Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsSiddharth Routh 3

Siddharth Routh 3

Uploaded by

siddharthrouth59Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Cost of Capital Solved ProblemsDocument16 pagesCost of Capital Solved ProblemsHimanshu Sharma85% (209)

- Sem 2 Question Bank (Moderated) - Financial ManagementDocument63 pagesSem 2 Question Bank (Moderated) - Financial ManagementSandeep SahadeokarNo ratings yet

- Test Bank For Financial Management Theory Practice 14th Edition by Eugene F Brigham Michael C Ehrhardt SampleDocument70 pagesTest Bank For Financial Management Theory Practice 14th Edition by Eugene F Brigham Michael C Ehrhardt SampleDiệp Phạm HồngNo ratings yet

- Financee ExerciseHandbook SolvedDocument59 pagesFinancee ExerciseHandbook SolvedRodrigo RamosNo ratings yet

- Actuarial Notation: AnnuitiesDocument12 pagesActuarial Notation: AnnuitiesCallum Thain BlackNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- 08 Konys Inc 3Document18 pages08 Konys Inc 3RohanMohapatraNo ratings yet

- Fundamentals of Finance Case StudyDocument13 pagesFundamentals of Finance Case Studydkushaj73No ratings yet

- Assignment 44Document14 pagesAssignment 44Khadar MaxamedNo ratings yet

- Corporate FinanceDocument5 pagesCorporate Financesureshgovekar98No ratings yet

- Assignment 2 Principles of Finance (FIN101: Deadline For Students: (13/11/2022@ 23:59)Document8 pagesAssignment 2 Principles of Finance (FIN101: Deadline For Students: (13/11/2022@ 23:59)Habib NasherNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Bmmf5103 861024465000 Managerial Finance - RedoDocument14 pagesBmmf5103 861024465000 Managerial Finance - Redomicu_san100% (1)

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Assignment - Managerial FinanceDocument20 pagesAssignment - Managerial FinanceBoyNo ratings yet

- Cost of Capital Pretax and After-TaxDocument18 pagesCost of Capital Pretax and After-TaxBob MarshellNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalRiti Nayyar100% (1)

- Chapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument19 pagesChapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- BBCF1013 Final ExamDocument24 pagesBBCF1013 Final Examnazirulhzq01No ratings yet

- Dani IFM AssignmentDocument9 pagesDani IFM AssignmentdanielNo ratings yet

- Session 5 and 6 - Time Value of MoneyDocument24 pagesSession 5 and 6 - Time Value of MoneyDebi PrasadNo ratings yet

- Theory and Numericals Types of FactoringDocument7 pagesTheory and Numericals Types of FactoringShweta YadavNo ratings yet

- Financial ManagementDocument67 pagesFinancial Managementankitborkar81No ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalGagan RajpootNo ratings yet

- Some Exercises On Capital Structure and Dividend PolicyDocument3 pagesSome Exercises On Capital Structure and Dividend PolicyAdi AliNo ratings yet

- Corporate FinanceDocument6 pagesCorporate Financeashwinimore811No ratings yet

- Corporate FinanceDocument10 pagesCorporate FinanceMayur AgarwalNo ratings yet

- Answer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)Document4 pagesAnswer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)erijfNo ratings yet

- Ratio of Price To Book 2.22Document14 pagesRatio of Price To Book 2.22Lê Hữu LựcNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- Corporate FinanceDocument11 pagesCorporate FinanceShamsul HaqimNo ratings yet

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavNo ratings yet

- Chapter - 3 Short Term FinancingDocument11 pagesChapter - 3 Short Term FinancingRafia TasnimNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceanusuyagaudNo ratings yet

- CCE 2 Ashutosh Rangdale 147Document9 pagesCCE 2 Ashutosh Rangdale 147ashutoshrangdaleNo ratings yet

- Chapter 10Document5 pagesChapter 10Usman KhalidNo ratings yet

- Final-Term Quiz Mankeu Roki Fajri 119108077Document4 pagesFinal-Term Quiz Mankeu Roki Fajri 119108077kota lainNo ratings yet

- Suggested SolutionsDocument7 pagesSuggested SolutionsSunder ChaudharyNo ratings yet

- Financial Services Factoring ProblemDocument6 pagesFinancial Services Factoring ProblemAditya BvNo ratings yet

- 72 Hours Take Home Exercise - Corporate Finance 4 - Lê Quốc Anh - WSU21000189Document7 pages72 Hours Take Home Exercise - Corporate Finance 4 - Lê Quốc Anh - WSU21000189ale68185No ratings yet

- Unit # 4 Present Value For Cash FlowsDocument8 pagesUnit # 4 Present Value For Cash FlowsZaheer Ahmed SwatiNo ratings yet

- Chapter - 3 Short Term FinancingDocument11 pagesChapter - 3 Short Term FinancingmuzgunniNo ratings yet

- N1227106 Busi48901 261123Document11 pagesN1227106 Busi48901 261123malisiddhant2602No ratings yet

- Chapter 04 Short Term FinancingDocument19 pagesChapter 04 Short Term FinancingTarek Monowar 1921659042No ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingRalph Clarence NicodemusNo ratings yet

- Solved Problems Cost of CapitalDocument16 pagesSolved Problems Cost of CapitalPrramakrishnanRamaKrishnan0% (1)

- Corporate Strategic Financial DecisionDocument22 pagesCorporate Strategic Financial Decisionsaloni jainNo ratings yet

- Corporate Finance 2Document5 pagesCorporate Finance 2Murat OmayNo ratings yet

- Multiple Choice Questions Finance: BondsDocument4 pagesMultiple Choice Questions Finance: BondsRene HohmannNo ratings yet

- 120 Resource November 1991 To November 2006Document174 pages120 Resource November 1991 To November 2006Bharat MendirattaNo ratings yet

- Assignment For Business Finance Subject Code: FIN 201: MD - Al-MamunDocument9 pagesAssignment For Business Finance Subject Code: FIN 201: MD - Al-MamunAziz Bin AnwarNo ratings yet

- Module 4 - ValuationDocument29 pagesModule 4 - ValuationKishore JohnNo ratings yet

- Concept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyDocument34 pagesConcept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyRasumathi SNo ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Chapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsDocument14 pagesChapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsMarine De CocquéauNo ratings yet

- Tally AssignmentDocument9 pagesTally AssignmentDebjit Naskar100% (1)

- Home Depot Case Group 2Document10 pagesHome Depot Case Group 2Rishabh TyagiNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingValierry VelascoNo ratings yet

- Fa BobadillaDocument11 pagesFa BobadillaKamille ValdezNo ratings yet

- Case Group BICDocument5 pagesCase Group BICyalemorgan69No ratings yet

- AmalgamationDocument4 pagesAmalgamationMadhura KhapekarNo ratings yet

- Stocks and Their Valuation: After Studying This Chapter, Students Should Be AbleDocument35 pagesStocks and Their Valuation: After Studying This Chapter, Students Should Be AbleShantanu ChoudhuryNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementManish FloraNo ratings yet

- Financial Statement Analysis ToaDocument6 pagesFinancial Statement Analysis ToaRampotz Ü EchizenNo ratings yet

- Cost Acctg Absorption QuizDocument5 pagesCost Acctg Absorption QuizNah HamzaNo ratings yet

- Financial Management Economics For Finance 2023 1671444579Document26 pagesFinancial Management Economics For Finance 2023 1671444579RADHIKANo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- TYBBA Fin ProjectDocument30 pagesTYBBA Fin ProjectShaikh FarheenNo ratings yet

- LQ45 List IDX August 2018 - January 2019Document189 pagesLQ45 List IDX August 2018 - January 2019Nicodemus Sigit SutantoNo ratings yet

- Module 11 Cash Flows and Decisions RevistedDocument17 pagesModule 11 Cash Flows and Decisions RevistedAnkit AgrawallaNo ratings yet

- Bba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Document5 pagesBba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Nikkie pieNo ratings yet

- ProblemsDocument11 pagesProblemsMohamed RefaayNo ratings yet

- CEKA - Annual Report 2019Document124 pagesCEKA - Annual Report 2019Kamila AiniNo ratings yet

- Baker Wurgler 2015 Do Strict Capital Requirements Raise The Cost of Capital Bank Regulation Capital Structure and TheDocument15 pagesBaker Wurgler 2015 Do Strict Capital Requirements Raise The Cost of Capital Bank Regulation Capital Structure and TheIssabella SonneNo ratings yet

- Assignment 1 - Fin242 Set 2Document4 pagesAssignment 1 - Fin242 Set 22022328009No ratings yet

- Samudera Indonesia TBK - 31 Mar 2023Document116 pagesSamudera Indonesia TBK - 31 Mar 2023damycenelNo ratings yet

- FINANCIAL STATEMENT ANALYSIS Sessions 1 - 10Document20 pagesFINANCIAL STATEMENT ANALYSIS Sessions 1 - 10Bhagwat BalotNo ratings yet

- 2.1 The Recording Phase: Sheet and Income Statement AccountsDocument12 pages2.1 The Recording Phase: Sheet and Income Statement Accountsayitenew temesgenNo ratings yet

- DMS Case (HPCL)Document11 pagesDMS Case (HPCL)Yashi SharmaNo ratings yet

- 1 Daftar AkunDocument2 pages1 Daftar Akunnazwa utami27No ratings yet

- Financial Analysis of L&TDocument7 pagesFinancial Analysis of L&TPallavi ChoudharyNo ratings yet

- Arvind MillsDocument33 pagesArvind MillshasmukhNo ratings yet

Siddharth Routh 3

Siddharth Routh 3

Uploaded by

siddharthrouth590 ratings0% found this document useful (0 votes)

3 views4 pagesOriginal Title

SIDDHARTH ROUTH 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views4 pagesSiddharth Routh 3

Siddharth Routh 3

Uploaded by

siddharthrouth59Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Inspiria Knowledge Campus

2021-2024

Affiliated to

Maulana Abul Kalam Azad University of

Technology

West Bengal

Subject Name- Financial Management Submitted

By- SIDDHARTH ROUTH

Subject Code- BBA ATA 601

Registration No.- 213442051410025(2021-22)

Roll No.- 34451421042

Illustration :-

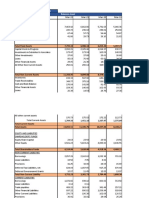

1.Calculate the cost of capital from the following:-

(i) A company issued 10000 ,12% Debentures @ Rs. 100 each for 6 years at a

premium of Rs. 20 each. brokerage 2% and Tax rate 40%.

(i) Also issued 5000 , 10% Preference shares @ Rs. 100 each at a discount of 10%

for

5 years. Brokerage 2% and Tax Rate 40%. Show the % of cost.

Solution :-

(i) Cost of Debt

Face value per debenture = Rs. 100

● Premium per debenture = Rs. 20

● Number of debentures issued = 10,000

● Brokerage = 2% of the total amount raised

● Tax rate = 40%

● Maturity period = 6 years

Total amount raised from debentures = (Face value + Premium) ×Number of

debentures

= (100 + 20) ×10,000

= Rs. 1,200,000

Brokerage on debentures = 2% of Rs. 1,200,000 = Rs. 24,000

Net amount received from debentures = Total amount raised - Brokerage

= Rs. 1,200,000 - Rs. 24,000

= Rs. 1,176,000

Annual interest payment on debentures = Face value ×Interest rate

= Rs. 100 ×12% = Rs. 12 per debenture

Total annual interest payment = 12 ×10,000 = Rs. 120,000

After-tax cost of debentures = (Interest payment - Tax shield on interest) / Net

amount

received

from debentures

= (120,000 - (120,000 ×0.4)) / 1,176,000

= (120,000 - 48,000) / 1,176,000

= 72,000 / 1,176,000

=0.061224 × 100

=6.12%

Solution :-

(ii) Cost of Preference Capital

Face value per preference share = Rs. 100

Discount = 10%

Number of preference shares issued = 5,000

Brokerage = 2% of the total amount raised

Tax rate = 40%

Maturity period = 5 years

Total amount raised from preference shares = (Face value - Discount) ×Number

of shares

= (100 - 10% of 100) ×5,000

= Rs. 90 × 5,000

= Rs. 450,000

Brokerage on preference shares = 2% of Rs. 450,000 = Rs. 9,000

Net amount received from preference shares = Total amount raised - Brokerage

= Rs. 450,000 - Rs. 9,000

= Rs. 441,000

Annual dividend payment on preference shares = Face value × Dividend rate

= Rs. 100 × 10% = Rs. 10 per share

Total annual dividend payment = 10 ×5,000 = Rs. 50,000

After-tax cost of preference shares = (Dividend payment - Tax shield on dividend)

/ Net

amount

received from preference shares

= (50,000 - (50,000 × 0.4)) / 441,000

= (50,000 - 20,000) / 441,000

= 30,000 / 441,000

= 0.068027 × 100

=6.80%

Therefore, the cost of capital from debentures is approximately 6.12%, and the

cost of capital

from preference shares is approximately 6.80%.

You might also like

- Cost of Capital Solved ProblemsDocument16 pagesCost of Capital Solved ProblemsHimanshu Sharma85% (209)

- Sem 2 Question Bank (Moderated) - Financial ManagementDocument63 pagesSem 2 Question Bank (Moderated) - Financial ManagementSandeep SahadeokarNo ratings yet

- Test Bank For Financial Management Theory Practice 14th Edition by Eugene F Brigham Michael C Ehrhardt SampleDocument70 pagesTest Bank For Financial Management Theory Practice 14th Edition by Eugene F Brigham Michael C Ehrhardt SampleDiệp Phạm HồngNo ratings yet

- Financee ExerciseHandbook SolvedDocument59 pagesFinancee ExerciseHandbook SolvedRodrigo RamosNo ratings yet

- Actuarial Notation: AnnuitiesDocument12 pagesActuarial Notation: AnnuitiesCallum Thain BlackNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- 08 Konys Inc 3Document18 pages08 Konys Inc 3RohanMohapatraNo ratings yet

- Fundamentals of Finance Case StudyDocument13 pagesFundamentals of Finance Case Studydkushaj73No ratings yet

- Assignment 44Document14 pagesAssignment 44Khadar MaxamedNo ratings yet

- Corporate FinanceDocument5 pagesCorporate Financesureshgovekar98No ratings yet

- Assignment 2 Principles of Finance (FIN101: Deadline For Students: (13/11/2022@ 23:59)Document8 pagesAssignment 2 Principles of Finance (FIN101: Deadline For Students: (13/11/2022@ 23:59)Habib NasherNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Bmmf5103 861024465000 Managerial Finance - RedoDocument14 pagesBmmf5103 861024465000 Managerial Finance - Redomicu_san100% (1)

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Assignment - Managerial FinanceDocument20 pagesAssignment - Managerial FinanceBoyNo ratings yet

- Cost of Capital Pretax and After-TaxDocument18 pagesCost of Capital Pretax and After-TaxBob MarshellNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalRiti Nayyar100% (1)

- Chapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument19 pagesChapter # 10 - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- BBCF1013 Final ExamDocument24 pagesBBCF1013 Final Examnazirulhzq01No ratings yet

- Dani IFM AssignmentDocument9 pagesDani IFM AssignmentdanielNo ratings yet

- Session 5 and 6 - Time Value of MoneyDocument24 pagesSession 5 and 6 - Time Value of MoneyDebi PrasadNo ratings yet

- Theory and Numericals Types of FactoringDocument7 pagesTheory and Numericals Types of FactoringShweta YadavNo ratings yet

- Financial ManagementDocument67 pagesFinancial Managementankitborkar81No ratings yet

- Cost of CapitalDocument20 pagesCost of CapitalGagan RajpootNo ratings yet

- Some Exercises On Capital Structure and Dividend PolicyDocument3 pagesSome Exercises On Capital Structure and Dividend PolicyAdi AliNo ratings yet

- Corporate FinanceDocument6 pagesCorporate Financeashwinimore811No ratings yet

- Corporate FinanceDocument10 pagesCorporate FinanceMayur AgarwalNo ratings yet

- Answer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)Document4 pagesAnswer To FIN 402 Exam 1 - Section002 - Version 2 Group B (70 Points)erijfNo ratings yet

- Ratio of Price To Book 2.22Document14 pagesRatio of Price To Book 2.22Lê Hữu LựcNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- Corporate FinanceDocument11 pagesCorporate FinanceShamsul HaqimNo ratings yet

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavNo ratings yet

- Chapter - 3 Short Term FinancingDocument11 pagesChapter - 3 Short Term FinancingRafia TasnimNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceanusuyagaudNo ratings yet

- CCE 2 Ashutosh Rangdale 147Document9 pagesCCE 2 Ashutosh Rangdale 147ashutoshrangdaleNo ratings yet

- Chapter 10Document5 pagesChapter 10Usman KhalidNo ratings yet

- Final-Term Quiz Mankeu Roki Fajri 119108077Document4 pagesFinal-Term Quiz Mankeu Roki Fajri 119108077kota lainNo ratings yet

- Suggested SolutionsDocument7 pagesSuggested SolutionsSunder ChaudharyNo ratings yet

- Financial Services Factoring ProblemDocument6 pagesFinancial Services Factoring ProblemAditya BvNo ratings yet

- 72 Hours Take Home Exercise - Corporate Finance 4 - Lê Quốc Anh - WSU21000189Document7 pages72 Hours Take Home Exercise - Corporate Finance 4 - Lê Quốc Anh - WSU21000189ale68185No ratings yet

- Unit # 4 Present Value For Cash FlowsDocument8 pagesUnit # 4 Present Value For Cash FlowsZaheer Ahmed SwatiNo ratings yet

- Chapter - 3 Short Term FinancingDocument11 pagesChapter - 3 Short Term FinancingmuzgunniNo ratings yet

- N1227106 Busi48901 261123Document11 pagesN1227106 Busi48901 261123malisiddhant2602No ratings yet

- Chapter 04 Short Term FinancingDocument19 pagesChapter 04 Short Term FinancingTarek Monowar 1921659042No ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingRalph Clarence NicodemusNo ratings yet

- Solved Problems Cost of CapitalDocument16 pagesSolved Problems Cost of CapitalPrramakrishnanRamaKrishnan0% (1)

- Corporate Strategic Financial DecisionDocument22 pagesCorporate Strategic Financial Decisionsaloni jainNo ratings yet

- Corporate Finance 2Document5 pagesCorporate Finance 2Murat OmayNo ratings yet

- Multiple Choice Questions Finance: BondsDocument4 pagesMultiple Choice Questions Finance: BondsRene HohmannNo ratings yet

- 120 Resource November 1991 To November 2006Document174 pages120 Resource November 1991 To November 2006Bharat MendirattaNo ratings yet

- Assignment For Business Finance Subject Code: FIN 201: MD - Al-MamunDocument9 pagesAssignment For Business Finance Subject Code: FIN 201: MD - Al-MamunAziz Bin AnwarNo ratings yet

- Module 4 - ValuationDocument29 pagesModule 4 - ValuationKishore JohnNo ratings yet

- Concept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyDocument34 pagesConcept of Time Value of Money (TVM) Need / Reasons For Time Value of MoneyRasumathi SNo ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Chapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsDocument14 pagesChapter 7: Ppe and Intangibles: 1. Types of Non-Current AssetsMarine De CocquéauNo ratings yet

- Tally AssignmentDocument9 pagesTally AssignmentDebjit Naskar100% (1)

- Home Depot Case Group 2Document10 pagesHome Depot Case Group 2Rishabh TyagiNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingValierry VelascoNo ratings yet

- Fa BobadillaDocument11 pagesFa BobadillaKamille ValdezNo ratings yet

- Case Group BICDocument5 pagesCase Group BICyalemorgan69No ratings yet

- AmalgamationDocument4 pagesAmalgamationMadhura KhapekarNo ratings yet

- Stocks and Their Valuation: After Studying This Chapter, Students Should Be AbleDocument35 pagesStocks and Their Valuation: After Studying This Chapter, Students Should Be AbleShantanu ChoudhuryNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementManish FloraNo ratings yet

- Financial Statement Analysis ToaDocument6 pagesFinancial Statement Analysis ToaRampotz Ü EchizenNo ratings yet

- Cost Acctg Absorption QuizDocument5 pagesCost Acctg Absorption QuizNah HamzaNo ratings yet

- Financial Management Economics For Finance 2023 1671444579Document26 pagesFinancial Management Economics For Finance 2023 1671444579RADHIKANo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- TYBBA Fin ProjectDocument30 pagesTYBBA Fin ProjectShaikh FarheenNo ratings yet

- LQ45 List IDX August 2018 - January 2019Document189 pagesLQ45 List IDX August 2018 - January 2019Nicodemus Sigit SutantoNo ratings yet

- Module 11 Cash Flows and Decisions RevistedDocument17 pagesModule 11 Cash Flows and Decisions RevistedAnkit AgrawallaNo ratings yet

- Bba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Document5 pagesBba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Nikkie pieNo ratings yet

- ProblemsDocument11 pagesProblemsMohamed RefaayNo ratings yet

- CEKA - Annual Report 2019Document124 pagesCEKA - Annual Report 2019Kamila AiniNo ratings yet

- Baker Wurgler 2015 Do Strict Capital Requirements Raise The Cost of Capital Bank Regulation Capital Structure and TheDocument15 pagesBaker Wurgler 2015 Do Strict Capital Requirements Raise The Cost of Capital Bank Regulation Capital Structure and TheIssabella SonneNo ratings yet

- Assignment 1 - Fin242 Set 2Document4 pagesAssignment 1 - Fin242 Set 22022328009No ratings yet

- Samudera Indonesia TBK - 31 Mar 2023Document116 pagesSamudera Indonesia TBK - 31 Mar 2023damycenelNo ratings yet

- FINANCIAL STATEMENT ANALYSIS Sessions 1 - 10Document20 pagesFINANCIAL STATEMENT ANALYSIS Sessions 1 - 10Bhagwat BalotNo ratings yet

- 2.1 The Recording Phase: Sheet and Income Statement AccountsDocument12 pages2.1 The Recording Phase: Sheet and Income Statement Accountsayitenew temesgenNo ratings yet

- DMS Case (HPCL)Document11 pagesDMS Case (HPCL)Yashi SharmaNo ratings yet

- 1 Daftar AkunDocument2 pages1 Daftar Akunnazwa utami27No ratings yet

- Financial Analysis of L&TDocument7 pagesFinancial Analysis of L&TPallavi ChoudharyNo ratings yet

- Arvind MillsDocument33 pagesArvind MillshasmukhNo ratings yet