Professional Documents

Culture Documents

Cashflow (Consolidated) - Class Notes

Cashflow (Consolidated) - Class Notes

Uploaded by

Shaheryar ShahidCopyright:

Available Formats

You might also like

- Micro Notes On A2 IAL AccountingDocument15 pagesMicro Notes On A2 IAL AccountingRajibul Haque Shumon100% (2)

- Educational Trading PDFDocument39 pagesEducational Trading PDFSebastianNo ratings yet

- VedantaDocument45 pagesVedantajackkapupara100% (1)

- Preparation of Financial Statement For A Sole TraderDocument8 pagesPreparation of Financial Statement For A Sole TraderDebbie Debz100% (3)

- CHAPTER 16 PartnershipDocument22 pagesCHAPTER 16 PartnershipbabarNo ratings yet

- FDHTFB YdjDocument5 pagesFDHTFB YdjSarathy KannanNo ratings yet

- XXXX XXX XXX XXX XXX XXX XXXDocument3 pagesXXXX XXX XXX XXX XXX XXX XXXIzaya -kunNo ratings yet

- (Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR CompleteDocument12 pages(Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR Completets tanNo ratings yet

- Ias 7: Cashflow Statements: Format - Indirect MethodDocument3 pagesIas 7: Cashflow Statements: Format - Indirect MethodrjmandiaNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Fund From OperationDocument1 pageFund From OperationGood VibesNo ratings yet

- Cash Flow Statement - FormatDocument2 pagesCash Flow Statement - FormatHassan AsgharNo ratings yet

- Cash Flow Statement - IFRS - EN-GBDocument2 pagesCash Flow Statement - IFRS - EN-GBDaniela DeCandiaNo ratings yet

- AC 102 Financial Statements FormatsDocument5 pagesAC 102 Financial Statements FormatsBendroza MelatosiNo ratings yet

- Statement of Cash FlowDocument1 pageStatement of Cash FlowYeehui HayleyNo ratings yet

- Formats of Income Statement, Balance Sheet & Cash Flow StatementDocument3 pagesFormats of Income Statement, Balance Sheet & Cash Flow StatementAli RazaNo ratings yet

- 9 - IAS 7 SummaryDocument2 pages9 - IAS 7 Summaryhuzaifa.sami96No ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Di Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai BerikutDocument2 pagesDi Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai Berikutnoviliaa7No ratings yet

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- SUBJECT:-Management Accounting Unit II: Fund Flow StatementDocument12 pagesSUBJECT:-Management Accounting Unit II: Fund Flow Statementganeshteggihalli7022No ratings yet

- Partnership Name Computation of Partners' - For YA2020Document1 pagePartnership Name Computation of Partners' - For YA2020Anis RoslanNo ratings yet

- Funds Flow Statement FormatDocument2 pagesFunds Flow Statement FormatBheemeswar ReddyNo ratings yet

- Summary Sheet NumericalDocument2 pagesSummary Sheet NumericalSamina HyderNo ratings yet

- Statement of Cash Flows TemplatesDocument1 pageStatement of Cash Flows TemplatesKana jillaNo ratings yet

- Limited Liability Partnership (LLP)Document10 pagesLimited Liability Partnership (LLP)sejal ambetkarNo ratings yet

- Format of Cash FlowDocument3 pagesFormat of Cash Flowsaldanha889No ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- Mutiara Enterprise Statement of Profit or Loss For The Year Ended 31 December 2019Document3 pagesMutiara Enterprise Statement of Profit or Loss For The Year Ended 31 December 2019Zafran100% (1)

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Divisible Income/ (Loss) : Computation of Tax Payable For Each PartnerDocument1 pageDivisible Income/ (Loss) : Computation of Tax Payable For Each PartnerNURAISHA AIDA ATANNo ratings yet

- Cash Flow Statement Cpale BoardDocument2 pagesCash Flow Statement Cpale BoardSharon CarilloNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- ACYAVA 2 Formula SheetDocument13 pagesACYAVA 2 Formula SheetN SNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- RoadmapDocument2 pagesRoadmaplamslamNo ratings yet

- SOPL and SOFP FormatDocument3 pagesSOPL and SOFP Formatnurizzatul syazwaniNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- FABM FORMAT STATEMENT (Final)Document6 pagesFABM FORMAT STATEMENT (Final)RishiiieeeznNo ratings yet

- General Format For Final AccountsDocument2 pagesGeneral Format For Final AccountsGokulCj GroveNo ratings yet

- Format of Final Accounts (Vertical Format)Document3 pagesFormat of Final Accounts (Vertical Format)ummieulfahNo ratings yet

- Employee Benefit Plan Trust - Provident FundDocument4 pagesEmployee Benefit Plan Trust - Provident FundMuhammad Asif KhanNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXMiera FrnhNo ratings yet

- Intermediate Accounting Second Sem ReviewerDocument7 pagesIntermediate Accounting Second Sem ReviewerchxrlttxNo ratings yet

- Proforma of Vertical IncomeDocument2 pagesProforma of Vertical IncomeBheemeswar ReddyNo ratings yet

- Financial Statement of Sole Trader LHADocument2 pagesFinancial Statement of Sole Trader LHASameer AliNo ratings yet

- FS FormatDocument3 pagesFS FormatMaryam AhmedNo ratings yet

- Annex D - SCFDocument44 pagesAnnex D - SCFJohn Eivor Go OrroNo ratings yet

- Part Ii - Statement of Profit and LossDocument3 pagesPart Ii - Statement of Profit and LossSaumyajit DeyNo ratings yet

- Income Statement FormatDocument2 pagesIncome Statement FormatShruti MohanNo ratings yet

- Partnership - Income StatementDocument2 pagesPartnership - Income StatementChan Chin ChunNo ratings yet

- Final - Accounts Format 234 PDFDocument13 pagesFinal - Accounts Format 234 PDFajaychattaNo ratings yet

- Final - Accounts Format PDFDocument13 pagesFinal - Accounts Format PDFajaychatta100% (1)

- Funds Flow State Ment Method 2Document1 pageFunds Flow State Ment Method 2Vignesh NarayananNo ratings yet

- Format For Financial StatementDocument3 pagesFormat For Financial StatementmmasalekNo ratings yet

- Accountancy All FormulaDocument23 pagesAccountancy All FormulaThe Unknown vlogger100% (1)

- Chapter 6 - SOPL FormatDocument1 pageChapter 6 - SOPL Formatquraisha irdinaNo ratings yet

- Fundamentals of Accounting and Business ManagementDocument4 pagesFundamentals of Accounting and Business ManagementSan Juan Ezthie100% (1)

- Cash FlowDocument5 pagesCash FlowSirdar MukodzaniNo ratings yet

- 1-Cash Flow StatementDocument21 pages1-Cash Flow StatementOvais Zia100% (1)

- Cash Flow StatementDocument5 pagesCash Flow StatementDebaditya SenguptaNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Stock Valuation Is The Process of Determining The Intrinsic Value of A CompanyDocument3 pagesStock Valuation Is The Process of Determining The Intrinsic Value of A CompanyShaheryar ShahidNo ratings yet

- KPI's For Accounts & Finance DeptDocument1 pageKPI's For Accounts & Finance DeptShaheryar ShahidNo ratings yet

- Q-1 Jun-16 SOLUTIONDocument3 pagesQ-1 Jun-16 SOLUTIONShaheryar ShahidNo ratings yet

- Q-1 Jun-11 SOLUTIONDocument1 pageQ-1 Jun-11 SOLUTIONShaheryar ShahidNo ratings yet

- 12 - Consolidated Financial Statement (July 23) 1Document474 pages12 - Consolidated Financial Statement (July 23) 1Shaheryar ShahidNo ratings yet

- ResultofCAFExamination Autumn2021Document196 pagesResultofCAFExamination Autumn2021Shaheryar ShahidNo ratings yet

- Leveraged Buyouts: Characteristics Evidence On Lbos An Lbo (Private Equity) Model Reverse LbosDocument36 pagesLeveraged Buyouts: Characteristics Evidence On Lbos An Lbo (Private Equity) Model Reverse Lboschand1234567893No ratings yet

- Finance: Sample Exam QuestionsDocument32 pagesFinance: Sample Exam QuestionsYasir ShaikhNo ratings yet

- CF Export 29 04 2023Document9 pagesCF Export 29 04 2023Shubham KumarNo ratings yet

- Img 20200525 0001Document1 pageImg 20200525 0001Tisha ReddyNo ratings yet

- CSLDocument4 pagesCSLEnriqueNo ratings yet

- Smart InsureWealth Plus - BrochureDocument24 pagesSmart InsureWealth Plus - BrochureIswarya SelvarajNo ratings yet

- DJSR Second EditionDocument65 pagesDJSR Second EditionPrabhashini WijewanthaNo ratings yet

- FIN 605.Ch 1Document45 pagesFIN 605.Ch 1Torun SoktyNo ratings yet

- Module 2Document28 pagesModule 2Jiane SanicoNo ratings yet

- Abacus Capital - Investment Corp v. TabujaraDocument1 pageAbacus Capital - Investment Corp v. TabujaraRoger Montero Jr.No ratings yet

- Chapter 6 - Stu PDFDocument42 pagesChapter 6 - Stu PDFGiang GiangNo ratings yet

- Factors To Consider When Setting Prices and Its General Pricing ApproachesDocument5 pagesFactors To Consider When Setting Prices and Its General Pricing Approacheschelseamanacho11No ratings yet

- ProspectusDocument9 pagesProspectusRakesh BhoirNo ratings yet

- Arker Enter: Working Paper SeriesDocument47 pagesArker Enter: Working Paper SeriesLiviu FrîncuNo ratings yet

- A Term Paper On Sources of Finance in Specific Industries in BangladeshDocument13 pagesA Term Paper On Sources of Finance in Specific Industries in BangladeshFahim MalikNo ratings yet

- G 11 Eco Worksheet Unit 5 Trade and FinanceDocument7 pagesG 11 Eco Worksheet Unit 5 Trade and FinanceKifle BerhaneNo ratings yet

- Leverage and Capital StructureDocument63 pagesLeverage and Capital Structurepraveen181274100% (1)

- Multifamily Finance ReformDocument7 pagesMultifamily Finance ReformDanielSiesser100% (1)

- (Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Document156 pages(Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Vignesh KathiresanNo ratings yet

- Financial Structure and GrowthDocument4 pagesFinancial Structure and GrowthFabiola García FernándezNo ratings yet

- BFC5935 - Tutorial 5 SolutionsDocument5 pagesBFC5935 - Tutorial 5 SolutionsXue XuNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio AnalysisFranco Martin MutisoNo ratings yet

- Exam1 WS1213Document10 pagesExam1 WS1213Faisal AzizNo ratings yet

- QuestionsDocument80 pagesQuestionsjoshuaNo ratings yet

- SFP Act 2021Document4 pagesSFP Act 2021moreNo ratings yet

- Fitri Risma Utami - Tugas 2Document4 pagesFitri Risma Utami - Tugas 2Resti ViadonaNo ratings yet

- Aaa Top100 - 12dec2022-1Document13 pagesAaa Top100 - 12dec2022-1Cm BeNo ratings yet

Cashflow (Consolidated) - Class Notes

Cashflow (Consolidated) - Class Notes

Uploaded by

Shaheryar ShahidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cashflow (Consolidated) - Class Notes

Cashflow (Consolidated) - Class Notes

Uploaded by

Shaheryar ShahidCopyright:

Available Formats

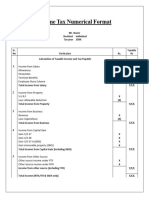

IAS 7 – CASHFLOW STATEMENT [Consolidated] – Class notes

[Indirect method]

Group name

Consolidated Statement of cash flows

For the year ended -----------------

Rs.’000 Rs.’000

Cash flow from operating activities:

Profit before tax XXX

Add: Depreciation / Amortization XXX

Loss on disposal of asset XXX

Loss on disposal of subsidiary/associate XXX

Impairment loss XXX

Impairment loss of goodwill (W-1) XXX

Total interest expense / Finance cost XXX

Bad debt expense XXX

Retirement benefits cost (e.g. gratuity) XXX

Fair value loss [P&L] XXX

Less: Interest income / Investment income (XXX)

Dividend income (XXX)

Fair value gain [P&L] (XXX)

Grant income (XXX)

Share or profit from associate [Share of PAT – URP (P to A)] (W-2) (XXX)

Profit on derecognition of earlier investment [i.e. direct investment in SS] (XXX)

Gain on disposal of subsidiary/associate (XXX)

Profit on sale of asset (XXX)

Operating profit before working capital changes: XXX

(Increase) / Decrease in debtors (XXX) / XXX

(Increase) / Decrease in stocks (XXX) / XXX

(Increase) / Decrease in advances (XXX) / XXX

(Note-2)

(Increase) / Decrease in prepayments (XXX) / XXX

Increase / (Decrease) in creditors XXX / (XXX)

Increase / (Decrease) in accruals XXX / (XXX)

Increase / (Decrease) in short term provisions XXX / (XXX)

Cash generated from operations XXX

Tax paid / Tax refund (XXX) / XXX

Retirement benefits paid (XXX)

Interest / Finance cost paid (XXX)

Cash inflow / (Outflow) from operating activities (A) XXX

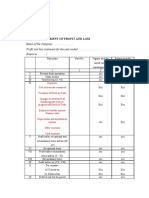

Cash flow from investing activities:

Purchase of PPE (XXX)

Sale of PPE XXX

Purchase of investment property (XXX)

Sale of investment property XXX

Purchase of intangible asset (XXX)

Sale of intangible asset XXX

Expenditure on capital WIP (XXX)

NASIR ABBAS FCA Page 1 | 5

IAS 7 – CASHFLOW STATEMENT [Consolidated] – Class notes

Long term deposits (XXX)

Govt. grant received XXX

Govt. grant repaid (XXX)

Purchase of subsidiary (W-3) (XXX)

Sale of subsidiary (W-4) XXX

Purchase of associate (W-2) (XXX)

Sale of associate XXX

Purchase of investment (XXX)

Sale of investment XXX

Interest received XXX

Dividend received from associate (W-2) XXX

Dividend received XXX

Cash inflow / (outflow) from investing activities (B) XXX

Cash flow from financing activities:

Issue of shares XXX

Issue of shares to NCI XXX

Proceeds from loan XXX

Dividend paid (XXX)

Dividend paid to NCI (W-5) (XXX)

Repayment / redemption of loan (XXX)

Repayment of lease liabilities (XXX)

Cash inflow / (outflow) from financing activities (C) XXX

Net cash inflow / (outflow) during the year (A + B + C) XXX

Cash and cash equivalents at start of year XXX

Cash and cash equivalents at end of year XXX

CASH AND CASH EQUIVALENTS:

Opening Closing

Cash in hand XXX XXX

Bank balance XXX XXX

Bank overdraft / running finance (XXX) (XXX)

Short term investments (e.g. treasury bills) XXX XXX

XXX XXX

Exchange gain / (loss) on cash & cash equivalent XXX -

XXX XXX

OTHER EXAM NOTES:

1. Inter-company receipts and payments are eliminated (i.e. not shown on consolidated cashflow statement)

2. While calculating working capital changes DEDUCT:

- Value (at acquisition date) of relevant asset/liability of S acquired during the year FROM year-end

balance of corresponding asset/liability

- Value (at disposal date) of relevant asset/liability of S disposed during the year FROM year-start

balance of corresponding asset/liability.

NASIR ABBAS FCA Page 2 | 5

IAS 7 – CASHFLOW STATEMENT [Consolidated] – Class notes

3. In all other workings we studied in revision, put values at acquisition date and values at disposal date of

assets/liabilities arising on purchase of subsidiary and disposal of subsidiary respectively during the year in relevant

accounts as non-cash items. For example:

PPE at NBV

Opening balance (NBV) XXX Disposal (NBV) XXX

Addition: Revaluation loss XXX

- Cash (balancing) XXX Depreciation XXX

- Non cash XXX Impairment loss XXX

Recognized on acquisition of subsidiary XXX Derecognized on disposal of subsidiary XXX

Transfer from capital WIP (W – 11) XXX Closing balance (NBV) XXX

Revaluation gain XXX

Leased during the year (W – 17) XXX

WORKINGS

W–1 Impairment loss of goodwill

Goodwill

Opening balance XXX Carrying amount of goodwill derecognized XXX

on disposal of subsidiary during the year

Goodwill arising on acquisition of subsidiary XXX Impairment loss XXX

during the year

Closing balance XXX

W–2 Investment in associates

Investment in associates

Opening balance XXX Share of dividend declared by associate XXX

during the year

New investment in associate made during XXX Carrying amount of investment in associate XXX

the year derecognized during the year

Share of PAT for the year XXX URP on goods/PPE [P to A] XXX

Share of OCI for the year XXX Closing balance XXX

Dividend received from associate

= Opening dividend receivable + Share of dividend declared by associate – Closing dividend receivable

W–3 Purchase of subsidiary

Purchase of subsidiary = Cash consideration paid – Cash & cash equivalents of S at acquisition date

W–4 Sale of subsidiary

Sale of subsidiary = Cash consideration received – Cash & cash equivalents of S at disposal date

NASIR ABBAS FCA Page 3 | 5

IAS 7 – CASHFLOW STATEMENT [Consolidated] – Class notes

W–5 Dividend paid to NCI

NCI

NCI share of dividend declared by S during XXX Opening balance XXX

the year

NCI derecognized on disposal of subsidiary XXX TCI attributable to NCI XXX

during the year

Closing balance XXX NCI recognized at acquisition of subsidiary XXX

during the year

Dividend paid to NCI

= Opening dividend payable + NCI share of dividend declared by S – Closing dividend payable

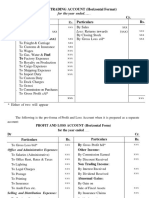

[Direct method]

Group name

Consolidated Statement of cash flows

For the year ended -----------------

Rs.’000 Rs.’000

Cash flow from operating activities:

Receipts from customers (W-1) XXX

Payments to suppliers (W-2) (XXX)

Payment for other operating expenses (W-3) (XXX)

Cash generated from operations XXX

``

``

Remaining format after “cash generated from operations” is exactly

same as Indirect method

``

``

W–1 Receipts from customers

Debtors

Opening balance (Gross) XXX Bad debts written off XXX

Recognized on acquisition of subsidiary XXX Derecognized on disposal of subsidiary XXX

Sales XXX Receipts (balancing) XXX

Closing balance (Gross) XXX

W–2 Payments to suppliers

Creditors

Payments (balancing) XXX Opening creditors XXX

Derecognized on disposal of subsidiary XXX Recognized on purchase of subsidiary XXX

Closing creditors (Note) XXX Purchases (from Inventory account) XXX

Inventory

Opening stock XXX Cost of sales XXX

Recognized on purchase of subsidiary XXX Derecognized on disposal of subsidiary XXX

Purchases (balancing) XXX Closing stock XXX

NASIR ABBAS FCA Page 4 | 5

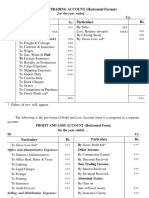

IAS 7 – CASHFLOW STATEMENT [Consolidated] – Class notes

W–3 Payment for other operating expenses

Operating expenses

Opening advances & prepayments XXX Opening accrued expenses XXX

Accrued expenses derecognized on disposal XXX Accrued expenses recognized on purchase of XXX

of subsidiary subsidiary

Recognition of prepayments on purchase of XXX Derecognition of prepayments on disposal XXX

subsidiary of subsidiary

Payments (balancing) XXX Operating expenses (Note) XXX

Closing accrued expenses XXX Closing advances & prepayments XXX

Notes – Operating expenses = Admin expenses + Distribution cost + Other expenses – Depreciation – Amortization

– Bad debt expense – Impairment loss – retirement benefit expense – loss on disposal of

asset/subsidiary – fair value loss – exchange loss

DISCLOSURES

1. When subsidiary is purchased or disposed during the year, following shall be disclosed:

- Total consideration paid or received

- Portion of consideration consisting of cash and cash equivalents

- Amount of cash and cash equivalents in subsidiaries purchased or disposed

- Amount of assets and liabilities other than cash and cash equivalents in subsidiaries purchased or

disposed

2. Non-cash transactions in investing and financing activities such as:

- Acquisition of assets assuming directly related liabilities (e.g. loan)

- Leases

- Acquisition of an entity by an equity issue

- Conversion of debt to equity

3. Components of cash and cash equivalents.

NASIR ABBAS FCA Page 5 | 5

You might also like

- Micro Notes On A2 IAL AccountingDocument15 pagesMicro Notes On A2 IAL AccountingRajibul Haque Shumon100% (2)

- Educational Trading PDFDocument39 pagesEducational Trading PDFSebastianNo ratings yet

- VedantaDocument45 pagesVedantajackkapupara100% (1)

- Preparation of Financial Statement For A Sole TraderDocument8 pagesPreparation of Financial Statement For A Sole TraderDebbie Debz100% (3)

- CHAPTER 16 PartnershipDocument22 pagesCHAPTER 16 PartnershipbabarNo ratings yet

- FDHTFB YdjDocument5 pagesFDHTFB YdjSarathy KannanNo ratings yet

- XXXX XXX XXX XXX XXX XXX XXXDocument3 pagesXXXX XXX XXX XXX XXX XXX XXXIzaya -kunNo ratings yet

- (Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR CompleteDocument12 pages(Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR Completets tanNo ratings yet

- Ias 7: Cashflow Statements: Format - Indirect MethodDocument3 pagesIas 7: Cashflow Statements: Format - Indirect MethodrjmandiaNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Fund From OperationDocument1 pageFund From OperationGood VibesNo ratings yet

- Cash Flow Statement - FormatDocument2 pagesCash Flow Statement - FormatHassan AsgharNo ratings yet

- Cash Flow Statement - IFRS - EN-GBDocument2 pagesCash Flow Statement - IFRS - EN-GBDaniela DeCandiaNo ratings yet

- AC 102 Financial Statements FormatsDocument5 pagesAC 102 Financial Statements FormatsBendroza MelatosiNo ratings yet

- Statement of Cash FlowDocument1 pageStatement of Cash FlowYeehui HayleyNo ratings yet

- Formats of Income Statement, Balance Sheet & Cash Flow StatementDocument3 pagesFormats of Income Statement, Balance Sheet & Cash Flow StatementAli RazaNo ratings yet

- 9 - IAS 7 SummaryDocument2 pages9 - IAS 7 Summaryhuzaifa.sami96No ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Di Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai BerikutDocument2 pagesDi Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai Berikutnoviliaa7No ratings yet

- Fund Flow:: Working CapitalDocument19 pagesFund Flow:: Working CapitalAlex JayachandranNo ratings yet

- SUBJECT:-Management Accounting Unit II: Fund Flow StatementDocument12 pagesSUBJECT:-Management Accounting Unit II: Fund Flow Statementganeshteggihalli7022No ratings yet

- Partnership Name Computation of Partners' - For YA2020Document1 pagePartnership Name Computation of Partners' - For YA2020Anis RoslanNo ratings yet

- Funds Flow Statement FormatDocument2 pagesFunds Flow Statement FormatBheemeswar ReddyNo ratings yet

- Summary Sheet NumericalDocument2 pagesSummary Sheet NumericalSamina HyderNo ratings yet

- Statement of Cash Flows TemplatesDocument1 pageStatement of Cash Flows TemplatesKana jillaNo ratings yet

- Limited Liability Partnership (LLP)Document10 pagesLimited Liability Partnership (LLP)sejal ambetkarNo ratings yet

- Format of Cash FlowDocument3 pagesFormat of Cash Flowsaldanha889No ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- Mutiara Enterprise Statement of Profit or Loss For The Year Ended 31 December 2019Document3 pagesMutiara Enterprise Statement of Profit or Loss For The Year Ended 31 December 2019Zafran100% (1)

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Divisible Income/ (Loss) : Computation of Tax Payable For Each PartnerDocument1 pageDivisible Income/ (Loss) : Computation of Tax Payable For Each PartnerNURAISHA AIDA ATANNo ratings yet

- Cash Flow Statement Cpale BoardDocument2 pagesCash Flow Statement Cpale BoardSharon CarilloNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- ACYAVA 2 Formula SheetDocument13 pagesACYAVA 2 Formula SheetN SNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- RoadmapDocument2 pagesRoadmaplamslamNo ratings yet

- SOPL and SOFP FormatDocument3 pagesSOPL and SOFP Formatnurizzatul syazwaniNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- FABM FORMAT STATEMENT (Final)Document6 pagesFABM FORMAT STATEMENT (Final)RishiiieeeznNo ratings yet

- General Format For Final AccountsDocument2 pagesGeneral Format For Final AccountsGokulCj GroveNo ratings yet

- Format of Final Accounts (Vertical Format)Document3 pagesFormat of Final Accounts (Vertical Format)ummieulfahNo ratings yet

- Employee Benefit Plan Trust - Provident FundDocument4 pagesEmployee Benefit Plan Trust - Provident FundMuhammad Asif KhanNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXMiera FrnhNo ratings yet

- Intermediate Accounting Second Sem ReviewerDocument7 pagesIntermediate Accounting Second Sem ReviewerchxrlttxNo ratings yet

- Proforma of Vertical IncomeDocument2 pagesProforma of Vertical IncomeBheemeswar ReddyNo ratings yet

- Financial Statement of Sole Trader LHADocument2 pagesFinancial Statement of Sole Trader LHASameer AliNo ratings yet

- FS FormatDocument3 pagesFS FormatMaryam AhmedNo ratings yet

- Annex D - SCFDocument44 pagesAnnex D - SCFJohn Eivor Go OrroNo ratings yet

- Part Ii - Statement of Profit and LossDocument3 pagesPart Ii - Statement of Profit and LossSaumyajit DeyNo ratings yet

- Income Statement FormatDocument2 pagesIncome Statement FormatShruti MohanNo ratings yet

- Partnership - Income StatementDocument2 pagesPartnership - Income StatementChan Chin ChunNo ratings yet

- Final - Accounts Format 234 PDFDocument13 pagesFinal - Accounts Format 234 PDFajaychattaNo ratings yet

- Final - Accounts Format PDFDocument13 pagesFinal - Accounts Format PDFajaychatta100% (1)

- Funds Flow State Ment Method 2Document1 pageFunds Flow State Ment Method 2Vignesh NarayananNo ratings yet

- Format For Financial StatementDocument3 pagesFormat For Financial StatementmmasalekNo ratings yet

- Accountancy All FormulaDocument23 pagesAccountancy All FormulaThe Unknown vlogger100% (1)

- Chapter 6 - SOPL FormatDocument1 pageChapter 6 - SOPL Formatquraisha irdinaNo ratings yet

- Fundamentals of Accounting and Business ManagementDocument4 pagesFundamentals of Accounting and Business ManagementSan Juan Ezthie100% (1)

- Cash FlowDocument5 pagesCash FlowSirdar MukodzaniNo ratings yet

- 1-Cash Flow StatementDocument21 pages1-Cash Flow StatementOvais Zia100% (1)

- Cash Flow StatementDocument5 pagesCash Flow StatementDebaditya SenguptaNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Stock Valuation Is The Process of Determining The Intrinsic Value of A CompanyDocument3 pagesStock Valuation Is The Process of Determining The Intrinsic Value of A CompanyShaheryar ShahidNo ratings yet

- KPI's For Accounts & Finance DeptDocument1 pageKPI's For Accounts & Finance DeptShaheryar ShahidNo ratings yet

- Q-1 Jun-16 SOLUTIONDocument3 pagesQ-1 Jun-16 SOLUTIONShaheryar ShahidNo ratings yet

- Q-1 Jun-11 SOLUTIONDocument1 pageQ-1 Jun-11 SOLUTIONShaheryar ShahidNo ratings yet

- 12 - Consolidated Financial Statement (July 23) 1Document474 pages12 - Consolidated Financial Statement (July 23) 1Shaheryar ShahidNo ratings yet

- ResultofCAFExamination Autumn2021Document196 pagesResultofCAFExamination Autumn2021Shaheryar ShahidNo ratings yet

- Leveraged Buyouts: Characteristics Evidence On Lbos An Lbo (Private Equity) Model Reverse LbosDocument36 pagesLeveraged Buyouts: Characteristics Evidence On Lbos An Lbo (Private Equity) Model Reverse Lboschand1234567893No ratings yet

- Finance: Sample Exam QuestionsDocument32 pagesFinance: Sample Exam QuestionsYasir ShaikhNo ratings yet

- CF Export 29 04 2023Document9 pagesCF Export 29 04 2023Shubham KumarNo ratings yet

- Img 20200525 0001Document1 pageImg 20200525 0001Tisha ReddyNo ratings yet

- CSLDocument4 pagesCSLEnriqueNo ratings yet

- Smart InsureWealth Plus - BrochureDocument24 pagesSmart InsureWealth Plus - BrochureIswarya SelvarajNo ratings yet

- DJSR Second EditionDocument65 pagesDJSR Second EditionPrabhashini WijewanthaNo ratings yet

- FIN 605.Ch 1Document45 pagesFIN 605.Ch 1Torun SoktyNo ratings yet

- Module 2Document28 pagesModule 2Jiane SanicoNo ratings yet

- Abacus Capital - Investment Corp v. TabujaraDocument1 pageAbacus Capital - Investment Corp v. TabujaraRoger Montero Jr.No ratings yet

- Chapter 6 - Stu PDFDocument42 pagesChapter 6 - Stu PDFGiang GiangNo ratings yet

- Factors To Consider When Setting Prices and Its General Pricing ApproachesDocument5 pagesFactors To Consider When Setting Prices and Its General Pricing Approacheschelseamanacho11No ratings yet

- ProspectusDocument9 pagesProspectusRakesh BhoirNo ratings yet

- Arker Enter: Working Paper SeriesDocument47 pagesArker Enter: Working Paper SeriesLiviu FrîncuNo ratings yet

- A Term Paper On Sources of Finance in Specific Industries in BangladeshDocument13 pagesA Term Paper On Sources of Finance in Specific Industries in BangladeshFahim MalikNo ratings yet

- G 11 Eco Worksheet Unit 5 Trade and FinanceDocument7 pagesG 11 Eco Worksheet Unit 5 Trade and FinanceKifle BerhaneNo ratings yet

- Leverage and Capital StructureDocument63 pagesLeverage and Capital Structurepraveen181274100% (1)

- Multifamily Finance ReformDocument7 pagesMultifamily Finance ReformDanielSiesser100% (1)

- (Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Document156 pages(Studies in Finance and Accounting) Michael Firth (Auth.) - Management of Working Capital-Macmillan Education UK (1976)Vignesh KathiresanNo ratings yet

- Financial Structure and GrowthDocument4 pagesFinancial Structure and GrowthFabiola García FernándezNo ratings yet

- BFC5935 - Tutorial 5 SolutionsDocument5 pagesBFC5935 - Tutorial 5 SolutionsXue XuNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio AnalysisFranco Martin MutisoNo ratings yet

- Exam1 WS1213Document10 pagesExam1 WS1213Faisal AzizNo ratings yet

- QuestionsDocument80 pagesQuestionsjoshuaNo ratings yet

- SFP Act 2021Document4 pagesSFP Act 2021moreNo ratings yet

- Fitri Risma Utami - Tugas 2Document4 pagesFitri Risma Utami - Tugas 2Resti ViadonaNo ratings yet

- Aaa Top100 - 12dec2022-1Document13 pagesAaa Top100 - 12dec2022-1Cm BeNo ratings yet