Professional Documents

Culture Documents

Ques 22

Ques 22

Uploaded by

AbhijnaRao MedavarapuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ques 22

Ques 22

Uploaded by

AbhijnaRao MedavarapuCopyright:

Available Formats

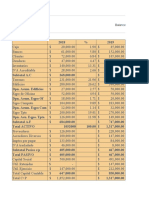

Balance sheet

Company A Company B

12- 31-2023 12-31-2022 12- 31-2023 12-31-2022

Cash $ 10,000.00 $ 5,000.00 $ 10,000.00 $ 5,000.00

Accounts receivable $ 10,000.00 $ 15,000.00 $ 50,000.00 $ 40,000.00

inventory $ 20,000.00 $ 13,000.00 $ 35,000.00 $ 20,000.00

Total current assets $ 40,000.00 $ 33,000.00 $ 95,000.00 $ 65,000.00

property, plan, equipment $ 90,000.00 $ 100,000.00 $ 90,000.00 $ 100,000.00

long term investments $ 60,000.00 $ 60,000.00 $ 25,000.00 $ 25,000.00

total assets $ 190,000.00 $ 193,000.00 $ 210,000.00 $ 190,000.00

accounts payable $ 5,000.00 $ 5,000.00 $ 5,000.00 $ 5,000.00

short term debt $ 10,000.00 $ 10,000.00 $ 30,000.00 $ 30,000.00

Accrued Liabilities $ 15,000.00 $ 20,000.00 $ 15,000.00 $ 20,000.00

Total Current Liabilities $ 30,000.00 $ 35,000.00 $ 50,000.00 $ 55,000.00

Long-term Debt $ 90,000.00 $ 100,000.00 $ 90,000.00 $ 120,000.00

Total Liabilities $ 120,000.00 $ 135,000.00 $ 140,000.00 $ 175,000.00

Owner's Equity $ 70,000.00 $ 58,000.00 $ 70,000.00 $ 15,000.00

Total Liabilities and Owner's Equity $ 190,000.00 $ 193,000.00 $ 210,000.00 $ 190,000.00

Income statement

Revenue $ 100,000.00 $ 50,000.00 $ 100,000.00 $ 50,000.00

cost of sales 55000 10000 55000 10000

gross profit $ 45,000.00 $ 40,000.00 $ 45,000.00 $ 40,000.00

operating expenses 30000 30000 30000 30000

net income $ 15,000.00 $ 10,000.00 $ 15,000.00 $ 10,000.00

margin 15 20 15 20

Return of asserts 0.07894736842 0.0518134715 0.0714285714 0.0526315789

Assert turnover ratio 0.52631578947 0.2590673575 0.4761904762 0.2631578947

Based on these calculations, Company A appears to be more efficient than Company B in both

profitability (ROA) and revenue generation (Asset Turnover Ratio).

You might also like

- 07-10-23 Rentabilidad, RiesgoDocument2 pages07-10-23 Rentabilidad, RiesgoDIANA JACKELINE RAMOS CARTAGENANo ratings yet

- Activo Circulante:: Efectivo Clientes InventariosDocument2 pagesActivo Circulante:: Efectivo Clientes InventariosRodrigo VegaNo ratings yet

- Trial BalanceDocument1 pageTrial Balancevannisa alliaNo ratings yet

- SHOPIEDocument1 pageSHOPIEMariaNo ratings yet

- Hotel HTLQBCDocument7 pagesHotel HTLQBCVerito FrancoNo ratings yet

- Flujo de CajaDocument2 pagesFlujo de CajaalejandraNo ratings yet

- Valor Presente NetoDocument7 pagesValor Presente NetoAngela JmNo ratings yet

- Método Estándar e Indicador BásicoDocument6 pagesMétodo Estándar e Indicador BásicoalexisNo ratings yet

- Primer Caso Practico, Administracion de Presupuestos.Document13 pagesPrimer Caso Practico, Administracion de Presupuestos.Erick HernandezNo ratings yet

- Practica 2 Ejer 8,9,10Document11 pagesPractica 2 Ejer 8,9,10KATERINE RODRIGUEZ VILLARROELNo ratings yet

- Tablas de AmortizaciónDocument2 pagesTablas de Amortizaciónisabellarios458No ratings yet

- Total Aset 1,335,000.00 563,000.00 623,000.00 60,000.00Document9 pagesTotal Aset 1,335,000.00 563,000.00 623,000.00 60,000.00dalil aldaryNo ratings yet

- Jackson 5Document13 pagesJackson 5mariapocol202130548No ratings yet

- KyleDocument4 pagesKyleJericho EstrellaNo ratings yet

- Flujo de EfectivoDocument17 pagesFlujo de EfectivoLalo CTNo ratings yet

- Sistema de InventarioDocument5 pagesSistema de Inventarioangie lazoNo ratings yet

- NeracaDocument2 pagesNeracasiti rahmahNo ratings yet

- EL ULTIMO SAMURAI SAC.1xlsxDocument7 pagesEL ULTIMO SAMURAI SAC.1xlsxBECERRA GAVINO KAREN PAOLANo ratings yet

- Exercício 11 - Diário e Razão GABARITO PROVA ADocument7 pagesExercício 11 - Diário e Razão GABARITO PROVA AGleiciane SantosNo ratings yet

- Libro (2) 2Document6 pagesLibro (2) 22jwjkpjbjkNo ratings yet

- Ventas A PlazosDocument7 pagesVentas A PlazosDarwin CabrejaNo ratings yet

- No Le HayoDocument6 pagesNo Le HayoJonathan MejiaNo ratings yet

- Latihan 02Document1 pageLatihan 02Sigit PamungkasNo ratings yet

- 14.working Capital ManagementDocument4 pages14.working Capital ManagementDAISYBELLE S. BAÑASNo ratings yet

- Hola KolaDocument2 pagesHola KolaWasif AhmedNo ratings yet

- Laporan Arus Kas Jawaban ExerciseDocument3 pagesLaporan Arus Kas Jawaban Exercisemuh.akbarNo ratings yet

- Taller Ago 22Document15 pagesTaller Ago 22Elizabeth Sanabria AriasNo ratings yet

- Balanza de Comprobacion 1Document1 pageBalanza de Comprobacion 1carlosalexismendiolaNo ratings yet

- Balanza de Comprobacion 1Document1 pageBalanza de Comprobacion 1carlosalexismendiolaNo ratings yet

- Registro de OperacionesDocument2 pagesRegistro de OperacionesAbril Margarita Domínguez GarcíaNo ratings yet

- 2021 3 SMMM Yeterlilik Finansal Tablolar AnaliziDocument8 pages2021 3 SMMM Yeterlilik Finansal Tablolar AnalizialisanbakirNo ratings yet

- Exercise 2 - Capital BudgetingDocument1 pageExercise 2 - Capital BudgetingValerie Fae MesinaNo ratings yet

- 02 El Caballo Loco, S. A. Marzo 2016Document14 pages02 El Caballo Loco, S. A. Marzo 2016Jose TerracanNo ratings yet

- Tugas Ko BrianDocument4 pagesTugas Ko Brianstefansa2410No ratings yet

- BALANCE SHEET - PDDocument2 pagesBALANCE SHEET - PDJoan Bunao SeraficaNo ratings yet

- Assignment 2Document5 pagesAssignment 2Mohamed MamdouhNo ratings yet

- Analisis Laporan Keuangan: Analisis Komparatif & Common-SizeDocument11 pagesAnalisis Laporan Keuangan: Analisis Komparatif & Common-SizeAnnaNo ratings yet

- ExamenxlsxDocument4 pagesExamenxlsxelisamatorreszamoraNo ratings yet

- Tarea Semana 8Document2 pagesTarea Semana 8Gonzalo RivasNo ratings yet

- Analisa Laporan KeaunganDocument3 pagesAnalisa Laporan KeaunganSMK ISLAM BABURROHMAHNo ratings yet

- La Lince S.A.Document9 pagesLa Lince S.A.Moon CasesNo ratings yet

- Renta 5taDocument2 pagesRenta 5taAndrea Arauco GonzalesNo ratings yet

- Copia de Outsourcing Fees - COLOMBIADocument10 pagesCopia de Outsourcing Fees - COLOMBIAJohn Edwar PardoNo ratings yet

- Financial Transaction Worksheet and T-Accounts SampleDocument2 pagesFinancial Transaction Worksheet and T-Accounts SampleJoyce Anne SobremonteNo ratings yet

- Balanta de Verificare 07122022 102931Document1 pageBalanta de Verificare 07122022 102931Anamaria CojocariuNo ratings yet

- Taller Repaso 3-04-2024Document12 pagesTaller Repaso 3-04-2024Jeimy CartagenaNo ratings yet

- Ejemplo Flujo de CajaDocument8 pagesEjemplo Flujo de CajaJosé andersonNo ratings yet

- Datos Tarea3Document10 pagesDatos Tarea3torreselmer565No ratings yet

- UntitledDocument14 pagesUntitledMarian SandovalNo ratings yet

- Balance Comprobacion G2an-2023-1Document1 pageBalance Comprobacion G2an-2023-1Mirella ReyesNo ratings yet

- Persamaan Dasar Salon HumanisDocument3 pagesPersamaan Dasar Salon HumanisKsatria Pamungkas100% (2)

- WANABI Print - Rahmadini Cahya Ayu Salsabila - 1701622062 - UAS KOMPAK-Neraca Saldo-2014-01-01 - 2014-01-31Document1 pageWANABI Print - Rahmadini Cahya Ayu Salsabila - 1701622062 - UAS KOMPAK-Neraca Saldo-2014-01-01 - 2014-01-31pacar haechanNo ratings yet

- Examen 3er ParcialDocument14 pagesExamen 3er Parcialcristian vargasNo ratings yet

- SensibilidadDocument8 pagesSensibilidadwillian lozada tezenNo ratings yet

- La Vaca Brava Alumnos22 Fernanda GarciaDocument23 pagesLa Vaca Brava Alumnos22 Fernanda GarciaMARIA FERNANDA GARCIA MONROYNo ratings yet

- Solution PartnershipDocument3 pagesSolution PartnershipJasmine ActaNo ratings yet

- Trabajo 2 CostosDocument21 pagesTrabajo 2 Costoswilson cueva portalNo ratings yet

- Pricing ExerciseDocument4 pagesPricing ExerciseffNo ratings yet