Professional Documents

Culture Documents

AEC 8 & 9 Homeworks

AEC 8 & 9 Homeworks

Uploaded by

Ic Sherenne ValeCopyright:

Available Formats

You might also like

- British Gas Bill SampleDocument2 pagesBritish Gas Bill SampleeBay Trackings20% (5)

- How To Get Cash With Just A Credit Card Number (Works 100%)Document6 pagesHow To Get Cash With Just A Credit Card Number (Works 100%)Pink Ice73% (11)

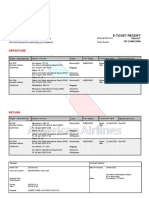

- T.icket Number 157-2340613206Document2 pagesT.icket Number 157-2340613206Samuel Nsiah BoatengNo ratings yet

- Abm Fabm2 Module 6 Lesson 1 Basic Bank Documents and TransactionsDocument20 pagesAbm Fabm2 Module 6 Lesson 1 Basic Bank Documents and TransactionsDark Slayer100% (5)

- Financial Management 16th Edition Chapter 7Document32 pagesFinancial Management 16th Edition Chapter 7drcoolzNo ratings yet

- SOP - Credit Card DeclinedDocument5 pagesSOP - Credit Card DeclinedEstefania Martinez Rodriguez0% (1)

- Fabm 2 SG 12 Q2 0901Document18 pagesFabm 2 SG 12 Q2 0901Tin CabosNo ratings yet

- Group (10) - AUDIT OF CASH AND FINANCIAL INSTRUMENTSDocument19 pagesGroup (10) - AUDIT OF CASH AND FINANCIAL INSTRUMENTSEsti SetianingsihNo ratings yet

- LM Business Finance Q3 WK 3 4 Module 6Document24 pagesLM Business Finance Q3 WK 3 4 Module 6Minimi LovelyNo ratings yet

- Financial Accounting 1 Unit 9Document23 pagesFinancial Accounting 1 Unit 9chuchuNo ratings yet

- Assignment in Chapter 2 - Ando, RejieDocument2 pagesAssignment in Chapter 2 - Ando, RejieRejie AndoNo ratings yet

- Project 01Document54 pagesProject 01Chaitanya FulariNo ratings yet

- Working Capital CashDocument6 pagesWorking Capital CashNiña Rhocel YangcoNo ratings yet

- Cash and Marketable SecuritiesDocument4 pagesCash and Marketable SecuritiesIrish NicolasNo ratings yet

- Financial Management Chap16 William LasherDocument24 pagesFinancial Management Chap16 William LasherMichelle de Guzman100% (3)

- Chapter 3 Cash Flow StatementDocument38 pagesChapter 3 Cash Flow Statementswarna dasNo ratings yet

- B. Cash Flow StatementDocument6 pagesB. Cash Flow Statementrahul jambagiNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFDocument61 pagesFinancial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFthomasowens1asz100% (11)

- FABM2 Q4 Module 2Document23 pagesFABM2 Q4 Module 2Jet Planes100% (1)

- FABM2-MODULE 8 - With ActivitiesDocument7 pagesFABM2-MODULE 8 - With ActivitiesROWENA MARAMBANo ratings yet

- Basic Accounting 2: Fundamentals of Accountancy, Business and ManagementDocument23 pagesBasic Accounting 2: Fundamentals of Accountancy, Business and ManagementShiella PimentelNo ratings yet

- Working Capital ManagmentDocument15 pagesWorking Capital ManagmentTeam PsNo ratings yet

- FMA Project (Cash Flow Statement)Document16 pagesFMA Project (Cash Flow Statement)PowerPoint GoNo ratings yet

- Financial Statements: What Is Financial Statement Analysis?Document17 pagesFinancial Statements: What Is Financial Statement Analysis?GUDDUNo ratings yet

- FABM 2 Module 4Document14 pagesFABM 2 Module 4Gotenk JujuNo ratings yet

- PorterSM03final FinAccDocument60 pagesPorterSM03final FinAccGemini_0804100% (1)

- FIN AC 1 - Module 3Document4 pagesFIN AC 1 - Module 3Ashley ManaliliNo ratings yet

- Petty Cash and Bank ReconcilliationDocument28 pagesPetty Cash and Bank ReconcilliationAnnisya FadillaNo ratings yet

- Yawa PerdDocument8 pagesYawa Perdyawi diskatersNo ratings yet

- (Download PDF) Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions Manual Full ChapterDocument46 pages(Download PDF) Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions Manual Full Chaptergudacvodu100% (7)

- Cash Management - IIFLDocument59 pagesCash Management - IIFLkrishna saiNo ratings yet

- Chapter 2 Cash ManagementDocument37 pagesChapter 2 Cash ManagementTwinkle FernandesNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementSs KkNo ratings yet

- (Download PDF) Foundations of Financial Management Canadian 11th Edition Block Solutions Manual Full ChapterDocument61 pages(Download PDF) Foundations of Financial Management Canadian 11th Edition Block Solutions Manual Full Chapterkofaiabcabc9100% (7)

- G12 Buss Finance W5 LASDocument16 pagesG12 Buss Finance W5 LASEvelyn DeliquinaNo ratings yet

- Fund ManagementDocument47 pagesFund Managementjanine mujeNo ratings yet

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocument14 pagesInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloLindaCruzykeaz100% (86)

- Intermediate Accounting Kieso, Weygandt, and WarfieldDocument23 pagesIntermediate Accounting Kieso, Weygandt, and WarfieldAnis SandikaNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Test Bank Full Chapter PDFDocument57 pagesFinancial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Test Bank Full Chapter PDFchristinecohenceyamrgpkj100% (13)

- 6 - Cash Flow StatementDocument42 pages6 - Cash Flow StatementBhagaban DasNo ratings yet

- s1 Commerce Week 6 & 7 - Loan & OverdraftDocument7 pagess1 Commerce Week 6 & 7 - Loan & OverdraftGodswill OkpolokpoNo ratings yet

- Cash & Internal ControlDocument17 pagesCash & Internal Controlginish12No ratings yet

- 1.2 Introduction To Cash ManagementDocument8 pages1.2 Introduction To Cash Managementasmamatha23No ratings yet

- Banking and Financial Institutions Module5Document14 pagesBanking and Financial Institutions Module5bad genius100% (1)

- Accounitng Lec 2Document3 pagesAccounitng Lec 2Fahomeda Rahman SumoniNo ratings yet

- The Management of Working CapitalDocument16 pagesThe Management of Working Capitalsalehin1969No ratings yet

- BlackbookDocument55 pagesBlackbookYashasvi ShekhawatNo ratings yet

- Chapter 4 PAS 7 Statement of Cash FlowsDocument20 pagesChapter 4 PAS 7 Statement of Cash FlowsSimon RavanaNo ratings yet

- Assignment Banking 3Document9 pagesAssignment Banking 3Al RafiNo ratings yet

- Q1 - Module 6 Tools in Managing Cash Receivables - InventoryDocument10 pagesQ1 - Module 6 Tools in Managing Cash Receivables - InventoryWj Pacadar Alad-adNo ratings yet

- CH 3Document25 pagesCH 3yared gebrewoldNo ratings yet

- Deposit ProcessingDocument5 pagesDeposit ProcessingROKSHANA AKTER POPYNo ratings yet

- Topic 3 Cash, AR, Short Term InvestmentsDocument29 pagesTopic 3 Cash, AR, Short Term InvestmentsHà Trang NguyễnNo ratings yet

- Fundamentals of Accountancy Business and Management 2Document20 pagesFundamentals of Accountancy Business and Management 2MOST SUBSCRIBER WITHOUT A VIDEO43% (7)

- Week 1Document16 pagesWeek 1Hannah CabatcanNo ratings yet

- FABM Week 8 - Bank Accounts, Transactions and DocumentsDocument26 pagesFABM Week 8 - Bank Accounts, Transactions and Documentsvmin친구No ratings yet

- Answers To Bai Giang Goc Anh Cn2 CLCDocument42 pagesAnswers To Bai Giang Goc Anh Cn2 CLCLưu NguyệtNo ratings yet

- Course Materials BAFINMAX Week6Document7 pagesCourse Materials BAFINMAX Week6emmanvillafuerteNo ratings yet

- Part A - Written Responses: Assessment 2Document4 pagesPart A - Written Responses: Assessment 2Chriseth CruzNo ratings yet

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationFem FataleNo ratings yet

- Chapter 8 Financial Reporting and Management Reporting SystemsDocument45 pagesChapter 8 Financial Reporting and Management Reporting SystemsIc Sherenne ValeNo ratings yet

- NROTC Answer KeyDocument5 pagesNROTC Answer KeyIc Sherenne ValeNo ratings yet

- Group 2 AC 101 PresentationDocument22 pagesGroup 2 AC 101 PresentationIc Sherenne ValeNo ratings yet

- Preliminary-Examinations AccountingDocument16 pagesPreliminary-Examinations AccountingIc Sherenne ValeNo ratings yet

- Business Startup CostsDocument7 pagesBusiness Startup CostsTaufik RohmanNo ratings yet

- (English) 5 Truths About Money That Banks Don't Want You To Know (DownSub - Com)Document7 pages(English) 5 Truths About Money That Banks Don't Want You To Know (DownSub - Com)Hoàng Ngọ ChíNo ratings yet

- Account SummaryDocument1 pageAccount Summaryvickyjaiya6No ratings yet

- 001 - Practice Sheet Journal EntriesDocument2 pages001 - Practice Sheet Journal EntriesAnkit SharmaNo ratings yet

- Most Important Terms and ConditionsDocument22 pagesMost Important Terms and ConditionsAnkit PatelNo ratings yet

- Amadeus B2B Wallet Prepaid FAQDocument14 pagesAmadeus B2B Wallet Prepaid FAQRabih AbdoNo ratings yet

- Fillable - PSCC 1090 PAPP FormDocument1 pageFillable - PSCC 1090 PAPP FormxinlianpeterNo ratings yet

- New SchemeDocument452 pagesNew Schememynameislakhan2122No ratings yet

- BSA REVIEW Cash TheoriesDocument4 pagesBSA REVIEW Cash TheorieschristineNo ratings yet

- Foreclosure Letter - 20 - 26 - 49Document3 pagesForeclosure Letter - 20 - 26 - 49B. Srini VasanNo ratings yet

- Circular - Fourth Quarter School Fees Toddlers To Grade XII 4402Document1 pageCircular - Fourth Quarter School Fees Toddlers To Grade XII 4402vsp.jackpotNo ratings yet

- Fabm1 - DiagnosticDocument2 pagesFabm1 - Diagnosticar-jay romeroNo ratings yet

- 55 Chapter 7 PracticeDocument1 page55 Chapter 7 Practicegio gioNo ratings yet

- Film BulletinDocument2 pagesFilm BulletinBernewsNo ratings yet

- Chapter 3-Cash&ReceivablesDocument22 pagesChapter 3-Cash&ReceivablesDr. Mohammad Noor Alam100% (1)

- INFO SHEET 3 - Solving Problems Involving Cash Budget, Bank Deposits Withdrawals, Bank Accounts Bank Reconciliation and Inventory ProfitDocument7 pagesINFO SHEET 3 - Solving Problems Involving Cash Budget, Bank Deposits Withdrawals, Bank Accounts Bank Reconciliation and Inventory ProfitMelody RadiNo ratings yet

- BHC63H ItineraryDocument5 pagesBHC63H ItineraryKinjal SharmaNo ratings yet

- EBOOK6131f1fd1229c Unit 4 Subdivision of A Journal PDFDocument30 pagesEBOOK6131f1fd1229c Unit 4 Subdivision of A Journal PDFYaw Antwi-AddaeNo ratings yet

- Mba Project Report On HDFC BankDocument80 pagesMba Project Report On HDFC BankAbhinav RandevNo ratings yet

- American Culture Lesson PlanDocument6 pagesAmerican Culture Lesson Plansantycz1978No ratings yet

- Mathematics: Interest Rates and FinanceDocument55 pagesMathematics: Interest Rates and FinanceAmr Tarek100% (1)

- Your DetailsDocument2 pagesYour DetailsPragnesh PrajapatiNo ratings yet

- ACC291-Week 1 PresentationDocument133 pagesACC291-Week 1 PresentationJason ThomasNo ratings yet

- 1st PartDocument9 pages1st PartJeyssa YermoNo ratings yet

- Direct Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerDocument2 pagesDirect Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerKelvin WiegersNo ratings yet

- Accounts Revision GuideDocument31 pagesAccounts Revision GuideCandiceNo ratings yet

AEC 8 & 9 Homeworks

AEC 8 & 9 Homeworks

Uploaded by

Ic Sherenne ValeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AEC 8 & 9 Homeworks

AEC 8 & 9 Homeworks

Uploaded by

Ic Sherenne ValeCopyright:

Available Formats

Vale, Ic Sherenne S.

AEC 8 Financial Management

BSAIS Mr. Rudy Talavera

FINALS

HOMEWORK No. 1

Bank Reconciliation

1. Explain the three kinds of bank deposits.

Demand deposit - is money deposited into a bank account with funds that can be

withdrawn on-demand at any time. This deposit is noninterest-bearing.

Saving deposit - is an interest-bearing deposit account held at a bank or other

financial institution. Through passbook, they can make upon initial deposit and

withdrawals.

Time deposit - is an interest-bearing bank account with a fixed term such as

Certificate of Deposit. It may be withdrawn on demand or after a certain period of

time agreed upon.

2. What is bank reconciliation?

is the process by which the bank account balance in an entity’s books of account

is reconciled to the balance reported by the financial institution in the most recent bank

statement. It is usually prepared monthly because the bank provides the depositor with

the bank statement at the end of every month.

3. What is a bank statement?

is an official summary of financial transactions occurring within a given period

for each bank account held by a person or business with a financial institution. It’s an

exact copy of the depositor’s ledger in the records of the bank.

4. What are credit memos? Give examples of credit memos.

It refers to items not representing deposits credited by the bank to the account of

the depositor but not yet recorded by the depositor as cash receipts.

Some examples:

o Proceeds of bank loan credited to the account of the depositor.

o Matured time deposits transferred by the bank to the current account of the

depositor.

5. What are debit memos? Give examples of debit memos.

It refers to items not representing checks paid by the bank which are charged or

debited by the bank to the account of the depositor but not yet recorded by the depositor

as cash disbursement. Some examples:

o Technically defective checks

o Bank service charges

o Reduction of loan

6. What are deposits in transit? Outstanding checks?

Deposits in transit are collections already recorded by the depositor as cash

receipts but not yet reflected on the bank statement. While Outstanding checks are checks

already recorded by the depositor as cash disbursement but not yet reflected on the bank

statement.

7. Define a certified check. What is the treatment of certified checks for bank reconciliation

purposes?

A certified check is one where the bank has stamped on its face the word

‘accepted’ indicating sufficiency of the fund. The treatment of certified checks for bank

reconciliation purposes is certified checks should be deducted from the total outstanding

checks.

8. Explain the three forms of bank reconciliation.

Adjusted balance method – The book balance and the bank balance are brought

to a correct cash balance that must appear on the balance sheet.

Book to bank method – The book balance is reconciled with the bank balance or

the book balance is adjusted to equal the bank balance.

Bank to book method – The bank balance is reconciled with the book balance or

the bank balance is adjusted to equal the book balance.

9. What is proof of cash?

It’s an expanded reconciliation in that it includes proof of receipts and

disbursements. This may be useful in discovering possible discrepancies in handling cash

particularly when cash receipts have been recorded but have not been deposited.

10. Solve Problem nos. 10-1 up to 10-15.

10-1. A 10-6. A 10-11. C

10-2. D 10-7. B 10-12. A

10-3. C 10-8. C 10-13. B

10-4. A 10-9. A 10-14. C

10-5. A 10-10. C 10-15. D

Vale, Ic Sherenne S. AEC 8 Financial Management

BSAIS Mr. Rudy Talavera

FINALS

HOMEWORK No. 2

Statement of Cash Flows

1. What is a statement of cash flows?

It provides information about the cash receipts and cash payments of an entity. This

financial statement explains and summarizes the amount of cash and cash equivalents’ inflow

and outflow of the company or the movements of cash for a year or annually. It’s presented

based on the three major activities of the business which are operating, investing, and financing.

2. Explain the primary purpose of a statement of cash flows.

Its main purpose is to provide relevant information about cash inflows and outflows of an

entity during the period. It also enhances the comparability of operating performance by different

entities. And it’s also purpose is the determination of the cash balance of the entity at some

specific period of time. When we say the cash balance, it contains the details of only the cash

movements of the organization.

3. Define cash.

Cash is money on hand or cash in a bank, it can be coins or currency and we use it as an

exchange for goods and services that we need. In a business transaction, money is the medium

standard of exchange and its legal tender.

4. Define cash equivalents.

Cash equivalent is short-term investment securities with assets, it’s extremely liquid with

temporarily idle cash and easily convertible into a known cash amount. Some examples are

treasury bills, treasury notes, commercial paper, etc.

5. Give examples of cash equivalents.

Three-month BSP Treasury bill

Three-year BSP Treasury bill purchased three months before the date of maturity.

Three-month time deposit

Three-month money market instrument or commercial paper.

6. May equity securities qualify as cash equivalents? Explain.

Since shares do not have a maturity date, equity securities cannot qualify as cash

equivalents. However, preference shares with a specified redemption date and acquired three

months before the redemption date can qualify as cash equivalents.

7. What are the three classifications of cash flows?

Operating

Investing

Financing

8. Explain operating activities.

Operating activities are primarily derived from the main revenue-producing activities of

the business. It also generally results from transactions and other events that enter into the

determination of net income or loss.

9. Explain investing and financing activities.

Investing activities are cash flow derived from cash transactions related to the purchase

or sale of non-current assets and other long-term investments, such as PPE or Plant, Property,

and Equipment. While Financing activities report cash transactions related to changes in equity

and borrowings, it’s also meant to pay back the loan. These activities include transactions that

involve debt, equity, dividends, etc.

10. Solve Problem nos. 1 up to 12.

1. A 7. A

2. C 8. A

3. A 9. D

4. A 10. C

5. 11. C

6. D 12. B

Study well and Goodluck Future CPAs

Vale, Ic Sherenne S. AEC 9 IT Application Tools

BSAIS Mr. Rudy Talavera

FINAL TERM

HOMEWORK No. 1

Chap.28

Fundamentals of Management Information System

1. Distinguish between data and information.

The plural of datum is data, which refers to an unprocessed fact or figure from which a judgment

can be derived. We have information when data is collected and transformed into meaningful

communication. Information, on the other hand, is processed data that is relevant and helpful to users.

2. Explain the objective of MIS and benefits derived therefrom.

The primary objective of the Management Information System is to provide accurate, timely, and

meaningful data for management planning, analysis, control, and decision making to optimize the

performance of the organization. Some advantage of it is better integration-producing activities leads to

information that is more complete, and relevant. Managers are able to search, probe and find answers to

non-recurring questions, and decisions are made more timely due to prompt availability of information.

3. Give the characteristics of an effective MIS.

Relevance – Ability to define and support necessary action by appropriate persons.

Flexibility – adaptable to changing conditions and needs.

Economy – benefits equal exceed costs.

Accuracy – Ratio of correct information to the total amount of information produces over a

period of time.

Completeness – provides all the relevant information needed to make a decision.

Timeliness – response interval does not impair the opportunity to take action.

4. Enumerate the activities involved in the development of a firm's MIS.

Define the main and secondary goals and their priorities.

Identify those factors that are critical to the success of each goal.

Design a system’s structure to achieve the desired goals and priorities.

Implement the system.

Monitor and control the system.

5. Define Management Information System

It is defined as the process of providing information to decision-makers in order for them to make

and implement the appropriate decisions to maximize the interrelationships of available resources in order

to achieve the organization's objectives as effectively as possible.

Chapter 32

Information System Audit

1. How can inadequate controls in a computer system lead to incorrect decision-making?

Because uncontrolled use of computers can have a widespread impact on society, and also

inaccurate information could cause wrong decisions or erroneous choices, and fraud.

2. Why is there a need for control and audit of the computer system.?

Because it might lead to misallocation of resources due to decisions based on incorrect data, and

also the consequences and costs when data is lost. Computer abuse or fraud might also encounter in a

computer system.

3. What are the implications of a company losing its:

a. Personnel master file?

Personnel is always a valuable resource particularly in light of an ongoing scarcity of

well-trained computer professionals in many countries. Intentional or unintentional loss of data

can cause disruption and multimillion peso investments.

b. Inventory master file?

If the software is destroyed, operations will be disrupted and any confidential information

could be disclosed to competitors. If the software is a proprietary package, lost revenues and

lawsuits could arise due to the loss of confidential files.

4. Why are control still needed to protect hardware, software, and personnel, even though

substantial insurance coverage might have been taken out by an organization?

Because it’s still not enough. Like all assets, they must be protected by a system of internal

control, since hardware can be damaged maliciously, software and important data files can be stolen, and

supplies can be used for unauthorized purposes.

5. What are the major assets in an information system facility.

Hardware

Software

Facilities

People

Data files

System documentation

Supplies

6. Define data integrity.

In information system auditing, data integrity is a basic notion. It's a state wherein data is

assumed to have particular qualities including completeness, soundness, purity, and truthfulness or

veracity.

7. What factors affect the importance of data integrity to an organization?

The value of the informational content of the data item for individual decision-makers.

The extent to which the data item is shared among decision-makers

The value of the data item to competitors

Study well. Goodluck Future CPAs

You might also like

- British Gas Bill SampleDocument2 pagesBritish Gas Bill SampleeBay Trackings20% (5)

- How To Get Cash With Just A Credit Card Number (Works 100%)Document6 pagesHow To Get Cash With Just A Credit Card Number (Works 100%)Pink Ice73% (11)

- T.icket Number 157-2340613206Document2 pagesT.icket Number 157-2340613206Samuel Nsiah BoatengNo ratings yet

- Abm Fabm2 Module 6 Lesson 1 Basic Bank Documents and TransactionsDocument20 pagesAbm Fabm2 Module 6 Lesson 1 Basic Bank Documents and TransactionsDark Slayer100% (5)

- Financial Management 16th Edition Chapter 7Document32 pagesFinancial Management 16th Edition Chapter 7drcoolzNo ratings yet

- SOP - Credit Card DeclinedDocument5 pagesSOP - Credit Card DeclinedEstefania Martinez Rodriguez0% (1)

- Fabm 2 SG 12 Q2 0901Document18 pagesFabm 2 SG 12 Q2 0901Tin CabosNo ratings yet

- Group (10) - AUDIT OF CASH AND FINANCIAL INSTRUMENTSDocument19 pagesGroup (10) - AUDIT OF CASH AND FINANCIAL INSTRUMENTSEsti SetianingsihNo ratings yet

- LM Business Finance Q3 WK 3 4 Module 6Document24 pagesLM Business Finance Q3 WK 3 4 Module 6Minimi LovelyNo ratings yet

- Financial Accounting 1 Unit 9Document23 pagesFinancial Accounting 1 Unit 9chuchuNo ratings yet

- Assignment in Chapter 2 - Ando, RejieDocument2 pagesAssignment in Chapter 2 - Ando, RejieRejie AndoNo ratings yet

- Project 01Document54 pagesProject 01Chaitanya FulariNo ratings yet

- Working Capital CashDocument6 pagesWorking Capital CashNiña Rhocel YangcoNo ratings yet

- Cash and Marketable SecuritiesDocument4 pagesCash and Marketable SecuritiesIrish NicolasNo ratings yet

- Financial Management Chap16 William LasherDocument24 pagesFinancial Management Chap16 William LasherMichelle de Guzman100% (3)

- Chapter 3 Cash Flow StatementDocument38 pagesChapter 3 Cash Flow Statementswarna dasNo ratings yet

- B. Cash Flow StatementDocument6 pagesB. Cash Flow Statementrahul jambagiNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFDocument61 pagesFinancial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFthomasowens1asz100% (11)

- FABM2 Q4 Module 2Document23 pagesFABM2 Q4 Module 2Jet Planes100% (1)

- FABM2-MODULE 8 - With ActivitiesDocument7 pagesFABM2-MODULE 8 - With ActivitiesROWENA MARAMBANo ratings yet

- Basic Accounting 2: Fundamentals of Accountancy, Business and ManagementDocument23 pagesBasic Accounting 2: Fundamentals of Accountancy, Business and ManagementShiella PimentelNo ratings yet

- Working Capital ManagmentDocument15 pagesWorking Capital ManagmentTeam PsNo ratings yet

- FMA Project (Cash Flow Statement)Document16 pagesFMA Project (Cash Flow Statement)PowerPoint GoNo ratings yet

- Financial Statements: What Is Financial Statement Analysis?Document17 pagesFinancial Statements: What Is Financial Statement Analysis?GUDDUNo ratings yet

- FABM 2 Module 4Document14 pagesFABM 2 Module 4Gotenk JujuNo ratings yet

- PorterSM03final FinAccDocument60 pagesPorterSM03final FinAccGemini_0804100% (1)

- FIN AC 1 - Module 3Document4 pagesFIN AC 1 - Module 3Ashley ManaliliNo ratings yet

- Petty Cash and Bank ReconcilliationDocument28 pagesPetty Cash and Bank ReconcilliationAnnisya FadillaNo ratings yet

- Yawa PerdDocument8 pagesYawa Perdyawi diskatersNo ratings yet

- (Download PDF) Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions Manual Full ChapterDocument46 pages(Download PDF) Financial Accounting Reporting Analysis and Decision Making 5th Edition Carlon Solutions Manual Full Chaptergudacvodu100% (7)

- Cash Management - IIFLDocument59 pagesCash Management - IIFLkrishna saiNo ratings yet

- Chapter 2 Cash ManagementDocument37 pagesChapter 2 Cash ManagementTwinkle FernandesNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementSs KkNo ratings yet

- (Download PDF) Foundations of Financial Management Canadian 11th Edition Block Solutions Manual Full ChapterDocument61 pages(Download PDF) Foundations of Financial Management Canadian 11th Edition Block Solutions Manual Full Chapterkofaiabcabc9100% (7)

- G12 Buss Finance W5 LASDocument16 pagesG12 Buss Finance W5 LASEvelyn DeliquinaNo ratings yet

- Fund ManagementDocument47 pagesFund Managementjanine mujeNo ratings yet

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocument14 pagesInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloLindaCruzykeaz100% (86)

- Intermediate Accounting Kieso, Weygandt, and WarfieldDocument23 pagesIntermediate Accounting Kieso, Weygandt, and WarfieldAnis SandikaNo ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Test Bank Full Chapter PDFDocument57 pagesFinancial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Test Bank Full Chapter PDFchristinecohenceyamrgpkj100% (13)

- 6 - Cash Flow StatementDocument42 pages6 - Cash Flow StatementBhagaban DasNo ratings yet

- s1 Commerce Week 6 & 7 - Loan & OverdraftDocument7 pagess1 Commerce Week 6 & 7 - Loan & OverdraftGodswill OkpolokpoNo ratings yet

- Cash & Internal ControlDocument17 pagesCash & Internal Controlginish12No ratings yet

- 1.2 Introduction To Cash ManagementDocument8 pages1.2 Introduction To Cash Managementasmamatha23No ratings yet

- Banking and Financial Institutions Module5Document14 pagesBanking and Financial Institutions Module5bad genius100% (1)

- Accounitng Lec 2Document3 pagesAccounitng Lec 2Fahomeda Rahman SumoniNo ratings yet

- The Management of Working CapitalDocument16 pagesThe Management of Working Capitalsalehin1969No ratings yet

- BlackbookDocument55 pagesBlackbookYashasvi ShekhawatNo ratings yet

- Chapter 4 PAS 7 Statement of Cash FlowsDocument20 pagesChapter 4 PAS 7 Statement of Cash FlowsSimon RavanaNo ratings yet

- Assignment Banking 3Document9 pagesAssignment Banking 3Al RafiNo ratings yet

- Q1 - Module 6 Tools in Managing Cash Receivables - InventoryDocument10 pagesQ1 - Module 6 Tools in Managing Cash Receivables - InventoryWj Pacadar Alad-adNo ratings yet

- CH 3Document25 pagesCH 3yared gebrewoldNo ratings yet

- Deposit ProcessingDocument5 pagesDeposit ProcessingROKSHANA AKTER POPYNo ratings yet

- Topic 3 Cash, AR, Short Term InvestmentsDocument29 pagesTopic 3 Cash, AR, Short Term InvestmentsHà Trang NguyễnNo ratings yet

- Fundamentals of Accountancy Business and Management 2Document20 pagesFundamentals of Accountancy Business and Management 2MOST SUBSCRIBER WITHOUT A VIDEO43% (7)

- Week 1Document16 pagesWeek 1Hannah CabatcanNo ratings yet

- FABM Week 8 - Bank Accounts, Transactions and DocumentsDocument26 pagesFABM Week 8 - Bank Accounts, Transactions and Documentsvmin친구No ratings yet

- Answers To Bai Giang Goc Anh Cn2 CLCDocument42 pagesAnswers To Bai Giang Goc Anh Cn2 CLCLưu NguyệtNo ratings yet

- Course Materials BAFINMAX Week6Document7 pagesCourse Materials BAFINMAX Week6emmanvillafuerteNo ratings yet

- Part A - Written Responses: Assessment 2Document4 pagesPart A - Written Responses: Assessment 2Chriseth CruzNo ratings yet

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationFem FataleNo ratings yet

- Chapter 8 Financial Reporting and Management Reporting SystemsDocument45 pagesChapter 8 Financial Reporting and Management Reporting SystemsIc Sherenne ValeNo ratings yet

- NROTC Answer KeyDocument5 pagesNROTC Answer KeyIc Sherenne ValeNo ratings yet

- Group 2 AC 101 PresentationDocument22 pagesGroup 2 AC 101 PresentationIc Sherenne ValeNo ratings yet

- Preliminary-Examinations AccountingDocument16 pagesPreliminary-Examinations AccountingIc Sherenne ValeNo ratings yet

- Business Startup CostsDocument7 pagesBusiness Startup CostsTaufik RohmanNo ratings yet

- (English) 5 Truths About Money That Banks Don't Want You To Know (DownSub - Com)Document7 pages(English) 5 Truths About Money That Banks Don't Want You To Know (DownSub - Com)Hoàng Ngọ ChíNo ratings yet

- Account SummaryDocument1 pageAccount Summaryvickyjaiya6No ratings yet

- 001 - Practice Sheet Journal EntriesDocument2 pages001 - Practice Sheet Journal EntriesAnkit SharmaNo ratings yet

- Most Important Terms and ConditionsDocument22 pagesMost Important Terms and ConditionsAnkit PatelNo ratings yet

- Amadeus B2B Wallet Prepaid FAQDocument14 pagesAmadeus B2B Wallet Prepaid FAQRabih AbdoNo ratings yet

- Fillable - PSCC 1090 PAPP FormDocument1 pageFillable - PSCC 1090 PAPP FormxinlianpeterNo ratings yet

- New SchemeDocument452 pagesNew Schememynameislakhan2122No ratings yet

- BSA REVIEW Cash TheoriesDocument4 pagesBSA REVIEW Cash TheorieschristineNo ratings yet

- Foreclosure Letter - 20 - 26 - 49Document3 pagesForeclosure Letter - 20 - 26 - 49B. Srini VasanNo ratings yet

- Circular - Fourth Quarter School Fees Toddlers To Grade XII 4402Document1 pageCircular - Fourth Quarter School Fees Toddlers To Grade XII 4402vsp.jackpotNo ratings yet

- Fabm1 - DiagnosticDocument2 pagesFabm1 - Diagnosticar-jay romeroNo ratings yet

- 55 Chapter 7 PracticeDocument1 page55 Chapter 7 Practicegio gioNo ratings yet

- Film BulletinDocument2 pagesFilm BulletinBernewsNo ratings yet

- Chapter 3-Cash&ReceivablesDocument22 pagesChapter 3-Cash&ReceivablesDr. Mohammad Noor Alam100% (1)

- INFO SHEET 3 - Solving Problems Involving Cash Budget, Bank Deposits Withdrawals, Bank Accounts Bank Reconciliation and Inventory ProfitDocument7 pagesINFO SHEET 3 - Solving Problems Involving Cash Budget, Bank Deposits Withdrawals, Bank Accounts Bank Reconciliation and Inventory ProfitMelody RadiNo ratings yet

- BHC63H ItineraryDocument5 pagesBHC63H ItineraryKinjal SharmaNo ratings yet

- EBOOK6131f1fd1229c Unit 4 Subdivision of A Journal PDFDocument30 pagesEBOOK6131f1fd1229c Unit 4 Subdivision of A Journal PDFYaw Antwi-AddaeNo ratings yet

- Mba Project Report On HDFC BankDocument80 pagesMba Project Report On HDFC BankAbhinav RandevNo ratings yet

- American Culture Lesson PlanDocument6 pagesAmerican Culture Lesson Plansantycz1978No ratings yet

- Mathematics: Interest Rates and FinanceDocument55 pagesMathematics: Interest Rates and FinanceAmr Tarek100% (1)

- Your DetailsDocument2 pagesYour DetailsPragnesh PrajapatiNo ratings yet

- ACC291-Week 1 PresentationDocument133 pagesACC291-Week 1 PresentationJason ThomasNo ratings yet

- 1st PartDocument9 pages1st PartJeyssa YermoNo ratings yet

- Direct Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerDocument2 pagesDirect Debit Instruction: This Guarantee Should Be Detached and Retained by The PayerKelvin WiegersNo ratings yet

- Accounts Revision GuideDocument31 pagesAccounts Revision GuideCandiceNo ratings yet