Professional Documents

Culture Documents

Finance Management Consolidated MCQs

Finance Management Consolidated MCQs

Uploaded by

Vikesh MojeedraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Management Consolidated MCQs

Finance Management Consolidated MCQs

Uploaded by

Vikesh MojeedraCopyright:

Available Formats

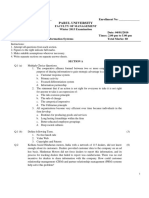

Finance Management Consolidated Question Paper of previous 6 years (MCQ)

Multiple Choice Question (MCQ)

1. If the interest rate is 12% , what is the doubling period as per rule 72? 3 Times

a. 7 years b. 6.3 years

c. 6 years d. 7.3 years

2. A(n)_______would be an example of a principal, while a(n) _______would be an example of an agent.

a. Shareholder, Manager b. Manager, owner

c. Accountant, Bond holder d. Shareholder, Bondholder

3. Ignoring the time value of money is the one of the limitation of__________

a. Profit Maximization

b. Wealth Maximization

c. Maximization of capital

d. Maximization of value of share

4. In _______________ approach, the capital structure decision is relevant to the valuation of the firm.

a. Net Income b. Net operating Income

c. Modigliani and Miller d. All of the above

5. Minimum Stock Levels is calculated as:

a. Re-order Level – (Average Usage x Average Lead Time)

b. Re-order Level + (Average Usage + Average Lead Time)

c. Re-order Level – (Average Usage + Average Lead Time)

d. None of the above

6. In Walter model formula, D stands for

a. Dividend per share b. Direct Dividend

c. Dividend Earning d. None of these

7. Finance Function comprises

a) Safe custody of funds only

b) Expenditure of funds only

c) Procurement of finance only

d) Procurement & effective use of funds

8. A project costs Rs.18,000. The estimated annual cash inflows during its 3 year life are Rs.8,000, Rs.7,000 and

Rs.6,000 respectively. What will be the pay-back period?

a) 2 years

b) 2.5 years

c) 3 years

d) 4 years

9. Criterion for accounting rate of return.....

a) Accept ARR>target rate

b) Accept ARR< target rate

c) Accept ARR=target rate

d) None of the above.

10. A critical assumption of the net operating income (NOI) approach to valuation is:

a) that debt and equity levels remain unchanged.

b) that dividends increase at a constant rate.

c) that ko remains constant regardless of changes in leverage.

d) that interest expense and taxes are included in the calculation.

11. To financial analyst, Net working capital means ___________.

a) Fixed Assets

b) Current Assets

c) Total Assetss

d) Current Assets – Current Liabilities

12. Higher operating leverage is related to the use of additional ___________.

a) Fixed cost

b) Variable cost

c) Debt financing

d) Common equity Financing

13. The private sector companies also issue bonds, which are called _____________ in India.

a) Debenture c) Capita

b) Equity Share d) Preference Share

14. _____is the number of years required to recover the original cash outlay invested in a project

a) Payback c) ARR

b) Profitability Index d) IRR

15. Zero Interest bond is also known as

a) Deep Discount bond c) Pure Discount Bond

b) Zero Coupon Bond d) All of the above

16. For calculating annuity which of the following table is considered

a) Table C c) Table B

b) Table D d) Option (C) & (B) both

17. In January 1992 __________ bank issued Zero Interest Bond for first time in India

a) SBI c) CBI

b) ICICI d) IDBI

18. If the nominal rate of interest is 10% per annum and there is quarterly compounding, the effective rate of

interest will be:

a) 10% per annum c) 10.25% per annum

b) 10.10% per annum d) 10.38% per annum

19.The only feasible purpose of financial management is

a) Wealth Maximization c) Profit Maximization

b) Sales Maximization d) Assets maximization

20. Financial management process deals with

a) Investments c) Both a and b

b) Financing decisions d) None of the above

21. The maximum amount with which the company is registered is called:

a) Authorized Share Capital c) Paid up capital

b) Issued Share Capital d) Called up capital

22. Which of the following is not an inventory?

a) Machines c) Finished products

b) Raw material d) Consumable tools

23. Valuation of bonds requires familiarity with which of the following term(s):

a) Par Value c) Coupon rate and Interest

b) Maturity Period d) All of these

24. An Insurance linked Fund requires a single investment of Rs. 10,000 today at a compound interest rate of 9%. The

lock-in period is 20 years for this Fund. What will be the future value of this investment after 20 years?

a) Rs. 59,066 c) Rs. 46,044

b) Rs. 49,066 d) Rs. 56,044

25. Which of the following is not a cash outflow for a firm?

a) Dividends c) Tax Payment

b) Interest Expense d) Depreciation

26. The difference between current assets and current liabilities is called:

a) Working Capital c) Operating Cycle

b) Gross working Capital d) Net Working capital

27. Which one of the following is/are an assumption(s) underlying the Modigliani and Miller Position analysis?

a) Perfect Capital market c) Equivalent Risk Classes

b) Rational Investors and Managers d) All of these.

28. Return on Investment may be improved by:

a) Increasing Turnover c) Increasing Capital Utilization

b) Reducing Expenses d) All of the above

29. Which of the following helps analysing return to equity Shareholders?

a) Return on Assets c) Net Profit Ratio

b) Earnings Per Share d) Return on Investment

30. Which of the following is not an inventory? 3 Time

a) Machines c) Finished products

b) Raw material d) Consumable tools

31. The following classes of costs are usually involved in inventory decisions except

a) Cost of ordering c) Cost of shortages

b) Carrying cost d) Machining cost

32. In calculating earning per share (EPS), the net profit is divided by which of the following?

a) Number of ordinary shares c) Paid up capital

b) Number of preference shares d) Authorized capital

31. The change in profit due to the change in sales is referred to as ,

a) Financial leverage b) Operating leverage

c) Profit planning d) Dividend-payout ratio

32. The par value states ,

a) The issued share capital b) The authorized share capital

c) The paid-up share capital d) The subscribed share capital

33. Dividend per share as a percentage of earnings per share is,

a) Dividend yield b) Payout ratio

c) Retention ratio d) Capital gains

34. One of the ways of mitigating agency costs is,

a) By giving ownership rights to managers

b) By creating satisfactory wealth for shareholders than maximum

c) By avoid taking high investment and financing risks

d) By giving higher perks to managers

36. An individual’s time preference for money can be attributed to –

a) Preference for future consumption

b) Delayed investment opportunity

c) Certainty

d) Risk

37. Replacement investment decisions are also called as –

a) Contingent investments

b) Cost – reduction investments

c) Mutually exclusive investments

d) Revenue –expansion investments

38. One of the ways of mitigating agency costs is,

a) By giving ownership rights to managers

b) By creating satisfactory wealth for shareholders than maximum

c) By avoid taking high investment and financing risks

d) By giving higher perks to managers

39. An individual’s time preference for money can be attributed to –

a) Preference for future consumption

b) Delayed investment opportunity

c) Certainty

d) Risk

40. Replacement investment decisions are also called as –

a) Contingent investments

b) Cost – reduction investments

c) Mutually exclusive investments

d) Revenue –expansion investments

41. The change in profit due to the change in sales is referred to as ,

a) Financial leverage

b) Operating leverage

c) Profit planning

d) Dividend-payout ratio

42. The par value states ,

a) The issued share capital

b) The authorized share capital

c) The paid-up share capital

d) The subscribed share capital

43. Dividend per share as a percentage of earnings per share is,

a) Dividend yield

b) Payout ratio

c) Retention ratio

d) Capital gains

44. The change in profit due to the change in sales is referred to as ,

a) Financial leverage

b) Operating leverage

c) Profit planning

d) Dividend-payout ratio

45. The par value states ,

a) The issued share capital

b) The authorized share capital

c) The paid-up share capital

d) The subscribed share capital

46. Dividend per share as a percentage of earnings per share is,

a) Dividend yield

b) Payout ratio

c) Retention ratio

d) Capital gains

47. Retained earnings per share as a percentage of earning per share is

a) Dividend Pay Out Ratio b) Retention Ratio

c) Capital Gain d) Dividend Yield

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- 2021 Mocks Instructions For Students: Download The Zip FileDocument23 pages2021 Mocks Instructions For Students: Download The Zip FileAnna SokolovaNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Selecting Stocks Presentation - MR - Kutumba - Rao's - Webinar - 28th - Feb - 2021 - PresentationDocument35 pagesSelecting Stocks Presentation - MR - Kutumba - Rao's - Webinar - 28th - Feb - 2021 - Presentationramakrishnaprasad908100% (1)

- FM MCQsDocument58 pagesFM MCQsPervaiz ShahidNo ratings yet

- MCQ of Corporate Finance PDFDocument11 pagesMCQ of Corporate Finance PDFsinghsanjNo ratings yet

- MCQ-Financial AccountingDocument13 pagesMCQ-Financial AccountingArchana100% (1)

- FSAI EXAM2 Solutions Fraser 10thDocument14 pagesFSAI EXAM2 Solutions Fraser 10thGlaiza Dalayoan Flores0% (1)

- FM McqsDocument43 pagesFM Mcqssuryakanta garnaik100% (4)

- Stock Valuation SolutionsDocument6 pagesStock Valuation SolutionsShubham Aggarwal100% (2)

- Finance 16UCF519-FINANCIAL-MANAGEMENTDocument23 pagesFinance 16UCF519-FINANCIAL-MANAGEMENTHuzaifa Aman AzizNo ratings yet

- Sub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceDocument12 pagesSub: Stretegic Financial Managment (Semvi) Class: Tybms Paper: Model Questions FinanceNetflix ChillNo ratings yet

- ACF End Term 2015Document8 pagesACF End Term 2015SharmaNo ratings yet

- CF MCQ ShareDocument17 pagesCF MCQ ShareMadhav RajbanshiNo ratings yet

- Corporate Finance MCQDocument35 pagesCorporate Finance MCQRohan RoyNo ratings yet

- Mba Ii Sem - FM - QBDocument29 pagesMba Ii Sem - FM - QBMona GhunageNo ratings yet

- MCQ of Corporate Valuation Mergers AcquisitionsDocument19 pagesMCQ of Corporate Valuation Mergers AcquisitionsNuman AliNo ratings yet

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Document27 pagesQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurNo ratings yet

- Financial Management Credit OfficerDocument11 pagesFinancial Management Credit OfficerMonika ChhatwaniNo ratings yet

- Financial ManagementDocument20 pagesFinancial ManagementMilind DesaiNo ratings yet

- MCQ PDFDocument23 pagesMCQ PDFAnandita Sharma0% (1)

- FINC521Document10 pagesFINC521All rounder NitinNo ratings yet

- CAIIB Bank Financial Management - Questions and AnswersDocument15 pagesCAIIB Bank Financial Management - Questions and Answerssuperman1293No ratings yet

- Mca - 204 - FM & CFDocument28 pagesMca - 204 - FM & CFjaitripathi26No ratings yet

- Financial Management - SmuDocument0 pagesFinancial Management - SmusirajrNo ratings yet

- 5678Document8 pages5678Prathmesh KadamNo ratings yet

- MCQ-on-FM WITH SOLDocument28 pagesMCQ-on-FM WITH SOLarmansafi761100% (1)

- Mcom Sem IV FM MCQ For Collage Web1Document4 pagesMcom Sem IV FM MCQ For Collage Web1Avi DVNo ratings yet

- MCQ On FMDocument28 pagesMCQ On FMSachin Tikale100% (1)

- MCQs of Financial ManagementDocument21 pagesMCQs of Financial Managementettappan10No ratings yet

- Corporate Finance - Question Bank 2Document10 pagesCorporate Finance - Question Bank 2Ganesh GaneshNo ratings yet

- MCQ On FM PDFDocument28 pagesMCQ On FM PDFharsh snehNo ratings yet

- Financial Management Course: BBA IV MCQDocument11 pagesFinancial Management Course: BBA IV MCQPriyanka Mahajan100% (1)

- B&a - MCQDocument11 pagesB&a - MCQAniket PuriNo ratings yet

- Questions Based On F Inancial Managem EntDocument21 pagesQuestions Based On F Inancial Managem EntHemant kumarNo ratings yet

- FM Recollected QuestionsDocument8 pagesFM Recollected Questionsmevrick_guyNo ratings yet

- FM MBA Final print outDocument3 pagesFM MBA Final print outIfa FayisaNo ratings yet

- Buad 804 Sourced MCQ LQADocument21 pagesBuad 804 Sourced MCQ LQAAbdulrahman Adamu AhmedNo ratings yet

- Finance MCQDocument46 pagesFinance MCQPallavi GNo ratings yet

- FMSM - Practice Tests - With AnswersDocument39 pagesFMSM - Practice Tests - With AnswersRani LohiaNo ratings yet

- Corporate Finance QBDocument27 pagesCorporate Finance QBVelu SamyNo ratings yet

- MCQ On FMDocument32 pagesMCQ On FMShubhada AmaneNo ratings yet

- SFM Objectives Unit 1 and 2 (MD)Document9 pagesSFM Objectives Unit 1 and 2 (MD)Anil GuptaNo ratings yet

- Financial Management: Code: MB0045 Marks (140) Time (2 HRS) Section-A 1mark 50 50 MarksDocument21 pagesFinancial Management: Code: MB0045 Marks (140) Time (2 HRS) Section-A 1mark 50 50 Marksmrahul29_400215311No ratings yet

- MCQ On Corporate FinanceDocument5 pagesMCQ On Corporate FinanceManika SharmaNo ratings yet

- Unit 2 MCQ Business FinanceDocument6 pagesUnit 2 MCQ Business FinancePrateek Yadav100% (1)

- FM Section 2Document7 pagesFM Section 2bekali811No ratings yet

- Compilation of FMSM Telegram McqsDocument17 pagesCompilation of FMSM Telegram McqsAddvit ShrivastavaNo ratings yet

- Finc 301 QuizDocument16 pagesFinc 301 QuizMichael KutiNo ratings yet

- Finance MCQs (3rd Sem SPL)Document4 pagesFinance MCQs (3rd Sem SPL)IndrajitNo ratings yet

- Gat Subject Management Sciences Finance Mcqs1 50Document5 pagesGat Subject Management Sciences Finance Mcqs1 50Muhammad NajeebNo ratings yet

- Fa, FM, Cost, Tax, AuditDocument7 pagesFa, FM, Cost, Tax, Auditamanuelgenet50No ratings yet

- Galaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii TrimesterDocument5 pagesGalaxy Institute of Management PGDM Degree Examination Financial Management - Ii Iii Trimesteralbinus1385No ratings yet

- Chapter 2 MCQs and Analytical Qs The Firm and Its Goals MDocument3 pagesChapter 2 MCQs and Analytical Qs The Firm and Its Goals Mhamna ikramNo ratings yet

- FINC521-Most Important QuestionsDocument24 pagesFINC521-Most Important QuestionsAll rounder NitinNo ratings yet

- Paper+1 2+ (Questions+&+Solutions)Document13 pagesPaper+1 2+ (Questions+&+Solutions)jhouvanNo ratings yet

- BBA 407 GUIDE BOOK Smu 4rth SemDocument81 pagesBBA 407 GUIDE BOOK Smu 4rth SemlalsinghNo ratings yet

- FN 415 Fsa Final Exam Study Questions and Answers RZz2Document10 pagesFN 415 Fsa Final Exam Study Questions and Answers RZz2Chatlyn Kaye MediavilloNo ratings yet

- FM Mbaquiz1Document4 pagesFM Mbaquiz1Pritee SinghNo ratings yet

- 11 Busienss Stu-WPS OfficeDocument9 pages11 Busienss Stu-WPS OfficeKiranNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Sums FMDocument11 pagesSums FMVikesh MojeedraNo ratings yet

- 63 Question PaperDocument3 pages63 Question PaperVikesh MojeedraNo ratings yet

- 25 Question PaperDocument3 pages25 Question PaperVikesh MojeedraNo ratings yet

- 250 Question PaperDocument2 pages250 Question PaperVikesh MojeedraNo ratings yet

- 63 Question PaperDocument2 pages63 Question PaperVikesh MojeedraNo ratings yet

- 152 Question PaperDocument2 pages152 Question PaperVikesh MojeedraNo ratings yet

- 250 Question PaperDocument2 pages250 Question PaperVikesh MojeedraNo ratings yet

- All You Need To Know About Angelique KantengwaDocument2 pagesAll You Need To Know About Angelique KantengwaAngelique KantengwaNo ratings yet

- Navigating The Dynamics of Finance - A Brief OverviewDocument1 pageNavigating The Dynamics of Finance - A Brief Overviewsyedmoeen2001No ratings yet

- Chen, Huanting Pca 2014-07-31 Final VersionDocument49 pagesChen, Huanting Pca 2014-07-31 Final VersionUlises ArayaNo ratings yet

- CH 3Document65 pagesCH 3MohammedNo ratings yet

- Corporate GovernanceDocument9 pagesCorporate GovernanceRajiv LamichhaneNo ratings yet

- Alcatel Lucent CasestudyDocument12 pagesAlcatel Lucent CasestudySudarshan SharmaNo ratings yet

- Assignment Chapter 1Document5 pagesAssignment Chapter 1Mark CalimlimNo ratings yet

- How To Do Your Best-EssayDocument11 pagesHow To Do Your Best-EssayMandar SuryawanshiNo ratings yet

- Sesbreno Vs CA DigestDocument2 pagesSesbreno Vs CA DigestriajuloNo ratings yet

- Liberty Agile Retirement Range Brochure ElectronicDocument11 pagesLiberty Agile Retirement Range Brochure ElectronicMariusNo ratings yet

- Dominican Republic Case of Study FV 21AUG2015Document21 pagesDominican Republic Case of Study FV 21AUG2015Denia Eunice Del ValleNo ratings yet

- 4 Omnibus InvestmentsDocument36 pages4 Omnibus InvestmentsBret BalbuenaNo ratings yet

- Accounting E Book 1Document159 pagesAccounting E Book 1Ranbir KapoorNo ratings yet

- Corporate Finance 3rd Edition Ehrhardt Test BankDocument51 pagesCorporate Finance 3rd Edition Ehrhardt Test BankSreeman RevuriNo ratings yet

- SSRN Id1667081Document23 pagesSSRN Id1667081Tanushri VermaNo ratings yet

- Williamson's Managerial Discretionary Theory:: I. Expansion of StaffDocument44 pagesWilliamson's Managerial Discretionary Theory:: I. Expansion of StaffAhim Raj JoshiNo ratings yet

- BMS Sem3Document13 pagesBMS Sem3Jamil HabibiNo ratings yet

- Understanding Intra-Asean Fdi Flows: Trends and Determinants and The Role of China and IndiaDocument19 pagesUnderstanding Intra-Asean Fdi Flows: Trends and Determinants and The Role of China and Indiatutruong_tuboNo ratings yet

- 2011-12-19 Rothstein Scott AMDocument178 pages2011-12-19 Rothstein Scott AMmatthendleyNo ratings yet

- Bush Foundation - Communications Program Manager(s)Document2 pagesBush Foundation - Communications Program Manager(s)Lars LeafbladNo ratings yet

- Obj ListDocument11 pagesObj Listrachna1108No ratings yet

- Acova Radiateurs (v7)Document4 pagesAcova Radiateurs (v7)Sarvagya JhaNo ratings yet

- F9 - Mock A - AnswersDocument15 pagesF9 - Mock A - AnswerspavishneNo ratings yet

- Why Divestment?Document3 pagesWhy Divestment?akhilmathewNo ratings yet

- Bitcoins and The Donald Bradley Siderograph - Historical CorrelationsDocument19 pagesBitcoins and The Donald Bradley Siderograph - Historical CorrelationsBradleySiderographNo ratings yet

- ACC 610 Final Project SubmissionDocument26 pagesACC 610 Final Project SubmissionvincentNo ratings yet

- Real Estate - U.S. Real Estate and Inflation - ENDocument9 pagesReal Estate - U.S. Real Estate and Inflation - ENTianliang ZhangNo ratings yet