Professional Documents

Culture Documents

Universiti Teknologi Mara Test: Confidential AC/TEST2021/ACC106

Universiti Teknologi Mara Test: Confidential AC/TEST2021/ACC106

Uploaded by

2023864756Copyright:

Available Formats

You might also like

- Cultural Genocide Yossef Ben JochannanDocument198 pagesCultural Genocide Yossef Ben JochannanDeyonne Chante Howard100% (31)

- Dec2022 Acc117 Acc106 Test 1 QDocument6 pagesDec2022 Acc117 Acc106 Test 1 Qlailanurinsyirah abdulhalimNo ratings yet

- Surprise Egg With Little LambDocument11 pagesSurprise Egg With Little Lambmagy4alex4min4100% (4)

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- RECENSEO 2020 Comprehensive Examination Reviewer Material PDFDocument124 pagesRECENSEO 2020 Comprehensive Examination Reviewer Material PDFCamille CastroNo ratings yet

- Sample 4 Soalan Test PDFDocument5 pagesSample 4 Soalan Test PDFEmmy LizaNo ratings yet

- Universiti Teknologi Mara Test 1: This Test Consists ofDocument6 pagesUniversiti Teknologi Mara Test 1: This Test Consists of2023864756No ratings yet

- 2022 Feb T1Document5 pages2022 Feb T1mustardNo ratings yet

- 2022 Aug T1Document6 pages2022 Aug T1mustardNo ratings yet

- Acc406 - Q - Set 1 - Sesi 1 July 2020Document12 pagesAcc406 - Q - Set 1 - Sesi 1 July 2020NABILA NADHIRAH ROSLANNo ratings yet

- Acc030 Test 1 May 2023-Qq (Set 2)Document5 pagesAcc030 Test 1 May 2023-Qq (Set 2)Aisyah NasriyahNo ratings yet

- Aud689 July2022Document7 pagesAud689 July2022AlexNo ratings yet

- 2021 AugDocument8 pages2021 AugmustardNo ratings yet

- Foundation May 2018Document140 pagesFoundation May 2018multenplanintegratedltdNo ratings yet

- D FAR110 Test Jun 2022 QuestionDocument6 pagesD FAR110 Test Jun 2022 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- Aud589 Dec2019Document6 pagesAud589 Dec2019LANGITBIRU0% (1)

- Acc466 Test 2 July2022 - Question (PW)Document9 pagesAcc466 Test 2 July2022 - Question (PW)nur hadhirahNo ratings yet

- D FAR110 Test Dec 2021 QuestionDocument6 pagesD FAR110 Test Dec 2021 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- Far110 (Q) Sep 2014 MelDocument12 pagesFar110 (Q) Sep 2014 MelAlieyaaNo ratings yet

- Tutorial 1Document5 pagesTutorial 1H4NG325No ratings yet

- BKAL1013 Tutorial 1Document5 pagesBKAL1013 Tutorial 1syuhadaNo ratings yet

- Chapter 1 Seatwork 2 PDFDocument6 pagesChapter 1 Seatwork 2 PDFmiles ebajanNo ratings yet

- Rift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual AssignmentDocument7 pagesRift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual Assignmentgenemu fejoNo ratings yet

- Test 1 Q Dec2021Document6 pagesTest 1 Q Dec2021syaza aidaNo ratings yet

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- File 1702544570921 9504754Document4 pagesFile 1702544570921 9504754yudhistira aditNo ratings yet

- A162 Answer Tutorial 1 and Answer Siti NorlizaDocument13 pagesA162 Answer Tutorial 1 and Answer Siti NorlizaXiao Yun Yap0% (2)

- CT Far110 Apr2019 QuestionDocument5 pagesCT Far110 Apr2019 QuestionNurul HudaNo ratings yet

- MSA 1st Exam - 2021 - Spring - v1 - No SolutionDocument15 pagesMSA 1st Exam - 2021 - Spring - v1 - No SolutionNai Nai Do ManhNo ratings yet

- Business Accounting (PAF3113)Document26 pagesBusiness Accounting (PAF3113)LIM LEE THONGNo ratings yet

- MOJAKOE AK1 UTS 2010 GasalDocument10 pagesMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudNo ratings yet

- P1-Kode Etik, Kerangka KonseptualDocument6 pagesP1-Kode Etik, Kerangka KonseptualNajwa KhansaNo ratings yet

- NOV Pathfinder November 2016 FoundationDocument151 pagesNOV Pathfinder November 2016 FoundationOgahNo ratings yet

- Semester 1 - PAPER IDocument7 pagesSemester 1 - PAPER IShilongo OliviaNo ratings yet

- CT - Acc407 - Dec 2021 QQDocument9 pagesCT - Acc407 - Dec 2021 QQ2024963073No ratings yet

- Midterm Exam With ANS PRAE 03Document4 pagesMidterm Exam With ANS PRAE 03Diane MagnayeNo ratings yet

- Financial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFDocument5 pagesFinancial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFani2sysNo ratings yet

- Advanced Audit & Assurance PDFDocument17 pagesAdvanced Audit & Assurance PDFmohed100% (1)

- Comment Test 2Document6 pagesComment Test 2AirasNo ratings yet

- Cma Inter Corporate Accounts and AuditDocument648 pagesCma Inter Corporate Accounts and Auditpari maheshwari100% (1)

- Foundation Nov 2019Document138 pagesFoundation Nov 2019Ntinu joshuaNo ratings yet

- Studentsdocumentsmay 2021 Path Foundation PDFDocument124 pagesStudentsdocumentsmay 2021 Path Foundation PDF9r2w6pqcndNo ratings yet

- A131 Tutorial 1 QDocument9 pagesA131 Tutorial 1 QJu RaizahNo ratings yet

- A162 Tutorial 1Document5 pagesA162 Tutorial 1Danny SeeNo ratings yet

- A152 Bkal 1013 Midsem Exam QDocument10 pagesA152 Bkal 1013 Midsem Exam QHeap Ke XinNo ratings yet

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- Past Exam PaperDocument6 pagesPast Exam Paperprecious mountainsNo ratings yet

- D24174R104709Document11 pagesD24174R104709Nurul 'Ain0% (1)

- Quiz Bee Problems Version 1Document68 pagesQuiz Bee Problems Version 1Lalaine De JesusNo ratings yet

- PART-I-INSIGHT-MARCH-2018 (1) Exam and MockDocument108 pagesPART-I-INSIGHT-MARCH-2018 (1) Exam and Mockanyasandra77No ratings yet

- Soal Preliminary AccountingDocument10 pagesSoal Preliminary AccountingZara WinterNo ratings yet

- Final Exam Jul 2022Document9 pagesFinal Exam Jul 2022Rosliana RazabNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRevanth GupthaNo ratings yet

- ACT15 Prelim ExamDocument8 pagesACT15 Prelim ExamPaw VerdilloNo ratings yet

- Accounting Quiz YP 51 BDocument4 pagesAccounting Quiz YP 51 Bnicasavio2725No ratings yet

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocument6 pagesManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNo ratings yet

- Ugb 252Document7 pagesUgb 252Abdumalik KakhkhorovNo ratings yet

- 2016 ACCT2111 Midterm KeyDocument10 pages2016 ACCT2111 Midterm KeyAnn MaNo ratings yet

- FHBM 1214 Financial Accounting Tutorial Workbook Student Copy October 2021 TrimesterDocument68 pagesFHBM 1214 Financial Accounting Tutorial Workbook Student Copy October 2021 TrimesterZi chen AngNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- What Factors Influence A Career Choice PDFDocument2 pagesWhat Factors Influence A Career Choice PDFmailk jklmnNo ratings yet

- Shooting Dad EssayDocument4 pagesShooting Dad Essaybopajagenal2100% (2)

- ED526 - Module 2 - Assignment 2 - GroupDocument11 pagesED526 - Module 2 - Assignment 2 - Groupterry berryNo ratings yet

- Quiz On SocializationDocument1 pageQuiz On SocializationJomar ArcillaNo ratings yet

- Ch-02-S-Developing Marketing Strategies and PlansDocument45 pagesCh-02-S-Developing Marketing Strategies and PlansIsmat Zerin SwarnaNo ratings yet

- The Coinage of Two Hundred Rupees and Ten Rupees Coins To Commemorate The Occasion of 200 H BIRTH ANNIVERSARY of TATYA TOPE Rules, 2015.Document6 pagesThe Coinage of Two Hundred Rupees and Ten Rupees Coins To Commemorate The Occasion of 200 H BIRTH ANNIVERSARY of TATYA TOPE Rules, 2015.Latest Laws TeamNo ratings yet

- Sense of Urgency Book Review by TMYDocument17 pagesSense of Urgency Book Review by TMYtajuddinmy100% (2)

- HPG HSC Mua 28.6Document5 pagesHPG HSC Mua 28.6Sergio FibonacciNo ratings yet

- Lawrence On Negotiable InstrumentsDocument10 pagesLawrence On Negotiable InstrumentsDeontosNo ratings yet

- Cojuanco Vs SandiganbayanDocument2 pagesCojuanco Vs SandiganbayanEANo ratings yet

- Activity 3Document5 pagesActivity 3Daryl SeraficaNo ratings yet

- National GoalsDocument19 pagesNational GoalsdarsaimarasheedNo ratings yet

- LEASE AGREEMEN Arifa FarhanDocument11 pagesLEASE AGREEMEN Arifa FarhanZarlala AliNo ratings yet

- A I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanyDocument102 pagesA I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanySajidNo ratings yet

- Econ 122 Week 1 9 by DwexDocument19 pagesEcon 122 Week 1 9 by DwexDestinyNo ratings yet

- Focus Group Discussion Questionnaire (24.01.2022)Document4 pagesFocus Group Discussion Questionnaire (24.01.2022)Mohammed EcoNo ratings yet

- Idea Source InternationalDocument24 pagesIdea Source InternationalDerek William NicollNo ratings yet

- Market Reaction To Multiple Buybacks in IndiaDocument32 pagesMarket Reaction To Multiple Buybacks in Indiagautam_gujral3088488No ratings yet

- Global Health Is More Than Just Public Health Somewhere Else'Document3 pagesGlobal Health Is More Than Just Public Health Somewhere Else'danfer_99No ratings yet

- IGEmailExtractor Phone 14 20240114024429Document9 pagesIGEmailExtractor Phone 14 20240114024429Dzibran FebryansyahNo ratings yet

- The Strange Case of DR Jekyll and MR Hyde: Science, Duality of Human and LondonDocument4 pagesThe Strange Case of DR Jekyll and MR Hyde: Science, Duality of Human and LondonKadir BostanogluNo ratings yet

- REcount TextDocument4 pagesREcount TextFarah HildyNo ratings yet

- Arogya Mitra Participant HandbookDocument139 pagesArogya Mitra Participant HandbookAditiya VashishtNo ratings yet

- Case Study - 2Document5 pagesCase Study - 2Aparna GuptaNo ratings yet

- 2016 Economics H2 JC2 HWA Chong InstitutionDocument38 pages2016 Economics H2 JC2 HWA Chong InstitutionmaxximNo ratings yet

- Bal Bharati Public School, Navi Mumbai Pre-Mid Term Examination, 2021-2022Document2 pagesBal Bharati Public School, Navi Mumbai Pre-Mid Term Examination, 2021-2022Sakshi NagotkarNo ratings yet

- SERVING WITH A SMILE and MOTIVATING EXCEPTIONAL SERVICEDocument27 pagesSERVING WITH A SMILE and MOTIVATING EXCEPTIONAL SERVICEarjonelgstodomingoNo ratings yet

- Conscience and Moral DevelopmentDocument17 pagesConscience and Moral DevelopmentThằng ThấyNo ratings yet

Universiti Teknologi Mara Test: Confidential AC/TEST2021/ACC106

Universiti Teknologi Mara Test: Confidential AC/TEST2021/ACC106

Uploaded by

2023864756Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Universiti Teknologi Mara Test: Confidential AC/TEST2021/ACC106

Universiti Teknologi Mara Test: Confidential AC/TEST2021/ACC106

Uploaded by

2023864756Copyright:

Available Formats

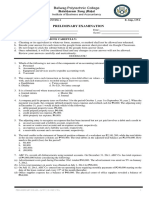

CONFIDENTIAL AC/TEST2021/ACC106

UNIVERSITI TEKNOLOGI MARA

TEST

COURSE : INTRODUCTION TO FINANCIAL ACCOUNTING

AND REPORTING

COURSE CODE : ACC106

TEST : 3 DECEMBER 2021 (FRIDAY)

TIME : 1 HOURS 30 MINUTES (3.00 PM – 4.30 PM)

THIS TEST CONSISTS OF:

i. PART A - TRUE FALSE QUESTIONS (10 MARKS)

ii. PART B - MULTIPLE CHOICE QUESTIONS (10 MARKS)

iii. PART C - SHORT STRUCTURE (30 MARKS)

TOTAL: 50 MARKS

INSTRUCTIONS TO CANDIDATES

1. Answer All Questions.

2. Only HANDWRITTEN answers (pen only) should be UPLOADED.

3. Please make sure your images are clear, in portrait and A4 size form (on writing pad)

4. Write your name on every page.

5. Save your answers in (1) file ONLY in Pdf Format.

6. Name the file (pdf format) to your FULL NAME (IC)_STUDENT’S ID_GROUP

E.g. NURBAYA BINTI ISMAIL_202054214521_N4AM1202A

7. Recheck the file and make sure the completeness of your answers.

8. Upload your file.

9. You are given 15-20 minutes to upload your file after the test ends. If your upload speeds takes

longer than the stipulated time, snap the upload progress image and send to your lecturer as

proof of the submission in progress.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This test consists of 5 pages including cover page

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL AC/TEST2021/ACC106

PART A: TRUE OR FALSE QUESTIONS

This part consists of 10 true false questions. Read the statements carefully. If the

statement is correct, write TRUE. If the statement is incorrect, write FALSE. Write the

answer in your answer sheet/booklet.

1. One of the objectives of financial accounting is to provide financial information to

the external users only.

2. Accounting is a process of classifying, recording, summarizing and

communicating financial information to users.

3. A partnership remains unchanged when a partner dies, retires or a new partner is

admitted to the business.

4. The management is one of an internal user of accounting information.

5. A faithful representation is a situation where financial statements represented a

legal form that is differed from the economic substance.

6. According to the economic entity concept, any economic events of a sole

proprietorship cannot be distinguished from the personal economic events of its

owner.

7. An assumption of a business that is to continue to operate for foreseeable future

is known as the going concern concept.

8. Accounting conceptual framework is established to assist MASB in developing

MFRS Standards that are based on comparability concepts.

9. Mortgage on lease-hold premises is a Non-Current Assets (Tangible).

10. According to the double entry principles, the credit side of an account is used to

record an increase in liabilities.

(10 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL AC/TEST2021/ACC106

PART B: MULTIPLE CHOICE QUESTIONS

This part consists of 10 multiple choice questions. Choose the most suitable answer

and write the alphabet representing the answer in your answer sheet/booklet.

1. The following statements are true, except:

A. Source documents are the evidence for any economic transactions occurred

in the business.

B. Bookkeeping is the records of all business and owner’s personal transactions.

C. Bookkeeping is a part of accounting cycles.

D. Preparation of financial statements is one of example how business

communicate their financial information to users.

2. Which type of business organization has the following characteristics:

Book of accounts must be properly kept and audited.

Capital contributed by shareholders.

Managed and controlled by board of directors appointed by the

shareholders.

A. Restoran Ahmad Dua Kali Lima

B. Tetuan Athiyah and Assosiates

C. Koperasi Sahabat Insani

D. MusKamal Synergy TT Sdn Bhd

3. The following are the external users of an organization, except:

A. Securities Commission, Inland Revenue Board and Bursa Malaysia.

B. Chief Executive Officer, Bank and Existing Shareholders.

C. Supplier, Government and Potential Customers.

D. Existing customers, Potential Shareholders and Tax Authorities.

4. What is the purpose of accounting?

i. Provide financial information to the users.

ii. Assist the management to make decision.

iii. Can be used as a tool of performance evaluation of the employees.

iv. To increase the wealth of the business.

A. i, ii and iii

B. i, iii and iv

C. i, ii and iv

D. ii, iii and iv

5. An accountant should record assets according to their equivalent cost. This is to

comply the:

A. money measurement concept

B. historical concept

C. materiality concept

D. confirmatory value concept

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL AC/TEST2021/ACC106

6. Which of the following statement describes the comparability concept?

A. Comparable information enables comparison within the organization only and

it is uniformity.

B. Comparable information enables comparison across organization only and it

is uniformity.

C. Comparable information enables comparison within and across the

organization and it is uniformity.

D. Comparable information enables comparison within and across the

organization and it is not uniformity.

7. Which of the following are the accounting assumptions and concepts to be

applied for an organization?

A. Going concern, economic entity, comparability ad neutrality.

B. Going concern, money measurement, timeliness and confirmatory value.

C. Going concern, money measurement, historical cost and economic entity.

D. Going concern, economic entity, comparability and materiality.

8. The separation of business transactions from personal transactions of owners

are known as:

A. Economic entity concept

B. Going concern concept

C. Money measurement concept

D. Completeness concept

9. The following accounting equation is true except:

A. Assets - Liabilities + Revenues = Capital - Expenses

B. Assets + Expenses = Capital + Liabilities + Revenues

C. Assets + Expenses – Revenues = Liabilities + Capital

D. Assets - Liabilities = Capital + Revenues - Expenses

10. The following statement described the principles of double entry, except:

A. Purchased of goods from supplier on credit will debit the purchases account.

B. Cash contributed by the owner of the business will be debited in the capital

account.

C. Withdrawal of cash by the owner of the business for his/her personal usage

will be debited in the drawings account.

D. Sold of good to existing customers on credit will credit the sales account.

(10 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL AC/TEST2021/ACC106

PART C

Kak Yak Enterprise which is owned by Pak Din started business on 1 November 2021.

Below are the business transactions during the month of November 2021.

Date Transactions

Nov

1 Pak Din brought in RM65,000 cash into the business bank account.

4 Purchased goods worth RM10,000 on credit from Purnama Enterprise.

5 Sold goods on credit RM8,500 to Cik Cun.

8 Returned defective goods worth RM800 to Purnama Enterprise

17 Paid Purnama Enterprise for the amount owed by cheque.

Pak Din took RM1,000 from the bank and RM800 worth of goods for his

20

personal use.

25 Pak Din paid RM600 electricity bill to TNB by cheque.

Required:

a. Identify the effects (increase or decrease) of assets, liabilities, owner's equity,

revenues or expenses for the transactions dated from 1 November 2021 to 25

November 2021.

b. Show the journal entry (debit and credit) of all above transactions.

(Use the format given below to answer the above questions)

Example: November 30 Paid RM2,000 for driver's salary by cash.

Date a. Effects b. Journal Entry

Nov Increase Decrease Debit Credit

30 Expenses Asset Salaries Cash

(30 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Cultural Genocide Yossef Ben JochannanDocument198 pagesCultural Genocide Yossef Ben JochannanDeyonne Chante Howard100% (31)

- Dec2022 Acc117 Acc106 Test 1 QDocument6 pagesDec2022 Acc117 Acc106 Test 1 Qlailanurinsyirah abdulhalimNo ratings yet

- Surprise Egg With Little LambDocument11 pagesSurprise Egg With Little Lambmagy4alex4min4100% (4)

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument5 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRavi ParmarNo ratings yet

- RECENSEO 2020 Comprehensive Examination Reviewer Material PDFDocument124 pagesRECENSEO 2020 Comprehensive Examination Reviewer Material PDFCamille CastroNo ratings yet

- Sample 4 Soalan Test PDFDocument5 pagesSample 4 Soalan Test PDFEmmy LizaNo ratings yet

- Universiti Teknologi Mara Test 1: This Test Consists ofDocument6 pagesUniversiti Teknologi Mara Test 1: This Test Consists of2023864756No ratings yet

- 2022 Feb T1Document5 pages2022 Feb T1mustardNo ratings yet

- 2022 Aug T1Document6 pages2022 Aug T1mustardNo ratings yet

- Acc406 - Q - Set 1 - Sesi 1 July 2020Document12 pagesAcc406 - Q - Set 1 - Sesi 1 July 2020NABILA NADHIRAH ROSLANNo ratings yet

- Acc030 Test 1 May 2023-Qq (Set 2)Document5 pagesAcc030 Test 1 May 2023-Qq (Set 2)Aisyah NasriyahNo ratings yet

- Aud689 July2022Document7 pagesAud689 July2022AlexNo ratings yet

- 2021 AugDocument8 pages2021 AugmustardNo ratings yet

- Foundation May 2018Document140 pagesFoundation May 2018multenplanintegratedltdNo ratings yet

- D FAR110 Test Jun 2022 QuestionDocument6 pagesD FAR110 Test Jun 2022 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- Aud589 Dec2019Document6 pagesAud589 Dec2019LANGITBIRU0% (1)

- Acc466 Test 2 July2022 - Question (PW)Document9 pagesAcc466 Test 2 July2022 - Question (PW)nur hadhirahNo ratings yet

- D FAR110 Test Dec 2021 QuestionDocument6 pagesD FAR110 Test Dec 2021 QuestionNADIYATUL AMIRAH AHMAD NAZMINo ratings yet

- Far110 (Q) Sep 2014 MelDocument12 pagesFar110 (Q) Sep 2014 MelAlieyaaNo ratings yet

- Tutorial 1Document5 pagesTutorial 1H4NG325No ratings yet

- BKAL1013 Tutorial 1Document5 pagesBKAL1013 Tutorial 1syuhadaNo ratings yet

- Chapter 1 Seatwork 2 PDFDocument6 pagesChapter 1 Seatwork 2 PDFmiles ebajanNo ratings yet

- Rift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual AssignmentDocument7 pagesRift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual Assignmentgenemu fejoNo ratings yet

- Test 1 Q Dec2021Document6 pagesTest 1 Q Dec2021syaza aidaNo ratings yet

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- File 1702544570921 9504754Document4 pagesFile 1702544570921 9504754yudhistira aditNo ratings yet

- A162 Answer Tutorial 1 and Answer Siti NorlizaDocument13 pagesA162 Answer Tutorial 1 and Answer Siti NorlizaXiao Yun Yap0% (2)

- CT Far110 Apr2019 QuestionDocument5 pagesCT Far110 Apr2019 QuestionNurul HudaNo ratings yet

- MSA 1st Exam - 2021 - Spring - v1 - No SolutionDocument15 pagesMSA 1st Exam - 2021 - Spring - v1 - No SolutionNai Nai Do ManhNo ratings yet

- Business Accounting (PAF3113)Document26 pagesBusiness Accounting (PAF3113)LIM LEE THONGNo ratings yet

- MOJAKOE AK1 UTS 2010 GasalDocument10 pagesMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudNo ratings yet

- P1-Kode Etik, Kerangka KonseptualDocument6 pagesP1-Kode Etik, Kerangka KonseptualNajwa KhansaNo ratings yet

- NOV Pathfinder November 2016 FoundationDocument151 pagesNOV Pathfinder November 2016 FoundationOgahNo ratings yet

- Semester 1 - PAPER IDocument7 pagesSemester 1 - PAPER IShilongo OliviaNo ratings yet

- CT - Acc407 - Dec 2021 QQDocument9 pagesCT - Acc407 - Dec 2021 QQ2024963073No ratings yet

- Midterm Exam With ANS PRAE 03Document4 pagesMidterm Exam With ANS PRAE 03Diane MagnayeNo ratings yet

- Financial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFDocument5 pagesFinancial - Accounting - and - Analysis - Assignment - Dec - 2020 - NmPXMM5fmB COMPLETE PDFani2sysNo ratings yet

- Advanced Audit & Assurance PDFDocument17 pagesAdvanced Audit & Assurance PDFmohed100% (1)

- Comment Test 2Document6 pagesComment Test 2AirasNo ratings yet

- Cma Inter Corporate Accounts and AuditDocument648 pagesCma Inter Corporate Accounts and Auditpari maheshwari100% (1)

- Foundation Nov 2019Document138 pagesFoundation Nov 2019Ntinu joshuaNo ratings yet

- Studentsdocumentsmay 2021 Path Foundation PDFDocument124 pagesStudentsdocumentsmay 2021 Path Foundation PDF9r2w6pqcndNo ratings yet

- A131 Tutorial 1 QDocument9 pagesA131 Tutorial 1 QJu RaizahNo ratings yet

- A162 Tutorial 1Document5 pagesA162 Tutorial 1Danny SeeNo ratings yet

- A152 Bkal 1013 Midsem Exam QDocument10 pagesA152 Bkal 1013 Midsem Exam QHeap Ke XinNo ratings yet

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- Past Exam PaperDocument6 pagesPast Exam Paperprecious mountainsNo ratings yet

- D24174R104709Document11 pagesD24174R104709Nurul 'Ain0% (1)

- Quiz Bee Problems Version 1Document68 pagesQuiz Bee Problems Version 1Lalaine De JesusNo ratings yet

- PART-I-INSIGHT-MARCH-2018 (1) Exam and MockDocument108 pagesPART-I-INSIGHT-MARCH-2018 (1) Exam and Mockanyasandra77No ratings yet

- Soal Preliminary AccountingDocument10 pagesSoal Preliminary AccountingZara WinterNo ratings yet

- Final Exam Jul 2022Document9 pagesFinal Exam Jul 2022Rosliana RazabNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission FormatRevanth GupthaNo ratings yet

- ACT15 Prelim ExamDocument8 pagesACT15 Prelim ExamPaw VerdilloNo ratings yet

- Accounting Quiz YP 51 BDocument4 pagesAccounting Quiz YP 51 Bnicasavio2725No ratings yet

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocument6 pagesManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNo ratings yet

- Ugb 252Document7 pagesUgb 252Abdumalik KakhkhorovNo ratings yet

- 2016 ACCT2111 Midterm KeyDocument10 pages2016 ACCT2111 Midterm KeyAnn MaNo ratings yet

- FHBM 1214 Financial Accounting Tutorial Workbook Student Copy October 2021 TrimesterDocument68 pagesFHBM 1214 Financial Accounting Tutorial Workbook Student Copy October 2021 TrimesterZi chen AngNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- What Factors Influence A Career Choice PDFDocument2 pagesWhat Factors Influence A Career Choice PDFmailk jklmnNo ratings yet

- Shooting Dad EssayDocument4 pagesShooting Dad Essaybopajagenal2100% (2)

- ED526 - Module 2 - Assignment 2 - GroupDocument11 pagesED526 - Module 2 - Assignment 2 - Groupterry berryNo ratings yet

- Quiz On SocializationDocument1 pageQuiz On SocializationJomar ArcillaNo ratings yet

- Ch-02-S-Developing Marketing Strategies and PlansDocument45 pagesCh-02-S-Developing Marketing Strategies and PlansIsmat Zerin SwarnaNo ratings yet

- The Coinage of Two Hundred Rupees and Ten Rupees Coins To Commemorate The Occasion of 200 H BIRTH ANNIVERSARY of TATYA TOPE Rules, 2015.Document6 pagesThe Coinage of Two Hundred Rupees and Ten Rupees Coins To Commemorate The Occasion of 200 H BIRTH ANNIVERSARY of TATYA TOPE Rules, 2015.Latest Laws TeamNo ratings yet

- Sense of Urgency Book Review by TMYDocument17 pagesSense of Urgency Book Review by TMYtajuddinmy100% (2)

- HPG HSC Mua 28.6Document5 pagesHPG HSC Mua 28.6Sergio FibonacciNo ratings yet

- Lawrence On Negotiable InstrumentsDocument10 pagesLawrence On Negotiable InstrumentsDeontosNo ratings yet

- Cojuanco Vs SandiganbayanDocument2 pagesCojuanco Vs SandiganbayanEANo ratings yet

- Activity 3Document5 pagesActivity 3Daryl SeraficaNo ratings yet

- National GoalsDocument19 pagesNational GoalsdarsaimarasheedNo ratings yet

- LEASE AGREEMEN Arifa FarhanDocument11 pagesLEASE AGREEMEN Arifa FarhanZarlala AliNo ratings yet

- A I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanyDocument102 pagesA I P C E Co Aipceco: Ftab Men Arto Onsulting Ngineers MpanySajidNo ratings yet

- Econ 122 Week 1 9 by DwexDocument19 pagesEcon 122 Week 1 9 by DwexDestinyNo ratings yet

- Focus Group Discussion Questionnaire (24.01.2022)Document4 pagesFocus Group Discussion Questionnaire (24.01.2022)Mohammed EcoNo ratings yet

- Idea Source InternationalDocument24 pagesIdea Source InternationalDerek William NicollNo ratings yet

- Market Reaction To Multiple Buybacks in IndiaDocument32 pagesMarket Reaction To Multiple Buybacks in Indiagautam_gujral3088488No ratings yet

- Global Health Is More Than Just Public Health Somewhere Else'Document3 pagesGlobal Health Is More Than Just Public Health Somewhere Else'danfer_99No ratings yet

- IGEmailExtractor Phone 14 20240114024429Document9 pagesIGEmailExtractor Phone 14 20240114024429Dzibran FebryansyahNo ratings yet

- The Strange Case of DR Jekyll and MR Hyde: Science, Duality of Human and LondonDocument4 pagesThe Strange Case of DR Jekyll and MR Hyde: Science, Duality of Human and LondonKadir BostanogluNo ratings yet

- REcount TextDocument4 pagesREcount TextFarah HildyNo ratings yet

- Arogya Mitra Participant HandbookDocument139 pagesArogya Mitra Participant HandbookAditiya VashishtNo ratings yet

- Case Study - 2Document5 pagesCase Study - 2Aparna GuptaNo ratings yet

- 2016 Economics H2 JC2 HWA Chong InstitutionDocument38 pages2016 Economics H2 JC2 HWA Chong InstitutionmaxximNo ratings yet

- Bal Bharati Public School, Navi Mumbai Pre-Mid Term Examination, 2021-2022Document2 pagesBal Bharati Public School, Navi Mumbai Pre-Mid Term Examination, 2021-2022Sakshi NagotkarNo ratings yet

- SERVING WITH A SMILE and MOTIVATING EXCEPTIONAL SERVICEDocument27 pagesSERVING WITH A SMILE and MOTIVATING EXCEPTIONAL SERVICEarjonelgstodomingoNo ratings yet

- Conscience and Moral DevelopmentDocument17 pagesConscience and Moral DevelopmentThằng ThấyNo ratings yet