Professional Documents

Culture Documents

A LTD - Investment Appraisal

A LTD - Investment Appraisal

Uploaded by

mamitjasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A LTD - Investment Appraisal

A LTD - Investment Appraisal

Uploaded by

mamitjasCopyright:

Available Formats

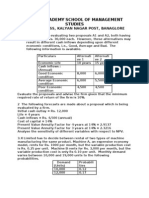

A Ltd

Investment appraisal

A Ltd is considering the purchase of a new machine. The new machine

manufactures product Z. The price of the machine is R10 000 000 (including

shipping costs of R500 000). A Ltd would have to train its staff to operate the

new machine. The cost of the training is R900 000.

If the new machine is purchased the accounts receivable will increase by R50

000, inventory will increase by R70 000, the cash on hand will increase by

R100 000 and the accounts payable will increase by R25 000.

Product Z is sold for R40 each. The variable manufacturing cost is R21 per

unit. A Ltd would also incur fixed manufacturing costs of R150 000 per year if

the new machine is purchased.

The expected sales volume of product Z is as follows:

Year 1 2 3

Sales volume in units 500 000 550 000 600 000

The new machine has a useful life of 3 years and will be depreciated over its

useful life using the straight-line method. SARS allows a wear and tear

deduction of 50% in the first year of use and 25% in the second and third

year. The wear and tear deduction will be granted on the cost of the

machine as well as on the shipping costs. The cost of the training is not tax

deductible.

A Ltd would borrow money to fund this project. Interest of R750 000 would be

paid annually on the borrowed funds.

The tax rate is 28%. A Ltd’s cost of capital is 17%.

Required:

Calculate the relevant annual cash flows for the new

machine. Calculate the net present value (NPV) for the

new machine.

Should A Ltd purchase the new machine?

You might also like

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- Problems On Cash FlowsDocument4 pagesProblems On Cash FlowsDeepakNo ratings yet

- Exercise Chapter 6Document3 pagesExercise Chapter 6Siti AishahNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar50% (2)

- Q 1Document3 pagesQ 1Rajendran KajananthanNo ratings yet

- Capital Budgeting 5Document9 pagesCapital Budgeting 5Sarvesh SharmaNo ratings yet

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- Capital BudgetingDocument6 pagesCapital Budgetingkaf_scitNo ratings yet

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Document3 pagesInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNo ratings yet

- Imo LTD Q3Document1 pageImo LTD Q3Rajendran KajananthanNo ratings yet

- Practice Question On Capital BudegetingDocument4 pagesPractice Question On Capital Budegetingaditisarkar080No ratings yet

- Chapter 4 - Annual WorthDocument15 pagesChapter 4 - Annual WorthUpendra ReddyNo ratings yet

- Assignment 1 PDFDocument2 pagesAssignment 1 PDFRohan SahdevNo ratings yet

- 1c183capital Budgeting AssignmentDocument6 pages1c183capital Budgeting Assignmentaman27842No ratings yet

- Lesse Evaluation ProblemsDocument3 pagesLesse Evaluation ProblemsAnshuNo ratings yet

- Cap BudgetingggDocument3 pagesCap BudgetingggSiva SankariNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingavinishNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Capital Budgeting AssignmentDocument3 pagesCapital Budgeting AssignmentRobert JohnsonNo ratings yet

- Project FinanceDocument19 pagesProject FinancejahidkhanNo ratings yet

- IRR of The ProjectDocument9 pagesIRR of The Projectsamuel kebedeNo ratings yet

- Questions On LeasingDocument5 pagesQuestions On Leasingriteshsoni100% (2)

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- CAF 8 CMA Autumn 2019 PDFDocument4 pagesCAF 8 CMA Autumn 2019 PDFbinuNo ratings yet

- Chapter 3 - Economic Evaluation of AlternativesDocument21 pagesChapter 3 - Economic Evaluation of Alternativessam guptNo ratings yet

- Capital BudgetingDocument108 pagesCapital BudgetingSakib Farooquie100% (1)

- Exrcises and Topics For Discussions DB 2024Document6 pagesExrcises and Topics For Discussions DB 2024Nguyễn Hồng HạnhNo ratings yet

- Homework - Cash Flow PrinciplesDocument2 pagesHomework - Cash Flow PrinciplesCristina Maria ConstantinescuNo ratings yet

- Class Exercise - 3 Lease FinancingDocument4 pagesClass Exercise - 3 Lease Financinggaurav shettyNo ratings yet

- ABC Limited - Case StudyDocument2 pagesABC Limited - Case StudyRahul BhagatNo ratings yet

- 4-Handout Four - Capital Budgeting and Estimating Cash Flows-Chapter Twelve-1Document12 pages4-Handout Four - Capital Budgeting and Estimating Cash Flows-Chapter Twelve-1Sharique KhanNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- Capital Investment Factors7to16Document15 pagesCapital Investment Factors7to16Spencer Tañada100% (1)

- Capital Expenditure DecisionDocument4 pagesCapital Expenditure DecisionSayan MitraNo ratings yet

- Cash Flow Analysis - Delta Co Problems - Docx + RepcoDocument2 pagesCash Flow Analysis - Delta Co Problems - Docx + RepcoAnjali ChopraNo ratings yet

- AFM Capital Budgeting AssignmentDocument5 pagesAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- DCF Group 5Document18 pagesDCF Group 5Ravi Kumar100% (1)

- ECON F315 - FIN F315 - Compre QP PDFDocument3 pagesECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- 4a. Capital BudgetingDocument6 pages4a. Capital BudgetingShubhrant ShuklaNo ratings yet

- NPV SumsDocument2 pagesNPV SumsSunitha RamNo ratings yet

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919No ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- Exercises (Capital Budgeting)Document2 pagesExercises (Capital Budgeting)bdiitNo ratings yet

- Quiz 1 PPE and ImpairmentDocument2 pagesQuiz 1 PPE and Impairmentlameck noah zuluNo ratings yet

- A Mining Company Is Considering To Open A New Coal MineDocument4 pagesA Mining Company Is Considering To Open A New Coal MineD Y Patil Institute of MCA and MBANo ratings yet

- 09 Cash FlowDocument1 page09 Cash FlowShekhar SinghNo ratings yet

- CapbudgetingproblemsDocument3 pagesCapbudgetingproblemsVishal PaithankarNo ratings yet

- 2015-Spring-F18-CIA Revision Practice QuestionsDocument2 pages2015-Spring-F18-CIA Revision Practice QuestionsMayal AhmedNo ratings yet

- IND-AS Tangible AssetDocument23 pagesIND-AS Tangible AssetsambhabdashcacsNo ratings yet

- Sample Problems On DepreciationDocument1 pageSample Problems On DepreciationrobNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- CF Assignment 2Document2 pagesCF Assignment 2Ambika SharmaNo ratings yet

- Assignment Bba 4th SemDocument3 pagesAssignment Bba 4th SemShadaab MalikNo ratings yet

- PPE and ImpairmentDocument3 pagesPPE and ImpairmentSelma IilongaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Chapter 1 - Introduction To Financial ManagementDocument5 pagesChapter 1 - Introduction To Financial ManagementmamitjasNo ratings yet

- A Pro LTD - Question With CommentsDocument1 pageA Pro LTD - Question With CommentsmamitjasNo ratings yet

- UFS-SAICA CF-in PerspectiveDocument10 pagesUFS-SAICA CF-in PerspectivemamitjasNo ratings yet

- Week 25 - IAS 7 Statement of Cash Flows - SlidesDocument56 pagesWeek 25 - IAS 7 Statement of Cash Flows - SlidesmamitjasNo ratings yet