Professional Documents

Culture Documents

SWAPS in The Income Tax Ordinance 2001

SWAPS in The Income Tax Ordinance 2001

Uploaded by

Dani DaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SWAPS in The Income Tax Ordinance 2001

SWAPS in The Income Tax Ordinance 2001

Uploaded by

Dani DaniCopyright:

Available Formats

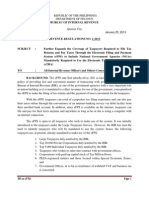

*SWAPS in the Income Tax Ordinance 2001*

Section [(62B) *” Synchronized Withholding Administration and Payment System agent”* or “SWAPS

agent” means any person or class of persons notified by the Board to collect or deduct withholding taxes

through Synchronized Withholding Administration and Payment System;]

The Synchronized Withholding Administration and Payment System (SWAPS) pertains to the income tax

framework outlined in the Income Tax Ordinance, 2001. This system has been introduced by the Federal

Board of Revenue (FBR) to modernize tax administration and enhance transparency in tax collection in

Pakistan. SWAPS focuses on income tax, sales tax, federal excise, and customs. The system is designed to

streamline the withholding tax administration and payment process, primarily by integrating real-time

data exchange and digital invoicing. Businesses are required to comply with regulations related to

SWAPS, including installation and utilization of FBR-approved fiscal devices and software, processing

transactions with digital invoices, and thorough data verification.

*SWAPS Agents' Obligations*

Notified SWAPS Agents, defined in section 2 of the Income Tax Ordinance, 2001, carry significant

obligations as per the notification by the FBR. These obligations include registration and integration with

the FBR's SWAPS platform, using approved fiscal electronic devices and software, processing transactions

only with digital invoices, and verifying key information of withholdees for precise tax deductions.

*Potential Benefits and Considerations*

The introduction of SWAPS is expected to offer several advantages, including enhanced transparency in

business transactions, improved tax collection efficiency, reduced compliance burden, and standardized

SWAPS Payment Receipts (SPR) serving as proof of tax payment. However, businesses need to stay

updated on the implementation timeline, as non-compliance might lead to penalties under the Income

Tax Ordinance, 2001. This shift towards modernizing the tax administration seeks to strengthen oversight

and prevent tax evasion, offering long-term benefits for both the government and businesses.

*Declaration of SWAPS Agents and Monitoring* The FBR has declared multiple banks as SWAPS agents

for the deduction and monitoring of withholding taxes under various provisions of the Income Tax

Ordinance, 2001. The system's enforcement and digital invoicing requirements are documented in *SRO

419(I)/2024* emphasizing strict measures to enhance tax transparency and combat evasion. Future

Actions and Implementation It's paramount for businesses to anticipate the implementation timeline

and any issuance of additional directives by the FBR for necessary adaptations. As SWAPS builds a

turning point for Pakistan's tax ecosystem, stakeholders are encouraged to familiarize themselves with

the framework and prepare for a future where tax transactions are more transparent, efficient, and

digital.

You might also like

- Nicholls David One DayDocument112 pagesNicholls David One DayJuan Perez100% (6)

- AFF Tax Memorandum v5Document28 pagesAFF Tax Memorandum v5Azhar AliNo ratings yet

- Economic ActivityDocument46 pagesEconomic ActivitySabitkhattakNo ratings yet

- Discussion Paper On Value Added Tax Modernisation 16205Document12 pagesDiscussion Paper On Value Added Tax Modernisation 16205Tiaan SmitNo ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- SAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.Document56 pagesSAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.imran mughalNo ratings yet

- Exploring The Salient Points of The Ease of Paying TaxesDocument4 pagesExploring The Salient Points of The Ease of Paying TaxespepyNo ratings yet

- Taxation - Self-Assessment SystemDocument15 pagesTaxation - Self-Assessment SystemToo YunHangNo ratings yet

- Equalisation Levy ICAI ModuleDocument37 pagesEqualisation Levy ICAI Modulelekhha bhansaliNo ratings yet

- FIRS Issues Simplified VAT RegimeDocument2 pagesFIRS Issues Simplified VAT RegimeOluwagbenga OgunsakinNo ratings yet

- UAT VAT Introduction 2314357.1Document4 pagesUAT VAT Introduction 2314357.1sreenivasNo ratings yet

- First Year Performance of PTI Govt 2018-19Document82 pagesFirst Year Performance of PTI Govt 2018-19Insaf.PK100% (1)

- Finance Act Tax Handbook 2023Document33 pagesFinance Act Tax Handbook 2023TANVEER HUSSAINNo ratings yet

- Equalisation Levy: After Studying This Chapter, You Would Be Able ToDocument29 pagesEqualisation Levy: After Studying This Chapter, You Would Be Able Toyash mehtaNo ratings yet

- GCC Tax and Other Regulatory Communique Jan 2023Document13 pagesGCC Tax and Other Regulatory Communique Jan 2023FAME AdvisoryNo ratings yet

- HOD - 13 - Papua New Guinea-SlidesDocument7 pagesHOD - 13 - Papua New Guinea-SlidesNickson KeruaNo ratings yet

- M.Akbar Wianda - Resume SalinanDocument3 pagesM.Akbar Wianda - Resume SalinanDaff PanelNo ratings yet

- Commentaries On FIRS Circulars Vis-à-Vis Finance Act 2021Document37 pagesCommentaries On FIRS Circulars Vis-à-Vis Finance Act 2021Kehinde OladipoNo ratings yet

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiNo ratings yet

- Finance Act Tax Handbook 2023Document33 pagesFinance Act Tax Handbook 2023Muhammad SufyanNo ratings yet

- Indonesia Legal Brief SampleDocument6 pagesIndonesia Legal Brief SampleHasan NawawiNo ratings yet

- Dec 2018 PDFDocument23 pagesDec 2018 PDFBien Bowie A. CortezNo ratings yet

- Tax Alert Efris RolloutDocument2 pagesTax Alert Efris RolloutdingNo ratings yet

- Deemed Interest IncomeDocument6 pagesDeemed Interest IncomeHaris HashimNo ratings yet

- RR No. 9-2022Document4 pagesRR No. 9-2022try saguilotNo ratings yet

- GITA Gt-Budget-Advisor-2024Document32 pagesGITA Gt-Budget-Advisor-2024albertsui.iii14No ratings yet

- The Computerized Accounting System Application Saga: Posted On March 16, 2017Document2 pagesThe Computerized Accounting System Application Saga: Posted On March 16, 2017ivyzafeNo ratings yet

- GEC Nov 13Document7 pagesGEC Nov 13koreanissueNo ratings yet

- 5E Kenya Budget Highlights and Analysis 2017Document17 pages5E Kenya Budget Highlights and Analysis 2017STRATEGIC REGISTRARNo ratings yet

- 68120RR 1-2013Document6 pages68120RR 1-2013Allan AlcantaraNo ratings yet

- The 2014 Priority Projects of The BIR RCU 02 06 14Document3 pagesThe 2014 Priority Projects of The BIR RCU 02 06 14JianSadakoNo ratings yet

- Guidelines and Conduct of TCVD RMO09-2006Document45 pagesGuidelines and Conduct of TCVD RMO09-2006Kris CalabiaNo ratings yet

- Tackling Beps in The Digital EconomyDocument12 pagesTackling Beps in The Digital EconomyMohan MohiniNo ratings yet

- In Philippine PesosDocument3 pagesIn Philippine PesosJheza Mae PitogoNo ratings yet

- Budget 2020-21 PointersDocument19 pagesBudget 2020-21 PointersJaved MushtaqNo ratings yet

- TAX BRIEF AmendmentsMadeThroughFinanceAct - 2022Document39 pagesTAX BRIEF AmendmentsMadeThroughFinanceAct - 2022haiderNo ratings yet

- GST EcosystemDocument15 pagesGST EcosystemAmarjit PriyadarshanNo ratings yet

- Report No. 5 - 22 - Chapter-3-062f0e3be996485.72192939Document30 pagesReport No. 5 - 22 - Chapter-3-062f0e3be996485.72192939srbhgangu123No ratings yet

- EY APAC Tax Matters 13th EditionDocument35 pagesEY APAC Tax Matters 13th EditionClownNo ratings yet

- Faceless Assessment GNDocument51 pagesFaceless Assessment GNP Mathavan RajkumarNo ratings yet

- Tax Alert - 2007 - MarDocument10 pagesTax Alert - 2007 - MarKeats QuindozaNo ratings yet

- Memorandum On Federal & Provincial Finance Acts, 2017Document90 pagesMemorandum On Federal & Provincial Finance Acts, 2017Rehan FarhatNo ratings yet

- Rmo 32-05Document8 pagesRmo 32-05nathalie velasquezNo ratings yet

- Chapter 1 - Introduction To GST: Applicability of Utgst ActDocument7 pagesChapter 1 - Introduction To GST: Applicability of Utgst ActSoul of honeyNo ratings yet

- Act 311 Term PaperDocument7 pagesAct 311 Term PaperKazi Shariat UllahNo ratings yet

- Rmo No 9-06 TCVD Tax MappingDocument16 pagesRmo No 9-06 TCVD Tax MappingGil PinoNo ratings yet

- SIGTAS & New IRC Forms - AmDocument24 pagesSIGTAS & New IRC Forms - AmAnnahMaso100% (2)

- WHT Presentation FinalDocument78 pagesWHT Presentation FinalMuhammad TaimurNo ratings yet

- TAX 2 Group 1 Handout PDFDocument6 pagesTAX 2 Group 1 Handout PDFMi-young SunNo ratings yet

- Municipal Accounting System-DV RaoDocument8 pagesMunicipal Accounting System-DV RaoeletsonlineNo ratings yet

- Revenue Regulation 1-2013Document7 pagesRevenue Regulation 1-2013Jerwin DaveNo ratings yet

- Feb 2019 SGVDocument26 pagesFeb 2019 SGVBien Bowie A. CortezNo ratings yet

- Corporate Tax in The UAEDocument6 pagesCorporate Tax in The UAEraseemjaleelNo ratings yet

- Icpak03/2012 - Position Paper On The Vat Bill 2012Document19 pagesIcpak03/2012 - Position Paper On The Vat Bill 2012Zimbo KigoNo ratings yet

- GST and Its Impact On GDP - May 1, 7 - 20 PMDocument14 pagesGST and Its Impact On GDP - May 1, 7 - 20 PMajitram.1327No ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- Laporan Tahunan DJP 2020 - EnglishDocument256 pagesLaporan Tahunan DJP 2020 - EnglishHaryo BagaskaraNo ratings yet

- E-Invoicing Detailed GuidelineDocument67 pagesE-Invoicing Detailed GuidelineMehul Bazaria100% (1)

- B4 Nov MSDocument13 pagesB4 Nov MSCerealis FelicianNo ratings yet

- Taxation of The Digital Economy - Evaluating The Nigerian and Global Approach - Lexology - Alliance Law FirmDocument5 pagesTaxation of The Digital Economy - Evaluating The Nigerian and Global Approach - Lexology - Alliance Law FirmMabruk Kunmi-OlayiwolaNo ratings yet

- Beginning and Intermediate Algebra - 3e - Ch08Document88 pagesBeginning and Intermediate Algebra - 3e - Ch08Alastair Harris100% (1)

- Tort I Vicarious LiabilityDocument6 pagesTort I Vicarious LiabilityMoureen MosotiNo ratings yet

- English KnottyDocument2 pagesEnglish Knottynehiltas2013No ratings yet

- Hummer-Bot Instruction ManualDocument108 pagesHummer-Bot Instruction Manualinghdj100% (1)

- RDS ManualDocument105 pagesRDS ManualSuwatchai SittipanichNo ratings yet

- Elementary 1Document4 pagesElementary 1Evelina PalamarciucNo ratings yet

- Structuralism (De Saussure), A Language vs. The Human Language Faculty (Chomsky) ... Etc SummaryDocument5 pagesStructuralism (De Saussure), A Language vs. The Human Language Faculty (Chomsky) ... Etc SummaryMarijana Lopec100% (3)

- Bank of India - Recruitment of Clerks Online Application Form For The Post of ClerksDocument2 pagesBank of India - Recruitment of Clerks Online Application Form For The Post of ClerksvikramchowdaryNo ratings yet

- Rutherford County BallotsDocument8 pagesRutherford County BallotsUSA TODAY NetworkNo ratings yet

- PushkalavatiDocument5 pagesPushkalavatiSana KhanNo ratings yet

- Romanesque Architecture in ItalyDocument35 pagesRomanesque Architecture in ItalySheree Labe100% (1)

- Organic Chemistry 4 Edition: Reactions of Alcohols, Ethers, Epoxides, and Sulfur-Containing CompoundsDocument50 pagesOrganic Chemistry 4 Edition: Reactions of Alcohols, Ethers, Epoxides, and Sulfur-Containing CompoundsDella AinurrohmaNo ratings yet

- PEE - Alice in WonderlandDocument5 pagesPEE - Alice in Wonderlandmary lauNo ratings yet

- 14 - CH - 06 Friction and Wear Analysis For BushingDocument18 pages14 - CH - 06 Friction and Wear Analysis For BushingSathish KumarNo ratings yet

- Resume Don Rimer, Police Investigator and Speaker, Satanic Ritual Abuse, 1-10-2011Document1 pageResume Don Rimer, Police Investigator and Speaker, Satanic Ritual Abuse, 1-10-2011Rick ThomaNo ratings yet

- 4in1 Template Item Analysis With MPS Mastery Level Frequency of Errors 1 NCR3Document5 pages4in1 Template Item Analysis With MPS Mastery Level Frequency of Errors 1 NCR3Babette CeletariaNo ratings yet

- FBI - Table 43Document1 pageFBI - Table 43eonwuka15No ratings yet

- Bourdieu - Public Opinion Does Not ExistDocument7 pagesBourdieu - Public Opinion Does Not ExistmargitajemrtvaNo ratings yet

- Assignment On PC Access TableDocument11 pagesAssignment On PC Access TableDrishti SharmaNo ratings yet

- History of HockeyDocument11 pagesHistory of HockeyLes LeynesNo ratings yet

- Projit Sen - Presentation About Me PDFDocument5 pagesProjit Sen - Presentation About Me PDFProjit SenNo ratings yet

- CV - Ani CuedariDocument5 pagesCV - Ani CuedariCVsMH17competitionNo ratings yet

- PWC Stock Based Compensation Second EditionDocument392 pagesPWC Stock Based Compensation Second EditionmzurzdcoNo ratings yet

- Successful New Design For The Fog HarpDocument2 pagesSuccessful New Design For The Fog HarpJohn OsborneNo ratings yet

- Dental Act 2018Document110 pagesDental Act 2018copyourpairNo ratings yet

- 5G Certification OverviewDocument14 pages5G Certification Overviewluis100% (1)

- Glamour MagickDocument2 pagesGlamour MagickIşınsu ÇobanoğluNo ratings yet

- Hebrews and The TrinityDocument14 pagesHebrews and The Trinitysbob255No ratings yet

- Thesis Maher e 2Document451 pagesThesis Maher e 2reenakini674717No ratings yet