Professional Documents

Culture Documents

2021 540 Tax Rate Schedules

2021 540 Tax Rate Schedules

Uploaded by

modi21xyzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 540 Tax Rate Schedules

2021 540 Tax Rate Schedules

Uploaded by

modi21xyzCopyright:

Available Formats

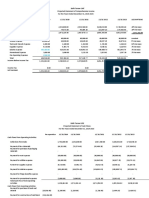

2021 California Tax Rate Schedules

To e-file and eliminate the math, go to ftb.ca.gov. To figure your tax online, go to ftb.ca.gov/tax-rates.

Use only if your taxable income on Form 540, line 19 is more than $100,000. If $100,000 or less, use the Tax Table.

If the amount on

Form 540, line 19 is Enter on Form 540, of the

over – But not over – line 31 amount over –

$ 0 $

9,325 $ 0.00 + 1.00% $ 0

Schedule X – 9,325 22,107 93.25 + 2.00% 9,325

Use if your filing status is 22,107 34,892 348.89 + 4.00% 22,107

Single or Married/RDP Filing Separately 34,892 48,435 860.29 + 6.00% 34,892

48,435 61,214 1,672.87 + 8.00% 48,435

61,214 312,686 2,695.19 + 9.30% 61,214

312,686 375,221 26,082.09 + 10.30% 312,686

375,221 625,369 32,523.20 + 11.30% 375,221

625,369 AND OVER 60,789.92 + 12.30% 625,369

If the amount on Form 540, line 19 is

over – But not over – Enter on Form 540, line 31 of the amount over –

$ 0 $ 18,650 $ 0.00 + 1.00% $ 0

Schedule Y – 18,650 44,214 186.50 + 2.00% 18,650

Use if your filing status is 44,214 69,784 697.78 + 4.00% 44,214

Married/RDP Filing Jointly or Qualifying 69,784 96,870 1,720.58 + 6.00% 69,784

Widow(er) 96,870 122,428 3,345.74 + 8.00% 96,870

122,428 625,372 5,390.38 + 9.30% 122,428

625,372 750,442 52,164.17 + 10.30% 625,372

750,442 1,250,738 65,046.38 + 11.30% 750,442

1,250,738 AND OVER 121,579.83 + 12.30% 1,250,738

If the amount on Form 540, line 19 is

over – But not over – Enter on Form 540, line 31 of the amount over –

$ 0 $ 18,663 $ 0.00 + 1.00% $ 0

Schedule Z – 18,663 44,217 186.63 + 2.00% 18,663

Use if your filing status is 44,217 56,999 697.71 + 4.00% 44,217

Head of Household 56,999 70,542 1,208.99 + 6.00% 56,999

70,542 83,324 2,021.57 + 8.00% 70,542

83,324 425,251 3,044.13 + 9.30% 83,324

425,251 510,303 34,843.34 + 10.30% 425,251

510,303 850,503 43,603.70 + 11.30% 510,303

850,503 AND OVER 82,046.30 + 12.30% 850,503

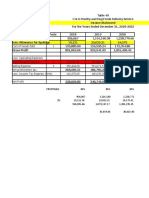

How to Figure Tax Using the 2021 California Tax Rate Schedules

Example: Chris and Pat Smith are filing a joint tax return using Form 540. Their taxable income on Form 540, line 19 is $125,000.

Step 1: Using Schedule Y, they find the taxable income range that includes their taxable income of $125,000.

Example Your Income

Step 2: They subtract the amount at the beginning of their range from $ 125,000 $

their taxable income. - 122,428 -

$ 2,572 $

Step 3: They multiply the result from Step 2 by the percentage for $ 2,572 $

their range. x .0930 x

$ 239.20 $

Step 4: They round the amount from Step 3 to two decimals (if $5,390.38 $

necessary) and add it to the tax amount for their income + 239.20 +

range. After rounding the result, they will enter $5,630 on $5,629.58 $

Form 540, line 31.

Personal Income Tax Booklet 2021 Page 93

You might also like

- Coca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)Document7 pagesCoca-Cola: Residual Income Valuation Exercise & Coca-Cola: Residual Income Valuation Exercise (TN)sarthak mendiratta100% (1)

- Business Finance Q4 Module 3Document21 pagesBusiness Finance Q4 Module 3randy magbudhi80% (15)

- PRTC - TAX-Final PB - May 2022Document16 pagesPRTC - TAX-Final PB - May 2022Luna VNo ratings yet

- PRTC TAX-1stPB 0522 220221 091723Document16 pagesPRTC TAX-1stPB 0522 220221 091723MOTC INTERNAL AUDIT SECTIONNo ratings yet

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- Essentials of Federal Income Taxation For Individuals and BusinessDocument860 pagesEssentials of Federal Income Taxation For Individuals and BusinessAbhisek chudalNo ratings yet

- 2023 Income Tax TablesDocument5 pages2023 Income Tax TablesKhushboo GuptaNo ratings yet

- PRTC 1stpb - 05.22 Sol TaxDocument21 pagesPRTC 1stpb - 05.22 Sol TaxCiatto SpotifyNo ratings yet

- Company Finance Profit & Loss Consolidated (Rs in CRS.)Document4 pagesCompany Finance Profit & Loss Consolidated (Rs in CRS.)rohanNo ratings yet

- PRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressDocument16 pagesPRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressNovemae CollamatNo ratings yet

- Team PRTC FPB Oct 2023 - Tax (Q)Document8 pagesTeam PRTC FPB Oct 2023 - Tax (Q)Daphne PerezNo ratings yet

- Adani CFDocument2 pagesAdani CFRishabhNo ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- Adani Bs MergedDocument10 pagesAdani Bs MergedRishabhNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintAbhay Kumar SinghNo ratings yet

- TSLA 2024 Analysis BBGDocument27 pagesTSLA 2024 Analysis BBGb35705232174ckNo ratings yet

- FM AssignmentDocument10 pagesFM AssignmentKaleab TadesseNo ratings yet

- Example of QofE 1693244744Document49 pagesExample of QofE 169324474467hff84wkxNo ratings yet

- Tax Final Exam Practice Material - CompressDocument10 pagesTax Final Exam Practice Material - CompressNovemae CollamatNo ratings yet

- Project Report 5Document27 pagesProject Report 5adwait kulkarniNo ratings yet

- Maryland TaxDocument2 pagesMaryland TaxsonykhatriNo ratings yet

- Cocopatch ProformaDocument9 pagesCocopatch ProformaRod OrtanezNo ratings yet

- Idea Vs RelianceDocument1 pageIdea Vs RelianceMayank BhardwajNo ratings yet

- GrowthDocument7 pagesGrowthFarooq HaiderNo ratings yet

- IncomeStatement Q12 2Document3 pagesIncomeStatement Q12 2adavidmontoyaNo ratings yet

- Demo Financial PlanDocument30 pagesDemo Financial PlanLinh Nguyễn Hoàng TúNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintUTSAVNo ratings yet

- Profit Loss - 12month ComparisonDocument2 pagesProfit Loss - 12month ComparisonIbrahim SyedNo ratings yet

- Income Statement: End of WorksheetDocument2 pagesIncome Statement: End of WorksheetChetan DasguptaNo ratings yet

- IncomeStatement Q6Document2 pagesIncomeStatement Q6mishuNo ratings yet

- Statement of Financial Position 2018 2019 AssetsDocument19 pagesStatement of Financial Position 2018 2019 AssetsChristine Margoux SiriosNo ratings yet

- NVDA F4Q24 Quarterly Presentation FINALDocument25 pagesNVDA F4Q24 Quarterly Presentation FINALMorby 10No ratings yet

- QofE Pages From A Sample 1705980370Document11 pagesQofE Pages From A Sample 1705980370Kartik KolluriNo ratings yet

- ??? 2023 PDFDocument9 pages??? 2023 PDFnihalNo ratings yet

- Profit & Loss Account of Reliance Industries - in Rs. Cr.Document9 pagesProfit & Loss Account of Reliance Industries - in Rs. Cr.Mansi DeokarNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsMehwish ArsalNo ratings yet

- January Lump: Payables and DifferentialsDocument4 pagesJanuary Lump: Payables and DifferentialsmessiNo ratings yet

- Financial Statements PLDT and GLobeDocument18 pagesFinancial Statements PLDT and GLobeArnelli GregorioNo ratings yet

- Paler, Karlo Dave - INCOME STATEMENT June 26, 2020Document7 pagesPaler, Karlo Dave - INCOME STATEMENT June 26, 2020Karlo PalerNo ratings yet

- Alphabet Inc (GOOGL US) - AdjustedDocument4 pagesAlphabet Inc (GOOGL US) - AdjustedAswini Kumar BhuyanNo ratings yet

- Kid'S Bloom Projected Income Statement For The Year Ended December 31Document3 pagesKid'S Bloom Projected Income Statement For The Year Ended December 31Myrose De La PeñaNo ratings yet

- Balik Tanaw Café Projected Statement of Comprehensive Income For The Years Ended December 31, 2019-2023Document3 pagesBalik Tanaw Café Projected Statement of Comprehensive Income For The Years Ended December 31, 2019-2023Karl Stephen MarbellaNo ratings yet

- Credit Card Payment CalculatorDocument10 pagesCredit Card Payment CalculatorMay Ann PiangcoNo ratings yet

- Bend Bend Bend Bend Spring Hill Mac+ T1 iOS T1 Mac+ T2 iOS T2 Mac+ T1Document3 pagesBend Bend Bend Bend Spring Hill Mac+ T1 iOS T1 Mac+ T2 iOS T2 Mac+ T1Ahsan TirmiziNo ratings yet

- Lab Assignment A8.2 IRS: BackgroundDocument1 pageLab Assignment A8.2 IRS: BackgroundArnav LondheNo ratings yet

- 2022-06 Appropriation Status ReportDocument18 pages2022-06 Appropriation Status Reportkartik soniNo ratings yet

- Cashflow of PowergridDocument2 pagesCashflow of PowergridSunil RathodNo ratings yet

- BIR Withholding Tax Table Effective January 1, 2023Document3 pagesBIR Withholding Tax Table Effective January 1, 2023Gennelyn OdulioNo ratings yet

- Bai Tap 3-SolutionDocument3 pagesBai Tap 3-SolutionMạnh hưng LêNo ratings yet

- Company Finance Balance Sheet (Rs in CRS.)Document13 pagesCompany Finance Balance Sheet (Rs in CRS.)Dinesh SharmaNo ratings yet

- Capital Investment 12-1 To 6 PanisalesDocument8 pagesCapital Investment 12-1 To 6 PanisalesVincent PanisalesNo ratings yet

- IC Digital Sales and Marketing Dashboard TemplateDocument7 pagesIC Digital Sales and Marketing Dashboard TemplatependejitusNo ratings yet

- Narration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Trailing Best Case Worst Caseudaysai shanmukhaNo ratings yet

- LBO EjemploDocument3 pagesLBO Ejemploa01552187No ratings yet

- Payslip Nov 2023Document1 pagePayslip Nov 2023VarshaNo ratings yet

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Boeing Co/The (BA US) - AdjustedDocument15 pagesBoeing Co/The (BA US) - AdjustedAswini Kumar BhuyanNo ratings yet

- CG Fs OLDDocument49 pagesCG Fs OLDDine CapuaNo ratings yet

- Calculator PAYMENTDocument10 pagesCalculator PAYMENTrealtorsinfaridabadNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tutorial 4 Q and ADocument7 pagesTutorial 4 Q and ASwee Yi LeeNo ratings yet

- IncomeDocument4 pagesIncomesonoo.sonoo9170No ratings yet

- Solution Aassignments CH 14Document9 pagesSolution Aassignments CH 14RuturajPatilNo ratings yet

- Macroeconomics Canadian 14th Edition Mcconnell Test Bank Full Chapter PDFDocument60 pagesMacroeconomics Canadian 14th Edition Mcconnell Test Bank Full Chapter PDFlilykeva56r100% (15)

- Chapter 2. Basic Income Tax ComputationDocument28 pagesChapter 2. Basic Income Tax Computationdungbebe2003No ratings yet

- GRADE 11 Lesson Notes On Other Adjustments To Final Accounts ACCRUALS AND PREPAYMENTS SEPT 2023Document11 pagesGRADE 11 Lesson Notes On Other Adjustments To Final Accounts ACCRUALS AND PREPAYMENTS SEPT 2023kxngdawkinz20No ratings yet

- CFAS ReviewerDocument17 pagesCFAS ReviewerJoshua Vladimir RodriguezNo ratings yet

- Taxation Law Last Minute Tips: 2019 Bar Operations CommissionDocument17 pagesTaxation Law Last Minute Tips: 2019 Bar Operations CommissionJoyce LapuzNo ratings yet

- Bafs MC QuestionDocument9 pagesBafs MC Questionle2ztungNo ratings yet

- Legal Accounting - AsselinDocument380 pagesLegal Accounting - Asselinnehaanehaa2002No ratings yet

- Tax Review RenewedDocument97 pagesTax Review RenewedMary Luz EbesNo ratings yet

- CARES Housing Assistance Program Application 1824768Document4 pagesCARES Housing Assistance Program Application 1824768daveNo ratings yet

- Practice Questions Quizz 1 - WITHOUT ANSWERSDocument40 pagesPractice Questions Quizz 1 - WITHOUT ANSWERSSun NyNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- 93 - Final Preboard AFARDocument18 pages93 - Final Preboard AFAREpfie SanchesNo ratings yet

- Lettuce ProductionDocument14 pagesLettuce ProductionJay ArNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pavani MsrNo ratings yet

- Group Fin533 Important TaxationDocument4 pagesGroup Fin533 Important Taxationnurul affidaNo ratings yet

- Accounting Test - Level1 - EnglishDocument4 pagesAccounting Test - Level1 - EnglishTamaraAssorCohenNo ratings yet

- Module 4. Donors Tax-Gross Gifts, Examptions and Tax RatesDocument5 pagesModule 4. Donors Tax-Gross Gifts, Examptions and Tax RatesYolly DiazNo ratings yet

- MGT402 FinalTerm 2017Document8 pagesMGT402 FinalTerm 2017HAADII BHUTTANo ratings yet

- Republic Act No. 11976 (EOPT) - Infographics - SGVDocument3 pagesRepublic Act No. 11976 (EOPT) - Infographics - SGVAlbert SantiagoNo ratings yet

- Nov 23 T2Document26 pagesNov 23 T2myracielolazartigueNo ratings yet

- Tee 1as Level QP Acc 2021Document10 pagesTee 1as Level QP Acc 2021Kalash JainNo ratings yet

- Fiscal PolicyDocument12 pagesFiscal PolicyWaleed YusufNo ratings yet

- Case 4-1Document15 pagesCase 4-1Cat-o ObillosNo ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- CREBA vs. Romulo, GR No. 160756 Dated March 9, 2010Document4 pagesCREBA vs. Romulo, GR No. 160756 Dated March 9, 2010daybarbaNo ratings yet

- Audited Financial Statements Airlines 2021Document60 pagesAudited Financial Statements Airlines 2021VENICE OMOLONNo ratings yet