Professional Documents

Culture Documents

MS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6

MS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6

Uploaded by

crescendo.mskCopyright:

Available Formats

You might also like

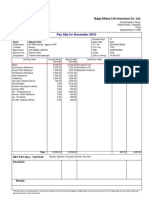

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

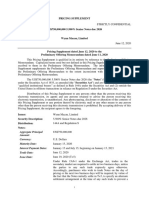

- Handout 5Document2 pagesHandout 5DelishaNo ratings yet

- EOC08 UpdatedDocument25 pagesEOC08 Updatedtaha elbakkushNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocument25 pagesSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MNo ratings yet

- Minutes of Finance Commitee Meeting Held 6th February 2021.editedDocument5 pagesMinutes of Finance Commitee Meeting Held 6th February 2021.editedAmanda EjusNo ratings yet

- Sara SinDocument3 pagesSara Sinbalaji.79No ratings yet

- The Goldman Sachs Group - 20150610 - ISIN - 10y - USD - FRN (Tranche) - 1 01Document5 pagesThe Goldman Sachs Group - 20150610 - ISIN - 10y - USD - FRN (Tranche) - 1 01crescendo.mskNo ratings yet

- Global Macro Commentary July 14Document2 pagesGlobal Macro Commentary July 14dpbasicNo ratings yet

- February 10, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorDocument5 pagesFebruary 10, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorChrispy DuckNo ratings yet

- Práctica Dirigida 3 2021Document5 pagesPráctica Dirigida 3 2021Winny Vento HerreraNo ratings yet

- Essential Guide To Stock InvestingDocument19 pagesEssential Guide To Stock Investingleorbalaguru100% (1)

- Iridian 3Q10 LetterDocument15 pagesIridian 3Q10 LetterHariharan SundaresanNo ratings yet

- 53na595066 E01 PDFDocument15 pages53na595066 E01 PDFRamesh ChandNo ratings yet

- Isbo Gic Terms and Conditions enDocument2 pagesIsbo Gic Terms and Conditions enKrishna PrasadNo ratings yet

- The Best Instrument Against Currency Risk.Document13 pagesThe Best Instrument Against Currency Risk.Hanane KoyakoNo ratings yet

- Cibc 5-Year GicDocument3 pagesCibc 5-Year GicSalimah ArabNo ratings yet

- Home Day Trading Technical Analysis Stocks Options Bonds Personal Finance Free Offers Scottrade: $7 Online Stock TradesDocument11 pagesHome Day Trading Technical Analysis Stocks Options Bonds Personal Finance Free Offers Scottrade: $7 Online Stock Tradesganesh061No ratings yet

- Transaction ExposureDocument11 pagesTransaction ExposureYash AwasthiNo ratings yet

- BANK3011 Workshop Week 3 SolutionsDocument5 pagesBANK3011 Workshop Week 3 SolutionsZahraaNo ratings yet

- Yield CurveDocument18 pagesYield CurveHaqqul YaqinNo ratings yet

- SMC Fixed RateDocument1 pageSMC Fixed RateKaizen CabralNo ratings yet

- MSDocument36 pagesMSJason WangNo ratings yet

- Need Analysis Summary: Personal Details Financial DetailsDocument17 pagesNeed Analysis Summary: Personal Details Financial DetailsFemilaNo ratings yet

- Wynn Macau, 5.5% 15jan2026, USD - Final - TermsDocument5 pagesWynn Macau, 5.5% 15jan2026, USD - Final - TermsRajendra AvinashNo ratings yet

- 2.1 Recap - Money Markets PDFDocument26 pages2.1 Recap - Money Markets PDFRedNo ratings yet

- EOC08 EdittedDocument12 pagesEOC08 EdittedFilip velico100% (1)

- LBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmaDocument35 pagesLBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmazvaibhavNo ratings yet

- Sociedad Química y Minera de Chile: Investor PresentationDocument26 pagesSociedad Química y Minera de Chile: Investor Presentationfrop8857No ratings yet

- Description: Micro Grameen What Ismicro Grameen?Document8 pagesDescription: Micro Grameen What Ismicro Grameen?Saligan DolfNo ratings yet

- Weekly Business Digest 21 October 08Document7 pagesWeekly Business Digest 21 October 08gayathirincNo ratings yet

- Práctica Dirigida 3 2016-IIDocument2 pagesPráctica Dirigida 3 2016-IILeonardo CastilloNo ratings yet

- Treasury Research News Bulletin - 25 October 2013Document2 pagesTreasury Research News Bulletin - 25 October 2013r3iherNo ratings yet

- SC Eoc08Document25 pagesSC Eoc08vanessagreco17No ratings yet

- PercentB Bollinger Bands HighlightsDocument47 pagesPercentB Bollinger Bands Highlightsmimi_mechant67% (6)

- Financial Analysis On British American Tobacco Bangladesh (BAT)Document12 pagesFinancial Analysis On British American Tobacco Bangladesh (BAT)Shoyeb MahmudNo ratings yet

- Econ1102 Week 8Document46 pagesEcon1102 Week 8AAA820100% (1)

- S.no Name of Security Type Amount AllocatedDocument5 pagesS.no Name of Security Type Amount AllocatedMohammad Rehan KhanNo ratings yet

- RCB Fixed Rate and Zero Coupon LTNCDs Due June 2017 PDFDocument130 pagesRCB Fixed Rate and Zero Coupon LTNCDs Due June 2017 PDFVIP CONSUMERNo ratings yet

- V-Chap 4 - Debt PricingDocument26 pagesV-Chap 4 - Debt PricingHải NhưNo ratings yet

- Forex Qs AnsDocument5 pagesForex Qs AnsChoudhristNo ratings yet

- Investment Process: Portfolio ConstructionDocument22 pagesInvestment Process: Portfolio ConstructionÃarthï ArülrãjNo ratings yet

- SSRN Id2200390Document17 pagesSSRN Id2200390AlexNo ratings yet

- CH0137259377Document90 pagesCH0137259377franviNo ratings yet

- CB Chapter 7 AnswerDocument4 pagesCB Chapter 7 AnswerSim Pei Ying100% (1)

- HOUSE Series A Due 2020 Series B Due 2022 and Series C Due 2025 Prospectus 25 Jun 2015Document146 pagesHOUSE Series A Due 2020 Series B Due 2022 and Series C Due 2025 Prospectus 25 Jun 2015jake.m.reynaldo.09No ratings yet

- DRM - Interest Rate FuturesDocument12 pagesDRM - Interest Rate FuturesParv MalikNo ratings yet

- Key Information Document SyntheticIndex ZumamarketsDocument4 pagesKey Information Document SyntheticIndex ZumamarketsCarlos Campuzano CalvoNo ratings yet

- ch10 Kopie PDFDocument19 pagesch10 Kopie PDFaadt91No ratings yet

- CDS JPM1Document1 pageCDS JPM1Dwayne BranchNo ratings yet

- Rfqmjfvpppq-Staging Termsheet-PrelimDocument14 pagesRfqmjfvpppq-Staging Termsheet-PrelimBuchotNo ratings yet

- Bank Failures Will Accelerate in 2010Document4 pagesBank Failures Will Accelerate in 2010ValuEngine.com0% (1)

- Valuation of Bonds NumericalsDocument30 pagesValuation of Bonds NumericalsankitNo ratings yet

- SmartElite19072022 8468161Document3 pagesSmartElite19072022 8468161manishNo ratings yet

- Currency SwapDocument5 pagesCurrency SwapSachin RanadeNo ratings yet

- Asset v1 IMF+FMAx+2T2017+Type@Asset+Block@M1 Assessments ActivityDocument7 pagesAsset v1 IMF+FMAx+2T2017+Type@Asset+Block@M1 Assessments ActivitySmitaNo ratings yet

- Terms and Conditions: Modified Date:16-03-2017Document6 pagesTerms and Conditions: Modified Date:16-03-2017Srinivas KotamarthiNo ratings yet

- Features of MICR ChequeDocument10 pagesFeatures of MICR ChequeAssignment HelperNo ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- AP Practice Test - BreakdownDocument4 pagesAP Practice Test - BreakdowncheyNo ratings yet

- Air Cooled Flooded Screw ChillersDocument50 pagesAir Cooled Flooded Screw ChillersAhmed Sofa100% (1)

- BNVD Eaufrance Metadonnees Vente 20230130Document16 pagesBNVD Eaufrance Metadonnees Vente 20230130moussaouiNo ratings yet

- Kisi-Kisi BHS Inggris-Soal Pas Kelas 8 K13Document6 pagesKisi-Kisi BHS Inggris-Soal Pas Kelas 8 K13Joko PrayitnoNo ratings yet

- CentrifugationDocument10 pagesCentrifugationBk FNo ratings yet

- Science TE804Document15 pagesScience TE804carolynhart_415No ratings yet

- A Movie Recommendation System (Amrs)Document27 pagesA Movie Recommendation System (Amrs)shanmukhaNo ratings yet

- Bolting Chart For Industrial FlangesDocument6 pagesBolting Chart For Industrial FlangesPritam JadhavNo ratings yet

- Wa0004.Document15 pagesWa0004.Sudhir RoyNo ratings yet

- Action ResearchDocument10 pagesAction ResearchNacion EstefanieNo ratings yet

- MTCNA Lab Guide INTRA 1st Edition - Id.en PDFDocument87 pagesMTCNA Lab Guide INTRA 1st Edition - Id.en PDFreyandyNo ratings yet

- Admission LetterDocument7 pagesAdmission Letterduke cyberNo ratings yet

- Activity Sheets Signal WordsDocument15 pagesActivity Sheets Signal WordsGrace Ann EscabarteNo ratings yet

- Commerce EMDocument344 pagesCommerce EMSTAR E WORLDNo ratings yet

- Find Me Phoenix Book 6 Stacey Kennedy Full ChapterDocument67 pagesFind Me Phoenix Book 6 Stacey Kennedy Full Chaptercatherine.anderegg828100% (21)

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- Anesthetic Consideration in Thyroid SurgeryDocument36 pagesAnesthetic Consideration in Thyroid Surgerymaulina13No ratings yet

- Aquamaster 4 Few4 and Fet4: Electromagnetic FlowmeterDocument48 pagesAquamaster 4 Few4 and Fet4: Electromagnetic FlowmeterAmol BorikarNo ratings yet

- Final PDF - To Be Hard BindDocument59 pagesFinal PDF - To Be Hard BindShobhit GuptaNo ratings yet

- Explosion Protection - E PDFDocument7 pagesExplosion Protection - E PDFAPCANo ratings yet

- 38 Parasrampuria Synthetics LTD 20 Sot 248Document5 pages38 Parasrampuria Synthetics LTD 20 Sot 248Chanakya ReddyNo ratings yet

- Error Message Reference: Oracle® Hyperion Tax GovernanceDocument6 pagesError Message Reference: Oracle® Hyperion Tax GovernanceAbayneh AssefaNo ratings yet

- Manual C28 Plus enDocument28 pagesManual C28 Plus enSveto SlNo ratings yet

- Testbank: Applying Ifrs Standards 4eDocument11 pagesTestbank: Applying Ifrs Standards 4eSyed Bilal AliNo ratings yet

- Using Value Stream Mapping To Eliminate Waste A CaDocument19 pagesUsing Value Stream Mapping To Eliminate Waste A CaRoger SalamancaNo ratings yet

- 01 02 BDocument453 pages01 02 BJose VieraNo ratings yet

- 10 Best JobsitesDocument14 pages10 Best JobsitesHemansu PathakNo ratings yet

- SAILOR 6081 Power Supply Unit and Charger: Installation ManualDocument72 pagesSAILOR 6081 Power Supply Unit and Charger: Installation ManualMariosNo ratings yet

- SAP Idoc Steps by Step ConfigDocument7 pagesSAP Idoc Steps by Step Configgirish85No ratings yet

MS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6

MS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6

Uploaded by

crescendo.mskOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6

MS TS24 06 2015 - XS1255042993 - Reoffer94 - 10Y USD STEP-UP COUPON NOTE - Morgan Stanley - PDF 6

Uploaded by

crescendo.mskCopyright:

Available Formats

10Y USD STEP-UP COUPON NOTE

Indicative Terms and Conditions

THE SECURITIES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933 (AS AMENDED) AND

ARE SUBJECT TO U.S. TAX REQUIREMENTS. THE SECURITIES MAY NOT BE OFFERED, SOLD OR DELIVERED AT ANY TIME, DIRECTLY

OR INDIRECTLY, WITHIN THE UNITED STATES OR TO OR FOR THE ACCOUNT OR BENEFIT OF A U.S. PERSON. THE SECURITIES ARE

NOT BANK DEPOSITS AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER

GOVERNMENTAL AGENCY, NOR ARE THEY OBLIGATIONS OF, OR GUARANTEED BY, A BANK. THE SECURITIES ARE NOT RATED

THE NOTES ARE SENIOR UNSECURED OBLIGATIONS OF MORGAN STANLEY, AND ALL PAYMENTS ON

THE NOTES, INCLUDING THE REPAYMENT OF PRINCIPAL, ARE SUBJECT TO THE CREDIT RISK OF

MORGAN STANLEY.

PRIVATE PLACEMENT ONLY. NOT FOR DISTRIBUTION TO U.S. INVESTORS. NO ONWARD DISTRIBUTION EXCEPT IN ACCORDANCE

WITH THE RELEVANT PRIVATE PLACEMENT RESTRICTIONS

Terms used but not defined herein are as defined in the Offering Circular in respect of the Regulation S Programme

for the Issuance of Notes Series A and B, Warrants and Certificates dated 18 August 2014 as supplemented on 29

September 2014 and 28 November 2014 (the “Offering Circular”).

A) PRODUCT DESCRIPTION

The Note pays fixed rate coupons that step up every year. The note is 100% principal protected by the issuer.

PRODUCT DETAILS: DATES:

SSPA Code 1140 – Capital Protection Trade Date 01 July 2015

with Coupon

ISIN XS1255042993 Issue Date 08 July 2015

Valoren TBD Maturity Date 01 July 2025

Issue Price 100.00%

Reoffer 94.00%

Issue Size Up to USD 100,000,000

Settlement Currency USD

Denomination (Par) USD 100,000

Minimum Investment USD 1,000,000

GENERAL INFORMATION:

Issuer Morgan Stanley, The Corporation Trust Center, 1209 Orange Street,

Wilmington, Delaware 19801 USA

Issuer Rating A- (S&P), A3 (Moody´s), A (Fitch)

Supervision of the Issuer Regulated by the Board of Governors of the Federal Reserve System (the

"Federal Reserve") under the Bank Holding Company Act of 1956, as amended

(the "BHC Act").

Dealer and Determination Agent Morgan Stanley & Co. International Plc, 25 Cabot Square, Canary Wharf,

London E14 4QA, United Kingdom (“MSI”)

Issuing and Paying Agent Bank of New York Mellon, One Canada Square, London, E14 5AL, United

Kingdom

This is not an offer (or solicitation of an offer) to buy or sell the product. The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or

for the account or benefit of, any U.S. Person (as defined in Regulation S under the Securities Act). Please refer to the important information at the end of this term sheet. © Copyright

2014 Morgan Stanley.

E-mail: swiss@ms.com Phone: +41 44 220 90 75 www.MorganStanleyIQ.ch

INTEREST:

Interest

1Y: 1.95% p.a.

2Y: 2.15% p.a.

3Y: 2.35% p.a.

4Y: 2.55% p.a.

5Y: 2.75% p.a.

6Y: 2.95% p.a.

7Y: 3.15% p.a.

8Y: 3.35% p.a.

9Y: 3.55% p.a.

10Y: 3.75% p.a.

Interest will be paid annually in arrears on a 30/360 basis, following unadjusted.

Interest Payment Dates Annually from, and including 01 July 2016 (First Interest Payment Date), to and

including, the Maturity Date subject to adjustments in accordance with the

Business Day Convention.

FINAL REDEMPTION AMOUNT:

Redemption amount 100% of Par

FURTHER INFORMATION:

Notices All notices concerning the Notes will be published on the internet on

website www.morganstanleyiq.ch or any successor website hereto

Settlement Type Cash

Business Days a Scheduled Trading Day in respect of the Underlying(s)

Business Day Convention Following, provided that the Maturity Date shall always be at least (5)

Business Days following the Determination Date.

Exercise Details, Exercise Style Not Applicable

Market Making Under normal market conditions, and subject to applicable law and

regulations and Morgan Stanley internal policy, Morgan Stanley & Co.

International plc will use reasonable efforts to quote bid and offer prices.

However, Morgan Stanley & Co. International plc will not be legally

obliged to do so.

Settlement Euroclear International

Listing None

Offer Private Placement in the European Economic Area, distribution to

qualified investors in Switzerland

Type Note

Form Registered

Governing Law, Place Of Jurisdiction English law, the courts of England

Fees In connection with the offer and sale of the Notes, the Issuer or the Dealer

may pay to any intermediary a one time or recurring intermediary fee.

The investor acknowledges and agrees that any such fees will be

retained by the intermediary. Further information is available from the

sales intermediary upon request.

Tax considerations A Non-U.S. holder will be subject to U.S. withholding tax unless the

beneficial owner of the note (or a financial institution holding the note on

This is not an offer (or solicitation of an offer) to buy or sell the product. The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or

for the account or benefit of, any U.S. Person (as defined in Regulation S under the Securities Act). Please refer to the important information at the end of this term sheet. © Copyright

2014 Morgan Stanley.

E-mail: swiss@ms.com Phone: +41 44 220 90 75 www.MorganStanleyIQ.ch

behalf of the beneficial owner) furnishes a Form W-8BEN, on which the

beneficial owner certifies under penalties of perjury that it is not a U.S.

person. If withholding or deduction of taxes is required by law, payments

on the notes will be made net of applicable withholding taxes, and we will

not be required to pay any additional amounts to Non-U.S. holders with

respect to any taxes withheld.

Swiss Tax Treatment The following Swiss tax summary is valid at the time of the issuance of

the product. It is for general information only and does not purport to be

a comprehensive description of all Swiss tax consequences that may be

relevant to a decision to purchase, own or dispose of the product. Swiss

tax laws and the practice of the Swiss tax authorities may change,

possibly with retroactive effect. Prospective Swiss resident, EU resident

and third country resident purchasers of the product should consult their

own tax advisers concerning the tax consequences of purchasing,

holding and disposing of the product in the light of their particular

circumstances.

Withholding tax and stamp duties

This product is not subject to Swiss withholding tax and Swiss stamp

issuance tax. Secondary market transactions concerning the product are

subject to Swiss stamp transfer tax if they are made by or through the

intermediary of a Swiss bank or Swiss securities dealer and no

exemption applies.

Tax Treatment for Swiss resident individuals

This product is classified for Swiss tax purposes as a non-Swiss bond

without a predominantly one-time interest payment (“non-IUP”).

As a result, the interest payments generated by the product are taxable

income at payment date for Swiss resident individual investors. Any

gain on the disposal of the product is tax-free for Swiss resident

individual investors holding the product for private investment purposes.

A capital loss is not tax-deductible.

EU Savings Tax retention

Interests paid by Swiss paying agents to a beneficial owner who is an

EU resident individual are subject to retention of 35% EU Savings Tax

(Telekurs Code 1). The Swiss paying agent may be explicitly authorised

by the beneficial owner of the interest payment to report interest

payments to the Swiss Federal Tax Administration, which will then

substitute the tax retention.

Bilateral agreements Switzerland

For any relevant person resident in a state with whom Switzerland has

concluded an agreement on a final withholding tax

(Abgeltungssteuerabkommen; currently in place with Austria and the

United Kingdom) and provided notes are held in a custody account with

a qualifying Swiss paying agent, any investment income or realised

capital gains might be subject to the final withholding tax as laid out in

the respective bilateral agreement.

For Investors resident in a state with whom Switzerland has concluded a bilateral agreement on a final withholding tax

(currently in place with Austria and the United Kingdom) and provided the product is held in a custody account with a

qualifying Swiss paying agent (deposit bank), any investment income or realised capital gains might be subject to the

final withholding tax as laid out in the respective bilateral agreement. The applicable tax rate depends on the home

country of the investor and the category of capital income or capital gain.

This is not an offer (or solicitation of an offer) to buy or sell the product. The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or

for the account or benefit of, any U.S. Person (as defined in Regulation S under the Securities Act). Please refer to the important information at the end of this term sheet. © Copyright

2014 Morgan Stanley.

E-mail: swiss@ms.com Phone: +41 44 220 90 75 www.MorganStanleyIQ.ch

The tax information is a non-binding summary and only provides a general overview of the potential tax consequences

linked to this Product at the time of issue. Tax laws and tax doctrine may change at any time, possibly with retroactive

effect.

Investors and prospective Investors are advised to consult with their tax advisers with respect to the Swiss tax

consequences of the purchase, ownership, disposition, lapse or exercise or redemption of a Product in light of their

particular circumstances. The Issuing Parties and the Lead Manager hereby expressly exclude any liability in respect of

any possible tax implications.

Updated bondfloor information, if a bondfloor is applicable to the Product (according to “Product Details” and “Taxation

Switzerland” herein), can be found on the following web page of the Swiss Federal Tax Administration (FTA):

www.ictax.admin.ch

B) PROFIT AND LOSS PROSPECTS

Market Expectation The Note is for Investors who target full capital protection at maturity and

want to receive an yearly fixed coupon

Characteristics Please see Product Description

Maximum Profit/Maximum Loss at The potential profit of the Capital Protected Note is limited to the sum of

Maturity the coupons. The Capital Protected Note at maturity repays at least

100% of the invested capital unless the issuer defaults.

C) SIGNIFICANT RISKS FOR INVESTORS

Risk Factors

Potential investors are urged to consult with their legal, regulatory, investment, accounting, tax and other advisors with

regard to any proposed or actual investment in the Notes and to review the Offering Circular. Please see the Offering

Circular together with the Pricing Supplement for a full detailed description of the Notes and in particular, please review

the Risk Factors associated with these Notes. Investing in the Notes entails certain risks including, but not limited to,

the following:

Adjustments by the Determination Agent: The terms and conditions of the Securities will allow the Determination Agent to make

adjustments or take any other appropriate action if circumstances occur where the Securities or any exchanges are affected by

market disruption, adjustment events or circumstances affecting normal activities.

Credit Risk: Investors are exposed to the credit risk of the Issuer.

Exit Risk: Any secondary market price of the Securities will depend on many factors, including the value and volatility

of the Underlying(s), interest rates, the dividend rate on the stocks that compose the Underlying (if any), time remaining

to maturity and the creditworthiness of the Issuer. The secondary market price may be lower than the market value of

the issued Securities as at the Issue Date to take into account amounts paid to distributors and other intermediaries

relating to the issue and sale of the Securities as well as amounts relating to the hedging of the Issuer's obligations. As

a result of all of these factors, the holder may receive an amount in the secondary market which may be less than the

then intrinsic market value of the Security and which may also be less than the amount the holder would have received

had the holder held the Security through to maturity.

Liquidity Risk: Any secondary market in the Securities made by the Dealer will be made on a reasonable efforts basis only and

subject to market conditions, law, regulation and internal policy. Even whilst there may be a secondary market in the Securities it

may not be liquid enough to facilitate a sale by the holders.

Market Risk: Price movements in the Underlying may not correlate with each other. Increases in the value of the

Underlying may be moderated, or wholly offset, by lesser increases or declines in the value of one or more of the other

components.

This is not an offer (or solicitation of an offer) to buy or sell the product. The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or

for the account or benefit of, any U.S. Person (as defined in Regulation S under the Securities Act). Please refer to the important information at the end of this term sheet. © Copyright

2014 Morgan Stanley.

E-mail: swiss@ms.com Phone: +41 44 220 90 75 www.MorganStanleyIQ.ch

Potential Conflict of Interest: The Determination Agent, which is an affiliate of the Issuer, will determine the payout to the investor

at maturity. Morgan Stanley & Co. International plc and its affiliates may trade the Underlying on a regular basis as part of its general

broker-dealer business and may also carry out hedging activities in relation to the Securities. Any of these activities could influence

the Determination Agent’s determination of adjustments made to any Securities and any such trading activity could potentially affect

the price of the Underlying and, accordingly, could affect the investor’s payout on any Security.

FURTHER INFORMATION

Selling Restrictions

No public offering of the Notes, or possession or distribution of any offering material in relation thereto, is permitted in

any jurisdiction where action for that purpose is required unless the relevant action has been taken. The Notes must

not be offered or sold in any jurisdiction except to persons whose investment activities involve them in acquiring, holding,

managing or disposing (as principal or agent) of investments of a nature similar to the Notes and who are particularly

knowledgeable in investment matters. In each member state of the European Economic Area which has implemented

the Prospectus Directive (Directive 2003/71/EC, as amended), no offer of the Notes to the public (as defined for the

purposes of such Directive and any implementing measures in any such member state) may be made, except in

circumstances which do not result in any breach of such Directive and any such implementing measures by the offeror

or the Issuer, the Dealer and their respective affiliates and for this purpose an offer shall not be treated as not requiring

the publication of a prospectus pursuant to Article 3 of the Prospectus Directive, or any corresponding provision of any

such implementing measures solely by virtue of the application of Article 3(2)(b) (offer to fewer than 150 persons) or

any corresponding provision of any such implementing measures.

Investor Representations

Any investment in the product made with the intention to offer, sell or otherwise transfer (together, “distribute” and each a “distribution”) such product

to prospective investors will be deemed to include, without limitation, the following representations, undertakings and acknowledgements:

a) you shall only distribute as principal or, alternatively, acting on a commission basis in your own name for the account of your investors and will

not do so as agent for any Morgan Stanley entity (together “Morgan Stanley”) who shall assume no responsibility or liability whatsoever in relation

to any such distribution. You shall distribute the product in your own name and to such customers as you identify in your own discretion, at your

own risk and under your sole responsibility. You shall make such enquiries you deem relevant in order to satisfy yourself that prospective

investors have the requisite capacity and authority to purchase the product and that the product is suitable for those investors;

b) you shall not make any representation or offer any warranty to investors regarding the product, the Issuer or Morgan Stanley or make any use

of the Issuer’s or Morgan Stanley’s name, brand or intellectual property which is not expressly authorised and you shall not represent you are

acting as an agent of Morgan Stanley in such distribution. You acknowledge that neither the Issuer nor Morgan Stanley assume any

responsibility or liability whatsoever in relation to any representation or warranty you make in breach hereof;

c) if you distribute any material prepared and transmitted by the Issuer or by Morgan Stanley, you shall only distribute the entire material and not

parts thereof. Any material you, or any third party you engage on your behalf, prepare shall be true and accurate in all material respects and

consistent in all material respects with the content of the Offering Circular and the Pricing Supplement and shall not contain any omissions that

would make them misleading. You shall only prepare and distribute such material in accordance with all applicable laws, regulations, codes,

directives, orders and/or regulatory requirements, rules and guidance in force from time to time (“Regulations”). You acknowledge that neither

the Issuer nor Morgan Stanley shall have any liability in respect of such material which shall, for the avoidance of doubt, at all times be your sole

responsibility;

d) you will not, directly or indirectly, distribute or arrange the distribution of the product or disseminate or publish (which for the avoidance of doubt

will include the dissemination of any such materials or information via the internet) any materials or carry out any type of solicitation in connection

with the product in any country or jurisdiction, except under circumstances that will result in compliance with all applicable Regulations and

selling practices, and will not give rise to any liability for the Issuer or Morgan Stanley. For the avoidance of doubt, this includes compliance with

the selling restrictions mentioned herein;

e) if you receive any fee, rebate or discount, you shall not be in breach of any Regulation or customer or contractual requirements or obligations

and you shall, where required to do so (whether by any applicable Regulation, contract, fiduciary obligation or otherwise), disclose such fees,

rebates and discounts to your investors. You acknowledge that where fees are payable, or rebates or discounts applied, the Issuer and Morgan

Stanley are obliged to disclose the amounts and/or basis of such fees, rebates or discounts at the request of any of your investors or where

required by any applicable Regulations.

f) you will be committed to purchase at the issue price stated in the term sheet (or at the price otherwise agreed between us) instruments, when

issued, in the agreed quantity and having terms, as provided in the definitive documentation, consistent with those in this term sheet (subject to

any modifications agreed between us);

g) you are not purchasing the Notes as an extension of credit to Morgan Stanley pursuant to a loan agreement entered into in the ordinary course

of your trade or business;

This is not an offer (or solicitation of an offer) to buy or sell the product. The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or

for the account or benefit of, any U.S. Person (as defined in Regulation S under the Securities Act). Please refer to the important information at the end of this term sheet. © Copyright

2014 Morgan Stanley.

E-mail: swiss@ms.com Phone: +41 44 220 90 75 www.MorganStanleyIQ.ch

h) we may enter into hedging or other arrangements in reliance upon your commitment, and, if you fail to comply with your commitment, your

liability to us shall include liability for our costs and losses in unwinding such hedging or other arrangements;

i) you agree and undertake to indemnify and hold harmless and keep indemnified and held harmless the Issuer, the Dealer and each of their

respective affiliates and their respective directors, officers and controlling persons from and against any and all losses, actions, claims, damages

and liabilities (including without limitation any fines or penalties and any legal or other expenses incurred in connection with defending or

investigating any such action or claim) caused directly or indirectly by you or any of your affiliates or agents to comply with any of the provisions

set out in (a) to (h) above, or acting otherwise than as required or contemplated herein.

YOU AGREE THAT THE REPRESENTATIONS, UNDERTAKINGS AND ACKNOWLEDGEMENTS IN THIS DOCUMENT ARE BINDING ON YOU

WITH RETROSPECTIVE EFFECTS AS OF THE TRADE DATE.

To the extent there is any conflict between these deemed representations and warranties and any terms included in a signed distribution agreement

between us, the terms of such distribution agreement shall apply.

Important Information

THIS COMMUNICATION IS DIRECTED TO THOSE PERSONS WHO ARE ELIGIBLE COUNTERPARTIES OR PROFESSIONAL CLIENTS (AS

DEFINED IN EU DIRECTIVE 2004/39/EC) OR, IN SWITZERLAND, ARE QUALIFIED INVESTORS AS THIS TERMS IS DEFINED UNDER CISA.

Morgan Stanley is not qualified to give legal, tax or accounting advice to its clients and does not purport to do so in this document. Clients are urged

to seek the advice of their own professional advisers about the consequences of the proposals contained herein.

US Treasury Circular 230 Notice - Morgan Stanley does not render advice on tax and tax accounting matters to clients. This material was not intended

or written to be used, and it cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer under U.S.

federal tax laws.

This is not an offer (or solicitation of an offer) to buy or sell the product. The product may not be offered, sold, transferred or delivered directly or indirectly in the United States to, or

for the account or benefit of, any U.S. Person (as defined in Regulation S under the Securities Act). Please refer to the important information at the end of this term sheet. © Copyright

2014 Morgan Stanley.

E-mail: swiss@ms.com Phone: +41 44 220 90 75 www.MorganStanleyIQ.ch

You might also like

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- Handout 5Document2 pagesHandout 5DelishaNo ratings yet

- EOC08 UpdatedDocument25 pagesEOC08 Updatedtaha elbakkushNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocument25 pagesSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MNo ratings yet

- Minutes of Finance Commitee Meeting Held 6th February 2021.editedDocument5 pagesMinutes of Finance Commitee Meeting Held 6th February 2021.editedAmanda EjusNo ratings yet

- Sara SinDocument3 pagesSara Sinbalaji.79No ratings yet

- The Goldman Sachs Group - 20150610 - ISIN - 10y - USD - FRN (Tranche) - 1 01Document5 pagesThe Goldman Sachs Group - 20150610 - ISIN - 10y - USD - FRN (Tranche) - 1 01crescendo.mskNo ratings yet

- Global Macro Commentary July 14Document2 pagesGlobal Macro Commentary July 14dpbasicNo ratings yet

- February 10, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorDocument5 pagesFebruary 10, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorChrispy DuckNo ratings yet

- Práctica Dirigida 3 2021Document5 pagesPráctica Dirigida 3 2021Winny Vento HerreraNo ratings yet

- Essential Guide To Stock InvestingDocument19 pagesEssential Guide To Stock Investingleorbalaguru100% (1)

- Iridian 3Q10 LetterDocument15 pagesIridian 3Q10 LetterHariharan SundaresanNo ratings yet

- 53na595066 E01 PDFDocument15 pages53na595066 E01 PDFRamesh ChandNo ratings yet

- Isbo Gic Terms and Conditions enDocument2 pagesIsbo Gic Terms and Conditions enKrishna PrasadNo ratings yet

- The Best Instrument Against Currency Risk.Document13 pagesThe Best Instrument Against Currency Risk.Hanane KoyakoNo ratings yet

- Cibc 5-Year GicDocument3 pagesCibc 5-Year GicSalimah ArabNo ratings yet

- Home Day Trading Technical Analysis Stocks Options Bonds Personal Finance Free Offers Scottrade: $7 Online Stock TradesDocument11 pagesHome Day Trading Technical Analysis Stocks Options Bonds Personal Finance Free Offers Scottrade: $7 Online Stock Tradesganesh061No ratings yet

- Transaction ExposureDocument11 pagesTransaction ExposureYash AwasthiNo ratings yet

- BANK3011 Workshop Week 3 SolutionsDocument5 pagesBANK3011 Workshop Week 3 SolutionsZahraaNo ratings yet

- Yield CurveDocument18 pagesYield CurveHaqqul YaqinNo ratings yet

- SMC Fixed RateDocument1 pageSMC Fixed RateKaizen CabralNo ratings yet

- MSDocument36 pagesMSJason WangNo ratings yet

- Need Analysis Summary: Personal Details Financial DetailsDocument17 pagesNeed Analysis Summary: Personal Details Financial DetailsFemilaNo ratings yet

- Wynn Macau, 5.5% 15jan2026, USD - Final - TermsDocument5 pagesWynn Macau, 5.5% 15jan2026, USD - Final - TermsRajendra AvinashNo ratings yet

- 2.1 Recap - Money Markets PDFDocument26 pages2.1 Recap - Money Markets PDFRedNo ratings yet

- EOC08 EdittedDocument12 pagesEOC08 EdittedFilip velico100% (1)

- LBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmaDocument35 pagesLBSIM, New Delhi: - Group 7 Gaurav Gupta Vivek Sharan Amrita Pattnaik Anand Wardhan Srikant SharmazvaibhavNo ratings yet

- Sociedad Química y Minera de Chile: Investor PresentationDocument26 pagesSociedad Química y Minera de Chile: Investor Presentationfrop8857No ratings yet

- Description: Micro Grameen What Ismicro Grameen?Document8 pagesDescription: Micro Grameen What Ismicro Grameen?Saligan DolfNo ratings yet

- Weekly Business Digest 21 October 08Document7 pagesWeekly Business Digest 21 October 08gayathirincNo ratings yet

- Práctica Dirigida 3 2016-IIDocument2 pagesPráctica Dirigida 3 2016-IILeonardo CastilloNo ratings yet

- Treasury Research News Bulletin - 25 October 2013Document2 pagesTreasury Research News Bulletin - 25 October 2013r3iherNo ratings yet

- SC Eoc08Document25 pagesSC Eoc08vanessagreco17No ratings yet

- PercentB Bollinger Bands HighlightsDocument47 pagesPercentB Bollinger Bands Highlightsmimi_mechant67% (6)

- Financial Analysis On British American Tobacco Bangladesh (BAT)Document12 pagesFinancial Analysis On British American Tobacco Bangladesh (BAT)Shoyeb MahmudNo ratings yet

- Econ1102 Week 8Document46 pagesEcon1102 Week 8AAA820100% (1)

- S.no Name of Security Type Amount AllocatedDocument5 pagesS.no Name of Security Type Amount AllocatedMohammad Rehan KhanNo ratings yet

- RCB Fixed Rate and Zero Coupon LTNCDs Due June 2017 PDFDocument130 pagesRCB Fixed Rate and Zero Coupon LTNCDs Due June 2017 PDFVIP CONSUMERNo ratings yet

- V-Chap 4 - Debt PricingDocument26 pagesV-Chap 4 - Debt PricingHải NhưNo ratings yet

- Forex Qs AnsDocument5 pagesForex Qs AnsChoudhristNo ratings yet

- Investment Process: Portfolio ConstructionDocument22 pagesInvestment Process: Portfolio ConstructionÃarthï ArülrãjNo ratings yet

- SSRN Id2200390Document17 pagesSSRN Id2200390AlexNo ratings yet

- CH0137259377Document90 pagesCH0137259377franviNo ratings yet

- CB Chapter 7 AnswerDocument4 pagesCB Chapter 7 AnswerSim Pei Ying100% (1)

- HOUSE Series A Due 2020 Series B Due 2022 and Series C Due 2025 Prospectus 25 Jun 2015Document146 pagesHOUSE Series A Due 2020 Series B Due 2022 and Series C Due 2025 Prospectus 25 Jun 2015jake.m.reynaldo.09No ratings yet

- DRM - Interest Rate FuturesDocument12 pagesDRM - Interest Rate FuturesParv MalikNo ratings yet

- Key Information Document SyntheticIndex ZumamarketsDocument4 pagesKey Information Document SyntheticIndex ZumamarketsCarlos Campuzano CalvoNo ratings yet

- ch10 Kopie PDFDocument19 pagesch10 Kopie PDFaadt91No ratings yet

- CDS JPM1Document1 pageCDS JPM1Dwayne BranchNo ratings yet

- Rfqmjfvpppq-Staging Termsheet-PrelimDocument14 pagesRfqmjfvpppq-Staging Termsheet-PrelimBuchotNo ratings yet

- Bank Failures Will Accelerate in 2010Document4 pagesBank Failures Will Accelerate in 2010ValuEngine.com0% (1)

- Valuation of Bonds NumericalsDocument30 pagesValuation of Bonds NumericalsankitNo ratings yet

- SmartElite19072022 8468161Document3 pagesSmartElite19072022 8468161manishNo ratings yet

- Currency SwapDocument5 pagesCurrency SwapSachin RanadeNo ratings yet

- Asset v1 IMF+FMAx+2T2017+Type@Asset+Block@M1 Assessments ActivityDocument7 pagesAsset v1 IMF+FMAx+2T2017+Type@Asset+Block@M1 Assessments ActivitySmitaNo ratings yet

- Terms and Conditions: Modified Date:16-03-2017Document6 pagesTerms and Conditions: Modified Date:16-03-2017Srinivas KotamarthiNo ratings yet

- Features of MICR ChequeDocument10 pagesFeatures of MICR ChequeAssignment HelperNo ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- AP Practice Test - BreakdownDocument4 pagesAP Practice Test - BreakdowncheyNo ratings yet

- Air Cooled Flooded Screw ChillersDocument50 pagesAir Cooled Flooded Screw ChillersAhmed Sofa100% (1)

- BNVD Eaufrance Metadonnees Vente 20230130Document16 pagesBNVD Eaufrance Metadonnees Vente 20230130moussaouiNo ratings yet

- Kisi-Kisi BHS Inggris-Soal Pas Kelas 8 K13Document6 pagesKisi-Kisi BHS Inggris-Soal Pas Kelas 8 K13Joko PrayitnoNo ratings yet

- CentrifugationDocument10 pagesCentrifugationBk FNo ratings yet

- Science TE804Document15 pagesScience TE804carolynhart_415No ratings yet

- A Movie Recommendation System (Amrs)Document27 pagesA Movie Recommendation System (Amrs)shanmukhaNo ratings yet

- Bolting Chart For Industrial FlangesDocument6 pagesBolting Chart For Industrial FlangesPritam JadhavNo ratings yet

- Wa0004.Document15 pagesWa0004.Sudhir RoyNo ratings yet

- Action ResearchDocument10 pagesAction ResearchNacion EstefanieNo ratings yet

- MTCNA Lab Guide INTRA 1st Edition - Id.en PDFDocument87 pagesMTCNA Lab Guide INTRA 1st Edition - Id.en PDFreyandyNo ratings yet

- Admission LetterDocument7 pagesAdmission Letterduke cyberNo ratings yet

- Activity Sheets Signal WordsDocument15 pagesActivity Sheets Signal WordsGrace Ann EscabarteNo ratings yet

- Commerce EMDocument344 pagesCommerce EMSTAR E WORLDNo ratings yet

- Find Me Phoenix Book 6 Stacey Kennedy Full ChapterDocument67 pagesFind Me Phoenix Book 6 Stacey Kennedy Full Chaptercatherine.anderegg828100% (21)

- 2018 Weekly CalendarDocument3 pages2018 Weekly CalendarFabian FebianoNo ratings yet

- Anesthetic Consideration in Thyroid SurgeryDocument36 pagesAnesthetic Consideration in Thyroid Surgerymaulina13No ratings yet

- Aquamaster 4 Few4 and Fet4: Electromagnetic FlowmeterDocument48 pagesAquamaster 4 Few4 and Fet4: Electromagnetic FlowmeterAmol BorikarNo ratings yet

- Final PDF - To Be Hard BindDocument59 pagesFinal PDF - To Be Hard BindShobhit GuptaNo ratings yet

- Explosion Protection - E PDFDocument7 pagesExplosion Protection - E PDFAPCANo ratings yet

- 38 Parasrampuria Synthetics LTD 20 Sot 248Document5 pages38 Parasrampuria Synthetics LTD 20 Sot 248Chanakya ReddyNo ratings yet

- Error Message Reference: Oracle® Hyperion Tax GovernanceDocument6 pagesError Message Reference: Oracle® Hyperion Tax GovernanceAbayneh AssefaNo ratings yet

- Manual C28 Plus enDocument28 pagesManual C28 Plus enSveto SlNo ratings yet

- Testbank: Applying Ifrs Standards 4eDocument11 pagesTestbank: Applying Ifrs Standards 4eSyed Bilal AliNo ratings yet

- Using Value Stream Mapping To Eliminate Waste A CaDocument19 pagesUsing Value Stream Mapping To Eliminate Waste A CaRoger SalamancaNo ratings yet

- 01 02 BDocument453 pages01 02 BJose VieraNo ratings yet

- 10 Best JobsitesDocument14 pages10 Best JobsitesHemansu PathakNo ratings yet

- SAILOR 6081 Power Supply Unit and Charger: Installation ManualDocument72 pagesSAILOR 6081 Power Supply Unit and Charger: Installation ManualMariosNo ratings yet

- SAP Idoc Steps by Step ConfigDocument7 pagesSAP Idoc Steps by Step Configgirish85No ratings yet