Professional Documents

Culture Documents

Tax Receipt Income Tax

Tax Receipt Income Tax

Uploaded by

caprajwalshettyCopyright:

Available Formats

You might also like

- Assignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Document1 pageAssignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Tenaj KramNo ratings yet

- 24010500502181HDFC ChallanReceiptDocument1 page24010500502181HDFC ChallanReceiptArun ShindeNo ratings yet

- 24031200008039SBIN ChallanReceiptDocument1 page24031200008039SBIN ChallanReceiptgudiverma111No ratings yet

- 24043000744401PUNB ChallanReceiptDocument1 page24043000744401PUNB ChallanReceiptbasantanidharmendraNo ratings yet

- 24030701423838SBIN ChallanReceiptDocument1 page24030701423838SBIN ChallanReceiptFiroz AliNo ratings yet

- 24043000941534UBIN_ChallanReceiptDocument1 page24043000941534UBIN_ChallanReceiptNickNo ratings yet

- 24040800124547IOBA ChallanReceiptDocument1 page24040800124547IOBA ChallanReceiptasafintax.consultingNo ratings yet

- 24043000763487PUNB ChallanReceiptDocument1 page24043000763487PUNB ChallanReceiptbasantanidharmendraNo ratings yet

- 24043000921238UBIN_ChallanReceiptDocument1 page24043000921238UBIN_ChallanReceiptNickNo ratings yet

- 23092400076660SBIN ChallanReceiptDocument1 page23092400076660SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24011500073557UTIB ChallanReceiptDocument1 page24011500073557UTIB ChallanReceipttyagirajkingNo ratings yet

- 24030701385192SBIN ChallanReceiptDocument1 page24030701385192SBIN ChallanReceiptFiroz AliNo ratings yet

- 23092600219233SBIN ChallanReceiptDocument1 page23092600219233SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24042100005559HDFC ChallanReceiptDocument1 page24042100005559HDFC ChallanReceiptUdit GuptaNo ratings yet

- 24060500164467SBIN ChallanReceiptDocument1 page24060500164467SBIN ChallanReceiptshrungar.ornament1No ratings yet

- 24031200304903HDFC ChallanReceiptDocument1 page24031200304903HDFC ChallanReceiptprasadriri45No ratings yet

- 24042400104981IBKL ChallanReceiptDocument1 page24042400104981IBKL ChallanReceiptaccounthoNo ratings yet

- 24050600458417SBIN ChallanReceiptDocument1 page24050600458417SBIN ChallanReceipttaxhouse37No ratings yet

- 24050600506918SBIN ChallanReceiptDocument1 page24050600506918SBIN ChallanReceipttaxhouse37No ratings yet

- 24041900123262HDFC ChallanReceiptDocument1 page24041900123262HDFC ChallanReceiptkshweta2605No ratings yet

- 24010600907116HDFC ChallanReceiptDocument1 page24010600907116HDFC ChallanReceiptmanishsharma76900No ratings yet

- TCS ChallanReceipt Oct-23Document1 pageTCS ChallanReceipt Oct-23ss_mirganjNo ratings yet

- 24050701122437CBIN ChallanReceiptDocument1 page24050701122437CBIN ChallanReceiptYALLAPPA BASAVAPATTANNo ratings yet

- 23120500291281UTIB ChallanReceiptDocument1 page23120500291281UTIB ChallanReceiptbinitashah11573No ratings yet

- 24051100032555HDFC ChallanReceiptDocument1 page24051100032555HDFC ChallanReceiptSiddharth MaheshwariNo ratings yet

- 24050500039264KKBK ChallanReceiptDocument1 page24050500039264KKBK ChallanReceiptRahul AgarwalNo ratings yet

- Screenshot 2023-12-07 at 5.27.16 PMDocument1 pageScreenshot 2023-12-07 at 5.27.16 PMdrsadhu2001No ratings yet

- 23080300048465HDFC ChallanReceiptDocument2 pages23080300048465HDFC ChallanReceiptmahesh rahejaNo ratings yet

- 24030701379609SBIN ChallanReceiptDocument1 page24030701379609SBIN ChallanReceiptFiroz AliNo ratings yet

- 24030200072253HDFC ChallanReceiptDocument1 page24030200072253HDFC ChallanReceiptMd Qurban HussainNo ratings yet

- 24042700187977ICIC ChallanReceiptDocument1 page24042700187977ICIC ChallanReceiptCA Alpesh TatedNo ratings yet

- 24050600410201SBIN ChallanReceiptDocument1 page24050600410201SBIN ChallanReceipttaxhouse37No ratings yet

- 24050800044933KKBK ChallanReceiptDocument1 page24050800044933KKBK ChallanReceiptChandrasekar KrishnamurthyNo ratings yet

- 24052300069742IBKL ChallanReceiptDocument1 page24052300069742IBKL ChallanReceiptaccounthoNo ratings yet

- 23092400074562SBIN ChallanReceiptDocument1 page23092400074562SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 23092400070301SBIN ChallanReceiptDocument1 page23092400070301SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24030600031518HDFC ChallanReceiptDocument1 page24030600031518HDFC ChallanReceiptAbbas WaniNo ratings yet

- 24042100006591HDFC ChallanReceiptDocument1 page24042100006591HDFC ChallanReceiptUdit GuptaNo ratings yet

- 24020900091148HDFC ChallanReceiptDocument1 page24020900091148HDFC ChallanReceiptArun ShindeNo ratings yet

- 23110700211376HDFC ChallanReceiptDocument1 page23110700211376HDFC ChallanReceiptArun ShindeNo ratings yet

- 24020600229610RBIS ChallanReceiptDocument1 page24020600229610RBIS ChallanReceiptaccounthoNo ratings yet

- 24042900347705IBKL ChallanReceiptDocument1 page24042900347705IBKL ChallanReceiptVBS & ASSOCIATESNo ratings yet

- 23101700013299RBIS ChallanReceiptDocument1 page23101700013299RBIS ChallanReceiptaccounthoNo ratings yet

- 2023-24 Sen Mani DebbarmaDocument1 page2023-24 Sen Mani Debbarmakartik DebnathNo ratings yet

- 24042900244546SBIN - ChallanReceipt - pdfVIREN TDSDocument1 page24042900244546SBIN - ChallanReceipt - pdfVIREN TDSSUNILNo ratings yet

- 24060700026544SBIN ChallanReceiptDocument1 page24060700026544SBIN ChallanReceiptNageswara Rao YerramreddyNo ratings yet

- 23120600536613HDFC ChallanReceiptDocument1 page23120600536613HDFC ChallanReceiptArun ShindeNo ratings yet

- 24043000935713UBIN_ChallanReceiptDocument1 page24043000935713UBIN_ChallanReceiptNickNo ratings yet

- 24042700186349ICIC ChallanReceiptDocument1 page24042700186349ICIC ChallanReceiptCA Alpesh TatedNo ratings yet

- Rent TDS 2024-25Document1 pageRent TDS 2024-25gorkhaptkNo ratings yet

- 24050800046177KKBK ChallanReceiptDocument1 page24050800046177KKBK ChallanReceiptChandrasekar KrishnamurthyNo ratings yet

- 23120500256641UTIB ChallanReceiptDocument1 page23120500256641UTIB ChallanReceiptbinitashah11573No ratings yet

- 24030100194480HDFC ChallanReceiptDocument1 page24030100194480HDFC ChallanReceipttravelpanel101No ratings yet

- 24021900057417HDFC ChallanReceiptDocument1 page24021900057417HDFC ChallanReceiptSumit ShahNo ratings yet

- 24040500031919HDFC ChallanReceiptDocument1 page24040500031919HDFC ChallanReceiptraghavcyberpointNo ratings yet

- Parmjit Singh Challan Ay 202324Document1 pageParmjit Singh Challan Ay 202324SANJEEV KUMARNo ratings yet

- 24052200117800IOBA ChallanReceiptDocument1 page24052200117800IOBA ChallanReceiptesancbe786No ratings yet

- 24020700082337ICIC ChallanReceiptDocument1 page24020700082337ICIC ChallanReceiptyadav.santosh650No ratings yet

- 24042900349707IBKL ChallanReceiptDocument1 page24042900349707IBKL ChallanReceiptVBS & ASSOCIATESNo ratings yet

- 24040900011525HDFC ChallanReceiptDocument1 page24040900011525HDFC ChallanReceiptkunal3152No ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- External Provider Billing Statement: To Be Filled Up by Accounting DepartmentDocument2 pagesExternal Provider Billing Statement: To Be Filled Up by Accounting DepartmentSophie Angela DayagroNo ratings yet

- W-8BEN QRG enDocument8 pagesW-8BEN QRG enKen McLeanNo ratings yet

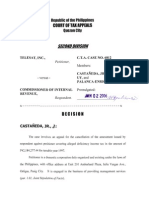

- Telesat v. CIRDocument12 pagesTelesat v. CIRRandy BelloNo ratings yet

- Price Ceiling: This WeekDocument6 pagesPrice Ceiling: This WeekAdreshNo ratings yet

- Sales Tax Test - SolutionDocument4 pagesSales Tax Test - SolutionBilal GouriNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online BillZohaib EliNo ratings yet

- Nirmal Multiple CampusDocument2 pagesNirmal Multiple CampusSabitaNo ratings yet

- 6 Kalaignar KarunanidhiDocument15 pages6 Kalaignar Karunanidhid2 sectionNo ratings yet

- 07.) Arya Kusuma XII AKL 1 Lembar Kerja Buku Besar PT MargatapaDocument4 pages07.) Arya Kusuma XII AKL 1 Lembar Kerja Buku Besar PT MargatapaArya KusumaNo ratings yet

- Income and Business TaxationDocument1 pageIncome and Business TaxationTomo Euryl San JuanNo ratings yet

- Gen Principle - Income Tax DigestDocument50 pagesGen Principle - Income Tax DigestJanelle TabuzoNo ratings yet

- Airtel Bill Mar 24-3Document1 pageAirtel Bill Mar 24-3Suryakant AgrawalNo ratings yet

- Tax Review Part 1Document29 pagesTax Review Part 1JImlan Sahipa IsmaelNo ratings yet

- Cir vs. BurmeisterDocument1 pageCir vs. BurmeisterFrancise Mae Montilla MordenoNo ratings yet

- Excitel Broadband BillDocument1 pageExcitel Broadband Billpritemp.23No ratings yet

- German Tax Law: An Overview (2014 Edition)Document6 pagesGerman Tax Law: An Overview (2014 Edition)My German Property100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearpawan kumar raiNo ratings yet

- IOP InvoiceDocument1 pageIOP InvoiceTeuku Budi AuliaNo ratings yet

- Open Session 01 Tax 2 Vat Updates Sept 29 2021Document31 pagesOpen Session 01 Tax 2 Vat Updates Sept 29 2021Paolo TarimanNo ratings yet

- Excise Tax Return: Department of The TreasuryDocument2 pagesExcise Tax Return: Department of The TreasuryRuro LaudaNo ratings yet

- Antido - Allowable Deductions Requisites For DeductibilityDocument2 pagesAntido - Allowable Deductions Requisites For DeductibilityZyra Mae AntidoNo ratings yet

- SW 1 Estate Tax USLSDocument1 pageSW 1 Estate Tax USLSJuly-Anne DublinNo ratings yet

- US Tax ReturnDocument13 pagesUS Tax Returnjamo christineNo ratings yet

- Maha Super Housing LoanDocument4 pagesMaha Super Housing Loansakshishree09No ratings yet

- Newman Affordable Housing ProposalDocument2 pagesNewman Affordable Housing ProposalDaniel WaltonNo ratings yet

- Miscellaneous Invoice (EU00001032) Passport LifestyleDocument1 pageMiscellaneous Invoice (EU00001032) Passport LifestyleindiatoursNo ratings yet

- Invoice 20154352Document2 pagesInvoice 20154352Milan NayekNo ratings yet

- Impact of GST On Manufacturer Distributors and RetailersDocument16 pagesImpact of GST On Manufacturer Distributors and RetailersShubham SinhaNo ratings yet

Tax Receipt Income Tax

Tax Receipt Income Tax

Uploaded by

caprajwalshettyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Receipt Income Tax

Tax Receipt Income Tax

Uploaded by

caprajwalshettyCopyright:

Available Formats

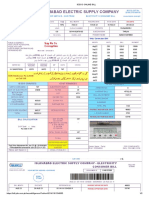

INCOME TAX DEPARTMENT

Challan Receipt

ITNS No. : 281

TAN : PNEA48151F

Name : AMOL ANIL CHAUDHARI

Assessment Year : 2024-25

Financial Year : 2023-24

Major Head : Income Tax (Other than Companies) (0021)

Minor Head : TDS/TCS Payable by Taxpayer (200)

Nature of Payment : 195

Amount (in Rs.) : ₹ 50,910

Amount (in words) : Rupees Fifty Thousand Nine Hundred And Ten Only

CIN : 24033000225716UTIB

Mode of Payment : Net Banking

Bank Name : Axis Bank

Bank Reference Number : 54294109

Date of Deposit : 30-Mar-2024

BSR code : 6360014

Challan No : 07272

Tender Date : 30/03/2024

Tax Breakup Details (Amount In ₹)

A Tax ₹ 50,910

B Surcharge ₹0

C Cess ₹0

D Interest ₹0

E Penalty ₹0

F Fee under section 234E ₹0

Total (A+B+C+D+E+F) ₹ 50,910

Total (In Words) Rupees Fifty Thousand Nine Hundred And Ten Only

Thanks for being a committed taxpayer!

Please print this challan receipt only if absolutely required. Save Paper, Save Environment.

Congrats! Here’s what you have just achieved by choosing to pay online:

Time Paper e-Receipt

Quick and Seamless Save Environment Easy Access

You might also like

- Assignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Document1 pageAssignment - Chapter 2 - Research Problem 1 (Due 09.20.20)Tenaj KramNo ratings yet

- 24010500502181HDFC ChallanReceiptDocument1 page24010500502181HDFC ChallanReceiptArun ShindeNo ratings yet

- 24031200008039SBIN ChallanReceiptDocument1 page24031200008039SBIN ChallanReceiptgudiverma111No ratings yet

- 24043000744401PUNB ChallanReceiptDocument1 page24043000744401PUNB ChallanReceiptbasantanidharmendraNo ratings yet

- 24030701423838SBIN ChallanReceiptDocument1 page24030701423838SBIN ChallanReceiptFiroz AliNo ratings yet

- 24043000941534UBIN_ChallanReceiptDocument1 page24043000941534UBIN_ChallanReceiptNickNo ratings yet

- 24040800124547IOBA ChallanReceiptDocument1 page24040800124547IOBA ChallanReceiptasafintax.consultingNo ratings yet

- 24043000763487PUNB ChallanReceiptDocument1 page24043000763487PUNB ChallanReceiptbasantanidharmendraNo ratings yet

- 24043000921238UBIN_ChallanReceiptDocument1 page24043000921238UBIN_ChallanReceiptNickNo ratings yet

- 23092400076660SBIN ChallanReceiptDocument1 page23092400076660SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24011500073557UTIB ChallanReceiptDocument1 page24011500073557UTIB ChallanReceipttyagirajkingNo ratings yet

- 24030701385192SBIN ChallanReceiptDocument1 page24030701385192SBIN ChallanReceiptFiroz AliNo ratings yet

- 23092600219233SBIN ChallanReceiptDocument1 page23092600219233SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24042100005559HDFC ChallanReceiptDocument1 page24042100005559HDFC ChallanReceiptUdit GuptaNo ratings yet

- 24060500164467SBIN ChallanReceiptDocument1 page24060500164467SBIN ChallanReceiptshrungar.ornament1No ratings yet

- 24031200304903HDFC ChallanReceiptDocument1 page24031200304903HDFC ChallanReceiptprasadriri45No ratings yet

- 24042400104981IBKL ChallanReceiptDocument1 page24042400104981IBKL ChallanReceiptaccounthoNo ratings yet

- 24050600458417SBIN ChallanReceiptDocument1 page24050600458417SBIN ChallanReceipttaxhouse37No ratings yet

- 24050600506918SBIN ChallanReceiptDocument1 page24050600506918SBIN ChallanReceipttaxhouse37No ratings yet

- 24041900123262HDFC ChallanReceiptDocument1 page24041900123262HDFC ChallanReceiptkshweta2605No ratings yet

- 24010600907116HDFC ChallanReceiptDocument1 page24010600907116HDFC ChallanReceiptmanishsharma76900No ratings yet

- TCS ChallanReceipt Oct-23Document1 pageTCS ChallanReceipt Oct-23ss_mirganjNo ratings yet

- 24050701122437CBIN ChallanReceiptDocument1 page24050701122437CBIN ChallanReceiptYALLAPPA BASAVAPATTANNo ratings yet

- 23120500291281UTIB ChallanReceiptDocument1 page23120500291281UTIB ChallanReceiptbinitashah11573No ratings yet

- 24051100032555HDFC ChallanReceiptDocument1 page24051100032555HDFC ChallanReceiptSiddharth MaheshwariNo ratings yet

- 24050500039264KKBK ChallanReceiptDocument1 page24050500039264KKBK ChallanReceiptRahul AgarwalNo ratings yet

- Screenshot 2023-12-07 at 5.27.16 PMDocument1 pageScreenshot 2023-12-07 at 5.27.16 PMdrsadhu2001No ratings yet

- 23080300048465HDFC ChallanReceiptDocument2 pages23080300048465HDFC ChallanReceiptmahesh rahejaNo ratings yet

- 24030701379609SBIN ChallanReceiptDocument1 page24030701379609SBIN ChallanReceiptFiroz AliNo ratings yet

- 24030200072253HDFC ChallanReceiptDocument1 page24030200072253HDFC ChallanReceiptMd Qurban HussainNo ratings yet

- 24042700187977ICIC ChallanReceiptDocument1 page24042700187977ICIC ChallanReceiptCA Alpesh TatedNo ratings yet

- 24050600410201SBIN ChallanReceiptDocument1 page24050600410201SBIN ChallanReceipttaxhouse37No ratings yet

- 24050800044933KKBK ChallanReceiptDocument1 page24050800044933KKBK ChallanReceiptChandrasekar KrishnamurthyNo ratings yet

- 24052300069742IBKL ChallanReceiptDocument1 page24052300069742IBKL ChallanReceiptaccounthoNo ratings yet

- 23092400074562SBIN ChallanReceiptDocument1 page23092400074562SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 23092400070301SBIN ChallanReceiptDocument1 page23092400070301SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24030600031518HDFC ChallanReceiptDocument1 page24030600031518HDFC ChallanReceiptAbbas WaniNo ratings yet

- 24042100006591HDFC ChallanReceiptDocument1 page24042100006591HDFC ChallanReceiptUdit GuptaNo ratings yet

- 24020900091148HDFC ChallanReceiptDocument1 page24020900091148HDFC ChallanReceiptArun ShindeNo ratings yet

- 23110700211376HDFC ChallanReceiptDocument1 page23110700211376HDFC ChallanReceiptArun ShindeNo ratings yet

- 24020600229610RBIS ChallanReceiptDocument1 page24020600229610RBIS ChallanReceiptaccounthoNo ratings yet

- 24042900347705IBKL ChallanReceiptDocument1 page24042900347705IBKL ChallanReceiptVBS & ASSOCIATESNo ratings yet

- 23101700013299RBIS ChallanReceiptDocument1 page23101700013299RBIS ChallanReceiptaccounthoNo ratings yet

- 2023-24 Sen Mani DebbarmaDocument1 page2023-24 Sen Mani Debbarmakartik DebnathNo ratings yet

- 24042900244546SBIN - ChallanReceipt - pdfVIREN TDSDocument1 page24042900244546SBIN - ChallanReceipt - pdfVIREN TDSSUNILNo ratings yet

- 24060700026544SBIN ChallanReceiptDocument1 page24060700026544SBIN ChallanReceiptNageswara Rao YerramreddyNo ratings yet

- 23120600536613HDFC ChallanReceiptDocument1 page23120600536613HDFC ChallanReceiptArun ShindeNo ratings yet

- 24043000935713UBIN_ChallanReceiptDocument1 page24043000935713UBIN_ChallanReceiptNickNo ratings yet

- 24042700186349ICIC ChallanReceiptDocument1 page24042700186349ICIC ChallanReceiptCA Alpesh TatedNo ratings yet

- Rent TDS 2024-25Document1 pageRent TDS 2024-25gorkhaptkNo ratings yet

- 24050800046177KKBK ChallanReceiptDocument1 page24050800046177KKBK ChallanReceiptChandrasekar KrishnamurthyNo ratings yet

- 23120500256641UTIB ChallanReceiptDocument1 page23120500256641UTIB ChallanReceiptbinitashah11573No ratings yet

- 24030100194480HDFC ChallanReceiptDocument1 page24030100194480HDFC ChallanReceipttravelpanel101No ratings yet

- 24021900057417HDFC ChallanReceiptDocument1 page24021900057417HDFC ChallanReceiptSumit ShahNo ratings yet

- 24040500031919HDFC ChallanReceiptDocument1 page24040500031919HDFC ChallanReceiptraghavcyberpointNo ratings yet

- Parmjit Singh Challan Ay 202324Document1 pageParmjit Singh Challan Ay 202324SANJEEV KUMARNo ratings yet

- 24052200117800IOBA ChallanReceiptDocument1 page24052200117800IOBA ChallanReceiptesancbe786No ratings yet

- 24020700082337ICIC ChallanReceiptDocument1 page24020700082337ICIC ChallanReceiptyadav.santosh650No ratings yet

- 24042900349707IBKL ChallanReceiptDocument1 page24042900349707IBKL ChallanReceiptVBS & ASSOCIATESNo ratings yet

- 24040900011525HDFC ChallanReceiptDocument1 page24040900011525HDFC ChallanReceiptkunal3152No ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- External Provider Billing Statement: To Be Filled Up by Accounting DepartmentDocument2 pagesExternal Provider Billing Statement: To Be Filled Up by Accounting DepartmentSophie Angela DayagroNo ratings yet

- W-8BEN QRG enDocument8 pagesW-8BEN QRG enKen McLeanNo ratings yet

- Telesat v. CIRDocument12 pagesTelesat v. CIRRandy BelloNo ratings yet

- Price Ceiling: This WeekDocument6 pagesPrice Ceiling: This WeekAdreshNo ratings yet

- Sales Tax Test - SolutionDocument4 pagesSales Tax Test - SolutionBilal GouriNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online BillZohaib EliNo ratings yet

- Nirmal Multiple CampusDocument2 pagesNirmal Multiple CampusSabitaNo ratings yet

- 6 Kalaignar KarunanidhiDocument15 pages6 Kalaignar Karunanidhid2 sectionNo ratings yet

- 07.) Arya Kusuma XII AKL 1 Lembar Kerja Buku Besar PT MargatapaDocument4 pages07.) Arya Kusuma XII AKL 1 Lembar Kerja Buku Besar PT MargatapaArya KusumaNo ratings yet

- Income and Business TaxationDocument1 pageIncome and Business TaxationTomo Euryl San JuanNo ratings yet

- Gen Principle - Income Tax DigestDocument50 pagesGen Principle - Income Tax DigestJanelle TabuzoNo ratings yet

- Airtel Bill Mar 24-3Document1 pageAirtel Bill Mar 24-3Suryakant AgrawalNo ratings yet

- Tax Review Part 1Document29 pagesTax Review Part 1JImlan Sahipa IsmaelNo ratings yet

- Cir vs. BurmeisterDocument1 pageCir vs. BurmeisterFrancise Mae Montilla MordenoNo ratings yet

- Excitel Broadband BillDocument1 pageExcitel Broadband Billpritemp.23No ratings yet

- German Tax Law: An Overview (2014 Edition)Document6 pagesGerman Tax Law: An Overview (2014 Edition)My German Property100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearpawan kumar raiNo ratings yet

- IOP InvoiceDocument1 pageIOP InvoiceTeuku Budi AuliaNo ratings yet

- Open Session 01 Tax 2 Vat Updates Sept 29 2021Document31 pagesOpen Session 01 Tax 2 Vat Updates Sept 29 2021Paolo TarimanNo ratings yet

- Excise Tax Return: Department of The TreasuryDocument2 pagesExcise Tax Return: Department of The TreasuryRuro LaudaNo ratings yet

- Antido - Allowable Deductions Requisites For DeductibilityDocument2 pagesAntido - Allowable Deductions Requisites For DeductibilityZyra Mae AntidoNo ratings yet

- SW 1 Estate Tax USLSDocument1 pageSW 1 Estate Tax USLSJuly-Anne DublinNo ratings yet

- US Tax ReturnDocument13 pagesUS Tax Returnjamo christineNo ratings yet

- Maha Super Housing LoanDocument4 pagesMaha Super Housing Loansakshishree09No ratings yet

- Newman Affordable Housing ProposalDocument2 pagesNewman Affordable Housing ProposalDaniel WaltonNo ratings yet

- Miscellaneous Invoice (EU00001032) Passport LifestyleDocument1 pageMiscellaneous Invoice (EU00001032) Passport LifestyleindiatoursNo ratings yet

- Invoice 20154352Document2 pagesInvoice 20154352Milan NayekNo ratings yet

- Impact of GST On Manufacturer Distributors and RetailersDocument16 pagesImpact of GST On Manufacturer Distributors and RetailersShubham SinhaNo ratings yet