Professional Documents

Culture Documents

FinanceDashboard Final 2

FinanceDashboard Final 2

Uploaded by

Adnan AhmarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FinanceDashboard Final 2

FinanceDashboard Final 2

Uploaded by

Adnan AhmarCopyright:

Available Formats

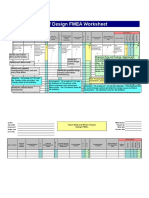

Atlas Battery Limited Fund Position Power BI Desktop Start Date 6/1/2023 6/30/2023 End Date

(Rs. in Million)

Summary Month End STB Utilization

Net Borrowing Utilized Limit Utilization % Monthly Available Monthly Utilization Monthly Earmarking

Long

Term Borrowing -782.0 100.0% 100%

Net Total -782.0 100.0%

Saving

0.0

Short Term Borrowing -4,371.4 6,600 69.9%

Net Total -4,371.4 6,600 69.9% 0%

Total -5,153.4 6,600 82.5%

Investment Funds Type Utilization % Market Value July 2022 August 2022 September 2022 October 2022 November 2022 December 2022 January 2023 February 2023 March 2023 April 2023 May 2023 June 2023

Atlas Money Market Fund Money Market 0.0 RF Limit 6600.0 6600.0 6600.0 6600.0 6600.0 6600.0

HBL Money MarketFund Money Market 266.7 Earmarking -350.0 -350.0

Total 266.7 Utilized 299.9 -358.7 -76.0 -1101.9 -1416.4 -616.4 1475.1 1387.3 630.5 -1026.7 -2027.5 -978.2

Available -300 359 76 1102 1416 616 5125 5213 5970 7627 8277 7228

LTB % STB % Utilization % 22.3% 21.0% 9.6% 15.6% 30.7% 14.8%

15.2% 84.8%

Long Term Borrowings Interest Rates

Account Name Opening Balance Bank Transfers Payments Receipts Closing Balance Composition % Composition Graph RF Rate Effective RF Rate

04-Apr-2023 21.0%

Long Term Loan ABL

0.0 0.0 0.0%

Long Term Loan Allied Bank Ltd (TERF) -73.7 -73.7 9.4% 1%+0.8% 1.8%

02-Mar-2023 20.0% STB

Long Term Loan Askari Bank -708.3 -708.3 90.6% 3MK+.50% 23.6% 23-Jan-2023 17.0% 23.0%

Long Term Loan HBL (Salary) 0.0 0.0 0.0% 25-Nov-2022 16.0%

Total -782.0 -782.0 100.0% 100.00% 3MK+.50% 25.4% LTB

10-Oct-2022 15.0%

21.5%

22-Aug-2022 30.0%

0% 20%

Short Term Borrowings

Account Name Opening Balance Deposits Payments Bank Transfers Closing Balance Total Limit Earmarking of Limits Available limits Available limits% Utilization % Utilization Composition Composition RF Rate Effective

Allied Bank Limited RF -579.2 334.3 -0.1 -320.0 -565.0 700 700 11.2% 80.7% Graph Graph % RF Rate

Askari Bank Ltd R/F 0.0 -400.0 -400.0

12.9% 3MK + 0.2% 23.1%

Account Name Opening Balance Bank Transfers Payments Receipts Closing Balance

Bank Alfalah Limited RF -0.5 34.4 -158.0 123.5 -0.6 400Limit Earmarking

-30 Available Limits

370 Available Limits %

5.9% Utilize

0.2%

0.0% 1MK + 1% 23.2%

Faysal Bank

Meezan

BankLtd R/F

Ltd. Saving Acco… -678.1

0.0 130.9 -4.71328.01 -105.11328.0 -656.9 0.0 800 800 12.8% 82.1%

15.0% 3MK + 0.25% 23.2%

Habib

HabibBank

BankLtd. Saving

Limited RF Account 0.0

-461.5 1,632.6 -4,855.8 0.00 3,256.7 0.0 -428.0 0.0 850 850 13.6% 50.4%

9.8% 1MK + 0.50% 23.0%

Subtotal

Habib Metropolitan Main Br R/F 0.0

-297.5 444.2 -392.11328.01 -44.01328.0 -289.3 0.0 700 -250 450 7.2% 64.3%

6.6% 3MK + 0.20% 23.1%

Bank

Alfalah

Meezan BankLimited

LimitedRF

RF -4.5

-957.4 1,889.7 3.0 -612.2 -0.19 -1,453.0 0.0 -1,132.8 -1.81,450 400 -30

-70 370

1,380 5.9%

22.1% 0.2%

82.1%

25.9% 1MK + 0.30% 22.9%

Habib Metropolitan

National Main Br

Bank of pakistan RFR/F -335.1

-345.9 100.0130.0 0.0-201.04 -40.0 452.6 -285.9 -2.5 400 700 -250 450

400 7.2%

6.4% 64.3%

71.5%

6.5% 3MK + 0.30% 23.2%

Soneri Bank R/F

Soneri Bank R/F -79.2

-34.5 109.0 77.5 -44.2 -7.19 -633.0 0.0 -602.7 -8.91,200 1,200 1,200

1,200 19.2%

19.2% 50.2%

50.2%

13.8% 1MK + 0.25% 22.6%

United

UnitedBank

BankLimited

LimitedRFRF -46.4

-38.7 -515.0

816.4 -0.3 79.75 -787.5 624.9 -10.1 -16.8 100 100 100

100 1.6%

1.6% 10.1%

10.1%

0.2% 1MK + 0.50% 23.1%

National

Subtotal Bank of pakistan RF -57.8

-3,393.2 5,491.5109.5-6,467.3 -68.56 -2.4 -4,371.4 -16.96,600 400 -350 400

6,250 6.4%

100.0% 71.5%

69.9%

Habib Bank Limited RF -62.6 1,247.6 -3552.42 2349.5 -32.2 850 850 13.6% 50.4% 69.9% 100.00% 100.0% 3MK + 0.30% 207.3%

Habib

Bank Ltd. Saving Account 0.0 0.0 0.0 0.0

Meezan Bank Limited RF -82.1 -1,255.0 72.70 1328.0 -96.4 1,450 -70 1,380 22.1% 82.1% 69.9% 100.00% 100.0% 3MK + 0.30% 207.3%

Meezan Bank Ltd. Saving Account 0.0 1,888.2 -1,888.2 0.0 0.0

Allied Bank Limited RF -321.3 -30.0 53.67 295.9 -96.9 700 700 11.2% 80.7%

Subtotal 0.0 1,888.2 -1,888.2 0.0 0.0

Faysal Bank Ltd R/F -428.6 230.0 8.63 0.0 -290.0 800 800 12.8% 82.1%

Total -3,393.2 7,379.7 -8,355.5 -2.4 -4,371.4 6,600 -350 6,250 100.0% 69.9%

Subtotal -1417.6 -2.4 -3614.65 5050.9 -562.4 6,600 -350 6,250 100.0% 69.9%

Corresponding Period -1417.6 -2.4 -2286.64 6378.9 -562.4 6,600 -350 6,250 100.0% 69.9%

Deposits

Deposits Today Actual To Date Further Est. Month Total Deposits March 2023 April 2023 May 2023 June 2023

Dealers 402.9 1002.1 200 1,202.1 Dealers 767.8 704.6 806.0

Export Export 27.9 32.3 59.9

OEMs Institutions 49.0 92.0 13 105.0 OEMs Institutions 81.5 11.9 34.4

Others 3994.5 6285.7 4 6,289.7 Others 7,472.1 4,993.8 5,243.3 0.0

Total 4446.4 7379.8 217 7,596.8 Total 8,349.2 5,742.6 6,143.6 0.0

Payments / Transfers

Payments Today Actual To Date Further Est. Month Total Payments March 2023 April 2023 May 2023

Import Payments 253.5 530.0 783.5 Import Payments 227.7 116.0 394.1

Local Suppliers / Vendors 4.2 5632.4 4.0 5636.4 Local Suppliers / Vendors 4511.5 4974.0 4663.3

Others 2312.6 2472.1 2.0 2474.1 Others 2774.7 1927.9 3151.1

Salaries (Mgt. staff + JCW) Salaries (Mgt. staff + JCW)

Taxes (Income & Sales Tax) Taxes (Income & Sales Tax)

Total 2316.8 8357.9 536.0 8893.9 Total 7513.9 7017.9 8208.4

You might also like

- Sushi Burrito Business PlanDocument26 pagesSushi Burrito Business Plannorshadia50% (2)

- Monthly Info 2023.08Document10 pagesMonthly Info 2023.08onlychess96No ratings yet

- Performance Summary of The FundDocument1 pagePerformance Summary of The FundSudheer KumarNo ratings yet

- Ikhtisar Data Keuangan enDocument8 pagesIkhtisar Data Keuangan enFarisNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- Grafik Perkembangan Keuangan Hyundai Motor CompanyDocument1 pageGrafik Perkembangan Keuangan Hyundai Motor CompanyKim OppaNo ratings yet

- Ratio AnalysisDocument25 pagesRatio AnalysisKolaNo ratings yet

- AbbVie 20210806 (BetterInvesting)Document5 pagesAbbVie 20210806 (BetterInvesting)professorsanchoNo ratings yet

- Atlas HondaDocument15 pagesAtlas HondaQasim AkramNo ratings yet

- Derivatives Monthly Outlook: Nifty May Continue To Lag Broader Markets in Absence of FII FlowsDocument17 pagesDerivatives Monthly Outlook: Nifty May Continue To Lag Broader Markets in Absence of FII FlowsEquityLabs IndiaNo ratings yet

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Factsheet 1705132209349Document2 pagesFactsheet 1705132209349umanarayanvaishnavNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- Fund Facts - HDFC Small Cap Fund - March 23Document2 pagesFund Facts - HDFC Small Cap Fund - March 23duttasahil19No ratings yet

- Axis Bluechip FundDocument1 pageAxis Bluechip Fundarian2026No ratings yet

- Commercial Proposal - Ooredoo RFIDocument4 pagesCommercial Proposal - Ooredoo RFIAntony KanyokoNo ratings yet

- Panel I - Jahja Setiaatmadja - CEO BCADocument21 pagesPanel I - Jahja Setiaatmadja - CEO BCADimas HardiNo ratings yet

- Nike Inc.: Cost of Capital: AssumptionsDocument6 pagesNike Inc.: Cost of Capital: AssumptionsrizqighaniNo ratings yet

- Weekly Debt Portfolio Summary 12202023Document2 pagesWeekly Debt Portfolio Summary 12202023final bossuNo ratings yet

- Ratio Analysis of Cement CompaniesDocument20 pagesRatio Analysis of Cement CompaniesMd. Zahid HossainNo ratings yet

- Q3 2020 High Yield Bank Loan ReportDocument16 pagesQ3 2020 High Yield Bank Loan Reportrwmortell3580No ratings yet

- TrafficDocument2 pagesTrafficDoanh ĐặngNo ratings yet

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Document37 pagesPerformance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Mahesh DhalNo ratings yet

- Investor Quarterly Presentation 2017Q1Document19 pagesInvestor Quarterly Presentation 2017Q1Elaine YeapNo ratings yet

- Business Profile Viz-a-Viz Target and Achievements As OnDocument3 pagesBusiness Profile Viz-a-Viz Target and Achievements As OnJunaid BakshiNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanNo ratings yet

- Satori Fund II LP Monthly Newsletter - 2023 06Document7 pagesSatori Fund II LP Monthly Newsletter - 2023 06Anthony CastelliNo ratings yet

- Weekly Derivatives, 2010 Sep 24Document2 pagesWeekly Derivatives, 2010 Sep 24Vijay GandeNo ratings yet

- Mera Pakistan Housing Payment PlanDocument1 pageMera Pakistan Housing Payment Planظفر حسین چوٹیال اعوانNo ratings yet

- ExhibitsDocument5 pagesExhibitsrameenNo ratings yet

- ValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05Document4 pagesValueResearchFundcard QuantumLongTermEquityValueFund DirectPlan 2019sep05manoj_sitecNo ratings yet

- Factsheet 1704957862487Document2 pagesFactsheet 1704957862487umanarayanvaishnavNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- 2 Wheelers in A Sweet Spot - Flag Bearer of The Recovery in Automotive SegmentDocument23 pages2 Wheelers in A Sweet Spot - Flag Bearer of The Recovery in Automotive SegmentayushNo ratings yet

- CBO's August 2010 Baseline: Medicare: by Fiscal YearDocument10 pagesCBO's August 2010 Baseline: Medicare: by Fiscal Yearapi-27836025No ratings yet

- Nifty 50 Quarterly Estimates Q4FY23Document9 pagesNifty 50 Quarterly Estimates Q4FY23gann wolfNo ratings yet

- Creative Enterprise Holdings Limited SEHK 3992 FinancialsDocument32 pagesCreative Enterprise Holdings Limited SEHK 3992 FinancialsxunstandupNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Fund Facts - HDFC Small Cap Fund - May 24Document3 pagesFund Facts - HDFC Small Cap Fund - May 24mk2bmh9sNo ratings yet

- Knight-Swift Transportation Holdings Inc A KNX: Growth Rates (Compound Annual)Document1 pageKnight-Swift Transportation Holdings Inc A KNX: Growth Rates (Compound Annual)Alejandro ElizondoNo ratings yet

- FD Customer Leaflet-A4 - WEBDocument1 pageFD Customer Leaflet-A4 - WEBmyloan partnerNo ratings yet

- Starhub FY21Document20 pagesStarhub FY21SurachaiNo ratings yet

- Balance Sheet Summary: (RP Billion) Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 YOY ChangeDocument3 pagesBalance Sheet Summary: (RP Billion) Mar-17 Jun-17 Sep-17 Dec-17 Mar-18 Jun-18 YOY ChangeTanuwijaya Jaya SugiNo ratings yet

- Year 2017 2018 2019 2020 2021 D/E 57.1 53.6 56.2 76.5 95.6 Times Inter 10.2 12.9 13.8 3Document4 pagesYear 2017 2018 2019 2020 2021 D/E 57.1 53.6 56.2 76.5 95.6 Times Inter 10.2 12.9 13.8 3Muhammad AnnasNo ratings yet

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- KFI Poush 20791 PDFDocument1 pageKFI Poush 20791 PDFRajendra NeupaneNo ratings yet

- NRB KFI-Ashwin-2079 PDFDocument1 pageNRB KFI-Ashwin-2079 PDFLikesh ShresthaNo ratings yet

- Risk and Return Analysis: 10 Prominent Large Cap Mutual FundsDocument38 pagesRisk and Return Analysis: 10 Prominent Large Cap Mutual FundsAman JainNo ratings yet

- ValueResearchFundcard CanaraRobecoEmergingEquitiesFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard CanaraRobecoEmergingEquitiesFund DirectPlan 2019mar04ChittaNo ratings yet

- WDC ModelDocument14 pagesWDC ModelthevalueguyNo ratings yet

- Meezan Bank Car Ijarah Rental Caculation: Booking PeriodDocument1 pageMeezan Bank Car Ijarah Rental Caculation: Booking PeriodMuhammad UsmanNo ratings yet

- SPS Sample ReportsDocument61 pagesSPS Sample Reportsphong.parkerdistributorNo ratings yet

- Axis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y UDocument1 pageAxis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y Ukishore13No ratings yet

- g19 FedReserveDocument2 pagesg19 FedReserveSean WongNo ratings yet

- Asian Paints Financial ModelDocument15 pagesAsian Paints Financial ModelDeepak NechlaniNo ratings yet

- ValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19Document4 pagesValueResearchFundcard MiraeAssetLargeCapFund DirectPlan 2019nov19asddsffdsfNo ratings yet

- Fundcard: Kotak Banking ETF Fund RegularDocument4 pagesFundcard: Kotak Banking ETF Fund RegularChittaNo ratings yet

- WACC (1) Group9 Section BDocument16 pagesWACC (1) Group9 Section BSarvesh KashyapNo ratings yet

- Select Economic IndicatorsDocument1 pageSelect Economic Indicatorspls2019No ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Annexure A - Discount & RebateDocument10 pagesAnnexure A - Discount & RebateAdnan AhmarNo ratings yet

- MT940Document2 pagesMT940Adnan AhmarNo ratings yet

- Tax SolutionDocument17 pagesTax SolutionAdnan AhmarNo ratings yet

- Document 1323509.1Document8 pagesDocument 1323509.1Adnan AhmarNo ratings yet

- Two Factor AuthenticationDocument1 pageTwo Factor AuthenticationAdnan AhmarNo ratings yet

- Payrol PF Increment Leave Enhancement DataDocument312 pagesPayrol PF Increment Leave Enhancement DataAdnan AhmarNo ratings yet

- ABL - GL - Aug 2023 WorkingDocument1,361 pagesABL - GL - Aug 2023 WorkingAdnan AhmarNo ratings yet

- Transfer OutDocument3 pagesTransfer OutAdnan AhmarNo ratings yet

- Budgeted P&L - For IXDocument13 pagesBudgeted P&L - For IXAdnan AhmarNo ratings yet

- MT940 Bank ReconDocument4 pagesMT940 Bank ReconAdnan AhmarNo ratings yet

- Massallocations 180808113359Document17 pagesMassallocations 180808113359Adnan AhmarNo ratings yet

- Payment Query UAT - FinalDocument160 pagesPayment Query UAT - FinalAdnan AhmarNo ratings yet

- TERRITORY DOCXcompleteDocument18 pagesTERRITORY DOCXcompleteAdnan AhmarNo ratings yet

- 9 Pivot ChartsDocument9 pages9 Pivot ChartsAdnan AhmarNo ratings yet

- Assignment3 SolverDocument2 pagesAssignment3 SolverAdnan AhmarNo ratings yet

- World Scale BasicDocument2 pagesWorld Scale BasicD.Muruganand100% (1)

- List Pejabat BoD-1 IASDocument1 pageList Pejabat BoD-1 IASmy.araleaNo ratings yet

- b291 حل واجبات 00966597837185 الجامعة العربية المفتوحة 00966597837185 ,, حلو ل واجبات الجامعة العربية المفتوحة ,, جروب الإمتياز المهندس أحمد حل واجب b291 حلول واجبات b291 حل الواجب b291 حلول الواجبات b291 TMA بدون تشابه حل واجبات الجامعة العربية المفتوحة 00966597837185 ,, حلو ل واجبات الجامعة العربية المفتوحة ,, جروب الإمتياز المهندس أحمد حل واجب b291 حلول واجبات b291 حل الواجب b291 حلول الواجبات b291 TMA بدون تشابهDocument10 pagesb291 حل واجبات 00966597837185 الجامعة العربية المفتوحة 00966597837185 ,, حلو ل واجبات الجامعة العربية المفتوحة ,, جروب الإمتياز المهندس أحمد حل واجب b291 حلول واجبات b291 حل الواجب b291 حلول الواجبات b291 TMA بدون تشابه حل واجبات الجامعة العربية المفتوحة 00966597837185 ,, حلو ل واجبات الجامعة العربية المفتوحة ,, جروب الإمتياز المهندس أحمد حل واجب b291 حلول واجبات b291 حل الواجب b291 حلول الواجبات b291 TMA بدون تشابهالأستاذ 00966597837185No ratings yet

- Lovepreet's, Cover Letter and Resume.Document4 pagesLovepreet's, Cover Letter and Resume.lovepreetsk0465No ratings yet

- Press ToolDocument12 pagesPress ToolJitendra Bhole100% (2)

- Brochure-UpGrad Digital Marketing Certification ProgramDocument34 pagesBrochure-UpGrad Digital Marketing Certification ProgramRajesh SamantNo ratings yet

- Memorandum OF Association OF: THE COMPANIES ACT, 2017 (XIX of 2017)Document5 pagesMemorandum OF Association OF: THE COMPANIES ACT, 2017 (XIX of 2017)AzeemNo ratings yet

- AkitaBox Key Features ChecklistDocument1 pageAkitaBox Key Features ChecklistAnonymous i1WordeYNo ratings yet

- Carlos Panadero JR ResumeDocument1 pageCarlos Panadero JR ResumeCJ PanaderoNo ratings yet

- Quality Management in Public E-Administration: J. Ruso, M. Krsmanovic, A. Trajkovic, Z. RakicevicDocument5 pagesQuality Management in Public E-Administration: J. Ruso, M. Krsmanovic, A. Trajkovic, Z. RakiceviceugenioNo ratings yet

- 13-17.400.EXT - behq-US Global Supplier Standards Manual V4!11!28-11Document52 pages13-17.400.EXT - behq-US Global Supplier Standards Manual V4!11!28-11nguyentho17No ratings yet

- Coca ColaDocument15 pagesCoca ColaShubham TyagiNo ratings yet

- EC563 Lecture 2 - International FinanceDocument15 pagesEC563 Lecture 2 - International FinanceOisín Ó CionaoithNo ratings yet

- C2R TrainingDocument27 pagesC2R TrainingPaul EspinozaNo ratings yet

- ISO 1711-2 Llaves Tubo PDFDocument10 pagesISO 1711-2 Llaves Tubo PDFJaime Alejandro HerreraNo ratings yet

- Globalisation and The Virtual Organization:: What Are The Communication Implications?Document16 pagesGlobalisation and The Virtual Organization:: What Are The Communication Implications?samantha-clair100% (1)

- PTI Financial Statement For Financial Year 2013-14Document7 pagesPTI Financial Statement For Financial Year 2013-14PTI Official100% (3)

- 10 - Consolidations - Changes in Ownership InterestsDocument42 pages10 - Consolidations - Changes in Ownership InterestsLukas PrawiraNo ratings yet

- Chap 011 HRMDocument27 pagesChap 011 HRMtwinkle_shahNo ratings yet

- Dmaic Versus DmadvDocument2 pagesDmaic Versus DmadvHoo Chee Wai100% (1)

- CH 6Document51 pagesCH 6Ella ApeloNo ratings yet

- TI30XIISDocument6 pagesTI30XIISPrashant BanerjeeNo ratings yet

- Experian CreditReport CRVD 471825902 1669236884097Document12 pagesExperian CreditReport CRVD 471825902 1669236884097Yogesh gyandev rathodNo ratings yet

- Automotive Sector Development StrategyDocument209 pagesAutomotive Sector Development Strategyraafat279No ratings yet

- Bu SundariDocument42 pagesBu SundariTeguh WahyudinNo ratings yet

- StatementDocument7 pagesStatementJaved AliNo ratings yet

- Usecase Inventory SystemDocument9 pagesUsecase Inventory SystemZemal MalikNo ratings yet

- Class Schedule - AccutDocument2 pagesClass Schedule - AccutZhenhua RuiNo ratings yet

- Example of Design FMEA WorksheetDocument5 pagesExample of Design FMEA Worksheetரஞ்சன் ஞானயோளிNo ratings yet