Professional Documents

Culture Documents

Engineering Economy Assignment

Engineering Economy Assignment

Uploaded by

prateekagrawal812004Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economy Assignment

Engineering Economy Assignment

Uploaded by

prateekagrawal812004Copyright:

Available Formats

MEH2450 - Home Assignment to be submitted on

th

Saturday (4 May 2024 between 11 and 11.30 am in Heat Power Lab in workshop area)

1. A special purpose machine is to depreciate following the Straight line method. It costs $25000 and is

expected to produce 100,000 units and then to be sold for $5000. Up to the end of the third year it had

produced 60,000 units and during the fourth year it produced 10,000 units. What is the depreciation

deduction for the fourth year and BV at the end of fourth year?

2. A machine was purchased two years ago for Rs. 10,000. Its annual maintenance cost is Rs. 750. Its life is

six years and its salvage value at the end of its life is Rs. 1,000. Now, a company is offering a new machine

at a cost of Rs. 10,000. Its life is four years and its salvage value at the end of its life is Rs. 4,000. The

annual maintenance cost of the new machine is Rs. 500. The company which is supplying the new

machine is willing to take the old machine for Rs. 8,000 if it is replaced by the new machine. Assume an

interest rate of 12%, compounded annually. Is it advisable to replace the old machine?

3. A certain individual firm desires an economic analysis to determine which of the two machines is

attractive in a given interval of time. The minimum attractive rate of return for the firm is 15%. The

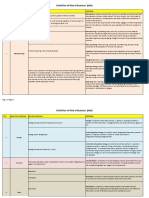

following data are to be used in the analysis:

Which machine would you choose? Base your answer on annual equivalent cost.

4. A company is considering replacing 15 workstations which are on a STAR network. These workstations

have a total salvage value of $8500. The existing system could last for another 3 years with a system

update that will cost $4500 immediately. Also, after the update, the current system will have the

following associated data

Year Salvage value($) Operating & Maintenance Costs ($)

1 7000 13000

2 3500 18000

3 1000 23000

The new workstations will cost $8000 each ($8000*15=$120,000 in total), and implementation for all

the computers will cost $1500. The technological life of the new equipment is 5 years and salvage value

decreases from the first cost by 28% per year. Operating costs will be $4000 for each of the first 2 years

(due to warranty issues) and will be $8000, $10000, and $13000 for years 3 through 5 respectively.

Should the company opt for replacement? If so, when? Use MARR of 8% per annum.

5. An asset that is book-depreciated over a 5-year period by the straight line method has BV3 = $62,000 with

a depreciation charge of $26,000 per year. Determine ( a ) the first cost of the asset and ( b ) the assumed

salvage value.

6. An asset for drilling was purchased and placed in service by a petroleum production company. Its cost

Basis is Rs 60000 and it has an estimated Market value of Rs 12000 at the end of an estimated useful life

of 14 years. Compute the depreciation amount in the third year and the Book Value at the end of the Fifth

year by using (i) straight line method (ii) SYD Method.

You might also like

- Paccar LeasingDocument11 pagesPaccar LeasingJennifer67% (3)

- Home Assignment - 1Document2 pagesHome Assignment - 1Pankaj kumarNo ratings yet

- Literature Review 1 PageDocument9 pagesLiterature Review 1 PageMahbub HussainNo ratings yet

- The Franchisor Feasibility StudyDocument12 pagesThe Franchisor Feasibility StudyLeighgendary CruzNo ratings yet

- Media Planning and Buying: Notes and PPT by Prof - Chahat HargunaniDocument35 pagesMedia Planning and Buying: Notes and PPT by Prof - Chahat HargunaniHarsha Bulani Chahat Hargunani100% (1)

- HA Unit 2Document2 pagesHA Unit 2prateekagrawal812004No ratings yet

- Break-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Document7 pagesBreak-Even Analysis and New Design Economics - Ii: (Draw Profit Volume Diagram)Garima PalNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051) Jul 2022Document6 pagesEngineering Economics and Finacial Management (HUM 3051) Jul 2022uday KiranNo ratings yet

- 2nd Assignment 2021Document3 pages2nd Assignment 2021No NameNo ratings yet

- Week 12 HomeworkDocument2 pagesWeek 12 HomeworkMichael Clark0% (1)

- Assignment 2 2015Document2 pagesAssignment 2 2015marryam nawazNo ratings yet

- IE SeminarDocument18 pagesIE SeminarRik PtlNo ratings yet

- Engg Econ QuestionsDocument7 pagesEngg Econ QuestionsSherwin Dela CruzzNo ratings yet

- BT Lựa Chọn Dự Án EDocument2 pagesBT Lựa Chọn Dự Án EstormspiritlcNo ratings yet

- Eefm ProblemsDocument4 pagesEefm ProblemsChitrala DhruvNo ratings yet

- MEC210 Assignment#4 241Document3 pagesMEC210 Assignment#4 241Mohamed Gamal100% (1)

- Break Even TutorialDocument7 pagesBreak Even TutorialAhmed BeheryNo ratings yet

- Ca-Ipcc Cost-Fm Question Paper Nov 13Document8 pagesCa-Ipcc Cost-Fm Question Paper Nov 13Pravinn_MahajanNo ratings yet

- Ca-Ipcc Question Paper Cost - FM Nov 13Document8 pagesCa-Ipcc Question Paper Cost - FM Nov 13Pravinn_MahajanNo ratings yet

- Cost FM WordDocument8 pagesCost FM WordPravinn_MahajanNo ratings yet

- Engineering Economics Tutorial Chapter Five (1) - 2Document4 pagesEngineering Economics Tutorial Chapter Five (1) - 2saugat pandeyNo ratings yet

- Assignment 2Document2 pagesAssignment 2Parth ShahNo ratings yet

- Unit 2 Problem SheetDocument9 pagesUnit 2 Problem SheetTejas ArgulewarNo ratings yet

- Assig5 2010Document4 pagesAssig5 2010WK LamNo ratings yet

- Corporate Finance AssignmentDocument2 pagesCorporate Finance AssignmentAsad razaNo ratings yet

- Question BankDocument5 pagesQuestion BankAmit KumarNo ratings yet

- Soal-Soal Capital Budgeting # 1Document2 pagesSoal-Soal Capital Budgeting # 1Danang0% (2)

- Engg Economy Assignment-3Document2 pagesEngg Economy Assignment-3Sahil AgrawalNo ratings yet

- Economics For Engineers Model QuestionsDocument16 pagesEconomics For Engineers Model QuestionsNaman KumarNo ratings yet

- Economics of Power GenerationDocument23 pagesEconomics of Power GenerationAbdullah NawabNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- MG2451 ModelDocument2 pagesMG2451 ModelchandrasekarcncetNo ratings yet

- Chapter 5 - Replacement AnalysisDocument29 pagesChapter 5 - Replacement AnalysisUpendra ReddyNo ratings yet

- 7 Problems On Investment Analysis V 1646203039086Document1 page7 Problems On Investment Analysis V 1646203039086Risshi AgrawalNo ratings yet

- CA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesDocument17 pagesCA Final - CA Inter - CA IPCC - CA Foundation Online Test SeriesAyush ThÃkkarNo ratings yet

- BMS College of Engineering, Bangalore-560019: December 2016 Semester End Main ExaminationsDocument3 pagesBMS College of Engineering, Bangalore-560019: December 2016 Semester End Main Examinationshemavathi jayNo ratings yet

- Assignment 5 (Economics Exercises)Document5 pagesAssignment 5 (Economics Exercises)OlyvianurmaharaniNo ratings yet

- Engineering Economics Assi-2SP2023Document2 pagesEngineering Economics Assi-2SP2023Abanob HanyNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Chapter 4 - Annual WorthDocument15 pagesChapter 4 - Annual WorthUpendra ReddyNo ratings yet

- ABPL90030: Project Evaluation Worksheet 2 - EUAC Model For Project EvaluationDocument1 pageABPL90030: Project Evaluation Worksheet 2 - EUAC Model For Project EvaluationMohamed MamdouhNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Mock 2Document16 pagesMock 2happywintNo ratings yet

- Study Set 5Document8 pagesStudy Set 5slnyzclrNo ratings yet

- Breakeven and Payback Analysis: Parameter or Decision VariableDocument5 pagesBreakeven and Payback Analysis: Parameter or Decision VariableZoloft Zithromax ProzacNo ratings yet

- Revalidation Test Paper Intermediate Group II: Revised Syllabus 2008Document6 pagesRevalidation Test Paper Intermediate Group II: Revised Syllabus 2008sureka1234No ratings yet

- Engineering Economy 16th Edition Sullivan Test BankDocument9 pagesEngineering Economy 16th Edition Sullivan Test Bankjohnquyzwo9qa100% (35)

- Pteroleum Economy Exercise - DepreciationDocument31 pagesPteroleum Economy Exercise - Depreciationshaziera omarNo ratings yet

- Annual Worth, Capitalized, RorDocument11 pagesAnnual Worth, Capitalized, RorNaveen KumarNo ratings yet

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- REPLACEMENT1Document51 pagesREPLACEMENT1Ramees KpNo ratings yet

- Capital Budgeting Old New DecisionDocument41 pagesCapital Budgeting Old New DecisionSachi SurbhiNo ratings yet

- Capital Budgeting 5Document9 pagesCapital Budgeting 5Sarvesh SharmaNo ratings yet

- S.No Particulars Old Machine Rs New Machine RsDocument2 pagesS.No Particulars Old Machine Rs New Machine RsnarunsankarNo ratings yet

- Ejercicio Segunda Parte - 2Document1 pageEjercicio Segunda Parte - 2Abril EsparzaNo ratings yet

- Chapter 8Document15 pagesChapter 8GOD100% (1)

- Groups Assignment EcoDocument4 pagesGroups Assignment Ecorobel pop100% (1)

- Mg6863 Engineering Economics: Unit Iv Replacement and Maintenance AnalysisDocument30 pagesMg6863 Engineering Economics: Unit Iv Replacement and Maintenance AnalysisSrinivasNo ratings yet

- Previous Assignment 2Document2 pagesPrevious Assignment 2marryam nawazNo ratings yet

- Replacement Analysis: Worksheet 2.7Document1 pageReplacement Analysis: Worksheet 2.7Spry CylinderNo ratings yet

- Solved Problems and Exercises-DepreciationDocument7 pagesSolved Problems and Exercises-DepreciationKaranNo ratings yet

- IPCC Capital Budgeting and FFS ScannerDocument27 pagesIPCC Capital Budgeting and FFS ScannerMadan SharmaNo ratings yet

- Case Study Arce Dairy Ice CreamDocument4 pagesCase Study Arce Dairy Ice CreamEj Lorido100% (1)

- Chap02 - Information System Building BlocksDocument18 pagesChap02 - Information System Building BlockskunsiahNo ratings yet

- (3.) Interphil Laboratories Employees Union (Digest)Document2 pages(3.) Interphil Laboratories Employees Union (Digest)Dom Robinson BaggayanNo ratings yet

- Appraisal Comments DraftDocument4 pagesAppraisal Comments DraftPramodSadasivanNo ratings yet

- Finance Training ManualDocument94 pagesFinance Training ManualSanju Dani100% (1)

- Opt Toc DBRDocument29 pagesOpt Toc DBRFischer SnapNo ratings yet

- RFQ Package BoilerDocument59 pagesRFQ Package BoilerShubha RoyNo ratings yet

- TSPA Scheme RKSV PDFDocument2 pagesTSPA Scheme RKSV PDFKolla Srikanth100% (1)

- Word of MouthDocument141 pagesWord of MouthMurali MuthusamyNo ratings yet

- Rmi Salinas Report Final DraftDocument62 pagesRmi Salinas Report Final Draftksmith99No ratings yet

- Yayasan IAR Indonesia Account ListDocument19 pagesYayasan IAR Indonesia Account ListYIARI BOGORNo ratings yet

- DEP 37.91.10.11-Gen Mobile Mooring Systems (Endorsement of API RP 2SK, API RP 2SM and API RP 2I)Document9 pagesDEP 37.91.10.11-Gen Mobile Mooring Systems (Endorsement of API RP 2SK, API RP 2SM and API RP 2I)Sd MahmoodNo ratings yet

- 02-05-MILESTONE1TASK2 Back To Envelope CalculationDocument2 pages02-05-MILESTONE1TASK2 Back To Envelope CalculationMuhamad AnnurNo ratings yet

- Coco Tan REO BioDocument3 pagesCoco Tan REO Bioreales8No ratings yet

- How To Start Your Business?Document11 pagesHow To Start Your Business?Resti Gamiarsi100% (1)

- EI Fund Transfer Intnl TT Form V3.0Document1 pageEI Fund Transfer Intnl TT Form V3.0Tosin SimeonNo ratings yet

- Prof Naresh Shroff's ACE Tutorials CS Executive: Costing ConceptsDocument32 pagesProf Naresh Shroff's ACE Tutorials CS Executive: Costing ConceptsSeema NaharNo ratings yet

- Budget and Budgetary ControlDocument14 pagesBudget and Budgetary ControlPassmore DubeNo ratings yet

- CHS CBLM - Apply Quality Standards - FINALDocument51 pagesCHS CBLM - Apply Quality Standards - FINALYvonne Janet Cosico-Dela Fuente100% (1)

- 2.1 Readiness AssessmentDocument4 pages2.1 Readiness AssessmentDwi DharmawanNo ratings yet

- 2.0 Element of Conversion (Latest)Document5 pages2.0 Element of Conversion (Latest)b2utifulxxxNo ratings yet

- Accounts Payable: Oracle Fusion FinancialsDocument20 pagesAccounts Payable: Oracle Fusion Financialsmaha AhmedNo ratings yet

- Bank Reconciliation (Practice Quiz)Document4 pagesBank Reconciliation (Practice Quiz)MoniqueNo ratings yet

- Practice 1 (TV)Document10 pagesPractice 1 (TV)Linh Truc VoNo ratings yet

- Quiz Techno Group1 ECEEEMEDocument2 pagesQuiz Techno Group1 ECEEEMEJohn Mark BallesterosNo ratings yet

- Account Closure Request FormDocument1 pageAccount Closure Request FormNiloy BiswasNo ratings yet

- Definition of Kind of Business (Kob)Document5 pagesDefinition of Kind of Business (Kob)yandexNo ratings yet