Professional Documents

Culture Documents

Chapter 16

Chapter 16

Uploaded by

shbalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 16

Chapter 16

Uploaded by

shbalaCopyright:

Available Formats

Chapter 16

Q16.1

The owner's equity of a partnership comprises of:

a. The capital contributed by each partner in cash.

b. Partners' capital plus partners' loans.

c. Partners' current and loan accounts.

d. Partners' capital and current accounts.

e. Partners' capital, current and loan accounts.

Q16.2

The balance on a partner's current account comprises of:

a. The partner's share of current profits.

b. Salary and interest earned by the partner less any distributions.

c. The cumulative excess of the partner's share of profits plus any salary or interest earned, over any

distributions.

d. Only distributions made by the partner.

e. The partner's share of current profits less any distributions.

Q16.3

The following information relates to questions 16.3.1, 16.3.2 and 16.3.3.

Ainsworthy, Buthelezi and Chada are in partnership sharing profits and losses in the ratio of 3:2:1. They operate a

small business selling imported spices in New Town. Their statement of financial position at 30 June 20X6 is as

follows:

Ainsworthy, Buthelezi & Chada

Statement of financial position

at 30 June 20X6

Assets C

Non-current assets 220 000

Equipment 90 000

Cost 170 000

Accumulated depreciation (80 000)

Motor vehicle 30 000

Cost 40 000

Accumulated depreciation (10 000)

Goodwill 100 000

Current assets 284 000

Inventory 20 000

Accounts receivable 100 000

Bank 164 000

504 000

Equity and liabilities

Equity

Capital accounts 468 000

Ainsworthy 234 000

Buthelezi 156 000

Chada 78 000

Current liabilities

Accounts payable 36 000

504 000

Daniels is admitted to the partnership on 1 July 20X6. He is to have a one-sixth share of the business, which

Ainsworthy, Buthelezi and Chada are to relinquish according to their existing profit-sharing ratio. The following

agreement is reached on the admission of Daniels:

© 2017 David Kolitz

1. The equipment is valued at C40 000.

2. The cash flow expected from accounts receivable is C60 000.

3. All other assets and liabilities are considered to be fairly valued.

4. Daniels is to pay a total of C129 600 into the partnership.

16.3.1

The new profit-sharing ratio is:

Ainsworthy Buthelezi Chada Daniels

a 8 5 2 3

b. 3 2 1 6

c. 18 12 6 6

d. 15 10 5 6

e. None of the above

16.3.2

On the statement of financial position of the new partnership at 1 July 20X6, the non-current tangible assets will

be reported as:

Cost Accumulated depreciation Carrying amount

C C C

a. 310 000 90 000 220 000

b. 170 000 — 170 000

c. 469 000 — 469 000

d. 210 000 90 000 120 000

e. 70 000 — 70 000

16.3.3

On the admission of Daniels to the partnership, goodwill is written up by an amount of:

a. C209 600

b. C299 600

c. C399 600

d. C317 600

e. C309 600

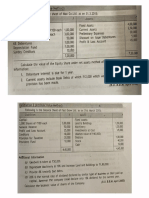

E16.1

Andy Arm and Leo Legg are in partnership practicing as physiotherapists. The partnership agreement provides

the following:

1. Interest is to be allowed on capital at 10% per annum but no interest is to be allowed on current

accounts or charged on drawings.

2. Arm is entitled to a salary of C60 000 per annum and Legg C48 000 per annum.

3. Arm is entitled to the first C10 000 of the remaining profit in each half-year, the balance being divided

equally between the partners.

The following is the trial balance of the partnership entity at 31 March 20X6, six months into the financial year:

Andy Arm and Leo Legg

Trial balance

at 31 March 20X6

Dr Cr

Bank 120

500

Capital – Arm 150

000

Capital – Legg 30 000

© 2017 David Kolitz

Current account – Arm (balance 30 September 20X5) 16 000

Current account – Legg (balance 30 September 20X5) 6 000

Distributions – Arm 68 000

Distributions – Legg 4 000

Equipment: cost 40 000

Equipment: accumulated depreciation 20 000

Accounts receivable 72 000

Allowance for doubtful debts 10 000

Accounts payable 4 000

Fees 132

300

Bad debts expense 5 600

General expenses 4 700

Rent expense 5 000

Salaries expense 47 200

Stationery expense 1 300

368 368

300 300

The following additional information is available:

1. Legg’s salary has been paid to him monthly and allocated to the salaries expense account but no entries

have been made in the accounting records in respect of Arm's salary. Salaries of the receptionist have

also been charged to the salaries expense account

2. The equipment is depreciated on the straight-line basis over a period of four years, with no residual

value.

3. At 31 March 20X6, an allowance of C12 000 is required for doubtful debts.

You are required to:

a. Prepare a statement of profit or loss for the six months ending 31 March 20X6.

b. Prepare a statement of changes in equity for the six months ending 31 March 20X6.

c. Prepare a statement of financial position at 31 March 20X6.

E16.2

Martin Moodley and Leigh Lawrence are in partnership business, sharing profits and losses in the ratio 3:2. Their

statement of financial position at 30 June 20X6 was as follows:

Martin Moodley and Leigh Lawrence

Statement of financial position

at 30 June 20X6

Assets C

Non-current assets 129 000

Land and buildings at carrying amount 90 000

Equipment at carrying amount 24 000

Motor vehicles at carrying amount 15 000

Current assets 225 000

Inventory 120 000

Accounts receivable 60 000

Cash at bank 45 000

354 000

Equity and liabilities

Equity

Capital accounts 285 000

Martin Moodley 177 000

Leigh Lawrence 108 000

Current liabilities

Accounts payable 69 000

354 000

On 1 July 20X6, Ruby Rikhotso is admitted to the partnership on the following conditions:

© 2017 David Kolitz

1. Rikhotso is to pay C90 000 for a quarter share of the business which Moodley and Lawrence give up

equally.

2. Land and buildings are valued at C120 000.

3. Equipment is valued at C33 000.

4. The cash flow from accounts receivable is expected to be C57 000.

5. Inventory has a net realisable value of C111 000.

You are required to:

a. Record the above transactions in the general journal of the partnership.

b. Prepare the statement of financial position for Moodley, Lawrence and Rikhotso at 1 July 20X6.

P16.1

A Anderson, B Bilal and C Chaplin are in partnership sharing profits and losses in the ratio 5:3:2. They own and

manage a business selling educational toys, trading as ‘ABC’. The following trial balance has been extracted from

their accounting records at 31 March 20X7:

ABC

Trial balance

at 31 March 20X7

Dr Cr

Interest received 750

Capital accounts (at 1 April 20X6):

A Anderson 80 000

B Bilal 15 000

C Chaplin 5 000

Carriage inwards 4 000

Carriage outwards 12 000

Cash at bank 4 900

Current accounts (at 1 April 20X6):

A Anderson 1 000

B Bilal 500

C Chaplin 400

Distributions:

A Anderson 25 000

B Bilal 22 000

C Chaplin 15 000

Motor vehicles:

Cost 80 000

Accumulated depreciation (at 1 April 20X6) 20 000

Office expenses 40 400

Equipment:

Cost 100 000

Accumulated depreciation (at 1 April 20X6) 36 600

Purchases 225 000

Rent, rates and electricity 8 800

Sales 409 030

Inventory (at 1 April 20X6) 30 000

Accounts payable 16 500

Accounts receivable 14 300

Allowance for doubtful debts (at 1 April 20X6) 420

583 300 583 300

Additional information:

1. Inventory at 31 March 20X7 cost C35 000.

2. Depreciation on the non-current assets is to be calculated as follows:

3. Motor vehicles — 25% per annum on the diminishing balance method.

4. Plant and machinery — 20% per annum on the straight-line method.

5. There were no purchases or sales of non-current assets during the year to 31 March 20X7.

6. The future cash flows from the accounts receivable are considered to be C13 585.

7. At 31 March 20X7, office expenses of C405 was payable, and rent amounting to C1 500 had been paid

in advance.

© 2017 David Kolitz

8. Interest on distributions and on the debit balance on each partner's current account is to be charged as

follows:

9. A Anderson C1 000

10. B Bilal C900

11. C Chaplin C720

12. According to the partnership agreement, C Chaplin is allowed a salary of C13 000 per annum. This

amount was owing to C Chaplin for the year to 31 March 20X7, and needs to be accounted for.

13. The partnership agreement also allows each partner interest on his/her capital account at a rate of 10%

per annum. There were no movements on the respective partners' capital accounts during the year to 31

March 20X7, and the interest had not been credited as at that date.

You are required to:

a. Prepare the statement of profit or loss of ABC Partnership for the year ending 31 March 20X7.

b. Prepare the statement of changes in equity of ABC Partnershipfor the year ending 31 March 20X7.

c. Prepare the current accounts of ABC Partnership (in columnar format) for the year from 1 April 20X6 to

31 March 20X7.

© 2017 David Kolitz

You might also like

- Uber, Operational StrategyDocument22 pagesUber, Operational StrategyNoelraj Kalkuri100% (3)

- Non Current Asset Questions For ACCADocument11 pagesNon Current Asset Questions For ACCAAiril RazaliNo ratings yet

- This Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementDocument74 pagesThis Bud's For Who The Battle For Anheuser-Busch, Spreadsheet SupplementRikhabh DasNo ratings yet

- 13 Irs Form 56Document2 pages13 Irs Form 56Dario100% (1)

- On January 1Document4 pagesOn January 1Kryzzel Anne JonNo ratings yet

- PartnershipDocument7 pagesPartnershipShane Nayah100% (2)

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- VSA System ExplainedDocument182 pagesVSA System ExplainedViswanathan Sundaresan88% (8)

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- CAPE Caribbean Studies Notes - Globalisation and DevelopmentDocument6 pagesCAPE Caribbean Studies Notes - Globalisation and Developmentsmartkid16780% (5)

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- p1 Quiz With TheoryDocument15 pagesp1 Quiz With TheoryGrace CorpoNo ratings yet

- Accountancy Test 5Document2 pagesAccountancy Test 5dixa mathpalNo ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Accountancy Worksheets 4Document15 pagesAccountancy Worksheets 4devanshubhattacharya018No ratings yet

- Retirement of Partners - Updated WorksheetDocument8 pagesRetirement of Partners - Updated WorksheetMisri SoniNo ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Retirement of A PartnerDocument6 pagesRetirement of A Partnerprksh_451253087No ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Accounting Advanced Level Test#1: Section A Anwser All The QuestionsDocument6 pagesAccounting Advanced Level Test#1: Section A Anwser All The QuestionsHuzaifa AbdullahNo ratings yet

- Test29th AugustDocument2 pagesTest29th Augustemraan_aazamNo ratings yet

- CHAPTER 7-Corporations in Financial Difficulty: Liquidation: Book Value Fair ValueDocument1 pageCHAPTER 7-Corporations in Financial Difficulty: Liquidation: Book Value Fair Valuelinkin soyNo ratings yet

- Assigment 1Document3 pagesAssigment 1Muhd Zulhusni MusaNo ratings yet

- Ratio Analysis ProblemsDocument4 pagesRatio Analysis ProblemsNavya SreeNo ratings yet

- Quiz 1 Partnership AnswersDocument4 pagesQuiz 1 Partnership Answersdianel villarico100% (2)

- WORKSHEET - 5 On CFSDocument6 pagesWORKSHEET - 5 On CFSNavya KhemkaNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingDocument97 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced AccountingSujit DasNo ratings yet

- Quiz - Chapter 4 - Partnership Liquidation - 2021 EditionDocument7 pagesQuiz - Chapter 4 - Partnership Liquidation - 2021 EditionYam SondayNo ratings yet

- Quiz - Chapter 4 - Partnership Liquidation - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Partnership Liquidation - 2020 EditionHell LuciNo ratings yet

- CAA CH 2 Questions Pt.1Document4 pagesCAA CH 2 Questions Pt.1JohnNo ratings yet

- Answer Question 2 - Company Financial StatementsDocument3 pagesAnswer Question 2 - Company Financial StatementsAmanda KatsioNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- AdmissionDocument3 pagesAdmissionaashishNo ratings yet

- OLC Chap 6Document11 pagesOLC Chap 6Isha SinghNo ratings yet

- PQ - Covnersion Partnership To CompanyDocument8 pagesPQ - Covnersion Partnership To CompanyAnshul BiyaniNo ratings yet

- Adobe Scan 05 Mar 2022Document5 pagesAdobe Scan 05 Mar 2022Titiksha Joshi100% (1)

- This Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsDocument2 pagesThis Study Resource Was: Current Asset - Cash & Cash Equivalents CompositionsKim TanNo ratings yet

- RTP Dec 18 AnsDocument36 pagesRTP Dec 18 AnsbinuNo ratings yet

- Retirement of PartnerDocument6 pagesRetirement of Partneradithyaravikumar2000No ratings yet

- A Cco ExerciseDocument13 pagesA Cco ExerciseClarisse Anne SajoniaNo ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- F M ADocument11 pagesF M AAjay SahooNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- QUESTION 2 - Change in PartnerDocument4 pagesQUESTION 2 - Change in PartnermaiNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- ACC-ACF2100 Lecture 5 HandoutDocument7 pagesACC-ACF2100 Lecture 5 HandoutDanNo ratings yet

- ACC 311 Ass#2Document7 pagesACC 311 Ass#2Justine Reine CornicoNo ratings yet

- Partnership LiquidationDocument9 pagesPartnership LiquidationJeasa LapizNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Corporate LiquidationDocument16 pagesCorporate LiquidationMidas Troy Victor100% (1)

- AFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTDocument5 pagesAFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTMakisa YuNo ratings yet

- AFAR - Corpo Liquidation: Home Office and Branch AccountingDocument5 pagesAFAR - Corpo Liquidation: Home Office and Branch AccountingJustine CruzNo ratings yet

- Audit of Financial StatementsDocument3 pagesAudit of Financial StatementsGwyneth TorrefloresNo ratings yet

- BACC I AssignmentDocument8 pagesBACC I AssignmentNicole TaylorNo ratings yet

- Problem 1-8Document11 pagesProblem 1-8JPIA-UE Caloocan '19-20 AcademicsNo ratings yet

- Corporate Liquidation & ReorganizationDocument6 pagesCorporate Liquidation & ReorganizationNahwi KimpaNo ratings yet

- Computation For Exercise 6Document3 pagesComputation For Exercise 6Xyzra AlfonsoNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Tgs Minggu 3 (Problem 3-2,3-5,3-7)Document7 pagesTgs Minggu 3 (Problem 3-2,3-5,3-7)Ca AdaNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Public Finance, Chapter 3Document8 pagesPublic Finance, Chapter 3YIN SOKHENGNo ratings yet

- Document 5Document15 pagesDocument 5shinta nasutionNo ratings yet

- Certificate of Business Name Registration: MGTV Sari Sari StoreDocument2 pagesCertificate of Business Name Registration: MGTV Sari Sari StoreMaria MalangNo ratings yet

- Cedarbrook Nursing Home Operational Assessment ReportDocument83 pagesCedarbrook Nursing Home Operational Assessment ReportScott OttNo ratings yet

- Database Design Exercises: Miguel Rebollo Introduction To Computer Science 2010-2011Document25 pagesDatabase Design Exercises: Miguel Rebollo Introduction To Computer Science 2010-2011pt7No ratings yet

- FI S4 GL Master 08.05.2021Document266 pagesFI S4 GL Master 08.05.2021srinivasNo ratings yet

- Sakthi Fianance Project ReportDocument61 pagesSakthi Fianance Project ReportraveenkumarNo ratings yet

- Ebook Ebook PDF Quantitative Literacy 3rd Edition by Bruce Crauder PDFDocument41 pagesEbook Ebook PDF Quantitative Literacy 3rd Edition by Bruce Crauder PDFjody.garton545100% (37)

- UB FinalDocument35 pagesUB FinalTrupti GoudarNo ratings yet

- Lessee - Capital Lease Lessor - Direct Financing LeaseDocument4 pagesLessee - Capital Lease Lessor - Direct Financing LeaseFeruz Sha RakinNo ratings yet

- Sample Accountant Clerk Resume - Great Sample ResumeDocument4 pagesSample Accountant Clerk Resume - Great Sample ResumedrustagiNo ratings yet

- Viceroy CapitecDocument33 pagesViceroy CapitecPrimedia Broadcasting100% (5)

- Proforma Invoice: Ser. No. HS Code Detail Description of Machineries Model Q'Ty Unit Price (USD$) Total Amount (USD$)Document3 pagesProforma Invoice: Ser. No. HS Code Detail Description of Machineries Model Q'Ty Unit Price (USD$) Total Amount (USD$)OLIYADNo ratings yet

- Bdo VS RCBCDocument21 pagesBdo VS RCBCMary Joyce Lacambra AquinoNo ratings yet

- QB Accounting For ManagementDocument47 pagesQB Accounting For ManagementDevi KomathyNo ratings yet

- Workshop 5 Multi Asset PortfoliosDocument2 pagesWorkshop 5 Multi Asset PortfoliosRoshan Khatri ChhetriNo ratings yet

- VA+Tech+Wabag Inititating+coverageDocument32 pagesVA+Tech+Wabag Inititating+coverageAkshat Kumar Sinha0% (1)

- Chapter 8: Implications of Heuristics and Biases For Financial Decision-MakingDocument10 pagesChapter 8: Implications of Heuristics and Biases For Financial Decision-MakingRobinson MojicaNo ratings yet

- Case Study Foreign Investment Analysis - A Tangled AffairDocument6 pagesCase Study Foreign Investment Analysis - A Tangled AffairAngel PinaHardinNo ratings yet

- A. Rules On Division of Profit & LossDocument2 pagesA. Rules On Division of Profit & LossVanessa May GaNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument14 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionOsvaldo GonçalvesNo ratings yet

- Internship Report at Janata BankDocument34 pagesInternship Report at Janata BankFaysalAminTamim0% (1)

- Uson Vs DiosomitoDocument1 pageUson Vs DiosomitoCJNo ratings yet