Professional Documents

Culture Documents

Oil and Gas Taxation Under The Petroleum Industry Act

Oil and Gas Taxation Under The Petroleum Industry Act

Uploaded by

ahassan20 ratings0% found this document useful (0 votes)

4 views3 pagesOriginal Title

Oil and Gas Taxation Under the Petroleum Industry Act

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views3 pagesOil and Gas Taxation Under The Petroleum Industry Act

Oil and Gas Taxation Under The Petroleum Industry Act

Uploaded by

ahassan2Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Oil and Gas Taxation Under

the Petroleum Industry Act

(PIA)

SO&C Compliance Services

SO&C Compliance Services

PROFESSIONALISM. PERFORMANCE. PRESTIGE

Published Oct 24, 2023

+ Follow

The Petroleum Industry Act (PIA) of 2021 is a landmark piece of

legislation that has introduced a number of significant changes to

the oil and gas sector in Nigeria. One of the most important

changes is the new oil and gas taxation regime, which is designed

to attract investment in the sector and to ensure that the

government receives a fair share of the revenue from oil and gas

production.

The PIA introduces a two-tiered tax system for oil and gas

companies:

· Hydrocarbon Tax (HT): The HT is a tax on the profits of oil and

gas companies. The rate of the HT is 50%.

· Royalty: A royalty is a payment made by oil and gas companies

to the government for the right to extract oil and gas from the

ground. The royalty rate is 10% for onshore oil and gas production

and 7.5% for offshore oil and gas production.

In addition to the HT and royalty, oil and gas companies may also

be subject to other taxes, such as value-added tax (VAT) and

company income tax.

The PIA also introduces a number of new tax incentives for oil and

gas companies, such as:

· A deduction for exploration and production costs

· A deduction for infrastructure costs

· A deduction for training costs

· A deduction for environmental remediation costs

The PIA also sets out a number of new rules for the taxation of oil

and gas companies, such as:

· The requirement to use transfer pricing to determine the arm's

length price of transactions between related parties

· The requirement to maintain accurate records of all oil and gas

activities

· The requirement to submit annual tax returns to the

government

The PIA is a significant development in the oil and gas taxation

regime in Nigeria. The new tax regime is designed to attract

investment in the oil and gas sector and to ensure that the

government receives a fair share of the revenue from oil and gas

production.

How does the PIA affect oil and gas companies?

The PIA has a number of implications for oil and gas companies

operating in Nigeria.

· Increased taxes: The introduction of the HT is a significant

increase in the tax burden for oil and gas companies. The rate of the

HT is 50%, which is higher than the rate of company income tax,

which is currently 30%.

· Reduced royalties: The royalty rate for offshore oil and gas

production has been reduced from 12.5% to 7.5%. This is a

significant reduction in the cost of doing business for oil and gas

companies operating in the offshore sector.

· New tax incentives: The PIA introduces a number of new tax

incentives for oil and gas companies, such as deductions for

exploration and production costs, infrastructure costs, training

costs, and environmental remediation costs. These incentives can

help to reduce the tax burden for oil and gas companies and make

it more attractive to invest in the sector.

· New rules and regulations: The PIA sets out a number of new

rules and regulations for the taxation of oil and gas companies.

These rules and regulations are designed to ensure that oil and gas

companies pay their fair share of taxes and that the government

receives a fair return on its investment in the oil and gas sector.

What are the challenges of complying with the PIA?

The PIA is a complex piece of legislation and it can be challenging

for oil and gas companies to comply with all of the requirements.

Some of the challenges of complying with the PIA include:

· The complexity of the tax regime

· The frequent changes to the tax regime

· The lack of clarity in some of the provisions of the PIA

· The lack of resources and expertise to comply with the PIA

How can oil and gas companies comply with the PIA?

There are a number of ways for oil and gas companies to comply

with the PIA. These include:

· Seeking professional advice from a tax advisor who is familiar

with the PIA

· Investing in training for employees on the PIA

· Maintaining accurate records of all oil and gas activities

· Submitting annual tax returns to the government on time

The PIA is a significant piece of legislation that has the potential to

have a major impact on the oil and gas sector in Nigeria. Oil and

gas companies need to be aware of the implications of the PIA and

take steps to comply with its requirements.

You might also like

- SAP RFID Enabled Integrated Demo ScriptDocument17 pagesSAP RFID Enabled Integrated Demo Scriptjayakrishna.kNo ratings yet

- Nigeria August Tax News Fiscal Regime Under The New Petroleum Industry BillDocument3 pagesNigeria August Tax News Fiscal Regime Under The New Petroleum Industry BillMark allenNo ratings yet

- Nigeria's Government Considers Petroleum Industry Bill 2020, A New Framework For The Oil and Gas SectorDocument6 pagesNigeria's Government Considers Petroleum Industry Bill 2020, A New Framework For The Oil and Gas Sectorpradeep s gillNo ratings yet

- General: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterDocument5 pagesGeneral: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterSuraj NaikNo ratings yet

- Budget Red Eye 2013Document5 pagesBudget Red Eye 2013Envisage123No ratings yet

- Ey Qatar Enacts New Income Tax LawDocument3 pagesEy Qatar Enacts New Income Tax Lawjenniferonyeke77No ratings yet

- Research - Note - 2014 07 10 - 10 27 38 000000Document6 pagesResearch - Note - 2014 07 10 - 10 27 38 000000prateekramchandaniNo ratings yet

- Global Petroleum Tax GuideDocument14 pagesGlobal Petroleum Tax Guidemuki10No ratings yet

- Oil and Gas Taxation in NigeriaDocument4 pagesOil and Gas Taxation in Nigeriaahassan2No ratings yet

- A Closr Look at PIBDocument17 pagesA Closr Look at PIBOluwasheyifunmi AdefullhouseNo ratings yet

- Petroleum Profit Tax and Performance of Listed Oil and Gas Firms in NigeriaDocument13 pagesPetroleum Profit Tax and Performance of Listed Oil and Gas Firms in NigeriaTumsifu SiaoNo ratings yet

- AIIT CH 12 Oil and Gas CoDocument17 pagesAIIT CH 12 Oil and Gas CoOdvut SwapnoNo ratings yet

- Union Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthDocument7 pagesUnion Budget 2010-2011: Symphony of Fiscal Consolidation and Continued GrowthChand AnsariNo ratings yet

- Comparative Analysis of Financial Bills: C C C CCDocument5 pagesComparative Analysis of Financial Bills: C C C CCpdabriwalNo ratings yet

- Tax Policy 2020Document35 pagesTax Policy 2020Javed MushtaqNo ratings yet

- SPE-193470-MS Analysis of Government and Contractor Take Statistics in The Proposed Petroleum Industry Fiscal BillDocument14 pagesSPE-193470-MS Analysis of Government and Contractor Take Statistics in The Proposed Petroleum Industry Fiscal Billipali4christ_5308248No ratings yet

- Usman Owolabi Akeem Adegbite Tajudeen Adejare: AbstractDocument12 pagesUsman Owolabi Akeem Adegbite Tajudeen Adejare: AbstractJaweria AlamNo ratings yet

- Lesson 6 Tax On Natural ResourcesDocument43 pagesLesson 6 Tax On Natural ResourcesakpanyapNo ratings yet

- Analysis of Nigeria Petroleum Industry Act, 2021Document22 pagesAnalysis of Nigeria Petroleum Industry Act, 2021Austin Sams UdehNo ratings yet

- Budget Chemistry 2010Document44 pagesBudget Chemistry 2010Aq SalmanNo ratings yet

- Gulf Cooperation CouncilDocument21 pagesGulf Cooperation Councilabid murtazaiNo ratings yet

- Tax Highlights 2020Document4 pagesTax Highlights 2020JehanzaibNo ratings yet

- The Impact of New Nigerian Petroleum Industry Bill PIB 2021 On Government andDocument39 pagesThe Impact of New Nigerian Petroleum Industry Bill PIB 2021 On Government andIbrahim SalahudinNo ratings yet

- Lesson 6 Tax On Natural ResourcesDocument47 pagesLesson 6 Tax On Natural ResourcesakpanyapNo ratings yet

- Resource Mobilization and TaxationDocument50 pagesResource Mobilization and TaxationMuhammad YaseenNo ratings yet

- Budget-Dtc-Tax Exemption IncomeDocument35 pagesBudget-Dtc-Tax Exemption IncomeAnkit MachharNo ratings yet

- Budget Snapshot 2011-12Document22 pagesBudget Snapshot 2011-12Sunil SharmaNo ratings yet

- 07 BE Week4 Shreyas Roll No 52Document4 pages07 BE Week4 Shreyas Roll No 52Shreyas RautNo ratings yet

- KPMG Budget 2012Document44 pagesKPMG Budget 2012Sanjiv GuptaNo ratings yet

- Worldwide Petroleum Fiscal Regimes Development: Observations and TrendsDocument63 pagesWorldwide Petroleum Fiscal Regimes Development: Observations and TrendsBenny Lubiantara100% (7)

- Trabaho BillDocument14 pagesTrabaho BillAvia ColorNo ratings yet

- Union Budget 2012-13 Review: Ansaf PMDocument21 pagesUnion Budget 2012-13 Review: Ansaf PMAnsaf MohdNo ratings yet

- Taxing The Mining Sector CompressedDocument22 pagesTaxing The Mining Sector CompressedBruce GomaNo ratings yet

- IT&STDocument2 pagesIT&STPraveen DsouzaNo ratings yet

- Tax Commentary 2020Document85 pagesTax Commentary 2020Javed MushtaqNo ratings yet

- Tax Reforms in PakistanDocument53 pagesTax Reforms in PakistanMübashir Khan100% (2)

- Cambodia Oil Gas Newsletter 8Document4 pagesCambodia Oil Gas Newsletter 8Murad MuradovNo ratings yet

- Salient Features: Customs Budgetary Measures 2008-09Document16 pagesSalient Features: Customs Budgetary Measures 2008-09sadiajanNo ratings yet

- Ghana Petrol Tax Guide 2011Document24 pagesGhana Petrol Tax Guide 2011William PyneNo ratings yet

- Recent Fiscal Changes in Nigeria's Oil and Gas SectorDocument6 pagesRecent Fiscal Changes in Nigeria's Oil and Gas Sectorahassan2No ratings yet

- Fiscal Guide ZambiaDocument9 pagesFiscal Guide ZambiaVenkatesh GorurNo ratings yet

- Definition of Taxation and Objectives of The Taxation LawsDocument30 pagesDefinition of Taxation and Objectives of The Taxation LawsMohammad MujahidNo ratings yet

- Presentation On PIB 2020Document27 pagesPresentation On PIB 2020Adegbola OluwaseunNo ratings yet

- Analyzing The Budget 2012-13Document13 pagesAnalyzing The Budget 2012-13nikhilp60No ratings yet

- Acc872 (Oil & Gas Accounting) - Austin S. UdehDocument22 pagesAcc872 (Oil & Gas Accounting) - Austin S. UdehAustin Sams UdehNo ratings yet

- VAT Reform in BangladeshDocument28 pagesVAT Reform in BangladeshhossainmzNo ratings yet

- SPE-203740-MS Implications of Petroleum Industry Fiscal Bill 2018 On Heavy Oil Field EconomicsDocument19 pagesSPE-203740-MS Implications of Petroleum Industry Fiscal Bill 2018 On Heavy Oil Field Economicsipali4christ_5308248No ratings yet

- 02 OraclDocument12 pages02 OraclJuan Carlos MtzNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Potential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractDocument15 pagesPotential Petroleum Revenues For The Government of Kenya: Implications of The Proposed 2015 Model Production Sharing ContractOxfamNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesFrom EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo ratings yet

- 4 Service DesignDocument30 pages4 Service Designhayder nuredinNo ratings yet

- Design Thinking - Detailed NotesDocument44 pagesDesign Thinking - Detailed NotesabhishekNo ratings yet

- FANUC LR Mate 200IB - Robots Done RightDocument3 pagesFANUC LR Mate 200IB - Robots Done RightorbedelodoNo ratings yet

- Financial Ratio Analysis-LiquidityDocument30 pagesFinancial Ratio Analysis-LiquidityZybel RosalesNo ratings yet

- Emily's Insider Guide To Meeting High Quality MenDocument8 pagesEmily's Insider Guide To Meeting High Quality MenleeNo ratings yet

- Travelling Tips in BaliDocument13 pagesTravelling Tips in BaliFilipo RomarioNo ratings yet

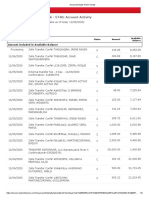

- Business Fundamentals CHK - 5740: Account Activity: All TransactionsDocument3 pagesBusiness Fundamentals CHK - 5740: Account Activity: All TransactionsAnnaly Carolina Bravo CastilloNo ratings yet

- Analyzing The Effectiveness of Confluence of Price Action Disciplines in Forex MarketDocument17 pagesAnalyzing The Effectiveness of Confluence of Price Action Disciplines in Forex MarketTinasheNo ratings yet

- 1st Chapter Slides of HRM Garry Dessler AmendedDocument43 pages1st Chapter Slides of HRM Garry Dessler AmendedMaarijNo ratings yet

- ROIC California v. CycleBar (Overdue Rent)Document13 pagesROIC California v. CycleBar (Overdue Rent)Fuzzy PandaNo ratings yet

- AssignmentDocument5 pagesAssignmentnaya inboxNo ratings yet

- Social Function of Business EthicsDocument29 pagesSocial Function of Business EthicsKevin Espinosa100% (1)

- Format - Rent AgreementDocument2 pagesFormat - Rent AgreementMritunjai SinghNo ratings yet

- Hutton AP Marcus AJ Tehranian H - 2009 - Opaque Financial Reports, R2, and Crash RiskDocument20 pagesHutton AP Marcus AJ Tehranian H - 2009 - Opaque Financial Reports, R2, and Crash RiskYara ZahrahNo ratings yet

- Fabm Week 11 20fabm 121 Week 11 20Document3 pagesFabm Week 11 20fabm 121 Week 11 20Criscel SantiagoNo ratings yet

- Analysis Period and Service PeriodDocument10 pagesAnalysis Period and Service PeriodsalmanNo ratings yet

- Account ShortNotes - CAB2FDocument171 pagesAccount ShortNotes - CAB2Fmopid68742No ratings yet

- Industry Report FormatDocument1 pageIndustry Report FormatVineet MishraNo ratings yet

- Unit 4Document16 pagesUnit 4hassan19951996hNo ratings yet

- ABN AMRO Presentation Morgan Stanley Conference March 2016Document27 pagesABN AMRO Presentation Morgan Stanley Conference March 2016steefhNo ratings yet

- FIDIC Contracts in Europe A Practical Guide To Application DonaldDocument692 pagesFIDIC Contracts in Europe A Practical Guide To Application DonaldvalerykapustinaaaNo ratings yet

- JAIIB - PPB - All Modules NotesDocument501 pagesJAIIB - PPB - All Modules Notesmanu.manohar0408No ratings yet

- LK TPM 31 Mar 2023 PDFDocument67 pagesLK TPM 31 Mar 2023 PDFAnonymous waj9QU06No ratings yet

- Competitive AdvantageDocument46 pagesCompetitive AdvantageJoshua-Lee Alagadan Bracero100% (1)

- g4.2 2021 Qualification of Bolting InspectorsDocument22 pagesg4.2 2021 Qualification of Bolting InspectorsNéstor SotoNo ratings yet

- FAR 0-ValixDocument5 pagesFAR 0-ValixKetty De GuzmanNo ratings yet

- Banana BoomDocument5 pagesBanana BoomNavarro Holguin Michelle ElizabethNo ratings yet

- 1403 Aspac Newsletter March2014Document54 pages1403 Aspac Newsletter March2014Andy SetiawanNo ratings yet

- Operations Management Processes and Supply Chains 12th Edition Krajewski Test BankDocument57 pagesOperations Management Processes and Supply Chains 12th Edition Krajewski Test Bankrandalltorresxntkdrobzp100% (32)