Professional Documents

Culture Documents

Class Practice Question 1 - Revenue

Class Practice Question 1 - Revenue

Uploaded by

Amanda Katsio0 ratings0% found this document useful (0 votes)

3 views2 pagesFinancial accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesClass Practice Question 1 - Revenue

Class Practice Question 1 - Revenue

Uploaded by

Amanda KatsioFinancial accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

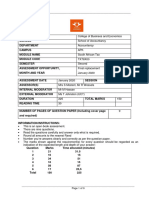

SPU

Financial Accounting 2A / Accounting 2A – 2024

Class practice question 1: Revenue

Example 1: Rendering services

Scrubbers Ltd signed an agreement whereby it is to scrape and re-plaster 50

buildings.

The total contract price is R80 000. The expected contract cost is R50 000.

The following details were available as of year-end 31/12/2008:

• According to the surveyor, R50 000 of the work had been done and may be

invoiced

• According to Scrubbers Ltd, 30 buildings had been scraped and re-plastered

• Costs of R35 000 have been incurred to date (31/12/2008) (Total expected

cost remains R50 000)

The following details were available as of year-end 31/12/2009

• According to the surveyor, R80 000 of the work had been done and may be

invoiced

• According to Scrubbers Ltd, 20 buildings had been scraped and re-plastered

• Costs of R15 000 have been incurred to date (31/12/2009) (Total expected

cost remains R50 000).

REQUIRED: Calculate the revenue amount to be recognised. Assume that the

percentage of completion is based on:

1. Surveys of work performed;

2. Services performed to date as a percentage of total services to be performed;

3. Costs incurred to date in relation to total estimated costs.

Example 2: Interest Recognition

Gomo Ltd manufactures and sells vehicle engines. The following transaction

occurred during the period:

• 1 July 2007: Mr Mechanic purchased 3 engines to be paid for over a period of

two years. The payment plan is 2 installments of R225 000 each, payable in

arrears, calculated using an interest rate of 7.32125% annually.

• The cash price of the three engines is R450 000.

• Sales agreement involved either 60 days terms or extended credit terms.

Required: Provide the journal entries required to record the transaction for the

period ending 31 August 2007 and calculate the revenue amount to be recognized

for the period ending on 31 August 2007.

Example 3: Dividend Recognition 1

A company declared its interim dividend on ordinary shares on 31 December 2008.

These interim dividends will be payable 2 months later to shareholders registered on

31 December 2008. The year-end of the reporting entity (entity receiving the

dividends) is 31 December.

Required: Briefly discuss how the revenue should be recognised.

Example 4: Dividend Recognition 2

A company declared its final dividend on ordinary shares on 31 December 2008.

These final dividends will be payable 2 months later to shareholders registered on 31

December 2008. The year-end of the reporting entity (entity receiving the dividends)

is 31 December.

Required: Briefly discuss how the revenue should be recognised.

You might also like

- Acc 621 Assign 2022Document5 pagesAcc 621 Assign 2022Sarah Precious NkoanaNo ratings yet

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Document6 pagesQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNo ratings yet

- SQB - Chapter 4 QuestionsDocument13 pagesSQB - Chapter 4 QuestionsracsoNo ratings yet

- Major Assessment - Current Liab-MahusayDocument5 pagesMajor Assessment - Current Liab-MahusayJeth Mahusay100% (1)

- MBAP - AF101-Accounting and Finance - 10 Nov 23Document6 pagesMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786No ratings yet

- Exercises - Ias 40 - ENDocument4 pagesExercises - Ias 40 - ENMAI PHAN THỊ HIỀNNo ratings yet

- LO5 QuestionDocument2 pagesLO5 QuestionFrederick LekalakalaNo ratings yet

- Question Bank Disclosure - 2023Document23 pagesQuestion Bank Disclosure - 2023thamsanqamanciNo ratings yet

- Financial Corporate Reporting (May-June 2013)Document4 pagesFinancial Corporate Reporting (May-June 2013)rezwan_scribdNo ratings yet

- Afa Revision - Final Session Activities QsDocument2 pagesAfa Revision - Final Session Activities Qshaddad2020No ratings yet

- Far Icaew Extra QuestionsDocument8 pagesFar Icaew Extra QuestionsK. Manish45No ratings yet

- Review Questions On Standard-1Document4 pagesReview Questions On Standard-1George Adjei100% (1)

- Taxation Philippines: Leasehold ImprovementsDocument17 pagesTaxation Philippines: Leasehold Improvementsmarklogan67% (3)

- Hi-Aims College of Commerce and Management Sargodha: ST TH ST ST STDocument6 pagesHi-Aims College of Commerce and Management Sargodha: ST TH ST ST STMozam MushtaqNo ratings yet

- FA3 Block 1 Tut Pack PrintingDocument165 pagesFA3 Block 1 Tut Pack Printingkatelynnewson07No ratings yet

- IAS 40 QuestionsDocument3 pagesIAS 40 QuestionsEddie PienaarNo ratings yet

- Specific Financial Reporting Ac413 May19bDocument5 pagesSpecific Financial Reporting Ac413 May19bAnishahNo ratings yet

- Su 7 Class Question 1 PrimehyperDocument4 pagesSu 7 Class Question 1 PrimehyperAsive BalisoNo ratings yet

- Moderator: Mr. L.J. Muthivhi (CA), SADocument11 pagesModerator: Mr. L.J. Muthivhi (CA), SANhlanhla MsizaNo ratings yet

- Class Example - Audit Report and Related Topics Copy - Pre LectureDocument3 pagesClass Example - Audit Report and Related Topics Copy - Pre Lecturesiboniso05sNo ratings yet

- PPE and ImpairmentDocument3 pagesPPE and ImpairmentSelma IilongaNo ratings yet

- FIA 324 - June 2013 - QuestionsDocument8 pagesFIA 324 - June 2013 - Questionspopla poplaNo ratings yet

- Contract CostingDocument12 pagesContract Costingvivek rajakNo ratings yet

- ACCC271 June Test 2017Document4 pagesACCC271 June Test 2017thivarNo ratings yet

- Extra Questions For AsDocument35 pagesExtra Questions For AsAmish DebNo ratings yet

- LU5.2 Contract CostingDocument22 pagesLU5.2 Contract CostingVj TjizooNo ratings yet

- Acct 2005 Practice Exam 1Document16 pagesAcct 2005 Practice Exam 1laujenny64No ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekera100% (1)

- Uj 38855+SOURCE1+SOURCE1.1Document9 pagesUj 38855+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- IAS 2 Inventory Questions-1Document8 pagesIAS 2 Inventory Questions-1lehlohonoloronaldinhoNo ratings yet

- Source Booklet Jan 09 6001Document12 pagesSource Booklet Jan 09 6001MashiatUddinNo ratings yet

- tUT3 MFRS15Document4 pagestUT3 MFRS15--bolabolaNo ratings yet

- C 1 June 2011 FM ArticleDocument2 pagesC 1 June 2011 FM ArticleDammika MadusankaNo ratings yet

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- Introduction To Financial AccountingDocument2 pagesIntroduction To Financial AccountingNdivho MavhethaNo ratings yet

- Accounting For BanksDocument4 pagesAccounting For BanksBrenda audrey SonfackNo ratings yet

- AARS Test 2 Q. Paper FinalDocument3 pagesAARS Test 2 Q. Paper FinalShahzaib VirkNo ratings yet

- Questions On Accounting StandardsDocument6 pagesQuestions On Accounting StandardsDEENo ratings yet

- Intermidiate FA II Group Assigment QuestionsDocument6 pagesIntermidiate FA II Group Assigment Questionsnewaybeyene5No ratings yet

- ASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheDocument5 pagesASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheJiaXinLimNo ratings yet

- Easy Method Institute: Adjusting EntriesDocument6 pagesEasy Method Institute: Adjusting EntriesKader Jewel100% (1)

- IFRS 15 Questions 02042024 122821pmDocument4 pagesIFRS 15 Questions 02042024 122821pmAbdullah ButtNo ratings yet

- 2009-Financial Reporting Main EQP and CommentariesDocument46 pages2009-Financial Reporting Main EQP and CommentariesBryan SingNo ratings yet

- RTP Cap III GR I June 2022Document92 pagesRTP Cap III GR I June 2022मदन कुमार बिस्टNo ratings yet

- Final Exam Revision Questions 1-5Document7 pagesFinal Exam Revision Questions 1-5Ken ChenNo ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- Instructions To Candidates:: Question 1 Continues OverleafDocument3 pagesInstructions To Candidates:: Question 1 Continues OverleafAung Kyaw HtayNo ratings yet

- BCOMSC - Accounting 1 - 15-Jan-24 - S1Document8 pagesBCOMSC - Accounting 1 - 15-Jan-24 - S1blessingmudarikwa2No ratings yet

- University of London Preliminary Exam 2017Document11 pagesUniversity of London Preliminary Exam 2017Pei TingNo ratings yet

- Financial Accounting 3BDocument5 pagesFinancial Accounting 3BMphoyaBadimo MphoyaBadimoNo ratings yet

- Maputim ProblemDocument2 pagesMaputim ProblemRowel Dela CruzNo ratings yet

- FR Pipfa Paper CompleteDocument20 pagesFR Pipfa Paper CompleteGENIUS15070% (1)

- 2018 - Test 2 - QuestionsDocument8 pages2018 - Test 2 - QuestionsmolemothekaNo ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- 2003 June (Question)Document6 pages2003 June (Question)Luke WanNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- 2023-Cacn012-Final - Suggested Memo - Test 1-18 August 2023-Mln KekoDocument9 pages2023-Cacn012-Final - Suggested Memo - Test 1-18 August 2023-Mln Kekonkgapelet46No ratings yet

- 2022 EACC 1614 - Test 1Document6 pages2022 EACC 1614 - Test 1sandilefanelehlongwaneNo ratings yet

- PL Financial Accounting and Reporting IFRS Exam June 2019Document10 pagesPL Financial Accounting and Reporting IFRS Exam June 2019scottNo ratings yet

- Winning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertFrom EverandWinning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertNo ratings yet

- You Have To Choose The Best Answer To Each Questions From The Alternatives GivenDocument5 pagesYou Have To Choose The Best Answer To Each Questions From The Alternatives Givenaida FitriahNo ratings yet

- Brand ManagementDocument4 pagesBrand ManagementahmadmujtabamalikNo ratings yet

- Japan - Land of The Rising SunDocument37 pagesJapan - Land of The Rising Sunvenesh bpNo ratings yet

- Cook and Serve Challenge 2024 Sponsorship Packages and Awards DinnerDocument3 pagesCook and Serve Challenge 2024 Sponsorship Packages and Awards DinnercarlateacherhellologosNo ratings yet

- ACHALDocument10 pagesACHALSilent GirlNo ratings yet

- SLNBR 15: Naval Headquarters ColomboDocument229 pagesSLNBR 15: Naval Headquarters ColomboOvidi RathnayakaNo ratings yet

- Benveniste, Emile The Nature of Pronouns PDFDocument13 pagesBenveniste, Emile The Nature of Pronouns PDFAldana Gauto100% (1)

- Traditional Chinese Dermatology: Zentral WellnessDocument14 pagesTraditional Chinese Dermatology: Zentral Wellnessan ssiNo ratings yet

- The Influence of Online Product Reviews On Consumer Purchase Intentions: The Moderating Roles of Cognitive Need and Product KnowledgeDocument4 pagesThe Influence of Online Product Reviews On Consumer Purchase Intentions: The Moderating Roles of Cognitive Need and Product KnowledgeRDNo ratings yet

- EiE Competency Framework CPHA Annex enDocument25 pagesEiE Competency Framework CPHA Annex enCumar Cadaani100% (1)

- Zhang Ear Accupuncture Rhinititis Cold PDFDocument391 pagesZhang Ear Accupuncture Rhinititis Cold PDFanimeshNo ratings yet

- Notes Calendar Free Time Displays No InformationDocument17 pagesNotes Calendar Free Time Displays No InformationfregolikventinNo ratings yet

- 28224lab 3Document6 pages28224lab 3aman singhNo ratings yet

- Balfour V Balfour: (1919) 2 KB 571, (1918-19) All ER860 (Court of Appeal)Document5 pagesBalfour V Balfour: (1919) 2 KB 571, (1918-19) All ER860 (Court of Appeal)Kelvin YapNo ratings yet

- Dr. Shayma'a Jamal Ahmed Prof. Genetic Engineering & BiotechnologyDocument32 pagesDr. Shayma'a Jamal Ahmed Prof. Genetic Engineering & BiotechnologyMariam QaisNo ratings yet

- Tubacex India CatalogueDocument12 pagesTubacex India CatalogueHimanshu UniyalNo ratings yet

- Modi Cabinet 3.0 Ministers NamesDocument6 pagesModi Cabinet 3.0 Ministers NamesRicha sharmaNo ratings yet

- Case 580n 580sn 580snwt 590sn Service ManualDocument20 pagesCase 580n 580sn 580snwt 590sn Service Manualwilliam100% (39)

- Journal Date Account Titles Debit CreditDocument9 pagesJournal Date Account Titles Debit CreditFrances Monique AlburoNo ratings yet

- Factors Considered During Supplier Evaluation in Procurement ProcessDocument15 pagesFactors Considered During Supplier Evaluation in Procurement Processwaghmodeakshay9337464No ratings yet

- Common Ailments LPDocument5 pagesCommon Ailments LPJeyxa Keizz Viernes-Apostol BalanayNo ratings yet

- MaleficentDocument7 pagesMaleficentbagasNo ratings yet

- CE 6301 DR Hasan - Adsorption L3Document40 pagesCE 6301 DR Hasan - Adsorption L3MD. NASIF HOSSAIN IMONNo ratings yet

- ASTM C 217 Standard Test Method For Weather Resistance of SlateDocument3 pagesASTM C 217 Standard Test Method For Weather Resistance of SlateRyan LasacaNo ratings yet

- Preparation of Ink FinalDocument16 pagesPreparation of Ink FinalRishabh Kumud40% (5)

- RWD 3 SpeedDocument6 pagesRWD 3 SpeedAbraham VegaNo ratings yet

- Đề Thi Thử Tuyển Sinh Lớp 10 Trung Học Phổ Thông 9Document3 pagesĐề Thi Thử Tuyển Sinh Lớp 10 Trung Học Phổ Thông 9Quỳnh NguyễnNo ratings yet

- Canning The Catch: University of Alaska FairbanksDocument4 pagesCanning The Catch: University of Alaska FairbanksChaix JohnsonNo ratings yet

- My Consignment Agreement PDFDocument3 pagesMy Consignment Agreement PDFtamara_arifNo ratings yet

- 737NG Genfam PresentationDocument48 pages737NG Genfam PresentationMiklós Meixner100% (1)