Professional Documents

Culture Documents

Exhibit S2B

Exhibit S2B

Uploaded by

Mohammad NouredeenCopyright:

Available Formats

You might also like

- Check List For False CeilingDocument1 pageCheck List For False CeilingShyamontika Choudhury Chakrabarti89% (9)

- Ultimate Guide To Debt & Leveraged Finance - Wall Street PrepDocument18 pagesUltimate Guide To Debt & Leveraged Finance - Wall Street PrepPearson SunigaNo ratings yet

- Technical & Financial Feasibility: Introduction To Project ManagementDocument27 pagesTechnical & Financial Feasibility: Introduction To Project ManagementPrince ANo ratings yet

- FIDIC Blue Book 2nd Edition - IADC WorkshopDocument25 pagesFIDIC Blue Book 2nd Edition - IADC WorkshopMubasher AwanNo ratings yet

- MBA VTU Syllabus 2012-13Document186 pagesMBA VTU Syllabus 2012-13Vinuta Ambresh KenchaNo ratings yet

- Exhibit S2ADocument2 pagesExhibit S2AMohammad NouredeenNo ratings yet

- Forecast Cash FlowDocument22 pagesForecast Cash FlowAqilah Bahtiar100% (1)

- Forecasting Retail Prices in Cement IndustryDocument12 pagesForecasting Retail Prices in Cement IndustryDebajit BurhagohainNo ratings yet

- Managing Project Risks: Prof M V MonicaDocument50 pagesManaging Project Risks: Prof M V Monicaanindya_kunduNo ratings yet

- Demand Issues Session 3&4Document20 pagesDemand Issues Session 3&4Anubhuti SinghNo ratings yet

- Overall Procedures: Bidding Planning Construction SafetyDocument9 pagesOverall Procedures: Bidding Planning Construction SafetyJhon Wai HinNo ratings yet

- Values and Costs-NietoDocument11 pagesValues and Costs-NietoOlegario SosaNo ratings yet

- Final PPT Risk AllocationDocument19 pagesFinal PPT Risk AllocationNavin Kumar KamalanathanNo ratings yet

- MPPP Session 3Document34 pagesMPPP Session 3Amisha LalNo ratings yet

- The Optimal Investment Scale and Timing: A Real Option Approach To Oilfield DevelopmentDocument36 pagesThe Optimal Investment Scale and Timing: A Real Option Approach To Oilfield Developmentapi-161028199No ratings yet

- Cargill // Steel SwapsDocument14 pagesCargill // Steel Swapsinfo8493No ratings yet

- Power Purchase Agreement PPA - Capacity Charge + Energy ChargeDocument24 pagesPower Purchase Agreement PPA - Capacity Charge + Energy ChargeHoncho Abhi Sinha100% (1)

- 70 Sme Mining Engineering Handbook: Cost of CapitalDocument1 page70 Sme Mining Engineering Handbook: Cost of CapitalYeimsNo ratings yet

- SVC TopCon 2018 Thin Film BucklingDocument21 pagesSVC TopCon 2018 Thin Film BucklingmjbrazilNo ratings yet

- Financing LNG Projects - Excellent Presentation Goldman SachDocument11 pagesFinancing LNG Projects - Excellent Presentation Goldman SachUJJWALNo ratings yet

- 120511/industrial Engineering Unit-4 Facility Location: Department of Mechanical EngineeringDocument40 pages120511/industrial Engineering Unit-4 Facility Location: Department of Mechanical EngineeringAman RajpootNo ratings yet

- Drilling Economics: Ø Drilling Costs in Field DevelopmentDocument14 pagesDrilling Economics: Ø Drilling Costs in Field Developmentyimam aliNo ratings yet

- CONRAD FELICE - GBR - Overview Nov 15 2020Document32 pagesCONRAD FELICE - GBR - Overview Nov 15 2020Sorabh GuptaNo ratings yet

- Managerial EconomicsDocument23 pagesManagerial EconomicsmukkusrikanthreddyNo ratings yet

- From Pandemic Disruption To Global Supply Chain RecoveryDocument50 pagesFrom Pandemic Disruption To Global Supply Chain RecoveryZaima LizaNo ratings yet

- German Cruz ExamDocument4 pagesGerman Cruz ExamRafael CoelloNo ratings yet

- Tech Prebid 701743Document10 pagesTech Prebid 701743PAWANNo ratings yet

- Nigeria The Dynamics of A Growing Gas Market - Presentation To The Africa Energy Forum 2008Document9 pagesNigeria The Dynamics of A Growing Gas Market - Presentation To The Africa Energy Forum 2008Adeoye AdefuluNo ratings yet

- NP 2 2 Lamarre PDFDocument12 pagesNP 2 2 Lamarre PDFReza MuhammadNo ratings yet

- Tsubaki Tani 1990Document12 pagesTsubaki Tani 1990clarinhaquintaNo ratings yet

- Current Price N Fltion CostDocument27 pagesCurrent Price N Fltion CostasmawiNo ratings yet

- Derivados 2Document26 pagesDerivados 2carlosNo ratings yet

- L01 PDFDocument12 pagesL01 PDFWilme NareaNo ratings yet

- Cost Overrun and Time Delay of Construction ProjecDocument9 pagesCost Overrun and Time Delay of Construction ProjecJesica SandaNo ratings yet

- MPTD and RentDocument26 pagesMPTD and Rentjasminemarch29No ratings yet

- Questionnaire Project Risk ManagementDocument3 pagesQuestionnaire Project Risk ManagementOlagunju olalekanNo ratings yet

- Ocr Economics 2019 TrackerDocument10 pagesOcr Economics 2019 Trackerywv22gg89jNo ratings yet

- TradeDocument12 pagesTradejuliekonpesNo ratings yet

- Paper 10245 v1-0 - Assessing The RiskDocument21 pagesPaper 10245 v1-0 - Assessing The RiskMace StudyNo ratings yet

- Chapter 2 - Part 1Document30 pagesChapter 2 - Part 1Elizabeth NelsonNo ratings yet

- Factors That in Uence Mine Design and Project Value: January 1999Document28 pagesFactors That in Uence Mine Design and Project Value: January 1999HILLARY FRANCIS SHENJERENo ratings yet

- 2018 Summer Model Answer PaperDocument15 pages2018 Summer Model Answer PaperNATIONAL A KHURSHEEDNo ratings yet

- EE458-CostsEmissionsDocument41 pagesEE458-CostsEmissionsEd ZNo ratings yet

- Construction Economics and Finance - Demands and Supply of ConstructionDocument13 pagesConstruction Economics and Finance - Demands and Supply of ConstructionMilashuNo ratings yet

- Case Linear ProgrammingDocument11 pagesCase Linear ProgrammingalexNo ratings yet

- Scheme of Work Economics Year 10Document10 pagesScheme of Work Economics Year 10sarazor08No ratings yet

- TROUBLE SHOOTING (Ravindra)Document4 pagesTROUBLE SHOOTING (Ravindra)ravindra kumarNo ratings yet

- Drilling Dynamics - 1Document52 pagesDrilling Dynamics - 1nitin_kulkarni_2No ratings yet

- 12 Second Generation of MarginalistsDocument22 pages12 Second Generation of MarginalistsbabinamomsaNo ratings yet

- RBT 02 2006Document8 pagesRBT 02 2006NithyaNo ratings yet

- Ijresm V2 I7 47Document5 pagesIjresm V2 I7 47Varun DesaiNo ratings yet

- BLD 802 Week 3 Lecture NoteDocument5 pagesBLD 802 Week 3 Lecture NoteRAHAMAN NAFISATNo ratings yet

- Illustration - Aviation-UpdateDocument11 pagesIllustration - Aviation-UpdaterihanamakeenNo ratings yet

- Icms 2 Excel Sheets Rics and Icms LogosDocument40 pagesIcms 2 Excel Sheets Rics and Icms LogosPatrick OsakweNo ratings yet

- Forum - 24 Oktober 2022 LB55Document2 pagesForum - 24 Oktober 2022 LB55calvin liemarvinNo ratings yet

- Foundation Optimisation For Ever Larger Offshore Wind Turbines - Geotechnical PerspectiveDocument77 pagesFoundation Optimisation For Ever Larger Offshore Wind Turbines - Geotechnical PerspectiveDoThanhTungNo ratings yet

- Reliance Industries Limited - Hazira Unit Central Engineering ServicesDocument1 pageReliance Industries Limited - Hazira Unit Central Engineering ServicesKande RameshNo ratings yet

- Concrete Blocks Business OutlookDocument6 pagesConcrete Blocks Business OutlookINF Consulting Services Private LimitedNo ratings yet

- Talren v5: A User-Friendly and Interactive InterfaceDocument2 pagesTalren v5: A User-Friendly and Interactive InterfaceAnshuman SinghNo ratings yet

- Plant Layout Notes Chapter 2Document10 pagesPlant Layout Notes Chapter 2KUBAL MANOJ SHAMSUNDARNo ratings yet

- Principles Of Political Economy Abridged with Critical, Bibliographical, and Explanatory Notes, and a Sketch of the History of Political EconomyFrom EverandPrinciples Of Political Economy Abridged with Critical, Bibliographical, and Explanatory Notes, and a Sketch of the History of Political EconomyNo ratings yet

- Soil Investigation and Foundation DesignFrom EverandSoil Investigation and Foundation DesignRating: 4.5 out of 5 stars4.5/5 (9)

- Exhibit S2ADocument2 pagesExhibit S2AMohammad NouredeenNo ratings yet

- Andreas Ittner: Accounting Is All About Trust: 1. Central BanksDocument4 pagesAndreas Ittner: Accounting Is All About Trust: 1. Central BanksMohammad NouredeenNo ratings yet

- Bcbs 117Document27 pagesBcbs 117Mohammad NouredeenNo ratings yet

- Hern Shin Ho: Advancing Corporate Governance in An Age of DisruptionsDocument6 pagesHern Shin Ho: Advancing Corporate Governance in An Age of DisruptionsMohammad NouredeenNo ratings yet

- Ong Chong Tee: Opening Remarks - SIAS Corporate Governance Digital SymposiumDocument3 pagesOng Chong Tee: Opening Remarks - SIAS Corporate Governance Digital SymposiumMohammad NouredeenNo ratings yet

- Emmanuel Tumusiime-Mutebile: Promoting and Strengthening Good Corporate Governance in UgandaDocument2 pagesEmmanuel Tumusiime-Mutebile: Promoting and Strengthening Good Corporate Governance in UgandaMohammad NouredeenNo ratings yet

- Etf PDFDocument6 pagesEtf PDFMohammad NouredeenNo ratings yet

- Yandraduth Googoolye: Corporate Governance: BIS Central Bankers' SpeechesDocument4 pagesYandraduth Googoolye: Corporate Governance: BIS Central Bankers' SpeechesMohammad NouredeenNo ratings yet

- Zambia Analysis 2011-12 Dec-Jan WebDocument34 pagesZambia Analysis 2011-12 Dec-Jan Webeditor_zambia_analysisNo ratings yet

- Tax LSPU Final Examination March 2016 AnswersDocument10 pagesTax LSPU Final Examination March 2016 AnswersKring de VeraNo ratings yet

- Tailoring UnitDocument8 pagesTailoring UnitSuresh sureshNo ratings yet

- Process DesignDocument12 pagesProcess Designrajaraghuramvarma1No ratings yet

- Cir vs. PlacerdomeDocument2 pagesCir vs. PlacerdomeMIKHAEL MEDRANONo ratings yet

- Sibelco Environmental, Social and Governance Version 3 October 2022 SRDocument24 pagesSibelco Environmental, Social and Governance Version 3 October 2022 SRJazmin Anabella CrognaleNo ratings yet

- Modern Marketing Assignment II Sem PDFDocument2 pagesModern Marketing Assignment II Sem PDFmartin santuroNo ratings yet

- Accounting WorksheetDocument6 pagesAccounting WorksheetRaff LesiaaNo ratings yet

- Govacc Chapter 8Document10 pagesGovacc Chapter 8Susan TalaberaNo ratings yet

- Project Feasibility Study For The Establishment of Footwear and Other AccessoriesDocument12 pagesProject Feasibility Study For The Establishment of Footwear and Other Accessoriesregata4No ratings yet

- GST QuestionnaireDocument2 pagesGST QuestionnaireIshan MehtaNo ratings yet

- Eb Lecturer Guide 1.2Document100 pagesEb Lecturer Guide 1.2Marcel JonathanNo ratings yet

- Kế Hoạch Học PMPDocument4 pagesKế Hoạch Học PMPKhacNam NguyễnNo ratings yet

- ClubX - October 2022Document78 pagesClubX - October 2022LeonardoNo ratings yet

- Chapter 08Document46 pagesChapter 08EneliaNo ratings yet

- Bai Tap HPDocument5 pagesBai Tap HPKhánh HưngNo ratings yet

- Automotive Transformation Scheme Customer Guideline 1 Introduction PDFDocument15 pagesAutomotive Transformation Scheme Customer Guideline 1 Introduction PDFAkash MenonNo ratings yet

- Value Chain AnalysisDocument4 pagesValue Chain AnalysisdanishNo ratings yet

- Epen AstroDocument2 pagesEpen AstrojfmohamadNo ratings yet

- Scope and RelevanceDocument8 pagesScope and RelevanceParul JainNo ratings yet

- Hyundai Motor India ParkDocument30 pagesHyundai Motor India ParkMir HassanNo ratings yet

- Adam SmithDocument6 pagesAdam SmithNathaniel LepasanaNo ratings yet

- ABN AMRO Presentation Morgan Stanley Conference March 2016Document27 pagesABN AMRO Presentation Morgan Stanley Conference March 2016steefhNo ratings yet

- 1572502911989Document23 pages1572502911989rohitNo ratings yet

- Msci Indonesia Esg Leaders Index Usd GrossDocument3 pagesMsci Indonesia Esg Leaders Index Usd GrossputraNo ratings yet

- Practice Problems TMVDocument2 pagesPractice Problems TMVShikharSrivastavaNo ratings yet

- TKB S2 2016-2017Document55 pagesTKB S2 2016-2017Diem Khoa Phan0% (1)

- Peran Pariwisata Dalam Meningkatkan Pertumbuhan Ekonomi MasyarakatDocument11 pagesPeran Pariwisata Dalam Meningkatkan Pertumbuhan Ekonomi MasyarakatAnnisa Wicha100% (1)

Exhibit S2B

Exhibit S2B

Uploaded by

Mohammad NouredeenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exhibit S2B

Exhibit S2B

Uploaded by

Mohammad NouredeenCopyright:

Available Formats

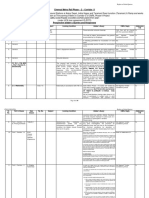

Exhibit S2B Post-Completion Risk Analysis

General Risks Risk Specific to Petrozuata and Venezuela Risk Mitigants

Market Risk: prices and quantities of • The price of oil available is volatile (case Exhibit • Conocoo 35-year off-take agreement (case p.6).

future output are uncertain. 8). • The price of syncrude is tied to the price of Maya (case

• There is not an established market for p.6).

Petrozuata’s syncrude (case p.6). • Petrozuata’s break-even price is low -- $8.63/barrel (case

p.10).

Only once since 1982 has the price of Maya fallen below

this level (case Exhibit 8)

• Chem Systems found syncrude’s pricing reasonable and

consistent with expected market developments and found

that a third-party market would develop (case pp.5-6).

Supply/Input Risk: the raw materials • Labour, materials and parts suppliers, and • Utilities are owned by the Venezuelan government or

needed to generate the project output utilities are located in Venezuela (case p.5). PDVSA (case Exhibit p.6).

must be available at the anticipated terms • Post-completion, the project will supply its own electricity,

Post-completion Risk

for the life of the project. gas, and water (case p.5).

Throughput Risk: the project must • The project has three components, all of which • The participants have project experience (case pp.3-5).

perform as projected for the life of the must run simultaneously to produce the • The technology is known (case p.5).

project. It includes: syncrude. • The pipeline is buried and located in a sparsely

• The amount of material put through a • The delayed coking technology used for the populated area (case p.5).

process in a given period; upgrader is complex (case p.5). • Engineers did not expect the crude’s varying density to

• The actual efficacy of the systems’ • The crude’s varying density could increase be a major problem (case p.5).

operations. throughput (case p.5). • Stone & Webster independently evaluated the project’s

projected performance and found it to be reasonable (case

pp.5-6).

Force majeure events: events that are • Neither the completion agreement nor the • The pipeline is buried and is located in a sparsely

beyond the control of the project—except purchase agreement are valid in the case of populated area (case p.5).

for oil market developments. force majeure events (case p.6).

• Political events – war, labour strikes,

terrorism, or changes in laws;

• Non-political events – “acts of God” such

as hurricanes or earthquakes.

Operating cost changes: any changes in • Forecasted costs are uncertain and are on • Stone & Webster independently evaluated the project’s

costs will change the project’s economics. numerous factors. costs and found it to be reasonable (case pp.5-6).

You might also like

- Check List For False CeilingDocument1 pageCheck List For False CeilingShyamontika Choudhury Chakrabarti89% (9)

- Ultimate Guide To Debt & Leveraged Finance - Wall Street PrepDocument18 pagesUltimate Guide To Debt & Leveraged Finance - Wall Street PrepPearson SunigaNo ratings yet

- Technical & Financial Feasibility: Introduction To Project ManagementDocument27 pagesTechnical & Financial Feasibility: Introduction To Project ManagementPrince ANo ratings yet

- FIDIC Blue Book 2nd Edition - IADC WorkshopDocument25 pagesFIDIC Blue Book 2nd Edition - IADC WorkshopMubasher AwanNo ratings yet

- MBA VTU Syllabus 2012-13Document186 pagesMBA VTU Syllabus 2012-13Vinuta Ambresh KenchaNo ratings yet

- Exhibit S2ADocument2 pagesExhibit S2AMohammad NouredeenNo ratings yet

- Forecast Cash FlowDocument22 pagesForecast Cash FlowAqilah Bahtiar100% (1)

- Forecasting Retail Prices in Cement IndustryDocument12 pagesForecasting Retail Prices in Cement IndustryDebajit BurhagohainNo ratings yet

- Managing Project Risks: Prof M V MonicaDocument50 pagesManaging Project Risks: Prof M V Monicaanindya_kunduNo ratings yet

- Demand Issues Session 3&4Document20 pagesDemand Issues Session 3&4Anubhuti SinghNo ratings yet

- Overall Procedures: Bidding Planning Construction SafetyDocument9 pagesOverall Procedures: Bidding Planning Construction SafetyJhon Wai HinNo ratings yet

- Values and Costs-NietoDocument11 pagesValues and Costs-NietoOlegario SosaNo ratings yet

- Final PPT Risk AllocationDocument19 pagesFinal PPT Risk AllocationNavin Kumar KamalanathanNo ratings yet

- MPPP Session 3Document34 pagesMPPP Session 3Amisha LalNo ratings yet

- The Optimal Investment Scale and Timing: A Real Option Approach To Oilfield DevelopmentDocument36 pagesThe Optimal Investment Scale and Timing: A Real Option Approach To Oilfield Developmentapi-161028199No ratings yet

- Cargill // Steel SwapsDocument14 pagesCargill // Steel Swapsinfo8493No ratings yet

- Power Purchase Agreement PPA - Capacity Charge + Energy ChargeDocument24 pagesPower Purchase Agreement PPA - Capacity Charge + Energy ChargeHoncho Abhi Sinha100% (1)

- 70 Sme Mining Engineering Handbook: Cost of CapitalDocument1 page70 Sme Mining Engineering Handbook: Cost of CapitalYeimsNo ratings yet

- SVC TopCon 2018 Thin Film BucklingDocument21 pagesSVC TopCon 2018 Thin Film BucklingmjbrazilNo ratings yet

- Financing LNG Projects - Excellent Presentation Goldman SachDocument11 pagesFinancing LNG Projects - Excellent Presentation Goldman SachUJJWALNo ratings yet

- 120511/industrial Engineering Unit-4 Facility Location: Department of Mechanical EngineeringDocument40 pages120511/industrial Engineering Unit-4 Facility Location: Department of Mechanical EngineeringAman RajpootNo ratings yet

- Drilling Economics: Ø Drilling Costs in Field DevelopmentDocument14 pagesDrilling Economics: Ø Drilling Costs in Field Developmentyimam aliNo ratings yet

- CONRAD FELICE - GBR - Overview Nov 15 2020Document32 pagesCONRAD FELICE - GBR - Overview Nov 15 2020Sorabh GuptaNo ratings yet

- Managerial EconomicsDocument23 pagesManagerial EconomicsmukkusrikanthreddyNo ratings yet

- From Pandemic Disruption To Global Supply Chain RecoveryDocument50 pagesFrom Pandemic Disruption To Global Supply Chain RecoveryZaima LizaNo ratings yet

- German Cruz ExamDocument4 pagesGerman Cruz ExamRafael CoelloNo ratings yet

- Tech Prebid 701743Document10 pagesTech Prebid 701743PAWANNo ratings yet

- Nigeria The Dynamics of A Growing Gas Market - Presentation To The Africa Energy Forum 2008Document9 pagesNigeria The Dynamics of A Growing Gas Market - Presentation To The Africa Energy Forum 2008Adeoye AdefuluNo ratings yet

- NP 2 2 Lamarre PDFDocument12 pagesNP 2 2 Lamarre PDFReza MuhammadNo ratings yet

- Tsubaki Tani 1990Document12 pagesTsubaki Tani 1990clarinhaquintaNo ratings yet

- Current Price N Fltion CostDocument27 pagesCurrent Price N Fltion CostasmawiNo ratings yet

- Derivados 2Document26 pagesDerivados 2carlosNo ratings yet

- L01 PDFDocument12 pagesL01 PDFWilme NareaNo ratings yet

- Cost Overrun and Time Delay of Construction ProjecDocument9 pagesCost Overrun and Time Delay of Construction ProjecJesica SandaNo ratings yet

- MPTD and RentDocument26 pagesMPTD and Rentjasminemarch29No ratings yet

- Questionnaire Project Risk ManagementDocument3 pagesQuestionnaire Project Risk ManagementOlagunju olalekanNo ratings yet

- Ocr Economics 2019 TrackerDocument10 pagesOcr Economics 2019 Trackerywv22gg89jNo ratings yet

- TradeDocument12 pagesTradejuliekonpesNo ratings yet

- Paper 10245 v1-0 - Assessing The RiskDocument21 pagesPaper 10245 v1-0 - Assessing The RiskMace StudyNo ratings yet

- Chapter 2 - Part 1Document30 pagesChapter 2 - Part 1Elizabeth NelsonNo ratings yet

- Factors That in Uence Mine Design and Project Value: January 1999Document28 pagesFactors That in Uence Mine Design and Project Value: January 1999HILLARY FRANCIS SHENJERENo ratings yet

- 2018 Summer Model Answer PaperDocument15 pages2018 Summer Model Answer PaperNATIONAL A KHURSHEEDNo ratings yet

- EE458-CostsEmissionsDocument41 pagesEE458-CostsEmissionsEd ZNo ratings yet

- Construction Economics and Finance - Demands and Supply of ConstructionDocument13 pagesConstruction Economics and Finance - Demands and Supply of ConstructionMilashuNo ratings yet

- Case Linear ProgrammingDocument11 pagesCase Linear ProgrammingalexNo ratings yet

- Scheme of Work Economics Year 10Document10 pagesScheme of Work Economics Year 10sarazor08No ratings yet

- TROUBLE SHOOTING (Ravindra)Document4 pagesTROUBLE SHOOTING (Ravindra)ravindra kumarNo ratings yet

- Drilling Dynamics - 1Document52 pagesDrilling Dynamics - 1nitin_kulkarni_2No ratings yet

- 12 Second Generation of MarginalistsDocument22 pages12 Second Generation of MarginalistsbabinamomsaNo ratings yet

- RBT 02 2006Document8 pagesRBT 02 2006NithyaNo ratings yet

- Ijresm V2 I7 47Document5 pagesIjresm V2 I7 47Varun DesaiNo ratings yet

- BLD 802 Week 3 Lecture NoteDocument5 pagesBLD 802 Week 3 Lecture NoteRAHAMAN NAFISATNo ratings yet

- Illustration - Aviation-UpdateDocument11 pagesIllustration - Aviation-UpdaterihanamakeenNo ratings yet

- Icms 2 Excel Sheets Rics and Icms LogosDocument40 pagesIcms 2 Excel Sheets Rics and Icms LogosPatrick OsakweNo ratings yet

- Forum - 24 Oktober 2022 LB55Document2 pagesForum - 24 Oktober 2022 LB55calvin liemarvinNo ratings yet

- Foundation Optimisation For Ever Larger Offshore Wind Turbines - Geotechnical PerspectiveDocument77 pagesFoundation Optimisation For Ever Larger Offshore Wind Turbines - Geotechnical PerspectiveDoThanhTungNo ratings yet

- Reliance Industries Limited - Hazira Unit Central Engineering ServicesDocument1 pageReliance Industries Limited - Hazira Unit Central Engineering ServicesKande RameshNo ratings yet

- Concrete Blocks Business OutlookDocument6 pagesConcrete Blocks Business OutlookINF Consulting Services Private LimitedNo ratings yet

- Talren v5: A User-Friendly and Interactive InterfaceDocument2 pagesTalren v5: A User-Friendly and Interactive InterfaceAnshuman SinghNo ratings yet

- Plant Layout Notes Chapter 2Document10 pagesPlant Layout Notes Chapter 2KUBAL MANOJ SHAMSUNDARNo ratings yet

- Principles Of Political Economy Abridged with Critical, Bibliographical, and Explanatory Notes, and a Sketch of the History of Political EconomyFrom EverandPrinciples Of Political Economy Abridged with Critical, Bibliographical, and Explanatory Notes, and a Sketch of the History of Political EconomyNo ratings yet

- Soil Investigation and Foundation DesignFrom EverandSoil Investigation and Foundation DesignRating: 4.5 out of 5 stars4.5/5 (9)

- Exhibit S2ADocument2 pagesExhibit S2AMohammad NouredeenNo ratings yet

- Andreas Ittner: Accounting Is All About Trust: 1. Central BanksDocument4 pagesAndreas Ittner: Accounting Is All About Trust: 1. Central BanksMohammad NouredeenNo ratings yet

- Bcbs 117Document27 pagesBcbs 117Mohammad NouredeenNo ratings yet

- Hern Shin Ho: Advancing Corporate Governance in An Age of DisruptionsDocument6 pagesHern Shin Ho: Advancing Corporate Governance in An Age of DisruptionsMohammad NouredeenNo ratings yet

- Ong Chong Tee: Opening Remarks - SIAS Corporate Governance Digital SymposiumDocument3 pagesOng Chong Tee: Opening Remarks - SIAS Corporate Governance Digital SymposiumMohammad NouredeenNo ratings yet

- Emmanuel Tumusiime-Mutebile: Promoting and Strengthening Good Corporate Governance in UgandaDocument2 pagesEmmanuel Tumusiime-Mutebile: Promoting and Strengthening Good Corporate Governance in UgandaMohammad NouredeenNo ratings yet

- Etf PDFDocument6 pagesEtf PDFMohammad NouredeenNo ratings yet

- Yandraduth Googoolye: Corporate Governance: BIS Central Bankers' SpeechesDocument4 pagesYandraduth Googoolye: Corporate Governance: BIS Central Bankers' SpeechesMohammad NouredeenNo ratings yet

- Zambia Analysis 2011-12 Dec-Jan WebDocument34 pagesZambia Analysis 2011-12 Dec-Jan Webeditor_zambia_analysisNo ratings yet

- Tax LSPU Final Examination March 2016 AnswersDocument10 pagesTax LSPU Final Examination March 2016 AnswersKring de VeraNo ratings yet

- Tailoring UnitDocument8 pagesTailoring UnitSuresh sureshNo ratings yet

- Process DesignDocument12 pagesProcess Designrajaraghuramvarma1No ratings yet

- Cir vs. PlacerdomeDocument2 pagesCir vs. PlacerdomeMIKHAEL MEDRANONo ratings yet

- Sibelco Environmental, Social and Governance Version 3 October 2022 SRDocument24 pagesSibelco Environmental, Social and Governance Version 3 October 2022 SRJazmin Anabella CrognaleNo ratings yet

- Modern Marketing Assignment II Sem PDFDocument2 pagesModern Marketing Assignment II Sem PDFmartin santuroNo ratings yet

- Accounting WorksheetDocument6 pagesAccounting WorksheetRaff LesiaaNo ratings yet

- Govacc Chapter 8Document10 pagesGovacc Chapter 8Susan TalaberaNo ratings yet

- Project Feasibility Study For The Establishment of Footwear and Other AccessoriesDocument12 pagesProject Feasibility Study For The Establishment of Footwear and Other Accessoriesregata4No ratings yet

- GST QuestionnaireDocument2 pagesGST QuestionnaireIshan MehtaNo ratings yet

- Eb Lecturer Guide 1.2Document100 pagesEb Lecturer Guide 1.2Marcel JonathanNo ratings yet

- Kế Hoạch Học PMPDocument4 pagesKế Hoạch Học PMPKhacNam NguyễnNo ratings yet

- ClubX - October 2022Document78 pagesClubX - October 2022LeonardoNo ratings yet

- Chapter 08Document46 pagesChapter 08EneliaNo ratings yet

- Bai Tap HPDocument5 pagesBai Tap HPKhánh HưngNo ratings yet

- Automotive Transformation Scheme Customer Guideline 1 Introduction PDFDocument15 pagesAutomotive Transformation Scheme Customer Guideline 1 Introduction PDFAkash MenonNo ratings yet

- Value Chain AnalysisDocument4 pagesValue Chain AnalysisdanishNo ratings yet

- Epen AstroDocument2 pagesEpen AstrojfmohamadNo ratings yet

- Scope and RelevanceDocument8 pagesScope and RelevanceParul JainNo ratings yet

- Hyundai Motor India ParkDocument30 pagesHyundai Motor India ParkMir HassanNo ratings yet

- Adam SmithDocument6 pagesAdam SmithNathaniel LepasanaNo ratings yet

- ABN AMRO Presentation Morgan Stanley Conference March 2016Document27 pagesABN AMRO Presentation Morgan Stanley Conference March 2016steefhNo ratings yet

- 1572502911989Document23 pages1572502911989rohitNo ratings yet

- Msci Indonesia Esg Leaders Index Usd GrossDocument3 pagesMsci Indonesia Esg Leaders Index Usd GrossputraNo ratings yet

- Practice Problems TMVDocument2 pagesPractice Problems TMVShikharSrivastavaNo ratings yet

- TKB S2 2016-2017Document55 pagesTKB S2 2016-2017Diem Khoa Phan0% (1)

- Peran Pariwisata Dalam Meningkatkan Pertumbuhan Ekonomi MasyarakatDocument11 pagesPeran Pariwisata Dalam Meningkatkan Pertumbuhan Ekonomi MasyarakatAnnisa Wicha100% (1)