Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

375 viewsSt. Hiliare V City of Danbury (Complaint)

St. Hiliare V City of Danbury (Complaint)

Uploaded by

Alfonso RobinsonSt. Hiliare v City of Danbury (complaint)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

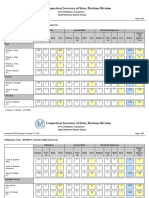

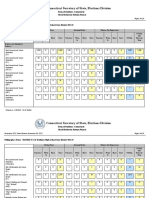

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2021 Danbury Head Moderator Return DataDocument136 pages2021 Danbury Head Moderator Return DataAlfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 January 10Document29 pagesRe-Elect Mayor Esposito SEEC 20 January 10Alfonso RobinsonNo ratings yet

- Roberto Alves SEEC 20 January 10 (Termination)Document31 pagesRoberto Alves SEEC 20 January 10 (Termination)Alfonso RobinsonNo ratings yet

- 3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementDocument36 pages3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementAlfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 April 10 2023Document201 pagesAlves For Danbury SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 October 10 2023Document75 pagesRe-Elect Mayor Esposito SEEC 20 October 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 July 10 2023Document80 pagesRe-Elect Mayor Esposito SEEC 20 July 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 January 10 2023Document54 pagesRe-Elect Mayor Esposito SEEC Form 20 January 10 2023Alfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 July 10 2023Document102 pagesAlves For Danbury SEEC 20 July 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 April 10 2023Document88 pagesRe-Elect Mayor Esposito SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Danbury 2021 Election TotalsDocument9 pagesDanbury 2021 Election TotalsAlfonso RobinsonNo ratings yet

- Danbury 2022 Head Moderators ReturnsDocument7 pagesDanbury 2022 Head Moderators ReturnsAlfonso RobinsonNo ratings yet

- To City of Danbury Election WardsDocument13 pagesTo City of Danbury Election WardsAlfonso RobinsonNo ratings yet

- Danbury Democrats Ward Reappointment Proposal (Plan A)Document6 pagesDanbury Democrats Ward Reappointment Proposal (Plan A)Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 October 10 2022Document32 pagesRe-Elect Mayor Esposito SEEC Form 20 October 10 2022Alfonso RobinsonNo ratings yet

- Governor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtDocument5 pagesGovernor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtAlfonso RobinsonNo ratings yet

- Joe DaSilva For Judge of Probate, Danbury CT 2022Document2 pagesJoe DaSilva For Judge of Probate, Danbury CT 2022Alfonso RobinsonNo ratings yet

- Danbury Republican Party Ward Reapportionment Proposal (Plan B)Document8 pagesDanbury Republican Party Ward Reapportionment Proposal (Plan B)Alfonso RobinsonNo ratings yet

- 2022 Danbury Head Moderators Return DataDocument118 pages2022 Danbury Head Moderators Return DataAlfonso RobinsonNo ratings yet

- Dean Esposito Attack Mailer 09.20.21Document2 pagesDean Esposito Attack Mailer 09.20.21Alfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 January 10Document37 pagesAlves For Danbury Form 20 January 10Alfonso RobinsonNo ratings yet

- Dean Esposito Form 20 October 2021Document104 pagesDean Esposito Form 20 October 2021Alfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 October 26 (7 Days Until Election)Document35 pagesAlves For Danbury Form 20 October 26 (7 Days Until Election)Alfonso RobinsonNo ratings yet

- Gartner Town Clerk Form 20 October 12Document33 pagesGartner Town Clerk Form 20 October 12Alfonso RobinsonNo ratings yet

- Roberto Alves Mailer 09.30.21Document2 pagesRoberto Alves Mailer 09.30.21Alfonso RobinsonNo ratings yet

St. Hiliare V City of Danbury (Complaint)

St. Hiliare V City of Danbury (Complaint)

Uploaded by

Alfonso Robinson0 ratings0% found this document useful (0 votes)

375 views91 pagesSt. Hiliare v City of Danbury (complaint)

Original Title

St. Hiliare v City of Danbury (complaint)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSt. Hiliare v City of Danbury (complaint)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

375 views91 pagesSt. Hiliare V City of Danbury (Complaint)

St. Hiliare V City of Danbury (Complaint)

Uploaded by

Alfonso RobinsonSt. Hiliare v City of Danbury (complaint)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 91

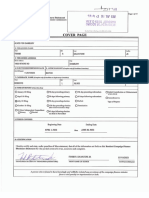

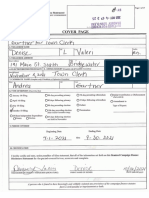

RETURN DATE: May 7,2024 : SUPERIOR COURT

DAVID ST. HILAIRE i J.D. OF DANBURY

VS. z AT DANBURY

CITY OF DANBURY. a APRIL 17 , 2024

COMPLAINT

COUNT ONE: BREACH OF CONTRACT

EMPLOYMENT AGREEMENT CITY OF DANBURY DIRECTOR OF FINANCE

1. David W. St. Hilaire, the plaintiff herein, hereinafter referred to as “Plaintiff” or "St

Hilaire",) was hired by the City of Danbury on June 5, 2007, as the Director of

Finance.

2. Atall times relevant, the defendant City of Danbury, ( hereinafter, the “City” or

‘Danbury") has been a municipal corporation organized and existing under the

law of the State of Connecticut.

3. Atall times relevant, the City has had a Charter known as the organic law of the.

municipality. Chapter 6, Sec 6-6. of the Charter describes the qualifications,

duties, and authority of the Director of Finance. The Director of Finance position

is a non-union civil service position subject to the “Merit System,” responsible for

the assessment of taxable property within the City, the collection of taxes, as well

as all purchasing, budgeting, bonding, risk management, accounting, and the

preparation of financial statements and reports for every department and agency

within the City.

4, Mark Boughton was the mayor of Danbury in 2007. Mayor Boughton, on behalf

of the City offered St. Hilaire

a. a starting annual salary of $119,000.00

b. a $5,000.00 annual contribution to the City's deferred compensation plan,

©. four weeks of paid vacation that could be accumulated indefinitely,

d. up to 80 hours of compensatory time’, as well as

e. health insurance, pension, and other benefits.

5. The City’s Benefits Handbook for Eligible Non-Union Employees provided St.

Hilaire the following additional benefits*;

a. In lieu of paid vacation leave, an employee may request payment for any

carry-over vacation time. Ex. 2, page 5.

b. At separation, all vacation time including the current year shall be paid out

and included in the calculation of his pension benefit. Id.

©. 10 days paid sick leave annually. 1d,

d. Unused sick leave paid out annually at 50%, Ex. 2, page 6.

6. Over the years, St. Hilaire and the City renegotiated his relationship, including;

a. In February 2009, the City presented St. Hilaire a written Employment

Agreement that Included the following changes and enhancements‘:

i, Residency requirement waived

+ St Hilaire had a 35 hour work week. When a non-union City employee worked in excess of the standard work:

week, they received compensatory paid time off on an hour for hour basis. “Comp time” could not be rolled over

into the following year.

® attached as Exhibit “1” isa true and accurate copy ofthe offer letter dated June 5, 2007, from Mayor Mark

Boughton to St. Hilaire, (hereinafter, the “Offer”)

> attached as Exhibit “2” isa true and accurate copy of the Benefits Handbook for Eligible Non-Union

Employees dated June 22, 2017. (hereinafter, “Non-union Benefits Handbook.’)

* Attached as Exhibit “3" isa true and accurate copy of the Employment Agreement City of Danbury Director of

Finance , back dated to July 16, 2007, a copy of which was provided to St, Hilaire in response to @ FOIA

request.

ili

vi

vii.

vill

Salary of $125,000.00 . ( requiring payment of $6,000.00 as back-

pay.) Ex. 3, page 1.

$5,000.00 semi- annual contribution to the City’s deferred

compensation plan, vested immediately and portable. Ex. 3, page

gi

. 12 paid Holidays annually. Id.

5 weeks paid vacation after 5 years. (City policy is 5 weeks after 12

years. Non-union Benefits Handbook. Ex. 2, page 4.)

Travel allowance of $2,000.00 annually. Ex. 3, page 3.

4 paid personal days annually. Ex. 3, page 4.

Position subject to merit system. Ex. 3, page 6.

Employee terminable for cause, defined as “gross misconduct”

after completion of investigation, notice of charges, and due

process hearing. Ex. 3, page 6.

b. On August 17, 2011, Mayor Boughton agreed to increase by $400.00 the

City’s contractual annual vehicle allowance .5 Ex. 4.

cc, On December 29, 2011, Mayor Boughton agreed to increase by

$5,000.00 the City’s annual contribution on behalf of St. Hilaire to the

City's deferred compensation plan, retroactive to St. Hilaire’s hire date.

= attached as Exhibit "4" Isa true and accurate copy of the authorization by Mayor Boughton dated August 17,

2011

Any amount in excess of IRS limitations would carryover to the following

year. Ex. 5, page 1

d. On January 14, 2014, Mayor Boughton awarded St. Hilaire an 8% wage

increase retroactively to the beginning of the fiscal year”

e. On December 19, 2019, Mayor Boughton, recognizing that St. Hilaire had

been fulfilling the duties of and supervising the Tax Assessor's Office for 2

years while taking the 300 hours of training to qualify for the CCMA II ( Tax

Assessor) certification on his own time, authorized St. Hilaire to be

credited with 150 hours of vacation time.° Ex. 7.

f. On March 12, 2020, Mayor Boughton, recognizing that members of the

Finance Department had been working significantly more than the 35

hours per week, authorized the Finance Department workers to be

credited with 40 hours of compensation time, including the ability to carry-

‘over to the following year any unused time and to request payment

instead of time off.° Ex. 8.

g. On March 12, 2020, Mayor Boughton, on behalffof the City, authorized

the following revisions to St. Hilaire's employment agreement", including;

® attached as Exhibit “5” fsa true and accurate copy of the email chain between Mayor Boughton, St. Hilaire and

Andi Gray, dated to December 29, 2011

" attached as Exhioit “6” is @ true and accurate copy of the authorization by Mayor Boughton dated January 14,

2014

* attached as Exhibit “7” isa true and accurate copy of the authorization by Mayor Boughton dated December 12,

2019

» attached as Exhibit “8” isa true and accurate copy of the authorization by Mayor Boughton dated March 12,

2020.

° attached as Exhibit “9” is a true and accurate copy of the Employment Contract revisions agreed to by Mayor

Boughton dated March 12, 2020.

i. increase to $20,000.00 the City's annual contribution on behalf of

St. Hilaire to the City’s deferred compensation plan, retroactive to

July 1, 2017

ii. Increase vacation time to 7 weeks per year.

iii, Credit 125 additional hours of vacation time.

iv. Authorize St. Hilaire to earn up to 160 hours of compensatory time

in each fiscal year, including the ability to carry-over any unused

time to the following year as vacation time, and to request payment

instead of leave. Ex.9.

7. On August 8, 2020, the City provided St. Hilaire an accounting of his 2899 hours

of tracked and accrued paid leave, including;

a

b.

c.

d.

e.

Vacation- 2770,

Sick- 70.

Holiday- 14.

Earned Personal- 14.

Personal- 31. " Ex. 10.

8. December 7, 2021, Mayor Joseph Cavo, on behalf of the City and, in recognition

of the approximately 1,000 hours of St. Hilaire's personal time spent to assist the

Board of Education by fulfilling numerous finance functions including acting as it's

° attached as Exhibit “10” isa true and accurate copy ofthe iseries Accruals, City of Danbury, CT report for St

Hilaire dated August 2, 2020,

temporary Director of Finance, authorized the following revisions to St. Hilaire’s

employment agreement, including;

i, Credit 750 additional hours of vacation time.

ii, Increase from $200 to $350 the City's monthly vehicle allowance.

Ex. 11

9. In fiscal year 2021, St. Hilaire was entitled to and did accrue 1177 hours of paid

time off, including;

a

b.

One time Vacation leave increase - 750 hours, Ex.14

7 weeks- 245 hours annual Vacation time. Ex. 7.

Sick- 70 hours. Ex. 10.

Holiday- 12 days- 84 hours. Ex. 10.

Earned Personal- 28 hours. Ex. 10.

Personal- 28 hours. Ex. 10.

Compensatory time - 200 hours that may be converted to vacation time,

carried over to future years, and paid out. Exs. 8, and 9.

10. On information and belief, based on the City’s business records available to St.

Hilaire as of the date of this complaint, in total, by the end of 2021, St. Hilaire had

accrued over 3790 hours of leave that could be paid out to him upon request.

a

b.

Vacation leave ~ 3520 hours accrued. Exs. 7, 10, and 11

Sick- 70 hours, eligible to be paid out at 50%. Ex. 10.

tached as Exhibit “11” isa true and accurate copy of the Employment Contract revisions agreed to by Mayor

avo dated November 30, 2021, and executed December 7, 2021.

c, Compensatory time - 200 hours that may be converted to vacation time,

carried over to future years, and paid out. Exs. 8, and 9.

14, Pursuant to the Benefits Handbook for Eligible Non-Union Employees dated

June 22, 2017," during 2021, St. Hilaire requested, and Danbury agreed to pay

out approximately 3400 hours of vacation leave that St. Hilaire had accrued. The

payments totaled $351,862.94.

12.On or about June 26, 2022 St. Hilaire was informed that he was suspended with

pay pending a disciplinary investigation.

43.On or about August 1, 2022, the City's attorney informed St. Hilaire’s attorney,

that the City intended to terminate St. Hilaire based on his purported conduct in

violation of City policies," including

a. That, beginning in 2019, St. Hilaire had requested, been awarded, and not

utilized vacation time

b. That in 2021, St. Hilaire had requested, and been paid 3400 hours of

acerued vacation leave, in an amount exceeding $352,000.00.

c. That St. Hilaire had violated City policy by requesting payment for vacation

time that had acerued in the current fiscal year.

4d. That St, Hilaire had violated City policy by accepting an annual car

allowance instead of a marked City car.

262. Pes,

+ attached as Exhibit "12" is a true and accurate copy of the final paycheck issued to St. Hilaire dated December

24, 2021

°5 attached as Exhibit “L3" isa teue and accurate copy of an email from the City’s attorney, Jahanna Zeiman to St

Hilaire's attorney, Lew Chimes dated August 1, 2022.

e. That St. Hilaire had violated City policy by not maintaining residency in

Danbury and by working remotely during the pandemic. Ex. 13.

14. Throughout his tenure as the Director of Finance, St. Hilaire fully and

competently fulfilled the duties and responsibilities of the position as described in

the Charter, including supervising operational, purchasing, risk management, and

budgeting roles for both the City of Danbury and the Board of Education, while

managing long term personnel vacancies. City Budgets and Annual Financial

Reports were prepared timely, while the auditors and reporting agencies

consistently recognized the proper and competent management of the City's

financial functions.

48, St. Hilaire had not breached any material term of the employment agreement

between the City and himself.

16. The City of Danbury breached material terms of the employment agreement

between the City and St. Hilaire by terminating St. Hilaire without just cause,

defined as “gross misconduct” after completion of investigation, notice of

charges, and due process hearing. Ex. 3, page 6.

17. St. Hilaire has been damaged by the Defendant's breach.

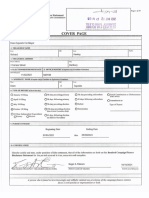

COUNT TWO: BREACH OF CONTRACT;

DAVID ST. HILAIRE RETIREMENT TERM SHEET

4.17. Paragraphs 1. Through 17. are hereby incorporated as paragraphs 1. through 17

of Count Two as if fully set forth herein.

18.After extensive negotiation, the parties entered into a contract entitled "David St.

Hilaire Retirement Term Sheet” executed by Mayor Dean Esposito and St. Hilaire

‘on August 25, 2022 (hereinafter, the “Term Sheet.”) *®

19. The Term Sheet is a written contract binding on both parties once authorized by

the City Council as it was, pursuant to the Charter, on September 7, 2022.

Approved Minutes of the September 7, 2022, City Council meeting report that,

“A motion was made by Councitman DiGilio, seconded by Councilman Levy, to

authorize the resolution of the pending legal matter in accordance with the discussion,

together with the certification of funds provided. 2 No Votes (Rotello, Fox), 16 Yes

Votes, | Abstention (Cavo). The motion carried.

20. St. Hilaire performed his obligations under the Term Sheet by submitting his

resignation to the mayor and City Council on September 7, 2022."®

21.On October 3, 2022, the City breached the material provisions of the Term Sheet

by ‘revoking’ its offer based on its need to investigate a tax lien.”

22.0n information and belief, based on correspondence with counsel, no such

investigation has been completed, nor has the City adopted or reaffirmed its,

obligations under the Term Sheet.

° attached as Exhibit “14” isa true and accurate copy of an agreement entitled "David St. Hilaire Retirement Term

Sheet” executed August 25, 2022

attached as Exhibit "15" is a true and accurate copy of the Approved Minutes of the September 7, 2022, City

Council meeting from the City's website.

* attached as Exhibit "16" is a true and accurate copy of St. Hilair’s Resignation dated September 7, 2022

attached as Exhibit "17" isa true and accurate copy of counset’s email informing St. Hilaire that the City was

“revoking its offer” dated October 3, 2022.

23.81. Hilaire has been damaged in at least the following ways;

a. Loss of employment, wages, and benefits,

b. Loss of the consideration agreed to in the Term Sheet, and

c. Loss of pension benefits.

WHEREFORE, PLAINTIFF CLAIMS A TRIAL BY JURY, JUDGMENT AGAINST

DEFENDANT AND DAMAGES AS FOLLOWS:

On Count One:

1. Money Damages in excess of $15,000.00

2. Such other relief as the court may deem just and equitable.

On Count Two

1. Specific Performance

2. Money Damages in excess of $15,000.00

3. Such other relief as the court may deem just and equitable,

Dated: April 17, 2024

THE PLAINTIFF, DAVID IR

By: /S/ Elisabeth 5 Ma Ah

Elisabeth Seieroe Maurer

Maurer & Associates, PC

PO Box 1098

Ridgefield, CT 06877

Phone: (203) 438-1388

Fax: (203) 446-4119

ElisabethMaurer@maurerandassociatespc.onmicrosoft.com

10

Ly

RETURN DATE: SEL : SUPERIOR COURT

DAVID ST. HILAIRE

vs.

CITY OF DANBURY.

The plaintiff demands:

On Count One:

J.D, OF DANBURY

AT DANBURY

April 17, 2024

DEMAND FOR RELIEF

1. Money Damages in excess of $15,000.00

2. Such other relief as the court may deem just and equitable.

On Count Two

1. Specific Performance

2. Money Damages in excess of $15,000.00

3. Such other relief as the court may deem just and equitable.

Dated: April 17, 2024

THE PLAINTIFE DAVID ST. HILAARE

By: /S/ efocteth soe ae AK

Elisabeth Seieroe Maurer

Maurer & Associates, PC

PO Box 1099

Ridgefield, CT 06877

a

Phone: (203) 438-1388

Fax: (203) 446-4119

ElisabethMaurer@maurerandassociatespc.onmicrosoft.com

12

Exhibit 1

CIry OF DANBURY

OFFICE OF THE MAYOR,

MAKE D. HOLGIELON cz0p 207-15)

MAYOR

June 5, 2007

Mr, David St. Hilaire

29 Ponderosa Boulevard

st Greenbush, NY 12061

Dear David:

J would like to extend my Congratulations on being selected as the new Director of

Finance for the City of Danbury. This letter is to confirm the details of the tentative offer

extended to you during our conversation on Monday June 4, 2007.

As discussed, salary will be $4576.92 biweekly which is an aunual equivalent of

$119,000, ‘This starting salary will be adjusted consistent with compensation ehanges for

all other non-union employees and you will be eligible for an increase on January 1,

2008,

You will be eligible to participate in any 457 deferred compensation plan administered by

the City, ‘The City shall contribute five thousand dollars ($5000) each fiseal year to a

deferred compensation plan administered by the City for your benefit and shall not be

subject to any vesting requirements and shall be portable in accordance with applicable

Jaws andior terms of the plans.

Vacation will be accrued at four weeks per year in accordance with the City of Danbury

Vacation Policy. All vacation time shall be with advance notice and approval. Any

unused vacation time may be carried over to the following fiscal year with approval, You

will also be eligible to carn up to eighty (80) hours of Compensatory Time each calendar

year for each hour worked beyond eight hours per day, Compensatory time must be

taken in the same calendar year that it is eared and unused compensatory time may not

be curried over to the next calendar year

‘Your employment with the City of Danbury will begin on or about July 15, 2007 and will

be contingent upon: your successful completion of the post offer physical examination

and any other applicable testing requirements; successful completion of the background

investigation and refer es; and your ability to establish residence in the

oyun

Danbury not later than six months from the date of your official appointment. Residence

in the City of Danbury must be maintained for the duration of your employment with the

City of Danbury,

Enclosed with this letter is information regarding The City of Danbury Health Insurance

Benefits, Deferred Compensation plans, Pension Benefits, and Policies. Upon your

review of all the information contained in this letter and accompanying packet, please

contact me no later than Thursday June 7, 2007 to inform me of your acceptance

decision

‘The City of Danbury and [ are looking very forward to having you as part of our dynamic

‘as we continue to lead, achieve, and succeed together. Please feel free to contact

me should you have any questions, | ean be reuched at 203-948-4605,

teal

Sincerely,

Mark D. Boetghi)on

Mayor

enclosures

Exhibit 2

Penne

BENEFITS HANDBOOK

FOR

ELIGIBLE NON-UNION

EMPLOYEES

Mark D. Boughifin, Mayor

Revised: June 21, 2017

PURPOSE OF THIS HANDBOOK

‘The City of Danbury issues this Benefits Handbook ("Handbook") to provide a summary of the

City’s benefit plans to the City's non-union employees and certain elected officials, namely, the

Mayer, Town Clerk, Registrars of Voters, and City Treasurer

THOSE COVERED BY THIS HANDBOOK (ELIGIBILITY)

The regular work week for full-time non-union employees shall be 36, 37.5 or 40 hours as

established by job title and assignment.

Non-union employees who work at least 35 hours per week are entitled to all benefits as

specified in this handbook.

Elected officials who work at least 35 hours per week are entitled to all benefits as specified in

this Handbook, namely: the Mayor, Town Clerk, Registrars of Voters, and City Treasurer.

‘+ Benefits for these elected officials shall begin to accrue at 12:00 noon on the first

business day following their respective election to office, or at such time when they

officially take office. With the exception of pension benefits and/or health insurance, if

applicable, such benefits shall terminate when the elected official vacates office, or at

the expiration of their term, Except as provided by state or federal law, such benefits are

offered to elected officials only if they are working their regular work schedule and

performing the job duties of their position as required by the City Charter, state law,

and/or state Constitution, as applicable, and as amended from time to time,

‘The terms "Employees and non-union employees are used interchangeably throughout this

Handbook. References to “Employees” and "Non-Union Employees” throughout this Handbook

include all eligible non-union employees and elected officials named above.

Non-union employees who work at least 30 hours per week are entitled to health, dental, life

and pension benefits, as specified in this Handbook. Other benefits in this Handbook may be

applicable on a prorated basis

2 of 28

Non-Unlon Benefits Handbook, Revised June 23,2017

DISCLAIMER

This Handbook is not intended to create an express or implied contract of employment, nor is it

intended to create an expectation of employment or employment of any duration. Employees

are “at will’ employees, which means that either the employee or the City may terminate

employment at any time for any reason, with or without notice. This Handbook is not intended

to be a complete description of the City's benefits and the City reserves the right to revise,

supplement, suspend or discontinue these plans at any time

Further, no manager, supervisor, or other agent of the City has the authority to make a

commitment of guaranteed or continued employment to an employee, and no City document

including this Handbook should be understood to make any such guarantee. The City does not

recognize any contract of employment unless it is reduced to writing and signed by the

employee and the Mayor.

This Handbook is intended to serve as a summary compiled for the convenience of our

employees and is not intended to cover all topics or circumstances of employment. Moreover, if

the descriptions in this Handbook conflict with the benefit plan documents, the benefit plan

documents will control in all instances.

The City may change, delete, suspend or discontinue any part or parts of this Handbook at any

time. Additionally, the City reserves the right to respond to specific situations in whatever

manner it believes best suits the needs of the City. Consequently, the City’s actions, from time

to time, may vary from the attached policies and procedures, or any subsequent policies and

procedures implemented. Furthermore, the City's actions are guided by federal and/or state

laws, regulations, policies and procedures, as amended from time to time, which are not

contained in this Handbook.

This Handbook supersedes any and all previous oral or written communications, discussions,

and/or agreements between the employees and the City with respect to the terms and

conditions of employment at the City.

‘Should any provision in this Handbook be found to be unenforceable and/or invalid, such finding

does not invalidate the entire Handbook, but only the affected provision(s).

3 of 28

Non-UnionSeneftsHandbock, Revised June 2, 2037

HOLIDAYS.

1, BENEFIT TIME

The following are the official holidays for employees:

New Year's Day independence Day

Martin Luther King Day Labor Day

Washington's Birthday Columbus Day

Lincoln's Birthday Veterans’ Day

Good Friday Thanksgiving Day

Memorial Day Christmas Day

or the day celebrated as such. Any holiday falling on a Sunday shall be observed on the

following Monday, and a holiday falling on a Saturday shall be observed on the preceding

Friday.

VACATION

Vacation leave shall be accrued for continuous service from the date of initial employment,

however employees are not credited with or eligible to use such leave until they have completed

one hundred twenty-five (125) days of work.

1. Vacation shall accrue in the following manner:

When an employee in his/her probationary year completes one hundred and

twenty-five (125) days of work, he/she shali be entitled to one (1) calendar week

of vacation.

When an employee has completed one (1) year of service as determined by

his/her date of hire, the employee shall be entitled to two (2) calendar weeks of

vacation during the fiscal year of the anniversary. If during the fiscal year the

employee is in a non-compensable status for a month or mare, the vacation

period shall be reduced on a pro-rated basis,

In each succeeding year, vacation will accrue on the same basis. In any year in

which the employee is in a non-compensable status for a month or more, the

stipulated vacation periods will be pro-rated. If the employee's first anniversary

date does not coincide with the end of the probation period, the entitlement to the

two week vacation shall be deferred to the completion of probation.

Three (3) calendar weeks after five (5) years continuous service.

Four (4) calendar weeks after ten (10) years of continuous service,

Five (6) calendar weeks after seventeen (17) years of continuous service.

4 of 28

"Non Union Benefits Hanbeok, Revised june 21,2017

g. No vacation leave shall accrue for any period in which an employee is on leave

of absence without pay.

Vacations shall be taken on a fiscal year basis and qualifying time shall be during the

fiscal year. (That is, if six (6) months service is completed during the fiscal year, then

one (1) week may be taken during that period; if one year of service is completed during

the fiscal year, then two (2) weeks may be taken during that period, etc.)

Vacation leave must be applied for by the employee and is subject to approval by the

Department Head and/or appointing authority. (Within each department certain periods

of the year may be withheld as a non-vacation period.)

Should @ holiday occur during the vacation of any employee, that holiday shall be

recorded as a holiday, and not as a vacation day.

Vacation Carryover: Employees hired prior to July 1, 2017 shall be eligible to carry over

vacation days into the next fiscal year.

Approval to use carry over vacation daysitime will be granted if:

a, the carry-over will not adversely effect the efficiency of the department;

b. the carry-over will not in itseif create a need for the hiring of temporary help;

Employees hired on or after July 1, 2017 will only be permitted to carry over a one week

full time equivalent (35, 37.5, or 40 hours) of vacation time into the next fiscal year

(vacation days in excess of a one week equivalent will be forfeited).

During the course of an employee's employment, in lieu of a request for vacation leave,

an employee may request payment for any portion of verifiable carry-over vacation time.

‘Such request shall not include the currant year's vacation accrual and is subject to

approval by the designated authority/Department Head and/or Mayor.

At the time of separation from employment, accrued vacation shall be paid to the

employee, except discharge for cause. if an employee has accrued a vacation balance

at the time of retirement, those vacation hours shail be included in the employees’

calculation for his or her pension,

Pro-rated vacation for employees who terminate their employment (for reasons other

than for cause) before the start of a new vacation period shall be paid on a pro-rated

basis from anniversary of date of employment to date of termination,

SICK LEAVE

Sick leave shall be granted for the illness or injury of the employee as follows:

1

Employees will receive ten (10) sick days per year on July 1. In the first year of service,

an employee will receive a pro-rated amount of sick days based on their start date.

‘An occasional leave for sickness or injury (not job related) shall mean any absence for

such reason of five (5) or less consecutive work days.

5 of 28

‘Non Union Benois Handbook, Revised une 24, 2017

3, Employees who are unable to work due to iliness shall notify their department head or

his/her designee within one (1) hour of their regular starting time,

4, Failure on the part of an employee to notify his/her department head promptly of his/her

absence due to sickness may be cause for denial of sick leave privilege.

5. A physician's certificate or other satisfactory evidence in support of any request for sick

leave with pay covering an absence of five (5) or more consecutive working days will be

required at the discretion of the department head or appointing authority

6. Employees who request pay for fractional portions of sick days shall be charged such

fractional periods of sick leave in half hour (30 minute) Increments.

7. Employees with more than six (6) months of continuous service, shall be paid to a total

of ten (10) occasional days for an absence due to injury or illness in any one fiscal year

upon the approval of the Department Head. Any absence in excess of ten paid days

shall only be paid if approved by the Department Head and Mayor. In the event that an

employee is on a leave of absence without pay or on short-term disability leave more

than one time in a single fiscal year, the occasional days shall be prorated accordingly.

8. Employees with less than six (6) months of continuous service may be paid for such

‘occasional days only when the department head specifically requests such payment and

the Mayor approves. An extended leave of absence for sickness or injury (not job

related) shall mean any absence for such reasons of more than five (5) consecutive

working days

9. The City will pay employees fifty percent (50%) of regular straight time daily wages for

unused sick days at the end of each fiscal year. In the event that an employee is on a

leave of absence without pay or on short-term disability leave more than one time in a

single fiscal year, the payment for the unused sick days shall be prorated accordingly,

Payment will be made before September 30 following the end of the fiscal year.

10. Any extended leave of absence for sickness or injury (not job related) shall mean any

absence for such reasons for more than five (5) consecutive working days.

11. Short Term Disability. For employees with six (6) months of continuous service, the first

five (5) working days of such absence shall be with continuation of normal pay if

approved by the Department Head. Such approval will not be unreasonably denied

After the first five (5) consecutive working days of absence and continuing up to

six (6) months from that date, the employees shall receive sixty-six and two

thirds percent (66 2/3%) of base pay on the normal payroll cycle.

If during a fiscal year an employee is absent on "Short Term Disability" two (2) or

more separate times, he/she shall receive normal pay for the first five (5) days of

the first such extended sick leave if approved by the Department Head, Such

approval will not be unreasonably denied. On any subsequent occasion of Short

Term Disability, the reduced amount of 68 2/3% will be paid from the first day of

absence

12. Long Term Disability. For employees with six (6) months of continuous service, after six

(6) months of absence and up to normal retirement date, the employee shall receive pay

6 of 28

Nom Union Benefits Hondbook, Revised une 21,2017

calculated and paid by the insurance carrier's procedures. The terms and provisions of

the contract of insurance shall govern the employee's eligibility for long-term disability

benefits.

13. Employees who are on injury leave and receiving Workers’ Compensation pay may

request use of unused sick leave days to augment the Workers’ Compensation payment

for full pay.

14. A holiday occurring during approved sick leave, short term disability leave, or worker's

compensation leave shall be recorded as a holiday and not as a day of leave.

JURY SERVICE

‘The City will pay an employee who is called for jury service, for each day of such service, the

difference between the employees' straight time earnings and the amount received for jury

service. In the case of a part-time employee, pay shall be for a maximum of two (2) weeks.

The employee will present proof of service and the amount of pay received. On any day when

the employee is released from jury service before 1:00 p.m. of his/her regularly scheduled

workday, the employee shall report back to work for the balance of the day.

Evening Shift employees shall not have to report to work if jury service lasts more than 4 hours

in any day.

This provision shall not apply where an employee voluntarily seeks jury service.

BEREAVEMENT

Any employee shall be given time off without loss of pay, annual leave or sick leave for the

death of a family member as follows:

1. Inthe event of death of a spouse, child, stepchild, mother, stepmother, father, or

stepfather, up to five (5) working days shall be granted as funeral leave.

Employees eligible for five (5) working days of funeral leave due to the death of a

spouse, child, stepchild, mother, stepmother. father, or stepfather, shall be

entitled to use said funeral leave days within thirty (30) calendar days from the

date of the death.

2. Up to three (3) working days shall be granted in the event of death of a sister,

brother, grandmother, grandfather, grandmother-in-law, grandfather-in-law,

grandchild, mother-in-law, father-in-law, sister-in-law, brother-in-law, daughter

law, son-in-law, or any relative who is domiciled in the employee's home.

3. One (1) working day leave shall be granted for the funeral of first aunts or uncles,

nieces or nephews of the employee or his/her spouse.

CIVIL EMERGENCY AND SPECIAL LEAVE

‘An employee shall be given time off without loss of pay, annual leave or sick leave when:

7 of 28

Nom Union Genefits Handbook, Revised June 23,2017

Court Appearances: Summoned to appear as a witness before a court, grand

jury or other public body or commission.

Emergency Duty: Performing emergency civilian duty in relation to national

defense

Civil Service Examinations: Participating in a City Merit System/Civil Service

examination on a regular work day or taking a required examination pertinent to

employment for the City, at the appropriate location, provided due notice is given

to the department head.

Extreme Situations: Unless otherwise directed, each employee is expected to

report to work on every scheduled work day. If all or part of a scheduled work

day is cancelled by the City due to snow, or in other extreme weather conditions,

the employee will be compensated unless s/he is on vacation, has called in sick

or is on other paid or unpaid leave, in which event the employees will be charged

with one full day of applicable leave or, in the case of unpaid leave, not paid for

the day.

If an employees’ usual assignment or place of work is unavailable (e.g., due to

the closing of a particular office or building), the employees may be given an

alternative assignment and/or work location.

FAMILY MEDICAL LEAVE (FMLA)

The City of Danbury provides leaves of absence for certain family and medical reasons. In

granting and administering such leaves, the City will comply with the Federal Family Medical

Leave Act, FMLA, as amended from time to time. An employee who anticipates FMLA leave

should contact their Department Head and the Human Resources Department to determine if

FMLA may apply to his or her specific circumstance

NON-FMLA LEAVE

1.

For Five Days or Less: A leave of absence not to exceed five (5) consecutive

work days at one time may be granted to any emplayee when requested in

writing and approved by the Department Head and Appointing Authority. The

maximum cumulative periods of such leave shall not exceed thirty (30) working

days in any twelve-month period

For Up To One Year: A leave of absence for causes considered reasonable and

proper by the Appointing Authority and approved in advance by the Department

Head and Human Resources Department, for a period not to exceed one (1) year

may be granted to any employee. Such leave of absence may be granted only to

employee who has completed an initial one year of service.

‘An employee may be required to use any eligible accrued leave time during the

leave of absence.

Leaves of absence shall be terminated if the reasons for which the leaves of

absence were granted no longer exist.

8 of 28

Non-Union Benefits Handbook, Revised June 23,2047

A denial or approval of a leave of absence shall be submitted to the employee in

writing by the Department Head, the Human Resources Department, and/or

Appointing Authority. A written approval for a leave of absence will Include the

following information

a) The position will be held for the employees pending his/her reinstatement,

or

b) The position will not be held for the employees and/or that his/her

reinstatement will depend upon the existence at the termination of the

leave of a suitable vacancy for which he/she is qualified.

If an employee fails to return at the expiration of a leave of absence, he/she shall

be terminated and no re-employment rights granted

PERSONAL DAYS

All employees with six (6) months or more of continuous service (125 days worked with the City

beginning with the date of employment), shall be entitled to two (2) personal days per year.

1

Additional personai days of leave may be eamed by employees for perfect attendance.

Perfect attendance for the purposes of this Article shall mean no time taken for sick

leave, unauthorized leave or authorized leave without pay. The criteria for earning and

using such personal days shall be:

a. Alleligible employees who have perfect attendance as recorded in the City’s

electronic time keeping system for the first thirteen (13) weeks of a fiscal year

shall earn one additional personal day.

b. Thereafter employees shall earn a personal day for each thirteen (13)

consecutive weeks of perfect attendance as defined herein.

¢. Such earned personal days shall be limited to four (4) per fiscal year.

d._ No more than two personal days may be carried over into the next fiscal year.

(One of those carry over days must have been eared in the last quarter of the

fiscal year.

COMPENSATORY TIME

Employees may be eligible for compensatory time when a substantial amount of time in excess

of the hours normally associated with the employee's position is worked, Compensatory time

may be granted and taken only with the approval of the employee's Department Head and/or

the Mayor.

1

Compensatory time will be granted only when the employee works substantially more

hours in a week than would normally be required to complete the employee's

professional responsiblities. Compensatory time is not given for those additional hours

‘often worked such as working through lunch or coming in early/staying late to complete

a meeting or do paperwork.

9 of 28

‘Non-Union Benefits Handbook, Revised une 24,2017

2. Compensatory time is discretionary, and requires express approval by the Department

Head and/or the Mayor. An employee must accurately record the hours worked for

which comp time is eamed and taken.

3. An employee may take compensatory time in the same manner and subject to the same

approval as vacation or personal time. All compensatory time should be taken in the

‘calendar year in which itis earned; it may not be carried over from one year to the next.

4, Employees will be granted or may take up to forty (40) hours of compensatory time in a

calendar year, However, in extenuating circumstances the Mayor may grant more than

40 hours of comp time per calendar year.

5. In no event will compensatory time be Used as the basis for additional compensation

There is no payment for unused compensatory time upon separation from employment

with the City

Il, LONGEVITY PAY

Employees hired prior to July 1, 2017 are eligible for longevity pay according to the following:

1. Full-time employees with more than ten (10) years but less than fifteen (15) years of

service with the City of Danbury will receive a longevity increment of three hundred fifty-

five ($355) dollars per year.

2. Fulltime employees with more than fiteen (15) years but less than twenty (20) years of

service with the City of Danbury will receive a longevity increment of four hundred fifty-

five ($455) dollars per year.

3. Full-time employees with twenty (20) years or more years of service with the City of

Danbury will receive a longevity increment of five hundred fifty-five ($555) dollars per

year.

4. Payment shall be made on the first payday of December.

Employees hired on or after July 1, 2017 are not eligible for longevity pay.

lll, HEALTH AND LIFE INSURANCE

Employees may only enroll in the City’s health plans within the first thirty (30) days of his/her

hire date or within thirty (30) days of a qualifying event (change of life status). Any other

enrollments or change to an employee's coverage can only be made once per fiscal year during

the City's open enrollment period.

HEALTH INSURANCE

4. Employees hired or who became eligible for benefits before March 1, 2004 shall have

the option to enroll in one of the following medical plans for the employee and his or her

eligible dependents:

‘a. Open Access Plan (AP) - 4. A summary of the major provisions of the plan is

attached hereto as Appendix A-t

10 of 28

Non-Uniongenetts Handbook, Revised June 23,2087

b. OAP-3 Plan. A summary of the major provisions of the pian is attached hereto as

Appendix A-2,

cc. High Deductible Health Plan (HOHP). A summary of the major provisions of the plan

is attached hereto as Appendix A-3.

2. Employees hired or who became eligible on or after March 1, 2004 shall be enrolled in

‘an OAP-3 (Appendix A-2) or a High Deductible Health Plan (HDHP) (Appendix A-3)

3. Employees hired or who become eligible for benefits on or after October 1, 2009 shall be

enrolled a High Deductible Health Plan (HDHP) with a Health Savings Account (HSA).

4. Employees enrolled in one of the following medical plans shall contribute the indicated

percentage of the cost of their medical and dental insurance through payroll deductions

as follows’

OAP-1: Twelve Percent (12%)

OAP-2: Twelve Percent (12%)

OAP-3: Six Percent (6%)

HDHP: Eight Percent (8%)

5. Prescription drug benefits will be administered in accordance with the provisions of their

respective health plans; however, those prescription drug benefits may be administered

by a different carrier.

6. Employees may enroll in a Flexible Spending Account or Limited Purpose Flexible

‘Spending Account, as applicable, in accordance with IRS regulations,

7. All cost sharing by an employee shall be in accordance with the IRS Section 125 Plan

DENTAL INSURANCE

The City shall pay for a dental plan for employees and their eligible dependents as follows:

Annual deductible: $50 per individual

$150 per family

Waived for preventive

Co-insurance: 100% preventive

80% routine

50% major

Maximum $1000 per calendar year per individual

{82000 per calendar year per individual, effective July 1, 2017)

Orthodontic treatment: $1000 lifetime per person.

Each employee shall pay six percent (6%) of the cost of dental coverage by payroll deduction.

LIFE INSURANCE

11 of 28

'Non-Union Benefits Handbook, Revised une 23,2017

The City will provide the following life insurance benefits to employees who die while employed

full-time by the City. The City shall insure the life of each full-time employee for the amounts

outlined below:

Years of Service ‘Amount of Coverage

Less than 5 7.5 x annual salary

More than 5 but less than 10 2.0 x annual salary

More than 10 but less than 15 2.5 x annual salary

More than 15 but less than 20 3.0.x annual salary

20+ 3.5 x annual salary

Upon the effective date of a salary increase, the employee's life insurance shall be adjusted to

reflect the base salary in effect on that date.

Taxability of Life Insurance shall be in accordance with IRS regulations.

DEPENDENT CARE ACCOUNT

Employees shall have the option to enroll and contribute to a dependent care account (DCAP)

through payroll deduction,

12 of 28

‘Non-Union Benefits Handboak, Revised June 23,2017

RETIREE HEALTH BENEFITS

2191849 as: uauno ove squapuadep /asnods aun! squepuedap/esnods ayn 20) afe1on09 jenypaus sures ays anu gU0d ye AD a

“syjouiag yyeay aaia1.oj 2148x9100 are Z102 “Thuan 4p 40 Uo pam 9504

aveys soo winyuand 24 yo 9657 Ad ZT “TAtenuey =20}3q PUR Gog? TJ9GORO sBYE 20 Uo PIHY SJEDIYO PAD2|2/SOHAOKIUE xe

osvadea

mo 19430 14 2 un}g wowayddns _amopiaymopyesnods| _s2mopinopin/asnods|

aropensAneuuijaue aun Aq pauuewereg 9] ai Aapouewew 2 99

Aew asnods ay) “gpueysued

‘sseoypay sepun afeseno> ueruteu

_esan09 222,99 | aevano: axrip9y\

ins {49 suapuadep| asnods aun Aq

j2/samopuw opin) asnods| 210.919 yasenipawy y! asuado umo sou/sey 2810409)

equopuniued] re aBearonaierpeyyyemauiaiddassAip ain} omSua aveompayy|

Loy 2161812 24 14 swwepuadep apaiija pur asnods| wapuadag/asnods,

yoy

afc op soxpens o/s

mo s9y/51y 3 au

‘upnp aBevanco ppue asnods sBe10n09,

jaa fous asnods s,aaig91 ay{} 30380030 44 KOOL Keg M19] 40150010 4 ROOT SHE AAD] —_urewRUs Mew siuapuadap 2jqiija pue asnods| wapuedaq/asnods|

i ‘Heeranas Tao Tie) ‘eranca ary Mee

‘a8eanco] _jo.nai ui sfesan00 tuswjddns| ul afexanoo wewa dng!

‘Besano0 sayio hue jo na

uy aBexenc> suawajdcns axerpay 50 ,, 5007 Shed]

fa ‘pourerurew j/-88 y arenpay sapun aBer9%09

urmuewsasnus aauna ‘aigi]2 axeopan 22v9|

ywawardéns aeipou —aieip2~ 0 «, wonT shed A

“paueruew "28 y SIP

spun aeson0>4

urpaowsaqisnwaainesaqi)| sone safe epan 240

Aang ia svete ayy yo 98 xp

aflesancs) si2omas ata yrunauawAojdua 2) ayy nun auauroyd|

uejdavawayééns axeipau| yo Aep se) ay uopey a2:n912Ip)_ Jo hep 3s 1p Uo ey aaa a9 j aeapay yo oe aya s aa2s au

247303809 84 Jo 4, SOOT 970] 042 [fL¥9pBuIpNpxs)aBeranes| KA (jPIUEP BuIpNPxe)eBesenas) _ynun yaULKOywa yo Ap Ze] ayn UO pey 92120

UADAW.A TV eEpaYY| [eNpew aus aL ojumerd] —o~pawlawes a ojumuard| aya seus jeWUeP BuIpn|oxe)aBesar2a apa |

Uuypayowaaqisnu 2amna 241} 461509)0 4, HOOT AEA AID] —__403900J0 4, OT Shed AuD| awes aio} unwiasd 0rS0>}0 4, ROOT Keg AD] aesonoy e=IReu|

SaRIBg NaHS eg ay “UNAS FORMAN eT ty BUY | SINE JO aRaN 90 GE MAY aayses jo aeak OT 5 oY |

Non-Union Genet Handbook Revised Sune 23,2017

13 of 28

TERM LIFE INSURANCE FOR RETIREES

Any employee who receives a pension immediately upon retiring, shall be entitled to paid term

life insurance coverage according to the following schedule:

Years of Service Face Value of Policy

Aminimum of 5 years and $2,500.00

less than 10 years

Aminimum of 10 years and $5,000.00

less than 15 years

A minimum of 15 years and $7,600.00

less than 20 years

20 years or more $10,000.00

CHANGE OF CARRIERS

The City shall have the right to change health insurance carriers or to self-insure.

COST SHARE PREMIUMS DURING LEAVE OF ABSENCE

‘An employee who is on leave of absence without pay for more than one month will be required

to pay health insurance premiums for the duration of such leave. An employee who is on a

leave of absence without pay must submit payment to the City for his/her health insurance

premium cost share amount that would have otherwise been paid through payroll deductions.

HEALTH CARE COST CONTAINMENT

The City reserves the right to establish health care cost containment measures in addition to

those which are presently part of its medical and dental benefit plans. Such measures may

include, but shall not be limited to:

1 prior authorization for non-emergency of elective hospitalization, surgical

procedure or extended hospital stay;

2. notification requirements for emergency treatment;

3. __pre- and post-admission or treatment utilization review;

4, limitations on diagnostic testing

5, __ limitations on treatment for nervous and mental disorders, and for substance

abuse, which may include but shall not be limited to required use of preferred

providers;

14 of 28

"Non-UnionfenefitsHondbook, Revised Sune 21,2017

a managed prescription drug program which combines a retail network with a

mail order program;

reasonable penalties for non-compliance with any cost containment measures

adopted,

IV. PENSION PLAN

Employees participate in the City's General Employees’ Pension Plan (GEPP) or Defined

Contribution (DC) Retirement Plan. These plans are codified in the City's Code of Ordinances,

Chapter 14, Please consult Chapter 14 for specific information on these Plans.

Pension contributions are governed by the GEPP Plan or the City's DC Plan Document.

1

Employees hired on or after July 1, 2017 will have the option to elect to

participate in the GEPP or the DC Pian within sixty (60) days of hire, If an

‘employes hired on or after July 1, 2017 does not elect either Plan, s/he will

participate in the City's GEPP.

Employees will have the option to transfer their accrued pension benefit in the

City's GEPP to the City’s DC Plan, or if they meet certain age requirements,

employees may transfer their accrued benefit in the City’s GEPP plan to a non

City qualified pian.

15 of 28

Non-inlon Benefits Hendbook, Kevised ane 71,2017

APPENDIX Act

Summary OAP-1 Plan Design for City of Danbury Employees

General Provisions

In Network

Out of Network

Eligibility Insured, spouse and

| dependents to age 26.

Insured, spouse and

dependents to age 26.

Non-compliance Penalties

3500 per event

‘3500 per event.

Co-payments

$ 0 hospital admission

$ 0 outpatient surgical

$ 10 office visit (no maximum)

$25 emergency room

Subject to deductible and co-

insurance.

Deductible Generally not applicable to in-

network usage,

$250 per individual

$500 for two-person coverage

$750 per family

Coinsurance Generally not applicable to in-

network services.

‘Maximum out-of pocket | Sum of all co-payments and

deductibles and

noncompliance penalties do

not apply towards out-out-of-

pocket expenses

80%/20% to maximum out-of

pocket of.

$ 750 for individual

$1,500 for two-person

coverage

$2,250 for a family

‘Sum of all co-payments and

deductibles. Noncompliance

penalties do not apply towards

‘out-of pocket expenses

“Payment Basis

billing,

Negotiated fees; no balance

‘90th percentile of reasonable

fee.

Tapatient Hospital Services

Semi private room (medically | Covered in full subject to

necessary private room), preadmission notification,

physicians and surgeons concurrent review and

charges, maternity charges for | managed care non-

mother and child, diagnostic | compliance penalties.

and laboratory fees, physical

therapy, occupational therapy,

drugs, operating room fees, | Medical excellence program

dialysis, et. on an optional basis.

16 of 28

Covered at 80 percent of |

reasonable fee above

deductible to out-of-pocket

maximum, then at 100% of

reasonable fee for up to 30

days, Subject to pre-

admission notification,

concurrent review and

managed care non-

compliance penalties,

‘Non-Union enetitsWandbook, Revised June 21, 2017,

General Provisions.

In Network

Out of Network

‘Outpatient Hospital

Services

‘Operating and recovery room,

surgeons fees, lab and x-ray,

Dialysis, radiation and

chemotherapy, ete

Covered in full subject to

concurrent review and

managed care non-

compliance penalties

Covered at 80 percent of

reasonable fee above

deductible to out-of-pocket

maximum, then at 100% of

reasonable fee. Subject to

concurrent review and

managed care non-

compliance penalties.

Inpatient Mental Health

Services

Inpatient Substance Abuse

Services

Covered in full, subject to pre-

admission notification,

concurrent review and

managed care non-

compliance penalties.

Covered in full, subject to pre

admission notification,

concurrent review and

managed care non-

compliance penalties

Covered at 80 percent of

reasonable and customary

above deductible to out-of-

pocket maximum. Subject to

pre-admission notification,

concurrent review and

managed care non-

compliance penalties. Does

not accumulate toward out-of-

pocket maximum,

Covered at 80 percent of

reasonable and customary

above deductible to out-of-

pocket, Subject to pre-

admission notification,

concurrent review and

managed care non-

compliance penalties. Does

not accumulate toward out-of-

pocket maximum

Outpatient Mental Health

and Substance Abuse

Physici

Medical Care

(clinical indications of illness)

Covered in full after $10

copay.

Covered in full above $10

copay. No annual or lifetime

maximum.

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum. Payments

do not apply to out-of-pocket

maximum.

Covered at 80 percent of

reasonable fee above

deductible to out-of-pocket

maximum then at 100% of

reasonable fee. No annual or

lifetime maximum,

17 of 28

Non Union Benefits Handbook, Revised une 21,2017

=e

General Provisions

In Network

Out of Network

Allergy Care

| Well Child Care

| (no clinical indications or

history)

Adult Physical

Examinations

(no clinical indications or

history)

(includes Hearing Soreening)

Covered in full $10 copay for

examination. No copay for

injections. No annual or

lifetime maximum. Subject to

case management,

Covered in full no copay.

Subject to age based

schedule: To six months,

cance per month; then to one

year every two months; then

to two years every three

months; then to three years

every six months; then once

per year to age 21

Covered in full no copay

‘Subject to age based

schedule: Every three years

to age 30, then every two

years to age 60, then every

year

Covered at 80 percent of

reasonable fee above

deductible to out-of pocket

maximum then at 100% of

reasonable fee. Injections at

80 percent of reasonable fee

above deductible to out-of-

pocket maximum, then at

100% of reasonable fee. No

annual or lifetime maximum.

Subject to case management

Covered at 80% of reasonable

fee above deductible to out-of

pocket maximum. Subject to

age based schedule: : To six

months, once per month; then

to one year every two months;

then to two years every three

months, then to three years

every six months; then once

per year to age 21

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum. Subject to

age based schedule: Every

three years to age 30, then

every two years to age 50,

then every year.

Routine Mammography

{no clinical indication or

history)

Vision Screening

Covered in full no copay

Subject to age based

schedule: ‘ baseline

screening between age 35

and 38; 1 screening per

calendar year from age 40.

Covered in full. Limited to one

per year.

Covered at 80% of reasonabie

fee above deductible to out-of-

pocket maximum. Subject to

age based schedule: 1

baseline screening between

age 35 and 39; 1 screening

per calendar year from age

40.

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum, Limited to

‘one per year.

Routine Gynecological

(no clinical indication or

history)

Coverad in full no copay.

Limited to one examination

per year.

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum, Limited to

‘one examination per year

Maternity Care

(Prenatal and Postnatal)

L 7:

copay.

“Covered in full after $10

18 of 28

Covered at 80% of reasonable

fee above deductible to out-of-

_| pocket maximums.

[Non-Uniondenefts Handbeok, Revised une 2, 2087

General Provisions In Network.

Out of Network

Emergency Care

Emergency Room Visits

Urgent Care

Walk-in Care

(walk in center or physician's

office)

Emergency room visits

covered in full above $26.

‘The $25 copay is waived if the

individual is admitted.

Covered subject to $25 copay

for medically necessary care.

Covered in full above $10

copay.

Emergency room visits

covered in full above $25.

The $25 copay is waived if the

individual is admitted,

Covered subject to $25 copay

for medically necessary care.

Covered at reasonable fee

above $10 co-pay if sudden

and serious. Otherwise

treated as an out-of-network

usage, Subject to deductible

and coinsurance.

Ambulance —

Coverage on an unlimited

basis for land or air. Non-

‘emergency use subject to

case management

Coverage on an unlimited

basis for land or air. Non-

emergency use subject to

case management

‘Outpatient Therapy

Coverage

Speech Therapy,

Occupational Therapy,

Physical Therapy and

Chiropractic Services

Electroshock Therapy

Covered in full no copay.

Maximum of 50 combined

visits per year. After

maximum, benefits are

available on out of network

basis. Subject to case

management after ten visits.

Covered above $35 copay for

up to 15 visits per year.

Subject to case management

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum. Maximum

of 50 combined visits per

year. Subject to case

management after ten visits.

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum for up to 15

visits per year. Subject to

case management.

Home Health and Hospice

Home Health Aid

Covered in full for up to 80,

days per year subject to a

combined 20-day maximum

for home health, nursing and

therapeutic services; subject

to case management.

19 of 28

Covered at 80% of reasonable

fee above deductible to out-of-

| pocket maximum for up to 80

| days per year subject to a

| combined 200-day maximum

| for home health, nursing and

therapeutic services, subject

to case management.

Non-Union tells Handbook, Hevses June 21,2017

—

for home health, nursing and

therapeutic services; subject

to case management

Hospice Care Covered in full for up to last

six months of life, subject to

case management.

General Provisions In Network Out of Network

Nursing and Therapeutic Covered in full for up to a ‘Covered at 80% of reasonable

Services combined 200-day maximum | fee above deductible to out-of-

pocket maximum for up to

combined 200 days per year

for home health, nursing and

therapeutic services, subject

to case management.

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum, for up to six

months, subject to case

management.

Skilled Nursing Facility Covered in full for up to 120

days; subject to case

management.

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum, for up to

120 days per year, subject to

case management.

| Durable Medical Equipment | Covered in full subject to case

Covered at 80% of reasonable

| $200 for frames and lenses.

and Prosthesis | management and ouy-lease fee above deductible to out-of-

decision. pocket maximum, subject to

| case management and buy-

| lease decision.

Vision Rider ~~ | Standard allowance up to ‘Standard allowances upto

$200 for frames and lenses.

Prescription Drug Benefits | Covered subject to copays of

$5 for generic, $10 for brand

name drugs. $3.00 for mail

order.

Unlimited maximum.

Covered at 80% of reasonable

fee above deductible to out-of-

pocket maximum,

The above chart is a summary of the highlights of this plan. A complete list of both covered and

non-covered services can be found in the Summary Plan Description which is the official plan

documents. If there are any differences between this summary and the official plan documents,

the information in the Plan Documents take precedence.

20 of 28

on-Unlon Benefit Handbook, Revised une 24,2017,

APPENDIX A-2

SUMMARY OAP3 PLAN DESIGN FOR CITY OF DANBURY EMPLOYEES

General Provisions In Network Out of Network

Calendar Year Deductible None Employee: $5,000

Employee & Family: $10,000

Calendar Year Out Of Packet | Unlimitied Employee: $15,000

Maximum Employee & Family: $30,000

Preventative Care T — OO

Pediatric Paid at 100%

After deductible is met, you

Adult Paid at 100% | pay 50% and Plan pays 50%

| of reasonable fees

Vision Paid at 100%

Hearing Screening

Gynecological

Routine Mammography

Medical Services

Medical Office Visit

Allergy Services

Diagnostic Labs & X-ray

Inpatient Medical Services

Surgery Fees -

‘One exam every 24 months

Screening as part of physical

exam

Paid at 100%

‘One exam every calendar

year

Covered

Covered according to age-

based schedule

1 baseline screening between

age 35 and 39;

4 soreening per calendar year

J frome 40 a

$15 Copay

$15 Copay for office visits and | After deductible is met, you

testing pay 50% and Plan pays 50%

$0 Copay for injections, of reasonable fees

covered 60 visits in 2 years |

|

Covered

Covered

_| Covered

1

21 of 28

‘Nom Union denefts Hondbook, Revised une 21,2037

General Provisions

Office Surgery

In Network Out of Network

Outpatient MH/SA

Emergency Care

Emergency Room

Urgent Care

Ambulance

(non-emergency transportation

is not covered al

inpatient Hospital

General/Medical/Surgical/

Maternity (semi-private)

Ancillary Services,

Medication, Supplies

Psychiatric

Substance Abuse

Rehabilitative

Skilled Nursing Facility

$50 Copay (waived if

admitted)

$15 Copay

Covered

Covered

Covered

Covered

Covered

Covered up to 90 days per

calendar year

Covered up to 90 days per

calendar year

Covered After deductible is met, you

pay 50% and Pian pays 50%

- ___| of reasonable fees

$15 Copay After deductible is met, you

pay 50% and Plan pays 50%

of reasonable fees

$50 Copay (waived if

admitted)

$15 Copay

Covered

After deductible is met, you

pay 50% and Plan pays 50%

of reasonable fees

Hospice Covered

Outpatient Hospital 7 ~ a

Outpatient Surgery Covered

Facility charge

Diagnostic Lab & X-ray

Covered; X-ray subject to $15

Copay when performed in a

hospital as a standalone

procedure

22 of 28

After deductible is met, you

pay 50% and Plan pays 50%

of reasonable fees

Non-Union Benefits Hondbook, Revised une 21,2017

Pre-Admission Testing — Covered

Durable Medical Equipment | Covered After deductible is met, you

| pay 50% and Plan pays 60%

of reasonable fees

Prosthetics Covered

Vision Rider ~~) Standard allowance up to | Standard allowances up to

$200 for frames and lenses, | $200 for frames and lenses

\

ion Drug Benefits Covered subject to copays of | Not covered

$10 for generic, $25 for listed

brand name, and $35 for non-

listed brand name for a 30 day

supply, Twice the applicable

copay for a 90 day supply by

mail order when available.

Unlimited maximum,

The above chart is a summary of the highlights of this plan. A complete list of both covered and

non-covered services can be found in the Summary Plan Description which is the official plan

documents. If there are any differences between this summary and the official plan documents,

the information in the Plan Documents take precedence.

23 of 28

‘Non-Union Reefs Hanebaok, Revised une 21,2087

APPENDIX A-3

SUMMARY HDHP PLAN DESIGN FOR CITY OF DANBURY EMPLOYEES

Effective July 1, 2012

Eligibility

HDHP Plan i HDUP Plan,

In Network ‘Out of Network

‘All employees except those

excluded by federal law

Eligible employees, spouse | Eligible employees, spouse

and dependents to age 26 | and dependents to age 26

TDHP Plan ADAP Plan

General Provisions In Network Member | Qut of Network Member

Pays Pays

Non-compliance Penalties | $500 per event $500 per event

‘All inpatient admissions | All inpatient admissions

and outpatient hospital | and outpatient hospital

services are subject to _| services are subject to

preadmission/ | pteadmission/

recertification | precertification

notification, concurrent _| notification, concurrent

review and managed care | review and managed cate

non-compliance penal non-compliance per

‘Co-payments| ‘Not applicable Not applicable

Deductible 31,500 per individual per — | $1,500 per individual per

plan year plan year

3,000 per family per plan | $3,000 per family per plan

year year

(Combined in network and | (Combined in network and

- out of network) out of network)

rance 0% after deductible 20% after deductible

(Plan pays 100% after (80% by Plan and 20% by

deductible) _ member) of reasonable fees |

Maximum out-of-pocket | $1,500 for individual per | $3,000 for individual per

plan year plan year

$3,000 for family per plan | $6,000 for family per plan

year year

(Combined in network and | (Combined in network and

| _ out of network) out of network) |

Payment Basis, ‘Negotiated fees; no balance | 300% of MRC

__| billing _

Plan Year July 1 = Tune 30 —__Liuly 1 Sune 30

24 of 28

‘Non-Union Benefits Handbook, Revised June 21, 2017

DHP Plan HDHP Plan

‘General Provisions In Network Member — | Out of Network Member

Pays ‘Pays

Inpatient Hospital ~

Services

Semi private room 0% after deductible 20% (Plan pays 80% of

(inedically necessary (Plan pays 100% after reasonable fee after