Professional Documents

Culture Documents

Result - 04 - 05 - 2024, 10 - 31 - 01

Result - 04 - 05 - 2024, 10 - 31 - 01

Uploaded by

Menna AghanyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Result - 04 - 05 - 2024, 10 - 31 - 01

Result - 04 - 05 - 2024, 10 - 31 - 01

Uploaded by

Menna AghanyCopyright:

Available Formats

The purpose of this strategic audit study is to analyse various business scenarios, strategic options, company

strategy, objectives, strengths, weaknesses, opportunities, and threats, as well as the competitive advantages of

Majid Al Futtaim Properties LLC (MAF). This study focuses mostly on analysing the market sizes, corporate

sales, and market shares of the (MAF) Group. Additionally, it encompasses an analysis of customer preferences,

ethical considerations, and the commitment of the company to corporate social responsibility. In addition, the

paper offers a forecast and suggestions for applying different techniques. Majid Al Futtaim, an Emirati

corporation, has experienced significant expansion since its inception in 1992. It has gained significant

recognition in the retail, entertainment, and shopping mall industries across the Middle East, Africa, and Asia.

Thanks to their diverse range of investments and strategic growth strategies, they have effectively established

themselves as a major competitor in the worldwide market. During the input phase, various analytical tools such

as the competitive profile matrix (CPM), the internal factor evaluation matrix (IFE), and the external factor

evaluation (EFE) were used to identify the main strengths, weaknesses, opportunities, and threats of MAF.

Furthermore, both the internal and external study produced noteworthy results, with the external analysis

uncovering the growing impact of ecommerce and its implications for brick-and-mortar retail stores.

Furthermore, it highlighted the achievements of rivals in the retail and real estate sectors, as well as the

increasing desire of customers for immersive retail experiences and entertainment options, all while taking into

account the substantial influence of the economic conditions in the MENA region on the company's

performance. After analysing MAF's internal resources, it is evident that Majid Al Futtaim's performance is

impacted by its competitive advantages, including a well-established brand awareness and reputation in the

MENA region, as well as a diverse portfolio comprising of cinemas, shopping centres, hotels, and entertainment

options. Furthermore, the company benefits from a robust and efficient logistics and supply chain network.

During the second step of the strategy formulation framework, a range of analytical tools, including the

Strength-Weaknesses Opportunities-Threats (SWOT) Matrix, are utilised to discover numerous alternative

strategies. The Strategic location and Action Evaluation (SPACE) Matrix is employed to determine the location

of Majid Al Futtaim in the aggressive quadrant, taking into account both internal and external influences.

Furthermore, the application of the Boston Consulting Group (BCG) Matrix facilitated the classification of

MAF items according to their market share and market growth rate, providing vital information on how the

company may effectively manage its extensive portfolio. The Internal-External (IE) Matrix was used to

determine the specific quadrant in which MAF is located. Furthermore, the Grand Matrix evaluates the

competitive standing of MAF and the extent of market expansion. Consistency among the five analysis

methodologies identified two strategic options to consider. The Quantitative Strategic Planning Matrix (QSPM)

formulates a suitable plan by evaluating the results of the previous two stages. The findings suggest that Majid

Al Futtaim should implement the market development strategy and Page

You might also like

- Seam Map v1Document24 pagesSeam Map v1api-608228135100% (1)

- INTRODUCTION TO STRATEGIC MARKETING (Chapter 1)Document41 pagesINTRODUCTION TO STRATEGIC MARKETING (Chapter 1)Wan Muhammad Abdul Hakim82% (11)

- Strategy DiamondDocument2 pagesStrategy DiamondSaurabh MalhanNo ratings yet

- EntrepreneurshipDocument2 pagesEntrepreneurshipRonna Taneca Drio100% (1)

- Content Writing Training Brochure PDFDocument10 pagesContent Writing Training Brochure PDFSakshi chauhan100% (1)

- Result - 03 - 05 - 2024, 18 - 08 - 36Document1 pageResult - 03 - 05 - 2024, 18 - 08 - 36Menna AghanyNo ratings yet

- Result - 04 - 05 - 2024, 10 - 31 - 40Document1 pageResult - 04 - 05 - 2024, 10 - 31 - 40Menna AghanyNo ratings yet

- Result - 04 - 05 - 2024, 10 - 31 - 20Document1 pageResult - 04 - 05 - 2024, 10 - 31 - 20Menna AghanyNo ratings yet

- Result - 04 - 05 - 2024, 10 - 31 - 11Document1 pageResult - 04 - 05 - 2024, 10 - 31 - 11Menna AghanyNo ratings yet

- Result - 03 - 05 - 2024, 18 - 08 - 16Document1 pageResult - 03 - 05 - 2024, 18 - 08 - 16Menna AghanyNo ratings yet

- Result - 04 - 05 - 2024, 10 - 31 - 30Document1 pageResult - 04 - 05 - 2024, 10 - 31 - 30Menna AghanyNo ratings yet

- Result - 03 - 05 - 2024, 18 - 07 - 17Document1 pageResult - 03 - 05 - 2024, 18 - 07 - 17Menna AghanyNo ratings yet

- Result - 03 - 05 - 2024, 18 - 07 - 57Document1 pageResult - 03 - 05 - 2024, 18 - 07 - 57Menna AghanyNo ratings yet

- Business Analysis of SIADocument9 pagesBusiness Analysis of SIAJasmine Siddhi BajracharyaNo ratings yet

- Factors Influencing Market and Entry Mode SelectionDocument11 pagesFactors Influencing Market and Entry Mode SelectionAndres Felipe FigueredoNo ratings yet

- Strategic Marketing PlanningDocument10 pagesStrategic Marketing PlanningFaizan Ahmad100% (1)

- Advise On The Different Stages of An e Marketing Plan That Delhi Airport Should Consider For A Better Performance of Its e Marketing StrategiesDocument3 pagesAdvise On The Different Stages of An e Marketing Plan That Delhi Airport Should Consider For A Better Performance of Its e Marketing StrategiesYeshna GunnooNo ratings yet

- Strategic Managment TotalDocument49 pagesStrategic Managment TotalkailashdhirwaniNo ratings yet

- Case 20 Prime GroupDocument19 pagesCase 20 Prime GroupKad SaadNo ratings yet

- Integrated Workplace Management System Market TrendsDocument6 pagesIntegrated Workplace Management System Market Trendsemeka2012No ratings yet

- SWOT AnalysisDocument6 pagesSWOT AnalysisTimothy Nshimbi100% (1)

- Introduction To Strategic MarketingDocument44 pagesIntroduction To Strategic MarketingrohailjibranNo ratings yet

- VERNON - Dialectic ReportDocument12 pagesVERNON - Dialectic ReportCleoNo ratings yet

- Principles of MarketingDocument14 pagesPrinciples of MarketingSundar RanjuNo ratings yet

- Final DRDocument8 pagesFinal DRThao Phuong QuachNo ratings yet

- Marketing Strat and Marke CompetitionDocument25 pagesMarketing Strat and Marke Competitionmhapha7No ratings yet

- Strategic DecisionDocument3 pagesStrategic Decisionshin maNo ratings yet

- SSRN Id881841Document46 pagesSSRN Id881841Yash GuptaNo ratings yet

- BA2111073 Kabirat Adenike LSME SMDocument12 pagesBA2111073 Kabirat Adenike LSME SMTanjim HossainNo ratings yet

- Global Marketing Strategic Approaches OnDocument7 pagesGlobal Marketing Strategic Approaches OnHero eNo ratings yet

- International Marketing Research - DocDocument19 pagesInternational Marketing Research - DocSachitChawla100% (1)

- The Specific Market Research Methodology Used at GDocument6 pagesThe Specific Market Research Methodology Used at GRAVI PRASAD KUSHWAHANo ratings yet

- The Marketing Process: I. Situation AnalysisDocument2 pagesThe Marketing Process: I. Situation AnalysisVivi AnggraeniNo ratings yet

- Swot Analysis-Group 2Document34 pagesSwot Analysis-Group 2Clarice Ilustre GuintibanoNo ratings yet

- Swot Analysis-Group 2Document34 pagesSwot Analysis-Group 2Clarice Ilustre GuintibanoNo ratings yet

- Aleena Amir EM Assignment 2Document1 pageAleena Amir EM Assignment 2Aleena AmirNo ratings yet

- Saudi Electronic University College of Administrative and Financial Sciences E-Commerce DepartmentDocument9 pagesSaudi Electronic University College of Administrative and Financial Sciences E-Commerce Departmentklm klmNo ratings yet

- SWOT Analysis Oman Air - An Organization Supporting TourismDocument2 pagesSWOT Analysis Oman Air - An Organization Supporting TourismAamirNo ratings yet

- EkitX6 Exemplar Essay StrategyDocument2 pagesEkitX6 Exemplar Essay Strategyy5vmfrbznxNo ratings yet

- SPM AssignmentDocument8 pagesSPM AssignmentKelvin MasekoNo ratings yet

- Module 2Document15 pagesModule 2Omkar MulekarNo ratings yet

- Strategic Management CH 6Document40 pagesStrategic Management CH 6karim kobeissiNo ratings yet

- Assignment 2Document2 pagesAssignment 2Umar GondalNo ratings yet

- Assignment - ShoneDocument27 pagesAssignment - ShoneAsckani ManuelNo ratings yet

- JOIM ManuscriptFeb2022 RR2XDocument36 pagesJOIM ManuscriptFeb2022 RR2Xadetayo.ayanleke150822015No ratings yet

- Swot PhilipsDocument25 pagesSwot PhilipsFair FASSTNo ratings yet

- Role of Competitive Intelligence in Multinational Companies: 1 Introduction and Background of The StudyDocument10 pagesRole of Competitive Intelligence in Multinational Companies: 1 Introduction and Background of The StudyAmber JamilNo ratings yet

- Tata MotorsDocument12 pagesTata MotorsChintan Detroja50% (2)

- Business Strategy and Development Canadian 2nd Edition Bissonette Solutions ManualDocument13 pagesBusiness Strategy and Development Canadian 2nd Edition Bissonette Solutions Manualariannenhannv0nwk100% (31)

- Penggunaan Matriks SWOT Dan Metode QSPM Pada Strategi Pemasaran Jasa Wedding Organizer: Studi Kasus Pada UMKM Gosimplywedding SukabumiDocument17 pagesPenggunaan Matriks SWOT Dan Metode QSPM Pada Strategi Pemasaran Jasa Wedding Organizer: Studi Kasus Pada UMKM Gosimplywedding SukabumiMustika ZakiahNo ratings yet

- A Strategy Analyst at A Canadian ChildrenDocument10 pagesA Strategy Analyst at A Canadian Childrenkaur DhillonNo ratings yet

- BuPols LevelDocument3 pagesBuPols LevelCristina RamirezNo ratings yet

- Assignment The Residence of MauritiusDocument15 pagesAssignment The Residence of MauritiusGwen JcNo ratings yet

- Studi KasusDocument2 pagesStudi Kasusadibnabil135No ratings yet

- Marketing Strategies Impact On Organizational Performance PDFDocument5 pagesMarketing Strategies Impact On Organizational Performance PDFPhoebe Rafunsel Sumbongan JuyadNo ratings yet

- Nedu, Chovancova y Ogbonna, 2016 PDFDocument7 pagesNedu, Chovancova y Ogbonna, 2016 PDFCésarAugustoSantanaNo ratings yet

- Environmental Scanning TechniquesDocument9 pagesEnvironmental Scanning TechniquesMhyr Pielago CambaNo ratings yet

- BUS7B64 Assignment (1) - Edit ItDocument7 pagesBUS7B64 Assignment (1) - Edit ItGrammarianNo ratings yet

- Seatwork No.6Document3 pagesSeatwork No.6Reymond AdayaNo ratings yet

- Strategic Marketing Plan For Aman Bank in Libya: Nassir Abdullah Nassir, Luo JianhongDocument7 pagesStrategic Marketing Plan For Aman Bank in Libya: Nassir Abdullah Nassir, Luo Jianhonganonymous dcNo ratings yet

- Coaching for Small Business Owners and Entrepreneurs: the BasicsFrom EverandCoaching for Small Business Owners and Entrepreneurs: the BasicsNo ratings yet

- Result - 3 - 15 - 2024, 2 - 47 - 53 PMDocument1 pageResult - 3 - 15 - 2024, 2 - 47 - 53 PMMenna AghanyNo ratings yet

- Result - 3 - 15 - 2024, 2 - 48 - 12 PMDocument1 pageResult - 3 - 15 - 2024, 2 - 48 - 12 PMMenna AghanyNo ratings yet

- Result - 3 - 15 - 2024, 2 - 48 - 40 PMDocument1 pageResult - 3 - 15 - 2024, 2 - 48 - 40 PMMenna AghanyNo ratings yet

- Result - 3 - 15 - 2024, 2 - 47 - 45 PMDocument1 pageResult - 3 - 15 - 2024, 2 - 47 - 45 PMMenna AghanyNo ratings yet

- Result - 3 - 15 - 2024, 2 - 48 - 19 PMDocument1 pageResult - 3 - 15 - 2024, 2 - 48 - 19 PMMenna AghanyNo ratings yet

- BatatDocument3 pagesBatatMenna AghanyNo ratings yet

- ECONOWEDocument2 pagesECONOWEMenna AghanyNo ratings yet

- Eric Ed465078 PDFDocument25 pagesEric Ed465078 PDFMenna AghanyNo ratings yet

- Alfa ResultSubServices PDFDocument1 pageAlfa ResultSubServices PDFMenna AghanyNo ratings yet

- Result 3 15 2023 10 22 29 AMDocument1 pageResult 3 15 2023 10 22 29 AMMenna AghanyNo ratings yet

- Result 3 15 2023 10 22 35 AMDocument1 pageResult 3 15 2023 10 22 35 AMMenna AghanyNo ratings yet

- Godrej IndustriesDocument30 pagesGodrej IndustriesNupur ParikhNo ratings yet

- Review of Related LiteratureDocument12 pagesReview of Related LiteratureDanielle BartolomeNo ratings yet

- AkbarDocument9 pagesAkbardura briteNo ratings yet

- Risk AssesmentDocument48 pagesRisk AssesmentRie UsunNo ratings yet

- Effects of Mastery Learning Instruction On Engineering Students Writing Skills Development and MotivationDocument11 pagesEffects of Mastery Learning Instruction On Engineering Students Writing Skills Development and MotivationRanii raniNo ratings yet

- Discrete Distributions: ASBE 6e Solutions For InstructorsDocument25 pagesDiscrete Distributions: ASBE 6e Solutions For InstructorsadirisinNo ratings yet

- Bryson 2015Document17 pagesBryson 2015JuliangintingNo ratings yet

- At Chapter 11Document38 pagesAt Chapter 11Jossie EjercitoNo ratings yet

- Ilovepdf MergedDocument31 pagesIlovepdf MergedCaluag , Kevin F.No ratings yet

- 2018 SpringDocument35 pages2018 SpringMladenNo ratings yet

- Brasil 2020Document9 pagesBrasil 2020Diego Cristhofer Grados SilvaNo ratings yet

- Jnvu Mba SyllabusDocument35 pagesJnvu Mba Syllabusakshita mehtaNo ratings yet

- Chisquare QuesDocument11 pagesChisquare QuesSuranjit RoyNo ratings yet

- Unit-1 INDUSTRIAL PSYCHOLOGYDocument13 pagesUnit-1 INDUSTRIAL PSYCHOLOGYashrajNo ratings yet

- Iii. Union and Intersection of Events Complement of An Event Odds Unions and IntersectionsDocument8 pagesIii. Union and Intersection of Events Complement of An Event Odds Unions and IntersectionsKristhel Pecolados RombaoaNo ratings yet

- 2122 M02 Banathy ISD ModelDocument16 pages2122 M02 Banathy ISD ModelImeldaFaniNo ratings yet

- BrendonBurchard 6InfluenceLeversDocument1 pageBrendonBurchard 6InfluenceLeversedy500No ratings yet

- Time Domain SSI Analysis of Typical Reactor Building Using Frequency Dependent Foundation Impedance Derived From SASSIDocument8 pagesTime Domain SSI Analysis of Typical Reactor Building Using Frequency Dependent Foundation Impedance Derived From SASSISaid EliasNo ratings yet

- What Is Sociology - AutosavedDocument99 pagesWhat Is Sociology - Autosavedgragii100% (1)

- Lecture 10 Nonlinear RegressionDocument10 pagesLecture 10 Nonlinear RegressionMartin StojanovicNo ratings yet

- Architectural and Structural Analysis of Historical StructuresDocument10 pagesArchitectural and Structural Analysis of Historical StructuresHiệp HuyNo ratings yet

- Plant With EggbeaterDocument5 pagesPlant With EggbeatervafdeleonNo ratings yet

- Rockafellar & Wets - Variational AnalysisDocument749 pagesRockafellar & Wets - Variational AnalysisGustavo Figueiredo100% (1)

- Journal of Sustainable TourismDocument15 pagesJournal of Sustainable TourismDiễm QuỳnhNo ratings yet

- Ardern 2016Document22 pagesArdern 2016Isabela NerysNo ratings yet

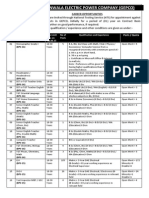

- Gujranwala Electric Power Company (Gepco)Document5 pagesGujranwala Electric Power Company (Gepco)JawadAmjadNo ratings yet

- Servicio Nacional de Aprendizaje Sena Procedimiento de Desarrollo Curricular Level A1.2 Support MaterialDocument2 pagesServicio Nacional de Aprendizaje Sena Procedimiento de Desarrollo Curricular Level A1.2 Support MaterialCARLOS SANTOSNo ratings yet