Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsT3 Npv+irr

T3 Npv+irr

Uploaded by

Hy ChongCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Engineering Construction Law & Contracts by J.K.yatesDocument131 pagesEngineering Construction Law & Contracts by J.K.yatesShabana Imran67% (3)

- CF Tutorial 2Document15 pagesCF Tutorial 21 KohNo ratings yet

- Gamma ScalpingDocument3 pagesGamma Scalpingprivatelogic33% (3)

- Solution Capital Budgeting AssignmentDocument8 pagesSolution Capital Budgeting AssignmentAryamanNo ratings yet

- Capital BudgetingDocument8 pagesCapital Budgetingneesha0% (1)

- Interest and Annuity Tables For Discrete and Continuous CompoundingDocument23 pagesInterest and Annuity Tables For Discrete and Continuous CompoundingAnas OdehNo ratings yet

- Allegro (ATC) C.ADocument8 pagesAllegro (ATC) C.Arubakhalid67No ratings yet

- MSC Finance Capital BudgetingDocument4 pagesMSC Finance Capital Budgetingshahsamkit08No ratings yet

- Time ValueDocument57 pagesTime ValueNatural scenesNo ratings yet

- Investment AppraisalDocument2 pagesInvestment AppraisalvincentNo ratings yet

- MNPV Excel ExampleDocument1 pageMNPV Excel ExampleaijazahmedkhanNo ratings yet

- Assigment 2Document4 pagesAssigment 2fatma mohamedNo ratings yet

- 0 - 50000 1 10000 2 15000 3 20000 4 25000 5 30000 at 10% NPV Pvcf-Icf 50000 22205Document2 pages0 - 50000 1 10000 2 15000 3 20000 4 25000 5 30000 at 10% NPV Pvcf-Icf 50000 22205AhmedmughalNo ratings yet

- CB Numericals 1Document13 pagesCB Numericals 1Vedashree MaliNo ratings yet

- Calculo TirDocument5 pagesCalculo TirCarmela GalianoNo ratings yet

- Paper 2Document5 pagesPaper 2dua95960No ratings yet

- Bomba PerisfericaDocument4 pagesBomba PerisfericaTriviño Lopez AndresNo ratings yet

- Afm - 2017-18Document17 pagesAfm - 2017-18HetviNo ratings yet

- Tahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanDocument9 pagesTahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanElis Lisa Pantolosang RegelNo ratings yet

- 1+ (I) 150000 1+ (I) 90000 1+ (I) 20000 1+ (I) 20000 1+ (I) 30000 1+ (I) 40000 1+ (I) 60000 1+ (I) 80000 1+ (I) 90000 1+ (I) 76852 1+ (I) 120000 1+ (I) 140000 1+ (I)Document2 pages1+ (I) 150000 1+ (I) 90000 1+ (I) 20000 1+ (I) 20000 1+ (I) 30000 1+ (I) 40000 1+ (I) 60000 1+ (I) 80000 1+ (I) 90000 1+ (I) 76852 1+ (I) 120000 1+ (I) 140000 1+ (I)CocoNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- N1 mc A B C H Ө N2 N3 N4 N5 n W Cheak 1 3.2636116E-12: Bending Moment Shear ForceDocument5 pagesN1 mc A B C H Ө N2 N3 N4 N5 n W Cheak 1 3.2636116E-12: Bending Moment Shear ForceqzakryaNo ratings yet

- Assignment 1Document8 pagesAssignment 1KiranNo ratings yet

- Capital Budgeting Solution1Document100 pagesCapital Budgeting Solution1MBaral100% (1)

- Investment AppraisalDocument18 pagesInvestment AppraisalKwasi MmehNo ratings yet

- Estimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Document5 pagesEstimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Somlina MukherjeeNo ratings yet

- Datos Push OverDocument1 pageDatos Push OverLuis H OrtzNo ratings yet

- CFDocument3 pagesCFMaham WasimNo ratings yet

- Capital Budgeting 1Document5 pagesCapital Budgeting 1Sohaib RiazNo ratings yet

- 2023 Special IssuesDocument5 pages2023 Special IssuesLovina EkkaNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- If Undesired Is The Middle Fraction If Desired Is Middle FractionDocument3 pagesIf Undesired Is The Middle Fraction If Desired Is Middle FractionSam Denielle TugaoenNo ratings yet

- Payback PeriodDocument11 pagesPayback PeriodAliNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- Elevation (FT) Li (In) W (Lbf/in) L (FT) L (In) L (In) L (In) L (In) L (In) I (In)Document2 pagesElevation (FT) Li (In) W (Lbf/in) L (FT) L (In) L (In) L (In) L (In) L (In) I (In)DarielaNo ratings yet

- Montecarlo SimulationDocument27 pagesMontecarlo Simulationsobhinmylesamy4No ratings yet

- Question 3, Ms - VinoDocument11 pagesQuestion 3, Ms - VinoPavitra RavyNo ratings yet

- SafariDocument49 pagesSafariwafaNo ratings yet

- Assignment 4 - Cost of Capital and Capital BudgetiDocument5 pagesAssignment 4 - Cost of Capital and Capital BudgetiBrian AlalaNo ratings yet

- Medidas FinalesDocument14 pagesMedidas FinalesDavid CastellanosNo ratings yet

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanNo ratings yet

- Taxation (WN1) : NPV 14434.84672557 NPV 14434.85 IRR 12.63%Document12 pagesTaxation (WN1) : NPV 14434.84672557 NPV 14434.85 IRR 12.63%Sreyas S KumarNo ratings yet

- (MCOF19M028) CF AssignmentDocument5 pages(MCOF19M028) CF AssignmentFaaiz YousafNo ratings yet

- WeatherDocument1 pageWeatherChandu DhageNo ratings yet

- 5 Rows × 23 Columns: 'Weatheraus (1) .CSV'Document1 page5 Rows × 23 Columns: 'Weatheraus (1) .CSV'Chandu DhageNo ratings yet

- WeatherDocument1 pageWeatherChandu DhageNo ratings yet

- Ejercicio Fluidos Newtonianos y No Newtonianos - Hernández Vizueto ValeriaDocument3 pagesEjercicio Fluidos Newtonianos y No Newtonianos - Hernández Vizueto ValeriaHernandez Vizueto ValeriaNo ratings yet

- Es - Group 8Document4 pagesEs - Group 8Papa NketsiahNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- Present & Future Value CalculationDocument9 pagesPresent & Future Value CalculationHoney SrivastavaNo ratings yet

- Book 1Document3 pagesBook 1aditisingh.mba23No ratings yet

- Cortante y Mto FroyDocument64 pagesCortante y Mto FroyYeraldo Tejada MendozaNo ratings yet

- Net Cashflow Net Income+Non Cashcharges Noncash RevenuesDocument4 pagesNet Cashflow Net Income+Non Cashcharges Noncash RevenuesSumiya KaleemNo ratings yet

- Section C Q 3 Dink CoDocument3 pagesSection C Q 3 Dink CoChandu NavalNo ratings yet

- Session4 and Mini CasesDocument18 pagesSession4 and Mini CasesVibhuti AnandNo ratings yet

- Taller Cinetica de DeterioroDocument6 pagesTaller Cinetica de DeteriorowgomezcNo ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingnishantNo ratings yet

- CP Vs Waktu Kurva EliminasiDocument4 pagesCP Vs Waktu Kurva EliminasisyiraNo ratings yet

- Laboratorio 2Document8 pagesLaboratorio 2Angel Enoc Gutiérrez AranibarNo ratings yet

- PSH B PDFDocument1 pagePSH B PDFLuis H OrtzNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesMatshepo SeletswaneNo ratings yet

- FM Crash Course Material 111Document65 pagesFM Crash Course Material 111Safwan Abdul GafoorNo ratings yet

- Trinomial Option Pricing ModelDocument5 pagesTrinomial Option Pricing Modelselozok1No ratings yet

- Binomial - Black-ScholesDocument21 pagesBinomial - Black-ScholesNgoni j MakaripeNo ratings yet

- Course Outline - HMTH216 Introduction To Financial MathematicsDocument3 pagesCourse Outline - HMTH216 Introduction To Financial MathematicsRealbouy SackyNo ratings yet

- Kartu Piutang-PrintDocument1 pageKartu Piutang-Printcepeut27No ratings yet

- Chapter Six 2024Document15 pagesChapter Six 2024Romario KhaledNo ratings yet

- Core Chapter 04 Excel Master 4th Edition StudentDocument150 pagesCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNo ratings yet

- Chapter 5 - Time Value of Money-Student VersionDocument8 pagesChapter 5 - Time Value of Money-Student Versionnamle999101No ratings yet

- Present and CompoundDocument3 pagesPresent and CompoundTricia LuceroNo ratings yet

- 3E Excell Worksheet DDocument18 pages3E Excell Worksheet DMirayya AidarovaNo ratings yet

- Optionstar EZ Single Calls or Puts: #VALUE! ####### ####### ####### ####### ####### #######Document18 pagesOptionstar EZ Single Calls or Puts: #VALUE! ####### ####### ####### ####### ####### #######kirron005No ratings yet

- Financial Engineering A Conceptual Study: Dr. Ambrish VeernaikDocument8 pagesFinancial Engineering A Conceptual Study: Dr. Ambrish VeernaikMohammed AliNo ratings yet

- 11 12a OptionsDocument38 pages11 12a Optionsdavid AbotsitseNo ratings yet

- BBMF 3083 Exam Paper September 2019Document6 pagesBBMF 3083 Exam Paper September 2019KAR ENG QUAHNo ratings yet

- Future Value InggrisDocument2 pagesFuture Value InggrisDian AgustinaNo ratings yet

- Studi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Document8 pagesStudi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Billy AdityaNo ratings yet

- Final Formula SheetDocument1 pageFinal Formula SheetFaryalNo ratings yet

- AnswerDocument15 pagesAnswerBIRHANU GEMECHU100% (1)

- Lecture 10 - CAPMDocument19 pagesLecture 10 - CAPMroBinNo ratings yet

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- A General Closed Form Option Pricing Formula: Ciprian NECULA Gabriel DRIMUS Walter FARKASDocument17 pagesA General Closed Form Option Pricing Formula: Ciprian NECULA Gabriel DRIMUS Walter FARKASGabriela ConstantinescuNo ratings yet

- Arbitrage Pricing TheoryDocument13 pagesArbitrage Pricing TheoryParas WaliaNo ratings yet

- Kelayakan Investasi (Invesment Feasibility) Pembangunan Pasar Tradisional Rukoh Barona Kota Banda AcehDocument7 pagesKelayakan Investasi (Invesment Feasibility) Pembangunan Pasar Tradisional Rukoh Barona Kota Banda AcehBianNo ratings yet

- Microsoft Excel Sheet For Calculating (Money) Future Value, Present Value, Future Value of Annuity, FVA Due, Present Value of Annuity, PVA Due, Unequal Cash FlowsDocument8 pagesMicrosoft Excel Sheet For Calculating (Money) Future Value, Present Value, Future Value of Annuity, FVA Due, Present Value of Annuity, PVA Due, Unequal Cash FlowsVikas AcharyaNo ratings yet

- Essentials of Investments 10th Edition Bodie Solutions Manual DownloadDocument14 pagesEssentials of Investments 10th Edition Bodie Solutions Manual DownloadJennifer Walker100% (21)

- Business Maths ExcelDocument10 pagesBusiness Maths ExcelIrfanNo ratings yet

- Solved Exercises - The Capital Asset Pricing Model Part IIDocument6 pagesSolved Exercises - The Capital Asset Pricing Model Part IIana lisa melanoNo ratings yet

T3 Npv+irr

T3 Npv+irr

Uploaded by

Hy Chong0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

T3 NPV+IRR

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesT3 Npv+irr

T3 Npv+irr

Uploaded by

Hy ChongCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

10

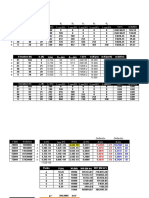

Variables Net Cash Flow Discount Present Value

Year

ANS Project I Project II Project III Project IV 1.10 Project I Project II

0 -20000 -10000 -45000 -60000 1 -20000 -10000

1 3500 2000 10000 40000 0.9091 3181.818 1818.182

2 4500 6500 15000 30000 0.8264 3719.008 5371.901

3 5000 10000 20000 20000 0.7513 3756.5 7513

4 5000 12000 20000 10000 0.6830 3415.067 8196.161

5 8000 14300 15000 0 0.6209 4967.371 8879.175

NPV -960.2357 21778.42

Net Cash Flow

Year

Project I Project II Project III Project IV

0 -150000 -10000 -45000 -60000

1 45000 2000 10000 40000

2 45000 6500 15000 30000

3 45000 10000 20000 20000

4 45000 12000 20000 10000

5 45000 14300 15000 0

IRR 15.24% 56.84% 20.92% 31.38%

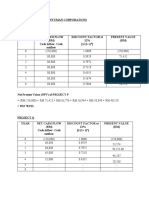

Present Value Amortization of Loans Sinking Funds

Project III Project IV PVAN 170000 FVAN 20000

-45000 -60000 i 0.00625 /12 i 0.12

9090.909 36363.64 1+i 1.00625 1+i 1.12

12396.69 24793.39 n 240 x12 n 5

15026 15026 (1 + i)^-n 0.2241742 (1 + i)^n 1.7623417

13660.27 6830.135 PMT 1369.51 PMT 3148.1946

9313.82 0

14487.69 23013.16 PVAN FVAN

PMT 100 PMT 50

i 0.1 i 0.015

1+i 1.1 1+i 1.015

n 3 n 12

1-(1 + i)^-n 0.2486852 [(1 + i)^n]-1 0.1956182

PVAN 248.69 FVAN 652.06

PVAND FVAND

PMT 100 PMT 12000

i 0.1 i 0.12

1+i 1.1 1+i 1.12

n 3 n 3

1-(1 + i)^-n 0.2486852 [(1 + i)^n]-1 0.404928

PVAND 273.55 FVAND 45351.94

You might also like

- Engineering Construction Law & Contracts by J.K.yatesDocument131 pagesEngineering Construction Law & Contracts by J.K.yatesShabana Imran67% (3)

- CF Tutorial 2Document15 pagesCF Tutorial 21 KohNo ratings yet

- Gamma ScalpingDocument3 pagesGamma Scalpingprivatelogic33% (3)

- Solution Capital Budgeting AssignmentDocument8 pagesSolution Capital Budgeting AssignmentAryamanNo ratings yet

- Capital BudgetingDocument8 pagesCapital Budgetingneesha0% (1)

- Interest and Annuity Tables For Discrete and Continuous CompoundingDocument23 pagesInterest and Annuity Tables For Discrete and Continuous CompoundingAnas OdehNo ratings yet

- Allegro (ATC) C.ADocument8 pagesAllegro (ATC) C.Arubakhalid67No ratings yet

- MSC Finance Capital BudgetingDocument4 pagesMSC Finance Capital Budgetingshahsamkit08No ratings yet

- Time ValueDocument57 pagesTime ValueNatural scenesNo ratings yet

- Investment AppraisalDocument2 pagesInvestment AppraisalvincentNo ratings yet

- MNPV Excel ExampleDocument1 pageMNPV Excel ExampleaijazahmedkhanNo ratings yet

- Assigment 2Document4 pagesAssigment 2fatma mohamedNo ratings yet

- 0 - 50000 1 10000 2 15000 3 20000 4 25000 5 30000 at 10% NPV Pvcf-Icf 50000 22205Document2 pages0 - 50000 1 10000 2 15000 3 20000 4 25000 5 30000 at 10% NPV Pvcf-Icf 50000 22205AhmedmughalNo ratings yet

- CB Numericals 1Document13 pagesCB Numericals 1Vedashree MaliNo ratings yet

- Calculo TirDocument5 pagesCalculo TirCarmela GalianoNo ratings yet

- Paper 2Document5 pagesPaper 2dua95960No ratings yet

- Bomba PerisfericaDocument4 pagesBomba PerisfericaTriviño Lopez AndresNo ratings yet

- Afm - 2017-18Document17 pagesAfm - 2017-18HetviNo ratings yet

- Tahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanDocument9 pagesTahun Biaya (Cost) Penerimaan DF Disconting Biaya Dicounting PenerimaanElis Lisa Pantolosang RegelNo ratings yet

- 1+ (I) 150000 1+ (I) 90000 1+ (I) 20000 1+ (I) 20000 1+ (I) 30000 1+ (I) 40000 1+ (I) 60000 1+ (I) 80000 1+ (I) 90000 1+ (I) 76852 1+ (I) 120000 1+ (I) 140000 1+ (I)Document2 pages1+ (I) 150000 1+ (I) 90000 1+ (I) 20000 1+ (I) 20000 1+ (I) 30000 1+ (I) 40000 1+ (I) 60000 1+ (I) 80000 1+ (I) 90000 1+ (I) 76852 1+ (I) 120000 1+ (I) 140000 1+ (I)CocoNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- N1 mc A B C H Ө N2 N3 N4 N5 n W Cheak 1 3.2636116E-12: Bending Moment Shear ForceDocument5 pagesN1 mc A B C H Ө N2 N3 N4 N5 n W Cheak 1 3.2636116E-12: Bending Moment Shear ForceqzakryaNo ratings yet

- Assignment 1Document8 pagesAssignment 1KiranNo ratings yet

- Capital Budgeting Solution1Document100 pagesCapital Budgeting Solution1MBaral100% (1)

- Investment AppraisalDocument18 pagesInvestment AppraisalKwasi MmehNo ratings yet

- Estimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Document5 pagesEstimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Somlina MukherjeeNo ratings yet

- Datos Push OverDocument1 pageDatos Push OverLuis H OrtzNo ratings yet

- CFDocument3 pagesCFMaham WasimNo ratings yet

- Capital Budgeting 1Document5 pagesCapital Budgeting 1Sohaib RiazNo ratings yet

- 2023 Special IssuesDocument5 pages2023 Special IssuesLovina EkkaNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- If Undesired Is The Middle Fraction If Desired Is Middle FractionDocument3 pagesIf Undesired Is The Middle Fraction If Desired Is Middle FractionSam Denielle TugaoenNo ratings yet

- Payback PeriodDocument11 pagesPayback PeriodAliNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- Elevation (FT) Li (In) W (Lbf/in) L (FT) L (In) L (In) L (In) L (In) L (In) I (In)Document2 pagesElevation (FT) Li (In) W (Lbf/in) L (FT) L (In) L (In) L (In) L (In) L (In) I (In)DarielaNo ratings yet

- Montecarlo SimulationDocument27 pagesMontecarlo Simulationsobhinmylesamy4No ratings yet

- Question 3, Ms - VinoDocument11 pagesQuestion 3, Ms - VinoPavitra RavyNo ratings yet

- SafariDocument49 pagesSafariwafaNo ratings yet

- Assignment 4 - Cost of Capital and Capital BudgetiDocument5 pagesAssignment 4 - Cost of Capital and Capital BudgetiBrian AlalaNo ratings yet

- Medidas FinalesDocument14 pagesMedidas FinalesDavid CastellanosNo ratings yet

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanNo ratings yet

- Taxation (WN1) : NPV 14434.84672557 NPV 14434.85 IRR 12.63%Document12 pagesTaxation (WN1) : NPV 14434.84672557 NPV 14434.85 IRR 12.63%Sreyas S KumarNo ratings yet

- (MCOF19M028) CF AssignmentDocument5 pages(MCOF19M028) CF AssignmentFaaiz YousafNo ratings yet

- WeatherDocument1 pageWeatherChandu DhageNo ratings yet

- 5 Rows × 23 Columns: 'Weatheraus (1) .CSV'Document1 page5 Rows × 23 Columns: 'Weatheraus (1) .CSV'Chandu DhageNo ratings yet

- WeatherDocument1 pageWeatherChandu DhageNo ratings yet

- Ejercicio Fluidos Newtonianos y No Newtonianos - Hernández Vizueto ValeriaDocument3 pagesEjercicio Fluidos Newtonianos y No Newtonianos - Hernández Vizueto ValeriaHernandez Vizueto ValeriaNo ratings yet

- Es - Group 8Document4 pagesEs - Group 8Papa NketsiahNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- Present & Future Value CalculationDocument9 pagesPresent & Future Value CalculationHoney SrivastavaNo ratings yet

- Book 1Document3 pagesBook 1aditisingh.mba23No ratings yet

- Cortante y Mto FroyDocument64 pagesCortante y Mto FroyYeraldo Tejada MendozaNo ratings yet

- Net Cashflow Net Income+Non Cashcharges Noncash RevenuesDocument4 pagesNet Cashflow Net Income+Non Cashcharges Noncash RevenuesSumiya KaleemNo ratings yet

- Section C Q 3 Dink CoDocument3 pagesSection C Q 3 Dink CoChandu NavalNo ratings yet

- Session4 and Mini CasesDocument18 pagesSession4 and Mini CasesVibhuti AnandNo ratings yet

- Taller Cinetica de DeterioroDocument6 pagesTaller Cinetica de DeteriorowgomezcNo ratings yet

- Capital BudgetingDocument28 pagesCapital BudgetingnishantNo ratings yet

- CP Vs Waktu Kurva EliminasiDocument4 pagesCP Vs Waktu Kurva EliminasisyiraNo ratings yet

- Laboratorio 2Document8 pagesLaboratorio 2Angel Enoc Gutiérrez AranibarNo ratings yet

- PSH B PDFDocument1 pagePSH B PDFLuis H OrtzNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesMatshepo SeletswaneNo ratings yet

- FM Crash Course Material 111Document65 pagesFM Crash Course Material 111Safwan Abdul GafoorNo ratings yet

- Trinomial Option Pricing ModelDocument5 pagesTrinomial Option Pricing Modelselozok1No ratings yet

- Binomial - Black-ScholesDocument21 pagesBinomial - Black-ScholesNgoni j MakaripeNo ratings yet

- Course Outline - HMTH216 Introduction To Financial MathematicsDocument3 pagesCourse Outline - HMTH216 Introduction To Financial MathematicsRealbouy SackyNo ratings yet

- Kartu Piutang-PrintDocument1 pageKartu Piutang-Printcepeut27No ratings yet

- Chapter Six 2024Document15 pagesChapter Six 2024Romario KhaledNo ratings yet

- Core Chapter 04 Excel Master 4th Edition StudentDocument150 pagesCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceNo ratings yet

- Chapter 5 - Time Value of Money-Student VersionDocument8 pagesChapter 5 - Time Value of Money-Student Versionnamle999101No ratings yet

- Present and CompoundDocument3 pagesPresent and CompoundTricia LuceroNo ratings yet

- 3E Excell Worksheet DDocument18 pages3E Excell Worksheet DMirayya AidarovaNo ratings yet

- Optionstar EZ Single Calls or Puts: #VALUE! ####### ####### ####### ####### ####### #######Document18 pagesOptionstar EZ Single Calls or Puts: #VALUE! ####### ####### ####### ####### ####### #######kirron005No ratings yet

- Financial Engineering A Conceptual Study: Dr. Ambrish VeernaikDocument8 pagesFinancial Engineering A Conceptual Study: Dr. Ambrish VeernaikMohammed AliNo ratings yet

- 11 12a OptionsDocument38 pages11 12a Optionsdavid AbotsitseNo ratings yet

- BBMF 3083 Exam Paper September 2019Document6 pagesBBMF 3083 Exam Paper September 2019KAR ENG QUAHNo ratings yet

- Future Value InggrisDocument2 pagesFuture Value InggrisDian AgustinaNo ratings yet

- Studi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Document8 pagesStudi Kelayakan Bisnis Bengkel Bubut Cipta Teknik Mandiri (Studi Kasus Di Perumnas Tangerang Banten)Billy AdityaNo ratings yet

- Final Formula SheetDocument1 pageFinal Formula SheetFaryalNo ratings yet

- AnswerDocument15 pagesAnswerBIRHANU GEMECHU100% (1)

- Lecture 10 - CAPMDocument19 pagesLecture 10 - CAPMroBinNo ratings yet

- FRM Test Portfolio ManagementDocument7 pagesFRM Test Portfolio Managementram ramNo ratings yet

- A General Closed Form Option Pricing Formula: Ciprian NECULA Gabriel DRIMUS Walter FARKASDocument17 pagesA General Closed Form Option Pricing Formula: Ciprian NECULA Gabriel DRIMUS Walter FARKASGabriela ConstantinescuNo ratings yet

- Arbitrage Pricing TheoryDocument13 pagesArbitrage Pricing TheoryParas WaliaNo ratings yet

- Kelayakan Investasi (Invesment Feasibility) Pembangunan Pasar Tradisional Rukoh Barona Kota Banda AcehDocument7 pagesKelayakan Investasi (Invesment Feasibility) Pembangunan Pasar Tradisional Rukoh Barona Kota Banda AcehBianNo ratings yet

- Microsoft Excel Sheet For Calculating (Money) Future Value, Present Value, Future Value of Annuity, FVA Due, Present Value of Annuity, PVA Due, Unequal Cash FlowsDocument8 pagesMicrosoft Excel Sheet For Calculating (Money) Future Value, Present Value, Future Value of Annuity, FVA Due, Present Value of Annuity, PVA Due, Unequal Cash FlowsVikas AcharyaNo ratings yet

- Essentials of Investments 10th Edition Bodie Solutions Manual DownloadDocument14 pagesEssentials of Investments 10th Edition Bodie Solutions Manual DownloadJennifer Walker100% (21)

- Business Maths ExcelDocument10 pagesBusiness Maths ExcelIrfanNo ratings yet

- Solved Exercises - The Capital Asset Pricing Model Part IIDocument6 pagesSolved Exercises - The Capital Asset Pricing Model Part IIana lisa melanoNo ratings yet