Professional Documents

Culture Documents

Indonesian Meat Processing Industry - Jakarta - Indonesia - 12-10-1999

Indonesian Meat Processing Industry - Jakarta - Indonesia - 12-10-1999

Uploaded by

Hans LangoCopyright:

Available Formats

You might also like

- Consumo Carne JaponDocument7 pagesConsumo Carne JaponVictor Josue Flores100% (1)

- TX200 Service ManualDocument132 pagesTX200 Service Manualalexis acevedo100% (5)

- Operational Manual of Model ButcheryDocument21 pagesOperational Manual of Model ButcherySoiab Khan100% (1)

- Pakan - Final Indonesia ReportDocument51 pagesPakan - Final Indonesia ReportPatricia NorevaNo ratings yet

- Pangasius Sp. - N.B. Rathod, Et Al PDFDocument15 pagesPangasius Sp. - N.B. Rathod, Et Al PDFDewi SetiyowatiNo ratings yet

- Feasibility Study Native ChickenDocument17 pagesFeasibility Study Native Chickenoy88% (16)

- SAI VRAT STORY KathaDocument2 pagesSAI VRAT STORY KathaRohit100% (2)

- JSA Template 2017-05-30 Powder Actuated ToolsDocument19 pagesJSA Template 2017-05-30 Powder Actuated ToolsJayvee Baradas Valdez100% (2)

- Indian Meat MarketDocument5 pagesIndian Meat MarketomkarkaromNo ratings yet

- Efisiensi Dan Nilai Ekonomi Daging Sapi Untuk Potongan Pasar Tradisional Berdasarkan Potongan Komersial Yang BerbedaDocument5 pagesEfisiensi Dan Nilai Ekonomi Daging Sapi Untuk Potongan Pasar Tradisional Berdasarkan Potongan Komersial Yang BerbedaRidho ZiskaNo ratings yet

- Meat & Meat Products Technology Including Poultry Products TechnDocument151 pagesMeat & Meat Products Technology Including Poultry Products TechnVoll EntertainmentNo ratings yet

- Indian Meat IndustryDocument26 pagesIndian Meat Industrychiragkaushik558No ratings yet

- Technical Articles: Indian Meat Industry: Opportunities and ChallengesDocument6 pagesTechnical Articles: Indian Meat Industry: Opportunities and ChallengesKarthic C MNo ratings yet

- Beef Substitution DevelopmentDocument6 pagesBeef Substitution DevelopmentRani YuliaNo ratings yet

- Goan Sausages ExportsDocument22 pagesGoan Sausages ExportsZico RodriguesNo ratings yet

- Fish FarmingDocument13 pagesFish FarmingmatsumotoNo ratings yet

- Impact of Covid 19 On Poultry-FinalDocument6 pagesImpact of Covid 19 On Poultry-FinalnasirNo ratings yet

- Value Added Meat ProductsDocument2 pagesValue Added Meat Productseditorveterinaryworld100% (2)

- Poultry SectorDocument29 pagesPoultry SectorPakSci MissionNo ratings yet

- Group3 - Organic Pig Production - Feasibility Study)Document38 pagesGroup3 - Organic Pig Production - Feasibility Study)Madelyn Arimado100% (1)

- GAIN Report: Indonesia Grain and Feed Feed Situation 2007Document8 pagesGAIN Report: Indonesia Grain and Feed Feed Situation 2007Aji GunawanNo ratings yet

- India: Report CategoriesDocument6 pagesIndia: Report Categoriesabhiraj roushanNo ratings yet

- Export Potential Analysis of Indian Meat IndustryDocument86 pagesExport Potential Analysis of Indian Meat IndustrymaxtheswainNo ratings yet

- Pandemic Impact On Frozen Foods MarketDocument5 pagesPandemic Impact On Frozen Foods MarketP. Rajan MATHEWSNo ratings yet

- Swine Microproject Final Manuscript (Giebon Quiros)Document40 pagesSwine Microproject Final Manuscript (Giebon Quiros)GIEBON QUIROSNo ratings yet

- Final PropasalbarasaDocument31 pagesFinal PropasalbarasaKeita VictorNo ratings yet

- Meat and Meat Products Technology Including Poultry Products Technology PDFDocument76 pagesMeat and Meat Products Technology Including Poultry Products Technology PDFDhanya M AlexNo ratings yet

- Asm 1 - IndividualDocument9 pagesAsm 1 - IndividualLeeAnnNo ratings yet

- Article A - Can A Country With No Livestock Become A Meat ProducerDocument3 pagesArticle A - Can A Country With No Livestock Become A Meat Producerlijianxi710No ratings yet

- Business Plan Outline - 1Document11 pagesBusiness Plan Outline - 1Ruel PeneyraNo ratings yet

- Slaughter House PrefeasibilityDocument39 pagesSlaughter House PrefeasibilityOmer Farooq100% (2)

- Indian Meat Industry: Opportunities and Challenges: January 2011Document7 pagesIndian Meat Industry: Opportunities and Challenges: January 2011satyajitNo ratings yet

- Pakistan Meat Sector Scope & Challenges-1Document16 pagesPakistan Meat Sector Scope & Challenges-1shakeel ahmad100% (1)

- TextDocument5 pagesTextLorie Ann Mercado LicupNo ratings yet

- Indian Meat IndustryDocument7 pagesIndian Meat IndustrysatyajitNo ratings yet

- Analysis of Supply and Demand of Broiler Chicken Meat in Bali ProvinceDocument9 pagesAnalysis of Supply and Demand of Broiler Chicken Meat in Bali ProvinceMc Alryn PatindolNo ratings yet

- IARPCoop CHICKEN-FARM-BUSINESS-PLAN r2Document6 pagesIARPCoop CHICKEN-FARM-BUSINESS-PLAN r2kingjam dimacaling2019100% (1)

- Final Fs 2Document23 pagesFinal Fs 2Markgil Gapunuan MalabananNo ratings yet

- E213946 PDFDocument8 pagesE213946 PDFmuditkalra90No ratings yet

- Emerging Supply Chain of Pork and The Opportunities For Small-Scale Raisers in A Countryside City, in The PhilippinesDocument92 pagesEmerging Supply Chain of Pork and The Opportunities For Small-Scale Raisers in A Countryside City, in The PhilippinesAmanNo ratings yet

- KACGAP BMCupdate Nov2021Document11 pagesKACGAP BMCupdate Nov2021Hy Tham CabigtingNo ratings yet

- Fanijo Poultry-Fesibility Study and Posible OutcomeDocument51 pagesFanijo Poultry-Fesibility Study and Posible OutcomeSamuel Fanijo100% (2)

- Usaha Kerupuk Ikan LeleDocument11 pagesUsaha Kerupuk Ikan LeleKelik Dwi BudiartoNo ratings yet

- Suguna Revisied 1Document37 pagesSuguna Revisied 1Girish JhaNo ratings yet

- Agribusiness ManagementDocument20 pagesAgribusiness Managementronald_leabresNo ratings yet

- Lean Finely Textured Beef: The "Pink Slime" Controversy: Joel L. GreeneDocument15 pagesLean Finely Textured Beef: The "Pink Slime" Controversy: Joel L. GreenePlatemagazineNo ratings yet

- Rabbit Farming: A Project Feasibility Study On An Urban Farming Project in Barangay San Juan, Antipolo CityDocument21 pagesRabbit Farming: A Project Feasibility Study On An Urban Farming Project in Barangay San Juan, Antipolo CityErman Deano100% (1)

- AECO121 BroilerDocument6 pagesAECO121 BroilerStephanie Nicole CruzNo ratings yet

- Angeles MeatProcessingDocument38 pagesAngeles MeatProcessingAnonymous gO6PtzXa6No ratings yet

- Broiler Production Business PlanDocument13 pagesBroiler Production Business Planchikondi.mtande25No ratings yet

- Cheese in Indonesia 2019Document9 pagesCheese in Indonesia 2019Su GitoNo ratings yet

- Piggery Value ChainDocument23 pagesPiggery Value ChainPrince Oludare AkintolaNo ratings yet

- Tocarea Carnii, Totul Despre Cirnat EngDocument266 pagesTocarea Carnii, Totul Despre Cirnat EngRinula16No ratings yet

- Indian Meat Industry - Media India GroupDocument7 pagesIndian Meat Industry - Media India GroupKrishnakumar KNo ratings yet

- Module 2 Lesson 2Document10 pagesModule 2 Lesson 2Kimberly C. LantoriaNo ratings yet

- Aricle On The Bangladesh Egg IndustryDocument4 pagesAricle On The Bangladesh Egg IndustryMd. Morshed AlamNo ratings yet

- Final Ipapasa-RevisedDocument112 pagesFinal Ipapasa-RevisedGem. SalvadorNo ratings yet

- Production of Egg TraysDocument11 pagesProduction of Egg TraysGETACHEWNo ratings yet

- Slaughter House By-Product Utilization For Sustainable Meat Industry: A ReviewDocument18 pagesSlaughter House By-Product Utilization For Sustainable Meat Industry: A ReviewAsdfNo ratings yet

- The feed INdustryDocument9 pagesThe feed INdustrymustcube3No ratings yet

- The Business of Being a Housewife: A Manual Efficiency and EconomyFrom EverandThe Business of Being a Housewife: A Manual Efficiency and EconomyNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets. November 2017From EverandFood Outlook: Biannual Report on Global Food Markets. November 2017No ratings yet

- Olin Epoxy Resins BrochureDocument12 pagesOlin Epoxy Resins BrochureMuhammad ZikryNo ratings yet

- Blood Flow Restriction Training and The Physique AthleteDocument15 pagesBlood Flow Restriction Training and The Physique AthleteDouglas MarinNo ratings yet

- No Faster Prop On The Water: Step 1. Engine/DRIVE Step 2. Installation Kit Step 3. PropellerDocument2 pagesNo Faster Prop On The Water: Step 1. Engine/DRIVE Step 2. Installation Kit Step 3. PropellerjitmarineNo ratings yet

- Wendra Deka Saputra: P R O F Il EDocument1 pageWendra Deka Saputra: P R O F Il EvheNo ratings yet

- Form-1 - HWM RulesDocument3 pagesForm-1 - HWM RulesPrasad V.ANo ratings yet

- Recovery of Platinum and Palladium From Scrap Automotive Catalytic ConvertersDocument11 pagesRecovery of Platinum and Palladium From Scrap Automotive Catalytic ConvertersMr RhodiumNo ratings yet

- MCN Nclex #1Document10 pagesMCN Nclex #1Bethlnly Nasayao100% (1)

- T.E Question Papers (2012 Pattern) May 2015Document297 pagesT.E Question Papers (2012 Pattern) May 2015Prof. Avinash MahaleNo ratings yet

- Ryan Martin Ko, M.DDocument54 pagesRyan Martin Ko, M.DDhaval Makwana100% (2)

- 2018 CONV Chassis 1 - DT - ABSDocument435 pages2018 CONV Chassis 1 - DT - ABSThanh HoangNo ratings yet

- Dental ProblemsDocument18 pagesDental ProblemsRenellie Quiñonez TrimidalNo ratings yet

- Project Profile On Kurkure Type Snacks PDFDocument2 pagesProject Profile On Kurkure Type Snacks PDFSundeep Yadav100% (4)

- Nisekoi Yomeiri English Text (WIP)Document86 pagesNisekoi Yomeiri English Text (WIP)Jan Dominic GUCORNo ratings yet

- Saic-Q-1065 Rev 1 (Final)Document2 pagesSaic-Q-1065 Rev 1 (Final)ryann mananquilNo ratings yet

- Oman Rainfall PDFDocument13 pagesOman Rainfall PDFConifer YuNo ratings yet

- AR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingDocument168 pagesAR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingYati Nurul HashfiNo ratings yet

- Definition Goals and Scope of Special and Inclusive EducationDocument8 pagesDefinition Goals and Scope of Special and Inclusive EducationBrenda Bravo100% (3)

- The Dark Side of ConscientiousnessDocument15 pagesThe Dark Side of ConscientiousnessMerlin PitNo ratings yet

- Business Continuity Planning and Disaster Recovery PlanDocument55 pagesBusiness Continuity Planning and Disaster Recovery PlanNeeraj Kohli100% (2)

- Magic Mushroom Spores - Where To Buy Psilocybin Spo - 240105 - 183240Document24 pagesMagic Mushroom Spores - Where To Buy Psilocybin Spo - 240105 - 183240coreeastcapitalNo ratings yet

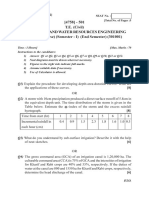

- Final Examination SEMESTER 2, SESSION 2017/2018: Instruction To CandidatesDocument7 pagesFinal Examination SEMESTER 2, SESSION 2017/2018: Instruction To CandidatesusssNo ratings yet

- 4 Mass Transfer Coefficients PDFDocument17 pages4 Mass Transfer Coefficients PDFYee LingNo ratings yet

- Fish Processing: By: Laureno, Divina Villaver Dela Cruz, Cedrick P. Estor, Vanessa RDocument24 pagesFish Processing: By: Laureno, Divina Villaver Dela Cruz, Cedrick P. Estor, Vanessa REstor, Vanessa R.No ratings yet

- The Goa GuideDocument48 pagesThe Goa GuideNehaNo ratings yet

- LPG Autogas Station: Ss Energy (Presents) Auto Gas Station Installation On Turnkey BasisDocument17 pagesLPG Autogas Station: Ss Energy (Presents) Auto Gas Station Installation On Turnkey BasisSaeed AwanNo ratings yet

- Spondilitis TB AnakDocument36 pagesSpondilitis TB Anaktry intan kartini50% (2)

- Chapter IiiDocument5 pagesChapter IiiAjzNo ratings yet

Indonesian Meat Processing Industry - Jakarta - Indonesia - 12-10-1999

Indonesian Meat Processing Industry - Jakarta - Indonesia - 12-10-1999

Uploaded by

Hans LangoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indonesian Meat Processing Industry - Jakarta - Indonesia - 12-10-1999

Indonesian Meat Processing Industry - Jakarta - Indonesia - 12-10-1999

Uploaded by

Hans LangoCopyright:

Available Formats

Foreign Agricultural Service

GAIN Report

Global Agriculture Information Network

Voluntary Report - public distribution Date: 12/10/1999

GAIN Report #ID9088

Indonesia

Livestock

Indonesian Meat Processing Industry

1999

Prepared by:

Dennis Voboril

U.S. Agricultural Trade Office

Drafted by:

Corey Rosenbusch-Texas A&M Intern Student & Fahwani Y. Rangkuti-ATO Jakarta

Report Highlights: The processed meat industry is an important and growing sector

in Indonesia. Bakso, an Indonesian meatball, and sausages are increasing in

popularity in this country of over 200 million people. The major companies are

looking for the competitive advantage, and searching for substitute products to be

used in their product lines. ATO Jakarta projects that there are excellent market

prospects for U.S. suppliers of MDM turkey and other ingredients that are of high

quality and competitively priced. Initial contacts would most likely necessitate

technical assistance for the major processors in proper utilization of new

ingredients.

Includes PSD changes: No

Includes Trade Matrix: No

Unscheduled Report

Jakarta ATO [ID2], ID

GAIN Report #ID9088 Page 1 of 4

MARKET BRIEF: INDONESIAN MEAT PROCESSING INDUSTRY

A POTENTIAL GROWTH MARKET

FOR U.S. MEAT & POULTRY INGREDIENTS

MARKET SUMMARY

When setting foot in any Indonesian city you are guaranteed to see small street stalls, called

warungs, selling the popular Indonesian meatballs called bakso. Bakso is processed meat that

can be compared to the American version of a meatball, but often contains other non-meat

ingredients such as flour and cornstarch. These small meatballs are very popular in Indonesian

soups and can also be a stand-alone product.

Next to chicken nuggets, Bakso can be considered as on of the top processed meats consumed in

the archipelago. Traditionally, bakso hasn’t been a product you would find in grocery store

shelves. If you wanted to purchase bakso, you would find them being hand compressed on a

street corner warung. Today, however, many supermarkets devote an entire refrigerated case to

these bite size meatballs. The enormous consumption rate and recovering Southeast Asian

economy has motivated meat processors to produce their own versions of the popular Indonesian

food. The trend of processed meats has become a thriving market in the Jakarta area, and many

producers are now buying raw meat products to produce a wide variety of processed meat,

dominated by bakso, sausages, and chicken nuggets.

This report takes an in-depth look at the processing of meat into bakso and sausages, including

information regarding consumption, production, market distribution channels, trade, and sales

information.

TRENDS IN CONSUMPTION

Bakso and sausage are two of the most common

processed meats that are consumed in Indonesian. Of

Processed Meat Production

the total processed meats consumed, 60-70 percent is

Per Month

sausage and bakso. Estimates indicate that 150 tons of

sausage and bakso are produced per month in the

greater Jakarta area alone. 100

80

Y-Axis

60 Tons

Perhaps it is even more important to understand that of 40

all of the consumed bakso, 70 percent is produce by 20

traditional means. Small warungs, restaurants, and 0

families, all make their own bakso by hand, from Sausage Bakso

scratch. This should be an invaluable indicator of the X-Axis

popularity of the product across the country. This is also

a strong indicator that most processed meats cater to the

middle and upper class, although all classes do eat the processed products. Some experts

UNCLASSIFIED Foreign Agricultural Service/USDA

GAIN Report #ID9088 Page 2 of 4

estimate that 70 percent of the people consuming processed meats are in Java.

Sausage has also become a popular meat for

Indonesia, but is not as big as bakso. Some experts Percentage of Processed Meats

indicate that of the total consumed sausage and

(60.0%)

bakso, 60 percent is bakso. As with most other

products in Indonesia, processed sausage and bakso

have experienced a decline in consumption because Bakso

Sausage

of the economy. One source suggests that the

consumption rate of processed sausage and bakso

should be back to normal by the year 2002. (40.0%)

TRENDS IN PRODUCTION

Since processing meat into sausages and bakso has become popular, four companies have

dominated the industry, and all are highly competitive. The sensitivity of this competition has

made exact figures of sales and production difficult to obtain.

Some companies have identified their own niches to compete, specializing in fresh bakso,

whereas others strictly sale their bakso in vacuum packs. In looking at the production as a

whole, including traditional production, only 5 percent of the total produced bakso is vacuum

packed.

Bakso is a very complex processed product. The primary ingredients are the meat, flour,

cornstarch, and assorted spices. The bakso is then graded on a scale of 1 to 14 based on the

content of the meat in the product. A grade 1 is the highest quality and would contain a higher

meat content percentage than the lowest quality, grade 14. Since most commercially processed

bakso is purchased by the upper and lower classes, processors usually don’t make anything below

a grade 7.

The quality grade of the bakso also has an impact on the

cost of the product. A grade 1 product would cost Rp Bakso Production

25,000 for a 700 gram unit 1. Grade 7 bakso is half of

that cost, at Rp 6,000 per 700 grams. (80.0%)

When exploring bakso production, beef dominates the (5.0%)

production, followed by seafood, and chicken. Some Beef

(15.0%) Shrimp/Fish

industry sources indicate that beef’s 80 percent of Chicken

produced bakso is likely to slump as alternate products

become available. High quality beef is a rarity in

Indonesian and any high quality product has to be

imported. This results in higher priced product. Chicken bakso will ultimately become more and

more popular for two reasons. Chicken is more abundant in the country and channels have

1

Rp: Indonesian currency of rupiah is approx. US$1/Rp 7,000 as of year-end 1999.

UNCLASSIFIED Foreign Agricultural Service/USDA

GAIN Report #ID9088 Page 3 of 4

become available to import cheap, high quality product from countries such as the United States.

Other sources disagree with the increasing demand of processed chicken. Some say that if

Indonesians want chicken they will consume a more traditional product. Additionally bakso is

their opportunity to eat beef without the expensive price associated with unprocessed products,

such as steak. Instead, the same source turns to seafood as the new arena in bakso production.

When looking at the current trend seafood products such as shrimp and fish are 10 percent more

popular than poultry bakso.

Sausage, on the other hand, is primarily dominated by the

beef industry. One expert indicates that 70 percent of Sausage Production

processed sausages are beef based, whereas only 30 percent

are chicken based. Companies have their eyes, however, on (70.0%)

an exciting new product to use in production - turkey. Two

of the large processors experimenting with the possibility of Beef

implementing a turkey sausage line in their plants. Turkey Chicken

is an excellent alternative they indicate because it’s a niche,

its cheap, high quality, and can be sold as the healthy (30.0%)

alternative.

DISTRIBUTION CHANNELS

Because such a small amount of the total consumed sausage and bakso is processed

commercially, most of production is centered in the Java area. The central Indonesian hub is one

of the few areas with the infrastructure to handle the production and distribution of the processed

meats. As a matter of the fact, 80 percent of the total processed bakso and sausage is sold on the

island of Java, and a large percentage of the remaining 20 percent is centered in Bali.

Most Bakso that is sold in the area is centralized in the supermarkets and restaurants. Sausage

and Bakso produced in the Central Java are distributed by company owned refrigerated trucks

directly to the stores and restaurants. Both venues split the market share with supermarkets

selling 51 percent of the product and restaurants 49 percent.

TRENDS IN TRADE

Of the three products to use in processing sausage and bakso, the chicken and seafood are 100

percent local. Ninety percent of the beef, however, primarily is imported from Australia and

New Zealand in quarters. Australia dominates the beef imports for processed meats with 90

percent of the market share. There is some local beef used in the production of sausage and

bakso but in very little amounts, and only in the lower quality products.

CONCLUSION

UNCLASSIFIED Foreign Agricultural Service/USDA

GAIN Report #ID9088 Page 4 of 4

One can obviously see the importance of the processed meat industry in Indonesia. Bakso, an

established product, and sausage, increasing in popularity, have entered the commercial market.

The future for commercially processed meats has a bright future in this country of over 200

million people. The major companies are looking for the competitive advantage, and searching

for substitute products to be used in their product lines. ATO Jakarta projects that there are

excellent market prospects for U.S. suppliers of MDM turkey and other ingredients that are of

high quality and competitively priced. Initial contacts would most likely necessitate technical

assistance for the major processors in proper utilization of new ingredients.

POST CONTACT AND FURTHER INFORMATION

The U.S. Agricultural Trade Office in Jakarta maintains up-to-date information covering food

and agricultural import opportunities in Indonesia and would be pleased to assist in facilitating

U.S. exports and entry to the Indonesia market. Questions or comments regarding this report

should be directed to the U.S. ATO in Jakarta at the following address:

U.S. Commercial Center

Wisma Metropolitan II, 3rd Floor

Jalan Jenderal Sudirman Kav.29-31

Jakarta 12920 - Indonesia

Tel: +62215262850

Fax: +62215711251

e-mail:atojkt@cbn.net.id

Homepage:http://www.usembassyjakarta.org/fas

Please contact our home page for more information on exporting U.S. food products to

Indonesia, including Exporter Guide: Indonesia; Food Processing Sector Report: Indonesia; The

Retail Sector Report: Indonesia; Market Brief: Indonesian Fresh Fruit Imports, Market Brief -

Indonesian Wine Imports; and Hotel and Restaurant Industry: Bali. As of January 2000, the

following reports are available: The HRI Food Service Sector Report: Indonesia; Market Brief -

Indonesian Bakery Industry; and Market Brief - Indonesian Beverage Industry.

For more information on exporting U.S. agricultural products to other countries, please visit the

Foreign Agricultural Service’s Home Page: http://www.fas.usda.gov

C:\RPT25556549.WPD

UNCLASSIFIED Foreign Agricultural Service/USDA

You might also like

- Consumo Carne JaponDocument7 pagesConsumo Carne JaponVictor Josue Flores100% (1)

- TX200 Service ManualDocument132 pagesTX200 Service Manualalexis acevedo100% (5)

- Operational Manual of Model ButcheryDocument21 pagesOperational Manual of Model ButcherySoiab Khan100% (1)

- Pakan - Final Indonesia ReportDocument51 pagesPakan - Final Indonesia ReportPatricia NorevaNo ratings yet

- Pangasius Sp. - N.B. Rathod, Et Al PDFDocument15 pagesPangasius Sp. - N.B. Rathod, Et Al PDFDewi SetiyowatiNo ratings yet

- Feasibility Study Native ChickenDocument17 pagesFeasibility Study Native Chickenoy88% (16)

- SAI VRAT STORY KathaDocument2 pagesSAI VRAT STORY KathaRohit100% (2)

- JSA Template 2017-05-30 Powder Actuated ToolsDocument19 pagesJSA Template 2017-05-30 Powder Actuated ToolsJayvee Baradas Valdez100% (2)

- Indian Meat MarketDocument5 pagesIndian Meat MarketomkarkaromNo ratings yet

- Efisiensi Dan Nilai Ekonomi Daging Sapi Untuk Potongan Pasar Tradisional Berdasarkan Potongan Komersial Yang BerbedaDocument5 pagesEfisiensi Dan Nilai Ekonomi Daging Sapi Untuk Potongan Pasar Tradisional Berdasarkan Potongan Komersial Yang BerbedaRidho ZiskaNo ratings yet

- Meat & Meat Products Technology Including Poultry Products TechnDocument151 pagesMeat & Meat Products Technology Including Poultry Products TechnVoll EntertainmentNo ratings yet

- Indian Meat IndustryDocument26 pagesIndian Meat Industrychiragkaushik558No ratings yet

- Technical Articles: Indian Meat Industry: Opportunities and ChallengesDocument6 pagesTechnical Articles: Indian Meat Industry: Opportunities and ChallengesKarthic C MNo ratings yet

- Beef Substitution DevelopmentDocument6 pagesBeef Substitution DevelopmentRani YuliaNo ratings yet

- Goan Sausages ExportsDocument22 pagesGoan Sausages ExportsZico RodriguesNo ratings yet

- Fish FarmingDocument13 pagesFish FarmingmatsumotoNo ratings yet

- Impact of Covid 19 On Poultry-FinalDocument6 pagesImpact of Covid 19 On Poultry-FinalnasirNo ratings yet

- Value Added Meat ProductsDocument2 pagesValue Added Meat Productseditorveterinaryworld100% (2)

- Poultry SectorDocument29 pagesPoultry SectorPakSci MissionNo ratings yet

- Group3 - Organic Pig Production - Feasibility Study)Document38 pagesGroup3 - Organic Pig Production - Feasibility Study)Madelyn Arimado100% (1)

- GAIN Report: Indonesia Grain and Feed Feed Situation 2007Document8 pagesGAIN Report: Indonesia Grain and Feed Feed Situation 2007Aji GunawanNo ratings yet

- India: Report CategoriesDocument6 pagesIndia: Report Categoriesabhiraj roushanNo ratings yet

- Export Potential Analysis of Indian Meat IndustryDocument86 pagesExport Potential Analysis of Indian Meat IndustrymaxtheswainNo ratings yet

- Pandemic Impact On Frozen Foods MarketDocument5 pagesPandemic Impact On Frozen Foods MarketP. Rajan MATHEWSNo ratings yet

- Swine Microproject Final Manuscript (Giebon Quiros)Document40 pagesSwine Microproject Final Manuscript (Giebon Quiros)GIEBON QUIROSNo ratings yet

- Final PropasalbarasaDocument31 pagesFinal PropasalbarasaKeita VictorNo ratings yet

- Meat and Meat Products Technology Including Poultry Products Technology PDFDocument76 pagesMeat and Meat Products Technology Including Poultry Products Technology PDFDhanya M AlexNo ratings yet

- Asm 1 - IndividualDocument9 pagesAsm 1 - IndividualLeeAnnNo ratings yet

- Article A - Can A Country With No Livestock Become A Meat ProducerDocument3 pagesArticle A - Can A Country With No Livestock Become A Meat Producerlijianxi710No ratings yet

- Business Plan Outline - 1Document11 pagesBusiness Plan Outline - 1Ruel PeneyraNo ratings yet

- Slaughter House PrefeasibilityDocument39 pagesSlaughter House PrefeasibilityOmer Farooq100% (2)

- Indian Meat Industry: Opportunities and Challenges: January 2011Document7 pagesIndian Meat Industry: Opportunities and Challenges: January 2011satyajitNo ratings yet

- Pakistan Meat Sector Scope & Challenges-1Document16 pagesPakistan Meat Sector Scope & Challenges-1shakeel ahmad100% (1)

- TextDocument5 pagesTextLorie Ann Mercado LicupNo ratings yet

- Indian Meat IndustryDocument7 pagesIndian Meat IndustrysatyajitNo ratings yet

- Analysis of Supply and Demand of Broiler Chicken Meat in Bali ProvinceDocument9 pagesAnalysis of Supply and Demand of Broiler Chicken Meat in Bali ProvinceMc Alryn PatindolNo ratings yet

- IARPCoop CHICKEN-FARM-BUSINESS-PLAN r2Document6 pagesIARPCoop CHICKEN-FARM-BUSINESS-PLAN r2kingjam dimacaling2019100% (1)

- Final Fs 2Document23 pagesFinal Fs 2Markgil Gapunuan MalabananNo ratings yet

- E213946 PDFDocument8 pagesE213946 PDFmuditkalra90No ratings yet

- Emerging Supply Chain of Pork and The Opportunities For Small-Scale Raisers in A Countryside City, in The PhilippinesDocument92 pagesEmerging Supply Chain of Pork and The Opportunities For Small-Scale Raisers in A Countryside City, in The PhilippinesAmanNo ratings yet

- KACGAP BMCupdate Nov2021Document11 pagesKACGAP BMCupdate Nov2021Hy Tham CabigtingNo ratings yet

- Fanijo Poultry-Fesibility Study and Posible OutcomeDocument51 pagesFanijo Poultry-Fesibility Study and Posible OutcomeSamuel Fanijo100% (2)

- Usaha Kerupuk Ikan LeleDocument11 pagesUsaha Kerupuk Ikan LeleKelik Dwi BudiartoNo ratings yet

- Suguna Revisied 1Document37 pagesSuguna Revisied 1Girish JhaNo ratings yet

- Agribusiness ManagementDocument20 pagesAgribusiness Managementronald_leabresNo ratings yet

- Lean Finely Textured Beef: The "Pink Slime" Controversy: Joel L. GreeneDocument15 pagesLean Finely Textured Beef: The "Pink Slime" Controversy: Joel L. GreenePlatemagazineNo ratings yet

- Rabbit Farming: A Project Feasibility Study On An Urban Farming Project in Barangay San Juan, Antipolo CityDocument21 pagesRabbit Farming: A Project Feasibility Study On An Urban Farming Project in Barangay San Juan, Antipolo CityErman Deano100% (1)

- AECO121 BroilerDocument6 pagesAECO121 BroilerStephanie Nicole CruzNo ratings yet

- Angeles MeatProcessingDocument38 pagesAngeles MeatProcessingAnonymous gO6PtzXa6No ratings yet

- Broiler Production Business PlanDocument13 pagesBroiler Production Business Planchikondi.mtande25No ratings yet

- Cheese in Indonesia 2019Document9 pagesCheese in Indonesia 2019Su GitoNo ratings yet

- Piggery Value ChainDocument23 pagesPiggery Value ChainPrince Oludare AkintolaNo ratings yet

- Tocarea Carnii, Totul Despre Cirnat EngDocument266 pagesTocarea Carnii, Totul Despre Cirnat EngRinula16No ratings yet

- Indian Meat Industry - Media India GroupDocument7 pagesIndian Meat Industry - Media India GroupKrishnakumar KNo ratings yet

- Module 2 Lesson 2Document10 pagesModule 2 Lesson 2Kimberly C. LantoriaNo ratings yet

- Aricle On The Bangladesh Egg IndustryDocument4 pagesAricle On The Bangladesh Egg IndustryMd. Morshed AlamNo ratings yet

- Final Ipapasa-RevisedDocument112 pagesFinal Ipapasa-RevisedGem. SalvadorNo ratings yet

- Production of Egg TraysDocument11 pagesProduction of Egg TraysGETACHEWNo ratings yet

- Slaughter House By-Product Utilization For Sustainable Meat Industry: A ReviewDocument18 pagesSlaughter House By-Product Utilization For Sustainable Meat Industry: A ReviewAsdfNo ratings yet

- The feed INdustryDocument9 pagesThe feed INdustrymustcube3No ratings yet

- The Business of Being a Housewife: A Manual Efficiency and EconomyFrom EverandThe Business of Being a Housewife: A Manual Efficiency and EconomyNo ratings yet

- Food Outlook: Biannual Report on Global Food Markets. November 2017From EverandFood Outlook: Biannual Report on Global Food Markets. November 2017No ratings yet

- Olin Epoxy Resins BrochureDocument12 pagesOlin Epoxy Resins BrochureMuhammad ZikryNo ratings yet

- Blood Flow Restriction Training and The Physique AthleteDocument15 pagesBlood Flow Restriction Training and The Physique AthleteDouglas MarinNo ratings yet

- No Faster Prop On The Water: Step 1. Engine/DRIVE Step 2. Installation Kit Step 3. PropellerDocument2 pagesNo Faster Prop On The Water: Step 1. Engine/DRIVE Step 2. Installation Kit Step 3. PropellerjitmarineNo ratings yet

- Wendra Deka Saputra: P R O F Il EDocument1 pageWendra Deka Saputra: P R O F Il EvheNo ratings yet

- Form-1 - HWM RulesDocument3 pagesForm-1 - HWM RulesPrasad V.ANo ratings yet

- Recovery of Platinum and Palladium From Scrap Automotive Catalytic ConvertersDocument11 pagesRecovery of Platinum and Palladium From Scrap Automotive Catalytic ConvertersMr RhodiumNo ratings yet

- MCN Nclex #1Document10 pagesMCN Nclex #1Bethlnly Nasayao100% (1)

- T.E Question Papers (2012 Pattern) May 2015Document297 pagesT.E Question Papers (2012 Pattern) May 2015Prof. Avinash MahaleNo ratings yet

- Ryan Martin Ko, M.DDocument54 pagesRyan Martin Ko, M.DDhaval Makwana100% (2)

- 2018 CONV Chassis 1 - DT - ABSDocument435 pages2018 CONV Chassis 1 - DT - ABSThanh HoangNo ratings yet

- Dental ProblemsDocument18 pagesDental ProblemsRenellie Quiñonez TrimidalNo ratings yet

- Project Profile On Kurkure Type Snacks PDFDocument2 pagesProject Profile On Kurkure Type Snacks PDFSundeep Yadav100% (4)

- Nisekoi Yomeiri English Text (WIP)Document86 pagesNisekoi Yomeiri English Text (WIP)Jan Dominic GUCORNo ratings yet

- Saic-Q-1065 Rev 1 (Final)Document2 pagesSaic-Q-1065 Rev 1 (Final)ryann mananquilNo ratings yet

- Oman Rainfall PDFDocument13 pagesOman Rainfall PDFConifer YuNo ratings yet

- AR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingDocument168 pagesAR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingYati Nurul HashfiNo ratings yet

- Definition Goals and Scope of Special and Inclusive EducationDocument8 pagesDefinition Goals and Scope of Special and Inclusive EducationBrenda Bravo100% (3)

- The Dark Side of ConscientiousnessDocument15 pagesThe Dark Side of ConscientiousnessMerlin PitNo ratings yet

- Business Continuity Planning and Disaster Recovery PlanDocument55 pagesBusiness Continuity Planning and Disaster Recovery PlanNeeraj Kohli100% (2)

- Magic Mushroom Spores - Where To Buy Psilocybin Spo - 240105 - 183240Document24 pagesMagic Mushroom Spores - Where To Buy Psilocybin Spo - 240105 - 183240coreeastcapitalNo ratings yet

- Final Examination SEMESTER 2, SESSION 2017/2018: Instruction To CandidatesDocument7 pagesFinal Examination SEMESTER 2, SESSION 2017/2018: Instruction To CandidatesusssNo ratings yet

- 4 Mass Transfer Coefficients PDFDocument17 pages4 Mass Transfer Coefficients PDFYee LingNo ratings yet

- Fish Processing: By: Laureno, Divina Villaver Dela Cruz, Cedrick P. Estor, Vanessa RDocument24 pagesFish Processing: By: Laureno, Divina Villaver Dela Cruz, Cedrick P. Estor, Vanessa REstor, Vanessa R.No ratings yet

- The Goa GuideDocument48 pagesThe Goa GuideNehaNo ratings yet

- LPG Autogas Station: Ss Energy (Presents) Auto Gas Station Installation On Turnkey BasisDocument17 pagesLPG Autogas Station: Ss Energy (Presents) Auto Gas Station Installation On Turnkey BasisSaeed AwanNo ratings yet

- Spondilitis TB AnakDocument36 pagesSpondilitis TB Anaktry intan kartini50% (2)

- Chapter IiiDocument5 pagesChapter IiiAjzNo ratings yet