Professional Documents

Culture Documents

PayFlex+RRA Generic+member+flyer

PayFlex+RRA Generic+member+flyer

Uploaded by

Ch tahaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PayFlex+RRA Generic+member+flyer

PayFlex+RRA Generic+member+flyer

Uploaded by

Ch tahaCopyright:

Available Formats

Retiree Reimbursement Account (RRA)

Helping you pay for specific health expenses

What is an RRA?

An RRA is an employer-funded account that helps you pay for eligible medical expenses during retirement. Expenses

include most healh-related expenses and health coverage premiums.

Benefits of an RRA

• Be better prepared for retirement. Use your RRA funds to pay for eligible health care expenses during retirement.

Your employer determines what's eligible.

• It's employer funded. Your employer contributions are usually credited to your account on a regular basis.

• Enjoy online support. You have 24/7 access to your account information from your PayFlex® member website.

You can:

- View your account balance and employer contributions

- Submit claims for reimbursement

- Enroll in direct deposit

- Review debit card transactions (if applicable)

69.03.753.1-ST (8/19) payflex.com

How to use your RRA funds

Using the funds in your RRA is easy. Your employer sets the

amount contributed to your RRA. And once you're eligible to

use your funds, you have three ways to spend your RRA

dollars.

You can:

• Pay for an eligible expense with cash, a check or a

personal credit card. Then, submit a claim for

reimbursement. You can do this online, through the PayFlex

Mobile® app or by filling out a paper claims form.

• Use your PayFlex Card to pay for an eligible expense (if

offered).

• Pay your provider: Use the PayFlex® online feature to pay

your provider directly from your account.

Things to remember

• Your RRA funds are available as soon as you retire.

• When submitting a claim for reimbursement, you can have

the money deposited directly into your checking or savings

account. If you don't sign up for direct deposit, we'll mail

you a check. Got questions?

• Qualified expenses are set by your employer according to

Visit payflex.com or call us directly at

Internal Revenue Service guidelines.

1–844–729–3539 (TTY: 711). We’re here to help

Monday - Friday 7a.m. -7p.m. CT, and Saturday

9a.m. - 2p.m. CT.

Good to go

The PayFlex Mobile app helps keep it simple.

Manage your account.

View alerts and notifications.

Snap a photo to submit a claim.

PayFlex Systems USA, Inc.

This material is for informational purposes only and is not an offer of coverage. It contains only a partial, general description of plan benefits

or programs and does not constitute a contract. It does not contain legal or tax advice. You should contact your legal counsel if you have any

questions or if you need additional information. In case of a conflict between your plan documents and the information in this material, the

plan documents will govern. Eligible expenses may vary from employer to employer. Please refer to your employer’s Summary Plan Description

(“SPD”) for more information about your covered benefits. Information is believed to be accurate as of the production date; however, it is

subject to change. PayFlex cannot and shall not provide any payment or service in violation of any United States (U.S.) economic or trade

sanctions. For more information about PayFlex, go to payflex.com.

PayFlex Mobile® is a registered trademark of PayFlex Systems USA, Inc.

PayFlex Card® is a registered trademark of PayFlex Systems USA, Inc.

©2019 PayFlex Systems USA, Inc.

69.03.753.1-ST (8/19)

You might also like

- Ebook PDF Child Development An Active Learning Approach 3rd Edition PDFDocument41 pagesEbook PDF Child Development An Active Learning Approach 3rd Edition PDFmike.casteel80798% (45)

- Joseph L Greenstein Aka The Mighty AtomDocument2 pagesJoseph L Greenstein Aka The Mighty Atomhbaki0296No ratings yet

- Iep For Chloe Hancock 43969099Document20 pagesIep For Chloe Hancock 43969099api-486886271No ratings yet

- Saving 5920Document5 pagesSaving 5920PhemmyDonOdumosu100% (2)

- Ca38 2014 2015Document72 pagesCa38 2014 2015chc011133No ratings yet

- DSM Oriented Guide For The ASEBADocument45 pagesDSM Oriented Guide For The ASEBACarla Gaspar Duarte100% (1)

- Payroll ProcessDocument16 pagesPayroll Processgeorgebabyc100% (2)

- Pharyngitis. NCPDocument2 pagesPharyngitis. NCPbiancaNo ratings yet

- Top 10 Things You Should Know - . .: About The Reemployment Assistance System When Filing Your ClaimDocument2 pagesTop 10 Things You Should Know - . .: About The Reemployment Assistance System When Filing Your ClaimPatrick PadgettNo ratings yet

- A Guide To Getting Started: Electronic Federal Tax Payment SystemDocument5 pagesA Guide To Getting Started: Electronic Federal Tax Payment SystemJermaine BrownNo ratings yet

- Payroll: Please Read: A Personal Appeal From Wikipedia Founder Jimmy WalesDocument17 pagesPayroll: Please Read: A Personal Appeal From Wikipedia Founder Jimmy WalesBoniface BazilNo ratings yet

- Floater's GuideDocument2 pagesFloater's GuideMarie Francesca HernandezNo ratings yet

- Scope and DelimitatonDocument3 pagesScope and DelimitatonTirso Jr.No ratings yet

- Paybooks Employee Self ServiceDocument19 pagesPaybooks Employee Self Servicejayen0296755No ratings yet

- A Guide To Payroll Management: Product Customers Pricing Resources LoginDocument11 pagesA Guide To Payroll Management: Product Customers Pricing Resources LoginGeetika apurvaNo ratings yet

- Preparing For Billing DetailedDocument4 pagesPreparing For Billing Detailedkhallushaik424No ratings yet

- Umbrella FAQDocument7 pagesUmbrella FAQKusuma NandiniNo ratings yet

- Ighlights: You Ask. We AnswerDocument2 pagesIghlights: You Ask. We AnswerFfsc Fort WorthNo ratings yet

- Tax Homework HelpDocument5 pagesTax Homework Helpbrgdfkvhf100% (1)

- Chapter Two 2.0 Literature Review: Wages DeductionsDocument12 pagesChapter Two 2.0 Literature Review: Wages DeductionsAnonymous J9el68d100% (1)

- Illinois Unemployment Office Help Creating ResumeDocument8 pagesIllinois Unemployment Office Help Creating Resumewisaj0jat0l3100% (1)

- Epf Balance Login UAN Claim Status Epfo IndiaDocument2 pagesEpf Balance Login UAN Claim Status Epfo IndiaRaju GinneNo ratings yet

- Top 6 Audit Triggers To AvoidDocument10 pagesTop 6 Audit Triggers To AvoidnnauthooNo ratings yet

- JobPlanDocument2 pagesJobPlanHarrison KerrNo ratings yet

- Ir340 2020 PDFDocument168 pagesIr340 2020 PDFmaria_nikol_3No ratings yet

- Alliance Trust Full Sipp Handbook 2011Document14 pagesAlliance Trust Full Sipp Handbook 2011rohit1000No ratings yet

- Den KseroDocument168 pagesDen Kseromaria_nikol_3100% (1)

- Xero User ManualDocument8 pagesXero User ManualIMUSIC Corp.No ratings yet

- Payroll Dictionary of Payroll and HR TermsDocument28 pagesPayroll Dictionary of Payroll and HR TermsMarkandeya ChitturiNo ratings yet

- Wage Assignment - Secure Your Financial FutureDocument20 pagesWage Assignment - Secure Your Financial Futureh68007q5No ratings yet

- Acct1130 EcDocument2 pagesAcct1130 EcTre WriNo ratings yet

- PAYROLLDocument17 pagesPAYROLLsaptaksamadder4No ratings yet

- JobPlanDocument2 pagesJobPlangygcj4by8nNo ratings yet

- Paying EmployeeDocument2 pagesPaying EmployeeMohammad YoussefiNo ratings yet

- Chapter Two Literature Review: Salaries Wages Bonuses Withheld TaxesDocument17 pagesChapter Two Literature Review: Salaries Wages Bonuses Withheld TaxesmujtabaNo ratings yet

- Agumentik Task 19 (Blog Writing On Various Topics) by Deep VyasDocument14 pagesAgumentik Task 19 (Blog Writing On Various Topics) by Deep VyasBUNDELKHAND TALENT HUNTNo ratings yet

- Mandatory Employee Benefits - PhilippinesDocument14 pagesMandatory Employee Benefits - Philippinesalexa castroNo ratings yet

- PF1 Chapter 7 - Record of EmploymentDocument76 pagesPF1 Chapter 7 - Record of EmploymentNamie NamieNo ratings yet

- Self Employed Carers GuideDocument3 pagesSelf Employed Carers GuideMagda PredaNo ratings yet

- April 2013 EbriefDocument2 pagesApril 2013 EbriefkyliemkaNo ratings yet

- Individual Tax Return Instructions 2017Document84 pagesIndividual Tax Return Instructions 2017mstephen2448No ratings yet

- How To Lodge Your PAYG ElectronicallyDocument20 pagesHow To Lodge Your PAYG ElectronicallyDuc Trung NguyenNo ratings yet

- FAQs 2021-11-04T15 47 50.021ZDocument3 pagesFAQs 2021-11-04T15 47 50.021ZAYOMIDE ADEMIDENo ratings yet

- WastableDocument164 pagesWastableFredKapuaNo ratings yet

- Redundancy Payments Are TaxedDocument2 pagesRedundancy Payments Are TaxedVivian KongNo ratings yet

- Employee Handbook: Nurses and HcasDocument14 pagesEmployee Handbook: Nurses and HcasAvril FerreiraNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- Qatar WPS - OCT2015 FinalDocument3 pagesQatar WPS - OCT2015 Finalanwarali1975No ratings yet

- Presentation On PayrollDocument19 pagesPresentation On Payrollmudra123456789No ratings yet

- E-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)Document7 pagesE-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)NISHA GHODAKENo ratings yet

- Chapter 3 - Human Resource: What Is Payroll?Document22 pagesChapter 3 - Human Resource: What Is Payroll?Sayyed Mohammad AbbasNo ratings yet

- Ru Les Pertaining To Employees' Provident Fund: Universal Account NumberDocument3 pagesRu Les Pertaining To Employees' Provident Fund: Universal Account NumberSaagar TikheNo ratings yet

- Coyle Personnel - Benefits of PAYEDocument7 pagesCoyle Personnel - Benefits of PAYEwbsltdNo ratings yet

- Instructions For Form 941: (Rev. January 2013)Document10 pagesInstructions For Form 941: (Rev. January 2013)alanngu93No ratings yet

- HRAPOKB HowtoCompleteYourOnboardingTasksinWorkday 261123 2203 142Document10 pagesHRAPOKB HowtoCompleteYourOnboardingTasksinWorkday 261123 2203 142Margaux YapNo ratings yet

- Michigan Employer AdvisorDocument5 pagesMichigan Employer AdvisorMichigan News100% (1)

- Payroll Bureau RichmondDocument2 pagesPayroll Bureau RichmondWillow PayNo ratings yet

- Payroll Fundamentals: RequiredDocument6 pagesPayroll Fundamentals: RequiredJoel Christian MascariñaNo ratings yet

- 84 Lumber 401k Plan Overview Oct 2023Document2 pages84 Lumber 401k Plan Overview Oct 2023cuchillito.sinfilooNo ratings yet

- Tutorial Apply For Benefits Online TWCDocument28 pagesTutorial Apply For Benefits Online TWCThuy PhamNo ratings yet

- Insurance Audits Q & A: Auto Home Business LifeDocument2 pagesInsurance Audits Q & A: Auto Home Business LifeSoe LwinNo ratings yet

- Payroll: Company Financial Salaries Wages DeductionsDocument5 pagesPayroll: Company Financial Salaries Wages DeductionsKavitaNo ratings yet

- NM Self/Participant Direction Employee Employment PacketDocument34 pagesNM Self/Participant Direction Employee Employment PacketShellyJacksonNo ratings yet

- Instructions For Form 941: (Rev. January 2011)Document9 pagesInstructions For Form 941: (Rev. January 2011)Ten TendulkarNo ratings yet

- Forward Budgeting: A Paperless and Electronic Household Budget SystemFrom EverandForward Budgeting: A Paperless and Electronic Household Budget SystemNo ratings yet

- StatrementDocument3 pagesStatrementCh tahaNo ratings yet

- 22Document3 pages22Ch tahaNo ratings yet

- Latif 09610976Document1 pageLatif 09610976Ch tahaNo ratings yet

- Statement 43052192 EUR 2023-05-03 2023-06-03Document1 pageStatement 43052192 EUR 2023-05-03 2023-06-03Ch tahaNo ratings yet

- 2019 - Chelation Therapy in Medicine - Derrick Lonsdale Hormones MatterDocument9 pages2019 - Chelation Therapy in Medicine - Derrick Lonsdale Hormones MatterSimon SaundersNo ratings yet

- NCM 109 Course Syllabus Ay 2022 2023Document17 pagesNCM 109 Course Syllabus Ay 2022 2023ShainaChescaEvans100% (1)

- Lab SafetyDocument75 pagesLab SafetyAskYahGirl ChannelNo ratings yet

- Easy Emg A Guide To Performing Nerve Conduction Studies and Electromyography 3Rd Edition Lyn D Weiss Full ChapterDocument52 pagesEasy Emg A Guide To Performing Nerve Conduction Studies and Electromyography 3Rd Edition Lyn D Weiss Full Chapterbenjamin.legg448100% (8)

- Cerebral Amyloid AngiopathyDocument2 pagesCerebral Amyloid AngiopathyPaolo Giordano100% (1)

- Approaches To Professional SupervisionDocument26 pagesApproaches To Professional SupervisionYvette Lopez CarpinteroNo ratings yet

- Defibrillation & DC Shock: Ns. Retno Setyawati, M.Kep., SP - KMBDocument34 pagesDefibrillation & DC Shock: Ns. Retno Setyawati, M.Kep., SP - KMBdanur ciyeeNo ratings yet

- Click Here To Access Full Test BankDocument9 pagesClick Here To Access Full Test BankRoxy Paris50% (2)

- IET The Chartered Engineer StandardDocument6 pagesIET The Chartered Engineer StandardNg Chee PengNo ratings yet

- Can Amitriptyline Makes You Feel More Awake Instead of DrowsyDocument3 pagesCan Amitriptyline Makes You Feel More Awake Instead of Drowsyteddypol100% (1)

- Unit 8.2 - Planning Final (1-9-2019)Document23 pagesUnit 8.2 - Planning Final (1-9-2019)Josephine TorresNo ratings yet

- PEBC Qualifying Exam References and Resources ListDocument5 pagesPEBC Qualifying Exam References and Resources ListAnkit ShahNo ratings yet

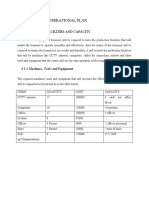

- Chapter Four: Operational Plan: 4.1 Production, Facilities and CapacityDocument4 pagesChapter Four: Operational Plan: 4.1 Production, Facilities and CapacityMonicah MuthokaNo ratings yet

- Domestic Violence Restraining Order Against Alicia ChampionDocument16 pagesDomestic Violence Restraining Order Against Alicia ChampionNationwide ReporterNo ratings yet

- ESP Syllabus For NursingDocument6 pagesESP Syllabus For NursingElut HidaNo ratings yet

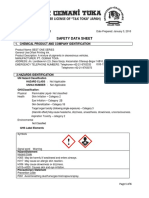

- SDS 175 BEST ONE SeriesDocument6 pagesSDS 175 BEST ONE SeriesWitara SajaNo ratings yet

- Practice 1 - What Is HappinessDocument6 pagesPractice 1 - What Is HappinessTrần Hoàng NamNo ratings yet

- Mapeh9 Assessment Q1 Mod12 W.rubricsDocument4 pagesMapeh9 Assessment Q1 Mod12 W.rubricsPaul Ryan VillanuevaNo ratings yet

- Welfare Schemes: Compiled by Mrs - Sujatha E.MullaDocument10 pagesWelfare Schemes: Compiled by Mrs - Sujatha E.MullaEmmanuel MullaNo ratings yet

- Standard Needs Assessment ReportDocument12 pagesStandard Needs Assessment ReportChantel BainNo ratings yet

- Mother and Child Hospital ReportDocument1 pageMother and Child Hospital ReportclinicallabmchNo ratings yet

- Harshal GawasDocument3 pagesHarshal GawasAnonymous T2Dy9X4FmNo ratings yet

- Best Sports Bra (Category Relaxation and Wellness)Document21 pagesBest Sports Bra (Category Relaxation and Wellness)Iqra 2000No ratings yet

- SAMPLE RobRiches UltraLean LR NEW PDFDocument16 pagesSAMPLE RobRiches UltraLean LR NEW PDFTilak Raj0% (1)

- CR INTRO LetterDocument2 pagesCR INTRO LetterJulio ParadaNo ratings yet