questions for Panel Discussion-zonal Seminar Patna

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageQuestions For Panel Discussion-Zonal Seminar Patna

Questions For Panel Discussion-Zonal Seminar Patna

Uploaded by

shivesh.agrawalCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

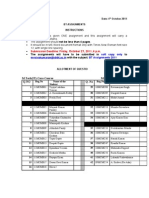

Zonal Seminar for Bhopal, Raipur and Nagpur – NAMCABS 3.

0 –

Panel Discussion: Innovative approaches to MSME lending – Sharing of Best

Practices – 1 hour

Introductory Round – (10 minutes) –

(I will request each one of you to speak for 2-3 minutes each) - Please give a

general opening, with a background of your MSME portfolio, supplemented with

Data - how many micro, small and medium loans, which sector out of these three is

the major borrower for your bank, NPAs in the portfolio and the challenges faced in

financing MSMEs. This may be an introduction before we start the panel discussion.

Round 1 (25 mins)

(I will request each one of you to speak for about 6-7 minutes each)

Panellist 1 – Sh. Bhagwan G Surshe - We all agree that customisation of

approaches is required for easing the constraints of smaller borrowers and MSMEs

in accordance with their unique needs. What is your experience in customising the

loan products for the MSME segment? If you could share a few examples from your

bank? How did you understand the need to customise and how has it benefitted the

bank and the customers?

Panellist 2 – Ms. Bindiya Jog - A wealth of data from various digital touchpoints is

available to us now which includes credit scores, IT and GST returns, utility bill

payments, social media interactions and other electronic transactions conducted by

the MSMEs / entrepreneurs. These can provide deep insights into the health and

performance of MSMEs. How have you leveraged AI/ML and sophisticated data

analytics for automated credit assessment of your MSME loans and risk assessment

of your msme portfolio?

Panellist – 3 - Dr Shyam Lal Sutar – How have you benefitted from the internal

rating models to assess the credit worthiness of your MSME Borrowers? How are

you using digital lending for your msme customers? Any special measures and best

practices adopted for protection of MSME customers?

Round 2 (15 min)

(I will request each one of you to speak for 5 minutes each. Here you can discuss in

general about your views and experiences regarding supply chain financing to

MSMEs)

Please share with us how your banks are using supply chain financing to finance

MSMEs. How do you think it has helped the bank overcome impediments in lending

to this sector?

Depending on the time left, the house will be open for questions for 5-10 minutes in

the end.

You might also like

- NMIMS Solution Dec 2023 Call 902510064Document57 pagesNMIMS Solution Dec 2023 Call 902510064Palaniappan NagarajanNo ratings yet

- BRM Research ProposalDocument8 pagesBRM Research Proposalfahadmemon55No ratings yet

- Pestle Analysis of Banking IndustryDocument15 pagesPestle Analysis of Banking Industryvipjatt00700757% (7)

- TMP DAFEDocument11 pagesTMP DAFEnithiananthiNo ratings yet

- Literature Review On NBFCDocument6 pagesLiterature Review On NBFCafmzndvyddcoio100% (1)

- NMIMS Assignment Answer Sheet Dec 2023Document62 pagesNMIMS Assignment Answer Sheet Dec 2023Palaniappan NagarajanNo ratings yet

- Marketing of Banking ServicesDocument50 pagesMarketing of Banking ServicesshivamNo ratings yet

- Dhruwan CRM ReportDocument19 pagesDhruwan CRM ReportajeeshNo ratings yet

- NMIMS Dec 2023 Sem 1 2 3 4 Solution Call 9025810064Document57 pagesNMIMS Dec 2023 Sem 1 2 3 4 Solution Call 9025810064Palaniappan NagarajanNo ratings yet

- 125980157Document15 pages125980157josephinechan789No ratings yet

- 2010 Live Project at Imantec: C A B, M P A MNC& N B IDocument15 pages2010 Live Project at Imantec: C A B, M P A MNC& N B Irakesh_raj68No ratings yet

- Book On Interview PDFDocument146 pagesBook On Interview PDFAyush Gupta100% (1)

- Retail Banking 2 SonuDocument33 pagesRetail Banking 2 Sonuvishal agarwalNo ratings yet

- Marketing ChannelDocument21 pagesMarketing ChannelNikhil DubeyNo ratings yet

- Nalini - Bangalore PublicationDocument6 pagesNalini - Bangalore PublicationWeb Research100% (1)

- Assignment No.7Document3 pagesAssignment No.7utkarshdanane4554No ratings yet

- Brochure FMLBBSDocument7 pagesBrochure FMLBBSNumanath PoudelNo ratings yet

- NMIMS Dec 2023 Solution - 9025810064Document57 pagesNMIMS Dec 2023 Solution - 9025810064Palaniappan NagarajanNo ratings yet

- Isb511 Video AssignmentDocument5 pagesIsb511 Video Assignment2022923703No ratings yet

- Dissertation Topics On Banking SectorDocument6 pagesDissertation Topics On Banking SectorWriteMyPaperIn3HoursCanada100% (1)

- MRP eCRMDocument43 pagesMRP eCRMAmit mehlaNo ratings yet

- Design of StudyDocument4 pagesDesign of Studysguldekar123No ratings yet

- Challenges: Need One Bank Licensing Policy, But Several Bank LicensingpoliciesDocument8 pagesChallenges: Need One Bank Licensing Policy, But Several Bank LicensingpoliciesAbhinav WaliaNo ratings yet

- Binary Analytics For EvaluatorsDocument6 pagesBinary Analytics For EvaluatorsGeoffrey KaraaNo ratings yet

- Retail Banking Research PaperDocument5 pagesRetail Banking Research Papern1dihagavun2100% (1)

- Q1-Rainbow's End InterviewDocument3 pagesQ1-Rainbow's End InterviewMuhammad HamzaNo ratings yet

- Internet Banking and Mobile Banking - Safe and Secure BankingDocument99 pagesInternet Banking and Mobile Banking - Safe and Secure BankingRehanCoolestBoy0% (1)

- Test Questions AnswersDocument4 pagesTest Questions AnswersadiasaurusNo ratings yet

- HSBC CaseStudy2022Document2 pagesHSBC CaseStudy2022TANUSHKA GUPTANo ratings yet

- Innovation in BankingDocument9 pagesInnovation in BankingHardik AraniyaNo ratings yet

- Emerging Trends in Retail BankingDocument6 pagesEmerging Trends in Retail Bankinganandsree12345100% (3)

- Bank NoteDocument2 pagesBank NoteRahul LoriyaNo ratings yet

- Research Paper On Net Banking PDFDocument8 pagesResearch Paper On Net Banking PDFafmcgebln100% (1)

- M.Tech (IT) Core Course MCA (Elective) Q.No Q. No: Submission Deadline: Friday, 2011 6 P.MDocument5 pagesM.Tech (IT) Core Course MCA (Elective) Q.No Q. No: Submission Deadline: Friday, 2011 6 P.MLoknath VishwakarmaNo ratings yet

- Bank Credit To MsmesDocument10 pagesBank Credit To MsmesAarthi ManoharanNo ratings yet

- 4Document2 pages4Comprehensive Viva VoceNo ratings yet

- Thesis On Sme Financing in IndiaDocument6 pagesThesis On Sme Financing in Indiamonicaramospaterson100% (1)

- Kotak's 811 Banking App - Digital Customer On-Boarding For The First Time in IndiaDocument9 pagesKotak's 811 Banking App - Digital Customer On-Boarding For The First Time in IndiajeetNo ratings yet

- Literature Review On Customer Relationship Management in BanksDocument4 pagesLiterature Review On Customer Relationship Management in Banksc5m07hh9No ratings yet

- (Template) MIDBS - Midterm Exam 2020Document6 pages(Template) MIDBS - Midterm Exam 2020sahil suranaNo ratings yet

- Customer Satisfaction IN Banking ServicesDocument10 pagesCustomer Satisfaction IN Banking ServicesSaurabh AgarwalNo ratings yet

- Dissertation Relation ClientDocument8 pagesDissertation Relation ClientCustomPapersSingapore100% (1)

- Core Bank in Axis BankDocument24 pagesCore Bank in Axis BankNatasha MistryNo ratings yet

- GP CoreDocument133 pagesGP CoreDivya GanesanNo ratings yet

- MIS442 FinalDocument5 pagesMIS442 FinalMd. Shahariar KoushikNo ratings yet

- Sid 10830873 7079cemDocument14 pagesSid 10830873 7079cemPabloNo ratings yet

- Bankers Plus March 2023Document55 pagesBankers Plus March 2023Nirlep SinghNo ratings yet

- MBA Finance Project On Retail Banking With Special Reference To YES BANKDocument115 pagesMBA Finance Project On Retail Banking With Special Reference To YES BANKManjeet Singh100% (2)

- Swot Analysis: David Mifsud The Financial Services EnviromentDocument9 pagesSwot Analysis: David Mifsud The Financial Services EnviromentJoseph RapaNo ratings yet

- FINAL Documentation-1Document46 pagesFINAL Documentation-1Sindhu sreeNo ratings yet

- Project F I MDocument18 pagesProject F I MAmit KumarNo ratings yet

- A Study On Services Quality of SBI In: P.RoselinDocument4 pagesA Study On Services Quality of SBI In: P.RoselinSanchit ParnamiNo ratings yet

- Summer Internships 2011 MBA 2010-12: Role of IT in The Banking IndustryDocument71 pagesSummer Internships 2011 MBA 2010-12: Role of IT in The Banking IndustrySakshi DuaNo ratings yet

- Vipul Sir Word FileDocument7 pagesVipul Sir Word Filepnchoubey609No ratings yet

- How to Write Business Plan for MicrofinanceDocument8 pagesHow to Write Business Plan for MicrofinancehxqweryfNo ratings yet

- Customer Service in Banks: Report of The Committee OnDocument180 pagesCustomer Service in Banks: Report of The Committee OnVenky PragadaNo ratings yet

- Title: Measuring Effectiveness of Retail Banking in Public Sector and Private Sector BankDocument5 pagesTitle: Measuring Effectiveness of Retail Banking in Public Sector and Private Sector BankMonisha KalaNo ratings yet

- Chat GPT Profits The Ultimate Guide To Making Money With Conversational AIFrom EverandChat GPT Profits The Ultimate Guide To Making Money With Conversational AINo ratings yet