Professional Documents

Culture Documents

ACCT 102 Handout Chapter 24

ACCT 102 Handout Chapter 24

Uploaded by

Muhammad WaqasCopyright:

Available Formats

You might also like

- Tape Reading 101 BookDocument62 pagesTape Reading 101 BookScott Tran88% (8)

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Capital Budgeting HandoutDocument15 pagesCapital Budgeting HandoutJoshua Cabinas100% (2)

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Commercial Lease For EpcDocument4 pagesCommercial Lease For Epchamza tariqNo ratings yet

- 2GO Group, Inc.Document5 pages2GO Group, Inc.john lloyd Jose100% (1)

- Capital Budgeting NotesDocument6 pagesCapital Budgeting NotesAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Presentation On: Capital BudgetingDocument23 pagesPresentation On: Capital Budgetingakhil_247No ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- Investment Appraisal TechniquesDocument6 pagesInvestment Appraisal TechniquesERICK MLINGWANo ratings yet

- Capital BudgetingDocument20 pagesCapital Budgetingmansi dhimanNo ratings yet

- Topic VII Capital Budgeting TechniquesDocument16 pagesTopic VII Capital Budgeting TechniquesSeph AgetroNo ratings yet

- Module 9Document32 pagesModule 9Precious GiftsNo ratings yet

- MAS 14 Capital Budgeting With Investment Risks ReturnsDocument16 pagesMAS 14 Capital Budgeting With Investment Risks ReturnsPRINCESS ANN GENEROSO ALINGIGNo ratings yet

- Projects) & Long-Term Projects orDocument8 pagesProjects) & Long-Term Projects orShahid MahmudNo ratings yet

- The Basics of Capital BudgetingDocument5 pagesThe Basics of Capital BudgetingChirrelyn Necesario SunioNo ratings yet

- Capitalbudgeting 2Document16 pagesCapitalbudgeting 2patrickjames.ravelaNo ratings yet

- Capital Investment AppraisalDocument3 pagesCapital Investment AppraisalGeorge Ayesa Sembereka Jr.No ratings yet

- NPV, Payback Period, PIDocument3 pagesNPV, Payback Period, PIAyush BankarNo ratings yet

- Lecture Capital BudgetingDocument5 pagesLecture Capital BudgetingJenelyn FloresNo ratings yet

- MS-44L (Capital Budgeting With Risks & Returns)Document18 pagesMS-44L (Capital Budgeting With Risks & Returns)juleslovefenNo ratings yet

- Chapter 02 Investment AppraisalDocument3 pagesChapter 02 Investment AppraisalMarzuka Akter KhanNo ratings yet

- Evaluation of Capital Budgeting TechniquesDocument36 pagesEvaluation of Capital Budgeting TechniquesAshish GoelNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingD Y Patil Institute of MCA and MBANo ratings yet

- CapitDocument8 pagesCapitjanice100% (1)

- Capital Budgeting-Lecture NotesDocument6 pagesCapital Budgeting-Lecture NotesAngela Nicole CalimbasNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingKhushbu PriyadarshniNo ratings yet

- Technic of Cap BudDocument6 pagesTechnic of Cap BudAmar NathNo ratings yet

- MS-12 (Capital Budgeting With Investment Risks and Returns)Document18 pagesMS-12 (Capital Budgeting With Investment Risks and Returns)musor.as084No ratings yet

- What Is Capital BudgetingDocument24 pagesWhat Is Capital BudgetingZohaib Zohaib Khurshid AhmadNo ratings yet

- Non Discounted Techniques LectureDocument3 pagesNon Discounted Techniques Lectureamormi2702No ratings yet

- Module 3 ARS PCC - Capital Budgeting and Cost of CapitalDocument11 pagesModule 3 ARS PCC - Capital Budgeting and Cost of CapitalJames Bradley HuangNo ratings yet

- Year, Financial Management: Capital BudgetingDocument9 pagesYear, Financial Management: Capital BudgetingPooja KansalNo ratings yet

- Evaluation of Capital BudgetingDocument24 pagesEvaluation of Capital BudgetingGayathri GopiramnathNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingRajatNo ratings yet

- CHAPTER 2 - Investment AppraisalDocument19 pagesCHAPTER 2 - Investment AppraisalMaleoaNo ratings yet

- Capital Budgeting: Navigation SearchDocument16 pagesCapital Budgeting: Navigation SearchVenkat Narayana ReddyNo ratings yet

- Discounting or Modern Methods of Capital BudgetingDocument18 pagesDiscounting or Modern Methods of Capital BudgetingRiyas Parakkattil100% (1)

- Capital BudgetingDocument31 pagesCapital BudgetingJanu JinniNo ratings yet

- Module in Financial Management - 09Document7 pagesModule in Financial Management - 09Karla Mae GammadNo ratings yet

- Capital BudgetingDocument26 pagesCapital BudgetingTisha SosaNo ratings yet

- Capital Budgeting TechniquesDocument8 pagesCapital Budgeting Techniqueswaqaar raoNo ratings yet

- 09.1 Module in Financial Management 09Document8 pages09.1 Module in Financial Management 09Fire burnNo ratings yet

- Chapter 14Document2 pagesChapter 14jhouvanNo ratings yet

- Chapter 2 - Investment AppraisalDocument10 pagesChapter 2 - Investment AppraisalHarmeet SinghNo ratings yet

- Colbourne College Unit 14 Week 6Document29 pagesColbourne College Unit 14 Week 6gulubhata41668No ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesMahima GirdharNo ratings yet

- Chapter 11, R, F...Document26 pagesChapter 11, R, F...Rida FatimaNo ratings yet

- DR - Naushad Alam: Capital BudgetingDocument38 pagesDR - Naushad Alam: Capital BudgetingUrvashi SinghNo ratings yet

- CHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeDocument2 pagesCHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeSeresa EstrellasNo ratings yet

- Captai Budgeting AssignmentDocument2 pagesCaptai Budgeting AssignmentPravanjan AumcapNo ratings yet

- Course Learning Outcomes For Unit II: Opportunity Costs and Organizational ArchitectureDocument3 pagesCourse Learning Outcomes For Unit II: Opportunity Costs and Organizational ArchitectureSwapan Kumar SahaNo ratings yet

- Investment Evaluation CriteriaDocument15 pagesInvestment Evaluation Criteriainq33108No ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- 03 - 20th Aug Capital Budgeting, 2019Document37 pages03 - 20th Aug Capital Budgeting, 2019anujNo ratings yet

- Acctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1Document8 pagesAcctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1masan01No ratings yet

- Capitalbudgeting 1227282768304644 8Document27 pagesCapitalbudgeting 1227282768304644 8Sumi LatheefNo ratings yet

- Financial ManagementDocument20 pagesFinancial ManagementGAURAV SHARMA100% (1)

- Financial Evaluation (Autorecovered)Document4 pagesFinancial Evaluation (Autorecovered)rohin gargNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Naveed Khattak PracticumDocument22 pagesNaveed Khattak PracticumNaqeebullah Haji AmanullahNo ratings yet

- Differences Between A Partnership and CorporationDocument4 pagesDifferences Between A Partnership and CorporationIvan BendiolaNo ratings yet

- GANN Full Rules TechniquesDocument1 pageGANN Full Rules TechniquesSalai ArulMozhiNo ratings yet

- The Gold Market-OutlineDocument5 pagesThe Gold Market-OutlineMartin SeruggaNo ratings yet

- And in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of ModificationDocument14 pagesAnd in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of Modificationupasana magarNo ratings yet

- Covered Interest ArbitrageDocument3 pagesCovered Interest ArbitrageKamrul HasanNo ratings yet

- Additional InformationDocument32 pagesAdditional InformationMabel GakoNo ratings yet

- MGMT 476 Homework #1Document3 pagesMGMT 476 Homework #1FangNo ratings yet

- LEDGERDocument10 pagesLEDGERKul DeepNo ratings yet

- Chapter 13 SolutionsDocument26 pagesChapter 13 SolutionsMathew Idanan0% (1)

- Statement of Axis Account No:911010047456925 For The Period (From: 01-08-2023 To: 02-02-2024)Document12 pagesStatement of Axis Account No:911010047456925 For The Period (From: 01-08-2023 To: 02-02-2024)shekhar17042012No ratings yet

- Intern Part 1Document11 pagesIntern Part 1Mrinal DasNo ratings yet

- Multiple Choice Questions CF1Document20 pagesMultiple Choice Questions CF1Đỗ Tuấn AnNo ratings yet

- Thesis 1Document50 pagesThesis 1Sudip ParajuliNo ratings yet

- TP Vii PDFDocument17 pagesTP Vii PDFshekarj100% (3)

- Water Refilling Station Business PlanDocument15 pagesWater Refilling Station Business PlanKeziah Kyle PoononNo ratings yet

- Odisha FIntech Hackathon-ProposalDocument5 pagesOdisha FIntech Hackathon-Proposalsanjib paridaNo ratings yet

- End of Chapter Exercises - Answers: Chapter 16: Predicting Stock ReturnsDocument2 pagesEnd of Chapter Exercises - Answers: Chapter 16: Predicting Stock ReturnsYvonneNo ratings yet

- Project Report Submitted in Partial Fulfillment For The Award of The Degree ofDocument67 pagesProject Report Submitted in Partial Fulfillment For The Award of The Degree ofMubeenNo ratings yet

- LCC Literature Review Report PDFDocument94 pagesLCC Literature Review Report PDFParhan AzizNo ratings yet

- 8 Financial Literacy Lesson1Document6 pages8 Financial Literacy Lesson1hlmd.blogNo ratings yet

- State Bank of Pakistan: Domestic Markets & Monetary Management DepartmentDocument1 pageState Bank of Pakistan: Domestic Markets & Monetary Management DepartmentMuhammadUsmanSaeedNo ratings yet

- Accounting Cycle of A Merchandising Business Part 2Document7 pagesAccounting Cycle of A Merchandising Business Part 2Amie Jane MirandaNo ratings yet

- Indifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, IsDocument5 pagesIndifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, Ismd mehedi hasanNo ratings yet

- Insta Pay Fact SheetDocument2 pagesInsta Pay Fact SheetStella DimitrivNo ratings yet

- Fasb 158 PDFDocument2 pagesFasb 158 PDFDavidNo ratings yet

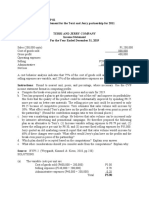

ACCT 102 Handout Chapter 24

ACCT 102 Handout Chapter 24

Uploaded by

Muhammad WaqasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT 102 Handout Chapter 24

ACCT 102 Handout Chapter 24

Uploaded by

Muhammad WaqasCopyright:

Available Formats

ACCT 102 – Chapter 24

Capital Budgeting and Investment Analysis

Johnson

The major goal of this chapter is to be familiar with and be able to implement four capital

investment analysis techniques.

Capital budgeting is a bit more challenging than other types of management decisions, because

the impact involves longer term predictions and estimates that can impact the company for many

years to come.

Capital budgeting and investment analysis can take one of two directions:

1. Non-present value methods that do not consider the time value of money

2. Present value methods that do consider the time value of money

See last page for a summary of the advantages and disadvantages of these methods.

NON PRESENT VALUE METHODS –

These DO NOT consider the time value of money

Cash Payback Method

This represents the expected time period to recover the initial amount invested. The shorter the

recovery period, the better the investment is because you can now use your cash for other

purposes. You must compute the expected cash flows over the life of the product. Non-cash

expenses (like depreciation and accruals and deferrals) are not considered and therefore are

backed out.

Payback Period = Cost of Investment / Annual net cash flow

(assumes equal cash flows)

Note that the answer will be in a period of months or years.

If cash flows are uneven, you can accumulate the cash over the life until you reach the

investment amount similar to the table in your text.

Accounting Rate of Return

This method, also called the return on average investment, is the only method that uses GAAP

net income as opposed to cash.

Formula: After Tax Net income

_________________ == Accounting Rate of Return

Average Amount Invested *

* (Average Book Values summed up / the number of years of the asset) OR

Alternatively for assets that use SL as method of depreciation

(Beg BV + End BV)/2

OR

If an asset has salvage value then (Beg BV + SV)/2

PRESENT VALUE METHODS THAT

DO CONSIDER THE TIME VALUE OF MONEY

Net Present Value – This method applies the time value of money to future cash inflows and

outflows so that management can determine whether it is earning above it’s minimum desired

rate of return, also called its “cost of capital” or sometimes “hurdle rate.”

We know that a dollar received today is worth more than the same dollar to be received a year

from now. The present value is what the future inflows on the assets would be worth in

TODAY’s dollars. We will run through a basic PV calculation in class, and then discuss how

tables can help us shortcut our calculations.

The net present value method schedules out cash flows and present values the amounts back

using the present value tables located in your book.

If the present values of the cash flows are greater than the cost, then the investment is earning

above what management desires. If not, and the resulting net present value is negative, then the

investment is earning less than what management desires and should be rejected.

If assets have salvage value, then a separate cash flow at the end of the life should be utilized and

added on to the schedule of cash flows.

If assets have differing costs, then you need calculate a profitability index in order to rank the

investments, because they will not be automatically comparable.

Profitability Index = NPV of cash flows/Amount of investment.

Computing the Internal Rate of Return – IRR

This method actually backs into the return, given the assets cash flows and life. It will yield the

rate that yields an NPV of zero for a given investment.

Step 1 – Compute the “Factor” for the investment

Factor = Amount Invested/Net annual cash flows

Step 2 – Look up the factor that you calculated based on life of the assets.

If it isn’t exact, then you can estimate as shown in text.

Excel provides an easy formula to calculate the IRR – and it will be demonstrated in class.

METHODS USED TO EVALUATE CAPITAL INVESTMENTS

METHOD ADVANTAGES DISADVANTAGES

Average Rate Easy to calculate Ignores cash flows

of Return

Considers accounting

income (often used to

evaluate managers) Ignores the time value of money

Cash Payback Considers cash flows Ignores profitability (accounting

income)

Shows when funds are

available for reinvestment Ignores cash flows after the

payback period

Ignores the time value of money

Net Present Considers cash flows and Assumes that cash received from

Value the time value of money the project can be reinvested at

the rate of return

Necessary to evaluate projects of

unequal size using a present

value index

Internal Rate Considers cash flows and Requires complex calculations or

of Return the time value of money trial-and-error methods

Ability to compare Assumes that cash received from

projects of unequal size the project can be reinvested at

the internal rate of return

You might also like

- Tape Reading 101 BookDocument62 pagesTape Reading 101 BookScott Tran88% (8)

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Capital Budgeting HandoutDocument15 pagesCapital Budgeting HandoutJoshua Cabinas100% (2)

- BUAD 839 ASSIGNMENT (Group F)Document4 pagesBUAD 839 ASSIGNMENT (Group F)Yemi Jonathan OlusholaNo ratings yet

- Commercial Lease For EpcDocument4 pagesCommercial Lease For Epchamza tariqNo ratings yet

- 2GO Group, Inc.Document5 pages2GO Group, Inc.john lloyd Jose100% (1)

- Capital Budgeting NotesDocument6 pagesCapital Budgeting NotesAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Techniques of Investment AnalysisDocument32 pagesTechniques of Investment AnalysisPranjal Verma0% (1)

- Presentation On: Capital BudgetingDocument23 pagesPresentation On: Capital Budgetingakhil_247No ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- Investment Appraisal TechniquesDocument6 pagesInvestment Appraisal TechniquesERICK MLINGWANo ratings yet

- Capital BudgetingDocument20 pagesCapital Budgetingmansi dhimanNo ratings yet

- Topic VII Capital Budgeting TechniquesDocument16 pagesTopic VII Capital Budgeting TechniquesSeph AgetroNo ratings yet

- Module 9Document32 pagesModule 9Precious GiftsNo ratings yet

- MAS 14 Capital Budgeting With Investment Risks ReturnsDocument16 pagesMAS 14 Capital Budgeting With Investment Risks ReturnsPRINCESS ANN GENEROSO ALINGIGNo ratings yet

- Projects) & Long-Term Projects orDocument8 pagesProjects) & Long-Term Projects orShahid MahmudNo ratings yet

- The Basics of Capital BudgetingDocument5 pagesThe Basics of Capital BudgetingChirrelyn Necesario SunioNo ratings yet

- Capitalbudgeting 2Document16 pagesCapitalbudgeting 2patrickjames.ravelaNo ratings yet

- Capital Investment AppraisalDocument3 pagesCapital Investment AppraisalGeorge Ayesa Sembereka Jr.No ratings yet

- NPV, Payback Period, PIDocument3 pagesNPV, Payback Period, PIAyush BankarNo ratings yet

- Lecture Capital BudgetingDocument5 pagesLecture Capital BudgetingJenelyn FloresNo ratings yet

- MS-44L (Capital Budgeting With Risks & Returns)Document18 pagesMS-44L (Capital Budgeting With Risks & Returns)juleslovefenNo ratings yet

- Chapter 02 Investment AppraisalDocument3 pagesChapter 02 Investment AppraisalMarzuka Akter KhanNo ratings yet

- Evaluation of Capital Budgeting TechniquesDocument36 pagesEvaluation of Capital Budgeting TechniquesAshish GoelNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingD Y Patil Institute of MCA and MBANo ratings yet

- CapitDocument8 pagesCapitjanice100% (1)

- Capital Budgeting-Lecture NotesDocument6 pagesCapital Budgeting-Lecture NotesAngela Nicole CalimbasNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingKhushbu PriyadarshniNo ratings yet

- Technic of Cap BudDocument6 pagesTechnic of Cap BudAmar NathNo ratings yet

- MS-12 (Capital Budgeting With Investment Risks and Returns)Document18 pagesMS-12 (Capital Budgeting With Investment Risks and Returns)musor.as084No ratings yet

- What Is Capital BudgetingDocument24 pagesWhat Is Capital BudgetingZohaib Zohaib Khurshid AhmadNo ratings yet

- Non Discounted Techniques LectureDocument3 pagesNon Discounted Techniques Lectureamormi2702No ratings yet

- Module 3 ARS PCC - Capital Budgeting and Cost of CapitalDocument11 pagesModule 3 ARS PCC - Capital Budgeting and Cost of CapitalJames Bradley HuangNo ratings yet

- Year, Financial Management: Capital BudgetingDocument9 pagesYear, Financial Management: Capital BudgetingPooja KansalNo ratings yet

- Evaluation of Capital BudgetingDocument24 pagesEvaluation of Capital BudgetingGayathri GopiramnathNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingRajatNo ratings yet

- CHAPTER 2 - Investment AppraisalDocument19 pagesCHAPTER 2 - Investment AppraisalMaleoaNo ratings yet

- Capital Budgeting: Navigation SearchDocument16 pagesCapital Budgeting: Navigation SearchVenkat Narayana ReddyNo ratings yet

- Discounting or Modern Methods of Capital BudgetingDocument18 pagesDiscounting or Modern Methods of Capital BudgetingRiyas Parakkattil100% (1)

- Capital BudgetingDocument31 pagesCapital BudgetingJanu JinniNo ratings yet

- Module in Financial Management - 09Document7 pagesModule in Financial Management - 09Karla Mae GammadNo ratings yet

- Capital BudgetingDocument26 pagesCapital BudgetingTisha SosaNo ratings yet

- Capital Budgeting TechniquesDocument8 pagesCapital Budgeting Techniqueswaqaar raoNo ratings yet

- 09.1 Module in Financial Management 09Document8 pages09.1 Module in Financial Management 09Fire burnNo ratings yet

- Chapter 14Document2 pagesChapter 14jhouvanNo ratings yet

- Chapter 2 - Investment AppraisalDocument10 pagesChapter 2 - Investment AppraisalHarmeet SinghNo ratings yet

- Colbourne College Unit 14 Week 6Document29 pagesColbourne College Unit 14 Week 6gulubhata41668No ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesMahima GirdharNo ratings yet

- Chapter 11, R, F...Document26 pagesChapter 11, R, F...Rida FatimaNo ratings yet

- DR - Naushad Alam: Capital BudgetingDocument38 pagesDR - Naushad Alam: Capital BudgetingUrvashi SinghNo ratings yet

- CHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeDocument2 pagesCHAPTER 10: Capital Budgeting Techniques: Annual Net IncomeSeresa EstrellasNo ratings yet

- Captai Budgeting AssignmentDocument2 pagesCaptai Budgeting AssignmentPravanjan AumcapNo ratings yet

- Course Learning Outcomes For Unit II: Opportunity Costs and Organizational ArchitectureDocument3 pagesCourse Learning Outcomes For Unit II: Opportunity Costs and Organizational ArchitectureSwapan Kumar SahaNo ratings yet

- Investment Evaluation CriteriaDocument15 pagesInvestment Evaluation Criteriainq33108No ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- Dr. Sandeep Malu Associate Professor SVIM, IndoreDocument14 pagesDr. Sandeep Malu Associate Professor SVIM, Indorechaterji_aNo ratings yet

- 03 - 20th Aug Capital Budgeting, 2019Document37 pages03 - 20th Aug Capital Budgeting, 2019anujNo ratings yet

- Acctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1Document8 pagesAcctg 505 - Decision Analysis II, Capital Budgeting Basics, Chapter 21 - Widdison S.V 1masan01No ratings yet

- Capitalbudgeting 1227282768304644 8Document27 pagesCapitalbudgeting 1227282768304644 8Sumi LatheefNo ratings yet

- Financial ManagementDocument20 pagesFinancial ManagementGAURAV SHARMA100% (1)

- Financial Evaluation (Autorecovered)Document4 pagesFinancial Evaluation (Autorecovered)rohin gargNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Naveed Khattak PracticumDocument22 pagesNaveed Khattak PracticumNaqeebullah Haji AmanullahNo ratings yet

- Differences Between A Partnership and CorporationDocument4 pagesDifferences Between A Partnership and CorporationIvan BendiolaNo ratings yet

- GANN Full Rules TechniquesDocument1 pageGANN Full Rules TechniquesSalai ArulMozhiNo ratings yet

- The Gold Market-OutlineDocument5 pagesThe Gold Market-OutlineMartin SeruggaNo ratings yet

- And in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of ModificationDocument14 pagesAnd in Particular, I'm Thinking Here About The Attractiveness of Selection Versus The Attractiveness of Modificationupasana magarNo ratings yet

- Covered Interest ArbitrageDocument3 pagesCovered Interest ArbitrageKamrul HasanNo ratings yet

- Additional InformationDocument32 pagesAdditional InformationMabel GakoNo ratings yet

- MGMT 476 Homework #1Document3 pagesMGMT 476 Homework #1FangNo ratings yet

- LEDGERDocument10 pagesLEDGERKul DeepNo ratings yet

- Chapter 13 SolutionsDocument26 pagesChapter 13 SolutionsMathew Idanan0% (1)

- Statement of Axis Account No:911010047456925 For The Period (From: 01-08-2023 To: 02-02-2024)Document12 pagesStatement of Axis Account No:911010047456925 For The Period (From: 01-08-2023 To: 02-02-2024)shekhar17042012No ratings yet

- Intern Part 1Document11 pagesIntern Part 1Mrinal DasNo ratings yet

- Multiple Choice Questions CF1Document20 pagesMultiple Choice Questions CF1Đỗ Tuấn AnNo ratings yet

- Thesis 1Document50 pagesThesis 1Sudip ParajuliNo ratings yet

- TP Vii PDFDocument17 pagesTP Vii PDFshekarj100% (3)

- Water Refilling Station Business PlanDocument15 pagesWater Refilling Station Business PlanKeziah Kyle PoononNo ratings yet

- Odisha FIntech Hackathon-ProposalDocument5 pagesOdisha FIntech Hackathon-Proposalsanjib paridaNo ratings yet

- End of Chapter Exercises - Answers: Chapter 16: Predicting Stock ReturnsDocument2 pagesEnd of Chapter Exercises - Answers: Chapter 16: Predicting Stock ReturnsYvonneNo ratings yet

- Project Report Submitted in Partial Fulfillment For The Award of The Degree ofDocument67 pagesProject Report Submitted in Partial Fulfillment For The Award of The Degree ofMubeenNo ratings yet

- LCC Literature Review Report PDFDocument94 pagesLCC Literature Review Report PDFParhan AzizNo ratings yet

- 8 Financial Literacy Lesson1Document6 pages8 Financial Literacy Lesson1hlmd.blogNo ratings yet

- State Bank of Pakistan: Domestic Markets & Monetary Management DepartmentDocument1 pageState Bank of Pakistan: Domestic Markets & Monetary Management DepartmentMuhammadUsmanSaeedNo ratings yet

- Accounting Cycle of A Merchandising Business Part 2Document7 pagesAccounting Cycle of A Merchandising Business Part 2Amie Jane MirandaNo ratings yet

- Indifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, IsDocument5 pagesIndifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, Ismd mehedi hasanNo ratings yet

- Insta Pay Fact SheetDocument2 pagesInsta Pay Fact SheetStella DimitrivNo ratings yet

- Fasb 158 PDFDocument2 pagesFasb 158 PDFDavidNo ratings yet