Professional Documents

Culture Documents

Chapter12 - Types of Events - MT

Chapter12 - Types of Events - MT

Uploaded by

neshlgbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter12 - Types of Events - MT

Chapter12 - Types of Events - MT

Uploaded by

neshlgbCopyright:

Available Formats

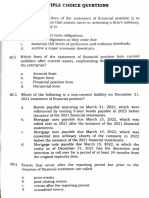

CHAPTER 12: EVENTS AFTER REPORTING PERIOD CFAST - MIDTERMS

TYPES OF EVENTS Example: Adjusting Events

75 Ltd is a producer and distributor of tea. The company’s year

ADJUSTING NON-ADJUSTING ended is 31 December. The directors of 75 ltd are due to sign the

EVENTS EVENTS company’s financial statements for the year ended 31 December on 5

Events after the reporting date and Event after the reporting date March. The following information is available:

before the date of authorization of and before date of authorization

the financial statements that of financial statements that is

1. Flavored tea is included in year-end inventory at its original

provides evidence of conditions indicative of conditions that

cost of P12,000,000. Audit work carried out in February 2024

that existed at the reporting date. arose after the reporting date.

indicated that the tea was sold for P10,000,000 in January 2024

due to a fall in demand for such products during 2023.

❖ IAS 10 states that where there ❖ No adjustment required to

is a material adjusting event, amounts recognized in the 2. During 2023 there had been industrial unrest amongst 75 Ltd

the financial statements must be financial statements but production workers following automation of one of the

changed to reflect this event. possible disclosure. manufacturing processes. Management had sought to make

20% of the workforce redundant. In February 2024, following

protracted negotiations it was agreed that 15% of the workforce

ADJUSTING EVENTS AFTER REPORTING PERIOD would be made redundant at a cost of P400,000.

1. Finding out the actual cost or money made from buying or selling assets

before the end of the reporting period. 3. On 31 January 2024, P2,500,000 was paid to Trevor Baggins as

compensation for his removal of Managing Director. Mr.

2. Checking a property and finding that its value has gone down Baggins has been dismissed by the Chairman at the December

(diminution) permanently. 2023 Board Meeting as a result of a serious disagreement over

3. Receipt of information after the reporting period that an asset was worth marketing strategy for 2023.

less than we thought or that previous impairment was not adequate.

4. It was discovered in January 2024 that a long serving employee

4. Sales of inventory after the reporting period, which shows their Net

had systematically stolen P25,000,000 over the previous four

Realizable Value (NRV) at the end of the reporting period.

years. Material errors had thus been made in the financial

5. Renegotiating with debtors or finding out they can't pay their debts statements over those years and there is now no chance of

(insolvency). recovery.

6. A debtor going bankrupt after the reporting period confirms a loss on

trade receivables existed at the end of the reporting period.

7. Receiving money from insurance claims that were still being discussed at

the end of the reporting period.

8. Discovery of errors or frauds which show the financial statements were

incorrect

NESHL ANGELISSE BALACANTA BSA 1B

CHAPTER 12: EVENTS AFTER REPORTING PERIOD CFAST - MIDTERMS

Issue 1: Inventory is valued at the lower of cost and net realizable value EXAMPLE: Non-Adjusting Events

(IAS 2 Inventories – See Chapter 11). Demand fell during 2023 and the sale

in January 2024 provides evidence of conditions that existed at the Pinewood Limited is a furniture manufacturing company. The

reporting date. Therefore, it is an adjusting event. company was informed on February 1, 2024 that one of its major customers,

Dr SPLOCI – P/L – Cost of goods gold P2,000,000 Cushion Limited, had gone into liquidation. The liquidator indicated that no

Cr SFP – Inventory P20,000 payments would be made to unsecured creditors. The amount owed by

Cushion Limited on February 1, 2024 amounted to P55,000, of which

Issue 2: This is an adjusting event. The redundancy conditions existed at the P30,000 related to goods invoiced on December10, 2023 and P25,000 to

reporting date and the final agreement merely settled the terms. Given its goods invoiced on January 15, 2024.

nature, it might be considered an exceptional item.

Explain how the above item would be dealt with in the financial

Dr SPLOCI – P/L – Redundancy costs P400,000

statements of Pinewood Limited for the year ended December 31, 2023.

Cr SFP – Restructuring provision P400,000

Solution

Issue 3: The dismissal of Mr. Baggins took effect before the end of • As the liquidation occurred after the reporting date, it is dealt with in

Therefore the compensation payment is an adjusting event in the 2023 accordance with IAS 10

financial statements. • The liquidation is an adjusting event

Dr SPLOCI – P/L – Termination costs P2,500,000

• The amount of the adjustment in the 2023 financial statements is

Cr SFP – Other payables P2,500,000 limited to P30,000 (i.e. the amount outstanding at the reporting date)

Issue 4: The discovery of errors/fraud that existed/occurred prior to the end • If the additional amount of P25,000 is deemed to be material, it

of the 2023 reporting period is an adjusting event. should be disclosed by way of note.

NON-ADJUSTING EVENTS AFTER REPORTING PERIOD

Going concern issues arising after the end of the reporting period.

Do not result in changes to the amounts recognized in the FS. They may, An entity should not prepare its financial statements on a going concern

however, be of such materiality that their disclosure is required to ensure that basis if management determines that after the reporting period either:

the FS are not misleading.

• that it intends to liquidate the entity or to cease trading; or

If material, disclose for each material category of non-adjusting event after

• that it has not realistic alternative but to do so.

the reporting date:

• Nature of the event;

• Estimate of the financial effect, or a statement that is not practicable to

make such an estimate; and

• Estimate of the financial effect should be disclosed before taking account

of taxation; and the taxation implications should be explained where

necessary for a proper understanding of the financial position.

NESHL ANGELISSE BALACANTA BSA 1B

CHAPTER 12: EVENTS AFTER REPORTING PERIOD CFAST - MIDTERMS

Proposed Dividends

• To accrue dividends at the reporting date they must have been

approved by shareholders at the Annual General Meeting prior to the ✓ Dividends proposed/declared after the end of the reporting period do not

reporting date. meet the definition of a liability at the end of the reporting period and

should not be accrued in the FS.

• If the dividends are proposed by the directors before the reporting ✓ Dividends due from subsidiaries are not income in parent’s individual

date but the AGM does not take place until after the reporting date accounts if declared after the end of the reporting period.

then the dividend cannot be accrued, but must be disclosed in the

notes to the financial statements.

Disclosure

In addition to the disclosures mentioned previously for non-adjusting

• Equity dividends declared after the end of the reporting period are not events, the following must also be disclosed:

a liability as at the end of the reporting period. These dividends

should be disclosed in a note to the financial statements as a • Date of authorization of the financial statements

contingent liability.

• Who gave authorization

• If the owners or others have the power to amend the financial

statements after issue, this must be disclosed

ADJUSTING EVENTS NON-ADJUSTING

EVENTS

ADJUST FINANCIAL

DISCLOSURE ONLY

STATEMENTS

NESHL ANGELISSE BALACANTA BSA 1B

You might also like

- Families Schools and Communities Together For Young Children PDFDocument2 pagesFamilies Schools and Communities Together For Young Children PDFMisty17% (6)

- Chapter 5Document6 pagesChapter 5jake doinog75% (4)

- Merloni Case - Group 1Document11 pagesMerloni Case - Group 1Prasanta Mondal100% (2)

- Ziva Meditation Ebook PDFDocument33 pagesZiva Meditation Ebook PDFLacramioara Ionescu100% (3)

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

- AP.2907 LiabilitiesDocument6 pagesAP.2907 LiabilitiesmarkNo ratings yet

- State of Maharashtra V. Praful B Desai (DR.), 2003 4 SCCDocument8 pagesState of Maharashtra V. Praful B Desai (DR.), 2003 4 SCCDrsika100% (1)

- Topic 6 - Part 2 Event After Reporting Period - A232Document14 pagesTopic 6 - Part 2 Event After Reporting Period - A232balqisNo ratings yet

- Events After The Reporting PeriodDocument18 pagesEvents After The Reporting PeriodShara Mae SameloNo ratings yet

- Homework 1 2Document1 pageHomework 1 2Aeron Carl SabadoNo ratings yet

- Topic 6 MFRS 110 3 Event - After - Reporting PeriodDocument14 pagesTopic 6 MFRS 110 3 Event - After - Reporting Perioddini sofia100% (1)

- Ias 10 Event After Reporting Period Bac 3Document5 pagesIas 10 Event After Reporting Period Bac 3smsechuNo ratings yet

- Quiz FAR 37 41 AnskeyDocument5 pagesQuiz FAR 37 41 Anskeyjessellejeanenot21No ratings yet

- Cq1 Topics Far2901 To 2926 PDF FreeDocument9 pagesCq1 Topics Far2901 To 2926 PDF FreeKlomoNo ratings yet

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- Trade and Other PayablesDocument4 pagesTrade and Other PayablesJOHANNANo ratings yet

- Auditing Problems Test Banks - LIABILITIES Part 2Document6 pagesAuditing Problems Test Banks - LIABILITIES Part 2Alliah Mae ArbastoNo ratings yet

- AP.3405 Audit of ReceivablesDocument5 pagesAP.3405 Audit of ReceivablesMonica GarciaNo ratings yet

- Satisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsDocument12 pagesSatisfy Short-Term Obligations.: Maintain IAS Levels of Preference and Ordinary DividendsJohn FloresNo ratings yet

- CPA Review Audit of Liabilities Problem No.1 PUKPOK, INC. Is A Manufacturer and Retailer of Household Furniture. Your Audit of The Company'sDocument18 pagesCPA Review Audit of Liabilities Problem No.1 PUKPOK, INC. Is A Manufacturer and Retailer of Household Furniture. Your Audit of The Company'sWerpa PetmaluNo ratings yet

- AP.2807 Liabilities.Document7 pagesAP.2807 Liabilities.May Grethel Joy PeranteNo ratings yet

- Cfas Pas 10Document15 pagesCfas Pas 10Bruegas, Elaiza Rein A.No ratings yet

- AP.3407 Audit of LiabilitiesDocument6 pagesAP.3407 Audit of LiabilitiesMonica GarciaNo ratings yet

- Batch 95 FAR First PreboardDocument15 pagesBatch 95 FAR First PreboardGRACE C. FRANCISCONo ratings yet

- CPAR 95 FAR FINAL PBDocument14 pagesCPAR 95 FAR FINAL PBcaryljoycemaceda3No ratings yet

- 2024 Cta FT January Concept Test 1 - RequiredDocument3 pages2024 Cta FT January Concept Test 1 - Requiredtoni maunganidzeNo ratings yet

- AP.3406 Audit of InvestmentsDocument5 pagesAP.3406 Audit of InvestmentsMonica GarciaNo ratings yet

- Acccob2 Quiz1 Set A With AnswersDocument5 pagesAcccob2 Quiz1 Set A With AnswersshirardadivisoNo ratings yet

- Auditing Problems Ocampo/Soliman/Ocampo AP.2905-Audit of Receivables OCTOBER 2020Document7 pagesAuditing Problems Ocampo/Soliman/Ocampo AP.2905-Audit of Receivables OCTOBER 2020moNo ratings yet

- ACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Document3 pagesACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Lucas BantilingNo ratings yet

- Audit Review PSA 560 Subsequent EventsDocument2 pagesAudit Review PSA 560 Subsequent Eventsetackenneth961No ratings yet

- Activity 1 ReceivablesDocument1 pageActivity 1 ReceivablesApril MagandaNo ratings yet

- Events After Reporting PeriodDocument4 pagesEvents After Reporting PeriodSandia EspejoNo ratings yet

- Week 04 - 01 - Module 09 - Accounting For Receivables (Part 4)Document10 pagesWeek 04 - 01 - Module 09 - Accounting For Receivables (Part 4)지마리No ratings yet

- Ias 10 & 37 - 1Document4 pagesIas 10 & 37 - 1Abdullah QureshiNo ratings yet

- Ias 10 Event After Reporting PeriodDocument6 pagesIas 10 Event After Reporting PeriodsmsechuNo ratings yet

- FD Audit Report July 2015 To Dec 2015 (Revised)Document25 pagesFD Audit Report July 2015 To Dec 2015 (Revised)Chief Of AuditNo ratings yet

- Summary Ias 10 EarpDocument3 pagesSummary Ias 10 EarpMuhammad Tufail DogarNo ratings yet

- AARS Solution Class Test 1 FinalDocument3 pagesAARS Solution Class Test 1 FinalWaseim KhanNo ratings yet

- Far QssolDocument16 pagesFar QssolMelvin BagasinNo ratings yet

- Events After Balancesheet Notes-1Document28 pagesEvents After Balancesheet Notes-1sudeis omaryNo ratings yet

- AUD-90 PW (Part 2 of 2)Document7 pagesAUD-90 PW (Part 2 of 2)Elaine Joyce GarciaNo ratings yet

- 9016 - IFRS 3 Business Combination MergerDocument4 pages9016 - IFRS 3 Business Combination Mergerせい じよNo ratings yet

- FAR Quiz No. 3 Set A Ocampo/Cabarles/Soliman/Ocampo October 2019Document3 pagesFAR Quiz No. 3 Set A Ocampo/Cabarles/Soliman/Ocampo October 2019ChjxksjsgskNo ratings yet

- AC1205 Module 3 - Audit of Liabilities (Discussion Guide) (Student) CorrectedDocument2 pagesAC1205 Module 3 - Audit of Liabilities (Discussion Guide) (Student) Correctedssslll2No ratings yet

- Chapter 12 - Events After The Reporting PeriodDocument3 pagesChapter 12 - Events After The Reporting PeriodFerb CruzadaNo ratings yet

- Ias 10 Events After The Reporting Period: Presented by Lamis Alhslabi Jullanar AldeebDocument16 pagesIas 10 Events After The Reporting Period: Presented by Lamis Alhslabi Jullanar AldeebLamis ShalabiNo ratings yet

- FAR Monthly Assessment November 2020Document11 pagesFAR Monthly Assessment November 2020Refinej WickerNo ratings yet

- FD Audit Report July 2015 To Dec 2015Document25 pagesFD Audit Report July 2015 To Dec 2015Chief Of AuditNo ratings yet

- FAR Preweek (B44)Document10 pagesFAR Preweek (B44)Haydy AntonioNo ratings yet

- ACREV 426 - AP 02 ReceivablesDocument5 pagesACREV 426 - AP 02 ReceivablesEve Jennie Rose MagnificoNo ratings yet

- Auditing Problems MidtermDocument20 pagesAuditing Problems MidtermjasfNo ratings yet

- IAS 10 Presentation. RecoveryDocument16 pagesIAS 10 Presentation. Recoverysaidkhatib368No ratings yet

- 7169 - Noncurrent Asset Held For Sale and Discountinued OperationDocument2 pages7169 - Noncurrent Asset Held For Sale and Discountinued Operationjsmozol3434qcNo ratings yet

- CFAP 6 AARS Winter 2020Document4 pagesCFAP 6 AARS Winter 2020ANo ratings yet

- UNIT 1 Discussion ProblemsDocument13 pagesUNIT 1 Discussion ProblemsMarynelle Labrador SevillaNo ratings yet

- Activity 1 - Auditing Assurance Concepts and ApplicationDocument5 pagesActivity 1 - Auditing Assurance Concepts and ApplicationKei VenusaNo ratings yet

- Cpar 92 Ap PreweekDocument7 pagesCpar 92 Ap PreweekseraseraquexNo ratings yet

- Part 2 PRE2Document3 pagesPart 2 PRE2School FilesNo ratings yet

- Events After The Reporting PeriodDocument4 pagesEvents After The Reporting PeriodGlen JavellanaNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- World Bank East Asia and Pacific Economic Update, Spring 2022: Risks and OpportunitiesFrom EverandWorld Bank East Asia and Pacific Economic Update, Spring 2022: Risks and OpportunitiesNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- ParCor Module 1 - ReviewerDocument6 pagesParCor Module 1 - ReviewerneshlgbNo ratings yet

- Module 1 - Lesson 1: Introduction To History Readings in Philippine HistoryDocument4 pagesModule 1 - Lesson 1: Introduction To History Readings in Philippine HistoryneshlgbNo ratings yet

- RPH M2Lesson 2 ReviewerDocument1 pageRPH M2Lesson 2 ReviewerneshlgbNo ratings yet

- Module 2 Lesson 1 The Philippine RevolutionDocument17 pagesModule 2 Lesson 1 The Philippine RevolutionneshlgbNo ratings yet

- T24-Jbase Editor Tips TricksDocument3 pagesT24-Jbase Editor Tips TricksHeng PutheaNo ratings yet

- CHILL ICE 2™ InstructionDocument2 pagesCHILL ICE 2™ InstructionPlavi MatkoNo ratings yet

- 1 s2.0 S1751616123004368 MainDocument11 pages1 s2.0 S1751616123004368 MainMihai MihaiNo ratings yet

- Apply 5S ProceduresDocument8 pagesApply 5S Proceduresdagmabay136No ratings yet

- Presentation Sussex Conference (1st Year PHD Student)Document9 pagesPresentation Sussex Conference (1st Year PHD Student)vsavvidouNo ratings yet

- Paper 3Document214 pagesPaper 3Denis FernandesNo ratings yet

- V 1Document2 pagesV 1j2daaaNo ratings yet

- MSO-002 Research Methodologies and Methods (WWW - upscPDF.cDocument405 pagesMSO-002 Research Methodologies and Methods (WWW - upscPDF.cABRARUL HAQNo ratings yet

- Exercise 09 - Investigating HazardsDocument23 pagesExercise 09 - Investigating HazardsJill ClarkNo ratings yet

- Sea Me We 4Document14 pagesSea Me We 4Uditha MuthumalaNo ratings yet

- Abbreviations and Acronyms: United Nations Editorial Manual OnlineDocument11 pagesAbbreviations and Acronyms: United Nations Editorial Manual OnlinekhuzaieNo ratings yet

- 01 Drillmec Company Profile E78913cf d70c 465b 911a Ab1b009160baDocument13 pages01 Drillmec Company Profile E78913cf d70c 465b 911a Ab1b009160baDaniel Marulituah SinagaNo ratings yet

- 7.10 Environment and Fossils Through TimeDocument2 pages7.10 Environment and Fossils Through TimeWyatt KesterNo ratings yet

- David Lean's Dedicated Maniac - Memoirs of A Film Specialist by R. Torne and E. FowlieDocument30 pagesDavid Lean's Dedicated Maniac - Memoirs of A Film Specialist by R. Torne and E. FowlieAustin Macauley Publishers Ltd.No ratings yet

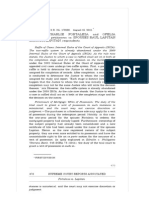

- Fortaleza vs. LapitanDocument15 pagesFortaleza vs. LapitanAji AmanNo ratings yet

- Contract Exam 2015 A PDFDocument7 pagesContract Exam 2015 A PDFAverroes Ibn RushdNo ratings yet

- The Life of Rural Poor Widows in Bangladesh Interview Schedule (Tick Where It Is Needed)Document2 pagesThe Life of Rural Poor Widows in Bangladesh Interview Schedule (Tick Where It Is Needed)Tanvir RezaNo ratings yet

- Grammar Practice 8B - Sofía Sendín B1ADocument1 pageGrammar Practice 8B - Sofía Sendín B1ASofia SendinNo ratings yet

- G10 Q4 Week2finalDocument10 pagesG10 Q4 Week2finalANALYN DEL CASTILLONo ratings yet

- BIO and CHEMDocument13 pagesBIO and CHEMKingfrancis Buga-asNo ratings yet

- Application of Rock Mass Classification Systems ForDocument238 pagesApplication of Rock Mass Classification Systems Fordrtahirnmc100% (1)

- WHAP AP Review Session 6 - 1900-PresentDocument46 pagesWHAP AP Review Session 6 - 1900-PresentNajlae HommanNo ratings yet

- YubiKey 5 CSPN Series Brief 2Document2 pagesYubiKey 5 CSPN Series Brief 2kyowatosiNo ratings yet

- L2 - ABFA1163 FA II (Student)Document4 pagesL2 - ABFA1163 FA II (Student)Xue YikNo ratings yet

- PBL Plant AdaptationDocument55 pagesPBL Plant Adaptationcindy_lee_11No ratings yet

- Broken When EnteringDocument17 pagesBroken When EnteringAbhilasha BagariyaNo ratings yet