Professional Documents

Culture Documents

CH-01 Fundamenats

CH-01 Fundamenats

Uploaded by

Nitin KumarCopyright:

Available Formats

You might also like

- FinAccUnit 3 - Partnership Accounts Lecture Notes PDFDocument8 pagesFinAccUnit 3 - Partnership Accounts Lecture Notes PDFSherona Reid100% (5)

- Affidavit of Loss Policy FORMATDocument1 pageAffidavit of Loss Policy FORMATJC Ardiente100% (2)

- SA Constitution Advantages and DisadvantagesDocument2 pagesSA Constitution Advantages and DisadvantagesPravind KumarNo ratings yet

- 1 - Accounting For Partnership Firms - FundamentalsDocument12 pages1 - Accounting For Partnership Firms - FundamentalsAnkit Roy100% (1)

- Chapter 1 - Formation of PartnershipDocument31 pagesChapter 1 - Formation of PartnershipAisyah Basir33% (3)

- Harry & Meghan V Doe Stipulated InjunctionDocument5 pagesHarry & Meghan V Doe Stipulated InjunctionTHROnline100% (1)

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- Buku Nota PertnershipDocument33 pagesBuku Nota PertnershipmaiNo ratings yet

- Final Account 2020Document30 pagesFinal Account 2020Viransh Coaching ClassesNo ratings yet

- C-1 (Fundamentals of Partnership)Document6 pagesC-1 (Fundamentals of Partnership)adwitanegi068No ratings yet

- Chapter 7: PARTNERSHIPDocument45 pagesChapter 7: PARTNERSHIPSuresh LamsalNo ratings yet

- Chapter 2 - Normal PartnershipDocument18 pagesChapter 2 - Normal PartnershipmaiNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- MBD SS Q. Bank ACC - G12 - Ch01Document26 pagesMBD SS Q. Bank ACC - G12 - Ch01Muskan KheraNo ratings yet

- Accounts Theory Chapterwise - 27069624 - 2023 - 12 - 27 - 19 - 231227 - 193022Document80 pagesAccounts Theory Chapterwise - 27069624 - 2023 - 12 - 27 - 19 - 231227 - 193022Vibhu VashishthNo ratings yet

- Partnership NotesDocument35 pagesPartnership Notesa86476007No ratings yet

- Partnership: Basics: DefinitionsDocument13 pagesPartnership: Basics: DefinitionsShiv PatelNo ratings yet

- All Theory Accounts SPCC - 18126678 - 2023 - 05 - 11 - 03 - 26Document28 pagesAll Theory Accounts SPCC - 18126678 - 2023 - 05 - 11 - 03 - 26guptavrinda911No ratings yet

- Work Sheet On Accounting For Partnership FundamentalsDocument19 pagesWork Sheet On Accounting For Partnership Fundamentals8qk77kkhwbNo ratings yet

- 3525 25108 Textbooksolution PDFDocument44 pages3525 25108 Textbooksolution PDFSatinder SinghNo ratings yet

- Partnership AccountingDocument7 pagesPartnership AccountingZaid ZubairiNo ratings yet

- Xii Accounts NOTESDocument13 pagesXii Accounts NOTESNavin PatidarNo ratings yet

- Chapter 2-Accounting For Partnership Firms - Fundamentals: ExerciseDocument44 pagesChapter 2-Accounting For Partnership Firms - Fundamentals: Exercise11 Mahin KhanNo ratings yet

- Fundamentals 2024 PDF SPCCDocument82 pagesFundamentals 2024 PDF SPCCJeetalal GadaNo ratings yet

- Accounting For Partnership Firms - FundamentalsDocument5 pagesAccounting For Partnership Firms - FundamentalsPainNo ratings yet

- Partnership AccountDocument9 pagesPartnership Accountndanujoy180No ratings yet

- Session 4 - Partnership AccountsDocument23 pagesSession 4 - Partnership AccountsFrederickNo ratings yet

- Part 1 Partnership BasicDocument11 pagesPart 1 Partnership BasicSagar YadavNo ratings yet

- IPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiDocument130 pagesIPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiM SheikhaNo ratings yet

- FAR 2 REVIEWER Other SourceDocument120 pagesFAR 2 REVIEWER Other SourceAirish GeronimoNo ratings yet

- New AccountsDocument26 pagesNew AccountsStudyNo ratings yet

- A001 - PartnershipDocument22 pagesA001 - PartnershipDesiree Dawn GabalesNo ratings yet

- 12 Accountancy Revision Notes Part A CH 1 PDFDocument16 pages12 Accountancy Revision Notes Part A CH 1 PDFniks525No ratings yet

- 12 Accountancy Revision Notes Part A CH 1Document16 pages12 Accountancy Revision Notes Part A CH 1SukhsanjamNo ratings yet

- Assignments For +2Document3 pagesAssignments For +2Prakhar SinghNo ratings yet

- Flow Chart (L-2)Document1 pageFlow Chart (L-2)JazaNo ratings yet

- ACC406 - Chapter 7Document24 pagesACC406 - Chapter 7Carol LeslyNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- Partnership Firms Part 2 Appropriation of ProfitDocument14 pagesPartnership Firms Part 2 Appropriation of ProfitDeepti BistNo ratings yet

- Theories Chapter 1 - 5Document11 pagesTheories Chapter 1 - 5u got no jamsNo ratings yet

- Partnership ActivitiesDocument32 pagesPartnership Activitiesandrea.huerto0730No ratings yet

- 457712th MCQ Test 29-1-2019Document6 pages457712th MCQ Test 29-1-2019MohitTagotraNo ratings yet

- Account: 5. in Case of Fixed Capitals, Partners Will HaveDocument3 pagesAccount: 5. in Case of Fixed Capitals, Partners Will HaveNavin PatidarNo ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- Fundamental of Partnership Revision NotesDocument16 pagesFundamental of Partnership Revision NotesTarun SinghalNo ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- The Following Instances Do Not Necessarily Establish A PartnershipDocument4 pagesThe Following Instances Do Not Necessarily Establish A PartnershipGIRLNo ratings yet

- Basic AccountingDocument35 pagesBasic AccountingKaraCassandra LayuganNo ratings yet

- Complete TheoryDocument28 pagesComplete TheoryGODSPEED. AltNo ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- DocxDocument11 pagesDocxClyden Jaile RamirezNo ratings yet

- Partnership AccountDocument67 pagesPartnership Accounttetteh godwinNo ratings yet

- PartnershipDocument6 pagesPartnershipabhishekanandsingh123goNo ratings yet

- Saint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Law On Partnerships Midterm ExamDocument17 pagesSaint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Law On Partnerships Midterm ExamDan RyanNo ratings yet

- Of 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250Document3 pagesOf 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250abhishekNo ratings yet

- Chapter 1 - Formation of PartnershipDocument31 pagesChapter 1 - Formation of PartnershipAisyah BasirNo ratings yet

- Financial Statements of A PartnershipDocument12 pagesFinancial Statements of A PartnershipCharlesNo ratings yet

- Partnership AccountingDocument8 pagesPartnership Accountingferdinand kan pennNo ratings yet

- MCQ Chap1 Scholars PDFDocument11 pagesMCQ Chap1 Scholars PDFPrince TyagiNo ratings yet

- 12 - Acc - Ch2 - Learning FeedbackDocument2 pages12 - Acc - Ch2 - Learning FeedbackSHAH SHREYANo ratings yet

- Basic Legal Ethics - Module 2 - Admission To The Practice of LawDocument39 pagesBasic Legal Ethics - Module 2 - Admission To The Practice of LawDash BencioNo ratings yet

- Binding Sales and Purchase Contract....Document6 pagesBinding Sales and Purchase Contract....Autosale PLCNo ratings yet

- 2022-01-11 Webb ComplaintDocument13 pages2022-01-11 Webb ComplaintErin FuchsNo ratings yet

- Foundation Plan Roof Beam Plan: C D E B A 14.00m C D E B ADocument1 pageFoundation Plan Roof Beam Plan: C D E B A 14.00m C D E B AJohn Carl SalasNo ratings yet

- Week 3 - Professional Practice5Document6 pagesWeek 3 - Professional Practice5jomarie apolinarioNo ratings yet

- Ramcharan V Deonarine - ProbateDocument23 pagesRamcharan V Deonarine - ProbateDarian SammyNo ratings yet

- Property Law-I NotesDocument7 pagesProperty Law-I NotesKritin BahugunaNo ratings yet

- Attachment 1a - SSF Project Memorandum of AgreementDocument6 pagesAttachment 1a - SSF Project Memorandum of AgreementCatherine BenbanNo ratings yet

- Nreing2021091402 5900086294Document2 pagesNreing2021091402 5900086294Thanh Hà LêNo ratings yet

- Industrial Relations: Chapter FourDocument3 pagesIndustrial Relations: Chapter FourAmir HamzahNo ratings yet

- Law Association of Zambia ActDocument41 pagesLaw Association of Zambia Actrobertkarabo.jNo ratings yet

- Appln Form - BTO For BCP (Aug 2018)Document7 pagesAppln Form - BTO For BCP (Aug 2018)Joharn ANo ratings yet

- Innodata v. IntingDocument2 pagesInnodata v. IntingJamiah Hulipas100% (1)

- Letter of Credit Proof of Purchase Funds Affidavit + Tampa Marriott WestshoreDocument2 pagesLetter of Credit Proof of Purchase Funds Affidavit + Tampa Marriott Westshoreshasha ann bey100% (4)

- Pope Francis Motu ProprioDocument18 pagesPope Francis Motu Proprionujahm1639No ratings yet

- VAT in General - CIR Vs CA &CMS, GR No. 125355Document2 pagesVAT in General - CIR Vs CA &CMS, GR No. 125355Christine Gel MadrilejoNo ratings yet

- 6 - Araneta v. Gatmaitan, G.R. Nos. L-8895 and L-9191, April 30, 1957Document2 pages6 - Araneta v. Gatmaitan, G.R. Nos. L-8895 and L-9191, April 30, 1957dasai watashiNo ratings yet

- Ceylon Builders SDN BHD V Ultimate Pursuit SDN BHD and Another Appeal (2018) MLJU 1918Document11 pagesCeylon Builders SDN BHD V Ultimate Pursuit SDN BHD and Another Appeal (2018) MLJU 1918Lawrence LauNo ratings yet

- Graduation 14092023 1Document51 pagesGraduation 14092023 1Venkatesh BhatNo ratings yet

- Name: Sahil Verma ROLL NO.: 2148 Semester: 5 YEAR: 2019-2024 Course: B.A., LL.B (Hons.)Document13 pagesName: Sahil Verma ROLL NO.: 2148 Semester: 5 YEAR: 2019-2024 Course: B.A., LL.B (Hons.)Sachin KumarNo ratings yet

- Testimony Poder Especial Zenaida - Ver EnglishDocument2 pagesTestimony Poder Especial Zenaida - Ver EnglishErnesto VelasquezNo ratings yet

- Halsbury's MistakeDocument73 pagesHalsbury's MistakeMinisterNo ratings yet

- Contract Law in Hong KongDocument52 pagesContract Law in Hong Kongtechang1No ratings yet

- FCC FOIA: StingRay, KingFish User Manual (2010)Document58 pagesFCC FOIA: StingRay, KingFish User Manual (2010)Matthew Keys86% (7)

- Annual Holidays Act 1944Document23 pagesAnnual Holidays Act 1944Ian FlynnNo ratings yet

- (1847) Beloved Physician (Edgar Allan Poe)Document1 page(1847) Beloved Physician (Edgar Allan Poe)StelioPassarisNo ratings yet

- The High Court of Orissa, Cuttack: List of Business For Friday The 18Th October 2019Document46 pagesThe High Court of Orissa, Cuttack: List of Business For Friday The 18Th October 2019sunita beharaNo ratings yet

CH-01 Fundamenats

CH-01 Fundamenats

Uploaded by

Nitin KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH-01 Fundamenats

CH-01 Fundamenats

Uploaded by

Nitin KumarCopyright:

Available Formats

Fundamentals Partnership Firm

Partnership is the relation between persons who have agreed to share the profits of a business carried on

by all or any of them acting for all.

Section 4 of partnership act, 1932

a) Minimum partner 2

b) Maximum partner 50 as per rule 10 of the companies rules, 2014

Essential condition of Partnership

Business + Profits + Mutual agency

a) Two or more persons

b) Agreement (Oral or written)

c) Lawful business (Existence of business & profit motive)

d) Sharing of profits

e) Principle and Agent relationship

f) No separate existence (legal point of View)

g) Business can be carried on by all or any one of them acting for all

Rights of a partner

a) Right to participate in management

b) Right to inspect books of account and have a copy of it

c) Right to share profits or losses

d) Right to received interest on his/her loan to the firm @6% p.a. (Charge)

e) A partner has the right not to allow the admission of a new partner

f) After giving proper notice, a partner has right to retire from the firm

Partnership Deed:-

A partnership deed is an agreement between the partners of a firm that contains the terms and conditions

of partnership.

a) It is not mandatory.

b) It also called “Articles of partnership”

It contains the following points

a) Name and Address of the firm & partners.

b) Nature of business, capital contribution, profit sharing ratio, Accounting period, Duration of

partnership & settlement of Disputes.

c) Interest on capital, salaries to partners, commission, etc.

d) Rights and Duties of Partners

IMPORTANT POINTS TO BE REMEMBERED

a) In partnership the liability of all partners are unlimited

b) Registration of Partnership firm is not Compulsory.

c) Partnership is separate business entity from Accounting point of view

LLP : Limited Liability Partnership (LLP ACT 2008)

Here liability of partners are limited

(Mix of Partnership and Company)

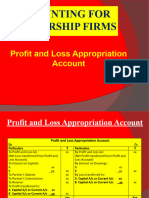

Dr Profit & Loss Appropriation A/c

Cr

Particular Amount($) Particular

To Interest on Capital: By Profit and Loss A/c (Net Profit) XXX

A XXX By Interest on Drawings: XXX

B XXX A XXX

To Partner’s Salary XXX B XXX

To Partner’s Commission XXX XXX

Fundamentals Partnership Firm

To Reserve XXX

To Profit Transferred to:

A’s Capital/Current A/C XXX

B’s Capital/Current A/C XXX XXX

XXX

Total XXX Total

In the absence of partnership deed (Partnership Act provisions are applicable)

a) Profit sharing ratio will equal

b) No interest on capital, no salary, no interest on drawings, etc.

c) Interest on (partners loan to firm) @6% p.a.

d) Interest on (firm loans to Partners) – NO INTEREST It is a charge against profit hence provided

even in case of losses

e) Interest on capital & salary if given in partnership deed then it will provided but only out of profits.

Charge against profits & Appropriation of profits

MINOR DECISION AND MAJOR DECISION

Salary and Commission to partners

Fundamentals Partnership Firm

Practical problems

Methods of partners capital Account.

GUARANTEE OF PROFITS TO A PARTNER

You might also like

- FinAccUnit 3 - Partnership Accounts Lecture Notes PDFDocument8 pagesFinAccUnit 3 - Partnership Accounts Lecture Notes PDFSherona Reid100% (5)

- Affidavit of Loss Policy FORMATDocument1 pageAffidavit of Loss Policy FORMATJC Ardiente100% (2)

- SA Constitution Advantages and DisadvantagesDocument2 pagesSA Constitution Advantages and DisadvantagesPravind KumarNo ratings yet

- 1 - Accounting For Partnership Firms - FundamentalsDocument12 pages1 - Accounting For Partnership Firms - FundamentalsAnkit Roy100% (1)

- Chapter 1 - Formation of PartnershipDocument31 pagesChapter 1 - Formation of PartnershipAisyah Basir33% (3)

- Harry & Meghan V Doe Stipulated InjunctionDocument5 pagesHarry & Meghan V Doe Stipulated InjunctionTHROnline100% (1)

- CH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Document12 pagesCH - 2 Accounting For Partnership Firms: Fundamentals: According To Section 4 of The Partnership Act 1932Laksh KhannaNo ratings yet

- Buku Nota PertnershipDocument33 pagesBuku Nota PertnershipmaiNo ratings yet

- Final Account 2020Document30 pagesFinal Account 2020Viransh Coaching ClassesNo ratings yet

- C-1 (Fundamentals of Partnership)Document6 pagesC-1 (Fundamentals of Partnership)adwitanegi068No ratings yet

- Chapter 7: PARTNERSHIPDocument45 pagesChapter 7: PARTNERSHIPSuresh LamsalNo ratings yet

- Chapter 2 - Normal PartnershipDocument18 pagesChapter 2 - Normal PartnershipmaiNo ratings yet

- Accounting For PartnershipDocument15 pagesAccounting For Partnershipnagesh dashNo ratings yet

- Study Material CH.-1 Fundamentals of Partnership 2023-24Document28 pagesStudy Material CH.-1 Fundamentals of Partnership 2023-24vsy9926No ratings yet

- Accounting For Partnership Firms - Fundamentals 2021Document183 pagesAccounting For Partnership Firms - Fundamentals 2021JPS J100% (1)

- MBD SS Q. Bank ACC - G12 - Ch01Document26 pagesMBD SS Q. Bank ACC - G12 - Ch01Muskan KheraNo ratings yet

- Accounts Theory Chapterwise - 27069624 - 2023 - 12 - 27 - 19 - 231227 - 193022Document80 pagesAccounts Theory Chapterwise - 27069624 - 2023 - 12 - 27 - 19 - 231227 - 193022Vibhu VashishthNo ratings yet

- Partnership NotesDocument35 pagesPartnership Notesa86476007No ratings yet

- Partnership: Basics: DefinitionsDocument13 pagesPartnership: Basics: DefinitionsShiv PatelNo ratings yet

- All Theory Accounts SPCC - 18126678 - 2023 - 05 - 11 - 03 - 26Document28 pagesAll Theory Accounts SPCC - 18126678 - 2023 - 05 - 11 - 03 - 26guptavrinda911No ratings yet

- Work Sheet On Accounting For Partnership FundamentalsDocument19 pagesWork Sheet On Accounting For Partnership Fundamentals8qk77kkhwbNo ratings yet

- 3525 25108 Textbooksolution PDFDocument44 pages3525 25108 Textbooksolution PDFSatinder SinghNo ratings yet

- Partnership AccountingDocument7 pagesPartnership AccountingZaid ZubairiNo ratings yet

- Xii Accounts NOTESDocument13 pagesXii Accounts NOTESNavin PatidarNo ratings yet

- Chapter 2-Accounting For Partnership Firms - Fundamentals: ExerciseDocument44 pagesChapter 2-Accounting For Partnership Firms - Fundamentals: Exercise11 Mahin KhanNo ratings yet

- Fundamentals 2024 PDF SPCCDocument82 pagesFundamentals 2024 PDF SPCCJeetalal GadaNo ratings yet

- Accounting For Partnership Firms - FundamentalsDocument5 pagesAccounting For Partnership Firms - FundamentalsPainNo ratings yet

- Partnership AccountDocument9 pagesPartnership Accountndanujoy180No ratings yet

- Session 4 - Partnership AccountsDocument23 pagesSession 4 - Partnership AccountsFrederickNo ratings yet

- Part 1 Partnership BasicDocument11 pagesPart 1 Partnership BasicSagar YadavNo ratings yet

- IPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiDocument130 pagesIPCC Paper I: Accounting Chapter No. 14 CA Shakuntala ChhanganiM SheikhaNo ratings yet

- FAR 2 REVIEWER Other SourceDocument120 pagesFAR 2 REVIEWER Other SourceAirish GeronimoNo ratings yet

- New AccountsDocument26 pagesNew AccountsStudyNo ratings yet

- A001 - PartnershipDocument22 pagesA001 - PartnershipDesiree Dawn GabalesNo ratings yet

- 12 Accountancy Revision Notes Part A CH 1 PDFDocument16 pages12 Accountancy Revision Notes Part A CH 1 PDFniks525No ratings yet

- 12 Accountancy Revision Notes Part A CH 1Document16 pages12 Accountancy Revision Notes Part A CH 1SukhsanjamNo ratings yet

- Assignments For +2Document3 pagesAssignments For +2Prakhar SinghNo ratings yet

- Flow Chart (L-2)Document1 pageFlow Chart (L-2)JazaNo ratings yet

- ACC406 - Chapter 7Document24 pagesACC406 - Chapter 7Carol LeslyNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- Partnership Firms Part 2 Appropriation of ProfitDocument14 pagesPartnership Firms Part 2 Appropriation of ProfitDeepti BistNo ratings yet

- Theories Chapter 1 - 5Document11 pagesTheories Chapter 1 - 5u got no jamsNo ratings yet

- Partnership ActivitiesDocument32 pagesPartnership Activitiesandrea.huerto0730No ratings yet

- 457712th MCQ Test 29-1-2019Document6 pages457712th MCQ Test 29-1-2019MohitTagotraNo ratings yet

- Account: 5. in Case of Fixed Capitals, Partners Will HaveDocument3 pagesAccount: 5. in Case of Fixed Capitals, Partners Will HaveNavin PatidarNo ratings yet

- Chapter 6: Appropriation of Profits: Rohit AgarwalDocument4 pagesChapter 6: Appropriation of Profits: Rohit AgarwalbcomNo ratings yet

- Fundamental of Partnership Revision NotesDocument16 pagesFundamental of Partnership Revision NotesTarun SinghalNo ratings yet

- Accounts Full ConceptsDocument91 pagesAccounts Full ConceptsAnmol BehalNo ratings yet

- The Following Instances Do Not Necessarily Establish A PartnershipDocument4 pagesThe Following Instances Do Not Necessarily Establish A PartnershipGIRLNo ratings yet

- Basic AccountingDocument35 pagesBasic AccountingKaraCassandra LayuganNo ratings yet

- Complete TheoryDocument28 pagesComplete TheoryGODSPEED. AltNo ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- DocxDocument11 pagesDocxClyden Jaile RamirezNo ratings yet

- Partnership AccountDocument67 pagesPartnership Accounttetteh godwinNo ratings yet

- PartnershipDocument6 pagesPartnershipabhishekanandsingh123goNo ratings yet

- Saint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Law On Partnerships Midterm ExamDocument17 pagesSaint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Law On Partnerships Midterm ExamDan RyanNo ratings yet

- Of 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250Document3 pagesOf 5% Charging Partnership Monthly (A) 7,5000 (B) 16,500 (C) 8,250abhishekNo ratings yet

- Chapter 1 - Formation of PartnershipDocument31 pagesChapter 1 - Formation of PartnershipAisyah BasirNo ratings yet

- Financial Statements of A PartnershipDocument12 pagesFinancial Statements of A PartnershipCharlesNo ratings yet

- Partnership AccountingDocument8 pagesPartnership Accountingferdinand kan pennNo ratings yet

- MCQ Chap1 Scholars PDFDocument11 pagesMCQ Chap1 Scholars PDFPrince TyagiNo ratings yet

- 12 - Acc - Ch2 - Learning FeedbackDocument2 pages12 - Acc - Ch2 - Learning FeedbackSHAH SHREYANo ratings yet

- Basic Legal Ethics - Module 2 - Admission To The Practice of LawDocument39 pagesBasic Legal Ethics - Module 2 - Admission To The Practice of LawDash BencioNo ratings yet

- Binding Sales and Purchase Contract....Document6 pagesBinding Sales and Purchase Contract....Autosale PLCNo ratings yet

- 2022-01-11 Webb ComplaintDocument13 pages2022-01-11 Webb ComplaintErin FuchsNo ratings yet

- Foundation Plan Roof Beam Plan: C D E B A 14.00m C D E B ADocument1 pageFoundation Plan Roof Beam Plan: C D E B A 14.00m C D E B AJohn Carl SalasNo ratings yet

- Week 3 - Professional Practice5Document6 pagesWeek 3 - Professional Practice5jomarie apolinarioNo ratings yet

- Ramcharan V Deonarine - ProbateDocument23 pagesRamcharan V Deonarine - ProbateDarian SammyNo ratings yet

- Property Law-I NotesDocument7 pagesProperty Law-I NotesKritin BahugunaNo ratings yet

- Attachment 1a - SSF Project Memorandum of AgreementDocument6 pagesAttachment 1a - SSF Project Memorandum of AgreementCatherine BenbanNo ratings yet

- Nreing2021091402 5900086294Document2 pagesNreing2021091402 5900086294Thanh Hà LêNo ratings yet

- Industrial Relations: Chapter FourDocument3 pagesIndustrial Relations: Chapter FourAmir HamzahNo ratings yet

- Law Association of Zambia ActDocument41 pagesLaw Association of Zambia Actrobertkarabo.jNo ratings yet

- Appln Form - BTO For BCP (Aug 2018)Document7 pagesAppln Form - BTO For BCP (Aug 2018)Joharn ANo ratings yet

- Innodata v. IntingDocument2 pagesInnodata v. IntingJamiah Hulipas100% (1)

- Letter of Credit Proof of Purchase Funds Affidavit + Tampa Marriott WestshoreDocument2 pagesLetter of Credit Proof of Purchase Funds Affidavit + Tampa Marriott Westshoreshasha ann bey100% (4)

- Pope Francis Motu ProprioDocument18 pagesPope Francis Motu Proprionujahm1639No ratings yet

- VAT in General - CIR Vs CA &CMS, GR No. 125355Document2 pagesVAT in General - CIR Vs CA &CMS, GR No. 125355Christine Gel MadrilejoNo ratings yet

- 6 - Araneta v. Gatmaitan, G.R. Nos. L-8895 and L-9191, April 30, 1957Document2 pages6 - Araneta v. Gatmaitan, G.R. Nos. L-8895 and L-9191, April 30, 1957dasai watashiNo ratings yet

- Ceylon Builders SDN BHD V Ultimate Pursuit SDN BHD and Another Appeal (2018) MLJU 1918Document11 pagesCeylon Builders SDN BHD V Ultimate Pursuit SDN BHD and Another Appeal (2018) MLJU 1918Lawrence LauNo ratings yet

- Graduation 14092023 1Document51 pagesGraduation 14092023 1Venkatesh BhatNo ratings yet

- Name: Sahil Verma ROLL NO.: 2148 Semester: 5 YEAR: 2019-2024 Course: B.A., LL.B (Hons.)Document13 pagesName: Sahil Verma ROLL NO.: 2148 Semester: 5 YEAR: 2019-2024 Course: B.A., LL.B (Hons.)Sachin KumarNo ratings yet

- Testimony Poder Especial Zenaida - Ver EnglishDocument2 pagesTestimony Poder Especial Zenaida - Ver EnglishErnesto VelasquezNo ratings yet

- Halsbury's MistakeDocument73 pagesHalsbury's MistakeMinisterNo ratings yet

- Contract Law in Hong KongDocument52 pagesContract Law in Hong Kongtechang1No ratings yet

- FCC FOIA: StingRay, KingFish User Manual (2010)Document58 pagesFCC FOIA: StingRay, KingFish User Manual (2010)Matthew Keys86% (7)

- Annual Holidays Act 1944Document23 pagesAnnual Holidays Act 1944Ian FlynnNo ratings yet

- (1847) Beloved Physician (Edgar Allan Poe)Document1 page(1847) Beloved Physician (Edgar Allan Poe)StelioPassarisNo ratings yet

- The High Court of Orissa, Cuttack: List of Business For Friday The 18Th October 2019Document46 pagesThe High Court of Orissa, Cuttack: List of Business For Friday The 18Th October 2019sunita beharaNo ratings yet