Professional Documents

Culture Documents

Carmax S&P

Carmax S&P

Uploaded by

trust2386Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carmax S&P

Carmax S&P

Uploaded by

trust2386Copyright:

Available Formats

Presale:

CarMax Auto Owner Trust 2022-3

July 7, 2022

PRIMARY CREDIT ANALYST

Preliminary Ratings Jack Zivitofsky

New York

Base Upsized Expected legal

+1 2124380548

Preliminary amount amount (mil. final maturity

jack.zivitofsky

Class rating Type Interest rate(i) (mil. $) $) date

@spglobal.com

A-1 A-1+ (sf) Senior Fixed 203.70 247.90 July 17, 2023 SECONDARY CONTACT

A-2a/A-2b(ii) AAA (sf) Senior Fixed/floating 406.00 494.26 Sept. 15, 2025 Steve D Martinez

A-3 AAA (sf) Senior Fixed 366.00 445.57 April 15, 2027 New York

+ 1 (212) 438 2881

A-4 AAA (sf) Senior Fixed 87.91 107.09 Feb. 15, 2028

steve.martinez

B AA (sf) Subordinate Fixed 29.19 35.54 Feb. 15, 2028 @spglobal.com

C A (sf) Subordinate Fixed 29.19 35.54 Feb. 15, 2028

D BBB (sf) Subordinate Fixed 28.01 34.10 Jan. 16, 2029

Note: This presale report is based on information as of July 7, 2022. The ratings shown are preliminary. This report does not constitute a

recommendation to buy, hold, or sell securities. Subsequent information may result in the assignment of final ratings that differ from the

preliminary ratings. (i)The tranches' coupons will be determined on the pricing date. (ii)The class A-2 notes may be split into fixed-rate class

A-2a notes and floating-rate class A-2b notes. The sizes of classes A-2a and A-2b will be determined at pricing, though the principal balance of

the class A-2b notes is not expected to exceed $203.00 million ($247.13 million for the upsized pool). The class A-2b coupon will initially be

expressed as a spread tied to the one-month SOFR. SOFR--Secured overnight financing rate.

Profile

Expected closing date July 20, 2022.

Collateral Prime auto loan receivables.

Issuer CarMax Auto Owner Trust 2022-3.

Originator, sponsor, and servicer CarMax Business Services LLC.

Depositor and seller CarMax Auto Funding LLC.

Indenture trustee Wilmington Trust N.A.

Owner trustee U.S. Bank Trust Co. N.A.

Lead underwriter RBC Capital Markets.

www.spglobal.com July 7, 2022 1

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

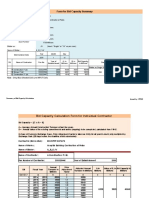

Credit Enhancement Summary (%)

CAOT 2022-3 CAOT 2022-2 CAOT 2022-1

Initial(i)(ii) Target(i)(ii) Floor(i)(ii) Initial(i)(ii) Target(i)(ii) Floor(i)(ii) Initial(i)(ii) Target(i)(ii) Floor(i)(ii)

Class A

Subordination 7.40 7.40 7.40 5.06 5.06 5.06 5.30 5.30 5.30

Reserve 0.40 0.40 0.40 0.50 0.50 0.50 0.25 0.25 0.25

account

O/C 1.50 1.50 1.50 2.35 2.35 2.35 0.25 0.25 0.25

Total 9.30 9.30 9.30 7.90 7.90 7.90 5.80 5.80 5.80

Class B

Subordination 4.90 4.90 4.90 3.50 3.50 3.50 4.20 4.20 4.20

Reserve 0.40 0.40 0.40 0.50 0.50 0.50 0.25 0.25 0.25

account

O/C 1.50 1.50 1.50 2.35 2.35 2.35 0.25 0.25 0.25

Total 6.80 6.80 6.80 6.35 6.35 6.35 4.70 4.70 4.70

Class C

Subordination 2.40 2.40 2.40 1.25 1.25 1.25 1.60 1.60 1.60

Reserve 0.40 0.40 0.40 0.50 0.50 0.50 0.25 0.25 0.25

account

O/C 1.50 1.50 1.50 2.35 2.35 2.35 0.25 0.25 0.25

Total 4.30 4.30 4.30 4.10 4.10 4.10 2.10 2.10 2.10

Class D

Reserve 0.40 0.40 0.40 0.50 0.50 0.50 0.25 0.25 0.25

account

O/C 1.50 1.50 1.50 2.35 2.35 2.35 0.25 0.25 0.25

Total 1.90 1.90 1.90 2.85 2.85 2.85 0.50 0.50 0.50

Estimated annual 2.86 -- -- 3.29 -- -- 5.66 -- --

excess spread(iii)

(i)Applicable for the base and upsized structures. (ii)Percentage of the initial receivables balance. (iii)Estimated unstressed annual excess spread is

pre-pricing for series 2022-3 and post-pricing for series 2022-2 and 2022-1. CAOT--CarMax Auto Owner Trust. O/C--Overcollateralization.

Rationale

The preliminary ratings assigned to CarMax Auto Owner Trust 2022-3's (CAOT 2022-3) auto

receivables asset-backed notes reflect:

- The availability of approximately 11.56%, 9.27%, 6.98%, and 5.06% credit support for the class

A, B, C, and D notes in the base and upsized pools, respectively, based on our stressed

break-even cash flow scenarios (including haircuts to excess spread). These credit support

levels provide coverage of approximately 5.00x, 4.00x, 3.00x, and 2.00x our 2.20%-2.30%

expected net loss range for the respective classes, and are commensurate with the assigned

preliminary 'A-1+ (sf)' and 'AAA (sf)', 'AA (sf)', 'A (sf)', and 'BBB (sf)' ratings (see the S&P Global

Ratings' Expected Loss and Cash Flow Modeling sections below).

www.spglobal.com July 7, 2022 2

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

- The timely interest and full principal payments made under the stressed cash flow modeling

scenarios appropriate for the assigned preliminary ratings (see the Cash Flow Modeling

section).

- Our expectation that under a moderate ('BBB') stress scenario (2.0x our expected loss level), all

else being equal, our preliminary ratings on the class A-1, A-2 through A-4, B, C, and D notes,

respectively, are consistent with the tolerances outlined in our credit stability criteria (see "S&P

Global Ratings Definitions," published Nov. 10, 2021).

- The performance of CarMax Business Services LLC's (CarMax) previous securitizations since

2001.

- The collateral characteristics of the securitized pool of auto loans, including a

weighted-average nonzero FICO score of approximately 710.

- The transaction's payment and legal structures.

Environmental, Social, And Governance (ESG) Factors

Our rating analysis considers a transaction's potential exposure to ESG credit factors. For the auto

ABS sector, we view the exposure to environmental credit factors as above average, to social

credit factors as average, and to governance credit factors as below average (see "ESG Industry

Report Card: Auto Asset-Backed Securities," published March 31, 2021).

In our view, the exposure to ESG credit factors in this transaction is in line with our sector

benchmark. Environmental credit factors are generally viewed as above average, given that the

collateral pool primarily comprises vehicles with internal combustion engines (ICEs), which emit

pollutants that contribute to climate transition risks. While the adoption of electric vehicles and

future regulation could in time lower ICE vehicle values, we believe our current approach to

evaluating recovery and residual values adequately accounts for vehicle values over the

transaction's relatively short expected life. As a result, we have not separately identified this as a

material ESG credit factor in our analysis.

SOFR Benchmark

CarMax intends to utilize the Secured Overnight Financing Rate (SOFR) interest rate benchmark

for CAOT 2022-3's floating-rate class A-2b notes. Prior to series 2022-3, CAOT transactions that

contained floating-rate tranches used one-month LIBOR as the benchmark. However, due to the

expected LIBOR cessation and regulatory guidance to transition away from using U.S. dollar LIBOR

on newly executed contracts after December 2021, many issuers are evaluating alternative

interest rate benchmarks for their securitizations.

The class A-2 notes will consist of two tranches: fixed-rate class A-2a and floating-rate class A-2b

notes. The class A-2b notes are indexed to SOFR plus a spread and may constitute up to 50.00% of

the class A-2 notes. The class A-2b coupons will initially be based on compounded SOFR (a 30-day

average SOFR calculated in advance by the calculation agent using the published rate on the

Federal Reserve Bank of New York's website). The spread added to SOFR is the total credit risk of

the transaction, and it does not contain a layer of bank credit risk as LIBOR does because SOFR is

essentially a risk-free rate. The guidelines for using SOFR are broadly consistent with The

Alternative Reference Rates Committee's March 2021 "Options for Using SOFR in New ABS, MBS,

CMBS Products" report.

In addition, provisions have been incorporated into securitization documents that govern rate

www.spglobal.com July 7, 2022 3

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

selection if SOFR becomes unavailable.

For the floating-rate tranche, we applied our stressed interest rates for one-month SOFR as

described in our criteria "Methodology To Derive Stressed Interest Rates In Structured Finance,"

published Oct. 18, 2019, and corresponding guidance.

Credit Enhancement Changes From Series 2022-2

CAOT 2022-3 includes some notable changes to credit enhancement compared with the CAOT

2022-2 transaction:

- Total hard credit enhancement increased to 9.30% from 7.90% for class A, to 6.80% from

6.35% for class B, to 4.30% from 4.10% for class C, and decreased to 1.90% from 2.85% for

class D.

- The initial, target, and floor overcollateralization (O/C) decreased to 1.50% of the initial

receivables balance from 2.35%.

- Subordination increased to 7.40% from 5.06% for class A, to 4.90% from 3.50% for class B, and

to 2.40% from 1.25% for class C.

- The reserve account decreased to 0.40% of the initial receivables balance from 0.50%.

- The estimated excess spread decreased to approximately 2.86% (pre-pricing) from 3.29%

(post-pricing) and 3.23% (pre-pricing).

The increase in total hard credit enhancement for class A, B, and C, (primarily due to a higher

percent of subordination) reflects an increase in our expected lifetime loss range to 2.20%-2.30%

from 2.15%-2.25% and the lower amount of available excess spread compared with those of

series 2022-2. Additionally, our preliminary rating on the class D notes is lower than that on the

series 2022-2 class D notes.

Collateral Changes From Series 2022-2

CAOT 2022-3's collateral credit quality is comparable to that of series 2022-2. The collateral pool

includes some notable characteristics, compared below with the same for CAOT 2022-2, that we

considered in our expected loss analysis:

- The down payment percentage increased to 19.33% (19.34% if upsized) from 19.20%.

- The percentage of the pool from the company's two highest internal credit score categories

(tiers A and B) decreased to 90.37% (90.39% if upsized) from 90.94%.

- The weighted average nonzero FICO score decreased to 710 from 711.

- The weighted average loan-to-value (LTV) ratio decreased to 87.57% (87.56% if upsized) from

87.74%.

- The weighted average annual percentage rate (APR) increased to 8.28% versus 7.80%.

Overall, we believe the series 2022-3 collateral credit characteristics are comparable to those of

series 2022-2 due to characteristics such as the two highest credit score categories and

percentage of long-term loans, both of which are generally comparable to those of series 2022-2.

In addition to the collateral characteristics, we also considered our most recent macroeconomic

outlook that incorporates a baseline forecast for U.S. GDP and unemployment. We have observed

www.spglobal.com July 7, 2022 4

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

delinquencies in CarMax's portfolio and recent securitizations continuing to normalize and, in

some cases, rise above pre-COVID-19 pandemic levels. Considering these factors, our initial loss

expectation for series 2022-3 increased to 2.20%-2.30% from 2.15%-2.25% for 2022-2.

Transaction Structure

CarMax will sell a pool of auto loan receivables to CarMax Auto Funding LLC, which will then sell

the receivables to CAOT 2022-3, the transaction's issuing trust (see chart 1). In rating this

transaction, we will review the legal matters we believe are relevant to our analysis, as outlined in

our criteria.

Chart 1

Transaction Summary

CAOT 2022-3 transaction incorporates the following structural features:

- A sequential-pay mechanism among the class A, B, C, and D notes, which is expected to result

in more credit enhancement as a percentage of the current pool balance for the more-senior

classes as the pool amortizes.

www.spglobal.com July 7, 2022 5

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

- Notes that pay a fixed interest rate except for the class A-2b notes, which pay a floating interest

rate tied to one-month SOFR. The exact amounts of the class A-2a and A-2b notes will be

determined at pricing, though the principal balance of the class A-2b notes is not expected to

exceed $203.0 million ($247.1 million for the upsized structure).

- Subordination of approximately 7.40%, 4.90%, and 2.40% for classes A, B, and C, respectively.

- A nonamortizing reserve account that will equal 0.40% of the initial pool balance.

- Initial and target O/C of 1.50% of the initial pool balance.

- The collateral characteristics for the base and upsized pool are similar.

Payment Structure

The trust will pay scheduled interest and principal on the rated notes on each monthly distribution

date beginning Aug. 15, 2022. The payment priority that CarMax presented to S&P Global Ratings

indicated that the trust will use the auto loan collections to make the distributions shown in table

1. In addition, the reserve account's funds are intended to be available to pay interest shortfalls

and make priority principal payments.

Table 1

Payment Waterfall

Priority Payment

1 Servicer fee (1.00% per year).

2 Pro rata: the successor servicer fees (if the servicer has been replaced) and transition expenses, capped at

$175,000; and any asset representation reviewer fees and expenses, capped at $175,000.

3 Class A note interest, pro rata.

4 The first-priority principal distributable amount to the class A noteholders, sequentially, to maintain the class A

notes' parity with the receivables.

5 Class B note interest.

6 The second-priority principal distributable amount sequentially to maintain the class A and B notes' parity with

the receivables.

7 Class C note interest.

8 The third-priority principal distributable amount sequentially to maintain the class A, B, and C notes' parity with

the receivables.

9 Class D note interest.

10 The fourth-priority principal distributable amount sequentially to maintain the class A, B, C, and D notes' parity

with the receivables.

11 To the reserve account until the required amount is met.

12 The regular principal distributable amount sequentially to the class A-1, A-2, A-3, A-4, B, C, and D notes until

each class is paid in full. This will also maintain overcollateralization to the target amount.

13 Pro rata: unpaid transition expenses exceeding the cap amounts listed in item 2 above that are due in the event

of a servicer termination; any additional servicing fees that are to be paid to the successor servicer and any

unpaid fees; any unpaid indemnity amounts due to the successor servicer that exceed the cap amounts listed in

item 2; any expenses due to the asset representations reviewer that exceed the related cap amounts listed in

item 2; and any amounts due and owing to the indenture trustee under the indenture that have not been paid in

full.

14 Any remainder to the certificateholders.

www.spglobal.com July 7, 2022 6

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Pool Analysis

As of the June 30, 2022, cutoff date, the series 2022-3 pool consists of 58,060 (70,744 if upsized)

loans totaling $1.17 billion ($1.42 billion if upsized) in motor vehicle loans originated by CarMax's

affiliates (see table 2).

Table 2

Collateral Comparison(i)

CAOT

2022-3 2022-3

(base) (upsized) 2022-2 2022-1 2021-3 2021-2 2021-1 2020-4 2020-3

Receivable 1.167 1.421 1.432 1.604 1.754 1.558 1.505 1.506 1.358

balance (bil. $)

No. of 58,060 70,744 74,036 86,274 102,990 109,955 89,890 82,341 89,174

receivables

Avg. loan 20,109 20,091 19,345 18,592 17,035 14,177 16,746 18,290 15,230

balance ($)

Weighted avg. 8.28 8.28 7.80 8.14 8.24 7.82 8.25 7.87 7.77

APR (%)

Weighted avg. 66.38 66.39 66.65 66.78 66.12 66.25 66.51 65.86 66.20

original term

(mos.)

Weighted avg. 60.61 60.63 60.40 60.94 61.42 58.52 61.76 62.80 58.61

remaining

term (mos.)

Weighted avg. 5.77 5.76 6.25 5.84 4.70 7.73 4.75 3.06 7.59

seasoning

(mos.)

Weighted avg. 710 709 711 707 706 708 711 713 714

FICO score

Original term 65.99 66.03 66.49 66.89 62.08 63.02 63.82 60.19 61.08

61–72 months

(%)

New vehicles 0.01 0.01 0.02 0.02 0.10 0.22 0.26 0.49 0.10

(%)

Used vehicles 99.99 99.99 99.98 99.98 99.90 99.78 99.74 99.51 99.90

(%)

Top five state concentrations (%)

CA=18.70 CA=18.69 CA=18.41 CA=18.89 CA=17.66 CA=16.83 CA=17.63 CA=18.43 CA=16.65

TX=11.73 TX=11.74 TX=11.50 TX=11.23 TX=10.07 TX=11.16 TX=10.59 TX=9.80 TX=12.36

FL=9.29 FL=9.29 FL=9.00 FL=8.72 FL=8.28 FL=9.03 FL=8.23 FL=7.29 FL=8.87

GA=7.13 GA=7.18 GA=6.80 GA=6.85 GA=7.17 GA=7.14 GA=7.21 MD=6.58 GA=6.96

NC=5.26 NC=5.25 VA=5.20 NC=5.65 NC=5.63 NC=5.90 VA=5.41 GA=6.36 NC=6.04

(i)All percentages are of the initial receivables balance. APR--Annual percentage rate. CAOT--CarMax Auto Owner Trust.

www.spglobal.com July 7, 2022 7

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Securitization Performance

We currently rate 16 CAOT transactions that closed in 2018 through 2022 (see table 3). In June

2022, we revised our lifetime loss expectations on one of the transactions (see "Two Ratings

Raised And Five Affirmed On CarMax Auto Owner Trust 2021-2," published June 14, 2022). The

outstanding classes all have adequate credit enhancement at their current rating levels, in our

view. We will continue to monitor the performance of the outstanding transactions to ensure that

the credit enhancement remains sufficient to cover our revised cumulative net loss expectations

under our stress scenarios for each of the rated classes (see charts 2 and 3).

Table 3

Performance Data For Outstanding CarMax Auto Owner Trust Transactions(i)

Pool factor 60+ day delinq. Initial lifetime CNL Revised lifetime CNL

Series Month (%) CNL (%) (%) exp. (%) exp. (%)(ii)

2018-3 47 11.92 1.71 2.34 2.20-2.30 1.90-2.00

2018-4 44 14.79 1.59 2.24 2.20-2.30 1.90-2.00

2019-1 41 17.74 1.54 2.08 2.20-2.30 1.95-2.05

2019-2 38 20.43 1.36 1.99 2.15-2.25 1.95-2.05

2019-3 35 25.04 1.23 1.74 2.20-2.30 1.95-2.05

2019-4 32 28.39 1.09 1.72 2.20-2.30 1.95-2.05

2020-1 29 32.53 0.94 1.44 2.15-2.25 1.95-2.05

2020-2 26 34.94 0.68 1.17 2.80-3.00 1.95-2.05

2020-3 23 38.87 0.73 1.44 2.80-3.00 1.95-2.05

2020-4 20 48.44 0.57 1.13 2.80-3.00 1.95-2.05

2021-1 17 52.26 0.63 1.44 2.65-2.85 2.05-2.15

2021-2 14 55.96 0.51 1.38 2.35-2.45 2.05-2.15

2021-3 11 66.80 0.60 1.67 2.15-2.25 N/A

2021-4 9 73.03 0.50 1.44 2.15-2.25 N/A

2022-1 5 82.67 0.11 0.81 2.15-2.25 N/A

2022-2 2 92.87 0.01 0.35 2.15-2.25 N/A

(i)As of the June 2022 distribution date. (ii)Revised August 2021, except for series 2020-3, 2020-4, and 2021-1, which were revised in February

2022 and series 2022-2, which was revised in June 2022. CNL--Cumulative net loss. Delinq.—Delinquency. CNL exp.--Cumulative net loss

expectation. N/A--Not applicable.

www.spglobal.com July 7, 2022 8

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Chart 2 Chart 3

Managed Portfolio

CarMax's serviced portfolio under its primary underwriting program totaled approximately

$15.679 billion as of May 31, 2022--an approximately 10.02% year-over-year increase. The

31-plus-day delinquency rate, which had dipped to 1.89% as of May 31, 2021, increased to 3.64%

for the same period in 2022. Annualized net charge-offs, as a percentage of the average

outstanding, increased to 0.77% as of May 31, 2022, from 0.27% for the same period in 2021 (see

table 4). We have observed delinquencies in CarMax's portfolio continuing to normalize and, in

some cases, rise above pre-COVID-19 pandemic levels. In addition, CarMax experienced a

servicing platform transition in fourth-quarter 2021, which may have contributed in part to the

observed delinquency and loss levels.

Table 4

Managed Portfolio Performance

Five months ended

May 31 Year ended Dec. 31

2022 2021 2021 2020 2019 2018 2017 2016

Portfolio at end of period (bil. 15.679 14.252 15.285 13.431 13.211 12.238 11.372 10.367

$)

No. of contracts 1,058,263 1,058,659 1,068,653 1,026,142 1,009,267 944,952 875,063 782,772

Delinquencies (%)

31-60 days 2.26 1.24 2.35 1.81 2.31 2.30 2.15 2.09

61-90 days 1.12 0.52 1.09 0.82 1.08 1.03 0.93 0.87

91 days or more 0.27 0.13 0.30 0.20 0.27 0.27 0.27 0.29

Total delinquencies (% of 3.64 1.89 3.75 2.83 3.66 3.61 3.35 3.25

the portfolio)

www.spglobal.com July 7, 2022 9

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Table 4

Managed Portfolio Performance (cont.)

Five months ended

May 31 Year ended Dec. 31

2022 2021 2021 2020 2019 2018 2017 2016

Avg. month-end amount 15.414 13.783 14.387 13.216 12.728 11.828 10.907 9.863

outstanding during the period

(bil. $)

Net charge-offs (mil. $) 49.660 15.717 77.829 86.473 128.056 118.881 111.189 97.912

Net charge-offs (% of avg. 0.77 0.27 0.54 0.65 1.01 1.01 1.02 0.99

month-end amount

outstanding)(i)

(i)Annualized.

S&P Global Ratings' Expected Loss: 2.20%-2.30%

To derive the base-case loss assumptions for the series 2022-3 transaction, we examined

CarMax's static pool performance data for CAOT 2007-1 through 2022-2, stratified by CarMax's

proprietary credit grades. The proprietary credit grade incorporates the loan structure (term and

advance rate) and demographic data (income, debt-to-income ratio, and payment-to-income

ratio).

We used the 2007-2018 paid-off loss curves to project losses for the outstanding 2018-2021

vintages that are not fully liquidated. We applied the pool composition weights by credit grade to

determine a weighted average loss projection for the series 2022-3 pool.

Based on our analysis of the static pool performance by credit grade, the pool's credit quality, a

peer comparison of the collateral pool, the recent securitization performance of CarMax pools,

and our forward-looking view of the economy, we expect the CAOT 2022-3 pool to experience

cumulative net losses in the 2.20%-2.30% range.

Cash Flow Modeling Assumptions And Results

We modeled the transaction to simulate stress scenarios commensurate with the preliminary 'AAA

(sf)', 'AA (sf)', 'A (sf)', and 'BBB (sf)' ratings (see table 5).

Table 5

Cash Flow Assumptions And Results

Class

A B C D

Front-loaded loss curve

Preliminary rating AAA (sf) AA (sf) A(sf) BBB (sf)

Net loss timing (mos.) 12/24/36/48 12/24/36/48 12/24/36/48 12/24/36/48

Net loss (%) 30-35-25-10 30-35-25-10 30-35-25-10 30-35-25-10

ABS voluntary prepayments (%) 1.50 1.50 1.50 1.50

Recovery rate (%) 50.00 50.00 50.00 50.00

www.spglobal.com July 7, 2022 10

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Table 5

Cash Flow Assumptions And Results (cont.)

Class

A B C D

Recovery lag (mos.) 3 3 3 3

Approximate break-even levels (%)(i) 11.56 9.27 6.98 5.10

Back-loaded loss curve

Preliminary rating AAA (sf) AA (sf) A (sf) BBB (sf)

Net loss timing (mos.) 12/24/36/48 12/24/36/48 12/24/36/48 12/24/36/48

Net loss (%) 25-30-30-15 25-30-30-15 25-30-30-15 25-30-30-15

ABS voluntary prepayments (%) 1.50 1.50 1.50 1.50

Recovery rate (%) 50.00 50.00 50.00 50.00

Recovery lag (mos.) 3 3 3 3

Approximate break-even levels (%)(i) 11.58 9.32 7.05 5.06

(i)Our stressed cash flows assume a 10.00% haircut to stressed excess spread. ABS--Absolute prepayment speed.

Based on the cash flow stress results, each class in the CAOT 2022-3 transaction is, in our view,

enhanced to the degree necessary to withstand a stressed level of net losses consistent with the

assigned preliminary ratings. The cash flow runs for the upsized pool yielded similar results.

Sensitivity Analysis

In addition to analyzing break-even cash flows, we conducted a sensitivity analysis to determine

whether under a moderate ('BBB') stress scenario, all else being equal, our preliminary ratings

would remain within the tolerances outlined in our credit stability criteria (see "S&P Global

Ratings Definitions," published Nov. 10, 2021) (see table 6). We found that our preliminary 'A-1+

(sf)' and 'AAA (sf)', 'AA (sf)', 'A (sf)', and 'BBB (sf)' ratings on the class A, B, C, and D notes,

respectively, are consistent with the tolerances outlined in our credit stability criteria.

Table 6

Scenario Analysis Summary

CNL level (%) 4.50

Loss timing (month 12/24/36/48) (%) 30/30/25/15

Voluntary ABS (%) 1.50

Servicing fee (%) 1.00

Recovery rate (%) 50.00

CNL--Cumulative net loss. ABS--Absolute prepayment speed.

Chart 4 shows the coverage multiples for the class A through D notes over time under a moderate

'BBB' stress scenario.

www.spglobal.com July 7, 2022 11

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Chart 4

We also ran a supplemental moderate stress scenario to stress excess spread by utilizing a

bifurcated pool method whereby loans with APRs less than or equal to 5.75% (approximately 30%

of the collateral pool) prepay at much slower rates than do loans with APRs above 5.75%. By

running low prepayments on the lower-APR contracts and applying a slower loss curve to these

contracts than to the higher-APR contracts, the cash flows stressed the weighted average APR on

the collateral and excess spread. The results of the supplemental moderate stress scenario were

generally consistent with the tolerances outlined in our credit stability criteria.

Money Market Tranche Sizing

The proposed money market tranche's (class A-1) legal final maturity date is July 17, 2023. To test

whether the money market tranche can be repaid by its maturity date, we ran cash flows using

assumptions to delay the principal collections. We assumed zero defaults and a 0.50% absolute

prepayment speed for our cash flow run, and we checked that 11 months or less of principal

collections would be sufficient to pay off the money market tranche.

www.spglobal.com July 7, 2022 12

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Legal Final Maturity

To test the legal final maturity dates set for the long-dated tranches (classes A-2 through C), we

determined the date when the respective notes were fully amortized in a zero-loss and

zero-prepayment scenario and then added three months to the result. For the longest-dated

security (class D), we added six months to the longest receivables' remaining term to

accommodate extensions on the receivables. Furthermore, in the break-even scenario for each

rating level, we confirmed that credit enhancement was sufficient to cover losses and to repay the

related notes in full by the legal final maturity date.

CarMax

CarMax is the largest retailer of used cars in the U.S., with 230 used-car stores in 107 television

markets as of February 2022. The company primarily purchases, reconditions, and sells used

vehicles under various franchise agreements. CarMax also provides a range of related products

and services, including financing, extended service contracts, accessories, and repair service. The

company has employed the used-car store concept since 1993.

Related Criteria

- Criteria | Structured Finance | ABS: Global Auto ABS Methodology And Assumptions, March 31,

2022

- General Criteria: Environmental, Social, And Governance Principles In Credit Ratings, Oct. 10,

2021

- Criteria | Structured Finance | General: Global Framework For Payment Structure And Cash

Flow Analysis Of Structured Finance Securities, Dec. 22, 2020

- Criteria | Structured Finance | General: Methodology To Derive Stressed Interest Rates In

Structured Finance, Oct. 18, 2019

- Criteria | Structured Finance | Legal: U.S. Structured Finance Asset Isolation And

Special-Purpose Entity Criteria, May 15, 2019

- Criteria | Structured Finance | General: Counterparty Risk Framework: Methodology And

Assumptions, March 8, 2019

- Criteria | Structured Finance | General: Incorporating Sovereign Risk In Rating Structured

Finance Securities: Methodology And Assumptions, Jan. 30, 2019

- General Criteria: Methodology For Linking Long-Term And Short-Term Ratings, April 7, 2017

- Criteria | Structured Finance | General: Global Framework For Assessing Operational Risk In

Structured Finance Transactions, Oct. 9, 2014

- General Criteria: Global Investment Criteria For Temporary Investments In Transaction

Accounts, May 31, 2012

- General Criteria: Principles Of Credit Ratings, Feb. 16, 2011

- Criteria | Structured Finance | General: Methodology For Servicer Risk Assessment, May 28,

2009

www.spglobal.com July 7, 2022 13

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Related Research

- Credit Conditions North America Q3 2022: Credit Headwinds Turn Stormy, June 28, 2022

- Economic Outlook U.S. Q3 2022: The Summer Of Our Discontent, June 27, 2022

- Eight Ratings Raised, 10 Affirmed On Three CarMax Auto Owner Trust Transactions, Feb. 14,

2022

- 20 Ratings Raised, 43 Affirmed On 12 CarMax Auto Owner Trust Transactions, Aug. 9, 2021

www.spglobal.com July 7, 2022 14

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer 2863200

on the last page.

Presale: CarMax Auto Owner Trust 2022-3

Copyright © 2022 Standard & Poor's Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS

OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR

USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE

CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct,

indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without

limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised

of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and

experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act

as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable,

S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related

publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited

to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties

disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage

alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from obligors.

S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.spglobal.com/ratings (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via

S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.spglobal.com/usratingsfees.

Standard & Poor’s | Research | July 7, 2022 15

2863200

You might also like

- Case JaguarDocument4 pagesCase JaguarDante Gustilo33% (3)

- Group - Assignment - 2 - Fall - 20214 MICHALDocument16 pagesGroup - Assignment - 2 - Fall - 20214 MICHALhalelz69No ratings yet

- Rakesh JhunjhunDocument11 pagesRakesh JhunjhunRanjith Shankar HanbalNo ratings yet

- RatingsDirect PresalePlanetFitnessMasterIssuerLLCSeries20181 39312924 Jul-23-2019Document18 pagesRatingsDirect PresalePlanetFitnessMasterIssuerLLCSeries20181 39312924 Jul-23-2019ougyajNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- The Principles of Altern at IV Investments ManagementDocument194 pagesThe Principles of Altern at IV Investments ManagementAntonio Climent100% (1)

- Share Buy-Back by Companies in NigeriaDocument8 pagesShare Buy-Back by Companies in NigeriaTope Adebayo LLPNo ratings yet

- AMG RobotDocument33 pagesAMG RobotShanNo ratings yet

- American Credit Acceptance Receivables Trust 2021-1 American Credit Acceptance Receivables Trust 2021-1Document23 pagesAmerican Credit Acceptance Receivables Trust 2021-1 American Credit Acceptance Receivables Trust 2021-1galter6No ratings yet

- Honda Auto Receivables 2021-3 Owner Trust Honda Auto Receivables 2021-3 Owner TrustDocument15 pagesHonda Auto Receivables 2021-3 Owner Trust Honda Auto Receivables 2021-3 Owner Trustsprite2lNo ratings yet

- Sabey Data Center Issuer LLC (Series 2022-1) Sabey Data Center Issuer LLC (Series 2022-1)Document20 pagesSabey Data Center Issuer LLC (Series 2022-1) Sabey Data Center Issuer LLC (Series 2022-1)kouroumaNo ratings yet

- Jockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)Document5 pagesJockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)ouo So方No ratings yet

- M K Fashion & Tailoting Audited 077-78Document11 pagesM K Fashion & Tailoting Audited 077-78Ujjwal GhimireNo ratings yet

- INC.0012 Monthly Disbursments AURADocument23 pagesINC.0012 Monthly Disbursments AURAedwilsonjafarxNo ratings yet

- Question Bank Memo 2022 Second SemesterDocument59 pagesQuestion Bank Memo 2022 Second SemesterWorship NtshuxekaniNo ratings yet

- Year 1 Year 2 Year 3 Year 4 Year 5Document10 pagesYear 1 Year 2 Year 3 Year 4 Year 5Rupert ScottNo ratings yet

- ValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11Document4 pagesValueResearchFundcard FranklinIndiaUltraShortBondFund SuperInstitutionalPlan DirectPlan 2017oct11jamsheer.aaNo ratings yet

- MDS Abril 2022Document2 pagesMDS Abril 2022edwilsonjafarxNo ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- Financial ReportDocument1 pageFinancial ReportFERRETERIA FERRETERIANo ratings yet

- Receivables Open Items Revaluation ReportDocument61 pagesReceivables Open Items Revaluation ReportShakhir MohunNo ratings yet

- Barclays N.A. EM Credit Strategy Emerging Markets Credit MonitorDocument22 pagesBarclays N.A. EM Credit Strategy Emerging Markets Credit MonitorVitor HenriqueNo ratings yet

- Cambridge O Level: Accounting 7707/22 May/June 2020Document12 pagesCambridge O Level: Accounting 7707/22 May/June 2020rAJBS;DFNo ratings yet

- SSAB - Presentation Q2 2023 - FDocument29 pagesSSAB - Presentation Q2 2023 - FHochbauer MáriaNo ratings yet

- Corporate US IGDocument23 pagesCorporate US IGtarja19761No ratings yet

- Sugarland Texas Water and Sewer 2020Document130 pagesSugarland Texas Water and Sewer 2020s88831139No ratings yet

- Template 04 Financial ProjectionsDocument338 pagesTemplate 04 Financial Projectionsokymk13No ratings yet

- 1cr4dm8kl 930744Document4 pages1cr4dm8kl 930744DGLNo ratings yet

- Build NYC 2018 Outstanding Bond IssuanceDocument24 pagesBuild NYC 2018 Outstanding Bond IssuanceHilton GrandNo ratings yet

- Question 1 of 20 11212 ASP Take Home Assignment Part BDocument5 pagesQuestion 1 of 20 11212 ASP Take Home Assignment Part BĐoàn Thùy DươngNo ratings yet

- Question-1-of-20-11212-ASP-Take-home-Assignment-Part-B 2Document5 pagesQuestion-1-of-20-11212-ASP-Take-home-Assignment-Part-B 2Đoàn Thùy DươngNo ratings yet

- AFA241Document5 pagesAFA241sarah josephNo ratings yet

- 0aeff7961f - Executive Summary: IR Cap - Live Execution Trade Details - 2022-10-12Document25 pages0aeff7961f - Executive Summary: IR Cap - Live Execution Trade Details - 2022-10-12Gabriel TorrejonNo ratings yet

- SBNY Signature Bank Annual Balance Sheet - WSJDocument1 pageSBNY Signature Bank Annual Balance Sheet - WSJSanchit BudhirajaNo ratings yet

- 2222.Sr - Yahoo Search Results 3Document1 page2222.Sr - Yahoo Search Results 3specul8tor10No ratings yet

- Task # Tab 1 Contracts 2 Cash Out 3 Cash Out SummaryDocument9 pagesTask # Tab 1 Contracts 2 Cash Out 3 Cash Out SummaryJared KimaniNo ratings yet

- Automotive Monthly Report Ratio V2Document11 pagesAutomotive Monthly Report Ratio V2Pathquest SolutionsNo ratings yet

- Fina h-3 6th-Sem 2022Document3 pagesFina h-3 6th-Sem 2022Gopinath MondalNo ratings yet

- US Flow of Funds 07sept2022Document39 pagesUS Flow of Funds 07sept2022scribbugNo ratings yet

- Visa Approved Dual Chip Cards - January 2022Document23 pagesVisa Approved Dual Chip Cards - January 2022王二刚No ratings yet

- TS XS2483061490 Usd 6y Atc BKTDocument9 pagesTS XS2483061490 Usd 6y Atc BKTankit bordiaNo ratings yet

- Report On Summer Training: Submitted byDocument21 pagesReport On Summer Training: Submitted bynavdhaps710864070No ratings yet

- Reynolds American Inc 5.85% 2045Document78 pagesReynolds American Inc 5.85% 2045jamesNo ratings yet

- Chandak Insurance Services: Magic Mix Illustration For Mr. - (Age 25)Document5 pagesChandak Insurance Services: Magic Mix Illustration For Mr. - (Age 25)Mohit DhakaNo ratings yet

- SaaS Financial Model 3.0 ExcelDocument367 pagesSaaS Financial Model 3.0 Excelმექანიკური ფორთოხალიNo ratings yet

- Abxpb2604f 2022Document5 pagesAbxpb2604f 2022Vineet KhuranaNo ratings yet

- Financial ReportDocument156 pagesFinancial Reportjennifer alvaradoNo ratings yet

- Stelco National BankDocument5 pagesStelco National BankForexliveNo ratings yet

- Financial Accounting 2A Final OSA PDFDocument5 pagesFinancial Accounting 2A Final OSA PDFdamian.levendalNo ratings yet

- CHAPTER6-NEWDocument13 pagesCHAPTER6-NEWredegeneratedNo ratings yet

- Sampa Video SpreadsheetDocument4 pagesSampa Video SpreadsheetVarsha ShirsatNo ratings yet

- 190922-Outstanding Bonds Details As On 15.09.2022Document2 pages190922-Outstanding Bonds Details As On 15.09.2022HantuNo ratings yet

- Research 0452 - 2022 - F - M - p22 - MsDocument23 pagesResearch 0452 - 2022 - F - M - p22 - MsV-academy MathsNo ratings yet

- Bankwise Audit Rating ReportDocument17 pagesBankwise Audit Rating ReportHAMMADHRNo ratings yet

- Agritopia Residential - 6 - 2021 Operating Budget BOD Resolution - 10-19-20Document12 pagesAgritopia Residential - 6 - 2021 Operating Budget BOD Resolution - 10-19-20Faaria ZainabNo ratings yet

- Nynyc03a FinDocument112 pagesNynyc03a FinKelson RodriguesNo ratings yet

- Ey Basel III EndgameDocument22 pagesEy Basel III EndgamemehuljgargNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document3 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Anita RatnawatiNo ratings yet

- Format Bid Capacity Issued by PPMO Cell PW 321Document5 pagesFormat Bid Capacity Issued by PPMO Cell PW 321Lakshman KhanalNo ratings yet

- Stove Kraft Limited-3Document5 pagesStove Kraft Limited-3venkyniyerNo ratings yet

- Cadbury Kraft AnalysisDocument358 pagesCadbury Kraft Analysisakashprasad0205No ratings yet

- Cambridge O Level: Accounting 7707/23 October/November 2020Document14 pagesCambridge O Level: Accounting 7707/23 October/November 2020ImanNo ratings yet

- STLDDocument9 pagesSTLDTom BiusoNo ratings yet

- Economic Indicators for Southeast Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeast Asia and the Pacific: Input–Output TablesNo ratings yet

- Find-Replace WorksheetDocument1 pageFind-Replace Worksheettrust2386No ratings yet

- Nvestment CompDocument115 pagesNvestment Comptrust2386No ratings yet

- Federal Reserve Act SECTION 22-Offenses of Examiners, Member Banks, Officers, and DirectorsDocument5 pagesFederal Reserve Act SECTION 22-Offenses of Examiners, Member Banks, Officers, and Directorstrust2386No ratings yet

- 26 CFR 1.671-5 - Reporting For Widely Held Fixed Investment Trusts.Document7 pages26 CFR 1.671-5 - Reporting For Widely Held Fixed Investment Trusts.trust2386No ratings yet

- 31 U.S. Code 3113 - Accepting GiftsDocument2 pages31 U.S. Code 3113 - Accepting Giftstrust2386No ratings yet

- 18 U.S. Code 8 - Obligation or Other Security of The United StatesDocument1 page18 U.S. Code 8 - Obligation or Other Security of The United Statestrust2386No ratings yet

- ALSTrading - Logic Behind Market MovementDocument16 pagesALSTrading - Logic Behind Market Movementbp149No ratings yet

- Credit Risk ModelingDocument131 pagesCredit Risk ModelingFrancisco Perez MendozaNo ratings yet

- Bitcoin Price PredictionDocument3 pagesBitcoin Price PredictionAlaa' Deen ManasraNo ratings yet

- Reviewer ExamDocument73 pagesReviewer ExamZalaR0cksNo ratings yet

- TJATUROSO IMAN MURSALIN - IW03991R - Jul-2019 PDFDocument1 pageTJATUROSO IMAN MURSALIN - IW03991R - Jul-2019 PDFCatur EmpatNo ratings yet

- Underwriting of Shares QuesDocument7 pagesUnderwriting of Shares Quesmoto E4 plus100% (1)

- Issue 57Document139 pagesIssue 57dgupta246859100% (1)

- 06 Activity 1panlaquiDocument1 page06 Activity 1panlaquiEmirish PNo ratings yet

- Chapter 3 Problems - Ia Part 2Document16 pagesChapter 3 Problems - Ia Part 2KathleenCusipagNo ratings yet

- Health OrangeDocument1 pageHealth OrangePrincess Orange AgdonNo ratings yet

- SpotifyDocument27 pagesSpotifyRana SheharyarNo ratings yet

- 8th ATMA by Dalta Rsi - AnalysisDocument44 pages8th ATMA by Dalta Rsi - Analysissuresh100% (2)

- Security Analysis and Portfolio Management - Mgt521Document11 pagesSecurity Analysis and Portfolio Management - Mgt521meetpal33% (3)

- WFG Upgrade From CIBCDocument9 pagesWFG Upgrade From CIBCForexliveNo ratings yet

- Securities and Exchange Board of IndiaDocument20 pagesSecurities and Exchange Board of IndiaShashank50% (2)

- (2017 Gray) Crypto-Currency - Risky As Hell But Worth A PuntDocument1 page(2017 Gray) Crypto-Currency - Risky As Hell But Worth A PuntToastNo ratings yet

- Business and ManagementDocument3 pagesBusiness and ManagementfaustynNo ratings yet

- DividendsDocument27 pagesDividendsSadia R ChowdhuryNo ratings yet

- Currency FinalDocument25 pagesCurrency FinalDhaval DamaniNo ratings yet

- Int Monetary System PPT 1Document31 pagesInt Monetary System PPT 1Abhijeet Bhattacharya100% (1)

- Notes For Financial InstrumentsDocument25 pagesNotes For Financial InstrumentsJaydenausNo ratings yet

- TEO - Fardapaper-Adopters-and-non-adopters-of-business-to-business-electronic-commerce-in-SingaporeDocument14 pagesTEO - Fardapaper-Adopters-and-non-adopters-of-business-to-business-electronic-commerce-in-SingaporeNonkuNo ratings yet

- Market Indices For Stocks and BondsDocument15 pagesMarket Indices For Stocks and BondsKayshiel Agus100% (1)

- Dividend Payout RatioDocument5 pagesDividend Payout RatioInnocent IssackNo ratings yet

- Fundamental and Technical Analysis of Portfolio Management.Document17 pagesFundamental and Technical Analysis of Portfolio Management.Deven RathodNo ratings yet

- (123doc) - Tieu-Luan-Mon-Tai-Chinh-Quoc-Te-Current-Situation-Of-Foreign-Exchange-Marke-In-Vietnam-And-Management-MeasuresDocument15 pages(123doc) - Tieu-Luan-Mon-Tai-Chinh-Quoc-Te-Current-Situation-Of-Foreign-Exchange-Marke-In-Vietnam-And-Management-MeasuresNam Anh VũNo ratings yet