Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsCase Study

Case Study

Uploaded by

AbhijnaRao MedavarapuCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- TF 062062831Document5 pagesTF 062062831kumarNo ratings yet

- W07 Case Study Loan AssignmentDocument66 pagesW07 Case Study Loan AssignmentArmando Aroni BacaNo ratings yet

- Capter 2Document5 pagesCapter 2DiwakarNo ratings yet

- Small Finance BankDocument9 pagesSmall Finance BankRohit SinghNo ratings yet

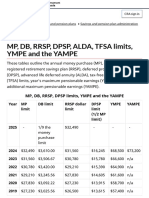

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet

- m3 Project Antonio NietoDocument2 pagesm3 Project Antonio Nietoapi-747331511No ratings yet

- Total Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison CalculatorDocument5 pagesTotal Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison Calculatorjohnsmith05046876No ratings yet

- Net Present Value Cost Savings DR 11% Discounted Cash InflowDocument10 pagesNet Present Value Cost Savings DR 11% Discounted Cash InflowFaraz BakhshNo ratings yet

- A Case Against Trading - Investment InsightsDocument6 pagesA Case Against Trading - Investment InsightsMONEY MINDED MILLENNIALNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Report俞悅No ratings yet

- Assignment 3 BookDocument14 pagesAssignment 3 Bookapi-604969350No ratings yet

- Home Buy Vs Rent Complex 2019 UpdateDocument6 pagesHome Buy Vs Rent Complex 2019 UpdateOthman Alaoui Mdaghri BenNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Reportnedian_2006No ratings yet

- Test #3 Review - Loan and NPV 2Document2 pagesTest #3 Review - Loan and NPV 2nikhil.dharmavaramNo ratings yet

- Costs of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionDocument6 pagesCosts of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionLogan WilsonNo ratings yet

- How To Invest in The Best CompanyDocument10 pagesHow To Invest in The Best Companysamir SenseNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Report俞悅No ratings yet

- TVM All SolutionDocument31 pagesTVM All SolutionANUP MUNDENo ratings yet

- Earning Potential 1Document1 pageEarning Potential 1api-746648814No ratings yet

- Time Value of MoneyDocument47 pagesTime Value of MoneyQuanNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- Taller 3Document22 pagesTaller 3CRISTIAN CAMILO MORALES SOLISNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Case Study#1Document6 pagesCase Study#1Scott SchroederNo ratings yet

- Mortgage Payment Calculator - TD Canada TrustDocument3 pagesMortgage Payment Calculator - TD Canada TrustTomura ShigarakiNo ratings yet

- R3 Page1Document1 pageR3 Page1Benjamin ChillamNo ratings yet

- Running Head: FinanceDocument7 pagesRunning Head: FinanceCarlos AlphonceNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Report俞悅No ratings yet

- Executive Summary: A. The North American Dermatology Division's 2017 EVADocument2 pagesExecutive Summary: A. The North American Dermatology Division's 2017 EVAAtul Anand bj21135No ratings yet

- Loans ListingDocument58 pagesLoans ListingsockeymmNo ratings yet

- FIRE in India - Investment InsightsDocument6 pagesFIRE in India - Investment Insightshariprasath1986No ratings yet

- Real Estate 1cqm9pdl6 - 232635Document68 pagesReal Estate 1cqm9pdl6 - 232635DGLNo ratings yet

- 3 4 5 YearsDocument10 pages3 4 5 YearsCherith MonteroNo ratings yet

- Annuity ComparisonDocument6 pagesAnnuity ComparisonMichael SherrinNo ratings yet

- Excel Sheet (1158)Document30 pagesExcel Sheet (1158)Saumil PatelNo ratings yet

- Quiz Chapter 5 - Haryo IndraDocument4 pagesQuiz Chapter 5 - Haryo IndraHaryo HartoyoNo ratings yet

- How Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next YearDocument7 pagesHow Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next Yearamaresh mahapatraNo ratings yet

- 2022PGP257 - Rent or Buy - Arpit Agarwal - Arpit AgarwalDocument11 pages2022PGP257 - Rent or Buy - Arpit Agarwal - Arpit AgarwalShrey RanaNo ratings yet

- Gmail Car Cost Comparison Tool For Excel Healthywealthywiseproject - JPGDocument3 pagesGmail Car Cost Comparison Tool For Excel Healthywealthywiseproject - JPGRoha JavidNo ratings yet

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaNo ratings yet

- Ocean Carriers FinalDocument3 pagesOcean Carriers FinalGiorgi MeskhishviliNo ratings yet

- Cuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosDocument16 pagesCuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosPaula GómezNo ratings yet

- Ryan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Document3 pagesRyan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Giorgi MeskhishviliNo ratings yet

- Personal Finance 2nd Edition Walker Solutions ManualDocument14 pagesPersonal Finance 2nd Edition Walker Solutions Manualsmiletadynamia7iu4100% (27)

- Applied Math Practice For Financial Advisors - Exercises (Solutions)Document62 pagesApplied Math Practice For Financial Advisors - Exercises (Solutions)Ali kamakuraNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Answer 3Document21 pagesAnswer 3Lyca MaeNo ratings yet

- Excel Drill Exercise 1 MDLDocument16 pagesExcel Drill Exercise 1 MDLEugine AmadoNo ratings yet

- Buy Fix&sellDocument1 pageBuy Fix&sellAriel ShapiraNo ratings yet

- FIRE in IndiaDocument4 pagesFIRE in IndiaNagarajan DSNo ratings yet

- Tutorial Solution DepreciationDocument2 pagesTutorial Solution DepreciationbillNo ratings yet

- Lauras School Budget (Edited)Document2 pagesLauras School Budget (Edited)xcupcakex122006No ratings yet

- Quantitative Problems Chapter 12Document9 pagesQuantitative Problems Chapter 12waqar hattarNo ratings yet

- Week 6 Go LiveDocument3 pagesWeek 6 Go Livewriter topNo ratings yet

- ULIP Return CalculatorDocument2 pagesULIP Return CalculatorMONEY MINDED MILLENNIALNo ratings yet

- Finanzas ESQUEMADocument6 pagesFinanzas ESQUEMARichard Taipe ChacaltanaNo ratings yet

- LR Borrowed $ 15000 Loan at A 14% Annual Rate Compounded Monthly Which Is To Be Repaid Over 5 YearsDocument7 pagesLR Borrowed $ 15000 Loan at A 14% Annual Rate Compounded Monthly Which Is To Be Repaid Over 5 YearsashabNo ratings yet

- Total RevenueDocument1 pageTotal RevenueethanselphNo ratings yet

- Quantitative Problems Chapter 12Document12 pagesQuantitative Problems Chapter 12AndrewVazNo ratings yet

- Ebook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFDocument17 pagesEbook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFfintanthamh4jtd100% (13)

- Las VegasDocument9 pagesLas VegasAbhijnaRao MedavarapuNo ratings yet

- HoustonDocument9 pagesHoustonAbhijnaRao MedavarapuNo ratings yet

- Des MoinesDocument9 pagesDes MoinesAbhijnaRao MedavarapuNo ratings yet

- WWM - SingaporeDocument25 pagesWWM - SingaporeAbhijnaRao MedavarapuNo ratings yet

- FormsDocument2 pagesFormsAbhijnaRao MedavarapuNo ratings yet

- HotelDocument2 pagesHotelAbhijnaRao MedavarapuNo ratings yet

- Restaurant Design Site AnalysisDocument2 pagesRestaurant Design Site AnalysisAbhijnaRao MedavarapuNo ratings yet

- Customer Request Forms - LoansDocument1 pageCustomer Request Forms - LoansChiragNo ratings yet

- EastWest Bank Home Loan Application Form SignedDocument2 pagesEastWest Bank Home Loan Application Form SignedJohn Andrew Mañacop100% (1)

- Financing Hospital ExpansionDocument6 pagesFinancing Hospital ExpansionJabu MpolokengNo ratings yet

- Bankers Confidential ReportDocument1 pageBankers Confidential ReportBappa ChakrabortyNo ratings yet

- Jayesh DMS Research ReportDocument49 pagesJayesh DMS Research ReportJayesh MunjalNo ratings yet

- Commercial Bank - Chapter #1Document4 pagesCommercial Bank - Chapter #1Tito R. GarcíaNo ratings yet

- Civ2 Quiz May 13 2023Document6 pagesCiv2 Quiz May 13 2023Ronalyn GaculaNo ratings yet

- Luzon Dev Bank Vs Enriquez - ObliconDocument2 pagesLuzon Dev Bank Vs Enriquez - ObliconJeraldine Tatiana PiñarNo ratings yet

- Self Help GroupsDocument18 pagesSelf Help Groupsykbharti101No ratings yet

- Rizwan & Co.: Chartered AccountantsDocument2 pagesRizwan & Co.: Chartered AccountantsfaheemNo ratings yet

- Toward The Efficient Impact Frontier: FeaturesDocument6 pagesToward The Efficient Impact Frontier: Featuresguramios chukhrukidzeNo ratings yet

- Assignment 01Document17 pagesAssignment 01Md Mahmudur RahmanNo ratings yet

- Loan Details Sheet 2023-10-30 23 51 13Document4 pagesLoan Details Sheet 2023-10-30 23 51 13aksinger108No ratings yet

- SAPM Mid TermDocument2 pagesSAPM Mid TermKartikyaNo ratings yet

- Annual Credit Report - ExperianDocument58 pagesAnnual Credit Report - ExperianliveyourbestlifehoNo ratings yet

- Intermediate Financing (Term Loan and Lease Financing)Document41 pagesIntermediate Financing (Term Loan and Lease Financing)Soo CealNo ratings yet

- AccountingDocument33 pagesAccountingJunel MontemayorNo ratings yet

- M-I-2.Time Value of MoneyDocument26 pagesM-I-2.Time Value of Moneymonalisha mishraNo ratings yet

- Bankruptcy! FMW by Shoichi Arai, Emu Eaglestone (Translator)Document71 pagesBankruptcy! FMW by Shoichi Arai, Emu Eaglestone (Translator)Salih ArandıNo ratings yet

- Letter of ContinuityDocument2 pagesLetter of ContinuityVikram PhalakNo ratings yet

- MG1600 Coursework Brief 2022.23v4Document8 pagesMG1600 Coursework Brief 2022.23v4SurayaNo ratings yet

- CARO 2016 Vs CARO 2020Document3 pagesCARO 2016 Vs CARO 2020JrkNo ratings yet

- Schedule K (Secured)Document5 pagesSchedule K (Secured)Jie Han100% (1)

- Bikila ResearchDocument57 pagesBikila ResearchBobasa S AhmedNo ratings yet

- ACF302 - Week 16 - Lecture - LeasingDocument79 pagesACF302 - Week 16 - Lecture - Leasingaryanrao098No ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsOm SinghNo ratings yet

- Integrated Approach To The Growing Msme Sector: Dr. B. Yerram Raju, Ph.D. Economist & Risk Management ConsultantDocument22 pagesIntegrated Approach To The Growing Msme Sector: Dr. B. Yerram Raju, Ph.D. Economist & Risk Management ConsultantmuschiobianccoNo ratings yet

- Loan Amortization ScheduleDocument12 pagesLoan Amortization ScheduleMuhammad JavedNo ratings yet

Case Study

Case Study

Uploaded by

AbhijnaRao Medavarapu0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

case study

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesCase Study

Case Study

Uploaded by

AbhijnaRao MedavarapuCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

Guss income statement for 10 years

Credit card student loan Car

Year Income interest interest car Loan maintenance

Year 1 $48000 $ 8,928.57 $ 13,414.45 $ 11,979.90 $ 2,400.00

Year 2 $48000 $ 8,928.57 $ 13,414.45 $ 11,979.90 $ 2,400.00

Year 3 $48000 $ - $ 13,414.45 $ 11,979.90 $ 2,400.00

Year 4 $48000 $ - $ 13,414.45 $ 11,979.90 $ 2,400.00

Year 5 $48000 $ - $ 13,414.45 $ 11,979.90 $ 2,400.00

Year 6 $48000 $ - $ 13,414.45 $ - $ 2,400.00

Year 7 $48000 $ - $ 13,414.45 $ - $ 2,400.00

Year 8 $48000 $ - $ 13,414.45 $ - $ 2,400.00

Year 9 $48000 $ - $ 13,414.45 $ - $ 2,400.00

Year 10 $48000 $ - $ 13,414.45 $ - $ 2,400.00

Car amortion

schedule

annual interest rate 9%

Loan term 5

Payments per year 12

Loan amount $ 15,000.00

period payment interest principle balance insurance

1 $ 11,979.90 ₹ 11,250.00 $ 729.90 $ 14,270.10 $ 1,200.00

2 $ 11,979.90 ₹ 10,702.58 $ 1,277.32 $ 13,722.68 $ 1,200.00

3 $ 11,979.90 ₹ 9,744.58 $ 2,235.32 $ 12,764.68 $ 1,200.00

4 $ 11,979.90 ₹ 8,068.10 $ 3,911.80 $ 11,088.20 $ 1,200.00

5 $ 11,979.90 ₹ 5,134.24 $ 6,845.66 $ 8,154.34 $ 1,200.00

3. After Gus’ car is paid off, he plans to continue setting aside the amount of his

car payment to accumulate funds for the car's replacement. If he invests this amount

at a rate of 3% compounded monthly, how much will he have saved by the end of

the initial 10-year period?

₹ 12,301,312.38 future value

living

expenses Expenses savings

$ 17,640.00 $ 54,362.92 $ -6,362.92

$ 17,640.00 $ 54,362.92 $ -6,362.92

$ 17,640.00 $ 45,434.34 $ 2,565.66

$ 17,640.00 $ 45,434.34 $ 2,565.66

$ 17,640.00 $ 45,434.34 $ 2,565.66

$ 17,640.00 $ 33,454.45 $ 14,545.55

$ 17,640.00 $ 33,454.45 $ 14,545.55

$ 17,640.00 $ 33,454.45 $ 14,545.55

$ 17,640.00 $ 33,454.45 $ 14,545.55

$ 17,640.00 $ 33,454.45 $ 14,545.55

savings by

the end of 10

years $ 67,698.89

expenses total

$ 2,400.00 $ 41,829.90

$ 2,400.00 $ 41,282.47

$ 2,400.00 $ 40,324.48

$ 2,400.00 $ 38,647.99

$ 2,400.00 $ 35,714.14

You might also like

- TF 062062831Document5 pagesTF 062062831kumarNo ratings yet

- W07 Case Study Loan AssignmentDocument66 pagesW07 Case Study Loan AssignmentArmando Aroni BacaNo ratings yet

- Capter 2Document5 pagesCapter 2DiwakarNo ratings yet

- Small Finance BankDocument9 pagesSmall Finance BankRohit SinghNo ratings yet

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet

- m3 Project Antonio NietoDocument2 pagesm3 Project Antonio Nietoapi-747331511No ratings yet

- Total Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison CalculatorDocument5 pagesTotal Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison Calculatorjohnsmith05046876No ratings yet

- Net Present Value Cost Savings DR 11% Discounted Cash InflowDocument10 pagesNet Present Value Cost Savings DR 11% Discounted Cash InflowFaraz BakhshNo ratings yet

- A Case Against Trading - Investment InsightsDocument6 pagesA Case Against Trading - Investment InsightsMONEY MINDED MILLENNIALNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Report俞悅No ratings yet

- Assignment 3 BookDocument14 pagesAssignment 3 Bookapi-604969350No ratings yet

- Home Buy Vs Rent Complex 2019 UpdateDocument6 pagesHome Buy Vs Rent Complex 2019 UpdateOthman Alaoui Mdaghri BenNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Reportnedian_2006No ratings yet

- Test #3 Review - Loan and NPV 2Document2 pagesTest #3 Review - Loan and NPV 2nikhil.dharmavaramNo ratings yet

- Costs of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionDocument6 pagesCosts of Homeownership: 2019 TCJA Inputs: Buy or Rent A House? Figure It Out With IRR - More Complex VersionLogan WilsonNo ratings yet

- How To Invest in The Best CompanyDocument10 pagesHow To Invest in The Best Companysamir SenseNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Report俞悅No ratings yet

- TVM All SolutionDocument31 pagesTVM All SolutionANUP MUNDENo ratings yet

- Earning Potential 1Document1 pageEarning Potential 1api-746648814No ratings yet

- Time Value of MoneyDocument47 pagesTime Value of MoneyQuanNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5Ahlam KassemNo ratings yet

- Taller 3Document22 pagesTaller 3CRISTIAN CAMILO MORALES SOLISNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Case Study#1Document6 pagesCase Study#1Scott SchroederNo ratings yet

- Mortgage Payment Calculator - TD Canada TrustDocument3 pagesMortgage Payment Calculator - TD Canada TrustTomura ShigarakiNo ratings yet

- R3 Page1Document1 pageR3 Page1Benjamin ChillamNo ratings yet

- Running Head: FinanceDocument7 pagesRunning Head: FinanceCarlos AlphonceNo ratings yet

- Personalized Mortgage ReportDocument3 pagesPersonalized Mortgage Report俞悅No ratings yet

- Executive Summary: A. The North American Dermatology Division's 2017 EVADocument2 pagesExecutive Summary: A. The North American Dermatology Division's 2017 EVAAtul Anand bj21135No ratings yet

- Loans ListingDocument58 pagesLoans ListingsockeymmNo ratings yet

- FIRE in India - Investment InsightsDocument6 pagesFIRE in India - Investment Insightshariprasath1986No ratings yet

- Real Estate 1cqm9pdl6 - 232635Document68 pagesReal Estate 1cqm9pdl6 - 232635DGLNo ratings yet

- 3 4 5 YearsDocument10 pages3 4 5 YearsCherith MonteroNo ratings yet

- Annuity ComparisonDocument6 pagesAnnuity ComparisonMichael SherrinNo ratings yet

- Excel Sheet (1158)Document30 pagesExcel Sheet (1158)Saumil PatelNo ratings yet

- Quiz Chapter 5 - Haryo IndraDocument4 pagesQuiz Chapter 5 - Haryo IndraHaryo HartoyoNo ratings yet

- How Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next YearDocument7 pagesHow Much Is Next Year's Money Worth Today? Double Checking From Value Today To Next Yearamaresh mahapatraNo ratings yet

- 2022PGP257 - Rent or Buy - Arpit Agarwal - Arpit AgarwalDocument11 pages2022PGP257 - Rent or Buy - Arpit Agarwal - Arpit AgarwalShrey RanaNo ratings yet

- Gmail Car Cost Comparison Tool For Excel Healthywealthywiseproject - JPGDocument3 pagesGmail Car Cost Comparison Tool For Excel Healthywealthywiseproject - JPGRoha JavidNo ratings yet

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaNo ratings yet

- Ocean Carriers FinalDocument3 pagesOcean Carriers FinalGiorgi MeskhishviliNo ratings yet

- Cuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosDocument16 pagesCuota Fina Cuota Fija y Recalculo de Cuota Fija Fija para Todos Los PeriodosPaula GómezNo ratings yet

- Ryan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Document3 pagesRyan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Giorgi MeskhishviliNo ratings yet

- Personal Finance 2nd Edition Walker Solutions ManualDocument14 pagesPersonal Finance 2nd Edition Walker Solutions Manualsmiletadynamia7iu4100% (27)

- Applied Math Practice For Financial Advisors - Exercises (Solutions)Document62 pagesApplied Math Practice For Financial Advisors - Exercises (Solutions)Ali kamakuraNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Answer 3Document21 pagesAnswer 3Lyca MaeNo ratings yet

- Excel Drill Exercise 1 MDLDocument16 pagesExcel Drill Exercise 1 MDLEugine AmadoNo ratings yet

- Buy Fix&sellDocument1 pageBuy Fix&sellAriel ShapiraNo ratings yet

- FIRE in IndiaDocument4 pagesFIRE in IndiaNagarajan DSNo ratings yet

- Tutorial Solution DepreciationDocument2 pagesTutorial Solution DepreciationbillNo ratings yet

- Lauras School Budget (Edited)Document2 pagesLauras School Budget (Edited)xcupcakex122006No ratings yet

- Quantitative Problems Chapter 12Document9 pagesQuantitative Problems Chapter 12waqar hattarNo ratings yet

- Week 6 Go LiveDocument3 pagesWeek 6 Go Livewriter topNo ratings yet

- ULIP Return CalculatorDocument2 pagesULIP Return CalculatorMONEY MINDED MILLENNIALNo ratings yet

- Finanzas ESQUEMADocument6 pagesFinanzas ESQUEMARichard Taipe ChacaltanaNo ratings yet

- LR Borrowed $ 15000 Loan at A 14% Annual Rate Compounded Monthly Which Is To Be Repaid Over 5 YearsDocument7 pagesLR Borrowed $ 15000 Loan at A 14% Annual Rate Compounded Monthly Which Is To Be Repaid Over 5 YearsashabNo ratings yet

- Total RevenueDocument1 pageTotal RevenueethanselphNo ratings yet

- Quantitative Problems Chapter 12Document12 pagesQuantitative Problems Chapter 12AndrewVazNo ratings yet

- Ebook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFDocument17 pagesEbook Cases in Finance 3Rd Edition Demello Solutions Manual Full Chapter PDFfintanthamh4jtd100% (13)

- Las VegasDocument9 pagesLas VegasAbhijnaRao MedavarapuNo ratings yet

- HoustonDocument9 pagesHoustonAbhijnaRao MedavarapuNo ratings yet

- Des MoinesDocument9 pagesDes MoinesAbhijnaRao MedavarapuNo ratings yet

- WWM - SingaporeDocument25 pagesWWM - SingaporeAbhijnaRao MedavarapuNo ratings yet

- FormsDocument2 pagesFormsAbhijnaRao MedavarapuNo ratings yet

- HotelDocument2 pagesHotelAbhijnaRao MedavarapuNo ratings yet

- Restaurant Design Site AnalysisDocument2 pagesRestaurant Design Site AnalysisAbhijnaRao MedavarapuNo ratings yet

- Customer Request Forms - LoansDocument1 pageCustomer Request Forms - LoansChiragNo ratings yet

- EastWest Bank Home Loan Application Form SignedDocument2 pagesEastWest Bank Home Loan Application Form SignedJohn Andrew Mañacop100% (1)

- Financing Hospital ExpansionDocument6 pagesFinancing Hospital ExpansionJabu MpolokengNo ratings yet

- Bankers Confidential ReportDocument1 pageBankers Confidential ReportBappa ChakrabortyNo ratings yet

- Jayesh DMS Research ReportDocument49 pagesJayesh DMS Research ReportJayesh MunjalNo ratings yet

- Commercial Bank - Chapter #1Document4 pagesCommercial Bank - Chapter #1Tito R. GarcíaNo ratings yet

- Civ2 Quiz May 13 2023Document6 pagesCiv2 Quiz May 13 2023Ronalyn GaculaNo ratings yet

- Luzon Dev Bank Vs Enriquez - ObliconDocument2 pagesLuzon Dev Bank Vs Enriquez - ObliconJeraldine Tatiana PiñarNo ratings yet

- Self Help GroupsDocument18 pagesSelf Help Groupsykbharti101No ratings yet

- Rizwan & Co.: Chartered AccountantsDocument2 pagesRizwan & Co.: Chartered AccountantsfaheemNo ratings yet

- Toward The Efficient Impact Frontier: FeaturesDocument6 pagesToward The Efficient Impact Frontier: Featuresguramios chukhrukidzeNo ratings yet

- Assignment 01Document17 pagesAssignment 01Md Mahmudur RahmanNo ratings yet

- Loan Details Sheet 2023-10-30 23 51 13Document4 pagesLoan Details Sheet 2023-10-30 23 51 13aksinger108No ratings yet

- SAPM Mid TermDocument2 pagesSAPM Mid TermKartikyaNo ratings yet

- Annual Credit Report - ExperianDocument58 pagesAnnual Credit Report - ExperianliveyourbestlifehoNo ratings yet

- Intermediate Financing (Term Loan and Lease Financing)Document41 pagesIntermediate Financing (Term Loan and Lease Financing)Soo CealNo ratings yet

- AccountingDocument33 pagesAccountingJunel MontemayorNo ratings yet

- M-I-2.Time Value of MoneyDocument26 pagesM-I-2.Time Value of Moneymonalisha mishraNo ratings yet

- Bankruptcy! FMW by Shoichi Arai, Emu Eaglestone (Translator)Document71 pagesBankruptcy! FMW by Shoichi Arai, Emu Eaglestone (Translator)Salih ArandıNo ratings yet

- Letter of ContinuityDocument2 pagesLetter of ContinuityVikram PhalakNo ratings yet

- MG1600 Coursework Brief 2022.23v4Document8 pagesMG1600 Coursework Brief 2022.23v4SurayaNo ratings yet

- CARO 2016 Vs CARO 2020Document3 pagesCARO 2016 Vs CARO 2020JrkNo ratings yet

- Schedule K (Secured)Document5 pagesSchedule K (Secured)Jie Han100% (1)

- Bikila ResearchDocument57 pagesBikila ResearchBobasa S AhmedNo ratings yet

- ACF302 - Week 16 - Lecture - LeasingDocument79 pagesACF302 - Week 16 - Lecture - Leasingaryanrao098No ratings yet

- Applicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsDocument4 pagesApplicant Details:: Online Account Opening / Applicant Information Form For Resident IndividualsOm SinghNo ratings yet

- Integrated Approach To The Growing Msme Sector: Dr. B. Yerram Raju, Ph.D. Economist & Risk Management ConsultantDocument22 pagesIntegrated Approach To The Growing Msme Sector: Dr. B. Yerram Raju, Ph.D. Economist & Risk Management ConsultantmuschiobianccoNo ratings yet

- Loan Amortization ScheduleDocument12 pagesLoan Amortization ScheduleMuhammad JavedNo ratings yet