Professional Documents

Culture Documents

BCOM 3RDIndirect Taxes2022

BCOM 3RDIndirect Taxes2022

Uploaded by

radic47998Copyright:

Available Formats

You might also like

- Atul Agarwal IDT Question BankDocument490 pagesAtul Agarwal IDT Question BankSavya Sachi100% (8)

- Affidavit of Revocation and Rescission Irs - TemplateDocument7 pagesAffidavit of Revocation and Rescission Irs - Templatemderigo100% (7)

- Paycheck - 2023 03 23 - 2023 04 07Document1 pagePaycheck - 2023 03 23 - 2023 04 07tebeck bertran forbitNo ratings yet

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- My Payslips 2022-11-07Document16 pagesMy Payslips 2022-11-07Ildikó Pető-Jánosi0% (1)

- Problem Exercises-Taxation Set 3Document2 pagesProblem Exercises-Taxation Set 3Danny LabordoNo ratings yet

- Solved Herbert A Collector of Rare Coins Bought A 1916 SpanishDocument1 pageSolved Herbert A Collector of Rare Coins Bought A 1916 SpanishAnbu jaromiaNo ratings yet

- Ella Lyman Cabot Trust Question ListDocument2 pagesElla Lyman Cabot Trust Question ListAdeyemi Oluwaseun JohnNo ratings yet

- Part - 2: Return Submission Data: Part - 1: Taxpayer'S InformationDocument2 pagesPart - 2: Return Submission Data: Part - 1: Taxpayer'S InformationMD. Mahbubur RahmanNo ratings yet

- Government of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormDocument11 pagesGovernment of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormMd. Abu NaserNo ratings yet

- Indian Fibre Board Antidumping Case StudyDocument7 pagesIndian Fibre Board Antidumping Case Studysnake8xNo ratings yet

- Instruction To Candidates: Date TransactionDocument5 pagesInstruction To Candidates: Date TransactionYeppeuddaNo ratings yet

- Instruction To Candidates: Date TransactionDocument5 pagesInstruction To Candidates: Date TransactionEphreen Grace MartyNo ratings yet

- Mushak-9 1Document8 pagesMushak-9 1ripon1195No ratings yet

- 63 Goodand Service Tax May 2022Document8 pages63 Goodand Service Tax May 2022bhavanikg00No ratings yet

- Igcrd 2022Document13 pagesIgcrd 2022Abhijyo SinghNo ratings yet

- Monetary Limit - Rates To Remember in GSTDocument15 pagesMonetary Limit - Rates To Remember in GSTtholsjk14No ratings yet

- E/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Document17 pagesE/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Krisha Lei SanchezNo ratings yet

- Quiz CompDocument7 pagesQuiz CompKimberly Anne Malingi LavillaNo ratings yet

- Faxon GroFin Financial PlanDocument8 pagesFaxon GroFin Financial PlanMasiko JamesNo ratings yet

- Ans Sesi Jun 2018Document8 pagesAns Sesi Jun 2018黄勇添No ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- Sanchit Grover Income Tax Amendments May2021 6Document71 pagesSanchit Grover Income Tax Amendments May2021 6Ismail RizwanNo ratings yet

- Ca Final: Paper 8: Indirect Tax LawsDocument499 pagesCa Final: Paper 8: Indirect Tax LawsMaroju Rajitha100% (1)

- Analysis of Chapter Compostion SchemeDocument18 pagesAnalysis of Chapter Compostion SchemeSunil Kumar PatroNo ratings yet

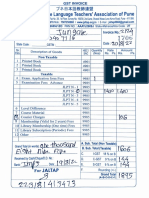

- JLPT ReceiptDocument1 pageJLPT ReceiptSanchita RahadeNo ratings yet

- Gr11 April P1 2020 - Marking SchemeDocument9 pagesGr11 April P1 2020 - Marking SchemeMartha AntonNo ratings yet

- Safe International Return September - 2021Document10 pagesSafe International Return September - 2021bidhank.dasNo ratings yet

- Mushak-9 1Document11 pagesMushak-9 1Arnold Roger Curry0% (1)

- Safe International Return August - 2021Document11 pagesSafe International Return August - 2021bidhank.dasNo ratings yet

- MTP 9 13 Answers 1695990555Document9 pagesMTP 9 13 Answers 1695990555Arun KambleNo ratings yet

- Cash Flow TemplateDocument13 pagesCash Flow TemplateJohn ArikoNo ratings yet

- L241 Law of TaxationDocument4 pagesL241 Law of TaxationFrancis ChikombolaNo ratings yet

- Circular-No-22-2020 For The Marketing CompaniesDocument1 pageCircular-No-22-2020 For The Marketing CompaniesAnkit SharmaNo ratings yet

- Paper 4 IDT - Pdfpaper 4 IDTDocument7 pagesPaper 4 IDT - Pdfpaper 4 IDTharsh agarwalNo ratings yet

- Aafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiDocument35 pagesAafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiMuhammad Sohaib AzharNo ratings yet

- Tax Revision Plan With Hrs and MarksDocument7 pagesTax Revision Plan With Hrs and MarksKukuNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Format 62 - Generating Company Data For Financial StudyDocument3 pagesFormat 62 - Generating Company Data For Financial StudymaheswarianuNo ratings yet

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254No ratings yet

- Cost and Management AccountingDocument5 pagesCost and Management AccountingIbtehaj KayaniNo ratings yet

- CITA 031 Test 1 - Memo 2022Document6 pagesCITA 031 Test 1 - Memo 2022Morongwa MamoseboNo ratings yet

- Safe International Return November - 2021Document11 pagesSafe International Return November - 2021bidhank.dasNo ratings yet

- Palamu PKG - 02Document6,188 pagesPalamu PKG - 02MECON-PMA DDUGJY-JBVNLNo ratings yet

- Report 6Document3 pagesReport 6bohigharNo ratings yet

- Budget 2021 Summary Mrunal Competitive ExamsDocument24 pagesBudget 2021 Summary Mrunal Competitive ExamsVarun MatlaniNo ratings yet

- Aziz Sir LPCDocument2 pagesAziz Sir LPCঅনি চৌধুরীNo ratings yet

- 73253bos59102 Final p8Document18 pages73253bos59102 Final p8Vishal AgarwalNo ratings yet

- Previous Year Question Paper 2024 GSTDocument6 pagesPrevious Year Question Paper 2024 GSTsangeetha3508No ratings yet

- Assign QP 2024 May - DP12.2 Tax Law and PracDocument6 pagesAssign QP 2024 May - DP12.2 Tax Law and PracshalomechinodyaNo ratings yet

- KR Vicco Testing & Configuration Business Process Open Sap Cources Sap SD QuestionsDocument18 pagesKR Vicco Testing & Configuration Business Process Open Sap Cources Sap SD QuestionsDiksha PalkeNo ratings yet

- FM Cases For Group PresentationDocument19 pagesFM Cases For Group PresentationSwati AmritNo ratings yet

- US Internal Revenue Service: I1120icd - 1992Document15 pagesUS Internal Revenue Service: I1120icd - 1992IRSNo ratings yet

- SilicaSandPh Intertek Lab Test Silica Quartz (SQSM)Document11 pagesSilicaSandPh Intertek Lab Test Silica Quartz (SQSM)SilicaSandPhNo ratings yet

- Bulletin: Additional Changes Being Made To CIH and FSW Services, Effective Jan. 1, 2022Document2 pagesBulletin: Additional Changes Being Made To CIH and FSW Services, Effective Jan. 1, 2022Indiana Family to FamilyNo ratings yet

- Notes About Section 88 Tax2Document1 pageNotes About Section 88 Tax2Farnaz CharandabiNo ratings yet

- Total No. of Printedpages-11 Maximummarks - 100 ..: PC! Group I-Paper Advanced AccountingDocument11 pagesTotal No. of Printedpages-11 Maximummarks - 100 ..: PC! Group I-Paper Advanced AccountingNyonikaNo ratings yet

- QUIKBook IDT - CA Inter Nov 21Document33 pagesQUIKBook IDT - CA Inter Nov 21Nisha BhandariNo ratings yet

- Illustration 1 - Computation of Duty Drawback: Gajanan & Co. Has Imported A PlantDocument5 pagesIllustration 1 - Computation of Duty Drawback: Gajanan & Co. Has Imported A PlantTapan BarikNo ratings yet

- The Umversity of The West IndiesDocument7 pagesThe Umversity of The West IndiesIsmadth2918388No ratings yet

- 3 Additional Q in 2nd Edition Revised BookDocument29 pages3 Additional Q in 2nd Edition Revised BookVishal AgarwalNo ratings yet

- MTP 1 Ans IdtDocument13 pagesMTP 1 Ans IdtAmra NaazNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxDSM DRIVING SCHOOLNo ratings yet

- M K Fashion & Tailoting Audited 077-78Document11 pagesM K Fashion & Tailoting Audited 077-78Ujjwal GhimireNo ratings yet

- Mock Sep 2023 - Question PaperDocument8 pagesMock Sep 2023 - Question Paperfahadkhn871No ratings yet

- Basics of Central ExciseDocument5 pagesBasics of Central ExciseAkash AgarwalNo ratings yet

- IIHMR Question PapersDocument1 pageIIHMR Question PapersRishi TripathiNo ratings yet

- Form No.16 (See Rule 31 (1) (A) )Document2 pagesForm No.16 (See Rule 31 (1) (A) )Akash ShedgeNo ratings yet

- Invoice: Order No.: 52113272 Order Placed On: 02/01/2023Document1 pageInvoice: Order No.: 52113272 Order Placed On: 02/01/2023Alexandru BadanauNo ratings yet

- Tax Invoice: Input CGST Input SGSTDocument1 pageTax Invoice: Input CGST Input SGSTOmprakash BaralaNo ratings yet

- Ghosh Engineering Corporation: Proforma InvoiceDocument1 pageGhosh Engineering Corporation: Proforma InvoiceKABIR CHOPRANo ratings yet

- f133 PDFDocument1 pagef133 PDFfaresNo ratings yet

- Taxation - Reviewer TaskDocument3 pagesTaxation - Reviewer TaskLaguna HistoryNo ratings yet

- Annex B-1:: Guide On Filling Up The DocumentDocument9 pagesAnnex B-1:: Guide On Filling Up The DocumentGrace UrbanoNo ratings yet

- Principles of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1Document7 pagesPrinciples of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1ambermcbrideokdcjfmgbx100% (32)

- Apr 21Document1 pageApr 21pavan kumarNo ratings yet

- Annex C RR 11-2018Document2 pagesAnnex C RR 11-2018Andoy Domingo CarulloNo ratings yet

- PayslipDocument2 pagesPaysliporrinlloyd750No ratings yet

- Payroll SystemDocument6 pagesPayroll SystemPriyan Trivedi50% (2)

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarNo ratings yet

- JMC Fee Structure 2022 23Document1 pageJMC Fee Structure 2022 23waqarkhan110305No ratings yet

- Income Tax Reviewer-1Document1 pageIncome Tax Reviewer-1Sano ManjiroNo ratings yet

- Capital Gains NotesDocument3 pagesCapital Gains NotesDhiraj SoniNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Investigation 2024 GR 12Document6 pagesInvestigation 2024 GR 12koekoeorefileNo ratings yet

- Income Tax Return 480.20 (U)Document3 pagesIncome Tax Return 480.20 (U)Alan EscobarNo ratings yet

- Payslip India April - 2023-1-2Document1 pagePayslip India April - 2023-1-2aamirashfaque20No ratings yet

- Letter To Commissioner BIRDocument3 pagesLetter To Commissioner BIReugene juliusNo ratings yet

- Amazon Invoice - Laptop Stand PDFDocument1 pageAmazon Invoice - Laptop Stand PDFAl-Harbi Pvt LtdNo ratings yet

BCOM 3RDIndirect Taxes2022

BCOM 3RDIndirect Taxes2022

Uploaded by

radic47998Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BCOM 3RDIndirect Taxes2022

BCOM 3RDIndirect Taxes2022

Uploaded by

radic47998Copyright:

Available Formats

[2]

Roll No. ........................... Total Printed Pages - 8 What do you mean by Customs Duty? Write nature

and types of Customs Duty in India.

/OR

F - 3055

B. Com. (Part III) Examination, 2022 FOB

(Compulsory)

(New Course)

GROUP - II

PAPER FIRST

(Indirect Taxes with GST)

Time : Three Hours] [Maximum Marks:75

[Minimum Pass Marks:25

Note: Attempt all the five questions. One question = `60

from each unit is compulsory. All questions 10%

carry equal marks.

CTA 12%

1/Unit - 1

GST

1.

P.T.O. F - 3055

[3] [4]

An importer has imported raw material from America 2/Unit - 2

at a FOB cost of 50,000 dollars, others details are as

2.

follows.

1 - Goods were packed for which packing

Mention the provisions relating to sale of intoxicants

charges were charged 5000 Dollars

under C.G. Excise Act.

2 - Goods were stuffed in returnable container. /OR

Price of container is 2000 Dollars

3 - Insurance charges 250 Dollars

4 - Sea freight charges 4000 Dollars

5 - Importer had paid commission to broker in `

America who arranged the transaction 500 Dollars

`

6 - Rate of exchange 1 Dollar = `60

7 - Basic Customs Duty 10% `

8 - Rate of Integrated Tax U/S 3(7) of

CTA 1975 12%

9 - Ignore GST compensation cess, find the customs duty

payable.

F - 3055 P.T.O. F - 3055

[5] [6]

The following intoxicants were issued to a dealer of

intoxicants from Bilaspur warehouse in the month of

A

June 2021.

B

1. Bhang auctioned for consumers 15 kg

Write short notes on:

2. Gin (Rate `1600 per case) 450 proof litre

(A) Concept of GST

3. Cordial (Rate `2700 per proof litre)225 proof litre

(B) Goods v/s Services

4. Rum to military organisation 150 proof litre

4/Unit - 4

5. Brandy (Rate `2300 per proof litre) 600 proof litre

4.

6. Whisky to military organisation 75 proof litre

7. Spiced country liquor 300 proof litre

Calculate the amount of excise duty payable by this What are the benefits of registration under GST laws?

dealer under C.G. Excise Act. What are the types of registration under GST? Explain

in details.

3/Unit - 3 /OR

3.

Explain the structure and functions of GST Council.

/OR What is E. Way Bill? Who is responsible for its gen-

eration with necessary information therein?

F - 3055 P.T.O. F - 3055

[7] [8]

5/Unit - 5

`

5.

What are the various returns prescribed under GST

Gupta Transport company (Registered) furnished the

Laws?

following information for the month Dec - 2021.

/OR

Tax Paid

1. Computer used for office 27,800

2. Truck used for transportation of goods 1,08,000

( `)

3. Motorcar used for business purposes 35,400

4. Stores and Lubricant obtained from the unregis-

tered supplier on which tax has been paid by Janta

Transport on reverse charge basis 6,800

5. Capital Goods purchased on which depreciation

has been taken on full value including input tax

thereon 85,000

6. Spare parts purchased from supplier who opted

composition scheme and the composite tax has

not been charged -

Total GST payable for December ` 2,50,000

Calculate allowable Input Tax credit and tax payable.

F - 3055 P.T.O. F - 3055

You might also like

- Atul Agarwal IDT Question BankDocument490 pagesAtul Agarwal IDT Question BankSavya Sachi100% (8)

- Affidavit of Revocation and Rescission Irs - TemplateDocument7 pagesAffidavit of Revocation and Rescission Irs - Templatemderigo100% (7)

- Paycheck - 2023 03 23 - 2023 04 07Document1 pagePaycheck - 2023 03 23 - 2023 04 07tebeck bertran forbitNo ratings yet

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- My Payslips 2022-11-07Document16 pagesMy Payslips 2022-11-07Ildikó Pető-Jánosi0% (1)

- Problem Exercises-Taxation Set 3Document2 pagesProblem Exercises-Taxation Set 3Danny LabordoNo ratings yet

- Solved Herbert A Collector of Rare Coins Bought A 1916 SpanishDocument1 pageSolved Herbert A Collector of Rare Coins Bought A 1916 SpanishAnbu jaromiaNo ratings yet

- Ella Lyman Cabot Trust Question ListDocument2 pagesElla Lyman Cabot Trust Question ListAdeyemi Oluwaseun JohnNo ratings yet

- Part - 2: Return Submission Data: Part - 1: Taxpayer'S InformationDocument2 pagesPart - 2: Return Submission Data: Part - 1: Taxpayer'S InformationMD. Mahbubur RahmanNo ratings yet

- Government of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormDocument11 pagesGovernment of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormMd. Abu NaserNo ratings yet

- Indian Fibre Board Antidumping Case StudyDocument7 pagesIndian Fibre Board Antidumping Case Studysnake8xNo ratings yet

- Instruction To Candidates: Date TransactionDocument5 pagesInstruction To Candidates: Date TransactionYeppeuddaNo ratings yet

- Instruction To Candidates: Date TransactionDocument5 pagesInstruction To Candidates: Date TransactionEphreen Grace MartyNo ratings yet

- Mushak-9 1Document8 pagesMushak-9 1ripon1195No ratings yet

- 63 Goodand Service Tax May 2022Document8 pages63 Goodand Service Tax May 2022bhavanikg00No ratings yet

- Igcrd 2022Document13 pagesIgcrd 2022Abhijyo SinghNo ratings yet

- Monetary Limit - Rates To Remember in GSTDocument15 pagesMonetary Limit - Rates To Remember in GSTtholsjk14No ratings yet

- E/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Document17 pagesE/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Krisha Lei SanchezNo ratings yet

- Quiz CompDocument7 pagesQuiz CompKimberly Anne Malingi LavillaNo ratings yet

- Faxon GroFin Financial PlanDocument8 pagesFaxon GroFin Financial PlanMasiko JamesNo ratings yet

- Ans Sesi Jun 2018Document8 pagesAns Sesi Jun 2018黄勇添No ratings yet

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboNo ratings yet

- Sanchit Grover Income Tax Amendments May2021 6Document71 pagesSanchit Grover Income Tax Amendments May2021 6Ismail RizwanNo ratings yet

- Ca Final: Paper 8: Indirect Tax LawsDocument499 pagesCa Final: Paper 8: Indirect Tax LawsMaroju Rajitha100% (1)

- Analysis of Chapter Compostion SchemeDocument18 pagesAnalysis of Chapter Compostion SchemeSunil Kumar PatroNo ratings yet

- JLPT ReceiptDocument1 pageJLPT ReceiptSanchita RahadeNo ratings yet

- Gr11 April P1 2020 - Marking SchemeDocument9 pagesGr11 April P1 2020 - Marking SchemeMartha AntonNo ratings yet

- Safe International Return September - 2021Document10 pagesSafe International Return September - 2021bidhank.dasNo ratings yet

- Mushak-9 1Document11 pagesMushak-9 1Arnold Roger Curry0% (1)

- Safe International Return August - 2021Document11 pagesSafe International Return August - 2021bidhank.dasNo ratings yet

- MTP 9 13 Answers 1695990555Document9 pagesMTP 9 13 Answers 1695990555Arun KambleNo ratings yet

- Cash Flow TemplateDocument13 pagesCash Flow TemplateJohn ArikoNo ratings yet

- L241 Law of TaxationDocument4 pagesL241 Law of TaxationFrancis ChikombolaNo ratings yet

- Circular-No-22-2020 For The Marketing CompaniesDocument1 pageCircular-No-22-2020 For The Marketing CompaniesAnkit SharmaNo ratings yet

- Paper 4 IDT - Pdfpaper 4 IDTDocument7 pagesPaper 4 IDT - Pdfpaper 4 IDTharsh agarwalNo ratings yet

- Aafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiDocument35 pagesAafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiMuhammad Sohaib AzharNo ratings yet

- Tax Revision Plan With Hrs and MarksDocument7 pagesTax Revision Plan With Hrs and MarksKukuNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Format 62 - Generating Company Data For Financial StudyDocument3 pagesFormat 62 - Generating Company Data For Financial StudymaheswarianuNo ratings yet

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254No ratings yet

- Cost and Management AccountingDocument5 pagesCost and Management AccountingIbtehaj KayaniNo ratings yet

- CITA 031 Test 1 - Memo 2022Document6 pagesCITA 031 Test 1 - Memo 2022Morongwa MamoseboNo ratings yet

- Safe International Return November - 2021Document11 pagesSafe International Return November - 2021bidhank.dasNo ratings yet

- Palamu PKG - 02Document6,188 pagesPalamu PKG - 02MECON-PMA DDUGJY-JBVNLNo ratings yet

- Report 6Document3 pagesReport 6bohigharNo ratings yet

- Budget 2021 Summary Mrunal Competitive ExamsDocument24 pagesBudget 2021 Summary Mrunal Competitive ExamsVarun MatlaniNo ratings yet

- Aziz Sir LPCDocument2 pagesAziz Sir LPCঅনি চৌধুরীNo ratings yet

- 73253bos59102 Final p8Document18 pages73253bos59102 Final p8Vishal AgarwalNo ratings yet

- Previous Year Question Paper 2024 GSTDocument6 pagesPrevious Year Question Paper 2024 GSTsangeetha3508No ratings yet

- Assign QP 2024 May - DP12.2 Tax Law and PracDocument6 pagesAssign QP 2024 May - DP12.2 Tax Law and PracshalomechinodyaNo ratings yet

- KR Vicco Testing & Configuration Business Process Open Sap Cources Sap SD QuestionsDocument18 pagesKR Vicco Testing & Configuration Business Process Open Sap Cources Sap SD QuestionsDiksha PalkeNo ratings yet

- FM Cases For Group PresentationDocument19 pagesFM Cases For Group PresentationSwati AmritNo ratings yet

- US Internal Revenue Service: I1120icd - 1992Document15 pagesUS Internal Revenue Service: I1120icd - 1992IRSNo ratings yet

- SilicaSandPh Intertek Lab Test Silica Quartz (SQSM)Document11 pagesSilicaSandPh Intertek Lab Test Silica Quartz (SQSM)SilicaSandPhNo ratings yet

- Bulletin: Additional Changes Being Made To CIH and FSW Services, Effective Jan. 1, 2022Document2 pagesBulletin: Additional Changes Being Made To CIH and FSW Services, Effective Jan. 1, 2022Indiana Family to FamilyNo ratings yet

- Notes About Section 88 Tax2Document1 pageNotes About Section 88 Tax2Farnaz CharandabiNo ratings yet

- Total No. of Printedpages-11 Maximummarks - 100 ..: PC! Group I-Paper Advanced AccountingDocument11 pagesTotal No. of Printedpages-11 Maximummarks - 100 ..: PC! Group I-Paper Advanced AccountingNyonikaNo ratings yet

- QUIKBook IDT - CA Inter Nov 21Document33 pagesQUIKBook IDT - CA Inter Nov 21Nisha BhandariNo ratings yet

- Illustration 1 - Computation of Duty Drawback: Gajanan & Co. Has Imported A PlantDocument5 pagesIllustration 1 - Computation of Duty Drawback: Gajanan & Co. Has Imported A PlantTapan BarikNo ratings yet

- The Umversity of The West IndiesDocument7 pagesThe Umversity of The West IndiesIsmadth2918388No ratings yet

- 3 Additional Q in 2nd Edition Revised BookDocument29 pages3 Additional Q in 2nd Edition Revised BookVishal AgarwalNo ratings yet

- MTP 1 Ans IdtDocument13 pagesMTP 1 Ans IdtAmra NaazNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxDSM DRIVING SCHOOLNo ratings yet

- M K Fashion & Tailoting Audited 077-78Document11 pagesM K Fashion & Tailoting Audited 077-78Ujjwal GhimireNo ratings yet

- Mock Sep 2023 - Question PaperDocument8 pagesMock Sep 2023 - Question Paperfahadkhn871No ratings yet

- Basics of Central ExciseDocument5 pagesBasics of Central ExciseAkash AgarwalNo ratings yet

- IIHMR Question PapersDocument1 pageIIHMR Question PapersRishi TripathiNo ratings yet

- Form No.16 (See Rule 31 (1) (A) )Document2 pagesForm No.16 (See Rule 31 (1) (A) )Akash ShedgeNo ratings yet

- Invoice: Order No.: 52113272 Order Placed On: 02/01/2023Document1 pageInvoice: Order No.: 52113272 Order Placed On: 02/01/2023Alexandru BadanauNo ratings yet

- Tax Invoice: Input CGST Input SGSTDocument1 pageTax Invoice: Input CGST Input SGSTOmprakash BaralaNo ratings yet

- Ghosh Engineering Corporation: Proforma InvoiceDocument1 pageGhosh Engineering Corporation: Proforma InvoiceKABIR CHOPRANo ratings yet

- f133 PDFDocument1 pagef133 PDFfaresNo ratings yet

- Taxation - Reviewer TaskDocument3 pagesTaxation - Reviewer TaskLaguna HistoryNo ratings yet

- Annex B-1:: Guide On Filling Up The DocumentDocument9 pagesAnnex B-1:: Guide On Filling Up The DocumentGrace UrbanoNo ratings yet

- Principles of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1Document7 pagesPrinciples of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1ambermcbrideokdcjfmgbx100% (32)

- Apr 21Document1 pageApr 21pavan kumarNo ratings yet

- Annex C RR 11-2018Document2 pagesAnnex C RR 11-2018Andoy Domingo CarulloNo ratings yet

- PayslipDocument2 pagesPaysliporrinlloyd750No ratings yet

- Payroll SystemDocument6 pagesPayroll SystemPriyan Trivedi50% (2)

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarNo ratings yet

- JMC Fee Structure 2022 23Document1 pageJMC Fee Structure 2022 23waqarkhan110305No ratings yet

- Income Tax Reviewer-1Document1 pageIncome Tax Reviewer-1Sano ManjiroNo ratings yet

- Capital Gains NotesDocument3 pagesCapital Gains NotesDhiraj SoniNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- Investigation 2024 GR 12Document6 pagesInvestigation 2024 GR 12koekoeorefileNo ratings yet

- Income Tax Return 480.20 (U)Document3 pagesIncome Tax Return 480.20 (U)Alan EscobarNo ratings yet

- Payslip India April - 2023-1-2Document1 pagePayslip India April - 2023-1-2aamirashfaque20No ratings yet

- Letter To Commissioner BIRDocument3 pagesLetter To Commissioner BIReugene juliusNo ratings yet

- Amazon Invoice - Laptop Stand PDFDocument1 pageAmazon Invoice - Laptop Stand PDFAl-Harbi Pvt LtdNo ratings yet