Professional Documents

Culture Documents

Price Sheet

Price Sheet

Uploaded by

Swapnil Mokashi0 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

Price Sheet (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views1 pagePrice Sheet

Price Sheet

Uploaded by

Swapnil MokashiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

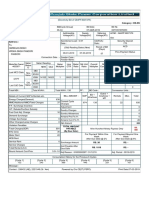

PURAVANKARA LIMITED

PURVA SILVERSANDS - Keshav Nagar, Mundhwa

Typology Total Usable Carpet Area (Sqft) Price

OC Received

2BHK 800 - 814 1.06 Cr Onwards

(Ready Possession)

3BHK 1057 1.34 Cr Onwards

PURVA EMERALD BAY - Keshav Nagar, Mundhwa

Typology Total Usable Carpet Area (Sqft) Price

Under Construction 2BHK Comfort 659 - 672 79 Lacs Onwards

(Nearing Possession) 2BHK Grand 828 99 Lacs Onwards

3BHK Comfort 1062 - 1075 1.29 Cr Onwards

Additional Charges :-

Agreement Stamping - As Applicable

Estimated Stamp Duty Charges - To be borne by Developer

Registration Charges (1% of the Agreement Value or guideline value whichever is higher) - To be borne by Developer

Advance Maintenance for 2 years - 2 BHK - 150,000 + 18% GST; 3 BHK - 175,000 + 18% GST

Interest Free Corpus Fund - 20,000 + 18% GST

Terms & Conditions :-

1. This Price is Valid for 15 days. This price list supercedes all other previous price list available in market or shared with the purchaser

2. Prices/Details are subject to revisions/escalations without prior notice. Such Revised price/details shall be applicable on the date of booking.

3. GST and other statutoty charges / levies are as per prevailing rates and subject to change. The same will be charged as applicable at the time of billing or realisation of payment. Further, price

is offered based on the assumption that the Developer will avail the input credit of GST and hence, there will not be any rebate of GST input credit to be passed

4. In addition to Agreement Value, Infrastructure and development cost,along with advance maintenance, legal charges with applicable taxes shall be paid by the customer on demand

5. In addition to Agreement Value, the cost of obtaining electricity and water connection to the said property shall be paid by the customer at actuals on demand.

6. Registration charges will be borne by developer.

7. All payments towards municipal taxes is payable on demand post intimation of possession.

8. All payments to be made as per attached payment schedule

9. Purchaser shall deduct TDS (as Applicable) at the time of payment and furnish form 16 B within 15 days of payment, failing to which the amount will be considered as overdue to Developer.

10. Delay in payment would attract interest and interest payable will be paid with applicable GST

You might also like

- ITIDC PGCIL - Colo Commercial - 09 05 22 - v1.0Document2 pagesITIDC PGCIL - Colo Commercial - 09 05 22 - v1.0Cse 2k17No ratings yet

- Papermaking 2017Document7 pagesPapermaking 2017quizizz section4No ratings yet

- Social Protection Rates of PaymentDocument98 pagesSocial Protection Rates of PaymentYvonne ChiltonNo ratings yet

- Caterpillar Bulldozer D7GDocument6 pagesCaterpillar Bulldozer D7GJi Uvex80% (5)

- The Online Poker Starting Guide (Frank Miller) PDFDocument39 pagesThe Online Poker Starting Guide (Frank Miller) PDFDe_VinciNo ratings yet

- Chapter 2 CircuitDocument37 pagesChapter 2 CircuitKemal Selman Altun100% (1)

- Category: SAP-SBM-DS-GEN: (Electricity Bill of 3000024609)Document1 pageCategory: SAP-SBM-DS-GEN: (Electricity Bill of 3000024609)Manoj PrabhakarNo ratings yet

- Electricity BillDocument1 pageElectricity BillunitedcapitaladvisoryNo ratings yet

- DCRTPP Wo DG SetDocument7 pagesDCRTPP Wo DG SetTanuj ShriNo ratings yet

- Estimate AbstractDocument6 pagesEstimate AbstractShashikumara SNo ratings yet

- Estimate AbstractDocument6 pagesEstimate AbstractShashikumara SNo ratings yet

- Price List For Fiesta Homes by SJR PrimecorpDocument1 pagePrice List For Fiesta Homes by SJR PrimecorpAswath FarookNo ratings yet

- Request For Quotation - Online Bidding: Conditions)Document27 pagesRequest For Quotation - Online Bidding: Conditions)Bhumi ShahNo ratings yet

- Small Savings Tamluk PCT QTNDocument1 pageSmall Savings Tamluk PCT QTNamkdsscnadiaNo ratings yet

- PUF Panel Spec Sheet BanganaDocument1 pagePUF Panel Spec Sheet Banganaarunlath7No ratings yet

- Amazon Realtors LTDDocument1 pageAmazon Realtors LTDdonking rajulaNo ratings yet

- Gateway Feb 2024Document14 pagesGateway Feb 2024kanishk.basuNo ratings yet

- QUOTATION FILE-2026-SUEZ-01Document1 pageQUOTATION FILE-2026-SUEZ-01muhammad saqib IlyasNo ratings yet

- BilldetailDocument1 pageBilldetailsenthilSKNo ratings yet

- SRM Notice 90Document1 pageSRM Notice 90PkNo ratings yet

- Service DetailsDocument1 pageService DetailssabeerNo ratings yet

- Extra Item Statement: Province: Punjab Branch: B&R Name of Work Contractor Name: Agreement NoDocument2 pagesExtra Item Statement: Province: Punjab Branch: B&R Name of Work Contractor Name: Agreement NoAsif HameedNo ratings yet

- Aug2017/zip/24425456 TD Gseb 31Document55 pagesAug2017/zip/24425456 TD Gseb 31Sunil BajpaiNo ratings yet

- (A Govt. of Rajasthan Undertaking) Corporate Identity Number (CIN) - U40102RJ2000SGC016484Document47 pages(A Govt. of Rajasthan Undertaking) Corporate Identity Number (CIN) - U40102RJ2000SGC016484Arun MishraNo ratings yet

- Small Savings Howrah Printer PCT QTNDocument1 pageSmall Savings Howrah Printer PCT QTNamkdsscnadiaNo ratings yet

- viewNitPdf 4288069Document26 pagesviewNitPdf 4288069Mohit AgarwalNo ratings yet

- 2017-Commercial Circular No. 291-Release of New HT ConnectionsDocument7 pages2017-Commercial Circular No. 291-Release of New HT ConnectionssachinoilNo ratings yet

- GeM Bidding 6321209Document17 pagesGeM Bidding 6321209tendersNo ratings yet

- Nit TD1733Document1 pageNit TD1733Surya ElectronicsNo ratings yet

- Requested To Supply Following Material (S) As Per Given Terms & ConditionsDocument8 pagesRequested To Supply Following Material (S) As Per Given Terms & ConditionsAnkitaNo ratings yet

- Tax Invoice For LT Current Consumption Charges For The Month of June 2024Document1 pageTax Invoice For LT Current Consumption Charges For The Month of June 2024Thirukumaran VenugopalNo ratings yet

- Tax Invoice For LT Current Consumption Charges For The Month of January 2024Document1 pageTax Invoice For LT Current Consumption Charges For The Month of January 2024jeromeprashanna1998No ratings yet

- LE-MSEDCL-010 DT 20.03.2024 Capacite InfraProjects LTD PNBTDocument34 pagesLE-MSEDCL-010 DT 20.03.2024 Capacite InfraProjects LTD PNBTDeelip ZopeNo ratings yet

- Activity Plan / Nov: No Date Material Type SupplierDocument6 pagesActivity Plan / Nov: No Date Material Type Supplierbetelehem hailuNo ratings yet

- Bill DetailDocument1 pageBill DetailDuraisamyNo ratings yet

- PT. Guna Karya Mekanika: Engineering Procurement and ContractingDocument1 pagePT. Guna Karya Mekanika: Engineering Procurement and ContractingHukleberipenNo ratings yet

- For Approval: Jawaharpur Vidyut Utpadan Nigam LimitedDocument6 pagesFor Approval: Jawaharpur Vidyut Utpadan Nigam Limitedsanjayprakash1979No ratings yet

- 1649 Knowteq Equipcare LLPDocument3 pages1649 Knowteq Equipcare LLPCwsNo ratings yet

- USA Golden StateDocument1 pageUSA Golden StatemehranNo ratings yet

- Civil Eng Maths-1Document1 pageCivil Eng Maths-1KsingNo ratings yet

- Dec InternetDocument1 pageDec InternetJeevan KumarNo ratings yet

- Pan India Infraprojects PVT LTD.: Measurement SheetDocument36 pagesPan India Infraprojects PVT LTD.: Measurement SheetLalit KumarNo ratings yet

- Tax Invoice For LT Current Consumption Charges For The Month of February 2024Document1 pageTax Invoice For LT Current Consumption Charges For The Month of February 2024ssm.thisaiyanvilaihdbfsNo ratings yet

- Tender Notice For Legal Vacancies - Draft ReferenceDocument2 pagesTender Notice For Legal Vacancies - Draft ReferenceNotes LawNo ratings yet

- Sales OrderDocument2 pagesSales Orderradhika DangiNo ratings yet

- T&T Fab To TKM 241123Document1 pageT&T Fab To TKM 241123Cyril ZachariasNo ratings yet

- Arkacheri 1Document4 pagesArkacheri 1Er. Ajit SolankeNo ratings yet

- Electric Bill RamudayanpattiDocument1 pageElectric Bill RamudayanpattiDanial ChakkaravarthyNo ratings yet

- KsebBill 1146234006904 4623231112247Document1 pageKsebBill 1146234006904 4623231112247krishnabtNo ratings yet

- (Electricity Bill of G64PF360737K) : Category: DS-DSDocument1 page(Electricity Bill of G64PF360737K) : Category: DS-DSdaljitjkNo ratings yet

- Offer 0324004 Version 1Document1 pageOffer 0324004 Version 1topwriterdbNo ratings yet

- Pi ShubhamDocument1 pagePi ShubhamsandeepNo ratings yet

- Acc NS2K 005735 20240410-1643Document4 pagesAcc NS2K 005735 20240410-1643reddyrabadaNo ratings yet

- RFX 2332301336Document3 pagesRFX 2332301336Mena KamelNo ratings yet

- QUOTATION FILE-2026-02-TORYDocument1 pageQUOTATION FILE-2026-02-TORYmuhammad saqib IlyasNo ratings yet

- Bill JanDocument2 pagesBill JanRaman KumarNo ratings yet

- GAH043Document1 pageGAH043Rupesh BhatNo ratings yet

- Tax Invoice For LT Current Consumption Charges For The Month of January 2024Document1 pageTax Invoice For LT Current Consumption Charges For The Month of January 2024goldentraders2574No ratings yet

- For Approval: Jawaharpur Vidyut Utpadan Nigam LimitedDocument10 pagesFor Approval: Jawaharpur Vidyut Utpadan Nigam Limiteddattasudipto4339No ratings yet

- Scda Cost Sheet Now WowDocument7 pagesScda Cost Sheet Now WowHimanshu KashyapNo ratings yet

- ManipurDocument3 pagesManipursushaant pahalwanNo ratings yet

- Aug2017/zip/24425456 TD Gseb 26Document49 pagesAug2017/zip/24425456 TD Gseb 26Sunil BajpaiNo ratings yet

- NIT Thirissur EdappallyDocument3 pagesNIT Thirissur EdappallyaryannetNo ratings yet

- Koradi Tps 08-05-24Document2 pagesKoradi Tps 08-05-24marketing1No ratings yet

- Answer All Questions, Each Carries 4 MarksDocument3 pagesAnswer All Questions, Each Carries 4 MarksKarthikaNo ratings yet

- SINCGARS Operations SOPDocument1 pageSINCGARS Operations SOPAndrew MarshNo ratings yet

- The Evolution of The CPUDocument17 pagesThe Evolution of The CPUDr-Ben Robert MatthewsNo ratings yet

- Spar Design of A Fokker D-VII - Aerospace Engineering BlogDocument8 pagesSpar Design of A Fokker D-VII - Aerospace Engineering Blogjohn mtz100% (1)

- Talisic Vs Atty. Rinen Feb. 12,2014Document3 pagesTalisic Vs Atty. Rinen Feb. 12,2014Katharina CantaNo ratings yet

- Akbayan Vs Thomas G. AquinoDocument14 pagesAkbayan Vs Thomas G. AquinoNicole IbayNo ratings yet

- Social Entrepeneurship Bootcamp SyllabusDocument7 pagesSocial Entrepeneurship Bootcamp SyllabusIsraelllNo ratings yet

- To Website Advt T-17 - 2021-22Document1 pageTo Website Advt T-17 - 2021-22Ramesh BabuNo ratings yet

- Mechanics of Deformable Bodies Module 2Document19 pagesMechanics of Deformable Bodies Module 2eysNo ratings yet

- Masterseal B1 Foam: Fire Retardant, Expanding Foam and Gap FillerDocument2 pagesMasterseal B1 Foam: Fire Retardant, Expanding Foam and Gap FillerAbidNo ratings yet

- Core Problems: Testing Web Applications For VulnerabilitiesDocument13 pagesCore Problems: Testing Web Applications For VulnerabilitiesAnonymous X8w05bOLNo ratings yet

- Center Tapped Transformer and 120/240 Volt Secondary ModelsDocument7 pagesCenter Tapped Transformer and 120/240 Volt Secondary ModelsAlhussain EmbarkNo ratings yet

- Astm D36Document4 pagesAstm D36Esteban FinoNo ratings yet

- Trend Micro Apex One: Endpoint Security RedefinedDocument2 pagesTrend Micro Apex One: Endpoint Security RedefinedtestNo ratings yet

- Guide On Advertising - 26032019-v3Document20 pagesGuide On Advertising - 26032019-v3kkNo ratings yet

- DLL Cookery 9 Week 6Document2 pagesDLL Cookery 9 Week 6Negi SotneirrabNo ratings yet

- Pokemon Resolute Version Full Walkthrough PDFDocument3 pagesPokemon Resolute Version Full Walkthrough PDFsildora cedrik markNo ratings yet

- Sensortronics Load Cells: Product OverviewDocument4 pagesSensortronics Load Cells: Product Overviewsrboghe651665No ratings yet

- Uni Line Top 4921240130 UkDocument6 pagesUni Line Top 4921240130 UkLUATNo ratings yet

- ME 4226 Heat Exchanger Compiled WconclusionDocument26 pagesME 4226 Heat Exchanger Compiled Wconclusionhamish888No ratings yet

- FX2N-16DNET Devicenet User ManualDocument126 pagesFX2N-16DNET Devicenet User ManualNguyen QuanNo ratings yet

- Chapter 7 - Strategy Implementation - NarrativeDocument14 pagesChapter 7 - Strategy Implementation - NarrativeShelly Mae SiguaNo ratings yet

- OCPDDocument61 pagesOCPDyankurokuNo ratings yet

- UntitledDocument7 pagesUntitledLehlohonolo NyakaleNo ratings yet

- TK19 - Final Report PDFDocument137 pagesTK19 - Final Report PDFekiNo ratings yet