Professional Documents

Culture Documents

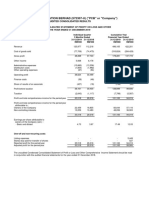

Statements of Comprehensive Income: For The Financial Year Ended 31 December 2018

Statements of Comprehensive Income: For The Financial Year Ended 31 December 2018

Uploaded by

nfarzana.jefriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statements of Comprehensive Income: For The Financial Year Ended 31 December 2018

Statements of Comprehensive Income: For The Financial Year Ended 31 December 2018

Uploaded by

nfarzana.jefriCopyright:

Available Formats

1058531-W

STATEMENTS OF

7-Eleven Malaysia Holdings Berhad

COMPREHENSIVE INCOME

(Incorporated in Malaysia)

FOR THE of

Statements FINANCIAL YEAR

comprehensive ENDED 31 DECEMBER 2018

income

For the financial year ended 31 December 2018

Group Company

2018 2017 2018 2017

Note RM'000 RM'000 RM'000 RM'000

Revenue 4 2,217,049 2,187,102 61,099 58,094

Cost of sales (1,400,333) (1,495,772) - -

Gross profit 816,716 691,330 61,099 58,094

Other operating income 4,568 137,199 - -

Selling and distribution expenses (642,803) (651,243) - -

Administrative and other

operating expenses (94,714) (97,558) (1,022) (1,569)

Profit from operations 5 83,767 79,728 60,077 56,525

Finance costs 7 (9,908) (9,232) (4,436) (4,632)

Profit before tax 73,859 70,496 55,641 51,893

Income tax expense 8 (22,529) (20,389) (24) (58)

Profit after tax 51,330 50,107 55,617 51,835

Other comprehensive income

not to be reclassified to profit

or loss in subsequent year:

Revaluation of land and buildings 9 2,513 44,996 - -

Taxation 26 (2,145) (4,212) - -

Total other comprehensive

income (net of taxation) 368 40,784 - -

Total comprehensive income

for the financial year 51,698 90,891 55,617 51,835

Profit after tax attributable to:

Equity holders of the Company 51,307 50,107 55,617 51,835

Non-controlling interest 23 -

51,330 50,107 55,617 51,835

Total comprehensive

income attributable to:

Equity holders of the Company 51,675 90,891 55,617 51,835

Non-controlling interest 23 -

51,698 90,891 55,617 51,835

Basic/diluted earnings per

share (sen) 37 4.57 4.51

The accompanying accounting policies and explanatory notes form an integral part of the

financial statements.

13

74 7-Eleven Malaysia Holdings Berhad (1058531-W) Annual Report 2018

1058531-W

7-Eleven Malaysia Holdings Berhad

1058531-W

(Incorporated in Malaysia) STATEMENTS OF

7-Eleven Malaysia

Statements Holdings

of financial Berhad

position FINANCIAL

as at 31 December 2018 POSITION

(Incorporated in Malaysia) AS AT 31 DECEMBER

Group 2018

Note 2018 2017

Statements of financial position as at 31 December 2018 RM'000 RM'000

Assets Group

Non-current assets Note 2018 2017

Property, plant and equipment 9 RM'000

323,982 RM'000

350,404

Assets

Investment property 10 400 400

Non-current

Intangible assets

assets 11 34,289 35,298

Property, plant

Other investmentand equipment 9

13 323,982

1 350,404

1

Investment property 10 400

358,672 400

386,103

Intangible assets 11 34,289 35,298

Other investment

Current assets 13 1 1

Inventories 14 358,672

224,682 386,103

221,957

Sundry receivables 15 93,465 113,526

Current

Tax assets

recoverable - 3,748

Inventories

Cash and bank balances 14

16 224,682

72,548 221,957

69,634

Sundry receivables 15 93,465

390,695 113,526

408,865

Tax recoverable

Total assets 749,367- 3,748

794,968

Cash and bank balances 16 72,548 69,634

Equity and liabilities 390,695 408,865

Total

Equityassets

attributable to equity 749,367 794,968

holders of the Company

Equity and liabilities

Share capital 17 1,485,138 1,485,138

Equitypremium

Share attributable to equity 18 - -

holders of the Company

Treasury shares 19 (161,941) (190,625)

Share capital

Capital reorganisation deficit 17

20 1,485,138

(1,343,248) 1,485,138

(1,343,248)

Share premium

Assets revaluation reserve 18

21 41,152- 40,784-

Treasury shares

Retained profits 19

22 (161,941)

71,208 (190,625)

81,985

Capital reorganisation deficit 20 (1,343,248)

92,309 (1,343,248)

74,034

Assets revaluation

Non-controlling reserve

interest 21 41,152

169 40,784-

Retained

Total profits

equity 22 71,208

92,478 81,985

74,034

92,309 74,034

Non-controlling interest

Non-current liabilities 169 -

Total equity

Provisions 23 92,478

7,742 74,034

7,400

Borrowings 24 44,611 42,400

Non-current liabilities

Contract liabilities 28 1,520 -

Provisionstax liabilities

Deferred 23

26 7,742

18,850 7,400

19,436

Borrowings 24 44,611

72,723 42,400

69,236

Contract liabilities 28 1,520 -

Deferred tax liabilities 26 18,850 19,436

72,723 69,236

The accompanying accounting policies and explanatory notes form an integral part of the

financial statements.

The accompanying accounting policies and explanatory notes form an integral part of the

financial statements. 14

7-Eleven Malaysia Holdings Berhad (1058531-W)

14 Annual Report 2018 75

1058531-W

7-Eleven Malaysia Holdings Berhad

STATEMENTS OF FINANCIAL POSITION

(Incorporated in Malaysia)

AS AT 31 DECEMBER 2018

Statements of financial position as at 31 December 2018

Group

2018 2017

Note RM'000 RM'000

Current liabilities

Provisions 23 249 277

Borrowings 24 127,303 143,619

Trade payables 27 345,735 392,617

Other payables 28 107,114 115,184

Contract liabilities 28 1,699 -

Taxation 2,066 1

584,166 651,698

Total liabilities 656,889 720,934

Total equity and liabilities 749,367 794,968

Company

2018 2017

Note RM'000 RM'000

Assets

Non-current asset

Investments in subsidiary

companies, representing total

non-current asset 12 1,402,539 1,378,248

Current assets

Sundry receivables 15 61,060 58,090

Tax recoverable 1,268 1,235

Cash and bank balances 16 1,284 1,503

63,612 60,828

Total assets 1,466,151 1,439,076

Equity and liability

Equity attributable to equity

holders of the Company

Share capital 17 1,485,138 1,485,138

Treasury shares 19 (161,941) (190,625)

Retained profits 22 57,951 60,998

Total equity 1,381,148 1,355,511

Current liability

Other payables, representing

total current liability 28 85,003 83,565

Total equity and liability 1,466,151 1,439,076

The accompanying accounting policies and explanatory notes form an integral part of the

financial statements.

15

76 7-Eleven Malaysia Holdings Berhad (1058531-W) Annual Report 2018

1058531-W

7-Eleven Malaysia Holdings Berhad

STATEMENTS OF CASH FLOWS

(Incorporated in Malaysia)

Statements of cash flows

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2018

For the financial year ended 31 December 2018

Group Company

2018 2017 2018 2017

RM'000 RM'000 RM'000 RM'000

Cash flows from operating activities

Cash receipts from customers

and other receivables 2,290,403 2,352,114 30 10

Cash paid to suppliers and employees (2,178,621) (2,282,307) (1,000) (1,789)

Cash generated from/(used in)

operations 111,782 69,807 (970) (1,779)

Interest paid (9,908) (9,232) (4,436) (4,632)

Tax paid (19,447) (11,527) (57) (505)

Net cash generated from/(used in)

operating activities 82,427 49,048 (5,463) (6,916)

Cash flows from investing activities

Purchase of property, plant and

equipment (35,452) (44,560) - -

Purchase of intangible assets - (3,613) - -

Proceeds from disposal of

property, plant and equipment 350 282 - -

Acquisition of subsidiary companies

(Note 12) (754) - (24,291) -

Movement in intercompany balances - - 1,416 (1,285)

Dividend income received - - 58,000 52,000

Interest received 1,008 888 99 94

Net cash (used in)/generated

from investing activities (34,848) (47,003) 35,224 50,809

Cash flows from financing activities

Dividends paid on ordinary shares (29,980) (52,188) (29,980) (52,188)

Proceeds from banker's acceptances 280,200 330,820 - -

Repayment of banker's acceptances (301,000) (324,533) - -

Proceeds from revolving credit - 40,000 - -

Proceeds from term loan 18,000 32,000 - -

Repayment of term loans (11,800) (7,800) - -

Repayment of hire purchase and

finance lease liabilities (85) (160) - -

Net cash (used in)/generated

from financing activities (44,665) 18,139 (29,980) (52,188)

19

80 7-Eleven Malaysia Holdings Berhad (1058531-W) Annual Report 2018

1058531-W

7-Eleven Malaysia Holdings Berhad

(Incorporated in Malaysia)

STATEMENTS OF CASH FLOWS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2018

Statements of cash flows

For the financial year ended 31 December 2018 (cont'd.)

Group Company

2018 2017 2018 2017

RM'000 RM'000 RM'000 RM'000

Net increase/(decrease) in cash

and cash equivalents 2,914 20,184 (219) (8,295)

Cash and cash equivalents at

1 January 69,634 49,450 1,503 9,798

Cash and cash equivalents at

31 December (Note 16) 72,548 69,634 1,284 1,503

The accompanying accounting policies and explanatory notes form an integral part of the

financial statements.

20

7-Eleven Malaysia Holdings Berhad (1058531-W) Annual Report 2018 81

You might also like

- NAACP Membership FormDocument1 pageNAACP Membership FormDerek Bauman100% (1)

- Capter 2Document5 pagesCapter 2DiwakarNo ratings yet

- UST Golden Notes - Negotiable InstrumentsDocument30 pagesUST Golden Notes - Negotiable InstrumentsJerik Solas95% (21)

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Cher NaNo ratings yet

- Example For Financial Statement AnalysisDocument2 pagesExample For Financial Statement AnalysisMobile Legends0% (1)

- Espresso Software Financial Statements and Supplementary DataDocument38 pagesEspresso Software Financial Statements and Supplementary DataAnwar AshrafNo ratings yet

- Capital BudgetingDocument8 pagesCapital Budgetingneesha0% (1)

- Assignment 3Document5 pagesAssignment 3Chaudhary AliNo ratings yet

- Products and Services Provided by BanksDocument61 pagesProducts and Services Provided by BanksVinay GovilkarNo ratings yet

- Statements of Comprehensive Income: For The Financial Year Ended 31 December 2020Document5 pagesStatements of Comprehensive Income: For The Financial Year Ended 31 December 2020nfarzana.jefriNo ratings yet

- Statements of Comprehensive Income: For The Financial Year Ended 31 December 2019Document5 pagesStatements of Comprehensive Income: For The Financial Year Ended 31 December 2019nfarzana.jefriNo ratings yet

- Financial Statement 7EDocument9 pagesFinancial Statement 7ENurin SyazarinNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Consolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberDocument5 pagesConsolidated Statement of Comprehensive Income: For The Year Ended 31 DecemberVajri Varun GuturuNo ratings yet

- AYER HOLDINGS BERHAD - Financial Report 2021-16-17Document2 pagesAYER HOLDINGS BERHAD - Financial Report 2021-16-172023149467No ratings yet

- Careplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomeDocument16 pagesCareplus Group Berhad: Unaudited Condensed Consolidated Statements of Comprehensive IncomethamNo ratings yet

- Tutorial 2 A192 QuestionDocument9 pagesTutorial 2 A192 QuestionMastura Abd HamidNo ratings yet

- Bursa Q1 2015v6Document19 pagesBursa Q1 2015v6Fakhrul Azman NawiNo ratings yet

- Bursa Announcement DIYQ12022Document13 pagesBursa Announcement DIYQ12022Quint WongNo ratings yet

- Quarterly Report 20180331Document15 pagesQuarterly Report 20180331Ang SHNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- CHB Dec18Document15 pagesCHB Dec18Sajeetha MadhavanNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Interim Report 2010Document38 pagesInterim Report 2010YennyNo ratings yet

- AMARILODocument8 pagesAMARILOIngrid Molina GarciaNo ratings yet

- MR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Document15 pagesMR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Mzm Zahir MzmNo ratings yet

- Operating Segments Comprehensive ProblemDocument2 pagesOperating Segments Comprehensive ProblemJazehl Joy ValdezNo ratings yet

- Vitrox q12008Document11 pagesVitrox q12008Dennis AngNo ratings yet

- Vitrox q22018Document14 pagesVitrox q22018Dennis AngNo ratings yet

- Vitrox q22011Document10 pagesVitrox q22011Dennis AngNo ratings yet

- Bursa Malaysia Berhad (30632-P) (Incorporated in Malaysia) : 15 July 2015Document35 pagesBursa Malaysia Berhad (30632-P) (Incorporated in Malaysia) : 15 July 2015Fakhrul Azman NawiNo ratings yet

- Bangladesh q1 Report 2020 Tcm244 553014 enDocument7 pagesBangladesh q1 Report 2020 Tcm244 553014 entdebnath_3No ratings yet

- M4 Example 2 SDN BHD FSADocument38 pagesM4 Example 2 SDN BHD FSAhanis nabilaNo ratings yet

- Annual Report - PadiniDocument23 pagesAnnual Report - PadiniCheng Chung leeNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Jeronimo Martins Colombia S.A.S. (Colombia)Document6 pagesJeronimo Martins Colombia S.A.S. (Colombia)LAURA VALENTINA PEREZ RODRIGUEZNo ratings yet

- 06 Pirelli Separate Financial Statements PDFDocument44 pages06 Pirelli Separate Financial Statements PDFCarlos PespNo ratings yet

- Star ReportsDocument38 pagesStar ReportsAnnisa DewiNo ratings yet

- Vitrox q42011Document10 pagesVitrox q42011Dennis AngNo ratings yet

- 2018 Annual ReportDocument4 pages2018 Annual ReportAbs PangaderNo ratings yet

- TZero 2018 10-KDocument20 pagesTZero 2018 10-KgaryrweissNo ratings yet

- Tutorial Questions - Trimester - 2210.Document26 pagesTutorial Questions - Trimester - 2210.premsuwaatiiNo ratings yet

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayNo ratings yet

- LWL Dec2021Document7 pagesLWL Dec2021Shabry SamoonNo ratings yet

- SCALP Handout 040Document2 pagesSCALP Handout 040Eren CuestaNo ratings yet

- Financial Statement 31 Dec 2011Document23 pagesFinancial Statement 31 Dec 2011safiyaainnurNo ratings yet

- Consolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Document45 pagesConsolidated Interim Financial Information (Unaudited) As of March 31, 2021 and 2020Fernando SeminarioNo ratings yet

- 2016 Nestle ExtratedDocument7 pages2016 Nestle ExtratednesanNo ratings yet

- Grumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsDocument2 pagesGrumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsKatherine GablinesNo ratings yet

- COMPANY 1 - SupaFood Financial Statements - 240102 - 143648Document5 pagesCOMPANY 1 - SupaFood Financial Statements - 240102 - 143648Marcel JonathanNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- PBCC ActivitiesDocument25 pagesPBCC ActivitiesykwaiNo ratings yet

- CHAPTER 6-FA Questions - BAsicDocument3 pagesCHAPTER 6-FA Questions - BAsicHussna Al-Habsi حُسنى الحبسيNo ratings yet

- Vitrox q42019Document17 pagesVitrox q42019Dennis AngNo ratings yet

- INTERIM REPORT YA2021 QUARTER 4 (01 MAY 2021 Until 31 JUL 2021)Document16 pagesINTERIM REPORT YA2021 QUARTER 4 (01 MAY 2021 Until 31 JUL 2021)pes myNo ratings yet

- PRC2019 FSDocument4 pagesPRC2019 FSDonaldDeLeonNo ratings yet

- Company 1Document5 pagesCompany 1purvimahajan027No ratings yet

- 3 Financial Statement To Analyze For Better UnderstandingDocument17 pages3 Financial Statement To Analyze For Better UnderstandingMeeka CalimagNo ratings yet

- PAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedDocument60 pagesPAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedMuhammad SamiNo ratings yet

- CHB Mar19 PDFDocument14 pagesCHB Mar19 PDFSajeetha MadhavanNo ratings yet

- Singtel 18 Financial Statements ExcerptsDocument4 pagesSingtel 18 Financial Statements ExcerptsAayush PrakashNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Artikel 1Document16 pagesArtikel 1jayawijaya191176No ratings yet

- Economic NumericalDocument26 pagesEconomic NumericalSantosh ThapaNo ratings yet

- Cafe Nikka Income StatementDocument4 pagesCafe Nikka Income StatementM-3308No ratings yet

- (BIWS) Quick Reference - Purchase Price AllocationDocument7 pages(BIWS) Quick Reference - Purchase Price AllocationgreenpostitNo ratings yet

- ESOPS Info SheetDocument2 pagesESOPS Info SheetlementenailleauNo ratings yet

- Worksheet 10 -: Yêu cầu không copy dưới mọi hình thứcDocument21 pagesWorksheet 10 -: Yêu cầu không copy dưới mọi hình thứcHải Đăng LêNo ratings yet

- Kulvir SinghDocument46 pagesKulvir SinghlalitsoniaNo ratings yet

- Specific Project 1 and 2 On HeromotocorpDocument7 pagesSpecific Project 1 and 2 On Heromotocorpchokeplayer15No ratings yet

- Indicative and Annualized Rates On Deposits W.E .F - 01 .02.2024 To 31 .03.2024 - Rate SheetDocument4 pagesIndicative and Annualized Rates On Deposits W.E .F - 01 .02.2024 To 31 .03.2024 - Rate Sheetmr.johndoe.whodiedNo ratings yet

- DBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002Document5 pagesDBS Bank India Limited Ground Floor, Express Towers, Nariman Point, Mumbai 400021 Maharashtra +91-22-66388888 DBSS0IN0811 400641002Srimoyee DeNo ratings yet

- General Guidelines For Spreading Financial StatementsDocument8 pagesGeneral Guidelines For Spreading Financial StatementsChandan Kumar ShawNo ratings yet

- Master of Management, Faculty of Economics and Business Universitas Gadjah Mada Syllabus Financial ManagementDocument3 pagesMaster of Management, Faculty of Economics and Business Universitas Gadjah Mada Syllabus Financial ManagementSatrio WiriawanNo ratings yet

- Account StatementDocument12 pagesAccount StatementRajneesh Jhorad0% (1)

- Financial Analysis of ProjectsDocument61 pagesFinancial Analysis of ProjectsMohamed MustefaNo ratings yet

- Islamic Financial Legal FrameworkDocument42 pagesIslamic Financial Legal Frameworknur atyraNo ratings yet

- Financial Statement Group 2 Assignment 1Document4 pagesFinancial Statement Group 2 Assignment 1Bryan LesmadiNo ratings yet

- Montecillo, Review QuestionsDocument7 pagesMontecillo, Review QuestionsIvory Mae MontecilloNo ratings yet

- Chap 15Document22 pagesChap 15Sakshi GuptaNo ratings yet

- TOT Model Toll Operate Transfer ModelDocument5 pagesTOT Model Toll Operate Transfer Modelyash panchalNo ratings yet

- Account Statement For Account Number0674001500113444: Branch DetailsDocument3 pagesAccount Statement For Account Number0674001500113444: Branch DetailsVed sinhaNo ratings yet

- Financial Market: Dr. Imam Mukhlis, Se., MsiDocument16 pagesFinancial Market: Dr. Imam Mukhlis, Se., MsiRahmawati Eka PitalokaNo ratings yet

- Clothing Manufacturer Business Plan ExampleDocument32 pagesClothing Manufacturer Business Plan ExampleAshu BlueNo ratings yet

- Alan & Co. Ltd. V El Nasr Export and Import Co. (1972) - 2-Q.B.-189Document33 pagesAlan & Co. Ltd. V El Nasr Export and Import Co. (1972) - 2-Q.B.-189Tan KSNo ratings yet

- APLI - Annual Report - 2017 PDFDocument156 pagesAPLI - Annual Report - 2017 PDFMichelle Hartasya SitompulNo ratings yet