Professional Documents

Culture Documents

Difference Between IFRS and Indian GAAP

Difference Between IFRS and Indian GAAP

Uploaded by

VuittonzarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Difference Between IFRS and Indian GAAP

Difference Between IFRS and Indian GAAP

Uploaded by

VuittonzarCopyright:

Available Formats

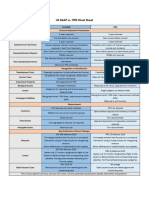

TABLE 17.

1 Differences between IFRS and Indian GAAP

Point of Difference IFRS Indian GAAP

Components of financial statements Statement of financial position Balance sheet

Statement of comprehensive Profit and loss account

income Cash flow statement

Cash flow statement Notes to accounts

Statement of change in equity

Notes to accounts

Fomat of financial position statement No specific format Format as per Schedule VI of

Companies Act. 1956

Format of income statement AS-1 specifies the format of income Format as per schedule Vi of

statement Companies Act. 1956

Cash flow statement Mandatory for all Exempted for certain entities

Extra ordinary items It prohibits the presentation of these These items are mandatory

items

Goodwill It is subject to annual impairment test To be amortized in five year's tme

Intangible assets Measured at fair value Measured at cost

Consolidated financial statements Valuation and presentation at fair Valuation and presentatian at book

value value

Change in depreciation method Prospective implementation Retrospectve implementabon

Lease of and and building Contains provisions about it Does not contain provisions about it

Inital direct cost in lease and implicit These costs are considered while These costs are not cosidered while

interest rate calculating implicit interest rate calculating implicit interest rate

Incepton and commencement of Differentiates between these twe Does not diferentiate between these

lease dates wo dates

Once complete implementation of IFRS is made mandatory, there will exist no difference betwecn

accounting standards of different countries

You might also like

- IAS 1 Presentation of Financial Statements (Revised)Document55 pagesIAS 1 Presentation of Financial Statements (Revised)Riza Mae MendozaNo ratings yet

- Ifrs at A Glance IAS 1 Presentation of Financial: StatementsDocument4 pagesIfrs at A Glance IAS 1 Presentation of Financial: StatementsMiladanica Barcelona BarracaNo ratings yet

- Accounting For Managers: Leasing Concept Under IfrsDocument9 pagesAccounting For Managers: Leasing Concept Under Ifrsvarshini sureshNo ratings yet

- Differences Between PSAK and IFRSDocument3 pagesDifferences Between PSAK and IFRSInney SildalatifaNo ratings yet

- Deferences Between PSAK and IFRSDocument3 pagesDeferences Between PSAK and IFRSInney SildalatifaNo ratings yet

- Ifrs - An Overview: International Financial Reporting StandardsDocument19 pagesIfrs - An Overview: International Financial Reporting Standardskitta880% (2)

- US GAAP Vs IFRSDocument1 pageUS GAAP Vs IFRSreg.comp2000No ratings yet

- Ifrs VS Us GaapDocument1 pageIfrs VS Us GaapPratidina Aji WidodoNo ratings yet

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- International Financial Accounting Standards (IFRS)Document5 pagesInternational Financial Accounting Standards (IFRS)reetutrNo ratings yet

- Comparison of IFRS With Ind AS - P3Document7 pagesComparison of IFRS With Ind AS - P3Zarana PatelNo ratings yet

- IFRS Assignment 4Document3 pagesIFRS Assignment 4Sandeep BodduNo ratings yet

- CFR Answers Year 2015Document15 pagesCFR Answers Year 2015Ashwini SwamyNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument39 pagesIas 1 Presentation of Financial StatementsYawar Khan KhiljiNo ratings yet

- IAS1 Presentation of FSDocument6 pagesIAS1 Presentation of FSIrishLove Alonzo BalladaresNo ratings yet

- 01 - Company A - IFRS Conversion 2018Document62 pages01 - Company A - IFRS Conversion 2018Nguyen Binh MinhNo ratings yet

- Ifrs 1:: First-Time Adoption ofDocument17 pagesIfrs 1:: First-Time Adoption ofEshetieNo ratings yet

- Ias 34-Interim Financial ReportingDocument2 pagesIas 34-Interim Financial ReportingfrondagericaNo ratings yet

- IAS 01 - Presentation of FS - SVDocument32 pagesIAS 01 - Presentation of FS - SVHồ Đan ThụcNo ratings yet

- FR Revision CapsuleDocument23 pagesFR Revision CapsuleSnehNo ratings yet

- Chapter - 6 Comparative Study of Indian Gaap, Ifrs & Ind AsDocument88 pagesChapter - 6 Comparative Study of Indian Gaap, Ifrs & Ind AsSaurabh GargNo ratings yet

- Presentation of Financial Statements: Judgements Provides Guidance On Making MaterialityDocument2 pagesPresentation of Financial Statements: Judgements Provides Guidance On Making MaterialityOsinloye Opeoluwa AdesubomiNo ratings yet

- Us Gaap Versus Ifrs: The BasicsDocument54 pagesUs Gaap Versus Ifrs: The BasicsAkhil ManglaNo ratings yet

- CFRA Sesison 1 - 5Document77 pagesCFRA Sesison 1 - 5Rishab AgarwalNo ratings yet

- Finance Director at Resources MenaDocument11 pagesFinance Director at Resources MenaRAM GOPAL GUPTANo ratings yet

- Electronic Way Bill Under GSTDocument46 pagesElectronic Way Bill Under GSTDeepak WadhwaNo ratings yet

- Financial Statements PresentationDocument2 pagesFinancial Statements PresentationJoel JimenezNo ratings yet

- Difference BTW As IFRS and INDDocument5 pagesDifference BTW As IFRS and INDrahul jambagiNo ratings yet

- IAS 21 Foreign Exchange TranslationsDocument19 pagesIAS 21 Foreign Exchange Translationsmae acuestaNo ratings yet

- Ind AS at A GlanceDocument100 pagesInd AS at A GlanceSanjayNo ratings yet

- Us Gaap Versus IFRS: The BasicsDocument51 pagesUs Gaap Versus IFRS: The Basicssicat robinNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSfenildivyaNo ratings yet

- Overview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPDocument16 pagesOverview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPvcsekhar_caNo ratings yet

- IFRSDocument14 pagesIFRSShruti KawaneNo ratings yet

- Philippine Accounting Standard (PAS) 1: Presentation of Financial StatementsDocument30 pagesPhilippine Accounting Standard (PAS) 1: Presentation of Financial StatementsJhon Cydric TiosaycoNo ratings yet

- NotesDocument2 pagesNotesNoella Marie BaronNo ratings yet

- Assignment Financial Accounting & Analysis: Answer 1. Sr. No Point of Differentiation Indian GAAP Ifrs Ind ASDocument3 pagesAssignment Financial Accounting & Analysis: Answer 1. Sr. No Point of Differentiation Indian GAAP Ifrs Ind ASRASHMINo ratings yet

- 28 Session1 Indasgym SPK1Document43 pages28 Session1 Indasgym SPK1Harsh GandhiNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSrajdeeppawarNo ratings yet

- National Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPDocument10 pagesNational Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPEshetieNo ratings yet

- IAS 1 - IFRS at A GlanceDocument2 pagesIAS 1 - IFRS at A Glancemajorobelampho2No ratings yet

- IFRS-illustrative-financial-statements-2011Document252 pagesIFRS-illustrative-financial-statements-2011Olusegun DanielNo ratings yet

- Limited Companies Financial StatementsDocument4 pagesLimited Companies Financial Statementskaleem khanNo ratings yet

- Summaries of International Accounting StandardsDocument68 pagesSummaries of International Accounting Standardsrakhee karNo ratings yet

- Understanding Financial Statements For Non-AccountantsDocument5 pagesUnderstanding Financial Statements For Non-AccountantsAngella RiveraNo ratings yet

- Chapter 3 - Presentation of Financial Statements - QN (Compatibility Mode)Document9 pagesChapter 3 - Presentation of Financial Statements - QN (Compatibility Mode)Chi Nguyễn Thị KimNo ratings yet

- Ias 1 - Presentation of Financial StatementsDocument3 pagesIas 1 - Presentation of Financial Statementsangelinamaye99No ratings yet

- 28 Diff Bet Usgaap Igaap IfrsDocument7 pages28 Diff Bet Usgaap Igaap IfrsRohit BeniwalNo ratings yet

- Presentation BCIC Session On Companies Act April 23, 2021Document56 pagesPresentation BCIC Session On Companies Act April 23, 2021NEHA NAYAKNo ratings yet

- Day 1 Dipifrs Batch 10 Weekend NotesDocument31 pagesDay 1 Dipifrs Batch 10 Weekend NotesKathleen De JesusNo ratings yet

- Sme PfrsDocument9 pagesSme PfrsAlmae Joy DieteNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting Standardsjoy26iNo ratings yet

- Illustrative-Financial-Statements - IGAAP PDFDocument65 pagesIllustrative-Financial-Statements - IGAAP PDFSubhash BhatNo ratings yet

- Microsoft PowerPoint Presentation IFRSDocument27 pagesMicrosoft PowerPoint Presentation IFRSSwati SharmaNo ratings yet

- Presentationof Financial Statements Pas 1Document7 pagesPresentationof Financial Statements Pas 1Amber AgustinNo ratings yet

- Unit 3 IAS1 Presentation of FS SlidesDocument4 pagesUnit 3 IAS1 Presentation of FS SlidesNandi MliloNo ratings yet

- 2005 Model FsDocument72 pages2005 Model FsMuji1No ratings yet

- IFRS - First-Time AdoptersDocument272 pagesIFRS - First-Time AdoptersMarvin Montero100% (1)

- Objective Wise Analysis and Comparison: 5.1 Comparison Among Indian Gaap, Ifrs and Indian AsDocument103 pagesObjective Wise Analysis and Comparison: 5.1 Comparison Among Indian Gaap, Ifrs and Indian AsRenuka LenkaNo ratings yet

- UK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPFrom EverandUK GAAP 2017: Generally Accepted Accounting Practice under UK and Irish GAAPNo ratings yet

- 138 ComplaintDocument28 pages138 Complaintzuhaib habibNo ratings yet

- The Iasb at A CrossroadDocument8 pagesThe Iasb at A Crossroadyahya zafarNo ratings yet

- Liston (2) Lafti V Laet (2022) DIFC SCT 024 (16 March 2022)Document3 pagesListon (2) Lafti V Laet (2022) DIFC SCT 024 (16 March 2022)abdeali hazariNo ratings yet

- What Does ?: SAP MeansDocument22 pagesWhat Does ?: SAP MeansNaif Al-AlolaNo ratings yet

- A STUDY ON DEPOSITORY SYSTEM - Docx NewDocument19 pagesA STUDY ON DEPOSITORY SYSTEM - Docx NewRajni WaswaniNo ratings yet

- Isthmus Partners - GCC & UAE Overview - Two Page FlyerDocument2 pagesIsthmus Partners - GCC & UAE Overview - Two Page FlyerMaterhonNo ratings yet

- OutSource APVVPDocument8 pagesOutSource APVVPNSS S.K.UniversityNo ratings yet

- Department of International Trade Promotion PDFDocument693 pagesDepartment of International Trade Promotion PDFMhareen Rose Llavado100% (1)

- Computer OperatorDocument3 pagesComputer OperatorHarish MudhirajNo ratings yet

- WLD First Draft Rubric PMGT 510 V02Document6 pagesWLD First Draft Rubric PMGT 510 V02PrashantRanjan2010No ratings yet

- Poem Analysis PresenationDocument8 pagesPoem Analysis PresenationMunachiNo ratings yet

- 【1001】The One After Joey and Rachel KissDocument31 pages【1001】The One After Joey and Rachel KissZop ZhangNo ratings yet

- Nama: Muhammad Cincin Rakhmadila Kelas: Vii-I No. Absen: 17 ANKATAN: 2019/2020 Lawang SewuDocument2 pagesNama: Muhammad Cincin Rakhmadila Kelas: Vii-I No. Absen: 17 ANKATAN: 2019/2020 Lawang SewuIXC-19-Muhammad Cincin RakhmadilaNo ratings yet

- SocioeconomicDocument9 pagesSocioeconomicRomak Roy ChowdhuryNo ratings yet

- Social Worker ILFM - Sittwe Job Description 21.8.23Document3 pagesSocial Worker ILFM - Sittwe Job Description 21.8.23nwenioowai007No ratings yet

- Crescent Petroleum, Ltd. vs. M:V "Lok Maheshwari"Document26 pagesCrescent Petroleum, Ltd. vs. M:V "Lok Maheshwari"Ailein GraceNo ratings yet

- Don Mariano Marcos Memorial State University South La Union Campus Agoo, La UnionDocument14 pagesDon Mariano Marcos Memorial State University South La Union Campus Agoo, La UnionRAVEN O. LARONNo ratings yet

- Notice of ResultDocument6 pagesNotice of Resultcarie justine estrelladoNo ratings yet

- The Vertues and Vertuous Actions of The Scared Month of Rajab by Ataul Mustafa AmjadiDocument4 pagesThe Vertues and Vertuous Actions of The Scared Month of Rajab by Ataul Mustafa AmjadiMohammad Izharun Nabi HussainiNo ratings yet

- Annexure 2 - Power Purchase Agreement (PPA) For NEW PROJECTSDocument54 pagesAnnexure 2 - Power Purchase Agreement (PPA) For NEW PROJECTSsamik_sarkar7041No ratings yet

- Tma 04Document21 pagesTma 04Neil YoungNo ratings yet

- United States Court of Appeals: UnpublishedDocument18 pagesUnited States Court of Appeals: UnpublishedScribd Government DocsNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesLokesh NANo ratings yet

- 2-15-19 US Manafort Sentencing MemoDocument120 pages2-15-19 US Manafort Sentencing Memozmtillman100% (2)

- AHW3e L3 Skills Test 4Document4 pagesAHW3e L3 Skills Test 4Lucero TapiaNo ratings yet

- In The Army NowDocument3 pagesIn The Army NowSégolène CharpentierNo ratings yet

- Hcs 608 Assignment 2 - Purvasha SharanDocument13 pagesHcs 608 Assignment 2 - Purvasha Sharanpurvashasharan16No ratings yet

- Belief in Divine Decree in IslamDocument2 pagesBelief in Divine Decree in IslamahmadnaiemNo ratings yet

- Business Studies Notes: Unit 3Document13 pagesBusiness Studies Notes: Unit 3Matt Robson100% (1)

- The Tail Wags The Dog Jason RobertsonDocument3 pagesThe Tail Wags The Dog Jason RobertsonIvonne Flores FernándezNo ratings yet