Professional Documents

Culture Documents

eFMyQStaTWk0dys2bnAxVjFlaElpZz09 Invoice

eFMyQStaTWk0dys2bnAxVjFlaElpZz09 Invoice

Uploaded by

nagasesha ReddyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

eFMyQStaTWk0dys2bnAxVjFlaElpZz09 Invoice

eFMyQStaTWk0dys2bnAxVjFlaElpZz09 Invoice

Uploaded by

nagasesha ReddyCopyright:

Available Formats

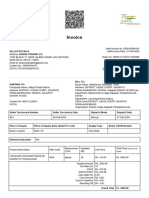

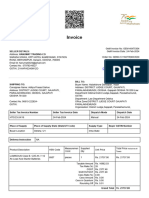

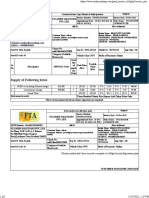

Invoice

GeM Invoice No: GEM-40783551

SELLER DETAILS: GeM Invoice Date: 01-Mar-2024

Address: CONDOR ENTERPRISES

23, WARD NO. 5, PANCHWATI COLONY,MANAWAR, Dhar, Order No: GEMC-511687743096585

MADHYA PRADESH, 454446 Order Date: 29-Feb-2024

Email Id: condorenterprises26@gmail.com

Contact No : 07909808180

GSTIN: 23HHFPS3010D1ZT Click here to download seller invoice

SHIPPING TO:

Consignee Name: Ramaranjan K BILL TO:

Address: BARC [M], RMP, HUNSUR HIGHWAY, Buyer Name: Ramaranjan K

RATNAHALLY COMPLEX, YELWALA, MYSURU, Address: BARC [M], RMP, HUNSUR HIGHWAY,

KARNATAKA, INDIA Mysuru RATNAHALLY COMPLEX, YELWALA, MYSURU,

KARNATAKA 571130 KARNATAKA, INDIA Mysuru KARNATAKA 571130

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

314 01-Mar-2024 Courier 01-Mar-2024

Type of Transport Tracking No Tracking URL Type & No of Packages

- NA Click here for tracking Custom 1

Place of Supply Place of Supply State (State/UT Code) Supply Type Consignee GSTIN Number

Consignee Location Karnataka / 29 Inter-State

Delivery Instruction NA

Measuremen Supplied Total Price inclusive all

Product Description HSN Code Unit Price

t Unit Qty Taxes

CAPRICORN CA--CAPRICORN

IDENTITY SERVICES PRIVATE

998319 pieces 4 Rs. 2495.00 Rs. 9980.00

LIMITED Signature and Encryption

Digital Signature Certificate

Taxable Amount Rs. 8457.63

Tax Rate (%) 18

IGST Rs. 1522.37

Cess Rate (%) 0.00

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.00

Grand Total Rs. 9980.00

I /We hereby declare that our firm/company has been specifically excluded from the requirement to comply with GST e-invoicing

provisions vide Notification number 13/2020-Central Tax dated 21 March 2020, as amended up to date. Accordingly, at present,

we are not covered under the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made

applicable to us, we shall issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- Handbook For Land Registration in ZanzibarDocument223 pagesHandbook For Land Registration in ZanzibarIan Corker100% (1)

- ZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3Document2 pagesZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3nagasesha ReddyNo ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Zk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 InvoiceDocument2 pagesZk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 Invoicerajrathwa85No ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- UVdqZ0Y4UkFWd1J6STdzaWpmbkk1QT09 InvoiceDocument2 pagesUVdqZ0Y4UkFWd1J6STdzaWpmbkk1QT09 Invoicenagasesha ReddyNo ratings yet

- eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceDocument2 pageseEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceAsad ShakilNo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- Invoice: Click Here To Download Seller Tax InvoiceDocument2 pagesInvoice: Click Here To Download Seller Tax InvoiceRaghavendra Rao GNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDocument2 pagesRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNo ratings yet

- Complition of Various DeliveryDocument22 pagesComplition of Various Deliverydipak kambleNo ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- 4087219755Document1 page4087219755devta1111No ratings yet

- TldEdURCaElod0FGVE12NldQL2l6Zz09 InvoiceDocument2 pagesTldEdURCaElod0FGVE12NldQL2l6Zz09 InvoicePratyush kumar NayakNo ratings yet

- ASSAMBILLDocument2 pagesASSAMBILLmahavirtrading0201No ratings yet

- ZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoiceDocument2 pagesZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoicePratyush kumar NayakNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Patel HeliNo ratings yet

- Eshwar Tradesr..Document1 pageEshwar Tradesr..ANAND KAGALENo ratings yet

- E-Invoice: CGST SGST Rounding OffDocument1 pageE-Invoice: CGST SGST Rounding Offsce mduNo ratings yet

- InvoiceDocument1 pageInvoiceas6810827No ratings yet

- Sales Invoice: Customer InformationDocument1 pageSales Invoice: Customer InformationRaghavendra S DNo ratings yet

- AmazonFile 0Document2 pagesAmazonFile 0malikmeerut6No ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- Rahman Industries LTD: Tax InvoiceDocument1 pageRahman Industries LTD: Tax InvoiceRashid KhanNo ratings yet

- Purchase Receipt 934883Document1 pagePurchase Receipt 934883Aryan VermaNo ratings yet

- Document - 2024-02-11T184800.633Document2 pagesDocument - 2024-02-11T184800.633PratapNo ratings yet

- 28 Oct - 406-1121117-5329126Document2 pages28 Oct - 406-1121117-53291261791No ratings yet

- Sale Bill 081Document2 pagesSale Bill 081Nilesh PatilNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mayank PanwarNo ratings yet

- Nitco Invoice No.-4907245361Document2 pagesNitco Invoice No.-4907245361rohanNo ratings yet

- Invoice 3035488213 Njg0nja5odgwoti2otyzmzaynf42odq2mdk4oda3mdyzodm4nziwDocument1 pageInvoice 3035488213 Njg0nja5odgwoti2otyzmzaynf42odq2mdk4oda3mdyzodm4nziwSantosh KARNo ratings yet

- Barrel Motors PVT LTD Invoice SEPT 22Document1 pageBarrel Motors PVT LTD Invoice SEPT 22Priyadarshan BanjanNo ratings yet

- eWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceDocument2 pageseWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceRuskin S. KhadirahNo ratings yet

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDocument2 pagesaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total Amountsolutionsprimotech.secNo ratings yet

- HIRVJIAYDocument1 pageHIRVJIAYArtish PadaiyaNo ratings yet

- Compress Invoice 20240402223953Document1 pageCompress Invoice 20240402223953h92662940No ratings yet

- Milton InvoiceDocument1 pageMilton InvoiceAyush Kumar MishraNo ratings yet

- InvoiceDocument1 pageInvoiceycumoNo ratings yet

- InvoiceDocument1 pageInvoiceshivamdhuriya278No ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- ZEE5 Invoice 07 01 2020Document1 pageZEE5 Invoice 07 01 2020pavan KumarNo ratings yet

- EV CoverDocument1 pageEV Coversantosh.sahuNo ratings yet

- Sales - 1Document1 pageSales - 1Sudhir GhormodeNo ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountSreedharNo ratings yet

- InvoiceDocument1 pageInvoiceVijay TiwariNo ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- HSRPDocument1 pageHSRPAbhinandan SahaniNo ratings yet

- InvertedDocument2 pagesInvertedShrikant KeskarNo ratings yet

- Print Invoice Old - PHPDocument1 pagePrint Invoice Old - PHPDishank RastogiNo ratings yet

- Purchase Invoice 021487352Document1 pagePurchase Invoice 021487352Manjunatha ManjuNo ratings yet

- 1 Shakti Sales AgencyDocument1 page1 Shakti Sales AgencyTIRTH SHAHNo ratings yet

- S&H Committee 1996 PDFDocument11 pagesS&H Committee 1996 PDFlinkencielNo ratings yet

- An Analysis Marxist Feminism The Awakening NovelDocument3 pagesAn Analysis Marxist Feminism The Awakening Novelsour canNo ratings yet

- Department of Education: Grade and Section: 9-WISDOM Adviser: Prilyn S. AlbaricoDocument13 pagesDepartment of Education: Grade and Section: 9-WISDOM Adviser: Prilyn S. Albaricoprilyn albaricoNo ratings yet

- Section 1: Short-Answer Questions (30 Points)Document5 pagesSection 1: Short-Answer Questions (30 Points)Yoon YoonNo ratings yet

- Non-Circumvention and Non-Disclosure AgreementDocument3 pagesNon-Circumvention and Non-Disclosure AgreementPaolo Bautista100% (1)

- Chapter 3 Liquidation ValueDocument11 pagesChapter 3 Liquidation ValueJIL Masapang Victoria ChapterNo ratings yet

- Book One Criminal Law Concepts With New InsertionsDocument296 pagesBook One Criminal Law Concepts With New InsertionsSheerlan Mark J. Quimson100% (1)

- Mexico ReportDocument12 pagesMexico ReportErica GarridoNo ratings yet

- 1643747-RoFM Companion 1 - Ten Towns (Printer Friendly)Document54 pages1643747-RoFM Companion 1 - Ten Towns (Printer Friendly)Hulla BallooNo ratings yet

- MOJO Stock SmallcapDocument3 pagesMOJO Stock SmallcapAnonymous Clm40C1No ratings yet

- Memorandum of Understanding - IPleadersDocument36 pagesMemorandum of Understanding - IPleadersAbhik SahaNo ratings yet

- Corporation Law NotesDocument6 pagesCorporation Law NotesFrances Angelie NacepoNo ratings yet

- Vardhaman Developers Limited Vs Thailambal Co-Op HSG Socy LTD & OrsDocument11 pagesVardhaman Developers Limited Vs Thailambal Co-Op HSG Socy LTD & Orsvineet jainNo ratings yet

- Sheikh Ahmed SirhindiDocument26 pagesSheikh Ahmed SirhindiJassmine Rose100% (6)

- Holt v. United States, 218 U.S. 245 (1910)Document6 pagesHolt v. United States, 218 U.S. 245 (1910)Scribd Government DocsNo ratings yet

- STKHM DcltnHEDocument94 pagesSTKHM DcltnHEhumejraNo ratings yet

- Engineering Economics: ECO31 - BIT401Document55 pagesEngineering Economics: ECO31 - BIT401Jonathan CasillaNo ratings yet

- Research Paper On FemaDocument4 pagesResearch Paper On Femafysxfjac100% (1)

- RPD Daily Incident Report 3/20/24Document4 pagesRPD Daily Incident Report 3/20/24inforumdocsNo ratings yet

- District Memorandum Gender Sensitivity Capacity BuildingDocument2 pagesDistrict Memorandum Gender Sensitivity Capacity BuildingMarquez CartelNo ratings yet

- C.V of ThatoDocument5 pagesC.V of ThatoNoni MphalaneNo ratings yet

- Other Files Group 5 AssignmentDocument30 pagesOther Files Group 5 Assignmentkassahun meseleNo ratings yet

- SONNY LO v. KJS ECO-FORMWORK SYSTEM (OBLI)Document5 pagesSONNY LO v. KJS ECO-FORMWORK SYSTEM (OBLI)SOEDIV OKNo ratings yet

- MOP-general ConditionDocument54 pagesMOP-general Conditionnadher albaghdadiNo ratings yet

- Partnership DeedDocument27 pagesPartnership Deedberwalvivek2febNo ratings yet

- MANSEI (Floridablanca)Document10 pagesMANSEI (Floridablanca)Feb Mae San DieNo ratings yet

- Kearifan Lokal Dan Pengembangan Identitas Untuk Promosi Wisata Budaya Di Kabupaten BanyumasDocument10 pagesKearifan Lokal Dan Pengembangan Identitas Untuk Promosi Wisata Budaya Di Kabupaten BanyumasJamesMasamNo ratings yet

- 2 Paradigms of Public AdministrationDocument10 pages2 Paradigms of Public AdministrationJhourshaiqrylle Wynch LozadaNo ratings yet

- Three-Month Human Rights Monitoring Report On Bangladesh: Reporting Period: January - March 2021Document45 pagesThree-Month Human Rights Monitoring Report On Bangladesh: Reporting Period: January - March 2021Md Raim razzakNo ratings yet